EMART Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMART Bundle

EMART navigates a retail landscape shaped by intense buyer power and the constant threat of new entrants, impacting its pricing and market share. Understanding these forces is crucial for any competitor or investor looking to gain an edge.

The complete report reveals the real forces shaping EMART’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Emart's bargaining power with suppliers is significantly bolstered by a fragmented supplier base across many product lines, especially for everyday items and fresh food. This means Emart can readily find alternatives if a supplier demands unfavorable terms. For instance, in 2024, the South Korean retail market for fresh produce saw numerous small-scale farms and distributors, making it difficult for any single supplier to exert substantial pressure on a major buyer like Emart.

Emart's strategic development of private label brands, such as No Brand and Peacock, directly counters the bargaining power of external suppliers. This strategy allows Emart to control product sourcing and manufacturing, leading to better cost management and quality assurance. For instance, the growth of Emart's private label sales has been a consistent driver of its performance, with these brands often offering a significant price advantage to consumers compared to national brands.

Emart is actively consolidating its procurement processes by transitioning to an integrated purchasing system. This move spans its hypermarkets, warehouse discount stores (Traders), and online platforms like Gmarket and SSG.com.

By centralizing purchasing, Emart aims to achieve significant economies of scale. This increased volume in procurement directly strengthens Emart's bargaining power with its suppliers, enabling more favorable terms and pricing for its extensive retail network.

Strategic Supplier Relationships

Emart recognizes that while it possesses considerable market influence, fostering strategic supplier relationships is paramount. This involves cultivating long-term partnerships built on transparency and mutual respect, especially for suppliers providing specialized or premium goods where their expertise is crucial. In 2024, Emart continued to invest in these collaborative frameworks, aiming to secure stable access to high-quality inventory and drive joint innovation.

This approach is particularly beneficial for niche product categories. For instance, Emart's commitment to sourcing unique artisanal food products in 2024 directly leveraged the expertise of smaller, specialized suppliers, enhancing its product differentiation and customer appeal. Such relationships can mitigate the bargaining power of suppliers by creating interdependence and shared value.

Emart's global sourcing strategy also plays a vital role in managing supplier power. By diversifying its supplier base across different regions, Emart can reduce reliance on any single supplier or region, thereby strengthening its negotiating position. This global reach, actively pursued in 2024, ensures supply chain resilience and access to competitive pricing, even for essential commodities.

- Strategic Partnerships: Emart prioritizes long-term, transparent relationships with key suppliers, fostering mutual respect and shared success.

- Value of Expertise: For specialized or high-quality products, Emart leverages supplier expertise, turning potential power imbalances into collaborative advantages.

- Global Sourcing: In 2024, Emart expanded its global sourcing efforts to build robust and diversified supply chains, mitigating risks and enhancing negotiating leverage.

Impact of Raw Material Costs and Specialized Goods

Even with Emart's substantial market presence, certain suppliers can still wield significant bargaining power. This is particularly true for specialized goods, such as unique electronics or high-demand imported items, where Emart may have fewer alternative sourcing options. For instance, in 2024, the global semiconductor shortage continued to impact the availability and pricing of electronic components, giving chip manufacturers considerable leverage over retailers like Emart.

Fluctuating raw material costs also play a crucial role. When the prices of key inputs, like agricultural commodities for private label food products or metals for appliances, surge unexpectedly, suppliers can pass these increased costs onto Emart. This was evident in early 2024, where rising energy prices contributed to higher production costs for a wide range of manufactured goods, affecting Emart's cost of goods sold.

- Specialized Goods: Suppliers of proprietary technology or unique product lines can command higher prices due to limited competition.

- Raw Material Volatility: Increases in raw material costs, such as those seen in energy and agricultural sectors in 2024, directly impact supplier pricing power.

- Emart's Mitigation: Emart's vast and diverse product catalog helps to dilute the impact of any single supplier's increased bargaining power by allowing for substitution and negotiation across a broad range of categories.

Emart generally faces moderate supplier bargaining power due to its large scale and diverse sourcing. However, this power can shift depending on the product category and supplier concentration.

For common goods, Emart's sheer volume and ability to switch suppliers keep their leverage high. Conversely, suppliers of unique or technologically advanced items, or those facing industry-wide shortages like semiconductors in 2024, can exert more influence.

Emart's development of private label brands and integrated procurement systems further reduces its reliance on external suppliers, thereby strengthening its negotiating position across most product lines.

| Factor | Emart's Position | Supplier Bargaining Power |

|---|---|---|

| Supplier Concentration | Fragmented for many goods; concentrated for specialized items. | Low for common goods; High for specialized/proprietary items. |

| Buyer Volume | High due to extensive retail network. | Low, as Emart is a significant buyer. |

| Switching Costs (Emart) | Low for common goods; High for specialized suppliers. | N/A |

| Supplier Differentiation | Low for commodities; High for private labels and unique products. | High for unique products; Low for commodities. |

| Impact of 2024 Trends | Semiconductor shortages increased supplier power for electronics. Rising energy costs boosted power for suppliers of manufactured goods. | Increased leverage for electronics and manufactured goods suppliers due to shortages and cost pressures. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to EMART's unique position in the retail sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

South Korean consumers are notably price-sensitive, actively hunting for deals, especially given the economic conditions in 2024. This means Emart must keep its prices competitive to attract and retain shoppers who are always comparing options.

Emart faces a crowded retail landscape with many alternatives. From other hypermarkets and numerous convenience stores to the booming e-commerce sector, customers have abundant choices, significantly increasing their bargaining power.

Customers face minimal switching costs when choosing between different retail formats or brands. The ease of moving from one hypermarket to another, or from offline to online grocery platforms, empowers customers to readily shift their purchases based on price, convenience, or product availability. For instance, in 2024, the global e-commerce penetration in retail reached approximately 22%, indicating a significant portion of consumers can easily switch between online and offline channels with little friction.

The surge in South Korea's e-commerce, with online retail sales reaching approximately 227 trillion Korean Won (KRW) in 2023, has dramatically boosted customer bargaining power. This digital shift, particularly in the grocery sector, means consumers can effortlessly compare prices and product availability across numerous platforms directly from their smartphones.

Demand for Convenience and Personalized Experiences

Modern consumers increasingly value convenience, seeking rapid delivery and effortless shopping journeys. Emart's investment in quick commerce and intuitive online platforms directly addresses this trend.

The demand for personalized recommendations and customized offers is also on the rise, with retailers like Emart leveraging artificial intelligence to meet these expectations.

- Convenience is King: In 2024, a significant portion of online shoppers, estimated to be over 70%, indicated that fast delivery options are a primary factor in their purchasing decisions.

- Personalization Drives Engagement: Retailers using AI for personalized recommendations saw an average increase of 15% in customer engagement and a 10% boost in conversion rates in early 2024.

- Seamless Digital Experience: Emart's focus on user-friendly apps and websites is crucial, as studies from late 2023 showed that over 60% of consumers will abandon a purchase if the online experience is not smooth.

Influence of Private Label Brands and Value Offerings

Emart's private label brands are a key factor in its customer bargaining power. While these brands offer competitive pricing, customers also have access to similar private label options from Emart's rivals, particularly as consumers increasingly seek value to manage their budgets. This means Emart must consistently deliver superior quality and unique value propositions within its private label offerings to cultivate and maintain customer loyalty.

The influence of private label brands is significant, as they directly impact price sensitivity. For instance, by mid-2024, reports indicated that private label sales in the grocery sector were capturing an increasing market share, with some analysts projecting this trend to continue. This rise in private label penetration means customers have more leverage, as they can readily switch to a competitor's store if Emart's private label prices or quality are not perceived as advantageous.

- Customer Price Sensitivity: The prevalence of private label options across the retail landscape heightens customer sensitivity to price differences.

- Quality Perception: Emart's private label quality must consistently meet or exceed customer expectations to mitigate the appeal of competitor offerings.

- Brand Loyalty: Building strong loyalty around Emart's private labels is crucial to counter the inherent bargaining power customers possess due to readily available alternatives.

- Market Trends: The ongoing consumer shift towards budget-conscious shopping further amplifies the bargaining power of customers seeking value in private label products.

Customers wield considerable power due to South Korea's price-sensitive market and Emart's competitive retail environment. With minimal switching costs and abundant alternatives, including a rapidly growing e-commerce sector, consumers can easily compare prices and product availability.

The increasing demand for convenience and personalized experiences further empowers shoppers. Emart's investments in quick commerce and AI-driven recommendations are direct responses to these evolving customer expectations.

Emart's private label brands, while offering value, also contribute to customer bargaining power as rivals provide similar options. Maintaining superior quality and unique value propositions is essential for customer retention.

| Factor | Impact on Emart | Customer Action |

|---|---|---|

| Price Sensitivity | High pressure to maintain competitive pricing. | Frequent price comparisons across retailers. |

| Availability of Alternatives | Need for strong differentiation and loyalty programs. | Easy switching to hypermarkets, convenience stores, or online platforms. |

| E-commerce Growth | Increased price transparency and convenience demands. | Shopping across multiple online platforms for best deals. |

| Private Label Competition | Requirement for superior quality and unique offerings. | Switching to competitor private labels if Emart's are not perceived as advantageous. |

What You See Is What You Get

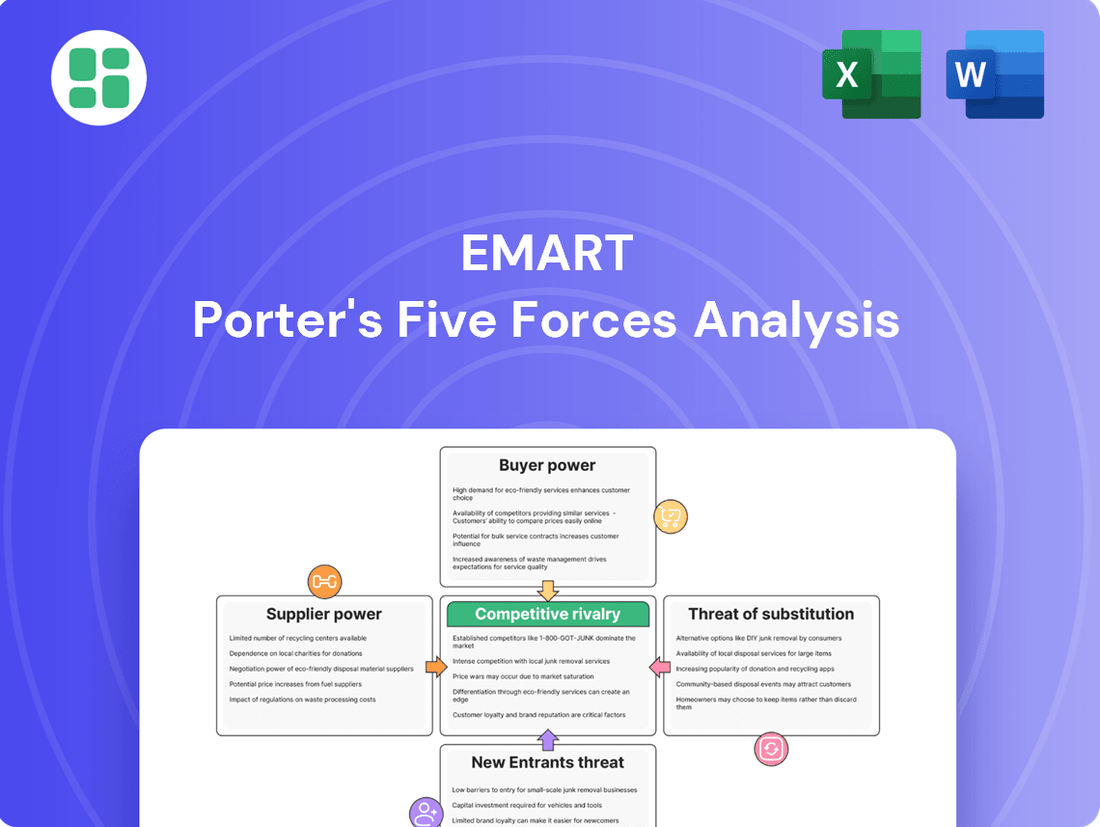

EMART Porter's Five Forces Analysis

This preview provides a comprehensive breakdown of EMART's competitive landscape through Porter's Five Forces analysis, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and formatting you see are precisely what you'll receive, offering immediate value for your strategic planning.

Rivalry Among Competitors

The hypermarket sector in South Korea is a battlefield, with Emart, Lotte Mart, and Homeplus locked in a fierce struggle for dominance. These giants are perpetually innovating, from aggressive pricing and frequent promotions to experimenting with new store concepts, all to capture a larger slice of the market.

The most significant competitive pressure for EMART stems from the rapid expansion of e-commerce giants like Coupang and Naver. These platforms offer vast product selections, aggressive pricing, and increasingly swift delivery, including same-day and next-day options, directly challenging traditional retail models, especially in the grocery sector.

The convenience store sector in South Korea is a robust growth engine, fueled by hyper-local strategies and a strong emphasis on private-label offerings. In 2023, the market saw continued expansion, with major players like CU and GS25 reporting steady sales growth, indicating strong consumer demand for accessible and convenient shopping options.

This competitive landscape is further intensified by specialized online retailers and direct-to-consumer (DTC) brands. These newer entrants often cater to specific consumer needs or offer curated product selections, presenting a challenge to traditional convenience store models by providing niche product assortments and unique, often digitally-driven, shopping experiences.

Omnichannel Strategies and Innovation

Emart faces intense competitive rivalry as retailers increasingly adopt omnichannel strategies to blend online and offline customer experiences. This push for seamless engagement, exemplified by investments in AI for personalization and operational efficiency, intensifies the battle for market share. For instance, in 2024, the global retail e-commerce market continued its robust growth, with many traditional brick-and-mortar players significantly enhancing their digital capabilities to compete with pure-play online retailers.

The expansion of quick commerce services further fuels this rivalry, requiring significant technological investment and logistical prowess. Retailers are differentiating themselves through innovative delivery models and personalized shopping journeys. Data from 2024 indicates a strong consumer preference for convenience, pushing companies to optimize their supply chains and last-mile delivery networks. This dynamic environment necessitates continuous innovation to maintain customer loyalty and capture incremental sales.

- Omnichannel investment: Retailers are channeling billions into integrating online and offline operations, with significant 2024 capital expenditures on e-commerce platforms and in-store technology.

- AI adoption: The use of artificial intelligence for customer personalization and supply chain optimization saw a marked increase in 2024, with many retailers reporting improved customer satisfaction and reduced operational costs.

- Quick commerce growth: The quick commerce sector experienced substantial expansion in 2024, driven by consumer demand for rapid delivery, leading to increased competition in urban logistics and fulfillment.

Homogenous Consumer Base and Easy Imitation

The South Korean consumer market exhibits a high degree of homogeneity, making it easier for competitors to replicate successful strategies. This means Emart must constantly innovate to stay ahead, as any unique selling proposition can be quickly mimicked, eroding its competitive edge. For instance, in 2023, Emart saw its market share in the hypermarket sector face increased pressure from online retailers and specialized grocers, highlighting the challenge of maintaining differentiation in a uniform market.

This ease of imitation forces Emart to invest heavily in continuous product development and customer experience enhancements. Without this commitment, rivals can swiftly capture market share by offering similar value propositions at potentially lower costs. In 2024, Emart's increased investment in private label brands and exclusive partnerships with popular influencers reflects this strategy to create distinct offerings that are harder to copy.

- Homogenous Consumer Base: South Korean consumers often share similar preferences and purchasing habits, simplifying market entry for new competitors.

- Ease of Imitation: Successful product launches or service innovations by Emart can be quickly replicated by rivals, diminishing their exclusivity.

- Need for Continuous Innovation: Emart must consistently introduce new products, services, and marketing campaigns to maintain customer interest and competitive advantage.

- Erosion of Competitive Advantages: Without ongoing innovation, Emart's unique selling points are vulnerable to rapid imitation, leading to price wars and reduced profitability.

Competitive rivalry is intense for EMART, with rivals like Lotte Mart and Homeplus constantly innovating through pricing, promotions, and new store concepts. The rise of e-commerce giants such as Coupang and Naver, offering vast selections and rapid delivery, further intensifies this rivalry, particularly in the grocery sector.

Omnichannel strategies are becoming standard, with retailers investing heavily in integrating online and offline experiences. Quick commerce is also a significant growth area, demanding advanced logistics and technology. In 2024, retailers focused on AI for personalization and operational efficiency, with quick commerce seeing substantial expansion driven by consumer demand for speed.

| Competitor | Key Strategy | 2024 Focus Areas |

| Lotte Mart | Aggressive pricing, Private label expansion | Omnichannel integration, Digital marketing |

| Homeplus | Convenience, Loyalty programs | Quick commerce development, AI personalization |

| Coupang (E-commerce) | Speedy delivery, Wide product range | Same-day/Next-day delivery, Groceries |

| Naver (E-commerce) | Platform integration, Marketplace | Personalized recommendations, Logistics partnerships |

SSubstitutes Threaten

The most significant substitute threat to traditional hypermarkets like E-Mart comes from online grocery delivery services and quick commerce platforms. These digital players offer a level of convenience that directly challenges the in-store experience, particularly for time-pressed urban consumers.

Platforms like Market Kurly and Coupang Fresh in South Korea, for instance, have seen substantial growth. In 2023, the Korean online grocery market was valued at over $20 billion, with quick commerce segments experiencing rapid expansion, often promising delivery within an hour. This speed and ease of access directly substitute the need for a physical trip to a hypermarket for many shoppers.

Convenience stores and small specialty shops pose a significant threat of substitution for hypermarkets like E-mart. Their widespread presence and round-the-clock availability mean consumers can easily fulfill immediate needs, particularly for groceries and beverages, without needing to visit a larger hypermarket. For instance, the number of convenience stores in South Korea has steadily increased, with the Korea Convenience Store Association reporting over 50,000 locations by the end of 2023, offering a readily accessible alternative for quick purchases.

Small specialty stores, focusing on niche products or artisanal goods, also divert customer traffic. These stores cater to specific consumer preferences, offering unique selections that hypermarkets might not carry, thereby attracting shoppers seeking differentiated experiences or higher quality items. This segment of the retail market continues to grow, with many small businesses leveraging online platforms to expand their reach and compete directly for consumer attention.

The proliferation of direct-to-consumer (DTC) brands presents a significant threat of substitutes for traditional retailers like Emart. In 2024, the online retail sector, heavily influenced by DTC models, continued its robust growth, with projections indicating a substantial increase in market share compared to brick-and-mortar sales.

These DTC players, particularly in sectors Emart operates within such as fresh food, beauty, and household goods, offer consumers a direct channel to purchase specialized or personalized products. This bypasses intermediaries, often leading to competitive pricing and a more tailored customer experience, directly challenging Emart's established retail model.

Meal Kit Services and Food Delivery Apps

Meal kit services and food delivery apps present a significant threat of substitutes for traditional grocery retailers like E-Mart. These services cater to the growing consumer demand for convenience, offering consumers ready-to-cook meal kits or fully prepared meals delivered directly to their homes. This bypasses the need for extensive in-store grocery shopping and meal preparation.

The convenience factor is a primary driver. For instance, by 2024, the global online food delivery market was projected to reach over $200 billion, highlighting a strong consumer preference for convenient food solutions. This directly competes with E-Mart's core grocery business by offering an alternative for meal procurement.

- Convenience: Meal kits and delivery apps eliminate the need for grocery shopping and extensive meal preparation.

- Market Growth: The online food delivery market continues to expand, indicating a sustained shift in consumer behavior towards convenience.

- Consumer Preferences: These substitutes align with a broad consumer desire for ready-to-eat or easily prepared meals, directly impacting traditional grocery sales.

Shift to Experiences Over Products

The growing consumer preference for experiences over tangible products presents a significant threat of substitution for retailers like Emart. This shift means consumers might allocate more of their discretionary spending towards travel, entertainment, or personal development rather than traditional goods. For example, a 2024 report indicated that global spending on experiences is projected to outpace spending on goods, suggesting a potential diversion of capital away from retail purchases.

This trend can manifest even within the shopping environment itself, with consumers seeking engaging or experiential retail formats. If Emart’s offerings are perceived as purely transactional, they could lose ground to competitors or alternative leisure activities that provide a more holistic or memorable experience. In 2023, a substantial portion of consumer spending, upwards of 30% in some developed markets, was directed towards services and leisure activities.

- Consumer spending shift: Global experience spending growth is outpacing goods spending.

- Retail experience demand: Consumers increasingly value engaging retail environments.

- Substitution impact: Less spending on products means less revenue for traditional retailers like Emart.

- Market data: Services and leisure accounted for over 30% of discretionary spending in developed markets in 2023.

The threat of substitutes for hypermarkets like E-Mart is multifaceted, encompassing digital convenience, specialized retail, and evolving consumer preferences. Online grocery and quick commerce platforms offer speed and ease, diverting shoppers from physical stores. For example, South Korea's online grocery market exceeded $20 billion in 2023, with rapid growth in same-day delivery services.

Convenience stores and specialty shops also act as substitutes, fulfilling immediate needs with their widespread accessibility and unique product offerings. The sheer number of convenience stores in South Korea, exceeding 50,000 by late 2023, underscores their role as readily available alternatives for quick purchases.

Furthermore, direct-to-consumer (DTC) brands and meal kit services bypass traditional retail channels, offering personalized products and convenient meal solutions. The global online food delivery market, projected to surpass $200 billion by 2024, highlights a significant consumer shift towards convenience in food procurement.

Finally, a broader trend of prioritizing experiences over goods diverts consumer spending away from traditional retail. By 2024, global experience spending was anticipated to grow faster than spending on goods, with services and leisure accounting for over 30% of discretionary spending in developed markets in 2023, impacting overall retail demand.

Entrants Threaten

The sheer scale of investment needed to launch a new hypermarket chain presents a formidable hurdle for potential competitors. For instance, constructing a single large-format store can easily run into tens of millions of dollars, factoring in prime real estate, extensive inventory stocking, and sophisticated supply chain management systems. This financial commitment, often exceeding hundreds of millions for a network of stores, effectively shields established players like Emart from widespread new entrants in the traditional brick-and-mortar space.

Established brand loyalty and robust supply chains present a significant barrier for new entrants aiming to compete with Emart. Emart's long history has cultivated deep customer trust and preference, making it challenging for newcomers to gain market share. For instance, in 2023, Emart reported a customer retention rate of over 85%, a testament to its enduring appeal.

Newcomers would face considerable hurdles in replicating Emart's established supplier relationships and efficient logistics. These existing networks allow Emart to secure favorable terms and ensure product availability, factors crucial for competitive pricing and a wide product selection. Building comparable supply chain infrastructure and supplier partnerships can take years and substantial investment.

The threat of new entrants into South Korea's retail sector is significantly influenced by regulatory hurdles and market saturation. Obtaining the necessary permits and licenses for large-scale physical retail operations can be a complex and time-consuming process, acting as a barrier for newcomers.

Furthermore, the physical retail landscape in South Korea is already quite developed, meaning prime locations are scarce and often expensive. This saturation, coupled with stringent regulations, makes it difficult for new, large physical stores to establish a strong foothold and compete effectively against established players.

Lower Barriers for Online-Only Models

While establishing a traditional brick-and-mortar retail presence presents significant capital and logistical hurdles, the digital landscape dramatically lowers the barriers to entry for online-only models. This means companies can launch and scale with far less upfront investment in physical stores and inventory.

Rapid technological advancements, including sophisticated AI for personalized customer experiences and the growth of social commerce, further empower agile startups and international competitors. For instance, platforms like AliExpress and Temu have demonstrated the ability to quickly capture market share by leveraging efficient supply chains and aggressive pricing strategies, often bypassing traditional retail infrastructure entirely.

- Lower Capital Requirements: Online retailers avoid the substantial costs associated with physical store leases, build-outs, and staffing.

- Global Reach: Digital platforms allow new entrants to access a global customer base from day one, unlike traditional retail which is geographically bound.

- Rapid Scalability: E-commerce businesses can scale operations more quickly by leveraging cloud infrastructure and digital marketing, as seen with the rapid growth of new online marketplaces.

- Technological Enablement: AI-driven personalization and social commerce features enable new players to quickly build customer engagement and loyalty, challenging established players.

Innovation in Niche Markets and Technology

New entrants can indeed challenge Emart by sidestepping the traditional hypermarket approach. They might target specific, underserved niches or embrace innovative technologies to offer a distinct value. For instance, specialized online grocers or subscription services can carve out their own customer bases by focusing on convenience, curated selections, or specific dietary needs, potentially bypassing the large-scale infrastructure Emart relies on.

The threat is amplified by the rapid evolution of retail technology. Direct-to-consumer (DTC) brands, powered by agile supply chains and sophisticated digital marketing, can emerge with lower overheads. In 2024, the growth of quick commerce, with delivery times measured in minutes, highlights how technology can redefine customer expectations and create new competitive landscapes. This allows new players to enter with a focused strategy, potentially capturing market share from segments Emart might not serve as efficiently.

- Niche Market Focus: New entrants can target specific customer segments, like organic food buyers or gourmet shoppers, with specialized offerings that Emart's broad hypermarket model might not cater to as effectively.

- Technological Disruption: Innovations in e-commerce, AI-driven personalization, and efficient logistics enable new players to offer superior convenience or unique shopping experiences, challenging established players like Emart.

- Lower Overhead Potential: Digital-first or specialized retailers often operate with leaner cost structures compared to large physical hypermarkets, allowing for more competitive pricing or higher margins in their chosen segments.

- Agile Business Models: Subscription services and direct-to-consumer models offer recurring revenue streams and direct customer relationships, fostering loyalty and providing valuable data insights that can be leveraged for rapid adaptation.

While traditional hypermarket entry is costly, online models and niche players pose a significant threat. In 2024, the rapid growth of quick commerce and direct-to-consumer brands, leveraging technology and agile supply chains, allows new entrants to bypass Emart's extensive physical infrastructure. These players often focus on specific customer segments or offer unique value propositions, challenging established players with lower overheads and innovative business models.

| Threat Factor | Impact on Emart | Examples |

|---|---|---|

| Digital-First Entry | High | Online grocers, subscription boxes |

| Niche Market Focus | Medium | Specialty organic food stores |

| Technological Innovation | High | Quick commerce platforms (e.g., delivery in minutes) |

| Direct-to-Consumer (DTC) | Medium | Brands selling directly online, bypassing retailers |

Porter's Five Forces Analysis Data Sources

Our EMART Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from EMART's public financial statements, investor relations disclosures, and comprehensive industry research reports. We also leverage market intelligence from reputable sources like Statista and IBISWorld to provide a thorough assessment of competitive dynamics.