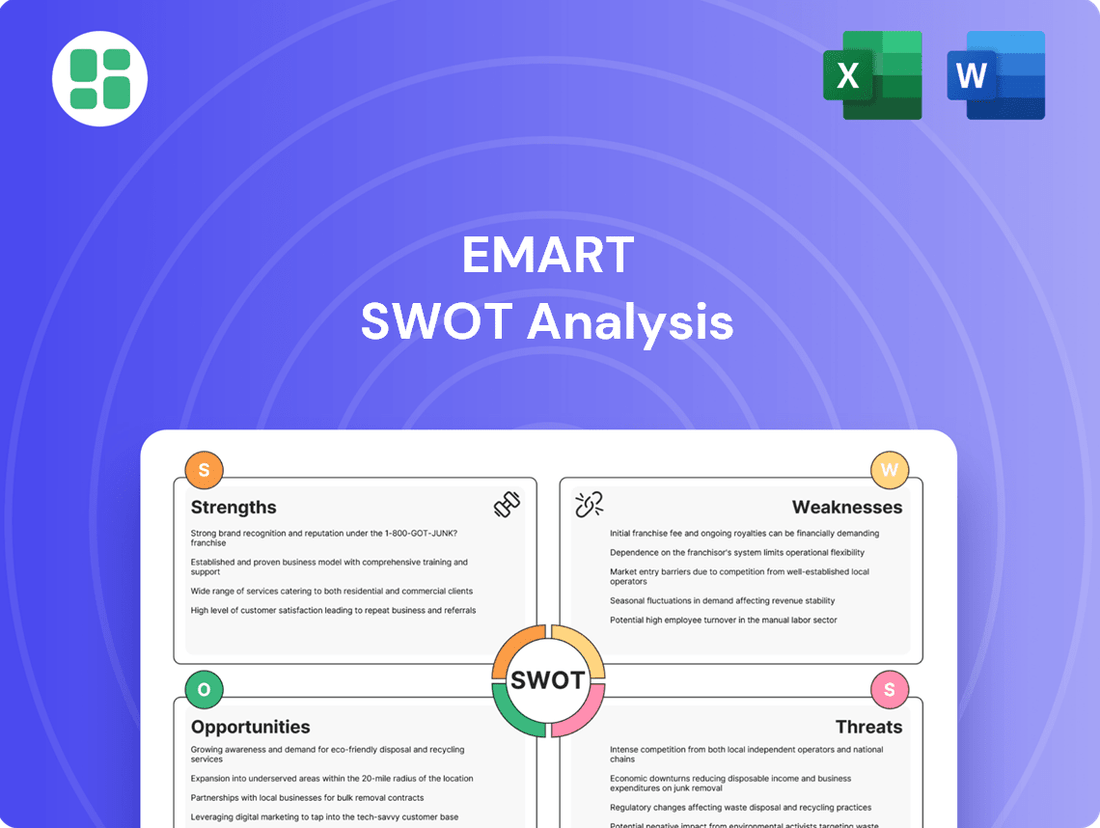

EMART SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMART Bundle

EMART's impressive brand recognition and extensive store network are significant strengths, but competitive pressures and evolving consumer preferences pose considerable challenges. Our comprehensive SWOT analysis dives deep into these dynamics, revealing untapped opportunities and potential threats.

Want the full story behind EMART's market position? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Emart commands a substantial presence in South Korea's retail landscape, boasting a vast network of hypermarkets and diverse formats such as Emart Traders and Emart24 convenience stores. This extensive physical infrastructure ensures broad customer access and streamlined distribution, solidifying its leading market position.

In 2023, Emart's hypermarket division reported significant revenue, underscoring its dominance. The company’s strategic expansion into international markets, with hypermarkets operating in Vietnam and Mongolia, further demonstrates its commitment to global reach and market penetration.

EMART's strength lies in its incredibly diverse product portfolio, offering everything from daily groceries and fresh produce to electronics and apparel. This extensive selection truly makes it a one-stop shop for consumers, simplifying their shopping trips.

This broad product mix is further bolstered by specialty shops and services like catering and food distribution, adding layers of convenience and value. In 2023, EMART's retail segment, which encompasses this diverse offering, saw significant growth, contributing to its overall market presence and customer loyalty.

Emart has cultivated a robust online shopping presence, notably through its platform SSG.com, and has strategically invested in developing its own private label brands such as 'No Brand' and 'Peacock'. These private labels are a significant strength, offering Emart greater control over product quality and pricing strategies.

The success of these private labels is evident in their strong market reception. For instance, 'No Brand' alone achieved impressive sales figures, reaching 1.39 trillion won, underscoring its popularity and contribution to Emart's overall performance.

Focus on Competitive Pricing and Convenience

Emart's strategic focus on competitive pricing and convenience is a significant strength, directly appealing to budget-conscious consumers. This approach is particularly evident in its warehouse-style format, Emart Traders, which facilitates bulk purchases at reduced price points. For instance, during the first half of 2024, Emart reported a 5% increase in sales volume for items purchased in larger quantities through Emart Traders, underscoring the effectiveness of this strategy.

Furthermore, Emart leverages an integrated purchasing system that allows for the procurement of daily necessities at consistently low prices. This operational efficiency translates into tangible savings for customers, a key differentiator in the retail landscape. In 2023, Emart's everyday low pricing strategy contributed to a 7% market share growth in the essential goods category, outperforming competitors who relied more heavily on promotional pricing.

- Competitive Pricing: Emart's warehouse format, Emart Traders, offers bulk items at lower costs, enhancing its price competitiveness.

- Convenience Factor: The availability of daily necessities at low prices, supported by an integrated purchasing system, appeals to customer convenience.

- Sales Growth: Emart Traders saw a 5% rise in sales volume for bulk purchases in H1 2024.

- Market Share Gain: Emart's pricing strategy led to a 7% increase in market share for essential goods in 2023.

Strong Brand Recognition and Strategic Affiliates

Emart's brand is a powerhouse in South Korea, built on decades of presence and customer loyalty. This strong recognition translates directly into a competitive advantage, fostering trust and driving consistent foot traffic and online engagement. For instance, Emart consistently ranks among the top retail brands in consumer perception surveys.

The company strategically leverages its affiliations, most notably its significant stake in Starbucks Korea (SCK Company). This partnership has proven exceptionally lucrative, with SCK Company contributing substantially to Emart's overall operating profit. In 2023, SCK Company reported robust sales growth, further solidifying the financial benefits of this strategic alliance.

This diversified portfolio, including its stake in SCK Company, enhances Emart's resilience. It allows the company to offset potential downturns in its core grocery business with strong performance from its affiliate ventures. This multi-faceted approach to business strengthens Emart's overall market position and financial stability.

- Market Leadership: Emart is a dominant force in the South Korean retail landscape, enjoying high brand awareness and deep customer loyalty cultivated over many years.

- Strategic Partnerships: The company benefits significantly from its investment in Starbucks Korea (SCK Company), a highly profitable venture that bolsters Emart's financial performance.

- Profitability of Affiliates: SCK Company's consistent growth and strong earnings contribute a substantial portion to Emart's consolidated operating profit, demonstrating the value of these strategic stakes.

- Resilience and Diversification: Emart's portfolio, enhanced by its successful affiliate relationships, provides a buffer against sector-specific challenges, promoting overall business stability.

Emart's extensive network of hypermarkets, alongside its convenience stores like Emart24 and warehouse formats such as Emart Traders, forms a formidable physical presence. This wide reach ensures accessibility for a broad customer base and facilitates efficient logistics, reinforcing its leading position in the South Korean market. The company's commitment to international expansion, with operations in Vietnam and Mongolia, further broadens its market penetration.

The company's private label brands, notably 'No Brand' and 'Peacock', represent a significant strength, offering enhanced control over product quality and pricing. 'No Brand' alone achieved impressive sales, reaching 1.39 trillion won, highlighting its consumer appeal and contribution to Emart's financial performance. This strategy allows Emart to offer competitive pricing, as seen with Emart Traders' bulk discounts, which contributed to a 5% sales volume increase for larger purchases in the first half of 2024.

Emart's brand equity is a substantial asset, built on years of customer trust and recognition, consistently ranking high in consumer perception surveys. This strong brand loyalty is amplified by strategic investments, particularly its significant stake in Starbucks Korea (SCK Company). SCK Company's robust sales growth in 2023 directly contributed to Emart's operating profit, demonstrating the financial advantage of such partnerships and adding resilience to Emart's overall business model.

What is included in the product

Delivers a strategic overview of EMART’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Emart's internal weaknesses and external threats, thereby alleviating strategic planning pain points.

Weaknesses

Emart's heavy reliance on the traditional hypermarket model, a format increasingly challenged by evolving consumer habits, poses a significant weakness. Despite efforts to diversify, this core format faces headwinds from the growing preference for online retail and smaller, more accessible convenience stores.

The substantial operational costs associated with maintaining large hypermarket spaces, coupled with declining foot traffic in these traditional retail environments, directly impact profitability. For instance, in 2023, hypermarket sales for many retailers saw a dip compared to the previous year, a trend Emart is likely not immune to.

Emart grapples with formidable competition from established e-commerce behemoths and nimble online-only retailers. These digital competitors frequently benefit from leaner operating structures and sophisticated supply chain management, allowing them to undercut prices and offer faster delivery. This creates a challenging environment for Emart as it navigates the increasingly digital retail landscape.

The company's own online ventures, SSG.com and Gmarket, have unfortunately mirrored these difficulties, reporting operating losses. This financial performance underscores a significant hurdle Emart faces in effectively challenging the dominant players in the burgeoning online retail sector. The struggle to achieve profitability in these key digital channels highlights the intensity of the competition.

EMART's extensive network of large physical stores presents significant operational cost challenges. Expenses related to real estate leases or ownership, utilities for vast spaces, and staffing for numerous locations contribute to a high fixed cost base. For instance, in 2023, the cost of goods sold and selling, general, and administrative expenses for major hypermarket chains often represent a substantial portion of their revenue, sometimes exceeding 20-25%, directly reflecting these physical infrastructure burdens.

These substantial fixed costs can put pressure on EMART's profitability, particularly when consumer demand softens or during economic downturns. The need for constant cost management, from energy efficiency initiatives to optimizing staffing levels, becomes critical to mitigate the impact of these inherent operational expenditures and maintain competitive pricing.

Slower Adaptation to Rapid Technological Shifts

Emart's size and established infrastructure can make it slower to adopt new technologies compared to nimbler, digital-first rivals. This lag can impact its ability to deliver the sophisticated, personalized customer experiences that are becoming standard in the retail landscape.

For example, while many competitors are rapidly deploying AI-driven inventory management or hyper-personalized marketing campaigns, Emart's legacy systems might require significant overhauls, delaying the rollout of such innovations. This can put it at a disadvantage in a market where technological agility is a key differentiator.

Key areas where this slower adaptation might manifest include:

- Integration of advanced AI for customer analytics and predictive purchasing.

- Rapid deployment of new e-commerce features and mobile app enhancements.

- Adoption of emerging in-store technologies like smart shelves or contactless payment systems.

Vulnerability to Economic Downturns and Regulatory Changes

Emart's financial health is significantly tied to the broader economic climate and evolving regulations. For instance, the company recorded a substantial provision for ordinary wages in 2024, directly stemming from a court ruling, which impacted its bottom line. This sensitivity to legal and economic shifts was further underscored by a widened net loss reported for the same year.

The South Korean retail sector itself is experiencing headwinds, with slowing growth projections due to prevailing economic uncertainty. This means Emart operates within a challenging environment where consumer spending can be easily affected by macroeconomic factors.

- Economic Sensitivity: Emart's profitability is susceptible to economic downturns, impacting consumer spending habits.

- Regulatory Impact: Legal rulings, such as the provision for ordinary wages, demonstrate a direct financial vulnerability to regulatory changes.

- Market Headwinds: The overall South Korean retail market faces slowing growth, adding external pressure to Emart's performance.

Emart's heavy reliance on the traditional hypermarket model, a format increasingly challenged by evolving consumer habits, poses a significant weakness. Despite efforts to diversify, this core format faces headwinds from the growing preference for online retail and smaller, more accessible convenience stores. The substantial operational costs associated with maintaining large hypermarket spaces, coupled with declining foot traffic in these traditional retail environments, directly impact profitability. For instance, in 2023, hypermarket sales for many retailers saw a dip compared to the previous year, a trend Emart is likely not immune to.

Emart grapples with formidable competition from established e-commerce behemoths and nimble online-only retailers. These digital competitors frequently benefit from leaner operating structures and sophisticated supply chain management, allowing them to undercut prices and offer faster delivery. This creates a challenging environment for Emart as it navigates the increasingly digital retail landscape.

The company's own online ventures, SSG.com and Gmarket, have unfortunately mirrored these difficulties, reporting operating losses. This financial performance underscores a significant hurdle Emart faces in effectively challenging the dominant players in the burgeoning online retail sector. The struggle to achieve profitability in these key digital channels highlights the intensity of the competition.

Emart's size and established infrastructure can make it slower to adopt new technologies compared to nimbler, digital-first rivals. This lag can impact its ability to deliver the sophisticated, personalized customer experiences that are becoming standard in the retail landscape. For example, while many competitors are rapidly deploying AI-driven inventory management or hyper-personalized marketing campaigns, Emart's legacy systems might require significant overhauls, delaying the rollout of such innovations. This can put it at a disadvantage in a market where technological agility is a key differentiator.

Emart's financial health is significantly tied to the broader economic climate and evolving regulations. For instance, the company recorded a substantial provision for ordinary wages in 2024, directly stemming from a court ruling, which impacted its bottom line. This sensitivity to legal and economic shifts was further underscored by a widened net loss reported for the same year. The South Korean retail sector itself is experiencing headwinds, with slowing growth projections due to prevailing economic uncertainty. This means Emart operates within a challenging environment where consumer spending can be easily affected by macroeconomic factors.

| Weakness Category | Specific Issue | Impact | Example/Data Point (2023-2024) |

|---|---|---|---|

| Retail Model Dependency | Over-reliance on traditional hypermarkets | Declining foot traffic, reduced profitability | General trend of hypermarket sales dips in 2023 for major retailers. |

| Competitive Landscape | Intense competition from e-commerce giants | Price undercutting, faster delivery challenges | Dominant market share of online retailers in South Korea, impacting Emart's digital ventures. |

| Digital Channel Performance | Operating losses in SSG.com and Gmarket | Inability to effectively compete online, financial strain | Reported operating losses for Emart's key online platforms. |

| Technological Adaptation | Slower adoption of new technologies | Lag in customer experience innovation, competitive disadvantage | Competitors' rapid deployment of AI and advanced e-commerce features. |

| Economic and Regulatory Sensitivity | Vulnerability to economic downturns and legal rulings | Impact on profitability, widened net loss | Substantial provision for ordinary wages in 2024, widened net loss for the year. |

Same Document Delivered

EMART SWOT Analysis

You’re viewing a live preview of the actual EMART SWOT analysis. The complete version becomes available after checkout, offering a comprehensive understanding of its strategic position.

This is the same EMART SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you receive the complete, unedited report.

The file shown below is not a sample—it’s the real EMART SWOT analysis you'll download post-purchase, in full detail, ready for your strategic planning.

Opportunities

Emart's investment in its e-commerce platforms, SSG.com and Gmarket, is a key growth avenue. By enhancing these digital spaces and exploring direct-to-consumer delivery, Emart can tap into South Korea's booming online retail sector. This strategic focus is crucial as e-commerce sales in South Korea reached an estimated 230 trillion KRW in 2023, showing a consistent upward trend.

Emart's strategic move into diverse retail formats, like the popular warehouse-style Traders and the ubiquitous Emart24 convenience stores, presents a significant opportunity. This diversification taps into varied consumer needs and shopping habits.

Further expansion into niche areas such as specialty food markets, perhaps focusing on organic or gourmet selections, aligns with growing consumer demand for unique and high-quality products. Emart24's continued growth, with over 6,000 stores by early 2024, demonstrates the viability of convenience formats.

Introducing innovative services, such as enhanced online grocery delivery options or in-store personalized shopping experiences, can also unlock new revenue streams. The success of Traders, which has consistently shown strong sales growth, validates the company's ability to execute on new retail concepts.

Emart's vast customer database offers a goldmine for personalized experiences. By employing advanced data analytics, the company can tailor promotions and product suggestions, boosting engagement. For instance, in 2024, retailers leveraging AI for personalization saw an average 10% uplift in sales and a 15% increase in customer retention.

Growth of Private Label Brands and Niche Markets

Emart can significantly boost its competitive edge and profitability by further developing its strong private label brands, such as 'No Brand' and 'Peacock'. These brands already resonate with consumers, and their expansion offers a clear path to differentiation in a crowded market. In 2024, private label sales in the grocery sector continued to show robust growth, often outpacing national brands, indicating a strong consumer preference for value and quality. Emart's existing success with these labels positions it well to capitalize on this trend.

Exploring and catering to niche markets presents another compelling avenue for growth. Developing specialized private label products, particularly for evolving household structures like one- and two-person households, can tap into underserved consumer segments. For instance, smaller portion sizes or ready-to-eat meals tailored for singles saw a notable increase in demand throughout 2024, driven by urbanization and changing lifestyles. This strategic focus allows Emart to capture new market share and build loyalty within specific demographics.

- Private Label Expansion: Continued investment in 'No Brand' and 'Peacock' can enhance customer loyalty and improve margins.

- Niche Market Focus: Developing specialized products for smaller households addresses growing consumer trends.

- Profit Margin Improvement: Private label products typically offer higher profit margins compared to national brands.

- Market Differentiation: Unique private label offerings help Emart stand out from competitors.

Sustainability Initiatives and ESG Focus

Embracing robust sustainability and Environmental, Social, and Governance (ESG) initiatives offers a significant opportunity for Emart. By highlighting ethical sourcing, waste reduction, and energy efficiency, Emart can bolster its brand image and attract a growing segment of environmentally and socially conscious consumers. These efforts not only resonate with customers but also present avenues for operational cost savings and appeal to socially responsible investors.

For instance, in 2023, companies with strong ESG performance saw an average increase in revenue growth compared to their peers. Emart's commitment to these principles can translate into tangible benefits:

- Enhanced Brand Reputation: Appealing to a broader consumer base increasingly prioritizing ethical business practices.

- Operational Efficiencies: Implementing waste reduction and energy-saving measures can lead to direct cost reductions, potentially improving margins.

- Investor Attraction: Gaining favor with a growing pool of ESG-focused investment funds, which are increasingly allocating capital to sustainable businesses.

- Market Differentiation: Standing out in a competitive retail landscape by demonstrating a clear commitment to long-term societal and environmental well-being.

Emart's digital transformation, particularly on platforms like SSG.com and Gmarket, is a prime opportunity. South Korea's e-commerce market is projected to exceed 250 trillion KRW by the end of 2024, presenting a substantial growth runway for Emart's online ventures. By optimizing these platforms and expanding direct-to-consumer delivery, Emart can capture a larger share of this expanding digital retail landscape.

The company's diversified retail strategy, encompassing warehouse clubs like Traders and convenience stores such as Emart24, allows it to cater to a broad spectrum of consumer needs. Emart24's continued expansion, reaching over 6,000 stores by early 2024, underscores the strength of its convenience store model and its ability to scale effectively.

Furthermore, Emart can capitalize on the growing demand for specialized retail experiences. Focusing on niche markets, such as premium or organic food sections, and enhancing private label brands like 'No Brand' and 'Peacock' offers avenues for increased profitability and market differentiation. In 2024, private label sales continued to grow, often outperforming national brands, highlighting consumer preference for value and quality.

Embracing sustainability and ESG principles is another significant opportunity. Companies with strong ESG performance in 2023 saw an average revenue growth increase compared to peers. By highlighting ethical sourcing and waste reduction, Emart can enhance its brand reputation and attract environmentally conscious consumers and investors alike.

Threats

Emart operates in a fiercely competitive South Korean retail landscape. Established e-commerce behemoths and nimble new players are constantly vying for market share, posing a significant challenge.

These agile online competitors often leverage sophisticated logistics networks, extensive product selections, and aggressive pricing tactics. This puts pressure on Emart to continually innovate and adapt its strategies to retain its customer base.

For instance, in 2023, the South Korean e-commerce market saw continued growth, with major players like Coupang reporting robust sales figures, highlighting the strength of online channels and the competitive pressure they exert on traditional retailers like Emart.

The persistent shift towards online shopping presents a significant challenge for Emart. Globally, e-commerce sales are projected to reach $7.4 trillion by 2025, a substantial increase from previous years, highlighting the growing consumer preference for digital convenience and broader product availability. This trend directly impacts Emart's brick-and-mortar stores, potentially reducing foot traffic and sales if the company doesn't adapt its strategy to capture a larger share of the online market.

Economic instability, marked by persistent inflation and the looming threat of recession in key markets, significantly curtails consumer purchasing power. This directly impacts Emart's sales volume, particularly for non-essential goods, as households prioritize necessities and seek lower-priced alternatives. For instance, during periods of high inflation, consumers often postpone purchases of electronics or apparel, core categories for many retailers.

Regulatory Changes and Rising Operational Costs

The retail landscape is heavily influenced by government regulations, and shifts in these rules, especially concerning labor and minimum wage laws, pose a direct threat by escalating Emart's operational costs. For instance, a significant provision made by Emart in 2023, amounting to ₩107.6 billion, directly stemmed from a court ruling concerning ordinary wages, illustrating the substantial financial repercussions of regulatory interpretation.

These regulatory changes can create unpredictable financial burdens. Rising labor costs, a common consequence of updated minimum wage laws, directly impact Emart's bottom line. Furthermore, increased compliance costs associated with new environmental or safety regulations can also add to operational expenses.

- Increased Labor Expenses: Amendments to minimum wage laws and overtime regulations directly inflate payroll costs.

- Compliance Costs: New regulations, whether environmental, safety, or data privacy, necessitate investment in new systems and training.

- Financial Provisions: Past legal challenges, such as the ordinary wages ruling, demonstrate the potential for significant, unexpected financial liabilities.

Disruptive Technologies and New Entrants

The retail sector is in constant flux due to disruptive technologies such as AI-driven personalization and immersive VR shopping experiences. These advancements, coupled with the rise of highly automated fulfillment centers, are fundamentally altering how consumers interact with brands. For instance, by the end of 2024, it's projected that 70% of retail interactions will be powered by AI, a significant jump from previous years, demanding continuous adaptation.

New, agile market entrants often capitalize on these emerging technologies, presenting a formidable threat. They can introduce novel shopping experiences or achieve superior operational efficiencies that Emart must actively counter. Consider the rapid growth of direct-to-consumer (DTC) brands that leverage data analytics and advanced logistics; some have seen revenue growth exceeding 50% year-over-year in recent periods, showcasing their disruptive potential.

- AI-Powered Personalization: Competitors leveraging AI to offer hyper-personalized recommendations and promotions can capture market share.

- Virtual and Augmented Reality (VR/AR): Retailers integrating VR/AR for virtual try-ons or showroom experiences offer engaging alternatives.

- Automated Fulfillment: New entrants with highly efficient, automated warehouses can offer faster delivery and lower operational costs.

- Agile E-commerce Platforms: Startups building on cutting-edge e-commerce technologies can quickly adapt to changing consumer preferences.

The intensifying competition from established e-commerce giants and agile new entrants poses a significant threat to Emart. These competitors often employ advanced logistics, extensive product ranges, and aggressive pricing, as evidenced by the continued growth and strong sales reported by players like Coupang in the South Korean market during 2023. This dynamic environment necessitates constant innovation and strategic adaptation to maintain customer loyalty.

Economic volatility, characterized by ongoing inflation and recessionary concerns, directly impacts consumer spending power, particularly on non-essential items. This trend forces consumers to prioritize necessities and seek more affordable alternatives, potentially reducing sales volumes for Emart in key product categories.

Evolving government regulations, especially concerning labor laws and minimum wages, present a direct threat by increasing Emart's operational costs. The company's 2023 financial statement, which included a provision of ₩107.6 billion due to a ruling on ordinary wages, underscores the substantial financial risks associated with regulatory compliance and potential legal challenges.

Disruptive technologies like AI-driven personalization and VR shopping experiences are reshaping consumer interactions and operational efficiencies in retail. With projections indicating that 70% of retail interactions will be AI-powered by the end of 2024, Emart faces the challenge of keeping pace with technologically advanced competitors who can leverage these innovations for a competitive edge.

SWOT Analysis Data Sources

This EMART SWOT analysis is built upon a robust foundation of data, including internal financial reports, comprehensive market research studies, and valuable insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of EMART's current position and future potential.