Emergent BioSolutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

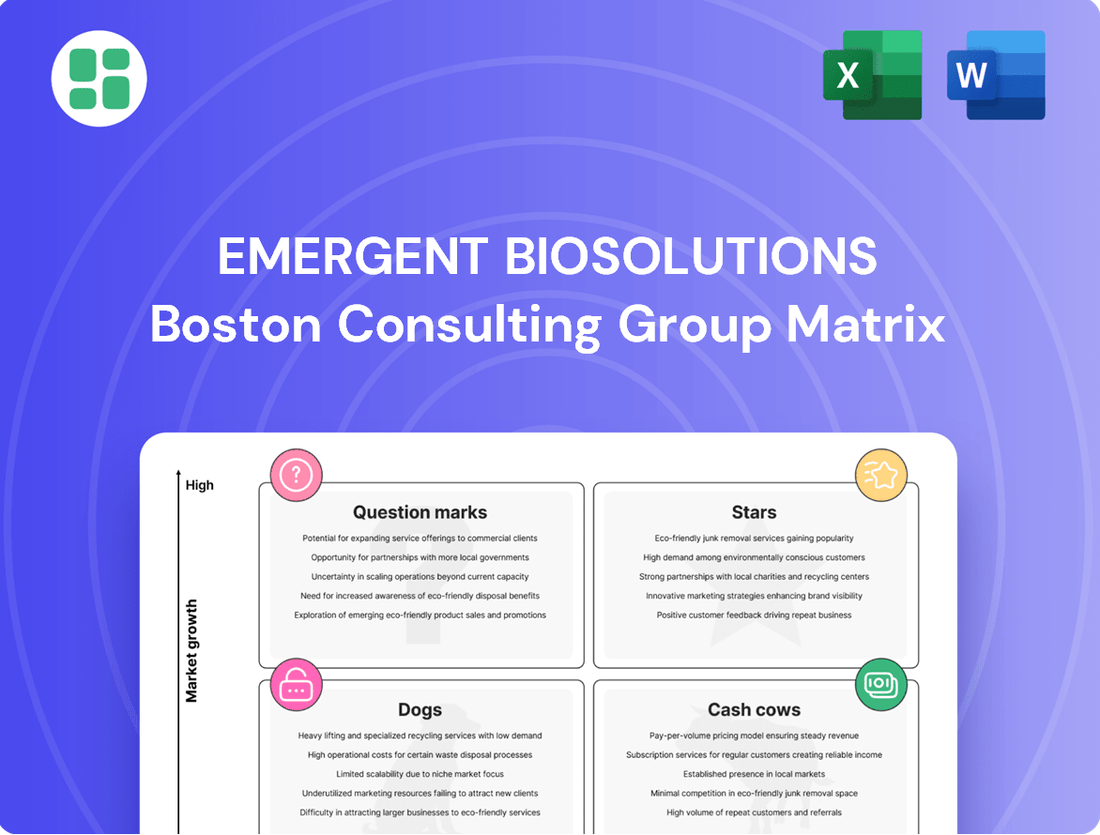

Emergent BioSolutions' product portfolio is a complex web of potential and performance. Understanding where each product sits—whether it's a high-growth Star, a reliable Cash Cow, a resource-draining Dog, or an uncertain Question Mark—is crucial for strategic decision-making. This preview offers a glimpse into that landscape.

To truly unlock the strategic advantage, dive deeper into Emergent BioSolutions' complete BCG Matrix. Gain a clear, actionable view of its product positioning, empowering you to make informed investment and resource allocation decisions. Purchase the full version for a comprehensive breakdown and the insights you need to navigate the market with confidence.

Stars

ACAM2000, Emergent BioSolutions' smallpox and mpox vaccine, is a prime example of a Star in the BCG matrix. The company secured approximately $400 million in orders for its smallpox and mpox vaccine portfolio for 2024 and 2025, demonstrating substantial market demand and rapid growth.

The FDA approval of ACAM2000 in August 2024 for mpox prevention in high-risk individuals further solidifies its position as a market leader. This expansion into a new indication, coupled with confirmed incremental orders, highlights its strong market share and continued upward trajectory.

VIGIV, or Vaccinia Immune Globulin Intravenous, is a vital product for Emergent BioSolutions, particularly in the realm of smallpox and mpox preparedness. Its role as a countermeasure against orthopoxviruses has led to substantial order increases.

For 2024 and 2025, VIGIV has seen significant incremental orders, mirroring the demand for ACAM2000, another key smallpox vaccine. This surge in orders underscores a growing market for orthopoxvirus countermeasures, driven by a heightened focus on public health security.

This increased demand positions VIGIV as a high-growth product for Emergent BioSolutions. The expanding market is a direct result of ongoing global health initiatives and preparedness strategies for viral threats.

TEMBEXA, an oral smallpox antiviral approved for all age groups, is a critical component of the U.S. strategic national stockpile. Its sales saw an uptick in the fourth quarter of 2024, underscoring its increasing importance.

While its growth rate in Q4 2024 was not as pronounced as ACAM2000, TEMBEXA's strategic value in addressing the evolving threat of orthopoxviruses is undeniable. This positions it for significant future market expansion as a key public health asset.

KLOXXADO (Naloxone HCl Nasal Spray 8 mg)

KLOXXADO, an 8 mg naloxone HCl nasal spray, represents Emergent BioSolutions' strategic entry into the burgeoning over-the-counter (OTC) naloxone market as of January 2025. This higher-dose formulation positions the company to potentially capture substantial market share within a critical public health sector experiencing rapid expansion.

The market for naloxone products, particularly OTC options, has seen significant growth driven by increased public awareness and governmental initiatives to combat the opioid crisis. By offering KLOXXADO, Emergent BioSolutions is addressing a clear need for more accessible and potent overdose reversal treatments.

- Market Entry: Acquired rights in January 2025, entering a high-growth public health market.

- Product Offering: 8 mg naloxone HCl nasal spray, a higher-dose OTC option.

- Strategic Importance: Aims to capture significant market share in the expanding naloxone segment.

- Public Health Impact: Addresses the critical need for accessible opioid overdose reversal.

International Expansion of Medical Countermeasures

Emergent BioSolutions is strategically expanding its medical countermeasures into new international territories, targeting significant growth in regions like the European Union, the Middle East, Africa, and the Asia Pacific. This push leverages their existing biodefense product portfolio, capitalizing on the rising global demand for enhanced public health security.

The company's international expansion efforts are particularly focused on markets where preparedness initiatives are gaining momentum. For example, in 2024, Emergent BioSolutions reported continued investment in its international sales infrastructure to support these growth objectives.

- Geographic Focus: EU, Middle East, Africa, Asia Pacific.

- Product Strategy: Leveraging established biodefense products.

- Market Driver: Increasing global preparedness needs.

- Growth Opportunity: High potential in emerging international markets.

Emergent BioSolutions' Stars, representing products with high market share in high-growth markets, include ACAM2000, VIGIV, TEMBEXA, and KLOXXADO. ACAM2000 and VIGIV are experiencing substantial demand for smallpox and mpox countermeasures, with significant orders anticipated through 2025. TEMBEXA, an oral antiviral, is strategically important for public health stockpiles, showing an uptick in sales. KLOXXADO marks Emergent's entry into the growing over-the-counter naloxone market, poised for substantial share capture.

| Product | Market Position | Growth Indicator | 2024/2025 Outlook |

|---|---|---|---|

| ACAM2000 | Leader in smallpox/mpox vaccine | High market share, rapid growth | ~$400M in orders |

| VIGIV | Key orthopoxvirus countermeasure | High market share, rapid growth | Significant incremental orders |

| TEMBEXA | Strategic antiviral for stockpile | Increasing importance, future expansion | Q4 2024 sales uptick |

| KLOXXADO | Entry into OTC naloxone market | High growth potential | Acquired rights Jan 2025 |

What is included in the product

This BCG Matrix overview details Emergent BioSolutions' products, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic guidance on investment, holding, or divestment for each product unit.

A clear BCG matrix visualizes Emergent BioSolutions' portfolio, easing strategic decision-making.

Cash Cows

NARCAN Nasal Spray, despite facing new competition and transitioning to over-the-counter sales, held a commanding approximately 75% market share in the naloxone nasal spray market in 2024. This strong position highlights its continued dominance in a growing sector.

This market leadership translates directly into significant revenue generation for Emergent BioSolutions, solidifying NARCAN's status as a cash cow. The substantial cash flow it provides is crucial for funding other areas of the company's portfolio.

BioThrax, Emergent BioSolutions' anthrax vaccine, continues to be a significant revenue generator. In January 2024, the company secured a new five-year contract with the U.S. Department of Defense, potentially worth up to $235.8 million. This ongoing government demand highlights BioThrax's established position in the biodefense market, providing a reliable income stream.

Anthrasil (Anthrax Immune Globulin Intravenous (Human)) is a prime example of a Cash Cow for Emergent BioSolutions within the BCG matrix. Its position as the sole FDA and Health Canada-licensed polyclonal antibody for treating inhalational anthrax grants it a dominant, high market share in a vital segment of the biodefense sector.

This exclusive status guarantees sustained demand, particularly from government procurement and stockpiling initiatives. For instance, in 2023, Emergent BioSolutions reported significant sales driven by its biodefense portfolio, which includes Anthrasil, reflecting its consistent revenue generation capabilities.

U.S. Government Strategic National Stockpile Contracts

Emergent BioSolutions' contracts with the U.S. government for its Strategic National Stockpile (SNS) are a prime example of a Cash Cow. These long-standing agreements for medical countermeasures, such as Narcan and anthrax vaccines, provide a stable and significant revenue base. The company holds a dominant position in this niche market, ensuring consistent demand and predictable cash flow.

The reliability of these government contracts is a key factor. For instance, in 2023, Emergent BioSolutions reported that its government business segment, which heavily features SNS contracts, generated approximately $700 million in revenue. This segment is characterized by high market share in public health preparedness, a sector with ongoing, essential needs.

- Established Government Contracts: Emergent benefits from long-term, established contracts with the U.S. government for various medical countermeasures, providing a reliable and substantial revenue stream.

- High Market Share: These contracts represent a high market share in the essential public health preparedness sector, ensuring consistent demand.

- Revenue Contribution: In 2023, the government business segment, largely driven by SNS contracts, contributed around $700 million to the company's revenue.

- Predictable Cash Flow: The nature of these contracts ensures a predictable and consistent cash flow, a hallmark of a Cash Cow business.

Core Medical Countermeasures Portfolio

Emergent BioSolutions' core medical countermeasures portfolio, encompassing products like Narcan nasal spray and anthrax vaccines, functions as a significant Cash Cow within its BCG matrix. This segment benefits from established market positions and consistent demand, driven by governmental preparedness initiatives and public health needs.

These vital products address persistent threats, ensuring a steady revenue stream. For instance, in 2023, Emergent BioSolutions reported that its Opioid Overdose and Rescue portfolio, primarily featuring Narcan, generated substantial revenue, highlighting its role as a reliable cash generator.

- Stable Revenue Generation: The consistent demand for countermeasures against biological and chemical threats provides a reliable income source.

- High Market Share: Emergent BioSolutions holds significant market share in key areas like opioid overdose reversal, reinforcing its Cash Cow status.

- Government Contracts: Long-term contracts with government agencies for strategic national stockpiles contribute to predictable cash flows.

- Critical Public Health Role: The essential nature of these products ensures ongoing sales, even in varying economic conditions.

Emergent BioSolutions' established medical countermeasures, particularly NARCAN Nasal Spray and BioThrax, are prime examples of its Cash Cows. These products benefit from high market share in critical public health segments and are bolstered by long-term government contracts, ensuring consistent and significant revenue generation.

NARCAN Nasal Spray maintained approximately 75% market share in the naloxone nasal spray market in 2024, underscoring its dominant position. Similarly, BioThrax, the anthrax vaccine, secured a new five-year contract with the U.S. Department of Defense in January 2024, potentially worth up to $235.8 million, highlighting its ongoing demand.

The company's government business segment, largely driven by Strategic National Stockpile (SNS) contracts for these countermeasures, generated around $700 million in revenue in 2023. This consistent demand and market leadership translate into predictable cash flows, a hallmark of Cash Cow products.

Anthrasil, the sole FDA and Health Canada-licensed polyclonal antibody for inhalational anthrax, also operates as a Cash Cow due to its exclusive market position and sustained government procurement.

| Product | Market Position | 2023/2024 Data Point | Cash Flow Indicator |

| NARCAN Nasal Spray | Dominant (approx. 75% market share in 2024) | Continued over-the-counter sales driving revenue | High, consistent revenue |

| BioThrax | Established biodefense product | New 5-year DoD contract (up to $235.8M) secured Jan 2024 | Reliable government demand |

| Anthrasil | Exclusive market (sole licensed product) | Significant sales driven by biodefense portfolio in 2023 | Sustained government procurement |

| Government Contracts (SNS) | High market share in public health preparedness | Govt. business segment revenue approx. $700M in 2023 | Predictable and substantial cash flow |

Full Transparency, Always

Emergent BioSolutions BCG Matrix

The BCG Matrix report you are previewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready file ready for immediate strategic application. You can confidently use this preview as a true representation of the comprehensive Emergent BioSolutions BCG Matrix you will download.

Dogs

RSDL (Reactive Skin Decontamination Lotion) was divested by Emergent BioSolutions in the third quarter of 2024. This sale directly contributed to a noticeable drop in the company's 'Other Product sales' revenue for that period.

The divestiture of RSDL signals its classification as a low-growth, low-market-share product. It was no longer aligned with Emergent BioSolutions' core strategic objectives, making it a suitable candidate for divestment within the BCG matrix framework.

Botulism Antitoxin Heptavalent (BAT) from Emergent BioSolutions is likely positioned as a Question Mark or a Dog in the BCG Matrix. Sales have decreased recently, with lower product sales and delivery timing impacting revenue in the 'Other Products' segment. This indicates a product with inconsistent or declining demand and a relatively minor contribution to the company's overall revenue picture.

Emergent BioSolutions has been strategically divesting its contract development and manufacturing organization (CDMO) and bioservices facilities, such as those in Camden and Bayview. This move signifies a deliberate shift away from these operations as a primary growth engine for the company. For instance, in 2023, Emergent completed the sale of its Bayview, Maryland facility, a move that aligns with its strategy to streamline operations and focus on core areas.

These divestitures are indicative of Emergent's effort to shed underperforming or non-core assets, thereby improving operational efficiency and financial focus. The company's strategic repositioning aims to concentrate resources on areas with higher growth potential and better alignment with its long-term objectives.

Prescription NARCAN

Prescription NARCAN, once a cornerstone of Emergent BioSolutions' portfolio, has seen its market position significantly shift. The introduction of over-the-counter (OTC) NARCAN, coupled with growing generic competition, has led to a decline in prescription sales. This has resulted in the discontinuation of the prescription formulation, marking this segment as a low-growth area for the company.

Emergent BioSolutions' strategic positioning of prescription NARCAN within the BCG matrix reflects this market evolution. The company's focus has pivoted towards the more dynamic OTC market for naloxone. For instance, in 2023, Emergent BioSolutions reported that the prescription naloxone market was facing headwinds due to the accessibility of the OTC product.

- Prescription NARCAN Discontinuation: The prescription version of NARCAN has been discontinued by Emergent BioSolutions.

- Market Shift: This decision was driven by the launch of over-the-counter (OTC) NARCAN and increased generic competition.

- Low-Growth Segment: The prescription naloxone market is now considered a low-growth area for Emergent BioSolutions.

- Strategic Pivot: Emergent BioSolutions is now focusing its efforts on the more promising OTC naloxone market.

Wind-down of Various Development Initiatives

Emergent BioSolutions' strategic shift is evident in the wind-down of several development initiatives, a move impacting its revenue streams. This strategic decision directly contributed to a decrease in revenues from contracts and grants during the fourth quarter of 2024.

The decline in these revenue sources signals that specific research and development projects did not meet their targeted milestones or were strategically deprioritized. This suggests that past investments in these areas are yielding limited current or future returns, prompting a reallocation of resources.

- Revenue Impact: Q4 2024 saw a reduction in contract and grant revenues due to project wind-downs.

- R&D Performance: Certain development initiatives failed to achieve key milestones or were no longer deemed strategically viable.

- Investment Reassessment: This indicates a critical evaluation of past R&D investments and their future potential.

- Strategic Realignment: The company is likely refocusing resources on more promising or established product lines.

Products classified as Dogs in the BCG matrix typically exhibit low market share and low growth potential. Emergent BioSolutions has strategically divested or deprioritized products fitting this profile to optimize its portfolio. The discontinuation of prescription NARCAN due to market shifts and the divestiture of RSDL are prime examples of managing Dog assets.

These actions reflect a deliberate strategy to shed underperforming or non-core assets, thereby improving operational efficiency and financial focus. The company's repositioning aims to concentrate resources on areas with higher growth potential and better alignment with its long-term objectives.

Botulism Antitoxin Heptavalent (BAT) is also likely positioned as a Dog or Question Mark, given recent sales declines impacting the 'Other Products' segment. This suggests inconsistent or declining demand and a relatively minor contribution to overall revenue.

Emergent BioSolutions' strategic wind-down of certain development initiatives, impacting contract and grant revenues in Q4 2024, further illustrates the management of products or projects that are not meeting strategic viability or performance milestones.

| Product/Segment | BCG Classification (Likely) | Rationale |

|---|---|---|

| Prescription NARCAN | Dog | Discontinued due to OTC launch and generic competition; low-growth market. |

| RSDL | Dog | Divested in Q3 2024, indicating low growth and low market share. |

| Botulism Antitoxin Heptavalent (BAT) | Dog/Question Mark | Recent sales decreases in 'Other Products' segment suggest declining demand. |

| Certain R&D Initiatives | Dog | Wind-down in Q4 2024 due to not meeting milestones or strategic deprioritization. |

Question Marks

CYFENDUS, Emergent BioSolutions' anthrax vaccine, recently received FDA approval for post-exposure prophylaxis, positioning it as a potentially significant product. This development targets a market with high growth potential, especially given its strategic importance in biodefense.

While the anthrax medical countermeasure (MCM) market is robust, CYFENDUS's future market share remains uncertain as adoption and consistent revenue generation are still in their nascent stages. Emergent BioSolutions' investment in this product reflects its belief in its long-term value, but its current position on the BCG matrix would likely be that of a question mark due to this early-stage market penetration.

Ebanga (Ansuvimab-zykl) represents a significant investment for Emergent BioSolutions within its BCG Matrix framework. Development activities for Ebanga were a key driver of the company's contracts and grants revenue, contributing to this stream in the first quarter of 2025.

As a product still undergoing development, Ebanga is currently a cash consumer, with expenditures directed towards crucial research and clinical trials. The potential future return on this investment is high, contingent on its successful navigation of the complex clinical and regulatory approval processes.

Emergent BioSolutions' focus on emerging infectious diseases and new market opportunities suggests a pipeline of countermeasures in early development. These initiatives represent high-growth potential, aligning with the question mark category of the BCG matrix. In 2024, the company continued to invest in its R&D efforts, though specific pipeline details within the question mark segment are often proprietary and subject to change as development progresses.

Specific International Market Penetration for New Products

While Emergent BioSolutions' overall international presence might be considered a Star, the specific penetration of new products into foreign markets presents a more nuanced picture, often resembling a Question Mark. Initial market entry for novel biopharmaceutical products is inherently challenging, demanding substantial upfront investment in regulatory approvals, distribution networks, and marketing to build awareness and adoption.

For instance, the launch of a new vaccine or therapeutic in a market with established competitors or different healthcare infrastructure requires a strategic, phased approach. This often means starting with a low market share in a high-growth potential region, necessitating significant capital allocation to overcome these initial hurdles. By 2024, the global biopharmaceutical market continued to see strong growth, with emerging markets showing particular promise, yet the path for new entrants remained complex.

- High Investment Needs: Entering new international markets for novel products requires substantial R&D, regulatory, and marketing expenditure, often exceeding initial revenue projections.

- Low Initial Market Share: Despite high growth potential, new products typically begin with a small market share, reflecting the challenges of brand recognition and customer acquisition.

- Strategic Resource Allocation: Companies must carefully allocate resources to these markets, balancing the risk of low initial returns against the long-term potential for significant growth and market leadership.

- Example Scenario: A hypothetical new influenza vaccine entering a key Asian market in 2024 might face initial low adoption due to existing preferences and distribution challenges, despite the region's high disease prevalence and growth potential.

Strategic Partnerships for Biopharmaceutical Development

Emergent BioSolutions leverages its contract development and manufacturing (CDMO) capabilities to foster strategic partnerships within the biopharmaceutical sector. Despite divesting certain CDMO assets, the company is positioning itself to capitalize on new, focused collaborations aimed at developing novel biopharmaceuticals.

These emerging partnerships represent potential high-growth opportunities, though their initial market share remains uncertain, placing them in a question mark category within a BCG matrix framework. For instance, in 2024, the global biopharmaceutical CDMO market was valued at approximately $200 billion, with significant growth projected due to increasing outsourcing by pharmaceutical companies and the rising complexity of drug development.

- Focus on Novel Biopharmaceuticals: Partnerships are geared towards developing innovative biological drugs, a segment experiencing rapid advancement.

- High-Growth Potential: These ventures are anticipated to yield substantial revenue growth, mirroring the expanding biopharmaceutical market.

- Market Uncertainty: Initial market penetration and competitive positioning for newly developed biopharmaceuticals are yet to be fully established.

- Strategic CDMO Role: Emergent's CDMO services provide essential manufacturing and development support, crucial for bringing these novel therapies to market.

Products in the question mark category, like Emergent BioSolutions' early-stage pipeline candidates, demand significant investment. These are often new ventures with high growth potential but currently low market share, making their future success uncertain. The company's strategic allocation of resources to these areas reflects a calculated risk for long-term market leadership.

In 2024, Emergent BioSolutions continued to invest in research and development for its pipeline, aiming to convert these question marks into future stars or cash cows. The success of these early-stage products is crucial for the company's sustained growth and market position in the evolving biodefense and public health sectors.

The company's CDMO partnerships also fall into this category, representing opportunities in the rapidly expanding biopharmaceutical outsourcing market, which was valued at approximately $200 billion in 2024. These collaborations require substantial upfront capital and face market uncertainties, typical of question mark products.

Emergent BioSolutions' international market entries for new products also exhibit question mark characteristics. Despite the global biopharmaceutical market's growth, new entrants face challenges in gaining market share, necessitating significant investment in regulatory processes and distribution networks.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.