Emaar Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emaar Properties Bundle

Emaar Properties operates within a dynamic global landscape, influenced by political stability, economic growth, and evolving social trends. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these factors, offering actionable insights to navigate Emaar's future. Unlock a deeper understanding of the opportunities and challenges shaping Emaar Properties by downloading the full PESTLE analysis today.

Political factors

Emaar Properties thrives within the UAE's stable political landscape, bolstered by consistent pro-business policies. The government's commitment to economic diversification, evident in initiatives like the Dubai Economic Agenda (D33), which aims to double the size of Dubai's economy by 2033, directly supports Emaar's growth by fostering a dynamic investment environment.

These governmental strategies, including significant investment in large-scale infrastructure and tourism, create a fertile ground for real estate development. The Dubai 2040 Urban Master Plan, for instance, strategically guides urban expansion and development, aligning perfectly with Emaar's extensive project pipeline and ensuring long-term relevance.

Recent UAE government reforms, including the expansion of freehold zones and the Golden Visa program, have significantly opened doors for foreign property investors. These initiatives, actively promoted in 2024 and expected to continue through 2025, allow for 100% foreign ownership in specific areas.

This policy shift directly enhances the appeal of real estate in the UAE, making it more accessible and attractive to international buyers. The introduction of long-term residency visas for substantial property investments further incentivizes foreign capital inflow into the sector.

Consequently, these changes are poised to drive increased demand for properties offered by developers like Emaar Properties. The ability for foreigners to own property outright and gain residency status simplifies and encourages significant investment, benefiting companies with a strong presence in key UAE markets.

The regulatory landscape for real estate in Dubai, Emaar's primary market, is robust and evolving. The Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) are key bodies ensuring market integrity and investor confidence.

Anticipated 2025 regulations will introduce more stringent escrow account rules for off-plan sales, aiming to safeguard buyer funds. Emaar, like other developers, will need to adapt to these measures, which are designed to bolster transparency in a sector that saw over AED 300 billion in property transactions in 2023.

Furthermore, new mandates for mandatory green certifications on all new constructions starting in 2025 will influence development practices. This pushes Emaar towards more sustainable building, aligning with global environmental trends and potentially impacting project costs and timelines.

Geopolitical Stability in the Middle East

Emaar Properties, while based in Dubai, is significantly influenced by the geopolitical stability of the wider Middle East region. Fluctuations in regional stability can impact investor sentiment and the flow of capital into the UAE and, by extension, Emaar's projects and global ventures.

Dubai's positioning as a relatively stable and secure hub within the Middle East has been a crucial factor in bolstering investor confidence. This perception of safety, even amidst broader regional challenges, has helped maintain robust demand for its real estate sector, directly benefiting Emaar's core business. For instance, Dubai's economy grew by an estimated 3.2% in 2023, a testament to its resilience.

The ongoing geopolitical landscape, while presenting potential risks, has also highlighted Dubai's attractiveness as a safe haven. This has translated into continued interest from international investors, supporting Emaar's ability to secure funding and drive sales. In the first half of 2024, Emaar reported a 27% increase in revenue compared to the same period in 2023, reaching AED 13.7 billion, underscoring the market's positive response.

- Regional Stability: Continued stability in the Middle East is vital for maintaining investor confidence in Dubai's real estate market, which is Emaar's primary operational base.

- Dubai's Safe Haven Status: Dubai's reputation as a secure location attracts foreign investment, supporting sustained demand for Emaar's developments.

- Investor Sentiment: Geopolitical events can directly influence global investor sentiment, impacting capital flows into the UAE and Emaar's financial performance.

Government Support for Tourism and Mega-Projects

The UAE government's proactive approach to boosting tourism, aiming to attract 40 million visitors annually by 2030, directly benefits Emaar Properties. This ambitious target fuels demand for Emaar's extensive portfolio in hospitality, leisure, and retail sectors, creating a fertile ground for growth.

Government-driven mega-projects and high-profile events consistently draw international visitors and new residents to the UAE. This influx translates into sustained demand for Emaar's integrated communities, luxury residences, and world-class hospitality services.

- Government Tourism Targets: UAE aims for 40 million tourists annually by 2030, supporting Emaar's hospitality and retail ventures.

- Mega-Project Impact: Government-backed initiatives create sustained demand for Emaar's residential and commercial developments.

- Event-Driven Demand: Major events attract global attention, boosting occupancy and retail sales within Emaar's properties.

The UAE's stable political environment and pro-business policies are key drivers for Emaar Properties. Initiatives like the Dubai Economic Agenda (D33), aiming to double Dubai's economy by 2033, and the Dubai 2040 Urban Master Plan, guide urban development and align with Emaar's extensive project pipeline, creating a favorable investment climate.

Government reforms, including expanded freehold zones and the Golden Visa program, have enhanced foreign property ownership and residency, making UAE real estate more attractive to international buyers. These policies are expected to sustain demand for Emaar's offerings through 2025.

Anticipated 2025 regulations will introduce stricter escrow account rules for off-plan sales, boosting transparency and buyer protection in a market that saw over AED 300 billion in property transactions in 2023. Mandatory green certifications for new constructions from 2025 will also shape development practices.

| Factor | Impact on Emaar Properties | Data/Initiative |

|---|---|---|

| Political Stability | Fosters investor confidence and economic growth | Dubai Economy grew 3.2% in 2023 |

| Government Policies | Supports real estate development and foreign investment | Dubai Economic Agenda (D33), Dubai 2040 Urban Master Plan |

| Regulatory Environment | Ensures market integrity and investor protection | New escrow rules (2025), mandatory green certifications (2025) |

| Foreign Ownership Reforms | Increases accessibility for international buyers | 100% foreign ownership in specific zones, Golden Visa program |

What is included in the product

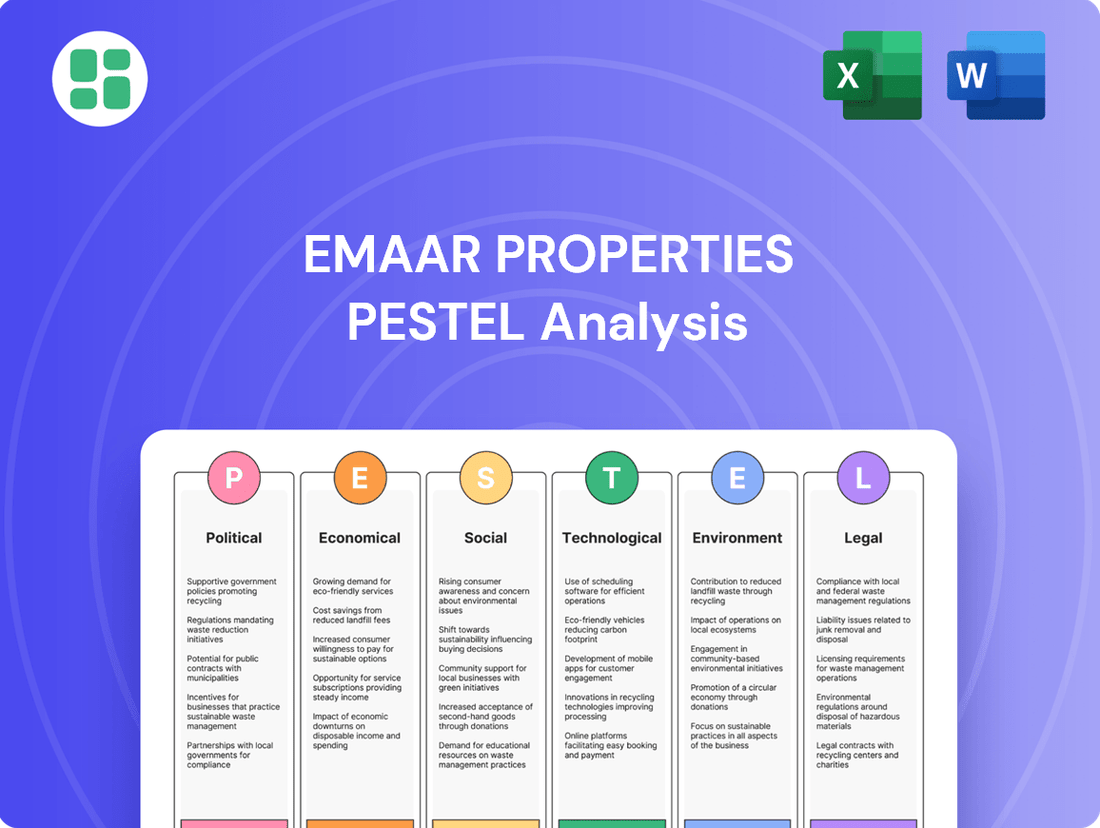

This PESTLE analysis for Emaar Properties meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations and strategic direction.

It provides a comprehensive overview of how these external factors create both challenges and avenues for growth within the real estate development sector.

The Emaar Properties PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for swift decision-making in meetings and presentations.

Economic factors

Dubai's real estate market is booming, with 2024 seeing record growth in both rents and sales prices. Projections indicate this upward trend will continue into 2025, creating a robust environment for property developers like Emaar Properties.

This surge in demand, coupled with a constrained supply of new properties, positions Emaar favorably for strong sales and successful project launches. The market's dynamism offers significant opportunities for Emaar to capitalize on its development pipeline.

Global economic growth directly influences Emaar Properties' financial health, particularly given its significant international investor base. In 2024, forecasts from the IMF suggest global growth around 3.2%, a moderate pace that can affect investment appetite for large-scale property development.

Investor confidence, a key driver for real estate markets, remains a critical factor. Despite some global economic uncertainties in early 2025, Dubai's consistent economic performance and its reputation as a secure investment haven continue to attract substantial foreign direct investment, bolstering confidence in its property sector.

Dubai's real estate sector, a primary market for Emaar, saw a notable increase in foreign investment in 2024, with transactions involving international buyers reaching significant volumes, indicating sustained investor interest despite broader global economic conditions.

Dubai's population is experiencing robust growth, with estimates reaching around 3.95 million by mid-2025 and expected to cross the 4 million mark by the third quarter of the same year. This expansion is largely attributed to strong job creation, a welcoming environment for investors, and the city's attractive lifestyle, all of which significantly boost the demand for residential and commercial properties. Emaar Properties, as a leading developer, directly benefits from this demographic trend, as a larger population translates into a greater need for housing solutions.

Interest Rates and Access to Financing

Changes in interest rates and the availability of flexible home financing directly influence how affordable properties are and, consequently, affect investment decisions. In 2025, the UAE's banking sector is actively supporting the property market by offering more attractive mortgage products. This includes lower interest rates and higher loan-to-value ratios, which significantly broadens the accessibility of property investment for a wider demographic of buyers.

These favorable financing conditions are crucial for a developer like Emaar Properties, as they directly stimulate demand. For instance, a decrease in mortgage rates can substantially lower monthly payments for buyers, making Emaar's diverse portfolio more appealing. The increased availability of capital for potential investors, coupled with competitive lending terms, creates a more robust environment for property sales and Emaar's revenue streams.

- Lower Interest Rates: UAE banks are offering mortgage rates as low as 3.5% in 2025, down from an average of 4.5% in 2023, making borrowing more affordable.

- Higher Loan-to-Value (LTV) Ratios: LTV ratios have increased, with many banks now offering up to 80% LTV on first-time homebuyer mortgages, reducing the upfront capital needed.

- Increased Financing Options: A wider array of flexible repayment plans and longer mortgage terms are available, catering to diverse buyer needs and financial capacities.

Oil Price Fluctuations and Diversification

While Dubai's economy has made significant strides in diversification away from oil, fluctuations in global oil prices can still exert an indirect influence. For instance, lower oil revenues might temper overall economic sentiment and potentially affect government spending on infrastructure projects, which could indirectly impact the real estate sector where Emaar Properties operates.

However, the UAE's strategic emphasis on bolstering non-oil economic sectors, including real estate, retail, and tourism, provides a robust framework for resilience against oil price volatility. This diversification strategy is crucial for maintaining economic stability and supporting growth in key industries.

- UAE Non-Oil GDP Growth: The UAE's non-oil GDP grew by an estimated 4.7% in 2023, demonstrating continued economic expansion independent of oil revenues.

- Real Estate Sector Contribution: The real estate sector's contribution to Dubai's non-oil GDP was approximately 7.8% in 2023, highlighting its importance to the diversified economy.

- Tourism Recovery: Dubai welcomed over 17 million visitors in 2023, a 19% increase from 2022, underscoring the strength of its tourism sector, which benefits the real estate market through demand for hospitality and residential properties.

Dubai's property market is experiencing significant growth, with 2024 and projections for 2025 indicating continued increases in rents and sales prices. This robust market, driven by strong demand and limited supply, presents a favorable landscape for Emaar Properties.

Globally, economic growth is projected around 3.2% for 2024, a moderate pace that can influence international investor appetite for large-scale projects like those undertaken by Emaar.

Investor confidence in Dubai remains high, supported by its consistent economic performance and reputation as a secure investment haven, attracting substantial foreign direct investment in 2024 and into 2025.

Favorable financing conditions, including mortgage rates as low as 3.5% in 2025 and higher loan-to-value ratios, are making property more accessible and stimulating demand for Emaar's offerings.

| Economic Factor | 2024/2025 Data Point | Impact on Emaar Properties |

|---|---|---|

| Dubai Property Market Growth | Record growth in rents and sales prices in 2024, projected to continue into 2025. | Strong sales and successful project launches. |

| Global Economic Growth (IMF Forecast) | Around 3.2% in 2024. | Influences international investor sentiment and capital flow. |

| Investor Confidence in Dubai | High, supported by consistent economic performance and FDI. | Bolsters demand for Emaar's developments. |

| UAE Mortgage Rates (2025) | As low as 3.5%. | Increases property affordability and stimulates buyer demand. |

| UAE Non-Oil GDP Growth | Estimated 4.7% in 2023. | Indicates economic resilience and supports key industries like real estate. |

What You See Is What You Get

Emaar Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Emaar Properties PESTLE Analysis offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into market dynamics and strategic planning.

Sociological factors

Dubai's population is remarkably diverse, with expatriates making up over 92% of residents as of 2025. This significant expatriate presence directly influences the real estate market, creating a strong demand for a wide array of housing types.

This demographic reality fuels the need for varied residential offerings, ranging from high-end luxury apartments to more family-oriented communities. Emaar Properties must continually adapt its portfolio to meet the diverse cultural preferences and distinct lifestyle requirements of this international resident base, ensuring continued market relevance and sales.

There's a noticeable shift towards integrated communities, where people want everything – homes, shops, and entertainment – all in one place. This trend is really strong, and Emaar Properties is perfectly positioned to meet this demand. For instance, their developments like Dubai Creek Harbour and Emaar South are designed to offer this comprehensive living experience, which is exactly what today's consumers are looking for in terms of convenience and a full suite of amenities.

Dubai's rapid urbanization, aiming for a high quality of life, fuels consistent demand for premium real estate. Emaar Properties directly addresses this by developing master-planned communities offering exceptional design, advanced infrastructure, and vibrant lifestyle amenities, aligning perfectly with societal aspirations for modern living.

Consumer Spending Habits and Retail/Hospitality Demand

Consumer spending habits are a critical driver for Emaar Properties, especially within its retail and hospitality divisions. Dubai's economy, fueled by a steadily increasing population and a thriving tourism sector, creates robust demand for Emaar's shopping malls and hotels. This trend is expected to continue, directly benefiting the company's revenue streams.

The outlook for Dubai's retail sector is particularly bright. Projections indicate continued growth in sales, which is excellent news for Emaar's extensive portfolio of shopping destinations. For instance, Dubai's retail sales were estimated to reach AED 150 billion in 2024, a figure expected to climb further.

- Growing Tourism: Dubai welcomed over 17 million visitors in 2023, a number anticipated to rise in 2024 and 2025, boosting hotel occupancy and retail spending.

- Retail Sales Growth: The retail sector is forecast to see a year-on-year growth of approximately 5-7% in the coming years, directly benefiting Emaar's mall operations.

- Disposable Income: Rising disposable incomes among residents and expatriates in Dubai support increased spending on luxury goods and experiences offered by Emaar's properties.

Changing Work Models and Property Utilization

The widespread adoption of hybrid work models, a trend significantly accelerated by events in the early 2020s, is reshaping how people use property. This shift influences demand for both office spaces and residential areas. For instance, a 2024 report indicated that 60% of surveyed companies plan to maintain hybrid work arrangements, impacting commercial real estate needs.

This evolving work-life dynamic presents both challenges and opportunities for property developers like Emaar. As more individuals work remotely or adopt flexible schedules, preferences may lean towards larger homes that can accommodate dedicated workspaces or towards community-based co-working facilities. Emaar's diversified portfolio, encompassing residential, commercial, and hospitality segments, positions it well to cater to these changing preferences by offering a range of property types designed for modern living and working.

Emaar's strategic response to these sociological shifts is evident in its development strategies. The company is increasingly incorporating flexible living and working solutions into its projects. For example, new residential developments are often designed with integrated amenities that support remote work, such as enhanced connectivity and communal business lounges. This adaptability ensures Emaar remains relevant in a market where the traditional separation between work and home is blurring.

- Hybrid Work Impact: Approximately 60% of companies planned to continue hybrid work in 2024, affecting office space demand.

- Residential Preferences: A growing trend shows a preference for larger homes with dedicated office spaces or flexible community co-working options.

- Emaar's Portfolio: Emaar's diverse property offerings, from residential to commercial, allow for adaptation to these evolving work-life needs.

- Development Strategy: New Emaar projects are integrating remote work-friendly features and flexible living solutions.

Dubai's societal fabric is characterized by its vast expatriate population, exceeding 92% in 2025, which drives demand for diverse housing. This demographic reality necessitates varied residential offerings, from luxury apartments to family communities, requiring Emaar Properties to continually adapt its portfolio to cultural preferences and lifestyle needs.

The growing preference for integrated communities, where living, shopping, and entertainment converge, is a significant sociological trend. Emaar's developments like Dubai Creek Harbour exemplify this by offering comprehensive living experiences, aligning with consumer desires for convenience and a full suite of amenities.

Consumer spending habits, particularly within retail and hospitality, are crucial for Emaar. Dubai's robust tourism sector, which saw over 17 million visitors in 2023, and increasing disposable incomes fuel demand for Emaar's malls and hotels, with retail sales projected to grow by 5-7% annually.

The widespread adoption of hybrid work models, with 60% of companies maintaining such arrangements in 2024, is reshaping property demand. This shift favors larger homes with office spaces or community co-working facilities, a trend Emaar is addressing by integrating flexible living and working solutions into new projects.

| Sociological Factor | Description | Impact on Emaar Properties | Supporting Data (2024/2025) |

| Demographic Diversity | High expatriate population | Drives demand for varied housing types | Over 92% expatriates in Dubai (2025) |

| Lifestyle Preferences | Demand for integrated communities | Opportunities for master-planned developments | Emaar's Dubai Creek Harbour, Emaar South |

| Consumer Spending | Growth in tourism and disposable income | Boosts retail and hospitality revenue | 17M+ visitors (2023), 5-7% retail sales growth forecast |

| Work-Life Balance | Hybrid work adoption | Influences demand for flexible living/working spaces | 60% companies maintaining hybrid work (2024) |

Technological factors

Emaar Properties is actively integrating smart city and building technologies into its developments, a move that resonates with the growing global demand for connected living environments. This includes AI-powered homes, intelligent traffic management, and app-driven community services, enhancing resident experience and operational efficiency.

The company's commitment to these advancements is evident in its ongoing projects, which are designed to offer seamless integration of technology for improved security, convenience, and sustainable energy management. This strategic focus positions Emaar to capitalize on the increasing consumer preference for technologically advanced and efficient living spaces, a trend expected to accelerate in the coming years.

Emaar Properties has significantly invested in digital transformation, evident in its comprehensive online property portals. These platforms offer features like 360-degree virtual tours and real-time agent chat, enhancing customer engagement and accessibility. For instance, in 2023, Emaar reported a substantial increase in digital inquiries, reflecting the growing reliance on online channels for property transactions.

Emaar Properties is increasingly integrating sustainable construction technologies to enhance its environmental performance. The company actively employs smart metering systems, advanced green building materials, and artificial intelligence solutions to meticulously manage and reduce resource consumption, particularly energy and water, across its developments.

This commitment to eco-friendly building practices is not just about environmental stewardship; it directly appeals to a growing segment of environmentally aware consumers and aligns with international climate change mitigation targets, a significant factor in attracting discerning buyers in the 2024-2025 market.

PropTech Innovations (e.g., Blockchain, Metaverse)

Emaar Properties is actively investigating cutting-edge PropTech, including blockchain technology, to bring greater transparency and security to property transactions. This move is designed to streamline the often complex buying process, offering potential buyers a more trustworthy and efficient experience.

Furthermore, Emaar is venturing into the metaverse to create virtual real estate experiences. This allows potential buyers to explore properties immersively from anywhere in the world, enhancing engagement and accessibility.

The global PropTech market is projected to reach $8.5 billion by 2025, indicating a significant shift towards digital solutions in real estate.

- Blockchain for Transaction Security: Emaar's exploration of blockchain aims to reduce fraud and increase the speed of property sales, a key concern for buyers and sellers alike.

- Metaverse for Immersive Showings: This innovation offers virtual tours that can significantly broaden Emaar's reach to international buyers, potentially boosting sales volume.

- Market Growth: The increasing adoption of PropTech signals a future where digital tools are integral to real estate operations, driving efficiency and customer satisfaction.

Data Analytics for Market Insights and Customer Satisfaction

Emaar Properties leverages advanced data analytics to dissect market trends, understand evolving customer desires, and monitor its own operational efficiency. This analytical prowess underpins its strategic planning, ensuring resources are deployed effectively. The company's 2024 integrated annual report highlighted how this data-driven strategy directly contributes to maintaining a strong customer satisfaction rating.

Key benefits Emaar derives from data analytics include:

- Enhanced Market Understanding: Identifying emerging property trends and investment opportunities by analyzing vast datasets.

- Customer Centricity: Tailoring offerings and services to meet specific customer needs, leading to improved engagement and loyalty.

- Operational Optimization: Streamlining development processes, sales, and property management for greater efficiency and cost savings.

- Informed Strategic Decisions: Using predictive analytics to forecast market shifts and guide future business development.

Emaar Properties is actively integrating smart city and building technologies into its developments, a move that resonates with the growing global demand for connected living environments. This includes AI-powered homes, intelligent traffic management, and app-driven community services, enhancing resident experience and operational efficiency. The company's commitment to these advancements is evident in its ongoing projects, which are designed to offer seamless integration of technology for improved security, convenience, and sustainable energy management.

Emaar Properties has significantly invested in digital transformation, evident in its comprehensive online property portals. These platforms offer features like 360-degree virtual tours and real-time agent chat, enhancing customer engagement and accessibility. For instance, in 2023, Emaar reported a substantial increase in digital inquiries, reflecting the growing reliance on online channels for property transactions.

Emaar Properties is increasingly integrating sustainable construction technologies, employing smart metering systems and advanced green building materials to meticulously manage and reduce resource consumption, particularly energy and water, across its developments. This commitment directly appeals to environmentally aware consumers and aligns with international climate change mitigation targets, a significant factor in attracting discerning buyers in the 2024-2025 market.

Emaar Properties is actively investigating cutting-edge PropTech, including blockchain technology for greater transparency and security in property transactions, and venturing into the metaverse to create virtual real estate experiences. The global PropTech market is projected to reach $8.5 billion by 2025, indicating a significant shift towards digital solutions in real estate.

Legal factors

UAE property laws, especially in Dubai, offer robust clarity on ownership rights. Recent legislative updates have significantly expanded freehold zones, now permitting 100% foreign ownership across numerous desirable districts. This legal framework directly benefits Emaar Properties by enhancing accessibility and confidence for its international investor base, a key driver for its projects.

Emaar Properties, as a leading global developer, navigates a complex web of construction and building regulations. These rules are crucial for ensuring the safety, quality, and overall compliance of its projects with local and international standards. For instance, in Dubai, where Emaar is headquartered, the Dubai Building Code sets rigorous requirements for structural integrity, fire safety, and environmental performance.

Recent regulatory shifts are placing even greater emphasis on developer accountability. This includes stricter enforcement of project deadlines and enhanced requirements for financial transparency, particularly concerning escrow accounts for off-plan sales. Furthermore, there's a growing mandate for green building certifications, such as LEED or Estidama, reflecting a global push towards sustainable development. Emaar's commitment to these evolving standards is vital for its continued success and reputation in the competitive real estate market.

Consumer protection laws, particularly concerning off-plan property purchases, have seen significant strengthening in 2025. New regulations mandate more rigorous escrow account management and tie fund releases to verified construction progress. This legal evolution is crucial for Emaar Properties, as it directly bolsters buyer confidence in their extensive off-plan developments, fostering a more secure investment environment.

Visa and Residency Regulations Linked to Property Investment

The UAE's updated visa regulations, particularly the Golden Visa program, are a significant driver for foreign real estate investment. This initiative grants long-term residency to individuals investing in property, making the UAE a more attractive prospect for international buyers and directly benefiting Emaar Properties by boosting demand for its developments.

These enhanced visa policies are designed to attract and retain foreign talent and capital. For instance, the Golden Visa can be granted for 10 years and is renewable, with a minimum investment threshold in real estate that varies but generally aims to encourage substantial capital inflow. This policy shift directly translates into increased interest and purchasing power for Emaar's portfolio.

- Golden Visa Impact: The UAE's Golden Visa program, offering 10-year renewable residency for property investors, has demonstrably increased foreign interest in the real estate market.

- Demand Stimulation: This long-term residency incentive makes the UAE a more appealing destination for expatriates and international investors, directly supporting sales volumes for developers like Emaar.

- Investment Thresholds: Specific property investment amounts, such as AED 2 million (approximately $545,000 USD) as of recent policy updates, unlock these residency benefits, channeling foreign capital into the property sector.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Following the UAE's removal from the Financial Action Task Force (FATF) Grey List in April 2024, there's an increased emphasis on robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations within the real estate sector. This means Emaar Properties, like all developers, must adhere to more stringent due diligence processes for all transactions. These enhanced measures are designed to bolster transparency and build greater investor confidence in the UAE's financial ecosystem.

Emaar must implement rigorous verification procedures for all clients to comply with these updated AML and KYC mandates. This includes thorough background checks and the meticulous recording of transaction details. The company is also obligated to report any suspicious activities to the relevant authorities, a critical step in combating financial crime and ensuring regulatory compliance.

- Enhanced Due Diligence: Emaar must conduct comprehensive checks on all buyers and sellers, verifying identities and the source of funds.

- Suspicious Transaction Reporting: A clear protocol for identifying and reporting any unusual or potentially illicit financial dealings is now essential.

- Increased Transparency: These regulations aim to make real estate transactions more transparent, thereby attracting legitimate international investment.

The UAE's legal framework continues to evolve, with recent updates in 2024 and early 2025 focusing on developer accountability and consumer protection. Stricter enforcement of project timelines and enhanced financial transparency, particularly concerning escrow accounts for off-plan sales, are now paramount. Furthermore, a growing emphasis on green building certifications reflects a global trend towards sustainability, which Emaar Properties must integrate into its operations to maintain its market standing.

Environmental factors

The UAE's commitment to sustainability is intensifying, with new regulations like the National Green Certificates Program pushing the real estate sector towards greener practices. By 2027, mandatory green certification for new master developments will be a reality.

Emaar Properties is proactively integrating these sustainability mandates into its development pipeline. This includes a focus on energy-efficient designs and the utilization of eco-friendly materials, ensuring compliance with evolving government standards and catering to a growing market preference for sustainable living.

Emaar Properties is actively addressing climate change, setting a target to achieve Net Zero emissions by 2050. This commitment directly supports the UAE's broader national objective of reaching Net Zero emissions by the same year.

To bolster this goal, Emaar has launched a significant energy efficiency program across its operational properties. The initiative aims to cut energy usage by a substantial 15-20% within the next five years, driven by strategic retrofits and operational optimization efforts.

Emaar Properties is actively integrating sustainable resource use and waste management into its development projects. This commitment is demonstrated through initiatives aimed at optimizing water and energy consumption via advanced technologies, such as smart building systems.

The company implements comprehensive strategies for waste reduction and recycling across its portfolio, aligning with its environmental responsibility and broader ESG targets. For instance, in 2023, Emaar reported a significant increase in its waste diversion rates, diverting over 60% of construction waste from landfills through dedicated recycling programs.

Environmental Impact Assessments for Large Projects

Emaar Properties, known for its expansive master-planned developments, places significant emphasis on environmental impact assessments (EIAs) as a prerequisite for project approvals and to foster positive public perception. These assessments are fundamental to navigating regulatory landscapes and ensuring that large-scale construction aligns with environmental protection goals.

The company's commitment to its Environmental, Social, and Governance (ESG) strategy directly supports these efforts, aiming to not only safeguard ecological systems but also to maintain strict adherence to all environmental laws and regulations across its global operations. This proactive approach is vital for sustainable development and long-term business viability.

- Regulatory Compliance: Emaar's projects, particularly in 2024 and 2025, are subject to increasingly stringent environmental regulations, necessitating thorough EIAs to secure necessary permits.

- Sustainable Development Goals: The company's ESG framework, which includes ambitious targets for reducing carbon emissions and improving resource efficiency, is directly supported by the findings and mitigation strategies identified in EIAs.

- Stakeholder Engagement: Public acceptance of Emaar's large-scale projects hinges on demonstrating responsible environmental stewardship, a key component addressed through transparent EIA processes and community consultations.

Corporate Social Responsibility (CSR) and Environmental Initiatives

Emaar Properties demonstrates a strong commitment to sustainability through its Corporate Social Responsibility (CSR) efforts, which frequently incorporate environmental programs. The company's integrated annual report underscores its dedication to fostering young talent within the UAE, alongside strategic cost optimization achieved through efficient resource management, with sustainability principles guiding these operations.

Emaar's sustainability focus is evident in its operational strategies. For instance, in 2023, the company continued to emphasize resource efficiency, aiming to reduce its environmental footprint across its diverse portfolio of developments and operations.

- Investment in UAE Talent: Emaar actively invests in training and developing young UAE nationals, contributing to local capacity building and a skilled workforce.

- Resource Optimization: The company prioritizes cost efficiencies through better resource management, which inherently supports environmental sustainability by minimizing waste and consumption.

- Sustainability Reporting: Emaar's integrated annual reports provide transparency on its CSR and environmental initiatives, detailing progress and future commitments.

Emaar Properties is actively aligning with the UAE's ambitious sustainability goals, including a national Net Zero by 2050 target, which is reflected in its own operational strategies. The company is focusing on energy efficiency, aiming for a 15-20% reduction in energy usage across its properties within five years. Furthermore, Emaar is prioritizing sustainable resource management and waste reduction, with over 60% of construction waste diverted from landfills in 2023.

| Environmental Focus Area | Emaar's Action/Target | Relevant Data/Year |

|---|---|---|

| Sustainability Mandates | Compliance with mandatory green certification for new master developments | Effective 2027 |

| Emissions Reduction | Achieve Net Zero emissions | Target by 2050 |

| Energy Efficiency | Implement energy efficiency program | 15-20% reduction target within 5 years |

| Resource Management | Optimize water and energy consumption, waste reduction | Over 60% construction waste diversion (2023) |

PESTLE Analysis Data Sources

Our Emaar Properties PESTLE analysis is meticulously constructed using data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.