Emaar Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emaar Properties Bundle

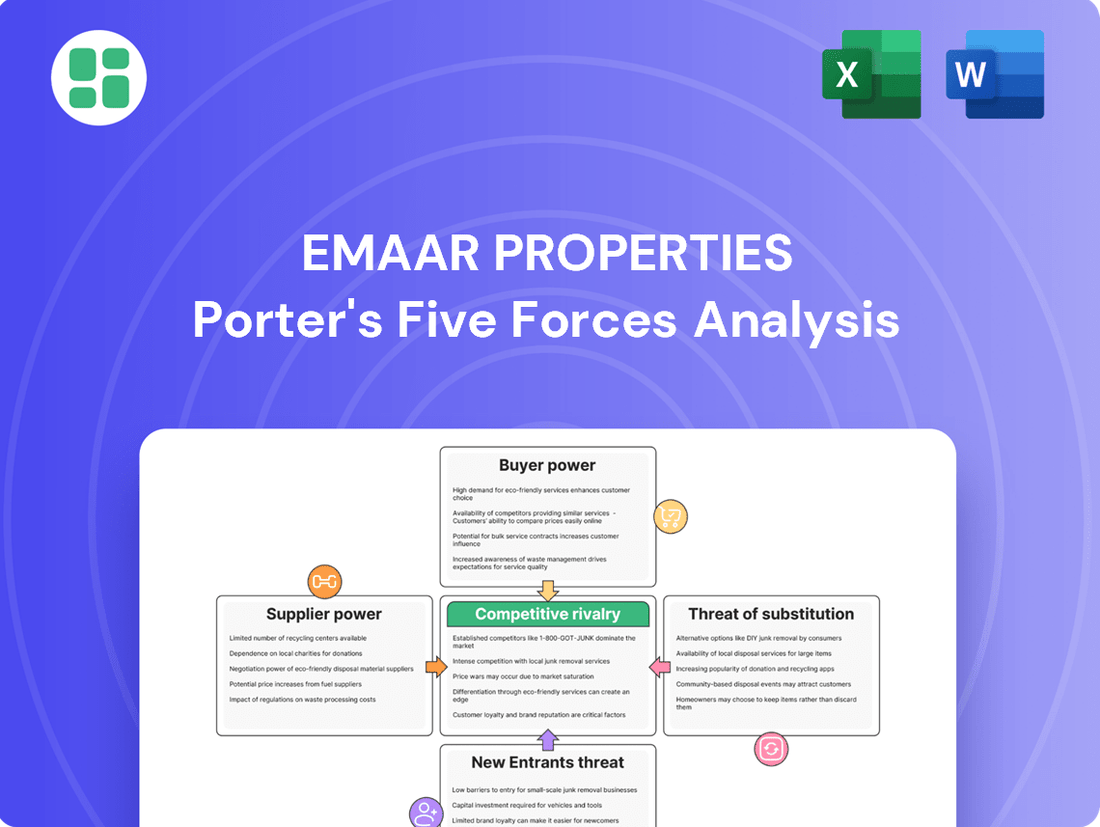

Emaar Properties navigates a complex landscape shaped by intense buyer power and the constant threat of new entrants, impacting its pricing strategies and market share. Understanding these forces is crucial for anyone looking to grasp Emaar's competitive position.

The complete report reveals the real forces shaping Emaar Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Emaar Properties' reliance on specialized contractors for unique architectural elements or high-end finishes can grant these suppliers significant leverage. When a project demands niche skills or proprietary technology, the pool of qualified contractors shrinks, increasing their bargaining power. For instance, securing contracts for complex façade systems or bespoke interior designs often involves a limited number of globally recognized firms.

The availability of land is a significant factor influencing the bargaining power of suppliers for Emaar Properties. Prime land in Dubai, a critical input for Emaar's real estate developments, can become a scarce resource. This scarcity can empower landowners, including government bodies, to negotiate more favorable terms, thereby increasing their bargaining power.

However, Emaar actively works to counter this by securing substantial land banks. For instance, in 2024, Emaar acquired approximately 141 million square feet of development land. This strategic acquisition of land assets helps Emaar to mitigate the potential leverage that individual landowners might otherwise wield, ensuring a more stable supply for its projects.

Fluctuations in the cost of essential construction materials like steel, concrete, and glass directly influence Emaar Properties' project expenses. For instance, in 2023, global steel prices saw significant volatility, impacting construction budgets worldwide. While Emaar's substantial scale enables advantageous bulk purchasing and the negotiation of long-term contracts, it doesn't entirely insulate them from the leverage suppliers hold.

The bargaining power of suppliers in the construction materials sector is notably influenced by the cost of these fundamental inputs. In 2024, continued global economic uncertainties and geopolitical events are expected to contribute to ongoing price pressures on commodities such as cement and rebar, potentially increasing supplier leverage over developers like Emaar.

Labor availability and cost

Labor availability and cost are critical factors impacting Emaar Properties. The construction sector, particularly in a rapidly developing region like the UAE, depends significantly on a consistent supply of both skilled and unskilled labor. Any scarcity or upward pressure on wages directly influences Emaar's project costs and delivery schedules.

In 2024, reports indicated a continued demand for construction workers in the UAE, driven by ongoing infrastructure projects and real estate development. This sustained demand can shift bargaining power towards labor, especially for specialized roles like project managers, engineers, and skilled tradespeople. For instance, an increase in average daily wages for construction laborers in Dubai, which saw fluctuations throughout 2023 and into 2024, directly impacts Emaar's bottom line.

- Skilled labor shortages: A lack of specialized construction professionals in the UAE can empower these workers, allowing them to command higher salaries and better benefits, increasing Emaar's labor costs.

- Wage inflation: Rising average wages in the construction sector, influenced by supply and demand dynamics, directly affect Emaar's project budgeting and profitability.

- Recruitment agency influence: Agencies that control access to labor can leverage their position to negotiate higher fees or secure better terms for workers, impacting Emaar's procurement costs.

- Project timelines: Labor availability issues can lead to delays in construction, potentially incurring penalties and increasing overall project expenses for Emaar.

Government and regulatory bodies

Government and regulatory bodies in the UAE, like the Real Estate Regulatory Authority (RERA), are crucial suppliers for Emaar Properties, providing essential approvals, licenses, and land leases. Their regulatory framework and land allocation policies directly impact Emaar's ability to operate and the overall cost of its development projects.

These entities wield significant bargaining power. For instance, RERA's oversight on off-plan sales and project timelines can affect Emaar's cash flow and market responsiveness. The availability and cost of government-leased land are also key determinants of project feasibility and profitability.

- Regulatory Approvals: Emaar's projects require numerous approvals from government bodies, giving these entities leverage over project timelines and specifications.

- Land Allocation: The UAE government's land policies and pricing directly influence Emaar's access to prime development sites and associated costs.

- Policy Changes: Shifts in real estate regulations or economic policies by the government can necessitate adjustments in Emaar's strategies, affecting its operational flexibility and costs.

The bargaining power of suppliers for Emaar Properties is influenced by specialized contractors and the availability of prime land. For example, securing unique architectural elements often involves a limited number of firms, granting them leverage.

Material costs also play a role; in 2024, ongoing price pressures on commodities like cement are expected to increase supplier leverage. Labor availability, particularly for skilled roles, can also empower workers, leading to higher wage demands for Emaar.

Government and regulatory bodies, such as RERA, act as key suppliers through land allocation and approvals, wielding significant power over project timelines and costs.

| Supplier Type | Influence on Emaar | Key Factors |

|---|---|---|

| Specialized Contractors | High leverage for unique project needs | Niche skills, proprietary technology |

| Landowners/Government | Significant power due to land scarcity | Prime location availability, government policies |

| Material Suppliers | Impact on project costs due to price volatility | Commodity prices (steel, cement), global economic factors |

| Labor Providers | Affects project costs and timelines | Skilled labor demand, wage inflation |

| Regulatory Bodies (e.g., RERA) | Controls approvals, land leases, and policies | Land allocation policies, regulatory framework changes |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Emaar Properties' position in the global real estate and hospitality sectors.

Effortlessly identify and mitigate competitive threats with a dynamic Emaar Porter's Five Forces model that adapts to changing market dynamics.

Customers Bargaining Power

Emaar Properties primarily targets high-net-worth individuals and international investors who are looking for premium real estate and sophisticated lifestyle offerings. These discerning customers, while not overly sensitive to price, wield significant influence through their exacting standards for quality, innovative design, and superior amenities. Their expectations shape Emaar's product development and service delivery significantly.

Even with Emaar Properties' strong market presence, customers in Dubai have a variety of other reputable developers to choose from. Competitors such as DAMAC Properties, Nakheel, Meraas, and Sobha Realty offer diverse projects, giving buyers significant leverage.

This competitive landscape, particularly in the mid-range and non-luxury segments, means customers can readily switch developers if Emaar's pricing or offerings aren't perceived as optimal. For instance, DAMAC Properties reported significant sales growth in 2023, indicating strong customer demand for their projects, which directly impacts Emaar's customer bargaining power.

In Dubai's real estate sector, market transparency is significantly increasing. Buyers now have readily available data on property prices, rental income potential, and developer track records, as evidenced by numerous online property portals and market analysis reports. This heightened access to information directly empowers customers, allowing them to compare offerings and negotiate more effectively with developers like Emaar Properties.

Off-plan investment trends

The bargaining power of customers in Dubai's real estate market, particularly concerning off-plan investments, is significant. Developers frequently offer flexible payment plans and attractive incentives to secure sales, demonstrating a clear willingness to accommodate buyer preferences. This dynamic allows customers to negotiate terms that align with their financial capabilities, thereby enhancing their influence.

The prevalence of off-plan property sales in Dubai, a key strategy for developers like Emaar Properties, inherently empowers buyers. These sales often involve staged payments spread over the construction period, giving customers considerable leverage in negotiating payment schedules and potentially other aspects of the deal.

- Off-plan sales accounted for a substantial portion of Dubai's property transactions in 2023, with reports indicating over 60% of sales value coming from off-plan projects.

- Flexible payment plans, often extending up to 5-7 years post-handover, are standard offerings, allowing buyers to manage cash flow and increasing their negotiation power.

- The competitive landscape among developers in Dubai means buyers can often compare offers and secure better terms, especially for larger investments or in sought-after projects.

Demand for integrated lifestyle communities

Emaar Properties' focus on integrated lifestyle communities, blending residential, commercial, leisure, and hospitality, significantly shapes customer bargaining power. While customers desire this all-encompassing experience, Emaar's ability to deliver it often reduces their direct leverage on pricing, as the value proposition is unique. This demand for a complete lifestyle ecosystem, however, means customers are highly sensitive to the overall value delivered, not just the price of individual components.

The demand for integrated lifestyle communities, a key Emaar specialty, means customers are looking for more than just a home. They seek a holistic living experience. For instance, Emaar's Dubai Hills Estate offers a blend of residences, a golf course, retail, and schools, creating a self-contained environment. This comprehensive offering can limit customers’ ability to bargain down prices, as they are buying into a complete lifestyle package rather than just a property. In 2023, Emaar reported strong sales performance, particularly in its master-planned communities, underscoring the robust demand for these integrated developments.

- Customer Demand for Integrated Living: Emaar's success in master-planned communities like Dubai Hills Estate and Arabian Ranches caters to a growing desire for convenience and a complete lifestyle, reducing individual component price sensitivity.

- Value Proposition vs. Price Bargaining: While customers seek value, the integrated nature of Emaar's developments often limits their direct bargaining power on individual unit prices, shifting focus to overall lifestyle benefits.

- Market Validation: Strong sales figures in 2023 for Emaar's integrated communities, such as the over 10,000 residential unit sales reported, demonstrate the market's willingness to pay a premium for this comprehensive lifestyle offering.

Customers in Dubai's real estate market, particularly those purchasing off-plan, possess considerable bargaining power. This is due to the competitive developer landscape and the prevalence of flexible payment plans, which often extend for several years post-handover. The increasing market transparency, fueled by readily available data on pricing and developer track records, further empowers buyers to negotiate favorable terms.

Emaar's focus on integrated lifestyle communities, while attractive to buyers seeking a holistic living experience, can limit direct price bargaining on individual units. Customers are often willing to pay a premium for the convenience and comprehensive offerings of developments like Dubai Hills Estate. This demand is validated by Emaar's strong sales performance in 2023, with over 10,000 residential units sold in its master-planned communities.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Developer Competition | Increases Power | Multiple reputable developers like DAMAC and Nakheel offer alternatives, increasing buyer options. |

| Off-Plan Sales Structure | Increases Power | Staged payments over construction periods provide leverage for negotiation on terms. |

| Market Transparency | Increases Power | Easy access to pricing, rental yields, and developer history allows for informed comparisons. |

| Integrated Lifestyle Demand | Decreases Power (on individual unit price) | Customers prioritize holistic living, accepting premiums for comprehensive community offerings. |

Full Version Awaits

Emaar Properties Porter's Five Forces Analysis

This preview showcases the comprehensive Emaar Properties Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, fully formatted file, ready for your immediate use and analysis.

Rivalry Among Competitors

Emaar Properties faces intense competition in the Dubai real estate sector from major developers like DAMAC Properties, Nakheel, Meraas, and Aldar. These established players actively vie for market dominance, particularly in lucrative segments such as luxury properties and large-scale master-planned communities. For instance, DAMAC Properties reported significant revenue growth in 2023, showcasing the aggressive market activity.

Dubai's real estate sector has seen robust expansion, with the market experiencing significant growth in recent years. This attractiveness, fueled by high yields and a consistent influx of investor capital, naturally draws in a multitude of developers, all eager to capitalize on the opportunities presented.

This high market growth directly translates into intensified competitive rivalry. As more developers enter the fray, each company must work harder to secure land, attract buyers, and differentiate their offerings in a crowded landscape. The sheer volume of new projects and the speed at which they are launched underscore this heightened competition.

For instance, in 2024, Dubai's property market continued its upward trajectory, with sales volumes reaching new heights. Transaction values in the first quarter of 2024 alone surpassed AED 110 billion, indicating a dynamic and highly competitive environment where developers are actively vying for market share.

Emaar Properties' competitive edge is frequently built on creating globally recognized landmarks like the Burj Khalifa and The Dubai Mall. These monumental projects are incredibly challenging for rivals to duplicate, fostering a powerful brand identity and distinct market positioning. For instance, The Dubai Mall, a flagship Emaar development, consistently ranks among the world's most visited retail destinations, attracting tens of millions of visitors annually, which is a testament to its iconic status and Emaar's development prowess.

Aggressive marketing and sales strategies

Emaar Properties faces intense competition, with rivals frequently employing aggressive marketing and sales tactics. These strategies often include attractive, flexible payment plans designed to entice buyers in a dynamic real estate market.

Competitors are also keen on differentiating themselves by targeting specific market segments. This means focusing on niches like the high-end luxury sector, the growing affordable luxury segment, or prime waterfront properties, all aimed at capturing distinct customer bases.

This continuous drive for innovation in sales and marketing approaches significantly escalates the overall competitive intensity within the industry. For instance, in 2023, Dubai's real estate market saw a surge in off-plan sales, with developers offering up to 80% payment on handover, a tactic Emaar also utilizes.

- Aggressive Marketing: Competitors frequently launch extensive advertising campaigns across multiple channels.

- Flexible Payment Plans: Offers like extended payment schedules or deferred installments are common.

- Niche Market Focus: Specialization in luxury, affordable luxury, or waterfront developments to attract specific buyer profiles.

- Sales Innovation: Constant introduction of new sales incentives and promotional activities to gain market share.

Market cycles and supply-demand dynamics

The Dubai real estate market is inherently cyclical, with periods of robust demand often followed by phases of oversupply. During these latter periods, competitive rivalry among developers like Emaar Properties intensifies significantly.

This heightened competition manifests as developers vie for a shrinking pool of potential buyers. To attract customers, companies resort to price reductions, offering attractive payment plans, and providing substantial incentives, all of which can compress profit margins.

- Developer Competition: In 2024, the Dubai market saw a notable increase in project launches, leading to a more competitive landscape.

- Price Sensitivity: Reports from Q1 2024 indicated a slight softening in average property prices in certain segments, driven by the need to move inventory.

- Incentive Wars: Developers extended payment terms and offered various perks, such as service charge waivers, to differentiate their offerings.

Emaar Properties operates in a highly competitive Dubai real estate market, facing strong rivals like DAMAC Properties and Nakheel. These developers actively compete for market share through aggressive marketing, flexible payment plans, and niche segment targeting. For instance, Dubai's property market saw transaction values exceeding AED 110 billion in Q1 2024, highlighting intense developer activity and the need for differentiation.

| Developer | 2023 Revenue (approx.) | Key Competitive Tactic | Notable Projects |

|---|---|---|---|

| Emaar Properties | AED 30.1 billion | Iconic landmarks, brand strength | Burj Khalifa, The Dubai Mall |

| DAMAC Properties | AED 24.4 billion | Luxury focus, aggressive sales | Aykon City, Paramount Hotel Dubai |

| Nakheel | Not publicly disclosed | Master-planned communities, waterfront living | Palm Jumeirah, Jumeirah Islands |

SSubstitutes Threaten

The threat of substitutes for Emaar Properties' core business, which is primarily real estate development and sales, is significant. Potential customers have a wide array of alternative investment vehicles for their capital. These include traditional financial assets like stocks and bonds, which offer different liquidity and risk-return profiles compared to property. For instance, as of Q1 2024, global equity markets have shown robust performance, potentially diverting investment away from real estate.

Furthermore, investors can choose to allocate their funds to other global real estate markets. Properties in cities like London, New York, or Singapore might present different growth prospects or yield opportunities that compete with Dubai's real estate sector. While real estate, particularly in desirable locations like those Emaar develops, is often seen as a stable, tangible asset, the allure of higher or faster returns from other asset classes remains a constant substitute threat.

Renting offers a flexible alternative to owning property, appealing to individuals prioritizing mobility or seeking to avoid substantial down payments. This is particularly relevant in real estate markets where the cost of entry for ownership can be high.

However, in Dubai, a notable trend in 2024 indicates a growing desire among expatriates to transition from renting to homeownership. This shift, driven by factors like increased stability and long-term investment goals, could lessen the competitive pressure from renting as a substitute for Emaar Properties' core business of property sales.

Long-term stay hotels and serviced apartments present a notable threat of substitutes for Emaar Properties, particularly for individuals seeking accommodation for short-to-medium terms or corporate housing needs. These options can directly compete with the idea of purchasing residential property or entering into traditional long-term rental agreements. For instance, in 2024, the serviced apartment sector in Dubai, a key market for Emaar, continued to see robust demand, with occupancy rates often exceeding 80% in prime locations, indicating a strong preference for flexible, furnished accommodation.

Furthermore, Emaar Properties itself operates a portfolio of hotels, creating a degree of internal substitution. When Emaar's own hotels offer competitive rates or attractive packages for extended stays, they can draw demand away from its residential leasing or sales segments, directly impacting its market share within the broader accommodation landscape.

Virtual or alternative leisure experiences

The threat of substitutes for Emaar Properties' leisure and entertainment ventures, such as its integrated developments like Dubai Mall and various theme parks, is present but somewhat mitigated by the unique nature of its offerings. Alternative leisure activities, including the rapidly evolving virtual reality (VR) and augmented reality (AR) entertainment sectors, pose a potential challenge. For instance, the global VR market was projected to reach over $22 billion in 2023 and is expected to continue its growth trajectory, offering immersive experiences that can be enjoyed from home.

However, Emaar's physical attractions often provide a tangible, social, and experiential dimension that virtual alternatives struggle to replicate entirely. While a significant portion of the global population engages with digital entertainment, the appeal of large-scale, real-world attractions remains strong, particularly in tourism-driven economies like Dubai. Emaar's strategy often involves creating integrated destinations that offer a diverse range of activities beyond just entertainment, such as retail, dining, and hospitality, which further differentiates them from simpler substitute options.

- Virtual Reality and Gaming: The increasing sophistication and accessibility of VR and gaming technologies offer at-home entertainment alternatives that can divert consumer spending and time.

- Alternative Tourism Destinations: Other cities and countries are continuously developing their own unique leisure and entertainment attractions, potentially drawing tourists away from Dubai and Emaar's offerings.

- Local Entertainment Options: In addition to global trends, local entertainment venues and activities within Dubai or other markets where Emaar operates can also serve as substitutes, albeit often on a smaller scale.

- Changing Consumer Preferences: A shift towards more experience-based spending could favor Emaar's physical attractions, but evolving preferences for convenience and digital engagement necessitate continuous innovation.

Relocation to other global cities

High-net-worth individuals and businesses may consider relocating to other global cities offering comparable or superior investment prospects or lifestyle amenities, rather than investing in Dubai. This presents a potential substitute for Emaar's real estate developments.

However, Dubai's established appeal, including its tax-free environment and strategic global positioning, significantly mitigates this threat. For instance, Dubai consistently ranks high in global surveys for quality of life and business friendliness, attracting significant foreign direct investment. In 2023, Dubai recorded AED 30 billion in FDI, a substantial increase from previous years, underscoring its continued attractiveness.

- Dubai's tax-free environment remains a strong deterrent to relocation for many investors.

- The city's strategic geographic location facilitates international business and travel.

- In 2023, Dubai's economy grew by an estimated 3.1%, showcasing its resilience and appeal.

The threat of substitutes for Emaar Properties is multifaceted, encompassing financial assets, alternative real estate markets, and even renting versus owning. While stocks and bonds offer different risk-return profiles, and other global cities present competing property markets, Dubai's unique advantages, including its tax-free environment and strategic location, help Emaar retain its appeal. For instance, Dubai's continued strong FDI in 2023, reaching AED 30 billion, highlights its resilience against relocation threats.

| Substitute Category | Emaar's Offering | Key Differentiating Factors | 2024 Market Trend/Data Point |

|---|---|---|---|

| Financial Assets (Stocks, Bonds) | Real Estate Development & Sales | Tangible asset, potential for capital appreciation, lifestyle benefits | Global equity markets showed robust performance in Q1 2024, potentially diverting investment. |

| Alternative Real Estate Markets | Dubai-based Properties | Dubai's tax-free environment, lifestyle amenities, strategic location | Dubai's economy grew by an estimated 3.1% in 2023, indicating continued attractiveness. |

| Renting vs. Owning | Property Ownership | Long-term investment, asset building, stability | Growing desire among Dubai expatriates to transition from renting to homeownership in 2024. |

| Alternative Leisure/Entertainment | Integrated Destinations (Malls, Theme Parks) | Tangible, social, experiential aspects; integrated retail, dining, hospitality | Global VR market projected to exceed $22 billion in 2023, offering immersive at-home alternatives. |

Entrants Threaten

Entering the large-scale real estate development market, particularly for projects of Emaar's caliber, demands immense capital. This includes significant outlays for prime land acquisition, construction, and essential infrastructure development. For instance, in 2024, prime land in Dubai continued to command premium prices, with some areas seeing per-square-foot costs in the hundreds of dollars, making initial investment a formidable hurdle.

Emaar Properties benefits significantly from its established brand reputation and deep customer loyalty, a formidable barrier against new entrants. Years of delivering iconic, high-quality developments, such as the Burj Khalifa and Dubai Mall, have cemented Emaar's image as a trusted and aspirational developer. In 2023, Emaar reported revenues of AED 27.3 billion, underscoring its market dominance and the financial strength backing its brand.

New developers entering Dubai's real estate market face considerable regulatory hurdles. Obtaining necessary permits and approvals from entities like the Dubai Land Department requires navigating a complex and often lengthy process. Emaar Properties, with its established history and deep-rooted relationships, has a distinct advantage in streamlining these procedures, a barrier that can significantly deter newcomers.

Access to skilled labor and supply chains

New developers entering the real estate market, especially in regions like Dubai where Emaar operates, can find it challenging to secure a consistent supply of skilled labor and specialized contractors. This is crucial for maintaining project timelines and quality standards. Emaar, having been in the market for years, has cultivated strong relationships with these essential resources.

The complexity of modern construction projects demands highly specialized skills, from advanced engineering to intricate finishing work. New entrants may struggle to attract and retain this talent, potentially leading to project delays and increased costs. Emaar's established reputation and ongoing projects ensure a steady demand for these professionals.

Furthermore, access to reliable and cost-effective supply chains for materials is another significant barrier. Emaar has likely negotiated favorable terms and built robust logistics networks over time, giving it an advantage over newcomers who might face higher procurement costs and potential disruptions. For instance, in 2023, global supply chain volatility continued to impact construction material prices, a challenge Emaar's established relationships would help mitigate.

- Skilled Labor Shortages: New developers may struggle to attract experienced construction workers and specialized tradespeople, impacting project execution.

- Contractor Access: Securing reliable and high-quality subcontractors for various project phases can be difficult for emerging firms.

- Supply Chain Dependencies: Disruptions or higher costs in sourcing construction materials can significantly hinder new entrants.

- Emaar's Advantage: Emaar Properties benefits from established networks and long-term relationships with labor and suppliers, providing a competitive edge.

Market saturation in specific segments

While the overall Dubai real estate market shows robust growth, specific segments can face temporary saturation. This occurs when a high volume of new projects are launched simultaneously, leading to an oversupply in certain property types or locations.

New entrants into these saturated segments would need to identify and target underserved niches within the market. Alternatively, they must be prepared for intense competition and potentially lower profit margins if they choose to enter already crowded areas.

- Market Saturation: Certain Dubai real estate segments, particularly high-demand residential areas, can experience oversupply due to concentrated project development.

- Competitive Landscape: New developers entering saturated segments face intense competition from established players and other new entrants, requiring significant differentiation.

- Niche Opportunities: Identifying and catering to specialized market needs, such as affordable housing or unique luxury concepts, can provide avenues for new entrants despite overall saturation.

- Impact on Returns: In saturated markets, new entrants may face pressure on pricing and sales velocity, potentially impacting initial return on investment.

The threat of new entrants for Emaar Properties is generally low due to substantial capital requirements, regulatory complexities, and established brand loyalty. Significant investments are needed for land acquisition and construction, with prime Dubai land prices in 2024 remaining a major barrier. Emaar's strong brand, evidenced by its 2023 revenue of AED 27.3 billion, and its streamlined navigation of Dubai's regulatory landscape, further deter new players.

| Barrier Type | Description | Emaar's Advantage |

|---|---|---|

| Capital Requirements | High cost of land and construction. | Established financial strength and access to capital. |

| Brand Loyalty & Reputation | Customer trust built over years of iconic projects. | Strong market recognition and aspirational brand image. |

| Regulatory Hurdles | Complex permitting and approval processes in Dubai. | Experience and established relationships with authorities. |

| Access to Resources | Securing skilled labor and reliable supply chains. | Long-standing relationships with contractors and suppliers. |

Porter's Five Forces Analysis Data Sources

Our Emaar Properties Porter's Five Forces analysis is built upon a foundation of verified data, including Emaar's annual reports, industry-specific market research from firms like Knight Frank, and publicly available regulatory filings. We also incorporate macroeconomic data to understand broader market influences.