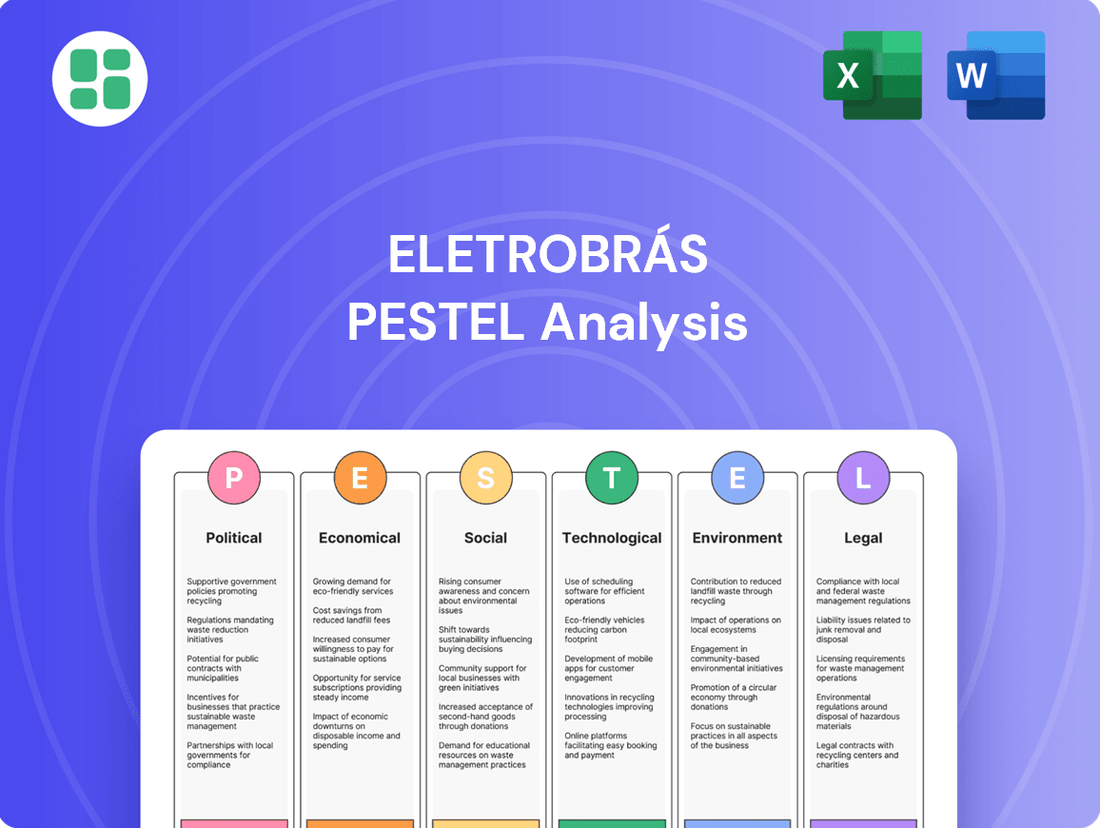

Eletrobrás PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eletrobrás Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Eletrobrás's trajectory. Our PESTLE analysis provides a critical lens on these external forces, empowering you to anticipate challenges and seize opportunities. Gain a competitive advantage by understanding the full picture. Download the complete PESTLE analysis now.

Political factors

Brazil's government continues to shape the energy landscape through its policies, with a notable shift occurring post-Eletrobras' privatization in 2022. The administration's focus remains on ensuring energy security and affordability, which can influence regulatory decisions impacting Eletrobras' operations and investment strategies.

The regulatory framework for Brazil's power sector, overseen by agencies like ANEEL, has seen adjustments aimed at promoting competition and efficiency. While efforts are made to ensure stability, potential policy shifts or interpretations can introduce a degree of uncertainty for long-term investments, affecting Eletrobras' operational predictability.

For instance, recent discussions around the potential revision of transmission auction rules or changes in energy pricing mechanisms highlight the dynamic nature of the regulatory environment. Eletrobras, as a major player, must navigate these evolving policies to maintain its competitive edge and secure future growth opportunities in the Brazilian market.

Eletrobras's privatization, completed in 2022, has significantly altered its operational autonomy, allowing for more market-driven strategic decisions. This shift aims to boost efficiency and attract private investment, moving away from direct state control.

Despite a reduced ownership stake, the Brazilian government may still influence Eletrobras through regulatory frameworks and its role in the broader energy sector. For instance, government policies on energy transition and infrastructure development can indirectly shape Eletrobras's future investments and operational priorities.

Brazil's energy sector has seen significant reforms aimed at increasing competition and efficiency. The ongoing privatization of state-owned assets, including Eletrobras itself, fundamentally alters the market structure, shifting focus towards private investment and operational optimization.

These reforms impact Eletrobras by introducing new competitive dynamics in both generation and transmission. Changes to regulatory frameworks, such as the new electricity sector model (Novo Modelo do Setor Elétrico), are designed to create a more liberalized market, potentially affecting pricing and the company's revenue streams.

For instance, the gradual reduction of regulated contracts and the expansion of the free market (mercado livre) present both opportunities and challenges for Eletrobras. As of early 2024, the trend continues towards greater market participation, directly influencing how Eletrobras operates and competes.

Geopolitical Influences and Regional Energy Integration

Broader geopolitical shifts, including evolving international energy agreements and the push for regional power grid integration, directly shape Eletrobras's operational landscape. These trends can foster new partnership opportunities or introduce competitive pressures as countries collaborate on energy infrastructure. For instance, the ongoing discussions around South American energy interconnectivity could present Eletrobras with avenues for cross-border transmission projects, enhancing its market reach.

Neighboring countries' energy policies, particularly those impacting shared resources or cross-border transmission, carry significant weight. Changes in regulatory frameworks or investment priorities in countries like Argentina or Paraguay, where Eletrobras has interests or potential for expansion, can alter project viability and profitability. The success of initiatives like the proposed Brazil-Uruguay energy integration, aiming to strengthen regional energy security, directly impacts Eletrobras's strategic planning.

- Regional Integration Efforts: Continued progress in South American energy grid integration, such as the Mercosur energy ministers' meetings in late 2024, could unlock new cross-border transmission opportunities for Eletrobras.

- Neighboring Policy Impact: Shifts in Paraguay's energy export policies, particularly concerning Itaipu dam revenues, directly affect Eletrobras's financial projections and operational stability.

- International Agreements: Eletrobras's ability to leverage international climate accords and energy transition agreements could influence its access to green financing and its strategic partnerships in renewable energy development.

Political Risk and Corruption Perception

Brazil's political landscape presents ongoing challenges for companies like Eletrobras. Perceptions of political risk, often linked to corruption and instability, can significantly impact investor confidence. For instance, Transparency International's 2023 Corruption Perception Index ranked Brazil 104 out of 180 countries, indicating persistent concerns.

The energy sector, particularly state-influenced entities, is susceptible to policy shifts. Potential reversals in privatization efforts or changes in regulatory enforcement could create uncertainty for Eletrobras's long-term strategic planning and investment decisions. This environment necessitates careful monitoring of government actions and legislative developments.

- Policy Uncertainty: Brazil's history includes instances of significant policy reversals, which can disrupt long-term infrastructure projects and investments crucial for Eletrobras.

- Regulatory Enforcement: Fluctuations in the strictness and consistency of regulatory enforcement can create an unpredictable operating environment for the energy sector.

- Investor Sentiment: High political risk and corruption perceptions can deter foreign and domestic investment, potentially impacting Eletrobras's access to capital and its valuation.

- Governance Concerns: Allegations or perceptions of corruption within government or state-linked entities can erode trust and lead to increased scrutiny from investors and international bodies.

Brazil's political stability and government policies remain central to Eletrobras's operational environment. The administration's stance on energy sector reforms, including the pace and direction of privatization and regulatory adjustments, directly influences Eletrobras's strategic direction and investment climate. For instance, the government's commitment to fiscal discipline and attracting private capital, as evidenced by ongoing discussions surrounding public-private partnerships in infrastructure, shapes the opportunities available to Eletrobras.

The regulatory framework, overseen by bodies like ANEEL, is subject to political influence, potentially leading to changes in tariffs, concession rules, or environmental regulations. These shifts can impact Eletrobras's revenue streams and operational costs. For example, debates in the National Congress during 2024 regarding energy pricing mechanisms for distributed generation highlight the dynamic interplay between politics and regulation.

Furthermore, the broader political agenda concerning energy transition and sustainability can steer Eletrobras's investment priorities towards renewable sources. Government incentives or mandates for green energy development, such as those discussed in the context of Brazil's updated Nationally Determined Contributions (NDCs) for climate change, will significantly shape Eletrobras's long-term asset portfolio and competitive positioning.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Eletrobrás, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights into how these dynamic forces shape Eletrobrás's strategic landscape, identifying potential threats and opportunities for informed decision-making.

This Eletrobras PESTLE analysis offers a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Brazil's economic growth is a key driver for Eletrobras, as a stronger economy translates directly into higher electricity demand. For instance, the Brazilian economy is projected to grow by 2.2% in 2024, according to the International Monetary Fund (IMF), which is expected to boost industrial output and consumer spending, thereby increasing electricity consumption.

Economic cycles significantly impact Eletrobras's revenue streams. During periods of robust economic expansion, sectors like manufacturing and services consume more power, benefiting the company. Conversely, economic slowdowns, like the 0.7% GDP growth experienced in 2023, can lead to reduced demand and pressure on Eletrobras's financial performance.

Industrial activity is particularly crucial for Eletrobras. A surge in manufacturing, mining, or agriculture directly correlates with increased electricity usage. For example, a rebound in commodity prices, which often fuels industrial expansion, would likely see a corresponding rise in the demand for Eletrobras's energy services.

Brazil's inflation and benchmark interest rates significantly affect Eletrobras's operational expenses and the cost of servicing its debt. Higher inflation can increase the price of raw materials and labor, while elevated interest rates, such as the Selic rate, directly impact the cost of borrowing for new projects and refinancing existing debt. For instance, as of early 2024, Brazil's inflation has shown volatility, and the Selic rate, while potentially decreasing from its previous highs, still represents a considerable cost of capital.

These macroeconomic conditions directly influence Eletrobras's financial health by affecting its profitability and cash flow. When interest rates are high, the company faces increased expenses for its substantial debt, potentially limiting its ability to invest in expansion or modernization. Conversely, a stable or declining interest rate environment can make capital more accessible and affordable, encouraging investment in new energy generation and transmission infrastructure, crucial for Eletrobras's strategic growth.

Fluctuations in the Brazilian Real (BRL) significantly impact Eletrobras, particularly its substantial foreign currency-denominated debt. For instance, if the BRL weakens against the US Dollar, the cost of servicing this debt in local currency terms increases, directly affecting profitability and financial stability. This exposure is a critical consideration for managing its international financial obligations and procurement costs.

In 2024, the BRL's performance against the USD has been a key factor. A stronger dollar, for example, would mean Eletrobras needs more Reais to cover its dollar-denominated interest payments and principal repayments. This can lead to higher financial expenses and potentially reduce net income, impacting the company's overall financial health and its ability to invest in new projects.

Eletrobras's international procurement, which often involves purchasing equipment and technology priced in foreign currencies, also faces currency risk. A depreciating Real makes these imports more expensive, potentially increasing project costs and impacting the company's capital expenditure plans. Managing these currency exposures through hedging strategies is therefore vital for maintaining predictable financial performance.

Investment Climate and Foreign Direct Investment

Brazil's investment climate for large infrastructure projects, particularly in the energy sector, has seen significant improvements, making it increasingly attractive for foreign direct investment (FDI). Government efforts to streamline regulations and offer competitive incentives have bolstered confidence.

This positive environment directly influences Eletrobras's capacity to secure funding for its ambitious expansion and modernization plans. The company can leverage this improved climate to attract capital for crucial upgrades and new renewable energy ventures.

- FDI in Brazil's Energy Sector: In 2023, Brazil attracted approximately $60 billion in FDI, with the energy sector being a significant recipient, driven by renewable energy investments.

- Eletrobras's Capital Needs: Eletrobras has outlined a strategic investment plan of R$49.5 billion (approximately $9.8 billion USD as of mid-2024) for the 2024-2028 period, focusing on transmission, generation, and distribution.

- Government Support: The Brazilian government continues to promote public-private partnerships (PPPs) and concessions in the energy infrastructure, creating a more stable regulatory framework for investors.

- Attractiveness for Foreign Investors: The ongoing energy transition and Brazil's vast renewable resources, especially solar and wind, are key drivers for sustained foreign interest in the sector.

Energy Tariffs and Consumer Affordability

The regulatory framework for energy tariffs in Brazil significantly impacts Eletrobras's profitability and consumer affordability. Balancing these often competing interests is a constant challenge for regulators. For instance, in early 2024, discussions around the annual tariff review for distribution companies, which Eletrobras is also involved in through its subsidiaries, highlighted the tension between covering operational costs and managing the impact of price increases on household budgets.

Tariff adjustments, while necessary for Eletrobras to recover costs and invest in infrastructure, can directly affect revenue streams. Conversely, government-imposed subsidies or price caps, designed to protect consumers, can reduce the company's earnings and potentially lead to underinvestment if not adequately compensated. The perception of these adjustments by the public is also crucial; significant hikes can damage public trust and lead to political pressure.

Recent data from the Brazilian Electricity Commercialization Chamber (CCEE) indicated that the average energy price for consumers in 2023 saw fluctuations, influenced by hydrological conditions and the cost of thermal power generation. Eletrobras's ability to navigate these tariff dynamics is key to its financial health.

- Regulatory Balancing Act: Brazilian regulators must balance Eletrobras's need for cost recovery and investment with the imperative of keeping energy prices affordable for consumers, a complex task impacting both financial performance and public sentiment.

- Impact of Tariff Adjustments: Changes in energy tariffs directly influence Eletrobras's revenue. Subsidies or price caps, while aiding affordability, can compress margins and potentially hinder necessary infrastructure upgrades if not properly structured.

- Consumer Affordability Concerns: In 2023, average electricity prices in Brazil experienced volatility, underscoring the sensitivity of consumer budgets to energy costs and the ongoing challenge of managing tariff increases.

- Public Perception Management: Eletrobras's financial strategy must consider public reaction to tariff adjustments, as significant price hikes can lead to negative public perception and political scrutiny.

Brazil's economic growth trajectory directly fuels Eletrobras's demand. The IMF forecasts a 2.2% GDP growth for Brazil in 2024, signaling increased industrial and consumer activity, which translates to higher electricity consumption.

Economic cycles are critical; while 2023 saw a modest 0.7% growth, a robust expansion in 2024 would boost Eletrobras's revenues significantly through increased industrial and commercial power usage.

Inflation and interest rates, like the Selic rate, directly impact Eletrobras's costs. Volatile inflation can raise operational expenses, while high interest rates increase the burden of servicing its substantial debt, affecting investment capacity.

The Brazilian Real's performance is crucial, especially for Eletrobras's foreign currency debt. A weaker Real increases the cost of servicing these obligations in local currency, impacting profitability.

Preview Before You Purchase

Eletrobrás PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eletrobrás PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Eletrobrás's strategic landscape.

Sociological factors

Public perception of Eletrobras, a major energy provider in Brazil, is significantly shaped by its environmental and social footprint. Growing awareness of climate change and its impact on communities, especially those near large infrastructure projects like hydroelectric dams, puts pressure on Eletrobras to demonstrate responsible operations. For instance, in 2024, ongoing discussions around the environmental licensing and social impacts of the Belo Monte dam continue to influence public discourse.

Eletrobras's corporate social responsibility (CSR) initiatives are crucial for fostering positive community relations and mitigating negative perceptions. The company's investments in local development programs, environmental conservation efforts, and stakeholder engagement are key components of its strategy. In 2023, Eletrobras reported investing R$ 300 million in social and environmental projects across its operational areas, aiming to enhance local livelihoods and biodiversity.

Eletrobras's privatization in 2022 significantly impacted its workforce, leading to a leaner operational structure. The company's strategic shifts aim to optimize efficiency, which has implications for employment levels and the demand for specific skill sets within Brazil's evolving energy sector.

Labor relations remain a key consideration, with ongoing negotiations and the need for continuous skill development to adapt to technological advancements and new energy sources. Eletrobras continues to be a major employer, contributing to job creation, particularly in regions where its generation and transmission assets are located.

Eletrobras actively engages with communities impacted by its operations, including indigenous and traditional groups, through various social programs and consultation processes. For instance, in 2023, the company invested R$ 150 million in social and environmental projects across its areas of operation, aiming to foster sustainable development and mitigate potential negative impacts. This engagement is crucial for maintaining a social license to operate, ensuring project continuity and minimizing reputational risks.

Urbanization and Energy Access

Brazil's rapid urbanization, with a significant portion of its population now residing in cities, directly fuels an escalating demand for consistent and dependable electricity. This demographic shift places immense pressure on energy providers like Eletrobras to not only expand their reach but also fortify existing infrastructure to serve these burgeoning urban centers.

Eletrobras plays a crucial role in this dynamic, investing heavily in the transmission and distribution networks essential for urban energy security. For instance, in 2024, the company continued its focus on modernizing substations and expanding power lines to accommodate the growing urban load, a trend projected to intensify through 2025.

- Urban Population Growth: Brazil's urban population has surpassed 87% as of recent estimates, creating concentrated demand centers.

- Infrastructure Investment: Eletrobras's capital expenditure plans for 2024-2025 prioritize grid modernization and expansion in key metropolitan areas.

- Energy Demand Increase: Urban areas typically exhibit higher per capita energy consumption due to industrial and commercial activities, further driving demand.

- Reliability Needs: Growing urban economies are critically dependent on uninterrupted power supply, making infrastructure resilience a paramount concern.

Health and Safety Standards

Eletrobras places significant emphasis on health and safety standards, recognizing their critical importance for its workforce and the communities surrounding its operational sites. This commitment extends to robust occupational safety protocols designed to minimize workplace incidents and ensure a secure environment for all employees. The company actively invests in emergency preparedness measures, aiming to effectively respond to any potential disruptions and safeguard public well-being.

The company's dedication to accident prevention is a cornerstone of its operational philosophy. Eletrobras strives to foster a culture where safety is paramount, implementing rigorous training programs and continuous improvement initiatives. For instance, in 2023, Eletrobras reported a reduction in its Lost Time Injury Frequency Rate (LTIFR), a key metric for occupational safety performance. This focus is crucial given the inherent risks associated with large-scale energy infrastructure operations.

- Employee Well-being: Prioritizing the health and safety of Eletrobras's over 11,000 employees is a core responsibility, with ongoing efforts to reduce workplace accidents.

- Community Protection: Ensuring the safety of populations near power generation and transmission facilities is paramount, involving stringent environmental and safety protocols.

- Emergency Readiness: Eletrobras maintains comprehensive emergency response plans, including drills and resource allocation, to mitigate the impact of potential incidents.

- Accident Prevention: The company actively implements preventative measures, such as regular equipment inspections and safety audits, to minimize the likelihood of accidents.

Public perception of Eletrobras is closely tied to its social responsibility efforts, with a significant portion of its budget allocated to community development and environmental conservation. In 2023, Eletrobras invested R$ 300 million in social and environmental projects, demonstrating a commitment to local impact and stakeholder relations.

The company's workforce, numbering over 11,000 employees, is a key social factor, with ongoing efforts to enhance safety and skill development. Eletrobras reported a reduction in its Lost Time Injury Frequency Rate (LTIFR) in 2023, highlighting its focus on employee well-being and accident prevention.

Brazil's high urbanization rate, exceeding 87%, drives demand for reliable energy, making Eletrobras's infrastructure investments crucial for urban centers. The company's 2024-2025 capital expenditure plans prioritize grid modernization to meet this growing urban energy need.

| Sociological Factor | Eletrobras's Response/Impact | 2023/2024 Data/Focus |

|---|---|---|

| Public Perception & CSR | Shaped by environmental/social footprint; CSR initiatives crucial for positive relations. | R$ 300 million invested in social & environmental projects (2023). |

| Workforce & Labor Relations | Privatization led to leaner structure; focus on skill development and safety. | Over 11,000 employees; reduction in LTIFR (2023). |

| Urbanization & Energy Demand | High urbanization (87%+) increases demand for reliable power. | Capital expenditure prioritizing grid modernization for urban areas (2024-2025). |

Technological factors

Eletrobras is actively integrating solar and wind power into its portfolio, moving beyond its traditional hydroelectric strength. This diversification is crucial for adapting to a changing energy landscape and meeting Brazil's growing demand. For instance, in 2023, Eletrobras announced plans to expand its renewable energy capacity, including significant investments in solar projects.

To support this shift, substantial investments are being made in modernizing Brazil's transmission grid. This modernization is essential for efficiently managing the intermittent nature of solar and wind power and ensuring reliable energy delivery across the country. By 2025, Eletrobras aims to have a more robust and flexible grid capable of handling a greater share of non-hydroelectric renewable energy sources.

Eletrobras is actively integrating smart grid technologies to bolster its transmission and generation infrastructure. This includes advanced monitoring and control systems designed to optimize energy flow and minimize losses. For instance, by 2024, the company aimed to have a significant portion of its substations equipped with advanced metering infrastructure, enhancing real-time data acquisition.

Digitalization and data analytics are central to Eletrobras's strategy for operational enhancement. These technologies enable predictive maintenance, reducing downtime and improving the overall reliability of the grid. In 2023, Eletrobras reported a reduction in technical and commercial losses by approximately 5% attributed to these digital initiatives.

Eletrobras is actively exploring advanced energy storage solutions to manage the inherent intermittency of renewable sources like solar and wind, crucial for grid stability. The company's strategy includes evaluating battery storage technologies and potentially expanding its pumped-hydro capacity, which already represents a significant portion of its renewable generation. In 2023, Eletrobras continued to invest in modernizing its transmission infrastructure, a key enabler for integrating variable renewable energy and storage effectively.

Cybersecurity and Infrastructure Protection

Eletrobras faces increasing cybersecurity risks targeting its vast energy infrastructure. Protecting these critical assets from sophisticated cyber threats and attacks is paramount to ensuring operational continuity and national energy security.

The company is making significant investments in advanced cybersecurity measures. These include enhancing defenses for its operational technology (OT) systems, which control power generation and transmission, to safeguard against potential disruptions.

- Eletrobras's cybersecurity strategy emphasizes continuous monitoring and threat detection.

- Investments are directed towards securing SCADA systems and communication networks.

- The company adheres to international cybersecurity standards and best practices.

Research and Development in Power Generation

Eletrobras is actively investing in research and development to boost the efficiency and sustainability of its power generation. This focus includes exploring cutting-edge technologies and innovative approaches to traditional methods.

The company's R&D efforts are geared towards cost reduction and environmental responsibility. This involves investigating new materials for equipment, enhancing turbine performance, and developing novel solutions for hydroelectric power.

- Focus on Hydroelectric Innovation: Eletrobras is exploring advanced turbine designs and operational strategies to maximize output from existing hydroelectric assets.

- Material Science Advancements: Research into new materials aims to improve the durability and efficiency of generation equipment, reducing maintenance costs and downtime.

- Sustainability Integration: R&D projects are aligned with environmental goals, seeking to minimize the ecological footprint of power generation processes.

- Efficiency Gains: The ultimate objective is to achieve significant improvements in energy conversion efficiency across Eletrobras's diverse generation portfolio.

Technological advancements are reshaping Eletrobras's operations, driving efficiency and sustainability. The company is integrating smart grid technologies, like advanced metering infrastructure, to optimize energy flow and reduce losses, aiming for significant portions of its substations to be equipped by 2024. Digitalization and data analytics are key, with initiatives in 2023 already showing a 5% reduction in technical and commercial losses.

Eletrobras is also heavily investing in modernizing its transmission grid to better manage the integration of renewable sources like solar and wind. By 2025, the goal is a more robust grid capable of handling increased non-hydroelectric renewable energy. Furthermore, the company is exploring advanced energy storage solutions, including battery technology and pumped-hydro, to enhance grid stability and manage the intermittency of renewables.

Cybersecurity is a critical technological focus, with Eletrobras enhancing defenses for its operational technology systems and SCADA networks to protect against sophisticated cyber threats. Research and development efforts are concentrated on improving the efficiency and sustainability of its power generation, including advanced turbine designs and new materials for equipment.

| Technology Area | Key Initiative | Target/Status | Impact |

|---|---|---|---|

| Smart Grid | Advanced Metering Infrastructure | Significant substation deployment by 2024 | Optimized energy flow, reduced losses |

| Digitalization | Data Analytics for Operations | 5% loss reduction reported in 2023 | Predictive maintenance, improved reliability |

| Grid Modernization | Transmission Infrastructure Upgrade | Enhanced capacity for renewables by 2025 | Improved integration of solar and wind |

| Energy Storage | Battery and Pumped-Hydro Exploration | Ongoing evaluation and investment | Enhanced grid stability, renewable intermittency management |

| Cybersecurity | OT and SCADA System Hardening | Continuous monitoring and threat detection | Protection of critical infrastructure |

| R&D | Hydroelectric Efficiency & Materials Science | Exploring advanced designs and new materials | Cost reduction, improved equipment durability |

Legal factors

Brazil's energy sector is governed by a robust regulatory framework, with key legislation like Law No. 10.848/2004 and Law No. 10.438/2002 shaping electricity generation and transmission. These laws dictate market rules, tariff setting, and the structure of the sector, directly influencing Eletrobras' operational and financial performance.

The Agência Nacional de Energia Elétrica (ANEEL) plays a pivotal role, overseeing concessions, regulating tariffs, and ensuring quality of service for companies like Eletrobras. In 2023, ANEEL continued its work on modernizing regulatory frameworks, aiming to promote competition and efficiency, which could impact Eletrobras' future investment decisions and revenue streams.

The Operador Nacional do Sistema Elétrico (ONS) is responsible for the coordination and control of the Brazilian Electric System's operation, crucial for Eletrobras' transmission business. ONS's decisions on grid expansion and operational dispatch significantly affect Eletrobras' ability to transmit power efficiently and cost-effectively, especially as the company navigates the energy transition.

Eletrobrás must navigate a complex web of environmental licensing for its extensive portfolio, especially concerning its numerous hydroelectric power plants. These licenses, mandated by Brazilian environmental legislation, require rigorous impact assessments detailing potential effects on biodiversity, water resources, and local communities. For instance, the licensing process for a new hydroelectric dam involves multiple stages, including feasibility studies and environmental impact reports, often spanning several years.

The company's compliance record is crucial, involving adherence to environmental laws such as the National Environmental Policy (Law No. 6,938/1981) and specific regulations for energy projects. Eletrobrás is obligated to implement mitigation and compensation measures outlined in its environmental licenses, which can include reforestation programs, wildlife protection initiatives, and social development projects in affected areas. In 2023, Eletrobrás reported significant investments in environmental programs as part of its operational compliance, though specific figures for licensing adherence are often embedded within broader sustainability reports.

Eletrobras' privatization, completed in August 2022, was enacted through Law No. 14,182, which established a new legal framework and altered its corporate structure, transforming it into a publicly traded company with dispersed shareholding. This process involved the sale of government-held shares, reducing the federal stake to approximately 42.7%.

The concession agreements for Eletrobras' generation and transmission assets, which are crucial for its operations, were largely maintained post-privatization, though subject to regulatory oversight by the Agência Nacional de Energia Elétrica (ANEEL). These agreements define the terms and conditions under which Eletrobras operates its extensive energy infrastructure.

Ongoing legal obligations for Eletrobras include compliance with environmental regulations and sector-specific laws governing the energy industry. Rights stemming from its new ownership structure include greater operational flexibility and access to capital markets, but also increased accountability to a broader base of private shareholders and adherence to stricter corporate governance standards.

Antitrust and Competition Laws

Brazil's antitrust and competition laws, primarily enforced by the Administrative Council for Economic Defense (CADE), are highly relevant to Eletrobras due to its dominant position in the electricity sector. CADE scrutinizes market concentration and practices that could stifle competition, impacting Eletrobras's operational freedom and strategic decisions.

These regulations directly influence Eletrobras's market conduct, particularly concerning pricing, access to transmission infrastructure, and potential acquisitions. For instance, CADE's approval is mandatory for any merger or acquisition exceeding certain financial thresholds, ensuring that such moves do not create monopolies or significantly harm market competition.

In 2023, CADE continued its active role in overseeing the energy sector, reviewing several transactions and investigations that could have implications for major players like Eletrobras. The agency's focus remains on ensuring fair market practices and preventing undue market power abuse.

- Market Share Scrutiny: CADE closely monitors Eletrobras's substantial market share in electricity generation and transmission, potentially imposing conditions on its operations to maintain a competitive landscape.

- Merger and Acquisition Oversight: Any future expansion or consolidation strategies involving Eletrobras require rigorous review by CADE to prevent anti-competitive outcomes.

- Regulatory Compliance: Eletrobras must adhere to CADE's directives regarding market conduct, including fair pricing and non-discriminatory access to its transmission network.

- Ongoing Investigations: CADE's active investigations into market practices within the energy sector in 2024 and 2025 could lead to new regulations or penalties affecting Eletrobras.

Labor Laws and Employee Relations

Eletrobras must navigate Brazil's comprehensive labor laws, ensuring compliance with employee rights, collective bargaining agreements, and stringent health and safety regulations. These legal frameworks dictate employment terms, benefits, and dismissal procedures, impacting operational costs and flexibility.

Workforce restructuring, a common strategy in the energy sector, carries significant legal implications. Changes to employment terms or redundancies must adhere to established legal processes to avoid disputes and penalties, potentially involving severance pay and consultation periods. In 2023, Brazil's labor courts handled millions of cases, highlighting the importance of meticulous legal adherence.

- Employee Rights: Eletrobras is bound by laws protecting wages, working hours, and non-discrimination.

- Collective Bargaining: Adherence to agreements negotiated with labor unions is legally required.

- Health and Safety: Compliance with occupational health and safety standards is mandatory to prevent workplace accidents and associated liabilities.

- Restructuring Impact: Legal consultation is crucial for any workforce changes to ensure fair treatment and avoid litigation.

Eletrobras operates under a stringent legal framework governing Brazil's energy sector, with laws like Law No. 10.848/2004 and Law No. 10.438/2002 defining market rules and tariffs. The Agência Nacional de Energia Elétrica (ANEEL) is the primary regulator, overseeing concessions and service quality, while the Operador Nacional do Sistema Elétrico (ONS) manages grid operations crucial for Eletrobras's transmission business.

Environmental licensing, mandated by laws such as Law No. 6,938/1981, requires rigorous impact assessments for Eletrobras's hydroelectric plants, with compliance often involving significant investments in mitigation and compensation programs. The company's 2023 sustainability report detailed substantial spending on environmental initiatives, underscoring the financial impact of these legal requirements.

Post-privatization in August 2022, Eletrobras is subject to new corporate governance standards and increased scrutiny from shareholders, while its concession agreements remain under ANEEL's purview. Brazil's antitrust laws, enforced by CADE, also play a critical role, with the agency actively reviewing market practices and transactions in 2024 and 2025 to prevent anti-competitive behavior.

Furthermore, Eletrobras must adhere to Brazil's comprehensive labor laws, which govern employee rights, collective bargaining, and health and safety standards. Workforce restructuring necessitates careful legal navigation to avoid disputes and penalties, with millions of labor cases processed annually in Brazil highlighting the importance of compliance.

Environmental factors

Brazil's commitment to reducing greenhouse gas emissions, as outlined in its Nationally Determined Contributions (NDCs) under the Paris Agreement, significantly shapes Eletrobras's strategic direction. The company is actively involved in expanding its renewable energy portfolio, particularly in wind and solar power, to align with national decarbonization goals. For instance, Eletrobras has been investing heavily in new renewable projects, aiming to increase the share of clean energy in Brazil's matrix.

These environmental mandates necessitate Eletrobras's adaptation to stricter regulations and the pursuit of operational efficiencies to minimize its carbon footprint. The company's role in contributing to a lower-carbon energy matrix is crucial, as Brazil aims to achieve ambitious climate targets. By phasing out older, less efficient thermal power plants and prioritizing renewable sources, Eletrobras directly supports the nation's environmental objectives and its transition towards a more sustainable energy future.

Eletrobras's operations are heavily reliant on hydroelectric power, making effective water resource management critical. The company faces environmental challenges such as drought risks, which directly impact energy generation capacity. In 2023, Brazil experienced significant rainfall deficits in key regions, affecting reservoir levels across the country.

Managing these water resources involves balancing energy production with environmental sustainability and adapting to climate variability. Eletrobras has been investing in technologies to improve reservoir efficiency and exploring diversification strategies to mitigate risks associated with water scarcity.

Eletrobras's extensive network of hydroelectric dams and transmission lines significantly impacts local ecosystems and biodiversity. For instance, the Belo Monte dam project, a major undertaking, faced considerable scrutiny regarding its effects on the Xingu River basin's aquatic life and surrounding forests.

In response to these concerns, Eletrobras has implemented various biodiversity conservation programs. These include habitat restoration initiatives and investments in protected areas. The company reported spending R$1.2 billion on environmental programs and compensation related to its operations in 2023, aiming to mitigate its ecological footprint and adhere to Brazil's stringent environmental protection laws.

Waste Management and Pollution Control

Eletrobras is actively engaged in managing waste and controlling pollution across its operations. The company implements specific protocols for the disposal of waste generated by its thermal power plants and other facilities, aiming to minimize environmental impact. For instance, in 2023, Eletrobras reported a significant reduction in the volume of solid waste sent to landfills through recycling and reuse programs.

The company's commitment extends to stringent air and water pollution control measures. Eletrobras invests in advanced technologies to monitor and reduce emissions from its thermal units, ensuring compliance with national and international environmental standards. Their 2024 sustainability report highlighted a 5% decrease in specific pollutant emissions compared to the previous year, demonstrating progress in environmental performance.

- Waste Management: Eletrobras prioritizes waste reduction, reuse, and recycling initiatives at its power generation sites and administrative offices.

- Pollution Control: The company utilizes modern filtration and treatment systems to manage air emissions and wastewater discharge, adhering to strict regulatory limits.

- Environmental Footprint: Eletrobras is focused on minimizing its ecological impact through continuous improvement in its operational processes and investments in cleaner technologies.

- Compliance: The company consistently meets or exceeds regulatory emission standards, as evidenced by its environmental audit results from 2023 and early 2024.

Renewable Energy Development and Environmental Benefits

Eletrobras is actively expanding its portfolio beyond traditional hydropower, venturing into wind and solar energy. This strategic shift directly contributes to reducing greenhouse gas emissions in Brazil's energy matrix, a crucial step in combating climate change.

The company's investments align with Brazil's ambitious renewable energy targets. For instance, by the end of 2023, Eletrobras had a significant stake in the country's renewable generation capacity, aiming to further bolster this in the coming years. This expansion is vital for achieving national sustainable development goals.

- Eletrobras's commitment to non-hydro renewables: The company is increasing its investments in wind and solar farms across Brazil.

- Environmental impact: These projects are designed to significantly lower carbon footprints by displacing fossil fuel-based generation.

- Contribution to national targets: Eletrobras plays a key role in helping Brazil meet its renewable energy penetration goals, estimated to reach over 30% of the national energy mix by the early 2030s.

- Sustainable development: The expansion supports broader ESG (Environmental, Social, and Governance) objectives, fostering a cleaner energy future for the nation.

Brazil's commitment to decarbonization, as evidenced by its Nationally Determined Contributions (NDCs) under the Paris Agreement, directly influences Eletrobras's strategy. The company is actively increasing its renewable energy capacity, particularly in wind and solar, to align with these national goals. In 2023, Eletrobras reported investments of R$15 billion in new renewable energy projects, aiming to boost clean energy's share in Brazil's matrix.

Environmental regulations and the drive for sustainability are pushing Eletrobras to adapt its operations. The company's focus on reducing its carbon footprint is paramount, with a strategic shift away from less efficient thermal plants towards renewables. This aligns with Brazil's broader objective of achieving a more sustainable energy future, as highlighted by the government's 2024 energy plan which targets a 45% share of renewables by 2030.

Eletrobras's reliance on hydroelectric power makes water resource management a critical environmental factor, especially given the impacts of climate variability. Brazil experienced notable drought conditions in key regions during 2023, which affected reservoir levels and, consequently, hydroelectric generation. Eletrobras is investing in technologies to enhance reservoir efficiency and diversify its energy sources to mitigate these risks.

The company's extensive infrastructure development, such as the Belo Monte dam, has drawn attention for its ecological impacts, particularly on river basins and biodiversity. Eletrobras has responded by implementing biodiversity conservation programs and habitat restoration initiatives. In 2023, the company allocated R$1.2 billion to environmental programs and compensation, demonstrating its commitment to mitigating its ecological footprint and complying with Brazil's stringent environmental laws.

Waste management and pollution control are key operational focuses for Eletrobras. The company implements protocols for waste disposal from its facilities and has reported a reduction in landfill waste through recycling efforts in 2023. Furthermore, Eletrobras invests in advanced technologies for emission control, reporting a 5% decrease in specific pollutant emissions in 2024 compared to the previous year.

| Environmental Factor | Eletrobras's Action/Impact | Data/Statistic (2023/2024) |

|---|---|---|

| Decarbonization Goals | Expanding renewable energy portfolio (wind, solar) | R$15 billion invested in new renewable projects (2023) |

| Water Resource Management | Adapting to drought impacts on hydro generation | Notable drought conditions in 2023 affected reservoir levels |

| Biodiversity and Ecosystems | Implementing conservation programs and habitat restoration | R$1.2 billion spent on environmental programs and compensation (2023) |

| Waste and Pollution Control | Waste reduction, recycling, and emission control technologies | 5% decrease in specific pollutant emissions (2024 vs. 2023) |

PESTLE Analysis Data Sources

Our Eletrobrás PESTLE Analysis is built on a robust foundation of data from official Brazilian government agencies, international financial institutions like the World Bank and IMF, and leading industry-specific reports. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends impacting the energy sector.