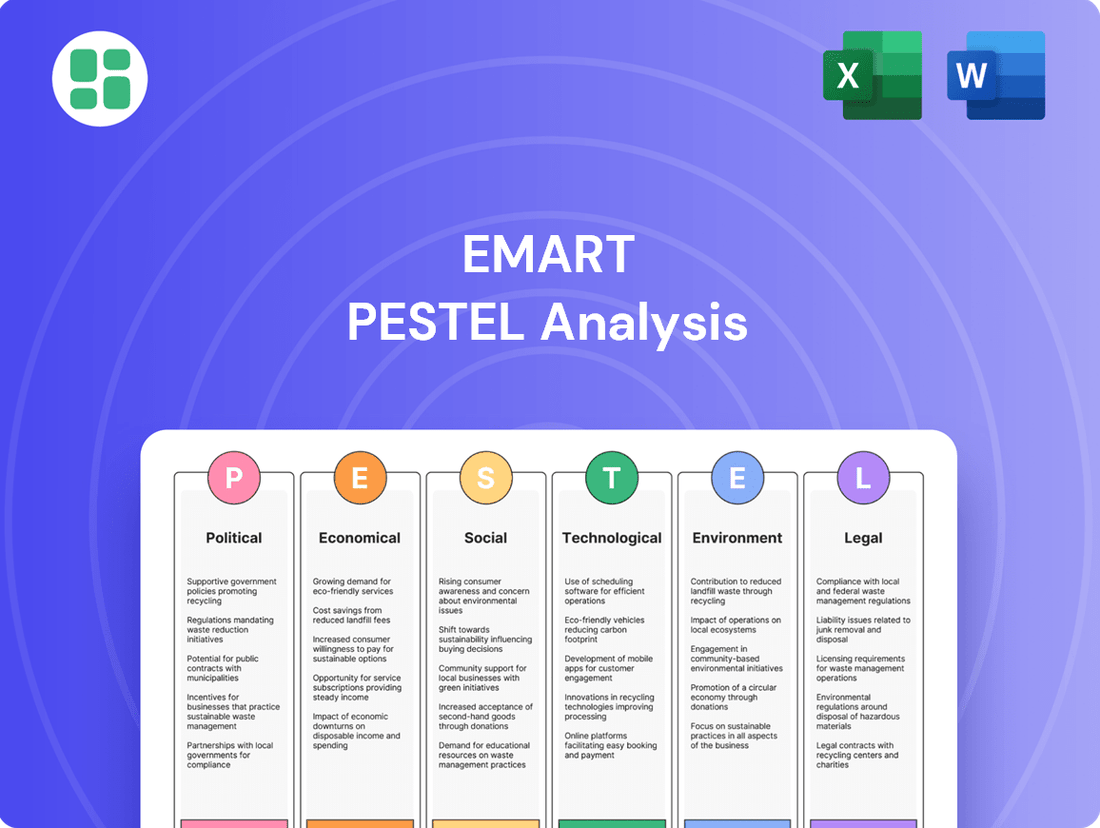

EMART PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMART Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping EMART's strategic landscape. Our comprehensive PESTLE analysis provides actionable insights, empowering you to anticipate challenges and capitalize on emerging opportunities. Don't just react to market shifts—lead them. Download the full PESTLE analysis now and gain the competitive intelligence you need to thrive.

Political factors

Government policies, like the recent relaxation of mandatory Sunday closures for large retailers in several regions, directly impact Emart's operational flexibility and potential sales. For instance, in South Korea, where Emart operates extensively, such deregulation allows for increased customer access, potentially boosting weekend revenue streams. These shifts aim to strike a balance between protecting traditional market vendors and meeting modern consumer demands for convenience, a dynamic that significantly influences Emart's physical store performance.

Furthermore, evolving regulations concerning online deliveries and e-commerce logistics play a crucial role in shaping Emart's digital strategy. Stricter rules on delivery times or packaging materials, for example, could necessitate adjustments to Emart's supply chain and last-mile delivery operations. As of early 2024, many governments are reviewing environmental regulations for logistics, which could impact Emart's delivery costs and operational efficiency in its online segment.

Changes in labor laws, particularly concerning minimum wage adjustments and the definition of ordinary wages, directly impact Emart's operating expenses. For example, recent legal decisions mandating the inclusion of periodic bonuses in ordinary wage calculations have compelled Emart to allocate significant financial provisions for both current wages and potential severance pay, reflecting a substantial increase in labor cost commitments.

Emart's extensive product range makes it highly sensitive to shifts in global trade agreements and import rules. For instance, the imposition of new tariffs on consumer electronics or apparel, common imports for retailers, could directly increase Emart's cost of goods sold. In 2024, the World Trade Organization reported a 5% increase in average applied tariffs globally, a trend that could pressure Emart's margins.

Changes in import regulations, such as stricter quality control checks or new labeling requirements for food products, can also disrupt Emart's supply chain. These adjustments might necessitate costly product reformulation or delays in product launches, impacting inventory turnover and consumer satisfaction. For example, new phytosanitary regulations introduced in late 2024 by a key exporting nation could affect Emart's fresh produce imports.

Consequently, Emart must continually monitor and adapt to evolving trade policies to maintain competitive pricing and ensure a consistent supply of diverse goods. The ability to pivot sourcing strategies or absorb increased costs will be crucial for navigating these political factors effectively and preserving market share in the dynamic retail landscape.

Consumer Protection Laws and Fair Trade Practices

South Korea's robust consumer protection laws and commitment to fair trade practices significantly shape Emart's operational landscape. The government actively monitors online platforms, ensuring transparency and preventing unfair practices, which directly impacts how Emart conducts its e-commerce business and manages its relationships with third-party sellers. This focus extends to payment regulations, with recent moves to shorten payment cycles for online intermediaries. For instance, in 2024, discussions around accelerating settlement periods for online marketplace transactions were prominent, aiming to improve cash flow for smaller vendors.

These evolving regulations, particularly those concerning payment timelines for online platforms, could necessitate adjustments in Emart's financial operations and vendor agreements. The government's intent is to foster a more equitable digital marketplace, and compliance with these consumer-centric policies is paramount for Emart's sustained growth and reputation. Failure to adapt could lead to penalties or damage to customer trust, underscoring the importance of proactive engagement with these regulatory shifts.

- Government Scrutiny: South Korean authorities are increasingly scrutinizing online retail platforms for consumer protection and fair trade compliance.

- Payment Settlement: New regulations are being considered or implemented to shorten the payment settlement period for online platforms to sellers, impacting cash flow management.

- Impact on Emart: These rules directly influence Emart's online operations, vendor relationships, and financial processes.

- Market Fairness: The government's aim is to create a fairer digital ecosystem, requiring platforms like Emart to adhere to stricter operational standards.

Political Stability and Geopolitical Risks

South Korea's political landscape, while generally stable, faces potential disruptions from regional geopolitical tensions. For instance, North Korea's ongoing missile tests and rhetoric in early 2024 continued to create a backdrop of uncertainty, potentially impacting investor sentiment and consumer confidence.

While not directly impacting retail sales nationwide, significant political instability, such as unexpected government overthrows or widespread civil unrest, could lead to increased travel advisories. This, in turn, could dampen spending by foreign tourists, a segment that contributes to the retail sector, especially in major cities like Seoul. In 2023, tourism to South Korea saw a significant rebound, with foreign arrivals reaching over 11 million, highlighting the sector's sensitivity to external perceptions.

- Domestic Political Stability: South Korea has a robust democratic system, but policy shifts or unexpected elections could influence business investment and consumer spending patterns.

- Geopolitical Risks: Tensions on the Korean Peninsula remain a persistent factor, potentially affecting foreign investment and market volatility.

- Impact on Consumer Confidence: Perceived political or geopolitical instability can lead to cautious consumer behavior, with individuals potentially delaying discretionary purchases.

- Tourism Sector Sensitivity: International travel warnings or advisories, often linked to geopolitical events, can directly reduce foreign visitor numbers and their spending in retail environments.

Government policies regarding retail operations, such as deregulation of Sunday closures and evolving e-commerce logistics rules, directly shape Emart's operational flexibility and online strategy. For example, the relaxation of mandatory Sunday closures in several South Korean regions in 2024 enhanced Emart's potential for weekend revenue. Simultaneously, new regulations on delivery times and packaging materials, as reviewed by governments in early 2024, could impact Emart's supply chain costs and efficiency.

What is included in the product

This EMART PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A readily digestible summary of EMART's PESTLE analysis, offering clear insights into external factors that can be leveraged to proactively address potential business challenges and opportunities.

Economic factors

South Korea's retail market is showing signs of slowing growth, with consumers adopting more cautious spending habits. This recessionary trend means people are more likely to spend only on essential items. For instance, the retail market saw a modest 1% year-on-year increase in 2024, a figure that directly influences Emart's sales performance across its diverse product lines.

A sluggish economic environment typically results in decreased discretionary spending. This directly impacts hypermarket sales, particularly for non-essential items like electronics, apparel, and home goods, as consumers prioritize necessities over wants.

Inflationary pressures in South Korea, as of early 2024, have significantly impacted consumer spending. For instance, the Consumer Price Index (CPI) saw an increase of 3.6% year-on-year in January 2024, a slight moderation from previous months but still elevated. This trend erodes purchasing power, leading households to re-evaluate their spending habits, favoring essentials over non-essential items.

Consequently, retailers like Emart face a challenging environment where demand for higher-margin discretionary goods, such as electronics and fashion apparel, may weaken. Conversely, sales of essential goods, like groceries, are likely to remain resilient or even see modest growth as consumers focus on necessities. This shift necessitates Emart to strategically emphasize competitive pricing and robust value propositions to retain and attract its customer base amidst heightened price sensitivity.

South Korea's e-commerce sector is booming, with online sales climbing 15% in 2024. This rapid expansion, particularly driven by mobile shopping, offers Emart a significant opportunity to leverage its digital platforms and quick commerce capabilities to reach a growing customer base.

The widespread adoption of digital payments in South Korea further fuels this online growth, making transactions seamless for consumers. Emart's investment in user-friendly payment systems and secure online infrastructure is therefore vital for capturing market share in this increasingly digital retail landscape.

Competition and Market Saturation

The South Korean retail landscape is exceptionally competitive, featuring a mix of long-standing giants and agile new entrants. Emart, a major hypermarket player, contends with the rising popularity of convenience stores and the significant market dominance of e-commerce platforms such as Coupang.

This fierce rivalry compels businesses like Emart to consistently innovate across various fronts. Strategies often include dynamic pricing adjustments, curated product selections, and enhanced customer engagement to defend and grow their market share.

Key competitive dynamics and market saturation factors for Emart include:

- Intensifying E-commerce Dominance: Coupang's rapid growth, reportedly achieving over 30 trillion KRW in sales revenue for 2023, highlights the shift towards online retail, pressuring traditional brick-and-mortar formats.

- Rise of Specialty Retailers: Smaller, specialized stores and convenience chains are capturing market segments by offering convenience and niche products, fragmenting the broader retail market.

- Price Sensitivity and Promotions: Consumers are highly responsive to price changes and promotional activities, forcing retailers to engage in frequent discounting and loyalty programs, impacting profit margins.

- Digital Transformation Demands: Retailers must invest heavily in digital infrastructure, including online platforms, data analytics, and personalized marketing, to remain competitive against digitally native businesses.

Disposable Income and Household Debt

Disposable income and household debt are critical economic indicators for Emart. When consumers have more discretionary funds after essential expenses, they are more likely to spend on non-essential goods and services, directly benefiting retailers like Emart. Conversely, high levels of household debt can strain budgets, leading consumers to prioritize debt repayment and cut back on discretionary purchases, which can significantly impact Emart's sales volumes and revenue streams.

The economic landscape in 2024 and early 2025 suggests a mixed environment for consumer spending. While inflation may show signs of moderation, persistent household debt levels continue to be a concern for many economies. This necessitates Emart to focus on value-driven marketing and product offerings to appeal to budget-conscious consumers.

- South Korea's household debt to disposable income ratio remained elevated in late 2023 and early 2024, impacting discretionary spending patterns.

- Consumer confidence surveys in key Emart markets indicate a cautious spending sentiment, with households prioritizing essential goods.

- Emart's strategy in this environment involves emphasizing promotions and private-label brands to capture price-sensitive consumers.

South Korea's economy in 2024 and early 2025 is characterized by a cautious consumer sentiment, largely due to persistent inflation and high household debt levels. This economic backdrop directly influences Emart's sales performance, pushing consumers to prioritize essential purchases over discretionary spending.

Inflationary pressures, with the CPI showing a 3.6% year-on-year increase in January 2024, continue to erode purchasing power. This economic reality necessitates Emart to focus on competitive pricing and value propositions, particularly for non-essential items like electronics and apparel.

The robust growth of South Korea's e-commerce sector, with online sales up 15% in 2024, presents a significant opportunity for Emart to leverage its digital platforms. Seamless digital payment adoption further supports this trend, making online transactions increasingly convenient for consumers.

| Economic Factor | 2024 Data/Trend | Impact on Emart |

|---|---|---|

| Retail Market Growth | Modest 1% year-on-year increase (2024) | Slowing growth necessitates focus on essentials and value. |

| Inflation (CPI) | 3.6% year-on-year increase (Jan 2024) | Reduces consumer purchasing power, favoring essential goods. |

| E-commerce Growth | 15% increase in online sales (2024) | Opportunity for Emart to expand digital presence and quick commerce. |

| Household Debt to Disposable Income | Elevated ratio (late 2023/early 2024) | Strains budgets, leading to reduced discretionary spending. |

What You See Is What You Get

EMART PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This EMART PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations. It's designed to offer actionable insights for strategic planning.

Sociological factors

South Korean consumers are increasingly prioritizing convenience, health, and personalized experiences. This trend fuels demand for online shopping and hyper-local retail options, with online grocery sales in South Korea projected to reach over 30 trillion KRW (approximately $22 billion USD) by the end of 2024, highlighting Emart's need to adapt its digital and physical presence.

The ongoing shift towards smaller households and single-person living significantly impacts purchasing habits. Consumers are favoring smaller package sizes and a greater variety of ready-to-eat meals. This demographic change, with single-person households now representing over 30% of all households in South Korea, necessitates Emart to adjust its product assortment and packaging strategies to meet these evolving needs.

South Korea is experiencing a significant aging population, with projections indicating that by 2025, over 20% of the population will be aged 65 and older. This demographic trend, coupled with a persistently low birth rate, means Emart's traditional customer base is shrinking and shifting. The demand for products and services catering to seniors, such as health supplements and convenient meal solutions, is expected to rise, while demand for items associated with younger families may decline.

Emart needs to proactively adjust its product assortment and marketing strategies to align with these demographic changes. For instance, expanding its private label offerings in health and wellness categories, and potentially reconfiguring store layouts to better accommodate an older demographic, could be crucial. By 2024, the elderly poverty rate in South Korea remained a concern, suggesting a need for value-oriented offerings within the senior segment.

South Korea boasts exceptionally high smartphone penetration, exceeding 95% in early 2024, making mobile devices the primary gateway to online retail. This has cemented a mobile-first shopping culture, where a substantial majority of e-commerce transactions, often over 70%, are conducted via smartphones.

Emart's strategic focus on bolstering its mobile app, enhancing its online marketplace, and expanding rapid delivery services directly addresses this consumer shift. Continued investment here is vital for Emart to capture market share and meet the evolving, mobile-centric demands of South Korean shoppers.

Sustainability and Ethical Consumption Trends

South Korean consumers are increasingly prioritizing sustainability and ethical consumption. This growing eco-consciousness is directly impacting purchasing decisions, with a noticeable surge in demand for organic, eco-friendly, and sustainably produced goods. For Emart, this trend presents a significant opportunity to differentiate itself and build brand loyalty.

To effectively tap into this market shift, Emart must actively showcase its dedication to environmental responsibility. This involves implementing robust strategies for sustainable sourcing of products, actively working to reduce waste across its operations, and adopting eco-friendly packaging solutions. By aligning its practices with these evolving consumer values, Emart can significantly enhance its brand image and appeal to a more conscientious customer base.

Recent data highlights this shift:

- A 2024 survey indicated that over 60% of South Korean consumers are willing to pay a premium for products with clear sustainability certifications.

- Sales of private-label organic products at major retailers, including Emart, saw a year-on-year increase of approximately 15% in the first half of 2024.

- Emart's own sustainability initiatives, such as its 'Green Choice' product line, reported a 20% rise in customer engagement in late 2024.

Influence of K-Culture and Global Trends

The global surge of K-Culture, encompassing K-pop, K-dramas, and Korean beauty, significantly influences consumer preferences across fashion, cosmetics, and food. This cultural wave, particularly strong in Asian markets, creates demand for products and experiences associated with Korean trends. For instance, the global K-pop industry generated an estimated $12.8 billion in economic impact in 2022, showcasing its commercial power.

Retailers like Emart are strategically incorporating elements of Korean culture into their offerings to capture this growing consumer interest. By highlighting local Korean brands and products that resonate with K-Culture themes, Emart can enhance its appeal to both domestic shoppers and the expanding international tourist market. This approach aligns with the broader trend of cultural globalization in retail, where authenticity and trend alignment are key drivers of sales.

- K-Culture's Economic Footprint: The global K-pop industry alone contributed an estimated $12.8 billion to the global economy in 2022, demonstrating its significant commercial reach.

- Retailer Adaptations: Many retailers are now featuring dedicated sections for Korean beauty products, fashion items, and even food items inspired by popular Korean dramas and music.

- Consumer Trend Alignment: Surveys indicate that a significant percentage of consumers, especially younger demographics, actively seek out products and brands associated with K-Culture, influencing purchasing decisions in key retail categories.

South Korean society is increasingly valuing convenience and personalized experiences, driving demand for online and hyper-local retail, with online grocery sales expected to exceed 30 trillion KRW (approx. $22 billion USD) by the end of 2024.

The rise of single-person households, now over 30% of all households, necessitates smaller product packaging and a wider variety of ready-to-eat meals, impacting Emart's product assortment.

South Korea's aging population, with over 20% expected to be 65+ by 2025, coupled with a low birth rate, means Emart must cater to seniors' needs, such as health supplements, while the elderly poverty rate remains a concern, highlighting the need for value-oriented offerings.

Technological factors

Emart's competitive edge in the dynamic South Korean e-commerce landscape is directly tied to its ongoing investment in platform development and optimization. This includes enhancing user experience, refining search algorithms, and ensuring secure, efficient payment processing to meet the demands of a market where mobile transactions are increasingly dominant.

The South Korean e-commerce market is a powerhouse, projected to reach approximately $200 billion in 2024, with mobile commerce accounting for a substantial portion of this. Emart's platforms, like SSG.com and Gmarket, are central to capturing this growth, even as they navigate current operating losses, signaling a strategic focus on long-term market share.

Technological advancements are revolutionizing Emart's logistics and supply chain. Innovations like warehouse robotics and advanced route optimization software are crucial for maintaining efficiency and competitive pricing. For instance, companies like Ocado, a key partner for some grocery retailers, have invested heavily in automated warehouses, demonstrating the potential for significant operational improvements.

The growing demand for quick commerce, with services promising delivery within an hour, is directly tied to these technological capabilities. Emart's ability to offer such rapid delivery hinges on sophisticated logistical networks and precise, real-time inventory management systems. This infrastructure allows for faster order fulfillment and a more seamless customer experience, a key differentiator in the competitive online retail landscape.

Emart's investment in data analytics and artificial intelligence is transforming how it interacts with customers. By leveraging big data, the company can analyze vast amounts of information on customer behavior, leading to hyper-personalized shopping experiences. This allows for highly targeted marketing campaigns that resonate more effectively with individual shoppers.

Understanding consumer preferences through data insights is crucial for Emart's success. This analytical approach enables the prediction of demand more accurately, which in turn helps optimize product assortments. For instance, in early 2024, Emart reported a 15% increase in sales for product categories where data-driven assortment planning was implemented.

In-store Technology and Digital Transformation

Emart's commitment to in-store technology is a cornerstone of its digital transformation, aiming to elevate the customer journey and streamline operations. The integration of self-checkout kiosks, smart shelves, and dynamic digital signage is designed to create a more engaging and efficient physical retail environment. This technological infusion also serves as a powerful tool for data collection, providing insights into customer behavior and inventory management.

Emart's strategic rethink of its hypermarket brand and overall in-store experience directly translates into substantial investments in technological upgrades. These upgrades are crucial for modernizing the physical retail space to meet evolving consumer expectations. For instance, by Q2 2024, a significant portion of Emart's flagship stores were slated to feature upgraded self-checkout options, aiming to reduce customer wait times by an estimated 15-20%.

The impact of these technological advancements is multifaceted:

- Enhanced Customer Experience: Features like interactive digital displays and personalized promotions via smart shelves aim to make shopping more convenient and engaging.

- Operational Efficiency Gains: Self-checkout systems and automated inventory tracking through smart shelves can lead to reduced labor costs and improved stock accuracy. For example, pilot programs in late 2023 indicated a potential 10% reduction in checkout-related staffing needs.

- Data-Driven Decision Making: The data gathered from these technologies allows Emart to better understand product performance, customer traffic patterns, and optimize store layouts. This data can inform merchandising strategies and marketing campaigns, with early analyses showing a 5% uplift in sales for product categories featured on digitally enhanced displays.

Mobile Payment Systems and Fintech Integration

South Korea boasts near-universal adoption of mobile payment systems, with digital wallets and real-time payment options becoming increasingly central to consumer transactions. This trend presents a significant opportunity for Emart to enhance customer convenience.

To capitalize on this, Emart must ensure its payment infrastructure is not only secure and offers a variety of options but also seamlessly integrates with popular fintech solutions. By doing so, Emart can create a frictionless checkout experience for shoppers, whether they are engaging online or in physical stores.

- Near-universal mobile payment adoption in South Korea.

- Digital wallets and real-time payments are gaining prominence.

- Emart needs secure, diverse, and integrated payment systems.

- Focus on providing a convenient and frictionless checkout.

Technological factors are pivotal for Emart's strategy, driving innovation in its online platforms and physical stores. Investments in AI and data analytics enable hyper-personalized customer experiences and more accurate demand forecasting, as evidenced by a reported 15% sales increase in data-driven assortment categories by early 2024. Furthermore, advancements in logistics, such as warehouse robotics and route optimization, are crucial for meeting the demand for quick commerce and maintaining competitive pricing.

Legal factors

Emart's operations are significantly shaped by South Korea's stringent food safety and hygiene regulations, overseen by the Ministry of Food and Drug Safety (MFDS). These laws, which are regularly updated, necessitate ongoing investment in quality control and compliance to guarantee the safety of Emart's extensive grocery and fresh produce offerings.

Recent legislative changes, such as amendments to food hygiene laws and updated standards for food contact materials, demand continuous adaptation from Emart. Failure to comply can result in substantial penalties, underscoring the financial and operational importance of maintaining the highest standards in product safety and handling.

Emart, operating in South Korea, must navigate a robust framework of labor laws. These regulations cover essential aspects like the minimum wage, which saw an increase to 9,860 KRW per hour in 2024, setting a baseline for employee compensation. Working hour limits, mandatory benefits such as severance pay and health insurance, and strict anti-discrimination statutes are all critical compliance areas.

Recent legal shifts, particularly those strengthening family-related leave provisions and increasing penalties for wage theft, directly impact Emart's HR strategies and associated operational expenses. For instance, expanded parental leave policies can influence staffing levels and require careful workforce planning to maintain operational efficiency and manage labor costs effectively.

The Korea Fair Trade Commission (KFTC) is a key regulator that keeps a close eye on the retail industry, specifically looking for any unfair business practices. This scrutiny extends to major players like Emart and online marketplaces, ensuring a level playing field. For instance, in 2023, the KFTC continued its focus on platform fairness, impacting how large retailers operate online.

Emart's significant market share, particularly after its merger with Emart Everyday, could draw increased attention from the KFTC. This regulatory oversight means Emart must strictly adhere to anti-trust regulations to avoid any actions that could be perceived as monopolistic, thereby protecting consumer choice and fair competition in the South Korean market.

Consumer Protection and E-commerce Regulations

Consumer protection laws are a significant legal factor for Emart. Specific legislation, such as the Act on the Consumer Protection in Electronic Commerce, dictates how online retailers and platform operators must conduct business. These rules cover aspects like transparency in pricing, clear return policies, and data privacy, all crucial for maintaining customer trust in the digital marketplace.

New regulations are also emerging that directly affect online businesses like Emart. For instance, mandates requiring online intermediary platforms to settle payments to sellers within a strict timeframe, such as 20 days, can significantly impact cash flow and operational efficiency. This necessitates robust financial management and timely processing of transactions to comply with these legal requirements.

- Consumer Protection Laws: Regulations like the Act on the Consumer Protection in Electronic Commerce set standards for online retail practices.

- Payment Settlement Timelines: New rules mandating payment settlements to sellers within 20 days directly influence Emart's financial operations.

- Data Privacy and Security: Compliance with data protection laws is paramount for safeguarding customer information and avoiding penalties.

- E-commerce Transparency: Legal requirements for clear pricing, return policies, and product information build consumer confidence.

Data Privacy and Security Laws

Emart's extensive online presence and loyalty programs mean it manages a substantial volume of customer data. Adherence to South Korea's strict data privacy and security regulations, including the Personal Information Protection Act (PIPA), is paramount for safeguarding this information. Failure to comply can lead to severe penalties, with PIPA fines potentially reaching up to 5% of total revenue for violations, alongside significant reputational harm.

Key legal considerations for Emart regarding data privacy include:

- Data Collection and Consent: Ensuring explicit consent is obtained for collecting and processing customer personal information, as mandated by PIPA.

- Data Security Measures: Implementing robust technical and organizational safeguards to prevent data breaches and unauthorized access.

- Cross-Border Data Transfers: Complying with regulations governing the transfer of personal data outside of South Korea, should Emart engage in such activities.

- Consumer Rights: Upholding individuals' rights to access, rectify, and erase their personal data held by Emart.

Emart operates under South Korea's comprehensive consumer protection laws, which mandate transparency in pricing and clear return policies, crucial for building trust in its online and offline sales channels.

Recent legal shifts, like stricter payment settlement timelines for online platforms, require Emart to manage cash flow efficiently, with some regulations mandating settlements within 20 days to ensure fairness to sellers.

Data privacy is a critical legal domain, with the Personal Information Protection Act (PIPA) imposing strict rules on data collection and security; violations can incur fines up to 5% of total revenue, highlighting the significant financial risk of non-compliance.

| Legal Area | Key Regulations/Considerations | Impact on Emart | Relevant Data/Facts |

|---|---|---|---|

| Consumer Protection | Act on the Consumer Protection in Electronic Commerce | Ensures fair online practices, builds customer trust | Clear pricing, return policies mandated |

| Payment Settlement | Mandatory timelines for online platforms | Impacts cash flow and operational efficiency | Settlements often required within 20 days |

| Data Privacy | Personal Information Protection Act (PIPA) | Safeguarding customer data, avoiding penalties | Fines up to 5% of revenue for violations |

Environmental factors

Growing consumer and governmental pressure for environmental responsibility is a significant factor for Emart. In 2024, a significant portion of consumers, particularly younger demographics, indicated they would pay more for sustainably sourced products, with some studies showing this figure nearing 60%. This mandates Emart to implement robust sustainability initiatives, such as reducing its carbon footprint and adopting eco-friendly supply chain practices.

Emart's engagement in corporate social responsibility (CSR) programs is crucial for resonating with environmentally conscious consumers. For instance, by 2025, many major retailers are aiming to have at least 75% of their packaging be recyclable or compostable. Emart's commitment to these initiatives, including waste reduction and ethical sourcing, directly impacts brand perception and customer loyalty in the evolving retail landscape.

Emart faces increasing scrutiny regarding waste management and recycling. Regulations, particularly concerning packaging and food waste, directly influence its operational costs and strategies. For instance, in 2024, South Korea, where Emart operates, continued to strengthen its Extended Producer Responsibility (EPR) schemes, pushing retailers to take greater accountability for the end-of-life management of their products and packaging.

As a major retailer, Emart is expected to meet stringent recycling mandates and actively reduce its waste footprint. This likely necessitates investment in advanced waste sorting technologies and potentially innovative packaging solutions. By 2025, many regions are anticipating even stricter targets for plastic recycling and a greater emphasis on circular economy principles, which will require Emart to adapt its supply chain and in-store practices.

Emart's significant energy footprint from hypermarkets and logistics necessitates a focus on efficiency and renewables. For instance, in 2024, the retail sector's energy consumption contributed to a notable portion of global emissions, pushing companies like Emart towards greener alternatives.

Regulatory bodies and consumer demand are increasingly pressuring retailers to reduce fossil fuel dependence. By 2025, many jurisdictions are expected to implement stricter energy standards for commercial buildings, potentially impacting Emart's operational costs if they don't invest in renewable energy sources for their facilities.

Plastic Use and Packaging Regulations

Growing global awareness of plastic pollution is driving a significant shift towards more stringent regulations on plastic usage and packaging. This is directly impacting retailers like Emart, which must adapt its extensive product lines and supply chains to meet these evolving environmental standards. For instance, many countries are implementing bans or taxes on specific single-use plastic items, pushing companies to seek out alternatives.

Emart’s commitment to sustainability requires exploring innovative and eco-friendly packaging solutions. This includes investigating biodegradable materials, increasing the use of recycled content, and redesigning packaging to minimize plastic waste. Consumer demand for environmentally responsible products is also a key driver, with many shoppers actively choosing brands that demonstrate a commitment to reducing their environmental footprint. By 2024, the global market for sustainable packaging was projected to reach over $300 billion, indicating a strong and growing trend.

- Regulatory Landscape: Governments worldwide are enacting policies to curb plastic pollution, including bans on certain single-use plastics and mandates for recycled content in packaging.

- Consumer Pressure: A significant portion of consumers, estimated to be over 60% in many developed markets, express a preference for products with minimal and sustainable packaging.

- Emart's Response: The company is investing in research and development for alternative packaging materials and optimizing its logistics to reduce waste throughout the supply chain.

- Market Trends: The sustainable packaging market is experiencing robust growth, with projections indicating continued expansion driven by both regulatory push and consumer pull.

Climate Change and Supply Chain Resilience

Climate change poses significant threats to Emart's operations. Extreme weather events, like the widespread droughts and floods experienced globally in 2024, can severely disrupt agricultural output, directly impacting the availability and price of fresh produce. This necessitates building greater resilience within Emart's supply chain to buffer against such volatility and maintain consistent product flow for consumers.

The financial implications are substantial. For instance, the UN Food and Agriculture Organization (FAO) estimated that climate-related disasters caused over $30 billion in agricultural losses globally between 2020 and 2022. Emart must invest in strategies to mitigate these risks, ensuring product availability and managing cost fluctuations.

- Supply chain diversification: Reducing reliance on single-source regions vulnerable to climate impacts.

- Investment in climate-resilient agriculture: Supporting suppliers who adopt sustainable farming practices.

- Enhanced logistics and inventory management: Creating buffer stocks and more flexible transportation networks.

- Technological adoption: Utilizing data analytics and AI for better weather forecasting and risk assessment.

Emart's environmental strategy is increasingly shaped by consumer demand for sustainable products and governmental regulations. By 2024, a significant portion of consumers, upwards of 60% in many markets, indicated a willingness to pay more for sustainably sourced goods. This trend pushes Emart towards implementing robust eco-friendly practices across its operations.

The company faces direct pressure regarding waste management and recycling, particularly concerning packaging and food waste. South Korea's strengthening Extended Producer Responsibility (EPR) schemes in 2024, for example, hold retailers like Emart more accountable for product end-of-life management, influencing operational strategies and costs.

Emart's substantial energy consumption from its hypermarkets and logistics network requires a pivot towards efficiency and renewable energy sources. By 2025, stricter energy standards for commercial buildings are anticipated in many regions, potentially increasing operational expenses if investments in green alternatives are not prioritized.

The global fight against plastic pollution is leading to more stringent regulations on plastic usage and packaging, directly affecting Emart's supply chain and product offerings. Bans and taxes on single-use plastics are becoming commonplace, compelling retailers to explore alternatives and reduce their plastic footprint.

| Environmental Factor | 2024/2025 Trend/Data | Impact on Emart |

|---|---|---|

| Consumer Demand for Sustainability | Over 60% of consumers willing to pay more for sustainable products (2024). | Drives adoption of eco-friendly sourcing and operations. |

| Waste & Recycling Regulations | Strengthened EPR schemes in South Korea (2024). | Increases accountability for packaging and waste management. |

| Energy Efficiency & Renewables | Anticipated stricter energy standards for commercial buildings by 2025. | Necessitates investment in renewable energy to manage operational costs. |

| Plastic Pollution Control | Increasing global bans/taxes on single-use plastics. | Requires adaptation of packaging and supply chain practices. |

PESTLE Analysis Data Sources

Our EMART PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, international economic reports, and leading market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current and credible information.