Emaar Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emaar Properties Bundle

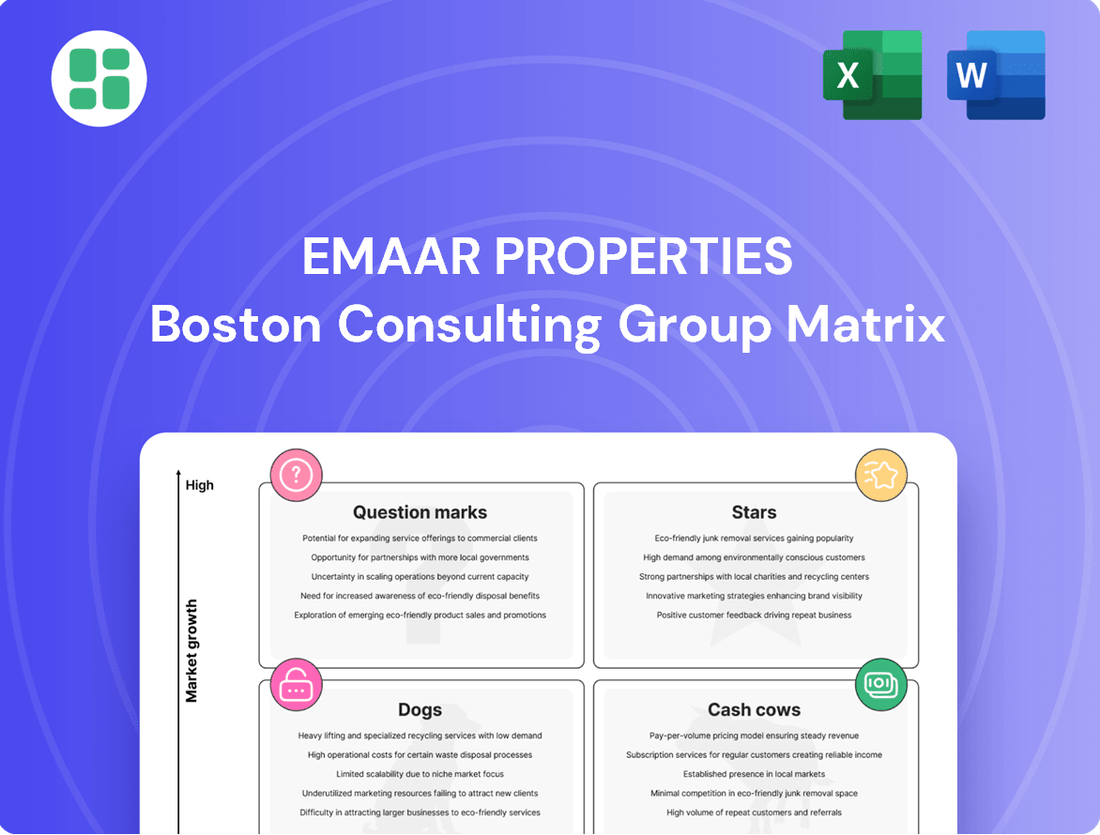

Curious about Emaar Properties' strategic positioning? Our BCG Matrix preview offers a glimpse into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture!

Purchase the complete Emaar Properties BCG Matrix to unlock detailed quadrant placements, data-driven insights, and actionable strategies for optimizing their diverse real estate ventures. Gain the competitive edge you need.

This report is your essential guide to understanding Emaar's market share and growth potential. Invest in the full BCG Matrix for a clear roadmap to informed decision-making and future success.

Stars

Emaar's new luxury off-plan residential projects in prime Dubai locations like Dubai Hills Estate, Dubai Creek Harbour, and The Oasis are positioned as Stars in the BCG Matrix. These developments are tapping into Dubai's robust luxury real estate market, which experienced substantial price appreciation and high investor demand in the first half of 2025. Emaar's dominant transaction volume in this segment highlights these projects as high-growth, high-market-share assets.

Emaar Properties' master-planned community development in the UAE firmly sits in the Star quadrant. This core business, characterized by ongoing new phases and expansions of existing integrated communities, shows robust performance. Emaar reported a significant 42% surge in property sales during Q1 2025, building on an impressive 72% increase for the full year 2024. This data highlights both high growth and Emaar's commanding market position.

The company's consistent success in launching new projects within these communities, exemplified by developments like The Valley and Emaar South, underscores its leadership in a dynamic and expanding market. This sustained project pipeline, coupled with a substantial revenue backlog, provides a strong foundation for continued future growth and predictable cash generation.

Emaar Properties' international property development, especially in India and Egypt, is a significant growth driver. These markets demonstrated robust performance in the first quarter of 2025 and throughout 2024, bolstering Emaar's international sales and overall revenue streams. For instance, Emaar reported a 15% year-on-year increase in international property sales in Q1 2025, with India and Egypt being key contributors.

While these regions may currently represent a smaller segment of Emaar's total revenue compared to its domestic market, their accelerated growth rates are noteworthy. This suggests Emaar is effectively capturing market share in these dynamic economies. The company's strategic focus and continued investment in India and Egypt are poised to leverage their substantial growth potential, positioning them as stars in the BCG matrix.

The Heights Country Club

The Heights Country Club, an expansive 81 million square foot master community, is a significant addition to Emaar Properties' portfolio, firmly placing it in the Star category due to its high-growth potential within the wellness sector.

This ambitious AED 55 billion development is currently in its foundational stages, designed to capitalize on Dubai's increasing consumer preference for health-oriented living.

Its prime location and integrated wellness amenities suggest a strong trajectory for market share capture in this burgeoning segment, necessitating continued investment to fuel its expansion.

- Project Scale: 81 million square feet master community.

- Investment Value: AED 55 billion.

- Market Focus: High-growth wellness and health-conscious lifestyle segment.

- BCG Matrix Classification: Star, indicating high market share and high market growth potential.

Digital Transformation & Smart Community Integration

Emaar Properties is aggressively investing in digital transformation, integrating smart home systems and IoT across its developments. This technological push, including AI for property management, is a key Star initiative, driving efficiency and customer satisfaction.

The company's focus on smart community integration positions it for leadership in the rapidly growing proptech sector. While specific market share in these niche tech applications is still developing, the high growth potential is undeniable.

- Digital Transformation Investment: Emaar's commitment to smart technologies, including IoT and AI, is a significant driver of its Star positioning.

- Smart Community Growth: The proptech market, encompassing smart living solutions, is experiencing substantial growth, validating Emaar's strategic focus.

- Enhanced Efficiency: The adoption of AI-powered analytics for property management and urban planning directly contributes to operational improvements.

- Customer Experience: Integrating smart home systems and digital platforms elevates the living experience for residents, a crucial differentiator.

Emaar's luxury off-plan residential projects in prime Dubai locations, alongside its master-planned communities, are solid Stars. These ventures benefit from Dubai's booming luxury real estate market, with substantial price appreciation and high investor demand observed in early 2025. Emaar's dominant transaction volume in these segments confirms their status as high-growth, high-market-share assets.

Emaar's international property development, particularly in India and Egypt, also shines as a Star. These markets showed robust performance in Q1 2025 and throughout 2024, with international sales increasing by 15% year-on-year in Q1 2025, driven by these key regions. This strategic expansion into high-growth economies positions these international ventures as stars in the BCG matrix.

| Segment | Market Growth | Market Share | BCG Classification |

| Luxury Off-Plan Dubai | High | High | Star |

| Master-Planned Communities (UAE) | High | High | Star |

| International Property (India, Egypt) | High | Growing | Star |

| Wellness Communities (The Heights) | High | Emerging | Star |

| Digital Transformation/Proptech | High | Emerging | Star |

What is included in the product

This BCG Matrix analysis for Emaar Properties offers strategic insights into its portfolio, highlighting which business units to invest in, hold, or divest.

The Emaar Properties BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

The Dubai Mall is a prime example of a Cash Cow within Emaar Properties' portfolio. Its dominance in the retail sector, evidenced by its status as the world's most visited mall, ensures consistent and significant revenue generation. In 2024 alone, it welcomed 111 million visitors, a testament to its enduring appeal and market leadership.

The mall's impressive 98% occupancy rate across its assets highlights its stability and strong demand. This high occupancy, coupled with the announced AED 1.5 billion expansion to include 240 new luxury stores, underscores its mature yet still growing position. Such an investment in expansion further solidifies its role as a reliable, high-profit generator for Emaar, requiring relatively low marketing expenditure to maintain its market share.

The Burj Khalifa, encompassing its residential and commercial assets, firmly sits as a Cash Cow for Emaar Properties. Its status as the world's tallest building allows for premium pricing and sustained high demand, generating consistent rental income and robust resale values within Dubai's premium property market.

This global icon requires minimal new investment for growth, instead contributing stable, high profit margins to Emaar's portfolio. In 2024, Dubai's luxury property market continued to show resilience, with the Burj Khalifa's units consistently achieving top-tier valuations, reflecting its enduring appeal and strong cash-generating capabilities.

Address Hotels + Resorts, Emaar Hospitality Group's premium luxury brand, represents a significant Cash Cow for Emaar Properties. These established hotels consistently achieve high occupancy rates, with UAE properties averaging 82% in Q1 2025, showcasing their strong market position and appeal.

The consistent revenue generation from these mature assets is bolstered by Dubai's thriving tourism sector and robust domestic demand. This stability makes them a cornerstone of Emaar's recurring revenue streams, providing a reliable income base.

With strong brand recognition and efficient operations, Address Hotels yield high profit margins. Crucially, they require minimal new investment to maintain their performance, a hallmark of a true Cash Cow in the BCG Matrix.

Commercial Leasing and Management Services

Emaar Properties' commercial leasing and property management services are a solid Cash Cow. These operations generate consistent, predictable income, benefiting from established tenant relationships and minimal need for aggressive expansion. This stability is crucial for Emaar's financial foundation.

The recurring revenue from these segments, bolstered by high profit margins, significantly contributes to Emaar's Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). For instance, in 2023, Emaar reported recurring revenue of AED 10.7 billion, with a substantial portion likely stemming from its leasing and management operations, underscoring their dependable contribution to the company's profitability.

- Stable Income: Commercial leasing provides consistent rental income.

- High Margins: Efficient management leads to strong profit margins.

- Diversified Portfolio: Emaar's commercial assets spread risk.

- EBITDA Contribution: These segments are key drivers of recurring EBITDA.

Downtown Dubai Master Community

The Downtown Dubai master community, a prime example of Emaar Properties' strategic vision, operates as a definitive Cash Cow within its portfolio. This fully developed, iconic district, centered around the Burj Khalifa and The Dubai Mall, consistently generates substantial revenue. Its mature status means that while growth is stable, the primary focus is on optimizing existing revenue streams.

Revenue generation for Downtown Dubai is robust, stemming from ongoing property sales, a vibrant resale market, and predictable recurring service charges. In 2024, Emaar reported strong performance in its Dubai property development segment, with Downtown Dubai continuing to be a significant contributor. For instance, Emaar's sales in the first nine months of 2024 reached AED 30.1 billion, and while specific figures for Downtown Dubai aren't always broken out, its established nature suggests a steady, high-margin contribution to this total.

- Consistent Revenue Streams: Driven by property sales, resales, and service charges, ensuring predictable income.

- Mature Market Position: Fully developed infrastructure and premium branding minimize the need for extensive new investments.

- High Profitability: Established demand and premium pricing contribute to strong profit margins.

- Stable Demand: Its status as a global landmark ensures sustained interest from buyers and investors.

Emaar Properties' portfolio features several strong Cash Cows, assets with high market share in mature industries that generate more cash than they consume. These businesses are vital for funding other ventures and providing stable returns. Their consistent profitability, despite low growth potential, makes them the backbone of Emaar's financial stability.

The Dubai Mall and Burj Khalifa exemplify this, consistently drawing visitors and premium buyers, respectively. Address Hotels + Resorts also contributes significantly through high occupancy rates, averaging 82% in Q1 2025 across UAE properties. Emaar's commercial leasing and property management services are another key Cash Cow, contributing substantially to the company's AED 10.7 billion recurring revenue in 2023.

| Emaar Cash Cow Example | Market Position | Revenue Driver | 2024/2025 Data Point |

|---|---|---|---|

| The Dubai Mall | Global Retail Dominance | High Footfall, Retail Sales | 111 million visitors in 2024 |

| Burj Khalifa | Global Icon, Premium Real Estate | Premium Rentals, Resale Values | Top-tier valuations in Dubai's luxury market |

| Address Hotels + Resorts | Premium Hospitality | High Occupancy, Room Revenue | 82% average occupancy (UAE, Q1 2025) |

| Commercial Leasing & Management | Established Market Presence | Recurring Rental Income | Key contributor to AED 10.7 billion recurring revenue (2023) |

Delivered as Shown

Emaar Properties BCG Matrix

The Emaar Properties BCG Matrix preview you're seeing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic tool. You can trust that the analysis and presentation style are exactly as intended for your business planning needs. This document is designed for immediate application, whether for internal strategy sessions or client presentations.

Dogs

Within Emaar Properties' extensive portfolio, certain smaller, older retail outlets, particularly those outside the prominent Dubai Mall ecosystem, may be classified as Dogs. These locations often struggle with declining footfall and tenant sales, failing to generate sufficient revenue to cover operational expenses.

These underperforming assets are typically situated in areas experiencing limited economic growth or facing heightened competition from newer, more attractive retail destinations. For instance, while Emaar continues to invest heavily in expanding its flagship Dubai Mall, which saw visitor numbers reach 100 million in 2023, these older, less prominent retail spaces may not align with the company's strategic focus for significant future capital allocation.

Legacy Non-Strategic Land Banks represent portions of Emaar's vast land holdings situated in less dynamic regions or those that have remained undeveloped for extended periods without concrete strategic objectives. These parcels might not directly support Emaar's current emphasis on prime real estate and high-tier, integrated communities.

The continued ownership of these legacy assets can incur significant holding expenses and represent a substantial opportunity cost, especially if market conditions in their respective locations are stagnant or experiencing minimal growth. For instance, if a significant portion of Emaar's land bank is in areas with projected GDP growth below 2% annually, as seen in some emerging markets in 2024, these parcels would likely fall into this category.

Within Emaar Entertainment's diverse offerings, some niche ventures might be categorized as Dogs in the BCG Matrix. These could include smaller, less publicized attractions or experiences that don't draw substantial crowds or generate significant income. For instance, a specialized interactive exhibit or a themed dining experience with limited appeal might fall into this category.

These underperforming ventures often require considerable investment relative to the revenue they generate, potentially barely breaking even or operating at a loss. Emaar's strategic emphasis is typically on its flagship attractions, which command higher visitor numbers and revenue streams, potentially leading to a neglect of these smaller, less popular segments.

While specific financial data for individual niche ventures within Emaar Entertainment isn't publicly disclosed, the general principle of the BCG Matrix suggests that such ventures would exhibit low market share and low market growth. For example, if a particular small-scale cinema or a niche sporting facility within Emaar's portfolio saw a decline in attendance or faced intense competition, it would likely be a candidate for the Dog quadrant.

Outdated Residential Offerings in Saturated Markets

Older residential projects in saturated Dubai sub-markets, such as some of Emaar's initial villa communities, might be considered 'Dogs' in the BCG Matrix. These fully-sold developments, while still generating service income, offer minimal new sales growth. For instance, by the end of 2023, Dubai's residential market saw a significant increase in supply, with over 30,000 new units delivered, intensifying competition for older stock.

These properties are characterized by a lack of current competitive advantage and limited potential for substantial capital appreciation or new revenue streams. While they contribute to Emaar's overall portfolio value through residual service fees, their strategic importance for growth is low. The cost of significant upgrades to compete with newer, more amenity-rich developments may outweigh the potential return on investment.

- Low Growth Potential: Properties in mature, saturated markets with ample existing supply offer limited opportunities for significant new sales or market share expansion.

- Mature Life Cycle: These residential offerings are past their prime growth phase, generating steady but not expanding revenue streams.

- Limited Competitive Advantage: Older designs and amenities may not align with current buyer preferences, reducing their appeal compared to newer projects.

- High Renovation Costs: Significant investment would be required to modernize these properties, with uncertain returns in a competitive landscape.

Minor International Ventures with Limited Scalability

Minor International Ventures with Limited Scalability

These are Emaar Properties' smaller, less successful international real estate ventures where significant market share has not been achieved. They might be consuming resources without delivering substantial growth or profit, often due to intense local competition or a lack of strategic focus.

While Emaar has a strong presence in markets like India and Egypt, any minor or stagnant projects in less strategic international locations would fall into this category. For instance, a hypothetical venture in a smaller European market with limited development opportunities and high regulatory hurdles could represent such a case.

- Limited Market Share: Ventures where Emaar holds a minimal percentage of the local real estate market.

- Resource Drain: Projects that require ongoing investment but yield low returns, impacting overall profitability.

- Stagnant Growth: Operations that show little to no expansion or revenue increase over several reporting periods.

- Competitive Pressure: Markets dominated by established local developers, making it difficult for Emaar to gain traction.

Within Emaar's portfolio, certain older, smaller retail outlets, particularly those outside prime locations like the Dubai Mall, can be classified as Dogs. These face declining footfall and sales, often struggling to cover operational costs due to limited economic growth in their areas or intense competition from newer retail hubs. For example, while the Dubai Mall attracted 100 million visitors in 2023, these less prominent spaces may not receive significant future capital investment.

Legacy non-strategic land banks, representing undeveloped parcels in less dynamic regions, also fit the Dog category. These holdings incur holding expenses and represent an opportunity cost, especially if their locations exhibit minimal economic growth, such as areas with projected GDP growth below 2% annually as observed in some emerging markets in 2024.

Niche ventures within Emaar Entertainment, such as specialized exhibits with limited appeal, can also be Dogs. These often require substantial investment relative to their low revenue generation, potentially operating at a loss compared to flagship attractions.

Older residential projects in saturated markets, like some initial Emaar villa communities, are considered Dogs. With over 30,000 new residential units delivered in Dubai by the end of 2023, competition for older stock intensified, limiting their growth potential and competitive advantage.

Question Marks

Emaar Properties' ventures into emerging international markets beyond its core strongholds like India and Egypt represent its Question Marks. These new or smaller-scale expansions, while holding significant growth potential, are characterized by Emaar's currently low market share. This necessitates substantial investment to build brand recognition and operational presence.

For instance, Emaar's recent developments in markets such as Pakistan or certain African nations exemplify this strategy. These regions offer untapped demand for quality real estate, but Emaar faces intense competition and the challenge of adapting its successful Dubai model to diverse local conditions. The outcome of these expansions remains uncertain, hinging on market acceptance and Emaar's execution capabilities.

Rove Hotels, a joint venture by Emaar Properties, fits the Question Mark category within the BCG Matrix. The brand is actively expanding, with new properties opening, but it competes in a crowded mid-market segment where Emaar's established luxury brands don't automatically confer dominance.

Significant capital infusion is necessary for Rove Hotels to aggressively capture market share and elevate its brand visibility. This strategic investment is crucial to transition Rove from a Question Mark into a Star or a Cash Cow for Emaar Properties.

As of early 2024, Rove Hotels had a portfolio of over 15 hotels across the UAE and Saudi Arabia, with further expansion plans announced. The midscale hotel market in the GCC is projected for robust growth, but also faces intense competition from both international and regional players.

Emaar Properties' early-stage themed master communities, like the Grand Polo Club & Resort, fit into the Question Mark category of the BCG matrix. These are nascent projects in burgeoning lifestyle sectors, meaning they have significant growth potential but currently hold a minimal market share. For instance, Emaar’s 2024 development pipeline continues to emphasize premium, niche offerings, reflecting this strategy.

These ventures demand substantial upfront capital for marketing and infrastructure development to attract initial buyers and build brand recognition. The success of such projects, while promising due to their alignment with high-growth trends, remains uncertain until they gain traction and establish a solid market presence. Emaar's investment in these areas in 2024 underscores a calculated risk for future market leadership.

Advanced Proptech and Metaverse Real Estate Initiatives

Emaar Properties is actively investing in advanced proptech, including metaverse real estate and blockchain for property transactions. These initiatives are positioned in high-growth, technologically driven sectors with the potential for significant future impact. For instance, the global metaverse market is projected to reach hundreds of billions of dollars by the end of the decade, with real estate being a key component.

While Emaar's current market share in these emerging technologies is minimal, the company's commitment signifies a strategic move towards future revenue streams. This requires substantial research and development, alongside efforts to foster market adoption and acceptance of these innovative platforms.

- Metaverse Real Estate: Exploring virtual property sales and experiences, tapping into a rapidly expanding digital economy.

- Blockchain Integration: Implementing blockchain for secure and transparent property transactions, aiming to streamline processes.

- AI for Predictive Analytics: Utilizing artificial intelligence to forecast market trends and optimize property management strategies.

New Urban Redevelopment Projects (Non-Prime Areas)

New urban redevelopment projects in Dubai's non-prime areas, such as Emaar's potential ventures into neighborhoods like Deira or Bur Dubai beyond their core prime locations, would likely be classified as Question Marks in the BCG Matrix.

These initiatives require significant capital outlay for infrastructure and amenities, aiming to transform underdeveloped zones. Emaar might initially hold a small market share in these emerging micro-markets, necessitating aggressive marketing and sales strategies to build demand and compete with more established districts.

- Low Market Share: Emaar's presence in these less-established areas would typically start with a limited footprint compared to its prime developments.

- High Market Growth Potential: Redevelopment projects aim to tap into areas with potential for significant future growth and value appreciation.

- High Investment Needs: These projects demand substantial upfront investment for land acquisition, construction, and infrastructure development.

- Uncertainty of Success: The outcome of revitalizing non-prime areas carries inherent risks, depending on market reception and economic conditions.

Emaar Properties' ventures into emerging international markets, like Pakistan and certain African nations, represent its Question Marks. These are new or smaller-scale expansions where Emaar has a low market share but sees significant growth potential, requiring substantial investment to build brand recognition and operations.

Rove Hotels, a mid-market brand, also falls into this category. Despite expansion, it competes in a crowded segment where Emaar's dominance in luxury doesn't automatically translate. Significant capital is needed to boost Rove's market share and visibility, aiming to elevate it from a Question Mark to a Star or Cash Cow.

Early-stage themed communities and advanced proptech initiatives like metaverse real estate and blockchain integration are also Question Marks. These are high-growth, technologically driven sectors where Emaar's current market share is minimal, demanding substantial R&D and market adoption efforts.

New urban redevelopment projects in Dubai's non-prime areas, requiring significant capital for infrastructure and amenities, also fit the Question Mark profile. These initiatives aim to transform underdeveloped zones, starting with a limited footprint but holding potential for future growth, contingent on market reception and economic conditions.

| Business Unit/Venture | BCG Category | Market Growth | Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|---|

| Emerging International Markets (e.g., Pakistan, Africa) | Question Mark | High | Low | High | Invest to gain market share or divest if prospects dim |

| Rove Hotels | Question Mark | Medium-High | Low-Medium | High | Invest for growth and market penetration |

| Metaverse Real Estate/Proptech | Question Mark | Very High | Very Low | Very High | Invest in R&D and market adoption for future leadership |

| Urban Redevelopment (Non-Prime Dubai) | Question Mark | Medium-High | Low | High | Invest to revitalize and build market presence |

BCG Matrix Data Sources

Our Emaar Properties BCG Matrix draws from Emaar's official annual reports, investor presentations, and reputable real estate market research. This ensures a robust foundation for analyzing business unit performance and market dynamics.