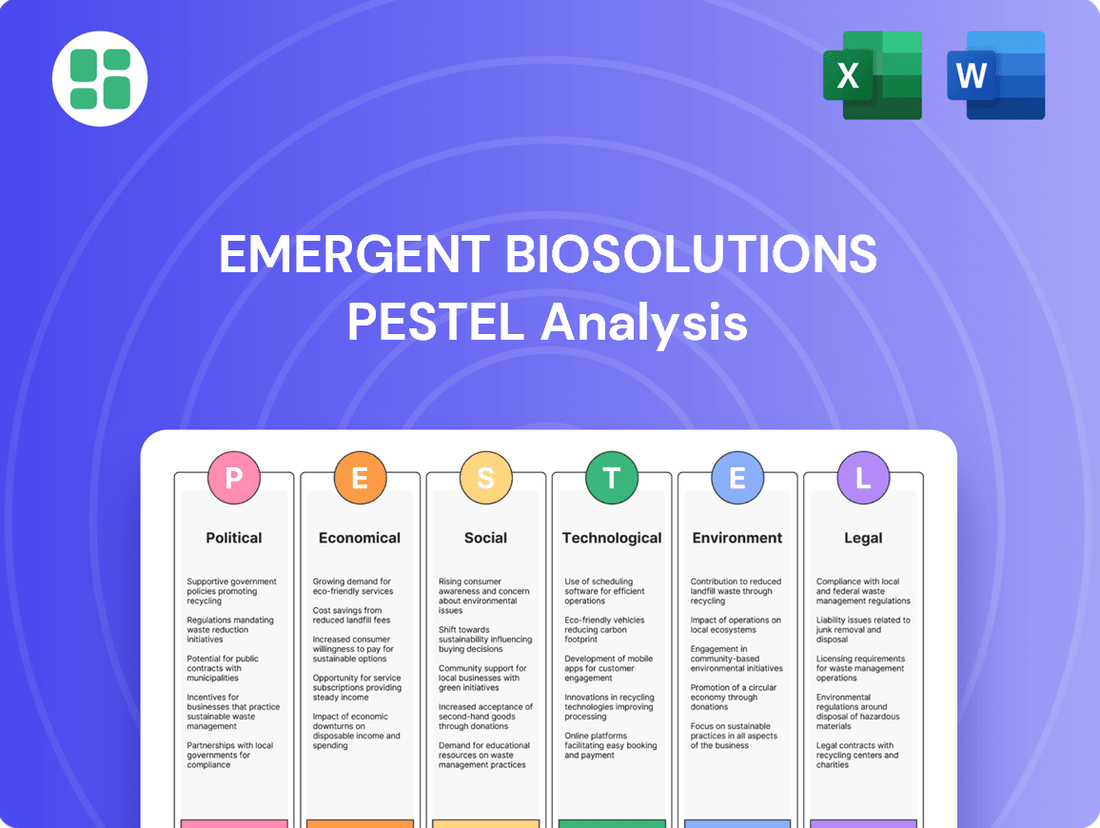

Emergent BioSolutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Emergent BioSolutions's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these complex external forces. Don't get left behind; download the full report now to gain a strategic advantage.

Political factors

Emergent BioSolutions' financial performance is deeply intertwined with government funding, particularly for its critical medical countermeasures. The company's revenue stream is significantly bolstered by development contracts and grants from the U.S. government. This reliance means that shifts in political priorities and budgetary decisions directly impact their operational capacity and future growth prospects.

Congressional appropriations are the lifeblood of these government programs, making them susceptible to political winds and fiscal limitations. For instance, in 2024, Emergent secured over $250 million in contract modifications from the U.S. Department of Health and Human Services (HHS). This funding is specifically designated for the supply of vital medical countermeasures against threats like anthrax, smallpox, and botulism, with ongoing deliveries scheduled into early 2025.

Emergent BioSolutions' core mission directly supports national and global public health preparedness, concentrating on products for biological and chemical threats and emerging infectious diseases. This strategic alignment means government policies in this area significantly impact the company's operations and market demand.

The U.S. government's sustained dedication to maintaining critical medical countermeasures within its biodefense stockpile serves as a foundational element for Emergent's business model. This ongoing need for preparedness fuels consistent demand for their specialized products.

A clear example of this support is the $62.4 million contract modification awarded in June 2025 for the supply of botulism antitoxin. Such substantial government contracts underscore the direct financial benefit Emergent receives from these public health preparedness policies.

Geopolitical stability significantly impacts global health security initiatives, which in turn drive demand for companies like Emergent BioSolutions. When nations cooperate on public health, it often translates into increased funding and a more robust market for medical countermeasures.

The Pandemic Fund's approval of $500 million for its third round of funding in December 2024 exemplifies this. This investment aims to bolster health systems in low- and middle-income countries, directly creating a wider market for essential medical supplies and vaccines.

Regulatory landscape and government oversight

Government regulatory bodies, particularly the U.S. Food and Drug Administration (FDA), wield substantial influence over Emergent BioSolutions' product approval pathways and overall market access. These agencies' evolving regulations and guidance documents directly shape product development strategies and commercialization efforts. For example, the FDA's 2025 guidance agenda for biologics signals a focus on areas like validating alternative microbial testing methods and enhancing potency assurance for advanced therapies such as cell and gene therapies.

The regulatory environment presents both opportunities and challenges. Companies like Emergent BioSolutions must navigate complex approval processes and adhere to stringent manufacturing standards. Staying abreast of regulatory changes is crucial for maintaining compliance and ensuring continued market presence. The FDA's commitment to modernizing its regulatory framework, as evidenced by its 2025 agenda, underscores the dynamic nature of this political factor.

- FDA Oversight: The FDA's role in approving new drugs and biologics is paramount, directly impacting Emergent BioSolutions' revenue streams.

- Evolving Guidance: Ongoing updates to FDA guidance, like those planned for 2025 concerning microbial methods and cell/gene therapy potency, necessitate continuous adaptation in research and development.

- Market Access Impact: Regulatory approvals and post-market surveillance significantly influence a product's ability to reach patients and generate sales.

Political focus on biodefense and national security

The heightened political focus on biodefense and national security is a significant driver for Emergent BioSolutions. A substantial part of their revenue stream is directly tied to government contracts for preparedness and response to biological threats. This political prioritization translates into demand for Emergent's products and services.

Organizations like the Alliance for Biosecurity advocate for sustained federal funding for biosecurity initiatives. For fiscal year 2025, these calls emphasize the critical need for consistent government investment in preparedness and response programs, which directly benefits companies like Emergent.

- Government Contracts: Emergent BioSolutions relies heavily on contracts with agencies like BARDA (Biomedical Advanced Research and Development Authority) for products such as Narcan and anthrax vaccines.

- FY2025 Appropriations: The Alliance for Biosecurity's push for sustainable funding in FY2025 highlights the ongoing government commitment to biodefense, a key market for Emergent.

- National Security Implications: Political emphasis on national security often includes bolstering public health infrastructure and stockpiles, creating opportunities for Emergent's offerings.

Government funding is the bedrock of Emergent BioSolutions' operations, particularly for its critical medical countermeasures. The company's revenue is heavily influenced by development contracts and grants from entities like the U.S. government. Consequently, shifts in political priorities and budgetary allocations directly shape their operational capacity and future growth.

Congressional appropriations are vital for these government programs, making them susceptible to political shifts and fiscal constraints. For example, in 2024, Emergent secured over $250 million in contract modifications from the U.S. Department of Health and Human Services (HHS) for vital medical countermeasures, with deliveries extending into early 2025.

The political emphasis on biodefense and national security directly fuels demand for Emergent BioSolutions' specialized products. This focus translates into significant government contracts for preparedness and response to biological threats, a core market for the company.

The U.S. government's commitment to maintaining critical medical countermeasures within its biodefense stockpile is a foundational element for Emergent's business model, ensuring consistent demand for their offerings.

| Factor | Description | Impact on Emergent BioSolutions | Data Point/Example |

| Government Funding & Appropriations | Reliance on U.S. government contracts and grants for medical countermeasures. | Directly impacts revenue and operational capacity. | Over $250 million in HHS contract modifications in 2024 for medical countermeasures. |

| Biodefense & National Security Focus | Political prioritization of preparedness and response to biological threats. | Drives demand for Emergent's specialized products and services. | Alliance for Biosecurity advocacy for sustained FY2025 federal funding for biosecurity initiatives. |

| Regulatory Environment (FDA) | FDA approval pathways and evolving guidance for biologics. | Shapes product development, market access, and commercialization. | FDA's 2025 guidance agenda focusing on microbial methods and cell/gene therapy potency. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Emergent BioSolutions, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights for strategic decision-making by highlighting key trends and their potential impact on the company's operations and future growth.

A concise PESTLE analysis of Emergent BioSolutions provides a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient decision-making.

Economic factors

Government budget allocations for health security are a critical economic factor for Emergent BioSolutions, directly influencing its revenue through contracts for medical countermeasures and stockpiling initiatives. For instance, the US government's continued investment in national biodefense programs, a significant portion of which is allocated to entities like Emergent, provides a stable, albeit fluctuating, revenue base. This spending is often tied to geopolitical events and public health preparedness, making it sensitive to broader economic conditions and competing government priorities.

The financial performance of Emergent BioSolutions is closely tied to these government expenditures. In its Q1 2025 earnings report, the company highlighted that revenues derived from contracts and grants saw an increase, which helped to buffer declines in other product segments. This underscores how vital government funding for health security remains as a key economic driver for the company's overall financial health and its ability to pursue future development and manufacturing contracts.

Broader global economic conditions, including inflation and economic growth, directly impact the affordability and demand for Emergent BioSolutions' products. For instance, higher inflation can reduce consumer purchasing power for commercial offerings like NARCAN®, while slower economic growth might constrain public health funding, affecting demand for government-contracted products.

Emergent BioSolutions experienced a significant revenue drop in Q4 2024, with its 2025 revenue forecast suggesting a continued potential decrease. This financial performance is indicative of the company navigating challenging macroeconomic headwinds and implementing strategic adjustments in response to evolving market dynamics and healthcare spending trends.

The biopharmaceutical and contract development and manufacturing organization (CDMO) sectors are intensely competitive, directly impacting pricing and market share dynamics for companies like Emergent BioSolutions. This fierce competition can lead to significant pricing pressures as companies vie for contracts and market dominance.

The biologics contract manufacturing market, a key area for CDMOs, is a prime example of this competitive environment. Projections indicate this market will reach USD 58 billion by 2035, signaling substantial growth but also underscoring the high level of competition companies must navigate to capture a significant portion of this expanding market.

Research and development investment trends

Public and private investment in biopharmaceutical research and development (R&D) significantly shapes Emergent BioSolutions' business. While Emergent's own R&D spending remained steady between Q1 2024 and Q1 2025, the overall industry trend toward investing in novel therapeutic areas, such as cell and gene therapies, is a key driver for contract development and manufacturing organizations (CDMOs) like Emergent. This increased focus on advanced modalities directly translates to greater demand for specialized CDMO services.

The biopharmaceutical R&D landscape is dynamic. For instance, in 2024, global biopharma R&D spending was projected to exceed $250 billion, with a notable portion allocated to emerging technologies. This sustained investment in innovation fuels the need for external manufacturing and development partners, benefiting companies positioned to support these advanced pipelines.

- Increased CDMO Demand: Growing investment in cell and gene therapies, a rapidly expanding segment of biopharma R&D, directly boosts the need for specialized CDMO services.

- Pipeline Impact: Trends in R&D investment influence the types of new therapies being developed, which in turn affects the potential pipeline opportunities for Emergent.

- Industry Investment Levels: The broader industry's commitment to R&D, projected to remain robust, provides a generally favorable environment for companies supporting drug development.

Currency fluctuations and global supply chain costs

Currency fluctuations present a significant economic challenge for global companies like Emergent BioSolutions. For instance, a strengthening US dollar in 2024 could make Emergent's products more expensive for international buyers, potentially dampening sales in key overseas markets. Conversely, a weaker dollar could increase the cost of imported raw materials and components essential for manufacturing medical countermeasures, impacting overall profitability.

The reliance on a global supply chain for medical countermeasures means that Emergent is exposed to a variety of economic factors beyond currency. Rising transportation costs, labor shortages in manufacturing hubs, and geopolitical instability can all contribute to increased supply chain expenses. For example, increased shipping rates observed throughout 2024 have directly added to the cost of bringing components and finished goods to market.

- Impact of Currency: A stronger USD can reduce the competitiveness of Emergent's products in international markets, while a weaker USD increases the cost of imported materials.

- Supply Chain Vulnerabilities: Global supply chain disruptions, including rising freight costs and material scarcity, directly inflate the cost of producing medical countermeasures.

- Contract Manufacturing Costs: Increased reliance on contract manufacturers, a trend observed in the pharmaceutical sector, can add another layer of cost variability influenced by economic conditions.

- Economic Volatility: The interplay of currency swings and supply chain pressures creates economic volatility that requires robust cost management and supply chain resilience strategies for Emergent.

Government budget allocations for health security remain a primary economic driver for Emergent BioSolutions, directly impacting its revenue through contracts for medical countermeasures and stockpiling. The company's Q1 2025 earnings highlighted increased revenue from government contracts, underscoring their crucial role in financial stability. However, these expenditures are sensitive to broader economic conditions and competing government priorities, creating a fluctuating revenue base.

Same Document Delivered

Emergent BioSolutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Emergent BioSolutions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

You'll gain valuable insights into the external forces shaping Emergent BioSolutions' business landscape, enabling informed decision-making. The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable report.

Sociological factors

Public perception and trust in vaccines and medical countermeasures are paramount for companies like Emergent BioSolutions, especially concerning infectious diseases and biodefense. Low trust can directly impact product adoption and government policy support, which are critical for their business model. For instance, in 2023, a significant portion of the population expressed concerns about vaccine safety, a sentiment that can spill over into broader medical countermeasures.

Emergent BioSolutions' reliance on government contracts for products like anthrax and smallpox vaccines means that public sentiment, often amplified by media narratives, can sway political will and funding. Maintaining transparency about product efficacy and safety is therefore not just a matter of public health but a direct business imperative. Surveys in late 2024 indicated that while confidence in established vaccines remained high, emerging threats and new countermeasures faced greater scrutiny, highlighting the need for proactive communication strategies.

Societal awareness and concern regarding biological threats, including emerging infectious diseases and potential pandemics, directly fuel demand for preparedness products and services. This heightened awareness translates into a greater perceived need for solutions that protect both civilian and military populations.

The ongoing global health landscape, marked by recent outbreaks and persistent threats, underscores the critical importance of medical countermeasures. For instance, the significant global investment in pandemic preparedness, with many nations increasing their biodefense budgets following the COVID-19 pandemic, highlights this societal driver.

Ethical considerations surrounding biodefense product development, stockpiling, and deployment are paramount. Issues of equitable access to life-saving countermeasures and ensuring informed consent for their use can significantly shape public policy and corporate social responsibility. Navigating these complex ethical landscapes is crucial for maintaining public trust and support for Emergent BioSolutions' critical mission.

Demographic shifts and public health needs

Demographic shifts, like the aging global population, are increasing the demand for healthcare solutions and medical countermeasures. For instance, by 2030, the number of people aged 65 and over is projected to reach 1.1 billion globally, a significant increase that directly impacts public health priorities and the types of products needed.

Emergent BioSolutions' strategy, which caters to both civilian and military populations, necessitates a keen awareness of these evolving public health landscapes. The company's product portfolio, including vaccines and therapeutics, must adapt to changing disease prevalence and the specific health needs of diverse age groups and user segments.

- Aging Population Growth: Global population aged 65+ expected to hit 1.1 billion by 2030, driving demand for elder care and related health solutions.

- Shifting Disease Burden: Increased prevalence of chronic diseases alongside ongoing infectious disease threats requires a broad product development approach.

- Military Health Requirements: Evolving global security landscapes necessitate specialized medical countermeasures for deployed personnel.

Workforce availability and skilled labor

The availability of a skilled workforce in the life sciences, especially in areas like biomanufacturing and research, is a significant sociological factor for Emergent BioSolutions. This skilled labor pool directly influences the company's ability to operate efficiently and expand its services. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in the employment of biological technicians from 2022 to 2032, indicating a competitive landscape for specialized talent.

Attracting and keeping talented individuals in niche fields such as biodefense and medical countermeasures is crucial for Emergent's ongoing innovation and production capabilities. The demand for these specialized skills often outstrips supply, creating challenges. In 2024, reports indicated a global shortage of experienced biopharmaceutical manufacturing professionals, a trend likely to persist.

- Biomanufacturing Expertise: Emergent relies heavily on a workforce proficient in complex biological processes and quality control.

- Research and Development Talent: The company needs scientists and researchers skilled in immunology, virology, and related fields for new product development.

- Talent Acquisition Challenges: Competition for highly specialized life science professionals can impact hiring timelines and costs.

- Workforce Retention: Maintaining a stable and experienced team is vital for consistent operational performance and knowledge transfer.

Public trust in medical countermeasures is a critical sociological factor for Emergent BioSolutions, directly influencing demand and government support. Concerns about vaccine safety, as seen in public sentiment surveys in 2023, can impact adoption rates for new products. The company's reliance on government contracts means public opinion, often shaped by media, can influence policy and funding decisions.

Societal awareness of biological threats, heightened by recent outbreaks, drives demand for preparedness solutions. This increased concern fuels investment in biodefense, with many nations boosting budgets post-COVID-19. Emergent's strategy must align with these evolving public health priorities.

Ethical considerations, such as equitable access to countermeasures and informed consent, are vital for maintaining public trust and support. Demographic shifts, like the growing aging population, also shape demand for healthcare solutions, requiring adaptable product portfolios.

A skilled life sciences workforce is essential for Emergent BioSolutions' operations and innovation. The company faces challenges in acquiring and retaining talent in specialized areas like biomanufacturing and research, with reports indicating a global shortage of experienced professionals in 2024.

| Sociological Factor | Impact on Emergent BioSolutions | Supporting Data/Trend |

|---|---|---|

| Public Trust & Perception | Influences product adoption and government funding. | Concerns over vaccine safety persist; proactive communication is key. |

| Societal Awareness of Threats | Drives demand for biodefense and preparedness products. | Increased global investment in pandemic preparedness post-COVID-19. |

| Ethical Considerations | Shapes public policy and corporate social responsibility. | Equitable access and informed consent are critical for public support. |

| Demographic Shifts | Alters healthcare needs and product demand. | Aging population growth (1.1 billion 65+ by 2030) increases demand for elder care solutions. |

| Skilled Workforce Availability | Impacts operational efficiency and innovation. | Global shortage of biopharmaceutical manufacturing professionals reported in 2024. |

Technological factors

Rapid progress in vaccine and therapeutic development, especially with platforms like mRNA and viral vectors, presents significant opportunities for Emergent BioSolutions to expand its offerings. These advancements allow for quicker development cycles and potentially more effective treatments.

The integration of artificial intelligence and machine learning is a game-changer, accelerating the identification of vaccine targets and improving the prediction of immune responses. This technological leap can streamline Emergent's R&D pipeline.

Innovations in biomanufacturing, like the adoption of single-use technologies and advanced process optimization, are significantly boosting efficiency and lowering production costs for critical medical countermeasures. This trend is vital for companies like Emergent BioSolutions to effectively manage large government contracts and scale their contract development and manufacturing organization (CDMO) services.

For instance, the biopharmaceutical industry saw substantial investment in advanced manufacturing technologies throughout 2024, with a focus on flexible and scalable solutions. This directly supports Emergent BioSolutions' ability to respond rapidly to public health emergencies and fulfill large-scale procurement orders, as demonstrated by their ongoing work with government agencies.

The development of rapid and accurate diagnostic technologies for biological and chemical threats significantly impacts the demand for medical countermeasures. For instance, advancements in point-of-care diagnostics, which became increasingly crucial during the COVID-19 pandemic, allow for faster identification of pathogens, leading to more targeted treatment and a potential shift in stockpiling needs. Emergent BioSolutions, as a provider of such countermeasures, must adapt its production and inventory strategies based on these diagnostic capabilities.

Application of AI and data analytics in R&D and operations

Emergent BioSolutions is increasingly leveraging artificial intelligence and data analytics to streamline its research and development processes and bolster operational efficiency. These advanced technologies are proving invaluable in accelerating drug discovery and development, as well as optimizing complex supply chain management. For instance, AI can rapidly analyze vast datasets, including genomic information, to identify potential drug candidates and predict patient responses, thereby shortening crucial development timelines.

The integration of AI and data analytics offers tangible benefits across Emergent's operations:

- Accelerated Drug Discovery: AI algorithms can sift through millions of molecular compounds, identifying promising candidates for further investigation at a pace far exceeding traditional methods.

- Enhanced Clinical Trial Efficiency: Data analytics can optimize patient selection for clinical trials, predict trial outcomes, and identify potential issues early, leading to more efficient and cost-effective trials.

- Optimized Supply Chain: Predictive analytics can forecast demand, manage inventory levels, and identify potential disruptions in the supply chain, ensuring timely delivery of critical products.

- Improved Manufacturing Processes: AI can monitor and optimize manufacturing parameters, leading to higher yields, reduced waste, and improved product quality.

Biotechnology advancements for novel countermeasures

Broader advancements in biotechnology, such as CRISPR gene editing and synthetic biology, are creating new avenues for developing innovative medical countermeasures. These powerful tools can accelerate the creation of treatments for diseases that were once considered untreatable or for rapidly emerging public health threats.

Emergent BioSolutions' ability to stay ahead in these rapidly evolving technological fields is crucial for maintaining its competitive edge. By integrating cutting-edge biotech, the company can better position itself to tackle future health crises and develop effective solutions.

For instance, the global biotechnology market was valued at approximately $1.37 trillion in 2023 and is projected to reach over $2.2 trillion by 2030, indicating significant investment and growth in this sector. Emergent's focus on these areas directly aligns with this expanding market.

- Gene Editing Capabilities: Technologies like CRISPR-Cas9 allow for precise modification of DNA, enabling the development of targeted therapies for genetic disorders and infectious diseases.

- Synthetic Biology Applications: This field enables the design and construction of new biological parts, devices, and systems, which can be used to produce novel vaccines, diagnostics, and therapeutics.

- Accelerated Drug Discovery: AI-driven platforms are now being integrated with biotech advancements to speed up the identification and validation of potential drug candidates, reducing development timelines.

- Personalized Medicine: Biotechnological progress is paving the way for more personalized medical countermeasures, tailored to individual genetic profiles and specific disease characteristics.

Advancements in mRNA and viral vector technologies are enabling faster development of vaccines and therapeutics, directly benefiting Emergent BioSolutions' product pipeline and response capabilities. The integration of AI and machine learning is significantly accelerating drug discovery and optimizing manufacturing processes, as seen in the projected growth of the AI in drug discovery market, which was estimated to be around $2.5 billion in 2023 and is expected to grow substantially.

Innovations in biomanufacturing, such as single-use technologies, are enhancing production efficiency and scalability, crucial for meeting large government contracts. The increasing sophistication of diagnostic tools also directly influences demand for countermeasures, requiring Emergent to adapt its inventory and production strategies.

Emergent BioSolutions is actively leveraging AI and data analytics to streamline R&D and improve operational efficiency. For example, AI can accelerate the identification of drug candidates by analyzing vast datasets, potentially shortening development timelines significantly.

The company's focus on cutting-edge biotechnology, including gene editing and synthetic biology, aligns with the expanding global biotech market, which was valued at approximately $1.37 trillion in 2023. These technologies open new avenues for developing innovative medical countermeasures.

Legal factors

Emergent BioSolutions’ ability to bring its products to market hinges critically on navigating the stringent approval processes of the FDA and its international counterparts. These regulatory bodies, including the European Medicines Agency (EMA) and Health Canada, impose rigorous standards for safety, efficacy, and manufacturing quality, directly influencing development timelines and market access.

The FDA's ongoing revisions to biologics license application requirements and guidance, particularly those referencing the Public Health Service Act, present a dynamic landscape for Emergent. For instance, in early 2024, the FDA continued to emphasize robust data submission for novel biologics, potentially extending review periods for complex products.

Emergent BioSolutions heavily relies on intellectual property, particularly patents, to safeguard its innovative medical countermeasures and unique manufacturing techniques. This protection is vital for maintaining its competitive edge in the biopharmaceutical market. For instance, in 2023, Emergent reported $1.1 billion in revenue, underscoring the commercial importance of its product portfolio, which is built upon protected technologies.

The complexities of patent litigation and the regulatory exclusivity periods granted to biologics present significant financial implications for Emergent. Navigating these legal frameworks directly impacts the company's ability to achieve market exclusivity and sustain profitability for its key products, such as Narcan nasal spray and its anthrax vaccines.

Emergent BioSolutions must navigate a complex web of product liability laws and stringent safety regulations, especially concerning its medical countermeasures used during public health crises. Failure to adhere to these standards, which are critical for ensuring public trust and efficacy, can lead to significant legal repercussions and damage to the company's reputation.

The company's history includes challenges related to product quality and safety, underscoring the importance of robust compliance. For instance, in 2021, the FDA halted production at its Bayview facility due to quality control issues, impacting the supply of COVID-19 vaccines. This event highlights the direct link between regulatory compliance and operational continuity, with potential financial implications stemming from production stoppages and remediation efforts.

Government contract compliance and procurement laws

Emergent BioSolutions’ significant reliance on government contracts means strict adherence to complex compliance and procurement laws is critical. These regulations govern everything from product quality and manufacturing processes to delivery timelines and pricing. Failure to meet these exacting standards can result in severe consequences, including financial penalties and the termination of lucrative agreements.

For instance, in 2023, the company faced scrutiny and potential penalties related to its COVID-19 vaccine manufacturing contracts, highlighting the direct impact of compliance failures. The U.S. government's procurement process, particularly for critical medical supplies, involves rigorous oversight and strict contractual obligations.

- Contractual Obligations: Emergent must meticulously follow terms related to supply chain integrity, product specifications, and delivery schedules for government orders.

- Regulatory Scrutiny: The company is subject to ongoing audits and reviews by government agencies like the FDA and Department of Defense to ensure ongoing compliance.

- Procurement Law Impact: Changes in U.S. federal procurement policies, such as those affecting sole-source contracts or domestic manufacturing requirements, directly influence Emergent's business operations and revenue streams.

- Risk of Penalties: Non-compliance can lead to financial penalties, debarment from future government contracts, or termination of existing agreements, impacting revenue and reputation.

International trade regulations and export controls

International trade regulations and export controls significantly influence Emergent BioSolutions' global operations. For instance, the company's reliance on distributing medical countermeasures worldwide means it must meticulously adhere to varying import duties and trade agreements. These regulations directly affect product accessibility and cost in key markets, impacting Emergent's ability to fulfill global health needs.

Navigating these complex legal landscapes is critical for Emergent's supply chain efficiency and market penetration. Failure to comply can lead to delays, penalties, and restricted market access, hindering the company's mission to support global preparedness. For example, adherence to export control regimes, such as those managed by the U.S. Department of Commerce, is paramount for any company dealing with sensitive biological materials or technologies.

Emergent BioSolutions' global reach means it must stay abreast of evolving international trade policies. Changes in tariffs or the imposition of new export restrictions could directly impact the cost and availability of its products, such as vaccines and therapeutics, in regions like Europe or Asia. The company's 2023 annual report highlights ongoing efforts to manage these international legal complexities as part of its strategic operational planning.

Emergent BioSolutions operates under a strict legal framework, heavily influenced by global regulatory bodies like the FDA and EMA. These entities dictate product safety, efficacy, and manufacturing standards, directly impacting market entry and development timelines. The company's reliance on intellectual property, particularly patents, is crucial for protecting its innovations and maintaining market exclusivity, as seen in its 2023 revenue of $1.1 billion, which reflects the commercial value of its patented technologies.

Product liability and safety regulations are paramount, especially for medical countermeasures used in public health emergencies. Past incidents, such as the 2021 FDA halt at its Bayview facility due to quality control issues, underscore the severe consequences of non-compliance, including production stoppages and reputational damage. Furthermore, Emergent's significant dependence on government contracts necessitates rigorous adherence to complex procurement laws and compliance standards, with potential penalties for failures, as evidenced by scrutiny over its COVID-19 vaccine contracts in 2023.

| Legal Factor | Impact on Emergent BioSolutions | Example/Data Point |

|---|---|---|

| Regulatory Approvals | Dictates market access and development timelines for products. | FDA and EMA standards for safety, efficacy, and manufacturing. |

| Intellectual Property | Protects innovations and ensures market exclusivity. | $1.1 billion revenue in 2023, reflecting value of protected technologies. |

| Product Liability & Safety | Mandates adherence to standards for public health products. | 2021 FDA halt at Bayview facility due to quality control issues. |

| Government Contracts | Requires strict compliance with procurement laws and standards. | Scrutiny over COVID-19 vaccine contracts in 2023; potential penalties. |

| International Trade | Affects global distribution, accessibility, and cost of products. | Adherence to export controls and import duties in various markets. |

Environmental factors

Climate change is a significant factor in the emergence and spread of new infectious diseases. As global temperatures rise, the geographic ranges of disease-carrying vectors like mosquitoes and ticks are expanding, bringing novel pathogens to new populations. This environmental shift directly fuels the ongoing demand for medical countermeasures, a core area of focus for Emergent BioSolutions.

The pharmaceutical industry, including companies like Emergent BioSolutions, faces increasing pressure to adopt robust sustainability practices in manufacturing and supply chains. This involves minimizing waste, improving energy efficiency, and ensuring responsible resource management throughout their operations.

For Emergent BioSolutions, embracing these eco-friendly approaches is crucial. For instance, a focus on reducing hazardous waste in biopharmaceutical production can lead to significant cost savings and a stronger environmental footprint. Companies that prioritize sustainability often see a boost in their corporate reputation, attracting environmentally conscious investors and customers.

Furthermore, adhering to evolving environmental regulations is not just a compliance issue but a strategic advantage. As of early 2024, many global markets are implementing stricter standards for carbon emissions and waste disposal, directly influencing manufacturing processes and supply chain logistics for companies like Emergent.

Strict regulations govern the safe handling and disposal of biological materials and pharmaceutical by-products, impacting companies like Emergent BioSolutions. Failure to comply can lead to significant fines and reputational damage.

As a manufacturer of biologics, Emergent must adhere to stringent environmental and health safety standards to prevent contamination and ensure public safety. This includes managing waste from its Bayview facility, which experienced heightened scrutiny in recent years.

Environmental impact assessments for facilities

Emergent BioSolutions, like any company in the biopharmaceutical sector, faces significant environmental considerations for its facilities. New manufacturing sites or substantial expansions often necessitate thorough environmental impact assessments (EIAs). These assessments are critical for understanding and mitigating potential effects on local ecosystems, water resources, and air quality. For instance, in 2023, regulatory bodies continued to scrutinize facility expansions, with EIA processes potentially adding several months to project timelines and incurring substantial costs for specialized studies and reporting.

Compliance with a growing array of environmental protection laws is not just a legal requirement but a fundamental aspect of operational viability for Emergent BioSolutions' production sites. These regulations cover everything from waste management and emissions control to water usage and chemical handling. Failure to adhere to these standards can result in hefty fines, operational shutdowns, and severe reputational damage. The company's commitment to environmental stewardship is therefore directly linked to its ability to maintain and expand its manufacturing capabilities.

- Environmental Impact Assessments (EIAs): New manufacturing facilities or expansions require comprehensive EIAs, adding to regulatory hurdles and development schedules.

- Regulatory Burden: Compliance with environmental protection laws is essential for establishing and operating production sites, influencing project timelines and costs.

- Operational Viability: Adherence to environmental standards is crucial for maintaining uninterrupted operations and avoiding penalties.

- Sustainability Focus: Growing global emphasis on sustainability may lead to stricter environmental regulations, impacting future facility planning and operational practices.

Resource scarcity and impact on raw material sourcing

The increasing global focus on sustainability and climate change presents potential challenges for companies like Emergent BioSolutions. Environmental factors can lead to resource scarcity, which directly impacts the availability and cost of raw materials crucial for manufacturing medical countermeasures. For instance, disruptions in agricultural yields due to extreme weather events could affect the supply of biological components used in vaccine production.

A robust and adaptable supply chain is therefore paramount. Emergent BioSolutions must proactively assess and mitigate environmental risks that could disrupt the sourcing of essential raw materials. This includes diversifying suppliers and exploring alternative materials to ensure the continuous production of life-saving products.

- Supply chain resilience: Investments in supply chain visibility and flexibility are critical to navigate potential disruptions caused by climate-related events.

- Cost implications: Resource scarcity can drive up the cost of raw materials, potentially impacting the overall profitability and pricing of Emergent BioSolutions' products.

- Geopolitical factors: Environmental degradation can exacerbate geopolitical instability, further complicating international sourcing and trade of critical components.

- Regulatory landscape: Evolving environmental regulations may necessitate changes in sourcing practices and manufacturing processes, requiring ongoing adaptation.

Climate change is a significant driver for Emergent BioSolutions, as it fuels the demand for medical countermeasures due to the expanding ranges of disease vectors. For example, the increased incidence of vector-borne diseases in North America in 2024 directly correlates with warmer temperatures and altered precipitation patterns. The company must also navigate stringent environmental regulations, such as those concerning waste disposal and emissions, which can impact manufacturing costs and timelines. In 2023, stricter EPA guidelines for pharmaceutical waste management, for instance, required investments in new processing technologies, adding to operational expenses.

PESTLE Analysis Data Sources

Our PESTLE analysis for Emergent BioSolutions is built on a comprehensive review of government regulatory filings, public health data from international organizations, and reports from leading financial and market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.