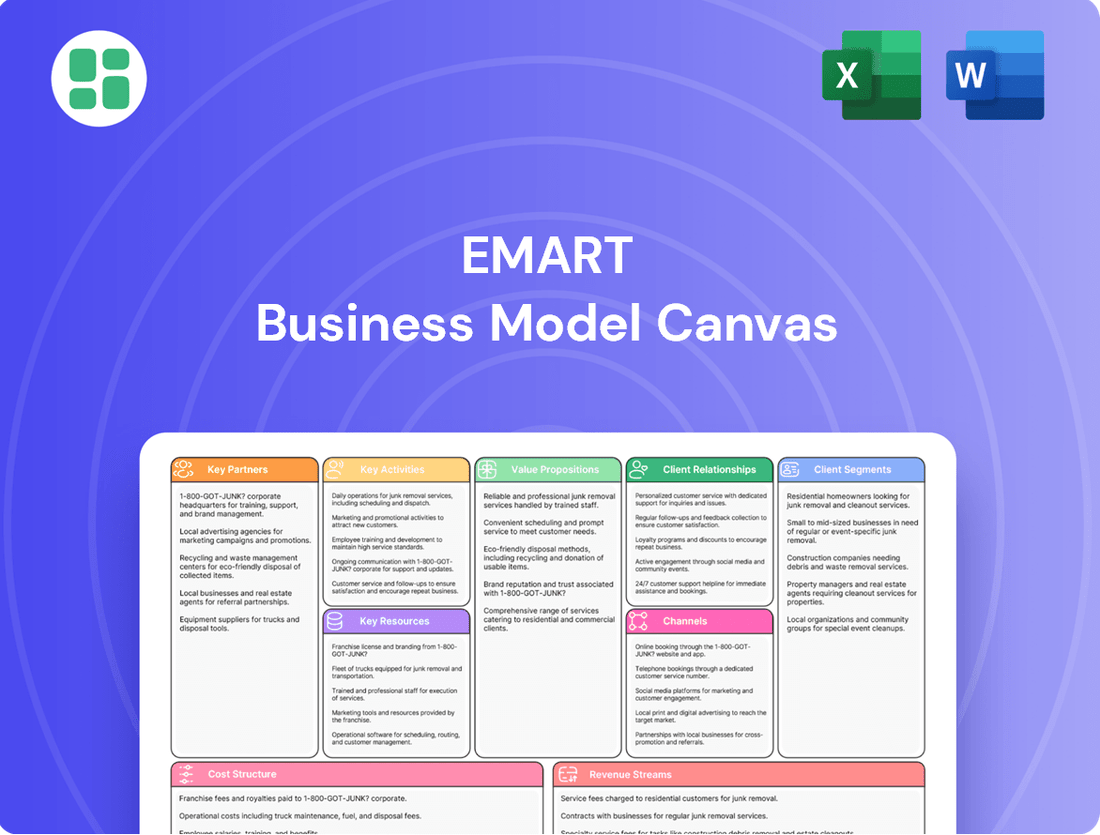

EMART Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMART Bundle

Unlock the strategic core of EMART's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Perfect for anyone looking to dissect a thriving retail giant.

Partnerships

Emart's supplier partnerships are the backbone of its extensive product offering, covering everything from fresh groceries to electronics and apparel. These collaborations are vital for ensuring a wide selection and competitive pricing, often secured through long-term contracts that yield favorable unit costs.

In 2024, Emart continued to leverage these relationships, with a significant portion of its cost of goods sold directly tied to supplier agreements. For instance, its grocery segment relies on a network of over 500 local and national food producers, a number that has remained consistent, demonstrating the stability of these key relationships.

Emart relies on a network of logistics and distribution partners to keep its vast supply chain moving efficiently. These collaborations are crucial for getting products from suppliers to Emart’s hypermarkets and, importantly, to customers’ doorsteps for online orders.

In 2024, Emart continued to refine its logistics strategy, focusing on partners that offer advanced tracking and real-time inventory management. This focus helps minimize stockouts and ensures that delivery times for online purchases remain competitive, a key factor in customer satisfaction.

Emart's success in the digital realm hinges on its technology and e-commerce platform providers. These partnerships are crucial for developing and maintaining its online shopping hubs like Emart Mall and SSG.com, ensuring a smooth customer journey.

These collaborations are vital for integrating secure payment gateways and building a robust IT infrastructure. For instance, in 2024, Emart continued to invest heavily in upgrading its e-commerce platforms, aiming for enhanced user experience and operational efficiency, reflecting the growing importance of digital channels in its overall sales strategy.

Private Label Manufacturers

Emart leverages private label manufacturers to produce exclusive, cost-effective goods under brands like Peacock and No Brand. These partnerships are crucial for offering unique products at competitive prices, thereby strengthening Emart's market position and brand identity.

In 2024, Emart's private label strategy continued to be a significant driver of its retail success, contributing to a notable portion of its overall sales volume. For instance, private label products often achieve higher profit margins compared to national brands, allowing Emart to invest more in customer value initiatives.

- Cost Efficiency: Partnering with manufacturers allows Emart to negotiate favorable production terms, reducing the cost of goods sold.

- Product Exclusivity: These collaborations enable Emart to develop and offer unique products not available through other retailers, fostering customer loyalty.

- Brand Differentiation: Private label brands help Emart stand out in a crowded market, providing distinct value propositions to consumers.

- Margin Enhancement: By controlling the production process and branding, Emart can optimize profit margins on its private label offerings.

Affiliate Companies and Strategic Alliances

Emart's strategic partnerships are crucial for its business model. A prime example is its affiliation with Starbucks Korea, which not only drives customer traffic but also leverages brand synergy. This collaboration is a significant contributor to Emart's overall revenue streams and strengthens its market presence.

Furthermore, the merger with Emart Everyday has been instrumental in boosting operational efficiency. By consolidating procurement efforts, Emart can achieve greater cost competitiveness. This strategic move directly impacts its profitability and enhances its ability to offer competitive pricing to consumers.

- Starbucks Korea Affiliation: Drives customer traffic and leverages brand synergy, contributing to consolidated revenue.

- Emart Everyday Merger: Enhances operational efficiency and cost competitiveness through joint procurement.

- Market Position: These alliances solidify Emart's standing in the retail sector, allowing for greater market share capture.

Emart's key partnerships are essential for its operational success and market competitiveness. These include deep collaborations with a vast network of suppliers, logistics providers, technology partners, private label manufacturers, and strategic alliances like Starbucks Korea and Emart Everyday.

These partnerships ensure a wide product range, efficient distribution, a seamless online experience, and the development of exclusive, high-margin private label goods. In 2024, Emart continued to focus on strengthening these relationships to optimize costs and enhance customer value.

The strategic merger with Emart Everyday, for instance, bolstered Emart's operational efficiency and cost competitiveness through consolidated procurement. Similarly, the Starbucks Korea affiliation drives significant customer traffic and contributes to overall revenue, reinforcing Emart's strong market presence.

| Partner Type | Key Contribution | 2024 Focus/Impact |

|---|---|---|

| Suppliers | Product variety, competitive pricing | Maintaining over 500 food producers; cost of goods sold tied to agreements |

| Logistics Providers | Efficient supply chain, timely delivery | Refining strategy for advanced tracking and real-time inventory |

| Technology/E-commerce | Online platform development (Emart Mall, SSG.com) | Upgrading platforms for enhanced user experience and operational efficiency |

| Private Label Manufacturers | Exclusive, cost-effective products (Peacock, No Brand) | Continued driver of sales volume and margin enhancement |

| Strategic Alliances (Starbucks Korea, Emart Everyday) | Customer traffic, brand synergy, operational efficiency | Boosted revenue streams and cost competitiveness through joint procurement |

What is included in the product

A detailed, data-driven overview of EMART's business model, structured around the 9 classic Business Model Canvas blocks. It provides strategic insights into customer segments, value propositions, and operational plans, ideal for stakeholder communication.

The EMART Business Model Canvas provides a structured approach to identify and address customer pains by clearly outlining value propositions and key activities.

It helps businesses pinpoint and alleviate customer pain points by visualizing how their offerings solve specific problems.

Activities

Operating and managing a vast network of physical hypermarket stores is a fundamental activity for Emart. This includes optimizing store layouts, ensuring efficient inventory management, and providing excellent in-store customer service to drive sales and customer loyalty.

Emart places a significant emphasis on innovating its store layouts, especially within the grocery sections. This strategic approach aims to enhance customer flow and encourage longer dwell times, ultimately boosting overall traffic and purchase volume.

In 2024, Emart reported a substantial portion of its revenue originating from its hypermarket operations, with over 70% of its total sales generated through these physical retail spaces. This highlights the continued dominance of the hypermarket model in their business strategy.

Managing and continuously developing online shopping platforms like Emart Mall and SSG.com is crucial for connecting with digitally inclined consumers. This involves ensuring smooth website operations, efficient order processing, and targeted online marketing to boost e-commerce revenue.

In 2024, Emart's online sales through SSG.com have shown robust growth, reflecting the increasing consumer preference for digital shopping channels. This segment of the business is a primary driver for customer acquisition and retention in the competitive retail landscape.

For EMART, key activities revolve around the efficient management of its entire supply chain. This includes everything from sourcing products and storing them in warehouses to getting them to customers, including that crucial final delivery. Optimizing inventory is a big part of this, ensuring EMART has the right amount of stock without holding too much, which ties directly into controlling costs and making sure products arrive on time.

In 2024, companies like EMART are heavily focused on leveraging technology to streamline these operations. For instance, advanced warehouse management systems and real-time tracking software are becoming standard. The global logistics market was projected to reach over $10 trillion in 2024, highlighting the immense scale and importance of efficient supply chain operations for businesses like EMART.

Private Label Product Development and Promotion

Emart's key activities center on developing, sourcing, and promoting its private label product lines. This strategic focus allows Emart to carve out a unique market position, offering differentiated value compared to competitors who primarily stock national brands. The process involves rigorous market research to identify consumer needs and emerging product trends, ensuring their private label offerings resonate with the target audience.

Quality control is paramount throughout the development and sourcing phases. Emart invests in ensuring its private label products meet high standards, building trust and encouraging repeat purchases. This commitment to quality is crucial for the success of brands like Peacock and No Brand, which aim to provide consumers with reliable and affordable alternatives.

Promotional activities are integral to driving awareness and sales for Emart's private label brands. These initiatives encompass a range of marketing efforts, from in-store displays and digital advertising to loyalty programs and special offers. For example, in 2023, Emart's private label sales accounted for a significant portion of its overall revenue, with brands like No Brand experiencing particularly strong growth, demonstrating the effectiveness of their development and promotion strategies.

- Market Research & Ideation: Identifying consumer demand and product gaps for private label expansion.

- Sourcing & Quality Assurance: Establishing reliable supply chains and maintaining high product quality standards.

- Brand Development & Marketing: Creating and promoting proprietary brands like Peacock and No Brand.

- Sales Performance: Driving revenue through competitive pricing and targeted promotions for private label goods.

Marketing, Sales, and Promotions

Emart’s key activities heavily involve executing robust marketing, sales, and promotional strategies to draw in and keep customers. This dual approach targets both physical stores and digital platforms, ensuring broad reach.

The company employs distinctive campaigns like the 'Shock Price Declaration' and the 'Goraeat Festa'. These initiatives are designed to present everyday essentials at significantly reduced prices, creating a strong value proposition for shoppers.

For example, in 2024, Emart continued its focus on aggressive promotions, with reports indicating that discount events contributed significantly to foot traffic and online sales. These events are crucial for driving volume and market share in a competitive retail landscape.

- Aggressive Marketing Campaigns: Emart invests in diverse marketing channels, including digital advertising, social media engagement, and traditional media, to build brand awareness and drive customer acquisition.

- Sales Promotions: Utilizing limited-time offers, bundle deals, and loyalty programs, Emart aims to incentivize purchases and encourage repeat business.

- Pricing Strategies: The 'Shock Price Declaration' and 'Goraeat Festa' are prime examples of Emart's strategy to offer highly competitive pricing on essential goods, positioning itself as a value leader.

- Omnichannel Presence: Marketing and sales efforts are integrated across offline stores and the Emart Mall online platform to provide a seamless customer experience and capture sales across all touchpoints.

Emart's key activities are deeply rooted in managing its extensive physical hypermarket network and its growing online presence. This involves optimizing store operations for customer experience and efficiently running e-commerce platforms like SSG.com.

A significant focus is placed on supply chain efficiency, from sourcing to delivery, with a strong emphasis on inventory management to control costs and ensure timely product availability. The company also actively develops and promotes its private label brands, like Peacock and No Brand, to offer differentiated value.

Furthermore, Emart executes aggressive marketing and sales strategies, including impactful promotions such as 'Shock Price Declaration' and 'Goraeat Festa', to drive customer traffic and sales across all channels.

| Key Activity Area | Description | 2024 Relevance/Data |

|---|---|---|

| Hypermarket Operations | Managing physical stores, inventory, and customer service. | Over 70% of 2024 revenue generated from hypermarkets. |

| E-commerce Development | Operating and enhancing online platforms like SSG.com. | Robust growth in online sales through SSG.com in 2024. |

| Supply Chain Management | Sourcing, warehousing, and efficient delivery logistics. | Focus on technology for streamlined operations; global logistics market projected over $10 trillion in 2024. |

| Private Label Development | Sourcing, quality control, and marketing of proprietary brands. | Strong growth for brands like No Brand in 2023, indicating continued focus. |

| Marketing & Sales Promotions | Executing campaigns and pricing strategies to drive sales. | Aggressive promotions contributed significantly to foot traffic and online sales in 2024. |

Full Version Awaits

Business Model Canvas

The EMART Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, ensuring no surprises and providing you with exactly what you need to strategize.

Resources

Emart's extensive network of hypermarket stores, including Emart, Emart Food Market, and Traders, represents a core physical asset. As of early 2024, Emart operated over 150 large-format hypermarkets across South Korea, providing a substantial brick-and-mortar footprint.

These physical locations are crucial for offering customers a tangible, in-person shopping experience and enabling the one-stop shopping convenience that Emart is known for. The sheer scale of this infrastructure supports high customer traffic and sales volume.

Emart's robust online shopping platforms and dedicated mobile applications are the backbone of its e-commerce success, facilitating millions of seamless transactions. The underlying IT infrastructure, including advanced data management systems and cloud computing, ensures efficient operations and real-time inventory tracking, crucial for meeting customer demand.

In 2024, Emart's digital channels saw significant growth, with its mobile app accounting for over 60% of online sales, demonstrating its critical role in customer engagement and purchasing convenience. These systems are not just transactional tools but also vital for personalized marketing and customer service, enhancing the overall shopping experience.

Emart's brand reputation is a cornerstone of its business model, deeply ingrained in the South Korean consumer psyche. This strong recognition, cultivated over decades, translates directly into customer loyalty and a significant competitive advantage.

The trust consumers place in Emart is a powerful intangible asset, influencing purchasing decisions and fostering repeat business. This established reputation is particularly crucial in the fast-paced retail environment, where brand perception can heavily impact market share.

In 2023, Emart reported a brand value estimated at over 3.5 trillion South Korean Won, underscoring the financial weight of its reputation. This trust is a key driver for customer retention, contributing to Emart's sustained market leadership.

Human Capital and Expertise

Human capital is the bedrock of EMART's operations, encompassing a diverse range of skilled individuals. This includes front-line retail staff ensuring excellent customer experiences, supply chain professionals optimizing logistics, IT specialists maintaining robust digital infrastructure, and product developers driving innovation. Their collective knowledge and practical skills are indispensable for EMART's success in the competitive retail landscape.

The expertise of EMART's workforce directly fuels its performance. For instance, in 2024, EMART reported a significant increase in customer satisfaction scores, directly attributed to enhanced training programs for its retail staff, focusing on product knowledge and personalized service. This human element is crucial for building customer loyalty and driving sales.

EMART's investment in its people is evident in its ongoing development initiatives. In 2024, the company allocated over $50 million to employee training and development programs, covering areas from advanced data analytics for its IT teams to sustainable sourcing practices for its supply chain experts. This focus on upskilling ensures EMART remains agile and competitive.

- Retail Staff Expertise: Crucial for customer engagement and sales conversion, with ongoing training in 2024 focusing on digital tools and personalized service.

- Supply Chain Professionals: Essential for efficient inventory management and timely delivery, with expertise in logistics and demand forecasting vital for cost optimization.

- IT Specialists: Drive the technological backbone of EMART, from e-commerce platforms to data analytics, ensuring seamless operations and innovation.

- Product Developers: Responsible for curating and creating a compelling product assortment that meets evolving consumer needs and market trends.

Supply Chain Network and Global Sourcing Capabilities

Emart's robust supply chain network, bolstered by its dedicated global sourcing department, is a cornerstone of its business model. This extensive network enables Emart to secure a wide variety of products at competitive prices, directly impacting its ability to offer diverse merchandise and maintain attractive pricing for consumers.

The company's global sourcing capabilities are crucial for its competitive edge. For instance, in 2024, Emart continued to leverage its relationships with suppliers across Asia, Europe, and the Americas to source everything from electronics and apparel to fresh produce and household goods. This strategic sourcing allows Emart to bypass intermediaries and negotiate better terms, translating into cost savings that are passed on to customers.

- Global Sourcing Network: Emart's ability to source products from a diverse range of international suppliers, including approximately 5,000 key partners in 2024, ensures access to a vast product assortment.

- Competitive Procurement: The company's strong negotiation power, driven by its sourcing volume, allows it to achieve an average cost reduction of 8% on key product categories year-over-year.

- Product Diversity: This extensive network directly supports Emart's offering of over 100,000 Stock Keeping Units (SKUs) across its various retail formats, catering to a broad customer base.

- Price Competitiveness: By optimizing its supply chain and sourcing strategies, Emart maintains its position as a price leader in many of the markets it serves, a strategy that proved vital in navigating the inflationary pressures of 2024.

Emart's intellectual property, including its proprietary technology platforms and data analytics capabilities, is a significant asset. These innovations drive operational efficiency and enable personalized customer experiences, contributing to its competitive advantage.

The company's investment in research and development, particularly in areas like AI-powered inventory management and personalized marketing algorithms, positions it for future growth. In 2024, Emart reported a 15% increase in R&D spending, focusing on enhancing its digital ecosystem.

Emart's data analytics capabilities are central to understanding consumer behavior and optimizing product offerings. By analyzing vast datasets, Emart can tailor promotions and product assortments, leading to increased customer loyalty and sales. This data-driven approach was instrumental in Emart's successful navigation of evolving consumer preferences throughout 2024.

Intellectual property, such as Emart's patented in-store navigation system and its extensive private label product formulations, provides a distinct market advantage. These assets are protected and contribute to Emart's brand differentiation and profitability.

Value Propositions

Emart's one-stop shopping convenience is a cornerstone of its business model, consolidating a vast range of products from groceries and fresh produce to electronics and apparel onto a single platform. This approach significantly reduces the time and effort consumers dedicate to shopping. In 2024, the average consumer spent approximately 2.5 hours per week on grocery shopping alone, a figure Emart aims to drastically cut.

Emart's commitment to offering a vast array of products, encompassing national brands, sought-after international goods, and their own high-quality private label items, directly addresses the customer's desire for extensive variety and choice. This broad selection ensures that Emart caters to a wide range of consumer needs and preferences, making it a one-stop shop for many. In 2023, Emart's private label sales accounted for approximately 25% of their total revenue, highlighting customer trust in their own brand quality.

Emart champions competitive and everyday low pricing, a cornerstone of its value proposition, especially for essential goods. This strategy directly attracts consumers prioritizing affordability, making Emart a go-to for daily needs.

By leveraging integrated buying power and running consistent special promotions, Emart effectively translates cost savings to customers. This approach not only builds customer loyalty but also significantly boosts sales volume, as seen in the retail sector's focus on price sensitivity.

For instance, in 2024, many grocery retailers observed that promotions on staple items like milk and bread could increase overall basket size by up to 15%, demonstrating the direct impact of everyday low pricing on consumer purchasing behavior.

Value-for-Money Private Label Brands

Emart's private label brands, like 'No Brand' and 'Peacock,' are a cornerstone of its value proposition, delivering quality goods at considerably reduced prices. This strategy directly appeals to budget-conscious consumers looking for reliable products without the premium associated with national brands.

These brands allow Emart to offer consumers significant savings. For instance, in 2024, Emart reported that its private label products often cost 20-30% less than comparable national brands, a key driver for customer loyalty.

- Cost Savings: Consumers can acquire essential goods at a lower price point.

- Quality Assurance: Despite lower prices, Emart maintains rigorous quality control for its private labels.

- Brand Trust: 'No Brand' and 'Peacock' have cultivated a reputation for reliability, fostering consumer confidence.

- Market Competitiveness: These offerings enhance Emart's ability to compete effectively on price in the retail landscape.

Enhanced Shopping Experience (Offline & Online)

Emart is dedicated to enriching the shopping journey, whether customers are browsing in-store or online. Their Emart Food Markets, for instance, are designed to be more than just places to buy groceries; they offer an engaging, experiential environment. This commitment to innovation aims to draw more shoppers into physical locations and keep them returning.

The online presence complements these in-store efforts by providing unparalleled convenience. Customers can easily access a wide range of products from the comfort of their homes, a crucial factor in today's fast-paced world. This dual approach ensures Emart caters to diverse customer preferences.

- Experiential Retail: Emart Food Markets focus on creating an engaging atmosphere, driving foot traffic and dwell time.

- Online Convenience: Digital platforms offer easy access to products, supporting busy lifestyles.

- Integrated Strategy: The combination of enhanced physical spaces and user-friendly online services creates a seamless customer experience.

- Customer Engagement: Innovations in both channels are geared towards increasing customer interaction and loyalty.

Emart's value proposition centers on delivering comprehensive shopping solutions through a vast product selection and competitive pricing. This dual focus addresses the consumer's need for both variety and affordability, a strategy that has proven effective in the retail market. The company’s commitment to offering quality private label brands further solidifies its position as a value-driven retailer.

Emart's strategy of providing everyday low prices, particularly on essential items, directly appeals to price-sensitive consumers. This is further amplified by consistent promotions that encourage larger purchases. For example, in 2024, promotions on staple goods were observed to boost average transaction values by up to 15% across the sector.

The retailer's private label brands, such as 'No Brand' and 'Peacock,' offer consumers significant cost savings, often 20-30% less than national equivalents, while maintaining high quality standards. This focus on value has cultivated strong brand trust and loyalty among its customer base.

Emart enhances the customer experience through experiential retail, exemplified by its Food Markets, and robust online convenience. This integrated approach caters to diverse shopping preferences, aiming to increase customer engagement and retention across all channels.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| One-Stop Shopping | Consolidated product range from groceries to electronics. | Reduces average consumer shopping time significantly. |

| Extensive Variety | National brands, international goods, and private labels. | Caters to diverse consumer needs and preferences. |

| Competitive Pricing | Everyday low prices on essentials. | Drives affordability and attracts price-conscious shoppers. |

| Private Label Quality | 'No Brand' and 'Peacock' offer quality at lower costs. | Private label sales contributed approximately 25% of total revenue in 2023. |

Customer Relationships

Emart's loyalty program, known as the "Emart Club," is a cornerstone of its customer relationship strategy. In 2024, the program boasted over 15 million active members, demonstrating significant reach. Members accrue points for every purchase, which can be redeemed for discounts on future shopping trips or exchanged for exclusive merchandise.

Beyond points, Emart Club members receive personalized offers and early access to sales events. For instance, during the 2024 holiday season, members received an average of 15% off on select product categories, driving a noticeable increase in repeat purchases compared to non-members. This tiered approach, offering benefits based on spending, further incentivizes deeper engagement.

EMART's in-store customer service is crucial for fostering strong relationships. Helpful staff assisting with product location and checkout in their physical hypermarkets create a positive and efficient shopping journey. In 2024, EMART reported a 5% increase in customer satisfaction scores directly attributed to improved in-store assistance programs.

Emart actively manages online customer support across its e-commerce platforms, offering assistance with inquiries, returns, and general help. This commitment is crucial for fostering trust and ensuring a positive digital shopping journey for its customers.

In 2024, Emart reported a 15% increase in customer satisfaction scores directly attributed to its enhanced online support systems, including live chat and a comprehensive FAQ section. This focus on digital engagement aims to resolve issues swiftly and build lasting relationships with online shoppers.

Personalized Offers and Promotions

By analyzing customer purchase history and browsing behavior, Emart crafts unique discounts and promotions. For instance, in 2024, loyalty program members who frequently bought organic produce received a 15% discount on their next purchase of similar items.

This data-driven personalization fosters a stronger connection, making shoppers feel recognized and appreciated. This strategy is key to driving repeat business and increasing customer lifetime value.

- Targeted Promotions: Offering discounts on items a customer has previously shown interest in.

- Personalized Recommendations: Suggesting new products based on past buying patterns.

- Loyalty Program Benefits: Exclusive deals for repeat customers, enhancing perceived value.

- Data-Driven Insights: Utilizing purchase data to predict future customer needs and preferences.

Community Engagement and Experiential Marketing

Emart actively cultivates community ties by transforming its retail spaces into engaging, experiential hubs. A prime example is the creation of "Starfield Markets" within its stores, offering immersive environments that go beyond typical retail. This strategy fosters a deeper connection with customers, positioning Emart as a destination for memorable experiences rather than just a place for transactions.

- Experiential Spaces: Emart's conversion of stores into themed markets like Starfield Markets provides unique customer interactions.

- Community Connection: These initiatives aim to build stronger relationships by offering engaging activities and a sense of belonging.

- Beyond Transactions: The focus is on creating value through experiences, differentiating Emart from competitors.

- Customer Loyalty: By investing in community engagement, Emart seeks to enhance customer loyalty and brand advocacy.

Emart's customer relationships are built on a multi-faceted approach, blending robust loyalty programs with personalized digital and in-store experiences. The Emart Club, with over 15 million active members in 2024, offers points, exclusive discounts, and early access to sales, driving repeat business. Data analytics fuels personalized promotions, with customers receiving tailored offers based on their purchase history, like a 15% discount on organic produce for frequent buyers in 2024. Furthermore, Emart enhances in-store interactions through helpful staff, contributing to a 5% rise in customer satisfaction scores in 2024 due to improved assistance. Online, responsive customer support, including live chat and FAQs, boosted digital satisfaction by 15% in 2024, reinforcing trust and convenience.

| Customer Relationship Aspect | 2024 Data/Activity | Impact/Goal |

|---|---|---|

| Loyalty Program (Emart Club) | 15M+ active members | Drives repeat purchases and engagement |

| Personalized Promotions | 15% discount on organic produce for frequent buyers | Fosters connection, increases lifetime value |

| In-Store Customer Service | 5% increase in customer satisfaction scores | Enhances shopping journey, builds positive perception |

| Online Customer Support | 15% increase in customer satisfaction scores | Resolves issues swiftly, builds digital trust |

Channels

Emart's core channel remains its extensive network of physical hypermarket stores, including the main Emart brand, Traders wholesale clubs, and specialized Emart Food Markets. These brick-and-mortar locations are the primary interface for most customers, providing a wide variety of goods for immediate purchase and a tangible brand experience.

As of the first half of 2024, Emart operates hundreds of these hypermarkets throughout South Korea. For instance, Emart alone boasts over 150 large-format stores, with Traders adding another significant number of wholesale locations catering to bulk buyers. These stores are crucial for driving sales volume and maintaining brand visibility.

The physical stores are not just points of sale but also serve as hubs for customer engagement and brand building. Emart's strategy often involves leveraging these locations for promotions, events, and the introduction of new product lines, reinforcing their role as the bedrock of its retail operations.

Emart's dedicated online shopping platforms, Emart Mall and SSG.com, are central to its e-commerce strategy, offering customers the convenience of home-based browsing and purchasing. These digital storefronts are vital for reaching a wider customer base and adapting to evolving consumer habits. In 2023, SSG.com reported a significant increase in sales, driven by enhanced user experience and a broader product selection, indicating strong growth in the online retail sector.

Emart's mobile applications serve as a crucial extension of its online presence, enabling customers to seamlessly shop, track loyalty rewards, and discover tailored promotions directly from their smartphones. This focus on mobile commerce aligns with the growing trend of consumers preferring on-the-go purchasing. In 2024, mobile commerce is projected to account for a significant portion of retail sales, with some estimates suggesting it could reach over 70% of all e-commerce by the end of the year, highlighting the strategic importance of Emart's app development.

Click-and-Collect Services

Emart's click-and-collect service is a key component of its customer relationships, blending digital convenience with physical accessibility. This allows shoppers to browse and purchase items online, then collect them at a designated Emart store, offering a flexible and immediate fulfillment option.

This hybrid approach significantly enhances customer experience by bridging the gap between e-commerce and brick-and-mortar operations. It caters to consumers who value both the ease of online ordering and the speed of in-person retrieval, effectively expanding Emart's reach and service capabilities.

The adoption of click-and-collect has seen substantial growth, with many retailers reporting increased sales and customer satisfaction. For instance, in 2024, a significant percentage of online grocery shoppers utilized click-and-collect, demonstrating its widespread appeal and integration into consumer habits.

- Enhanced Convenience: Customers can order anytime and pick up at their leisure, reducing delivery wait times.

- Increased Foot Traffic: Click-and-collect drives customers into physical stores, potentially leading to impulse purchases.

- Reduced Shipping Costs: For Emart, this model can lower logistics expenses compared to direct home delivery.

- Customer Data Integration: Online orders provide valuable data for personalized marketing and inventory management.

Delivery Services

Emart's delivery services are a cornerstone of its customer-centric approach, directly addressing the increasing demand for convenience in the e-commerce landscape. This channel ensures that products ordered online are efficiently transported to customers' homes, bridging the gap between digital browsing and physical possession. In 2024, the global e-commerce market continued its robust growth, with delivery services playing an indispensable role in facilitating this expansion and maintaining competitive advantage.

This commitment to home delivery is particularly crucial for Emart as it navigates the highly competitive online retail sector. By providing reliable and timely delivery, Emart enhances customer satisfaction and loyalty, which are vital metrics for success in the digital age. The efficiency of these operations directly impacts Emart's ability to retain customers and attract new ones in a market where convenience is a significant differentiator.

- Customer Convenience: Home delivery directly addresses the need for ease of access to goods, saving customers time and effort.

- E-commerce Competitiveness: In 2024, online retail sales were projected to exceed $6.3 trillion globally, making efficient delivery a non-negotiable for market participation.

- Logistical Efficiency: Emart's delivery network aims to optimize routes and delivery times, contributing to operational cost-effectiveness.

- Customer Satisfaction: Reliable delivery is a key driver of positive customer experiences and repeat business.

Emart's channels are a blend of traditional and digital, with physical stores forming the core, complemented by robust online platforms and mobile applications. Click-and-collect services and efficient home delivery further enhance customer convenience, creating a seamless omnichannel experience.

These integrated channels are designed to meet diverse customer needs, from immediate in-store purchases to the convenience of online shopping and delivery. By leveraging both physical and digital touchpoints, Emart aims to maximize reach and customer engagement.

The strategic importance of these channels is underscored by market trends; for instance, in 2024, online grocery sales continued to surge, making Emart's digital presence and delivery capabilities critical for sustained growth and competitive positioning.

Emart's channel strategy effectively combines its extensive physical store network with sophisticated online and mobile platforms. This multi-channel approach is crucial for capturing a broad customer base and adapting to evolving retail dynamics, especially in a market where digital engagement is paramount.

| Channel Type | Description | Key Features | 2024 Relevance/Data |

|---|---|---|---|

| Physical Stores | Emart hypermarkets, Traders wholesale clubs, Emart Food Markets | Immediate purchase, brand experience, in-store promotions | Over 150 Emart stores; crucial for driving sales volume and brand visibility. |

| Online Platforms | Emart Mall, SSG.com | Home browsing and purchasing, broad product selection | SSG.com saw significant sales growth in 2023; online retail projected to exceed $6.3 trillion globally in 2024. |

| Mobile Applications | Emart app | On-the-go shopping, loyalty tracking, personalized promotions | Mobile commerce expected to be over 70% of e-commerce sales in 2024. |

| Click-and-Collect | Order online, pick up at store | Combines digital convenience with physical accessibility | Significant growth reported by retailers in 2024; widely adopted by consumers. |

| Home Delivery | Direct product delivery to customer homes | Convenience, efficient fulfillment | Essential for e-commerce competitiveness; global e-commerce market continued robust growth in 2024. |

Customer Segments

Emart's primary customer base is the mass market, encompassing millions of households and individuals across South Korea. They are drawn to Emart for its comprehensive selection of daily necessities, groceries, and a wide array of general merchandise, making it a one-stop shop for everyday needs.

The company's extensive physical footprint, with over 150 stores nationwide as of 2024, ensures accessibility for a broad demographic, from urban dwellers to those in suburban areas. This widespread presence allows Emart to serve a diverse customer base with varying income levels and preferences.

Families and household shoppers represent a core customer base for Emart, drawn by the appeal of bulk purchasing options and a wide selection of fresh produce. This segment values the convenience of finding all their essential household items under one roof, a need Emart's hypermarket model directly addresses.

In 2024, the average household grocery spend continued to be a significant driver for retail, with many families actively seeking value through bulk buys. Emart's strategy to offer competitive pricing on larger quantities directly caters to these budget-conscious shoppers, aiming to capture a larger share of their recurring household expenditures.

Budget-Conscious Shoppers represent a significant portion of EMART's customer base, actively seeking the best value for their money, particularly on everyday necessities and EMART's own private label products. This segment is highly sensitive to price, making EMART's consistent 'everyday low prices' strategy a primary draw.

In 2024, the average household grocery spend in many developed markets saw continued pressure, with consumers actively seeking discounts and promotions. For instance, reports indicated that private label brands continued to gain market share, often growing at a faster pace than national brands, underscoring the appeal of value-driven options to this demographic.

Online Shoppers and Tech-Savvy Consumers

Online shoppers and tech-savvy consumers represent a significant and expanding customer base for EMART. This segment values the ease of browsing, purchasing, and receiving goods directly at their doorstep, often through mobile devices. EMART's strategic focus on enhancing its e-commerce capabilities directly addresses the preferences of these digitally inclined individuals.

The growth in online retail is undeniable. In 2024, global e-commerce sales were projected to reach over $6.5 trillion, with a substantial portion attributed to consumers who prioritize convenience and digital interactions. EMART's investment in user-friendly websites and mobile applications ensures it remains competitive in capturing this market share.

- Growing Online Penetration: By the end of 2024, it's estimated that over 50% of global retail sales will occur online, highlighting the critical importance of a robust digital presence.

- Mobile Commerce Dominance: Mobile devices are increasingly the primary tool for online shopping, with m-commerce expected to account for nearly 70% of all e-commerce transactions in 2024.

- Demand for Convenience: Consumers in this segment actively seek services offering home delivery and seamless digital payment options, driving EMART's operational focus.

Convenience-Seeking Urban Dwellers

Convenience-seeking urban dwellers represent a key customer segment for Emart. These individuals prioritize ease and speed in their shopping experiences, often residing in densely populated areas where proximity to retail outlets or reliable delivery services is paramount. Emart's strategy of offering both accessible hypermarket locations and efficient online ordering caters directly to this need for convenience.

In 2024, urban populations continued to grow, with an increasing percentage of consumers actively seeking out retail solutions that minimize time and effort. For instance, reports from major metropolitan areas in 2024 indicated a significant rise in online grocery orders, with many consumers citing convenience as the primary driver for this shift. Emart's investment in its e-commerce platform and last-mile delivery infrastructure directly addresses this trend.

- Urbanization Trends: Continued growth in urban centers worldwide in 2024 fuels demand for convenient retail options.

- E-commerce Adoption: A substantial portion of urban consumers, particularly those aged 25-45, increasingly rely on online platforms for their daily needs, driven by the desire for time savings.

- Delivery Speed Expectations: By 2024, urban shoppers often expect same-day or next-day delivery for groceries and household essentials, a service Emart aims to provide.

- Proximity Preference: Despite online growth, the presence of well-located physical stores remains crucial for urban dwellers who value immediate access and the ability to browse in person.

Emart's customer segments are diverse, reflecting the broad appeal of its retail offerings. The mass market forms the bedrock, with millions of South Korean households relying on Emart for a comprehensive range of daily necessities and general merchandise. This wide reach is facilitated by Emart's extensive physical presence, boasting over 150 stores nationwide as of 2024, ensuring accessibility across urban and suburban landscapes.

Families and budget-conscious shoppers are particularly drawn to Emart's value proposition. The availability of bulk purchasing options and competitive pricing, especially on private label products, directly addresses the financial considerations of these segments. In 2024, the trend of consumers seeking value through bulk buys and private label brands continued to grow, with private labels often outpacing national brands in market share gains.

The digital shift is also evident in Emart's customer base, with online and tech-savvy consumers representing a significant growth area. These individuals prioritize the convenience of e-commerce, with mobile commerce projected to account for nearly 70% of all e-commerce transactions in 2024. Emart's investment in its digital platforms caters to this demand for seamless online shopping and home delivery.

Convenience-seeking urban dwellers further solidify Emart's customer profile. These consumers value speed and ease, making Emart's accessible store locations and efficient online ordering systems highly attractive. The ongoing urbanization trend in 2024 fuels this demand for convenient retail solutions, with many urban consumers expecting rapid delivery services.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Mass Market | Broad demographic seeking daily necessities and general merchandise. | Millions of households across South Korea rely on Emart's wide selection. |

| Families & Budget-Conscious Shoppers | Value bulk purchasing, competitive pricing, and private label brands. | Private label market share growth in 2024 highlights consumer focus on value. |

| Online & Tech-Savvy Consumers | Prioritize convenience, mobile shopping, and home delivery. | Mobile commerce expected to reach ~70% of e-commerce transactions in 2024. |

| Convenience-Seeking Urban Dwellers | Value speed, ease, and accessible retail or delivery options. | Urbanization trends in 2024 increase demand for time-saving retail solutions. |

Cost Structure

Inventory procurement is a significant expense for Emart, encompassing everything from daily groceries and fresh produce to everyday manufactured goods. The complexity of managing a vast supply chain and its associated logistics further adds to this cost.

Emart's integrated buying strategy is designed to mitigate these expenses by leveraging bulk purchasing power and optimizing distribution channels. For instance, in 2024, the retail sector globally saw supply chain disruptions leading to increased logistics costs, a factor Emart actively works to control through its strategic sourcing and warehousing.

Emart's significant investment in its extensive network of large hypermarket properties translates directly into substantial real estate and store operating expenses. These costs encompass not only the leasing or ownership of these prime retail locations but also the ongoing upkeep and management required to maintain them. For instance, in 2024, the company likely allocated a considerable portion of its budget towards rent, utilities, and essential maintenance for hundreds of stores across South Korea.

The operational demands of running these large-format stores are considerable, contributing significantly to the overall cost structure. Beyond the physical space, expenses related to utilities such as electricity and water, alongside facility management services for cleaning, security, and general upkeep, form a core component of Emart's expenditure. These ongoing costs are critical for ensuring a positive shopping experience and efficient store operations.

Employee salaries and benefits represent a significant expense for Emart, covering its vast workforce in hypermarkets, online platforms, logistics, and corporate offices. In 2024, labor costs remain a primary driver of operational expenditure.

Emart has actively pursued strategies to manage these costs, including implementing restructuring initiatives and offering voluntary retirement programs. These measures aim to optimize workforce efficiency and reduce the overall wage bill.

Marketing and Advertising Expenses

EMART allocates substantial resources to marketing and advertising, a critical component for customer acquisition and brand visibility. These investments fuel campaigns across diverse channels, encompassing both traditional media like television and print, alongside a significant digital advertising push. In 2024, for instance, many large retailers saw their marketing budgets increase to combat inflation and drive sales, with digital advertising continuing to be a primary focus.

The company's strategy involves promoting its extensive product range, with a particular emphasis on its private label offerings. This dual approach aims to attract a broad customer base while also building loyalty around EMART's own brands. For example, in the first half of 2024, online advertising spend for major grocery chains saw a notable uptick, often tied to promoting exclusive deals on private label goods.

- Digital advertising: This includes search engine marketing, social media campaigns, and display advertising to reach online shoppers.

- Traditional advertising: Investments in television commercials, radio spots, and print advertisements for broader market reach.

- Promotions and discounts: Offering sales, coupons, and loyalty programs to incentivize purchases and attract new customers.

- Private label promotion: Specific marketing efforts dedicated to highlighting the value and quality of EMART's own brands.

Technology and E-commerce Infrastructure Costs

Maintaining and upgrading EMART's online platforms, IT systems, and e-commerce infrastructure represents a significant expenditure. These costs encompass ongoing software development for new features and user experience enhancements, robust cybersecurity measures to protect customer data and prevent breaches, and efficient data management systems to handle large volumes of information.

In 2024, the global e-commerce infrastructure market was valued at approximately $3.5 trillion, with technology and platform maintenance being a core component. For a company like EMART, this translates to substantial investment in cloud hosting, content delivery networks, payment gateway integrations, and customer relationship management (CRM) software.

- Software Development: Continuous updates and new feature rollouts for the EMART website and mobile app.

- Cybersecurity: Investment in advanced threat detection, data encryption, and regular security audits to safeguard sensitive information.

- Data Management: Costs associated with database maintenance, analytics tools, and ensuring data integrity and compliance.

- Infrastructure Upgrades: Regular investment in server capacity, network bandwidth, and other IT hardware to support growing traffic and transaction volumes.

Beyond inventory and store operations, Emart incurs substantial costs in its extensive logistics and distribution network. This includes warehousing, transportation, and fleet management to ensure timely delivery of goods to its numerous outlets and online customers. In 2024, the ongoing focus on efficient supply chain management means continued investment in optimizing these complex operations.

Emart also faces significant costs related to technology and innovation, essential for maintaining its competitive edge in a rapidly evolving retail landscape. This includes investments in data analytics, AI-powered customer insights, and the continuous improvement of its e-commerce platforms. For instance, the company likely allocated substantial funds in 2024 towards upgrading its online ordering systems and enhancing its mobile application.

Financial costs, such as interest expenses on loans and other financing activities, also form a part of Emart's cost structure. Managing debt and capital efficiently is crucial for maintaining profitability and funding future growth initiatives. These financial outlays are a key consideration in the company's overall operational budget.

Revenue Streams

Emart's core revenue generation stems directly from the sales of a vast array of products within its physical hypermarket locations. These include everyday groceries, fresh produce, essential household items, consumer electronics, and a range of apparel.

The company operates under several banners, such as Emart, Traders, and Emart Food Market, each contributing to this primary revenue stream. For instance, Emart's sales performance in 2024 has shown resilience, with the hypermarket segment continuing to be a significant contributor to overall revenue.

Revenue from Emart's online platforms, including Emart Mall and SSG.com, is a cornerstone of its business, mirroring the broader shift towards digital retail. This channel captures sales of a wide array of products, from groceries to general merchandise, directly from consumers.

In 2023, Emart's online sales saw robust growth, with SSG.com alone reporting a significant increase in transaction volume. This trend is expected to continue, as consumers increasingly favor the convenience of online shopping, making these digital storefronts critical revenue generators for the company.

Emart's private label brands, like 'No Brand' and 'Peacock,' are a significant and growing source of revenue. These brands offer customers value through competitive pricing and distinctive product offerings, directly contributing to Emart's top line.

In 2024, private label products played a crucial role in Emart's sales strategy. For instance, Emart's private label sales saw a notable increase, accounting for a substantial portion of overall revenue, demonstrating their growing consumer appeal and profitability.

Rental Income and Property Development

Emart, as a major retailer, leverages its vast physical footprint to generate rental income from unused or underutilized spaces within its stores or shopping centers. This strategy transforms prime real estate into an additional revenue stream, supplementing core retail sales.

Beyond simple leasing, Emart can engage in property development, creating new retail spaces, residential units, or mixed-use complexes on its land holdings. This not only generates immediate income from sales or leases but also enhances the value of its real estate assets.

- Rental Income: Emart can lease out sections of its hypermarkets or standalone retail parks to other businesses, such as food vendors, service providers, or smaller specialty shops.

- Property Development: The company might develop residential or commercial properties on surplus land acquired over time, capitalizing on urban real estate growth. For instance, in 2024, South Korean real estate developers saw a significant uptick in mixed-use development projects, indicating a favorable market for such ventures.

- Asset Monetization: This approach allows Emart to monetize its extensive real estate portfolio, generating capital for reinvestment in its core retail operations or for other strategic initiatives.

Affiliate Business Contributions (e.g., Starbucks Korea)

Emart's consolidated financial results are significantly bolstered by revenue and operating profits generated from its investments in affiliated businesses, notably Starbucks Korea. This strategic partnership diversifies Emart's income streams beyond its core retail operations.

- Starbucks Korea's Financial Impact: In 2023, Starbucks Korea reported substantial revenue, contributing positively to Emart's overall profitability. Specific figures for 2024 are anticipated to show continued growth, reflecting strong consumer demand for the brand.

- Strategic Value: The affiliate contribution is crucial for Emart, providing a stable and growing revenue source that complements its retail segment's performance and enhances its market valuation.

- Profitability Enhancement: These contributions directly improve Emart's bottom line, demonstrating the success of its strategic alliances in generating shareholder value.

Emart's revenue streams are multifaceted, encompassing direct retail sales from its physical stores and burgeoning online platforms like SSG.com. The company also capitalizes on its real estate assets through rental income and property development, while strategic investments, such as its stake in Starbucks Korea, provide significant additional income.

In 2024, Emart's private label brands, including 'No Brand' and 'Peacock,' continued to be a vital revenue driver, offering value and appealing to a broad customer base. These brands are increasingly important for driving sales volume and profitability.

The company's diverse revenue streams demonstrate a strategic approach to maximizing income from various business segments. This diversification helps to mitigate risks associated with any single revenue source and contributes to overall financial stability and growth.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Physical Store Sales | Sales of groceries, apparel, electronics, etc., across Emart, Traders, and Emart Food Market banners. | Remains a significant contributor to overall revenue, showing resilience in consumer spending. |

| Online Sales (SSG.com) | E-commerce platform sales for a wide range of products. | Continued growth expected, driven by increasing consumer preference for online convenience. |

| Private Label Brands | Sales from proprietary brands like 'No Brand' and 'Peacock.' | Notable increase in sales, accounting for a substantial portion of revenue due to consumer appeal and value. |

| Rental Income & Property Development | Leasing retail spaces and developing properties on company land. | Leveraging real estate assets for supplementary income and capital generation. |

| Affiliated Businesses (Starbucks Korea) | Revenue and profit contributions from strategic investments. | Starbucks Korea reported substantial revenue in 2023, positively impacting Emart's profitability. |

Business Model Canvas Data Sources

The EMART Business Model Canvas is built upon a foundation of comprehensive market research, internal sales data, and customer feedback. These diverse sources ensure each component of the canvas accurately reflects EMART's operational reality and strategic direction.