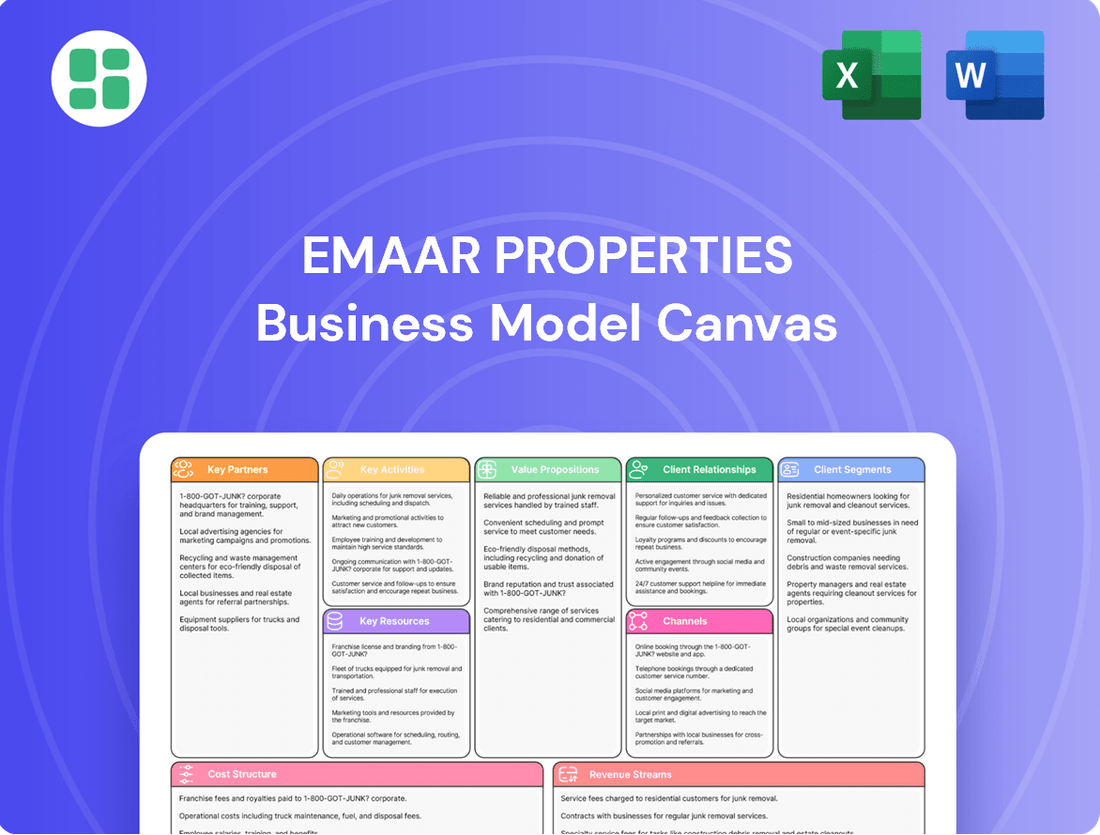

Emaar Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emaar Properties Bundle

Discover the strategic framework behind Emaar Properties's global success with our comprehensive Business Model Canvas. This detailed analysis breaks down their key partners, value propositions, and revenue streams, offering a clear understanding of their market dominance.

Unlock the full strategic blueprint behind Emaar Properties's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Emaar Properties maintains robust relationships with government entities and regulators across Dubai and its international operating regions. These collaborations are essential for navigating the complex regulatory environment, securing development approvals, and ensuring adherence to urban planning and land use policies. For instance, Emaar's ongoing projects in Dubai, such as the Dubai Creek Harbour development, rely heavily on close coordination with Dubai Municipality and other relevant authorities for permits and infrastructure integration.

These partnerships are critical for Emaar's ability to acquire prime land parcels and to facilitate the extensive infrastructure development required for its master-planned communities. The support of government bodies is instrumental in aligning Emaar's ambitious urban planning initiatives with national economic diversification and growth strategies, such as Dubai's Urban Development Framework. This symbiotic relationship underpins Emaar's capacity to undertake and deliver large-scale, transformative real estate projects.

Emaar Properties' success hinges on its robust partnerships with leading construction companies and specialized contractors. For instance, the construction of the iconic Burj Khalifa, completed in 2010, involved a consortium of global construction giants, showcasing the need for expertise on such massive undertakings.

These collaborations are critical for maintaining Emaar's reputation for delivering high-quality, large-scale projects on schedule. In 2023, Emaar reported significant progress across its development pipeline, underscoring the ongoing importance of these contractor relationships for project execution and managing the complexities of urban development.

Emaar Properties strategically partners with premier hospitality and retail operators to enrich its extensive portfolio of hotels, resorts, and shopping malls. These alliances are crucial for delivering exceptional leisure, entertainment, and shopping experiences within Emaar's integrated developments.

By collaborating with globally recognized brands, Emaar significantly boosts the appeal of its properties, drawing a broader customer base and securing vital recurring revenue. For instance, Emaar's hotels, such as those under Address Hotels + Resorts, consistently report strong occupancy rates, contributing to the company's robust financial performance, with revenues from hospitality segments often reaching billions of dollars annually.

Financial Institutions and Investors

Emaar Properties actively cultivates relationships with a diverse range of financial institutions and investors. These partnerships are crucial for securing the substantial capital required for its large-scale developments and ongoing expansion initiatives. This includes obtaining project financing, various debt facilities, and attracting both domestic and international capital to support its diverse portfolio of real estate ventures.

These collaborations are fundamental to Emaar's operational and strategic execution. For instance, Emaar frequently leverages syndicated loans and bond issuances to fund its mega-projects. In 2023, Emaar secured significant funding through various channels, contributing to its robust development pipeline and reinforcing its financial stability.

- Securing Project Finance: Emaar partners with leading banks and financial syndicates to arrange complex financing structures for its landmark projects, ensuring capital is available as construction progresses.

- Attracting Investment Funds: The company works with investment funds, including sovereign wealth funds and private equity firms, to bring in equity and debt capital for its real estate developments and strategic acquisitions.

- Debt Facilities and Bonds: Emaar regularly accesses capital markets through the issuance of corporate bonds and secures various credit facilities from banking partners to manage its liquidity and fund growth.

- Investor Relations: Maintaining strong relationships with a broad base of local and international investors is key to Emaar's ability to raise capital efficiently for its ambitious growth plans.

Technology and Innovation Providers

Emaar Properties actively seeks partnerships with technology and innovation providers to embed smart home solutions and sustainable building materials into its developments. These collaborations are crucial for enhancing property appeal and operational efficiency, meeting the growing demand for modern, eco-conscious living spaces. For instance, in 2024, Emaar continued its focus on integrating advanced IoT technologies for seamless property management and resident experience.

These strategic alliances allow Emaar to differentiate its luxury offerings in a highly competitive real estate market. By incorporating cutting-edge innovations, Emaar ensures its projects remain at the forefront of urban development and customer expectations. The company's commitment to innovation was evident in its 2024 project pipelines, which featured enhanced digital integration and sustainable design principles.

- Smart Home Integration: Partnerships with leading technology firms to provide residents with advanced, connected living experiences.

- Sustainable Materials: Collaborations with material science innovators to incorporate eco-friendly and high-performance building components.

- Urban Planning Technology: Working with tech providers for data-driven urban planning and smart city solutions within Emaar's master communities.

- Digital Customer Experience: Partnering with tech companies to enhance digital platforms for sales, customer service, and property management.

Emaar Properties' strategic alliances with government entities and regulators are foundational to its operations, enabling smooth project execution and adherence to urban planning standards. These partnerships are vital for securing land and permits, aligning Emaar's developments with national economic goals, as seen in Dubai's ambitious urban development frameworks.

The company's reliance on top-tier construction firms and specialized contractors is paramount for delivering its large-scale, high-quality projects on time, as demonstrated by the complex construction of the Burj Khalifa. These relationships are critical for maintaining Emaar's reputation for excellence in project delivery, with ongoing projects in 2023 and 2024 reflecting the continued importance of these collaborations.

Emaar's partnerships with leading hospitality and retail operators are key to enhancing the appeal of its properties, driving customer traffic and generating stable recurring revenue streams. Collaborations with globally recognized brands, such as Address Hotels + Resorts, consistently contribute to strong occupancy rates and significant annual revenues in the hospitality sector.

The company actively engages with a diverse network of financial institutions and investors to secure substantial capital for its extensive development pipeline and expansion efforts. Emaar regularly utilizes syndicated loans and bond issuances, with significant funding secured in 2023, reinforcing its financial capacity for mega-projects.

Furthermore, Emaar partners with technology and innovation providers to integrate smart home solutions and sustainable building materials, differentiating its offerings and meeting evolving customer demands for modern, eco-conscious living. The company's 2024 project focus includes enhanced digital integration and sustainable design principles.

| Partnership Type | Key Collaborators | Strategic Importance | Example/Data Point |

|---|---|---|---|

| Government & Regulators | Dubai Municipality, Various International Authorities | Land acquisition, permits, regulatory compliance, alignment with national development goals | Dubai Creek Harbour development approvals |

| Construction & Contractors | Global Construction Giants, Specialized Contractors | Quality execution, timely delivery of large-scale projects | Burj Khalifa construction (completed 2010) |

| Hospitality & Retail Operators | Address Hotels + Resorts, Global Retail Brands | Enhancing property appeal, customer experience, recurring revenue generation | Strong occupancy rates in Emaar hotels |

| Financial Institutions & Investors | Leading Banks, Investment Funds, Sovereign Wealth Funds | Securing capital for large-scale developments, debt facilities, equity | Significant funding secured in 2023 for development pipeline |

| Technology & Innovation Providers | Smart Home Solution Providers, Sustainable Material Innovators | Property differentiation, operational efficiency, meeting demand for modern living | Integration of IoT technologies in 2024 projects |

What is included in the product

Emaar Properties' Business Model Canvas focuses on developing and selling high-quality real estate, leveraging its strong brand and integrated lifestyle offerings to attract affluent global customers through diverse sales channels.

Emaar Properties' Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their complex operations, enabling stakeholders to quickly grasp key value propositions and customer relationships.

This visual tool simplifies Emaar's vast development and hospitality portfolio, allowing for faster identification of areas for improvement and strategic alignment, thus alleviating the pain of navigating intricate business structures.

Activities

Emaar Properties' primary activity is the creation of extensive, master-planned communities. This involves envisioning, designing, and building integrated developments that blend homes, businesses, entertainment, and shopping, fostering complete living environments.

This core function encompasses intricate urban planning, the development of essential infrastructure like roads and utilities, and navigating complex zoning regulations to bring these ambitious projects to life.

In 2024, Emaar continued its focus on these large-scale developments, with projects like Dubai Hills Estate and Dubai Creek Harbour remaining key drivers of its growth, showcasing the successful integration of diverse components within a single community.

Emaar Properties' core activity involves aggressively marketing and selling its residential and commercial properties, often launching pre-sales to secure early funding and assess buyer interest. This strategy has been instrumental in their success, allowing them to generate significant revenue streams even before project completion.

To reach a broad international audience, Emaar employs multifaceted marketing strategies. These include robust digital campaigns, international property roadshows, and a wide network of sales agents, ensuring their properties are visible to potential buyers across the globe.

This proactive sales and marketing approach consistently yields impressive results. For instance, in 2023, Emaar Properties reported a significant increase in property sales, with revenue from property development reaching AED 14.3 billion, demonstrating the effectiveness of their market engagement.

Emaar actively manages a diverse portfolio of hotels, resorts, and leisure attractions, including globally recognized destinations like The Dubai Mall and its associated hospitality brands. This hands-on management focuses on operational excellence, exceptional guest services, and ongoing innovation in leisure experiences to maintain high occupancy and customer delight.

In 2023, Emaar Development reported a net profit of AED 3.9 billion, with its hospitality and leisure segments playing a crucial role in generating stable, recurring revenues for the group. These operations are central to Emaar's strategy of creating integrated lifestyle destinations.

Retail and Commercial Leasing

Emaar Properties' core operation involves the active management and leasing of its vast retail and commercial property portfolio. This encompasses overseeing premier destinations like The Dubai Mall, ensuring high occupancy through effective tenant relations and strategic leasing. The focus is on attracting and retaining sought-after brands to drive footfall and sales.

This activity is vital for Emaar's revenue generation, directly contributing to its consistent rental income streams. Maintaining high occupancy rates, which stood at an impressive 96% across its shopping malls in Dubai as of the first half of 2024, is a testament to the success of these operations. Strong tenant performance, reflected in robust sales figures, further solidifies the profitability of these assets.

- Operating and leasing extensive retail spaces in world-class shopping malls like The Dubai Mall.

- Managing tenant relationships, mall operations, and strategic retail planning.

- Maintaining high occupancy rates to attract premium brands and generate consistent rental income.

- Ensuring strong tenant sales performance to maximize property profitability.

Land Acquisition and Strategic Planning

Emaar Properties actively pursues prime land acquisitions globally, ensuring a steady stream of future development opportunities. This strategic land banking is crucial for maintaining its market leadership and sustained growth.

In 2024, Emaar continued its focus on identifying and securing strategic land parcels. For instance, their ongoing expansion in Dubai and international markets like Saudi Arabia and Egypt are underpinned by these land acquisition efforts. The company's ability to secure large, well-located land banks directly supports its long-term development pipeline and project execution capabilities.

- Strategic Land Identification: Emaar continuously scouts for high-potential development sites in key urban centers and emerging markets.

- Market Analysis & Feasibility: Rigorous studies are conducted to assess market demand, economic viability, and regulatory landscapes before acquisition.

- Long-Term Growth Pipeline: Securing extensive land reserves is fundamental to Emaar's sustained expansion and ability to launch new, impactful projects.

Emaar Properties is deeply involved in the development and sale of real estate, focusing on creating integrated communities. This includes residential, commercial, and retail spaces, often launched through pre-sales to secure funding and gauge market interest. This strategy was evident in 2023 when property sales revenue reached AED 14.3 billion.

The company also actively manages a significant portfolio of hospitality and leisure assets, enhancing its lifestyle destination offerings. This segment contributes to stable, recurring revenues, as seen in the AED 3.9 billion net profit reported by Emaar Development in 2023, where hospitality played a key role.

Furthermore, Emaar excels in operating and leasing prime retail spaces, exemplified by The Dubai Mall. Maintaining high occupancy rates, such as 96% across its Dubai malls in the first half of 2024, is crucial for attracting premium brands and generating consistent rental income.

Strategic land acquisition is another cornerstone activity, ensuring a robust pipeline for future projects. Emaar's expansion into markets like Saudi Arabia and Egypt in 2024 is directly supported by these efforts to secure well-located land banks.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Real Estate Development & Sales | Envisioning, designing, and building master-planned communities and selling properties. | AED 14.3 billion property sales revenue (2023). Focus on Dubai Hills Estate and Dubai Creek Harbour. |

| Hospitality & Leisure Management | Operating hotels, resorts, and attractions to enhance lifestyle destinations. | Key contributor to recurring revenue; Emaar Development reported AED 3.9 billion net profit (2023). |

| Retail Property Operations | Managing and leasing retail spaces in premier shopping destinations. | 96% mall occupancy (H1 2024) drives rental income and tenant sales performance. |

| Strategic Land Acquisition | Identifying and securing prime land for future development opportunities. | Underpins expansion in Dubai, Saudi Arabia, and Egypt (2024). |

What You See Is What You Get

Business Model Canvas

The Emaar Properties Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive analysis, ready for immediate use.

Resources

Emaar Properties boasts an extensive land bank, a cornerstone of its business model, particularly in the UAE and other significant global markets. This strategic asset is crucial for undertaking its signature large-scale, master-planned communities and iconic developments.

As of 2024, Emaar's land reserve surpassed an impressive 405 million square feet. This substantial holding serves as a vital pipeline for future projects, ensuring the company's capacity for sustained growth and development well into the future.

Emaar Properties' iconic brand reputation, cemented by landmarks like the Burj Khalifa and The Dubai Mall, is a critical resource. This global recognition, built on a foundation of quality and innovation, attracts significant international investment and customer interest, enabling premium pricing power.

The company's portfolio of world-renowned structures, such as the Dubai Opera and Address Hotels, directly translates into a powerful competitive advantage. This established track record of delivering high-profile projects instills immense customer confidence and loyalty, a key driver for sustained demand and market leadership.

Emaar Properties leverages significant financial capital, including strong operating cash flows and access to capital markets, to fund its extensive development pipeline. This financial strength allows the company to embark on ambitious, capital-intensive projects.

The company's robust financial performance in 2024, marked by record revenue and profit, directly fuels its investment capacity for new ventures. This financial health is critical for maintaining Emaar's position as a leading global developer.

Skilled Workforce and Management Expertise

Emaar Properties relies heavily on its highly skilled workforce, encompassing urban planners, architects, construction managers, and hospitality experts. This deep talent pool is fundamental to executing complex, large-scale developments.

The management team's extensive experience in international real estate development, project execution, and market expansion is a core asset. Their strategic guidance is crucial for navigating global markets and ensuring project success.

Emaar's commitment to talent development, particularly focusing on young UAE nationals, ensures a pipeline of future leaders and reinforces its operational capabilities. This investment in human capital is vital for sustained growth and innovation.

- Skilled Workforce: Architects, urban planners, construction managers, hospitality professionals.

- Management Expertise: Large-scale development, project management, international market penetration.

- Talent Development: Focus on young UAE nationals for future leadership.

Advanced Technology and Digital Infrastructure

Emaar Properties' commitment to advanced technology is a cornerstone of its operational strategy. The company employs cutting-edge construction technologies, ensuring efficiency and quality in its extensive developments. This technological integration extends to smart building solutions, which enhance the functionality and appeal of its properties. For instance, in 2023, Emaar continued to invest in digital platforms to streamline its project management lifecycle, from initial design to final handover.

A robust digital infrastructure underpins Emaar's customer relationship management and digital marketing efforts. This allows for personalized customer interactions and targeted campaigns. The company actively utilizes data analytics to glean market insights, which inform strategic decisions and improve customer experiences. By leveraging data, Emaar aims to anticipate market trends and tailor its offerings more effectively.

The embrace of technology directly supports Emaar's operational efficiency and fosters innovative project delivery. This focus on digital transformation is crucial for maintaining a competitive edge in the global real estate market. Emaar's investment in these areas reflects a forward-thinking approach to business operations and customer engagement.

- Advanced Construction Technologies: Emaar utilizes technologies like Building Information Modeling (BIM) and prefabrication to optimize construction timelines and reduce waste.

- Smart Building Solutions: Integration of IoT devices and smart home systems in properties to enhance resident experience and operational efficiency.

- Digital Infrastructure: Robust CRM systems and digital marketing platforms for enhanced customer engagement and data-driven marketing strategies.

- Data Analytics: Employed for market trend analysis, customer behavior insights, and personalized service delivery.

Emaar Properties' intellectual property, including its brand name and proprietary development methodologies, is a significant intangible asset. This intellectual capital drives innovation and reinforces its market positioning. The company's established track record and reputation for excellence are invaluable resources that attract both customers and investors.

Value Propositions

Emaar Properties goes beyond selling homes; they curate complete luxury lifestyle ecosystems. Their master-planned communities integrate residences with world-class retail, hospitality, and entertainment, offering residents unparalleled convenience and a high quality of life. For instance, Dubai Hills Mall, a key Emaar development, reported over 20 million visitors in its first year of operation, showcasing the draw of these integrated environments.

Emaar Properties is globally recognized for creating iconic landmarks, including the Burj Khalifa, the world's tallest building, and The Dubai Mall, one of the largest shopping and entertainment destinations. This focus on architectural excellence offers customers the unique proposition of owning or living in visually stunning and significant structures.

This dedication to superior design and cutting-edge construction distinguishes Emaar in the competitive international real estate landscape. These developments not only represent modern urban lifestyles but also serve as enduring symbols of investment value and prestige.

Emaar Properties consistently emphasizes its commitment to superior construction quality and meeting project deadlines. This dedication fosters significant trust and confidence among its customers. For instance, in 2023, Emaar reported strong project delivery pipelines, contributing to its robust revenue streams and reinforcing its reputation for reliability.

The company's operational efficiency and proven construction excellence are frequently cited as core elements of its sustained success. This focus on quality and punctuality directly translates into high levels of customer satisfaction and bolsters Emaar's brand credibility in the competitive real estate market.

Strategic Locations and Investment Potential

Emaar's developments are strategically positioned in prime areas, boasting excellent connectivity and proximity to key business districts, which translates into significant investment potential and capital appreciation. These prime locations often evolve into highly desirable addresses, bolstered by Dubai's robust economic expansion and investor-friendly regulations. For instance, Emaar's Downtown Dubai, a prime example of strategic location, saw property values in 2024 continue to reflect strong demand, with average apartment prices per square foot remaining competitive against other global luxury hubs.

The appeal of Emaar's communities as stable and lucrative investments is directly linked to these advantageous locations. Investors are drawn to the inherent growth prospects and the established desirability of areas where Emaar consistently delivers high-quality, master-planned communities. This focus on prime real estate ensures that Emaar properties are not just homes, but also sound financial assets.

- Prime Location Advantage: Emaar prioritizes locations with superior infrastructure and access to economic centers.

- Investor Confidence: Strategic positioning in growing economies like Dubai fosters investor trust.

- Capital Appreciation: Properties in Emaar's well-placed developments historically show strong capital growth.

- Desirability Factor: Proximity to business hubs and amenities makes these addresses highly sought after.

Diversified Portfolio and Recurring Revenue Opportunities

Emaar Properties presents a compelling value proposition for investors through its highly diversified portfolio. This spans residential, commercial, retail, and hospitality sectors, offering a broad spectrum of investment opportunities. This strategic diversification inherently mitigates risk by not relying on a single market segment.

Furthermore, Emaar capitalizes on recurring revenue streams, primarily generated through rental income and robust asset management activities. This consistent income generation provides a stable foundation for profitability and predictable financial returns for stakeholders. The company's commitment to growing rental income directly translates to enhanced financial stability.

- Diversified Asset Base: Emaar's presence across residential, commercial, retail, and hospitality segments reduces reliance on any single market.

- Recurring Revenue Streams: Rental income from its vast property holdings and fees from asset management offer consistent cash flow.

- Risk Mitigation: Diversification across sectors and geographies helps cushion against sector-specific downturns.

- Stable Profitability: Focus on rental income growth ensures predictable and stable profit generation.

Emaar Properties' value proposition is built on creating integrated luxury lifestyle destinations, not just residences. These master-planned communities blend living spaces with retail, hospitality, and entertainment, offering residents a holistic and convenient lifestyle. For example, Emaar's developments often feature extensive amenities that enhance community living and property desirability.

The company's reputation for developing iconic landmarks, such as the Burj Khalifa and The Dubai Mall, provides customers with the unique opportunity to invest in world-renowned structures that carry significant prestige and potential for capital appreciation. These architectural marvels contribute to the enduring appeal and investment value of Emaar's projects.

Emaar's strategic focus on prime locations with excellent connectivity and proximity to economic hubs ensures that its properties offer strong investment potential and capital growth. These sought-after addresses benefit from Dubai's dynamic economic growth, making them attractive for both residents and investors. In 2024, Emaar's prime developments continued to demonstrate robust demand, reflecting sustained investor interest in these well-positioned assets.

The company's commitment to superior construction quality and timely project delivery builds significant customer trust and confidence. This reliability is a cornerstone of Emaar's brand, ensuring that projects are completed to high standards, which in turn supports customer satisfaction and reinforces the company's reputation for dependability in the real estate market.

| Value Proposition | Description | Supporting Fact/Data |

| Integrated Lifestyle Ecosystems | Curating complete luxury lifestyle environments within master-planned communities, blending residences with retail, hospitality, and entertainment. | Dubai Hills Mall, a key Emaar development, reported over 20 million visitors in its first year, highlighting the draw of integrated Emaar environments. |

| Iconic Landmark Development | Creating globally recognized architectural landmarks that offer unique ownership and living experiences in visually stunning and significant structures. | Emaar is renowned for developing the Burj Khalifa, the world's tallest building, and The Dubai Mall, one of the largest shopping and entertainment destinations globally. |

| Prime Location Advantage | Strategic positioning in prime areas with excellent connectivity and proximity to key economic centers, ensuring significant investment potential and capital appreciation. | In 2024, Emaar's Downtown Dubai continued to show strong demand, with property values reflecting its prime location and investor appeal. |

| Construction Excellence & Reliability | Dedication to superior construction quality and meeting project deadlines, fostering significant trust and confidence among customers. | Emaar consistently maintains a strong project delivery pipeline, contributing to its reputation for reliability and customer satisfaction. |

Customer Relationships

Emaar Properties cultivates deep customer loyalty through highly personalized sales and after-sales service. This includes tailored consultations and exclusive property viewings, ensuring each client feels uniquely valued. In 2024, Emaar's commitment to customer satisfaction was evident when they undertook repairs for homes impacted by rain at their own expense, reinforcing trust and a long-term relationship.

Emaar Properties actively cultivates a strong sense of belonging among residents through a consistent schedule of community engagement and lifestyle events. These gatherings, ranging from cultural festivals to family-friendly activities, are designed to enrich the living experience and foster vibrant neighborhood connections.

In 2023, Emaar hosted over 150 community events across its Dubai developments, including the popular Dubai Shopping Festival activations and Ramadan cultural nights. Such initiatives directly contribute to resident satisfaction and reinforce the appeal of Emaar's master-planned communities, driving repeat business and strong word-of-mouth referrals.

Emaar Properties actively uses its website, social media, and customer portals for information dissemination, communication, and online service delivery. This digital approach enhances accessibility and convenience, streamlining customer inquiries and updates.

In 2024, Emaar reported significant engagement across its digital platforms, with its website attracting millions of unique visitors monthly and its social media channels boasting a combined following of over 25 million. These platforms are vital for brand visibility and expanding customer reach.

Investor Relations and Transparency

Emaar Properties cultivates strong investor relationships through a commitment to transparency. They provide regular, detailed updates on project development and financial performance, ensuring shareholders are well-informed. This open communication fosters trust and confidence within their investor community.

The company actively engages with its stakeholders by making its integrated annual reports and financial statements readily accessible to the public. For instance, Emaar's 2023 integrated report offered comprehensive insights into their operational achievements and financial health.

- Transparent Financial Reporting: Emaar regularly publishes audited financial statements and integrated reports, detailing revenue, profit, and asset performance.

- Project Progress Updates: Investors receive consistent information on the status and timelines of Emaar's diverse real estate developments.

- Investor Accessibility: The company maintains channels for investor inquiries, facilitating direct communication and addressing concerns promptly.

- Publicly Available Information: Key financial documents, including annual reports, are accessible on Emaar's investor relations website, ensuring broad transparency.

Loyalty Programs and Exclusive Access

Emaar Properties cultivates strong customer ties through loyalty programs and exclusive access, particularly for repeat buyers and high-net-worth individuals. These initiatives are designed to reward sustained patronage and encourage ongoing investment within Emaar's diverse real estate offerings. By providing privileged access to upcoming projects and premium property selections, Emaar fosters a sense of belonging and exclusivity, thereby reinforcing long-term customer relationships and driving repeat business.

In 2024, Emaar continued to emphasize customer retention strategies. For instance, their Emaar One platform often provides early access to new developments for registered users and loyal customers. This approach directly addresses the need to incentivize continued investment, as evidenced by the consistent demand for Emaar's off-plan sales, which often see significant uptake from existing clientele.

- Loyalty Programs: Emaar's loyalty programs offer tiered benefits, potentially including priority bookings, exclusive event invitations, and personalized services for repeat customers.

- Exclusive Access: High-net-worth individuals and loyal buyers gain early access to new project launches and premium unit selections before they are made available to the general public.

- Incentivizing Investment: These customer relationship strategies aim to foster a continuous cycle of investment by rewarding existing customers and encouraging them to expand their Emaar property portfolio.

- Strengthening Relationships: By offering tangible rewards and privileged experiences, Emaar solidifies long-term customer loyalty and drives repeat business, a key component of sustained growth.

Emaar Properties fosters strong customer connections through personalized service and community building. Their commitment to resident satisfaction is highlighted by initiatives like covering rain-related home repairs in 2024, building trust. Digital platforms are key, with millions of monthly website visitors and over 25 million social media followers in 2024, facilitating communication and brand reach.

| Customer Relationship Aspect | Key Activities | 2023/2024 Data/Examples |

|---|---|---|

| Personalized Service | Tailored consultations, exclusive viewings | Rain damage repairs at own expense (2024) |

| Community Engagement | Lifestyle events, cultural festivals | Over 150 community events hosted (2023) |

| Digital Communication | Website, social media, customer portals | 25M+ social media followers, millions of website visitors (2024) |

| Investor Relations | Transparent financial reporting, project updates | Accessible integrated annual reports (e.g., 2023 report) |

| Loyalty & Exclusivity | Loyalty programs, early access to projects | Emaar One platform offering early access (2024) |

Channels

Emaar Properties maintains a robust network of direct sales offices and luxurious showrooms. These physical spaces are crucial for showcasing property models, detailed layouts, and offering personalized consultations to prospective buyers. This direct engagement is vital for high-value real estate transactions.

These showrooms serve as key customer touchpoints, fostering direct relationships and allowing potential clients to experience the quality and design of Emaar's developments firsthand. Sales teams are equipped to provide in-depth information and comprehensive support throughout the purchasing journey.

In 2024, Emaar continued to leverage these physical assets as a core component of its sales strategy, complementing its digital outreach. The company reported strong sales performance across its portfolio, with these offices playing a significant role in converting interest into purchases.

Emaar Properties leverages its official website and numerous property listing portals to connect with a worldwide customer base. These platforms are crucial for disseminating information, capturing potential leads, and fostering early interactions with prospective buyers.

Extensive digital marketing, encompassing social media engagement and search engine optimization, amplifies Emaar's reach. In 2024, the company continued to invest in these strategies to ensure prominent visibility and attract a diverse international clientele.

Emaar Properties leverages a broad network of real estate agencies and brokers, both locally and globally, to connect with a wide array of potential buyers. These collaborations are crucial for property sales and offer buyers, especially those from overseas, expert advice and support. In 2024, Emaar continued to strengthen these relationships, working with hundreds of agencies and providing training to thousands of agents to boost its market presence.

International Roadshows and Exhibitions

Emaar Properties leverages international roadshows and exhibitions as a vital channel to connect with global investors and high-net-worth individuals. These events, held in major financial hubs, offer a platform for direct interaction and detailed presentations of Emaar's diverse real estate developments.

By actively participating in and hosting these gatherings, Emaar aims to broaden its investor base and secure foreign capital essential for its ambitious growth strategies. For instance, in 2024, Emaar continued its global outreach, participating in key property expos in London, Singapore, and New York, showcasing projects like the Dubai Creek Tower and its various residential offerings.

- Global Investor Engagement: Direct interaction with potential investors in key international markets.

- Portfolio Showcase: Highlighting Emaar's flagship projects to a wide audience.

- Market Penetration: Crucial for entering new geographical territories and attracting foreign investment.

- Brand Visibility: Enhancing Emaar's global reputation and attracting premium clientele.

Hospitality and Retail Venues

Emaar Properties leverages its own hospitality and retail destinations, like The Dubai Mall and its portfolio of hotels, as crucial indirect channels. These iconic venues don't just generate revenue; they act as living showrooms for the Emaar lifestyle, drawing in visitors who then become potential buyers or investors in Emaar's residential projects. This experiential marketing approach is highly effective in capturing interest.

For instance, The Dubai Mall, a flagship Emaar property, consistently attracts millions of visitors annually. In 2023, it reported over 108 million visitors, demonstrating its immense reach. This high footfall creates a natural funnel, exposing a vast audience to the quality and desirability of Emaar's broader offerings, including its residential developments.

- Showcasing Emaar Lifestyle: Emaar's hotels and malls provide a tangible experience of the brand's commitment to luxury and quality, influencing consumer perception and desire for Emaar's residential properties.

- Attracting Potential Buyers: Visitors to these high-traffic destinations are often exposed to Emaar's residential projects through integrated marketing efforts, leading to direct inquiries and sales leads.

- Experiential Marketing: These venues serve as powerful platforms for experiential marketing, allowing potential customers to immerse themselves in the Emaar brand before committing to a property purchase.

- Brand Reinforcement: The success and prestige of Emaar's retail and hospitality assets reinforce the overall brand value, making its residential offerings more attractive in a competitive market.

Emaar Properties utilizes a multi-faceted channel strategy, blending physical presence with extensive digital outreach and strategic partnerships. Direct sales offices and showrooms are paramount for high-value real estate transactions, offering personalized consultations and showcasing property quality. These physical touchpoints are complemented by a strong online presence through its official website and property listing portals, amplified by robust digital marketing efforts to reach a global audience.

Furthermore, Emaar actively engages international investors through roadshows and exhibitions in key financial hubs, fostering direct interaction and securing foreign capital. The company also leverages its own hospitality and retail destinations, such as The Dubai Mall, as indirect channels. These high-traffic venues act as experiential showrooms, exposing millions of visitors to the Emaar lifestyle and generating leads for residential projects. In 2024, Emaar continued to strengthen its network of real estate agencies and brokers, supporting thousands of agents to enhance market penetration.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Offices/Showrooms | Physical spaces for property display and personalized consultations. | Core strategy for high-value transactions and customer relationship building. |

| Online Platforms (Website, Portals) | Digital dissemination of information and lead generation. | Continued investment in digital marketing for global reach and visibility. |

| Real Estate Agencies/Brokers | Local and global partnerships for wider market access. | Strengthened relationships with hundreds of agencies, training thousands of agents. |

| International Roadshows/Exhibitions | Direct engagement with global investors and high-net-worth individuals. | Participation in key expos in London, Singapore, and New York. |

| Hospitality/Retail Destinations | Indirect channels acting as experiential showrooms (e.g., The Dubai Mall). | Leveraging high footfall (over 108 million visitors in 2023 for Dubai Mall) to showcase Emaar lifestyle. |

Customer Segments

Emaar Properties actively courts High-Net-Worth Individuals (HNWIs) and institutional investors, both within the UAE and globally. These discerning clients are drawn to Emaar's portfolio, which includes exclusive residential projects, lucrative commercial spaces, and top-tier hospitality ventures.

The appeal for these sophisticated investors lies in the inherent prestige, superior quality, and the proven track record of significant capital appreciation associated with Emaar's developments. For instance, in 2023, Emaar reported a 10% increase in property sales, with a substantial portion attributed to international buyers seeking these premium assets.

Emaar's global reputation for delivering iconic landmarks and high-quality living experiences ensures consistent demand from international investors. This is further evidenced by their successful launches in key global markets, attracting significant capital inflows and reinforcing their position as a preferred developer for affluent clientele.

Expatriates and international migrants represent a crucial customer segment for Emaar Properties. Many are drawn to Dubai by the promise of a high quality of life, excellent amenities, and a secure environment, with Emaar's master-planned communities offering precisely that. This demand is further amplified by the increasing number of expatriates choosing to relocate to the UAE, a trend supported by initiatives like the Golden Visa program.

Emaar Properties deeply understands the desires of families yearning for integrated community living. They focus on creating master-planned environments that prioritize safety and a family-friendly atmosphere, ensuring residents have convenient access to essential amenities like schools, healthcare facilities, ample green spaces, and diverse recreational options.

Developments such as Dubai Hills Estate exemplify this commitment, offering a holistic living experience tailored to the comprehensive needs of today's families. This approach fosters a sense of belonging and provides a balanced lifestyle within a secure and engaging setting.

Luxury Tourists and Business Travelers

Emaar Properties caters to discerning luxury tourists and business travelers, offering them premium accommodation and unparalleled shopping and entertainment. This segment is crucial for generating consistent revenue from Emaar's hotel and retail properties.

The company's hospitality and leisure offerings are designed to attract high-spending individuals who value quality and exclusivity. These travelers seek more than just a place to stay; they desire immersive experiences.

- Target Audience: Affluent individuals seeking premium experiences, including luxury tourists and corporate travelers.

- Value Proposition: World-class accommodation, high-end retail, and diverse entertainment options.

- Revenue Streams: Hotels, serviced residences, and retail leasing within its developments.

- Key Activity: Developing and managing integrated lifestyle destinations.

Dubai Mall, a prime example of Emaar's success in this segment, saw an impressive 111 million visitors in 2024, highlighting the strong demand for its retail and leisure attractions.

Retailers and Commercial Businesses

Emaar Properties' commercial leasing segment is designed to attract a diverse range of tenants, including prominent international and local retail brands, popular food and beverage operators, and a variety of other businesses seeking premium commercial spaces. These entities are crucial for maintaining the dynamic atmosphere and driving revenue across Emaar's extensive portfolio of high-traffic shopping malls and bustling business districts.

These tenants are the lifeblood of Emaar's retail and commercial ventures, directly contributing to the vibrancy and financial success of its properties. For instance, in 2023, Emaar Malls reported significant rental income, demonstrating the strong demand for its commercial spaces. The occupancy rates across its prime assets remained robust, underscoring the appeal of its locations to established and emerging businesses.

- Tenant Mix: Attracts global luxury brands, popular F&B chains, and diverse service providers.

- Property Value: Prime locations in high-footfall malls and central business districts.

- Revenue Generation: Rental income from commercial leases forms a substantial part of Emaar's revenue.

- Market Position: Key anchor tenants enhance the overall attractiveness and value of Emaar's commercial assets.

Emaar Properties strategically targets affluent individuals and families seeking premium residential experiences. These customers value quality, prestige, and integrated community living, often prioritizing safety and access to amenities like schools and green spaces. In 2023, Emaar's residential sales saw a notable increase, with a significant portion coming from these discerning buyers looking for long-term value and lifestyle enhancement.

The company also appeals to expatriates and international migrants looking for a high quality of life in the UAE, a trend bolstered by government initiatives like the Golden Visa. Furthermore, Emaar caters to luxury tourists and business travelers who seek exceptional hospitality, retail, and entertainment, as exemplified by the high visitor numbers at Dubai Mall in 2024.

Commercial tenants, ranging from global luxury brands to local F&B operators, are also a key segment, drawn to Emaar's prime locations in high-footfall malls and business districts, contributing significantly to rental income.

| Customer Segment | Key Characteristics | Emaar's Offering | 2023/2024 Data Point |

| High-Net-Worth Individuals & Institutional Investors | Seek prestige, quality, capital appreciation | Exclusive residential, commercial, hospitality | 10% increase in property sales (2023) |

| Expatriates & International Migrants | Desire high quality of life, secure environment | Master-planned communities, family-friendly | Golden Visa program driving relocation |

| Families | Value integrated living, safety, amenities | Holistic living, schools, green spaces | Dubai Hills Estate as a prime example |

| Luxury Tourists & Business Travelers | Seek premium experiences, exclusivity | World-class hotels, retail, entertainment | 111 million visitors at Dubai Mall (2024) |

| Commercial Tenants | Require premium spaces, high footfall | Prime retail and office spaces | Robust occupancy rates in prime assets (2023) |

Cost Structure

Emaar's cost structure heavily relies on acquiring substantial tracts of prime real estate for its ambitious development projects. These land acquisition expenses are a significant capital outlay, essential for fueling future growth and maintaining its market position.

In 2024 alone, Emaar demonstrated this commitment by acquiring an impressive 141 million square feet of prime development land. This strategic land banking is a cornerstone of its business model, ensuring a robust pipeline of projects for years to come.

Emaar Properties faces significant expenses in the physical construction of its developments. These include the cost of raw materials like steel and concrete, skilled labor, heavy machinery, and advanced project management systems essential for overseeing vast, intricate projects.

Upholding Emaar's reputation for superior construction quality across its diverse portfolio of properties is a major driver of these expenditures. The company actively seeks cost efficiencies through meticulous resource planning and operational streamlining.

For instance, in 2023, Emaar Development reported construction costs that represented a substantial portion of its revenue, reflecting the scale of its ongoing projects such as Dubai Hills Estate and Emaar Beachfront.

Emaar Properties dedicates substantial resources to marketing, sales, and distribution to drive property sales and sustain brand recognition. This includes significant investment in global marketing initiatives and sales commissions paid to various agencies.

In 2023, Emaar's marketing and selling expenses amounted to AED 3.9 billion, reflecting a strategic focus on digital marketing and brand promotion to reach a broad spectrum of potential buyers in competitive international real estate markets.

Operational Costs for Recurring Revenue Businesses

Emaar Properties incurs substantial operational costs to maintain its vast array of shopping malls, hotels, and leisure destinations. These recurring expenses are crucial for ensuring the seamless operation and ongoing profitability of these income-generating segments.

Key cost drivers include:

- Maintenance and Repairs: Ongoing upkeep of properties, including structural integrity, landscaping, and aesthetic improvements. For example, in 2024, significant investments were directed towards modernizing key mall facilities to enhance customer experience.

- Utilities: Costs for electricity, water, and HVAC systems to operate large-scale venues, particularly critical for climate-controlled malls and hotels.

- Staffing: Salaries, benefits, and training for a large workforce across property management, customer service, security, and hospitality roles. Emaar's diverse operations necessitate a substantial human capital investment.

- Marketing and Promotion: Expenses related to advertising, events, and loyalty programs designed to attract and retain customers for its retail, hospitality, and entertainment offerings.

Administrative and Corporate Overheads

Emaar Properties' cost structure includes significant administrative and corporate overheads. These encompass general administrative expenses, salaries for corporate staff, and legal fees essential for managing a global real estate enterprise. For instance, in 2023, Emaar Properties reported selling, general and administrative expenses of AED 4.1 billion, reflecting these operational necessities.

The company actively seeks to optimize these costs through efficient resource management and innovation. This focus is crucial for maintaining profitability across its diverse portfolio of developments and hospitality ventures.

- General administrative expenses form a core part of these overheads.

- Corporate salaries account for a substantial portion, covering executive and support staff.

- Legal and professional fees are necessary for compliance and contract management.

- Other overheads include IT infrastructure and corporate communications.

Emaar’s cost structure is significantly influenced by land acquisition, with substantial outlays for prime real estate to fuel its development pipeline. Construction costs, encompassing materials, labor, and project management, represent another major expense category, reflecting the scale and quality of its projects.

Marketing and sales efforts, including global campaigns and commissions, are critical for driving property transactions, as evidenced by AED 3.9 billion in marketing and selling expenses in 2023. Operational costs for maintaining its vast portfolio of malls, hotels, and leisure destinations are ongoing, covering maintenance, utilities, and staffing.

Administrative and corporate overheads, including salaries and professional fees, are also a key component, with AED 4.1 billion in selling, general, and administrative expenses reported in 2023 for Emaar Properties. The company continually seeks cost efficiencies across all these areas.

| Cost Category | 2023 Expense (AED billion) | Key Drivers |

|---|---|---|

| Land Acquisition | Significant, but not explicitly itemized as a single figure | Acquisition of prime development land (e.g., 141 million sq ft in 2024) |

| Construction | Substantial portion of revenue (e.g., for Dubai Hills Estate) | Raw materials, skilled labor, machinery, project management |

| Marketing & Selling | 3.9 | Global marketing initiatives, sales commissions, digital marketing |

| Operational Costs (Malls, Hotels, etc.) | Ongoing, not a single consolidated figure | Maintenance, utilities, staffing, property management |

| Selling, General & Administrative | 4.1 | Corporate staff salaries, legal fees, administrative overheads |

Revenue Streams

Emaar's core revenue generation hinges on the sale of residential properties like apartments and villas, alongside commercial spaces, all integrated into its signature master-planned developments. This segment is the company's financial backbone.

In 2024, property sales surged to an impressive AED 70 billion, underscoring its dominance as the primary contributor to Emaar's overall revenue. This substantial figure reflects strong market demand for Emaar's diverse real estate offerings.

Emaar Properties secures significant recurring income through the leasing of retail and commercial spaces within its extensive portfolio of shopping malls and office buildings. This consistent revenue stream is a cornerstone of Emaar's diversified financial model.

In 2024, Emaar's shopping malls and retail operations were a major contributor, generating AED 5.6 billion in revenue, underscoring the strength of its leasing business.

Emaar Properties generates revenue from its extensive hospitality and leisure operations, which encompass a diverse portfolio of hotels and resorts. This includes income from room nights booked, sales of food and beverages, and various other guest services. In 2024, this vital segment of Emaar's business brought in AED 3.7 billion.

Beyond accommodation, the company also earns income from its leisure and entertainment attractions through ticket sales and unique guest experiences. These offerings contribute significantly to the overall performance of the hospitality and leisure division.

Property Management and Services Fees

Emaar Properties generates revenue through property management, facility management, and community services. These fees are essential for maintaining the quality and operational efficiency of its vast developments, ensuring a high standard of living and working environments for residents and businesses. This revenue stream directly supports the ongoing value proposition of Emaar's integrated communities.

These services are crucial for the long-term desirability and functionality of Emaar's properties. By covering maintenance, security, landscaping, and various resident amenities, these fees contribute to a stable and attractive living experience. This ongoing income stream also helps to preserve and enhance the asset value of the properties over time.

- Property Management Fees: Charged for overseeing residential and commercial properties, including leasing, rent collection, and tenant relations.

- Facility Management Fees: Cover the upkeep of shared infrastructure such as common areas, utilities, and building systems.

- Community Services Fees: Include charges for amenities like security, landscaping, waste management, and recreational facilities, enhancing the resident experience.

- Contribution to Value: These fees are integral to maintaining Emaar's reputation for high-quality, well-managed developments, fostering resident satisfaction and loyalty.

International Property Development and Sales

Emaar Properties generates significant revenue from its international property development and sales ventures. These overseas projects, including those in Egypt and India, are crucial for bolstering the company's overall group revenue and reducing its reliance on any single market.

In 2024, Emaar's international real estate operations achieved property sales totaling AED 4.1 billion. This strong performance was largely propelled by robust sales activity in key markets such as Egypt and India, demonstrating the company's successful global expansion strategy.

- International Property Sales: AED 4.1 billion in 2024.

- Key Markets: Egypt and India significantly contributed to international revenue.

- Strategic Importance: Diversifies geographical risk and enhances overall group revenue.

Emaar's revenue streams are diverse, encompassing property sales, retail leasing, hospitality, and property management. The company's ability to generate income from multiple sources provides financial stability and resilience.

In 2024, property sales were the dominant revenue driver, reaching AED 70 billion. This highlights the strength of Emaar's core real estate development business.

Recurring income from retail and hospitality operations, totaling AED 5.6 billion and AED 3.7 billion respectively in 2024, demonstrates the success of Emaar's integrated lifestyle developments.

| Revenue Stream | 2024 Revenue (AED Billion) | Key Activities |

|---|---|---|

| Property Sales | 70.0 | Residential and commercial property development and sales |

| Retail Leasing | 5.6 | Leasing of shopping malls and commercial spaces |

| Hospitality & Leisure | 3.7 | Hotel operations, food and beverage, guest services, entertainment attractions |

| Property & Facility Management | N/A | Management services for properties and communities |

| International Property Sales | 4.1 | Development and sales in markets like Egypt and India |

Business Model Canvas Data Sources

The Emaar Properties Business Model Canvas is built using a combination of Emaar's publicly available financial reports, investor presentations, and annual disclosures. These sources provide critical insights into revenue streams, cost structures, and key partnerships.

Market research reports, real estate industry analyses, and competitor benchmarking are also integral to the canvas. This ensures that customer segments, value propositions, and channels accurately reflect market dynamics and competitive landscape.