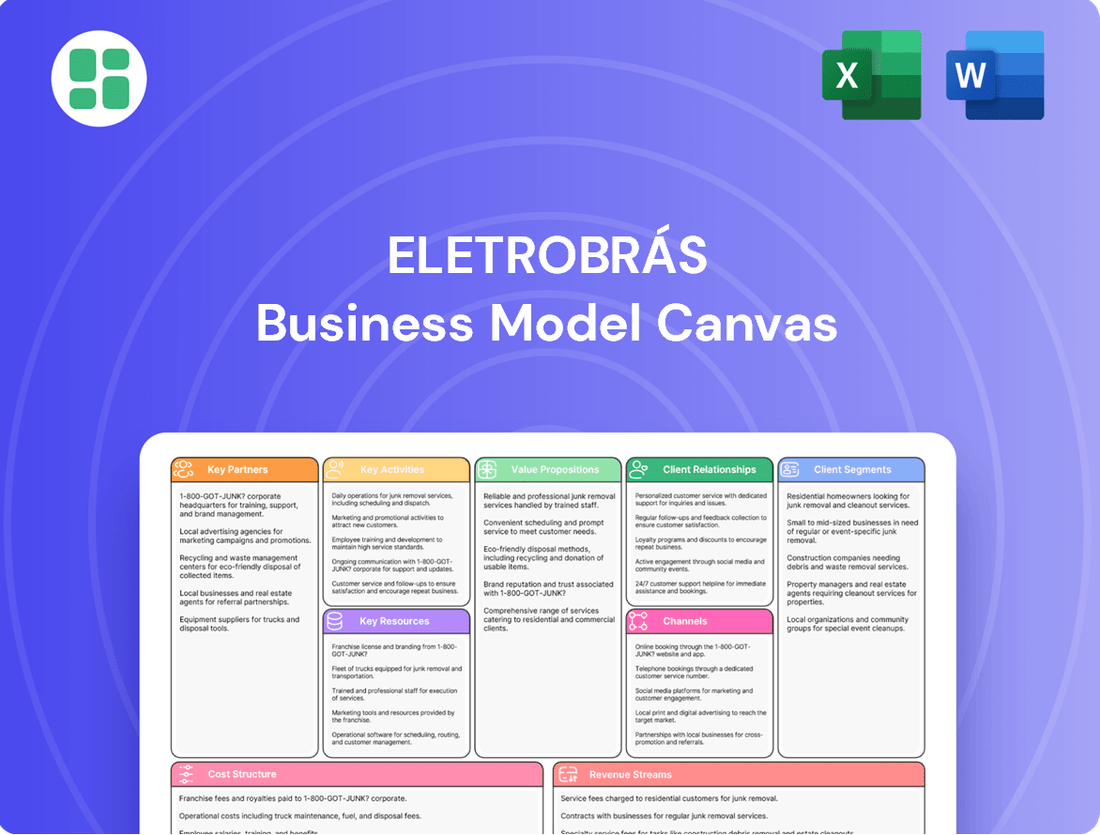

Eletrobrás Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eletrobrás Bundle

Unlock the strategic blueprint behind Eletrobrás's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down how the energy giant creates and delivers value, identifies key customer segments, and manages its cost structure. Discover the core components driving Eletrobrás's success and gain actionable insights for your own business ventures.

Partnerships

Eletrobrás's operations are deeply intertwined with regulatory bodies like ANEEL, the National Electric Energy Agency, and the Ministry of Mines and Energy. These partnerships are vital for navigating the complex legal and policy landscape governing Brazil's energy sector, ensuring Eletrobrás adheres to national directives and maintains its operational licenses. In 2023, Eletrobrás continued to engage with these agencies on evolving regulations impacting renewable energy integration and transmission expansion.

Eletrobrás collaborates with Independent Power Producers (IPPs) to integrate their generation into the national grid, facilitating energy trading and potentially co-investing in new renewable projects. This synergy helps optimize Brazil's energy resources and diversifies the national power mix. For instance, in 2024, Eletrobrás continued to manage a significant portion of Brazil's transmission network, enabling the flow of power from numerous IPPs, including those in solar and wind, thereby contributing to the country's energy security and the transition to cleaner sources.

Eletrobrás maintains crucial alliances with global and local manufacturers for essential equipment like turbines, transformers, and transmission line components. These partnerships are vital for sourcing, maintaining, and modernizing its extensive operational network.

Access to advanced grid technology from these providers is paramount for enhancing operational efficiency, ensuring system reliability, and adapting to evolving energy needs. For instance, Eletrobrás's 2024 initiatives include exploring AI and machine learning for predictive equipment maintenance, underscoring the importance of technology provider collaborations.

Engineering, Procurement, and Construction (EPC) Firms

Eletrobrás relies on Engineering, Procurement, and Construction (EPC) firms for executing its large-scale infrastructure projects, such as building new power plants and expanding transmission networks. These collaborations are crucial for ensuring projects are completed on time, within budget, and to high quality and safety specifications.

- Project Execution: EPC partners are vital for the successful development of Eletrobrás's complex energy infrastructure.

- Expertise and Capacity: Their specialized skills and resources are essential for managing intricate construction and engineering challenges.

- Transmission Projects: Eletrobrás has numerous transmission projects in progress, underscoring the ongoing importance of these EPC relationships.

Financial Institutions and Investors

Eletrobrás’s capital-intensive operations necessitate strong ties with financial institutions and investors. These relationships are foundational for securing the substantial funding required for large-scale expansion projects and ongoing operational needs. In 2024, Eletrobrás continued to leverage its access to capital markets, with significant debt refinancing activities aimed at optimizing its financial structure.

Post-privatization, attracting diverse investment capital remains a priority. Partnerships with investment funds and other financial entities are key to this strategy, providing the necessary capital for growth initiatives and enhancing shareholder value. The company’s ability to manage its debt effectively, evidenced by its strategic debt management practices, underscores the importance of these financial partnerships for long-term stability and expansion.

- Financing Expansion: Securing capital for major projects like new generation facilities and transmission infrastructure upgrades.

- Debt Management: Optimizing the company's debt profile through refinancing and strategic borrowing.

- Investment Attraction: Drawing in both domestic and international investors to support growth post-privatization.

- Financial Stability: Ensuring robust financial backing for sustained operations and future development.

Eletrobrás's key partnerships are crucial for its operational success and strategic growth, spanning regulatory bodies, independent power producers, equipment suppliers, construction firms, and financial institutions. These alliances enable the company to navigate complex regulations, integrate diverse energy sources, maintain its vast infrastructure, execute large-scale projects, and secure vital funding.

| Partner Type | Role in Eletrobrás's Business Model | Example of Collaboration/Impact (2023-2024) |

|---|---|---|

| Regulatory Bodies (ANEEL, MME) | Ensuring compliance, licensing, and navigating policy landscape. | Engaged in discussions on evolving renewable energy integration and transmission expansion regulations in 2023. |

| Independent Power Producers (IPPs) | Integrating generated power into the grid, energy trading. | Facilitated power flow from numerous solar and wind IPPs in 2024, supporting energy security and clean energy transition. |

| Equipment Manufacturers | Sourcing, maintaining, and modernizing turbines, transformers, etc. | Exploring AI for predictive maintenance in 2024, highlighting reliance on tech provider collaborations. |

| EPC Firms | Executing large-scale infrastructure projects (power plants, transmission). | Essential for timely and quality completion of numerous ongoing transmission projects. |

| Financial Institutions & Investors | Securing funding for expansion, debt refinancing, attracting capital. | Leveraged capital markets for significant debt refinancing in 2024, optimizing financial structure. |

What is included in the product

This Eletrobrás Business Model Canvas outlines its strategy for electricity generation, transmission, and distribution, focusing on key customer segments like residential and industrial users and leveraging its extensive infrastructure as a core value proposition.

The Eletrobrás Business Model Canvas offers a clear, structured approach to identifying and addressing operational inefficiencies, acting as a pain point reliever by simplifying complex processes.

It provides a visual roadmap for strategic adjustments, helping to alleviate pain points by highlighting areas for optimization within Eletrobrás's operations.

Activities

Eletrobrás's primary activity is the operation and maintenance of its extensive power generation assets. This includes managing a varied fleet comprising large hydroelectric dams, thermal power plants, and a growing number of wind farms across Brazil. The company's expertise lies in optimizing these diverse energy sources to ensure reliable supply.

Key to this operation is the meticulous management of resources, such as water levels for its substantial hydroelectric capacity, fuel sourcing for thermal generation, and maximizing the output from its expanding renewable energy portfolio. This operational efficiency is crucial for Eletrobrás's position as a major player in Brazil's energy landscape.

As of early 2024, Eletrobrás boasts an impressive installed capacity exceeding 44,000 MW, underscoring the scale and significance of its electricity generation activities. This vast capacity allows the company to meet a substantial portion of Brazil's energy demand.

Eletrobrás's key activities center on managing and expanding its vast electricity transmission network, a critical component of its operations. This involves the meticulous monitoring of grid stability to prevent disruptions and the proactive execution of maintenance to ensure the longevity and efficiency of its infrastructure. In 2024, Eletrobrás continued to operate and maintain its extensive transmission system, which spans over 74,000 kilometers of high-voltage lines, ensuring the reliable delivery of electricity across Brazil.

Eletrobrás's key activities extend beyond simply generating and transmitting electricity; a significant focus is placed on the diligent operation and maintenance of its extensive asset base. This ensures the consistent and dependable delivery of power to millions.

These operations involve a comprehensive strategy of preventative maintenance, rapid emergency repairs, and the strategic implementation of technology upgrades across its diverse portfolio of power generation facilities and vast transmission network. For instance, in 2023, Eletrobrás reported a significant improvement in operational efficiency, with its hydroelectric plants achieving an average availability factor of 95.2%, a testament to its robust maintenance programs.

By prioritizing proactive maintenance, Eletrobrás effectively minimizes costly downtime and maximizes the performance of its infrastructure. This commitment directly contributes to maintaining high availability rates, a critical factor for grid stability and customer satisfaction.

Energy Trading and Portfolio Management

Eletrobrás actively participates in the wholesale electricity market, buying and selling power to balance its diverse generation sources. This strategic activity is crucial for optimizing its portfolio, managing the inherent variability of renewable energy like hydro and solar, and ensuring a stable supply to meet demand.

The company employs sophisticated trading strategies, including forward contracts and options, to hedge against significant price swings in the energy market. For instance, in 2024, Eletrobrás continued to refine its risk management framework, aiming to lock in favorable prices for a portion of its future generation capacity.

Meeting contractual obligations with distributors and large consumers is paramount. Eletrobrás's trading desk works to ensure that supply commitments are met, even amidst unexpected generation shortfalls or demand surges, thereby maintaining market credibility and operational efficiency.

Key aspects of Eletrobrás's energy trading and portfolio management in 2024 include:

- Active participation in Brazil's National Electric Energy Commercialization Chamber (CCEE).

- Hedging strategies to mitigate exposure to spot price volatility.

- Optimization of dispatch from its hydro, thermal, and renewable generation assets.

- Ensuring compliance with regulatory frameworks governing energy trading.

Research and Development (R&D)

Eletrobrás's Research and Development (R&D) is a cornerstone for its future. The company is heavily invested in advancing renewable energy technologies, recognizing their growing importance in the global energy transition. This focus is essential for maintaining a competitive edge and adapting to the dynamic energy market.

A significant part of Eletrobrás's R&D efforts is directed towards modernizing its existing grid infrastructure. This includes implementing smart grid technologies to improve reliability, efficiency, and the integration of distributed energy resources. Such investments are critical for ensuring the stability and resilience of the power supply.

Operational efficiency improvements are also a key R&D activity. Eletrobrás is exploring innovative solutions to reduce costs, optimize resource utilization, and minimize environmental impact across its operations. This commitment to efficiency underpins its drive for sustainable practices.

Looking ahead, Eletrobrás is actively preparing for future energy challenges and opportunities, including the burgeoning field of renewable hydrogen production. This forward-thinking approach ensures the company remains at the forefront of energy innovation.

- Focus on Renewables: Eletrobrás is investing in R&D for solar, wind, and other renewable energy sources to expand its clean energy portfolio.

- Grid Modernization: Efforts include smart grid technologies, digitalization, and advanced metering infrastructure to enhance grid performance.

- Operational Efficiency: R&D aims to optimize plant operations, reduce energy losses, and improve maintenance strategies.

- Future Technologies: Exploration into areas like green hydrogen production and energy storage solutions is a key strategic R&D pillar.

Eletrobrás's key activities are centered on the operation and maintenance of its vast electricity generation and transmission infrastructure. This involves optimizing its diverse energy sources, including hydroelectric, thermal, and wind power, to ensure a reliable energy supply across Brazil. The company also actively participates in the wholesale electricity market, employing sophisticated trading strategies to manage its portfolio and meet contractual obligations.

Further key activities include significant investment in Research and Development (R&D) to advance renewable energy technologies, modernize its grid infrastructure with smart technologies, and improve operational efficiency. Eletrobrás is also exploring future energy solutions like green hydrogen production.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Generation & Transmission Operation | Managing and maintaining a diverse portfolio of power generation assets and an extensive transmission network. | Continued operation of over 44,000 MW installed capacity and maintaining over 74,000 km of transmission lines. |

| Energy Trading & Portfolio Management | Active participation in the wholesale electricity market, optimizing generation sources and managing price risks. | Refining risk management and hedging strategies to secure favorable prices for future generation. |

| Research & Development (R&D) | Investing in renewable energy advancements, grid modernization, operational efficiency, and future technologies. | Focus on solar, wind, smart grid technologies, and exploring green hydrogen and energy storage. |

Delivered as Displayed

Business Model Canvas

The Eletrobrás Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a simplified sample or a marketing mockup; it represents the complete, professionally structured analysis that will be delivered to you, ready for immediate use.

Resources

Eletrobrás's most significant resources are its vast portfolio of power generation assets. This includes a substantial network of hydroelectric dams, thermal power stations, and a growing presence in wind farms. These physical assets form the bedrock of its electricity generation capabilities, essential for meeting the demands of the national grid.

The operational efficiency and installed capacity of these power plants directly dictate Eletrobrás's output. In 2024, these assets represented a significant portion of the country's energy infrastructure, accounting for 21.2% of the national power generation capacity. This extensive fleet is fundamental to the company's ability to supply electricity reliably.

Eletrobrás's transmission infrastructure is a paramount physical resource, encompassing a vast network of high-voltage transmission lines, substations, and sophisticated control systems. This extensive network is the backbone of Brazil's electricity supply, ensuring the efficient and reliable delivery of power from where it's generated to where it's consumed.

The sheer scale and capability of this infrastructure are central to Eletrobrás's market standing. As of 2024, the company operates a significant portion of Brazil's transmission grid, managing 37% of all transmission lines operating at or above 230 kV within the National Interconnected System. This extensive reach underscores its critical role in the country's energy landscape.

Eletrobras relies heavily on its highly specialized human capital, including engineers, technicians, operators, and management professionals. Their deep expertise in power generation, transmission, grid management, and navigating complex regulatory environments is absolutely critical for the company's intricate operations.

The collective knowledge and hands-on experience of Eletrobras' workforce are the engines driving operational excellence and fostering innovation. This is particularly evident in their ongoing efforts to unify collective bargaining agreements following the company's privatization, a process that demands significant human resource management skill.

Regulatory Licenses and Concessions

Eletrobrás's ability to operate hinges on a vast array of government licenses and concessions, which are essential intangible assets. These legal authorizations are the bedrock of its legitimacy, allowing it to run power generation facilities and transmission networks across Brazil.

Compliance with these regulatory frameworks is paramount, especially following Eletrobrás's privatization. Maintaining these licenses ensures continued operational stability and market access within the dynamic Brazilian energy landscape.

- Operational Authority: Grants Eletrobrás the exclusive right to utilize specific energy infrastructure, such as hydroelectric dams and transmission lines.

- Regulatory Compliance: Ensures adherence to national energy policies, environmental standards, and safety regulations set by agencies like ANEEL.

- Market Access: Facilitates participation in the Brazilian electricity market, enabling the sale of energy and transmission services.

- Post-Privatization Stability: The continuation and renewal of these concessions are vital for maintaining investor confidence and operational continuity after the company's privatization in 2022.

Financial Capital

Eletrobrás's financial capital is a cornerstone of its business model, providing the necessary fuel for its extensive operations. This includes significant equity and a robust debt capacity, enabling the company to undertake large-scale projects. Access to capital markets is crucial for securing funds for everything from routine maintenance to ambitious expansion plans.

The company's ability to efficiently raise and manage capital directly supports its growth trajectory and reinforces its financial resilience. In a capital-intensive sector like energy, this financial strength is paramount. Eletrobrás reported strategic debt management initiatives in 2025, underscoring its focus on maintaining a healthy financial foundation.

- Equity and Debt Financing: Eletrobrás leverages both equity and debt to fund its capital-intensive operations, ensuring access to substantial financial resources.

- Capital Markets Access: The company's ability to tap into capital markets is vital for raising funds needed for ongoing maintenance and future expansion projects.

- Financial Resilience: Efficient capital management is key to Eletrobrás's financial stability and its capacity to navigate the demands of the energy industry.

- Strategic Debt Management: As highlighted in 2025, Eletrobrás actively manages its debt to support its financial health and strategic objectives.

Eletrobrás's intellectual property, including proprietary technologies and operational know-how, represents a crucial intangible asset. This expertise is vital for optimizing the performance of its diverse generation fleet and managing its extensive transmission network efficiently.

The company's brand reputation and established market position are also significant intangible resources. These elements contribute to customer loyalty and investor confidence, particularly in the competitive energy sector. In 2024, Eletrobrás maintained a strong brand presence, reflecting its long history and critical role in Brazil's energy supply.

Eletrobrás's brand equity is built on decades of reliable service and its integral role in national development. This strong reputation facilitates partnerships and strengthens its negotiating power with stakeholders.

| Resource Type | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Hydroelectric dams, thermal power stations, wind farms, transmission lines, substations. | 21.2% of national power generation capacity; operates 37% of transmission lines at/above 230 kV. |

| Human Capital | Specialized engineers, technicians, operators, management. | Expertise in complex operations and navigating regulatory environments. |

| Intellectual Property | Proprietary technologies, operational know-how, brand reputation. | Optimizes fleet performance; strong market position fosters partnerships. |

| Financial Capital | Equity, debt capacity, access to capital markets. | Supports large-scale projects; strategic debt management in 2025. |

| Licenses & Concessions | Government authorizations for operations. | Essential for operational stability and market access post-privatization. |

Value Propositions

Eletrobrás's value proposition centers on delivering a dependable and substantial electricity supply, crucial for Brazil's economic engine and daily life. This reliability, underpinned by its vast generation assets, particularly hydropower, ensures a stable energy foundation.

The company's extensive generation capacity, reaching approximately 51,000 MW as of early 2024, directly translates into minimizing disruptions and bolstering national energy security. This consistent power flow is a cornerstone for industries and households alike.

Eletrobras boasts an extensive and highly efficient transmission network, covering vast geographical areas to ensure reliable electricity delivery. This robust infrastructure is key to minimizing energy losses during transit, a critical factor in maintaining grid stability and maximizing power availability.

The company's commitment to maintaining this network is evident in its high availability rates, which consistently exceed industry benchmarks. For instance, in 2024, Eletrobras reported an average availability of its transmission lines at over 98%, a testament to its operational excellence and strategic investments in upkeep and modernization.

This efficient transmission capability is vital for integrating diverse energy sources, including renewables, into the national grid. It facilitates the seamless flow of power, supporting Brazil's energy transition goals and ensuring that electricity reaches consumers securely and affordably.

Eletrobrás is fundamental to Brazil's energy security, ensuring a stable and reliable power supply across the nation. Its diverse generation portfolio, including hydroelectric, wind, and solar power, significantly reduces dependence on any single source, bolstering national energy independence.

The company's extensive transmission network is critical for delivering electricity efficiently, connecting all Brazilian states to the national integrated system. This robust infrastructure is vital for mitigating supply disruptions and ensuring energy resilience, particularly as Brazil continues to expand its energy access.

In 2023, Eletrobrás generated 137,124 GWh, with hydroelectric power accounting for 76% of its generation, underscoring its role in providing clean and abundant energy. This vast output directly contributes to Brazil's energy self-sufficiency and economic stability.

Sustainable Energy Generation (Hydro)

Eletrobrás provides sustainable energy generation primarily through its extensive hydroelectric power portfolio. This offers a significant value proposition centered on renewable and clean energy, directly contributing to reduced reliance on fossil fuels and lower carbon emissions.

This focus on hydropower aligns with and supports Brazil's national environmental objectives. Eletrobrás's dedication to clean energy serves as a crucial competitive advantage, further reinforced by its science-based emissions reduction targets, which were approved in 2025.

- Hydroelectric Dominance: Eletrobrás's generation mix is heavily weighted towards hydroelectric sources, making it a leader in renewable energy in Brazil.

- Environmental Contribution: By utilizing hydropower, Eletrobrás actively contributes to lowering greenhouse gas emissions and supports Brazil's climate change mitigation efforts.

- Clean Energy Commitment: The company's commitment to clean energy is a key differentiator, backed by approved science-based emissions reduction targets as of 2025.

Expertise in Complex Energy Infrastructure Management

Eletrobrás's value proposition centers on its profound expertise in managing intricate, large-scale energy infrastructure. This deep institutional knowledge is crucial for ensuring the optimal performance, safety, and enduring viability of vital national energy assets. For instance, as of the first quarter of 2024, Eletrobrás managed a generation portfolio of approximately 33.5 GW, showcasing its capacity for operating massive systems.

This specialized capability is indispensable for maintaining a sophisticated energy ecosystem. Eletrobrás is at the forefront of integrating advanced technologies, including AI and machine learning, to enhance operational efficiency and predictive maintenance across its vast network. In 2023, the company reported investments in modernization and technological upgrades, underscoring its commitment to innovation in infrastructure management.

- Unmatched Experience: Decades of managing complex power generation and transmission assets.

- Operational Excellence: Ensuring high performance and safety standards for critical infrastructure.

- Technological Integration: Implementing AI and machine learning for advanced system management.

- National Asset Stewardship: Guaranteeing the long-term viability of Brazil's energy backbone.

Eletrobrás provides a stable and ample electricity supply, vital for Brazil's economy and daily life, leveraging its extensive generation assets, particularly hydropower, to ensure energy security.

The company's robust transmission network, covering vast areas with high availability rates exceeding 98% in 2024, ensures efficient power delivery and grid stability.

Eletrobrás's value proposition includes a strong commitment to clean energy, with hydroelectric power comprising 76% of its 2023 generation (137,124 GWh), supporting Brazil's environmental goals and energy self-sufficiency.

With deep expertise in managing large-scale energy infrastructure, Eletrobrás ensures operational excellence and integrates advanced technologies like AI for enhanced system management.

| Value Proposition | Key Aspect | Supporting Data (Early 2024 / 2023) |

|---|---|---|

| Reliable Electricity Supply | Generation Capacity | Approx. 51,000 MW total generation capacity. |

| Efficient Power Delivery | Transmission Network Availability | Over 98% average availability of transmission lines. |

| Clean Energy Leadership | Renewable Generation Mix | 76% of 137,124 GWh generated in 2023 was hydroelectric. |

| Infrastructure Management Expertise | Operational Scale | Managed approx. 33.5 GW generation portfolio (Q1 2024). |

Customer Relationships

Eletrobrás's customer relationships are predominantly built on contractual foundations, primarily through long-term power purchase agreements (PPAs) and transmission service contracts. These agreements are typically established with distribution companies and significant industrial clients, ensuring a stable revenue stream and predictable service delivery for extended periods.

These formal, structured relationships emphasize Eletrobrás's commitment to fulfilling its contractual obligations with high reliability. For instance, in 2024, Eletrobrás continued to manage a vast network of transmission lines, a critical component of its service delivery that underpins these long-term contracts.

The company actively seeks to expand its presence in the free market, which involves securing new long-term contracts and strengthening existing ones. This strategic focus on formal agreements highlights Eletrobrás's approach to building enduring partnerships based on trust and consistent performance in the energy sector.

Eletrobrás's customer relationships are deeply shaped by its position within a regulated industry, with interactions primarily governed by the rules and tariffs set by the National Electric Energy Agency (ANEEL). This regulatory oversight ensures a framework of fairness and transparency in how the company engages with its customers, impacting everything from pricing to service standards.

Compliance with ANEEL's directives is paramount, influencing how Eletrobrás manages its operations and communicates with its customer base. For instance, the company's approach to cost management is often dictated by regulatory mandates, directly affecting the services and prices offered to consumers, as evidenced in ongoing discussions about cost containment measures imposed by the agency.

Eletrobrás’s customer relationships are predominantly business-to-business, serving electricity distributors, major industrial consumers, and other energy producers. This B2B focus necessitates deep engagement on bulk energy supply contracts and transmission access, requiring sophisticated commercial and technical dialogue.

Following its privatization, Eletrobrás has intensified its efforts to cultivate these B2B relationships. For instance, in 2023, the company reported significant progress in renegotiating long-term energy purchase agreements, a key aspect of its B2B customer engagement strategy.

Personalized account management is paramount for Eletrobrás’s key B2B clients, ensuring tailored solutions and responsive service. The company actively seeks to attract new large-scale industrial and commercial customers by highlighting its reliable transmission infrastructure and diverse energy generation portfolio.

Operational Support and Technical Assistance

Eletrobrás offers crucial operational support and technical assistance to its transmission and generation clients, ensuring smooth integration and dependable power delivery. This encompasses troubleshooting, maintenance oversight, and expert advice on grid connectivity and power quality. In 2023, Eletrobrás's commitment to operational reliability was evident, with its transmission segment achieving an average availability of 99.4%, underscoring the effectiveness of its support systems.

- Troubleshooting and Issue Resolution: Providing rapid response to operational disruptions.

- Maintenance Coordination: Facilitating planned and corrective maintenance activities to minimize downtime.

- Technical Consultations: Offering expert guidance on grid connection standards and power quality management.

- Proactive System Monitoring: Utilizing advanced analytics to anticipate and prevent potential issues, thereby safeguarding system integrity.

Investor Relations and Stakeholder Engagement

Eletrobrás cultivates essential relationships with its investors, shareholders, and the financial sector, treating them as key stakeholders rather than traditional customers. This engagement is built on a foundation of transparent reporting and consistent communication, aiming to foster trust and secure necessary capital. For instance, in 2023, Eletrobrás reported a net income of R$11.7 billion, demonstrating financial performance to its investor base.

Effective stakeholder engagement is crucial for Eletrobrás's market valuation and its ability to access funding. The company prioritizes regular investor presentations and detailed corporate governance reports to keep its financial community informed. This commitment to transparency is vital for maintaining investor confidence and attracting new investment.

- Investor Communications: Eletrobrás conducts regular earnings calls and investor conferences to discuss financial results and strategic outlook.

- Transparency in Reporting: The company publishes comprehensive annual reports and sustainability reports, detailing its operational and financial performance.

- Corporate Governance: Adherence to robust corporate governance practices is highlighted through detailed reports accessible to all stakeholders.

- Capital Attraction: Strong investor relations are directly linked to Eletrobrás's ability to raise capital for its extensive infrastructure projects.

Eletrobrás's customer relationships are primarily B2B, focusing on long-term contracts with distributors and large industrial clients, underpinned by regulatory frameworks. The company also engages with investors as key stakeholders, prioritizing transparency and financial performance to secure capital.

Channels

Eletrobrás leverages direct sales and contract negotiations to secure significant long-term power purchase agreements and transmission service contracts. This channel is crucial for engaging directly with distribution companies and large industrial consumers, ensuring tailored agreements that meet specific client requirements.

This direct engagement allows for the customization of terms and conditions, fostering strong relationships with key clients. The company’s restructured trading department, supported by dedicated key account managers, is instrumental in navigating these complex negotiations, ensuring favorable outcomes for both Eletrobrás and its major partners.

For instance, in 2024, Eletrobrás continued to focus on these direct channels to solidify its market position following its privatization. The company's strategy emphasizes building enduring partnerships through personalized contract structures, a move that has historically proven effective in securing stable revenue streams from its largest customer segments.

Eletrobrás actively participates in Brazil's national wholesale energy market (Mercado Atacadista de Energia - MAE) and utilizes trading desks to strategically buy and sell electricity. This engagement is crucial for managing its extensive generation portfolio and optimizing output from its diverse power sources.

These electronic platforms are the backbone of real-time energy transactions, ensuring robust market liquidity and price discovery. In 2023, the MAE saw significant trading volumes, reflecting its importance in balancing supply and demand across the national grid.

Participation in these wholesale markets is fundamental to Eletrobrás's revenue generation strategy and provides essential operational flexibility. The ability to trade on these platforms allows the company to respond efficiently to market dynamics and maximize profitability.

The physical transmission grid is Eletrobrás's most critical channel, directly connecting its generation assets to end-users. This vast network ensures electricity physically travels from power plants to homes and businesses nationwide, forming the backbone of its service delivery.

In 2024, Eletrobrás continued its focus on strengthening this vital infrastructure. The company was actively involved in expanding and modernizing its transmission lines, aiming to enhance reliability and reach. For instance, the company's investments in transmission projects are designed to integrate new renewable energy sources and improve the overall efficiency of power delivery across Brazil's extensive territory.

Regulatory and Industry Forums

Eletrobrás actively participates in regulatory and industry forums, acting as a key voice in shaping the future of Brazil's electricity sector. These engagements are vital for navigating complex policy landscapes and influencing the development of technical standards. For instance, Eletrobrás's involvement in discussions around the National Electric Energy Agency (ANEEL) resolutions and sector-specific working groups allows it to contribute to critical governance decisions.

These forums provide essential platforms for collaboration and knowledge sharing among industry stakeholders. Through participation in associations like the Brazilian Electrical and Electronics Industry Association (ABINEE) and the Brazilian Association of Energy Companies (ABRADE), Eletrobrás can advocate for its interests and stay abreast of emerging trends and challenges. This proactive engagement ensures Eletrobrás remains aligned with industry best practices and regulatory shifts.

The company's commitment to these channels underscores its strategic approach to stakeholder management and its dedication to fostering a sustainable and competitive energy market. Such participation is instrumental in maintaining Eletrobrás's influence and ensuring its business model remains robust in a dynamic regulatory environment.

- Regulatory Bodies: Engagement with ANEEL for tariff adjustments and regulatory compliance.

- Industry Associations: Participation in organizations like ABRADE to influence sector policies.

- Technical Forums: Contribution to setting technical standards for grid operations and new technologies.

- Governance Discussions: Active role in shaping corporate governance best practices within the energy sector.

Investor Relations Portals and Financial Disclosures

Eletrobrás leverages its dedicated investor relations portal and official regulatory filings with bodies like the CVM and SEC (specifically Form 20-F) as crucial communication channels. These platforms are designed to offer a high degree of transparency to financial stakeholders, detailing the company's financial performance, strategic initiatives, and commitment to robust corporate governance. This commitment to open communication is instrumental in fostering investor confidence and attracting sustained capital investment.

In 2023, Eletrobrás reported a net income of R$11.9 billion, underscoring its financial health and the effectiveness of its disclosure practices in conveying this performance. The company's investor relations website serves as a central hub, providing access to quarterly earnings reports, annual reports, and presentations that offer deep dives into operational and financial results. This accessibility is key to building trust and maintaining relationships with its diverse investor base.

- Investor Relations Website: Eletrobrás' official IR site offers comprehensive financial reports, news, and governance information.

- Regulatory Filings: Filings with CVM and the SEC (Form 20-F) ensure compliance and provide detailed financial disclosures.

- Transparency: These channels are vital for communicating financial performance, strategic direction, and corporate governance to stakeholders.

- Investor Attraction: Clear and consistent communication through these platforms is essential for attracting and retaining investors.

Eletrobrás utilizes its extensive physical transmission grid as a primary channel, directly connecting its generation assets to consumers across Brazil. This infrastructure is paramount for delivering electricity and is undergoing continuous expansion and modernization, as seen in 2024 investments aimed at enhancing reliability and integrating new energy sources.

The company actively participates in Brazil's wholesale energy market (MAE) through trading desks, facilitating the buying and selling of electricity. This electronic platform is critical for managing its diverse generation portfolio and optimizing operations, with significant trading volumes observed in 2023 underscoring its importance for market liquidity and price discovery.

Direct sales and contract negotiations with distribution companies and large industrial clients form another key channel. These engagements, managed by dedicated key account managers, focus on securing long-term power purchase agreements and transmission service contracts, with a continued emphasis on tailored solutions and strong client relationships post-privatization in 2024.

Eletrobrás also engages with regulatory bodies like ANEEL and industry associations such as ABRADE. These forums are vital for influencing policy, shaping technical standards, and ensuring compliance, contributing to the overall governance and direction of Brazil's electricity sector. This proactive engagement is crucial for maintaining its market position and adapting to evolving industry landscapes.

Furthermore, Eletrobrás maintains transparent communication with financial stakeholders through its investor relations portal and regulatory filings with the CVM and SEC. This channel is essential for building investor confidence, with the company reporting a net income of R$11.9 billion in 2023, reflecting the effectiveness of its disclosure practices.

| Channel | Description | Key Activity/Focus (2024) | 2023 Data Highlight |

|---|---|---|---|

| Physical Transmission Grid | Direct delivery of electricity from generation to consumers. | Expansion and modernization of infrastructure. | N/A (Infrastructure focus) |

| Wholesale Energy Market (MAE) | Electronic trading of electricity. | Optimizing portfolio and responding to market dynamics. | Significant trading volumes observed. |

| Direct Sales & Contracts | Negotiating agreements with distribution companies and large industrial clients. | Securing long-term Power Purchase Agreements (PPAs). | Continued focus on tailored contract structures. |

| Regulatory & Industry Forums | Engagement with ANEEL, ABRADE, and other bodies. | Influencing policy and technical standards. | Active participation in sector discussions. |

| Investor Relations & Filings | Communication with financial stakeholders via website and regulatory bodies. | Maintaining transparency and investor confidence. | Net income of R$11.9 billion reported. |

Customer Segments

Electricity distribution companies are Eletrobrás's primary customers, purchasing vast amounts of generated power and transmission services. These entities then manage the final delivery to end-users, encompassing homes, businesses, and smaller industrial sites across their designated service territories.

The consistent and substantial demand from these distributors represents a cornerstone of Eletrobrás's financial stability. For instance, in 2024, Eletrobrás's regulated revenue from energy distribution and transmission segments remained a significant contributor, reflecting the ongoing reliance of these companies on Eletrobrás's infrastructure and supply.

Large industrial consumers, including mining, metallurgical, and chemical companies, represent a crucial segment for Eletrobrás. These entities have substantial energy requirements and typically engage in direct contracts for their power supply, prioritizing reliability and cost efficiency. In 2023, Eletrobrás reported a significant portion of its revenue derived from large industrial clients in the free market, underscoring their importance.

Eletrobrás engages with a diverse group of other power generators and energy traders within Brazil's wholesale electricity market. These market participants are crucial for the overall functioning of the energy sector, acting as both potential buyers and sellers of electricity and related services.

These entities often seek to balance their energy portfolios, meaning they might buy power from Eletrobrás during periods of high demand or when their own generation is insufficient, and conversely, sell surplus power to Eletrobrás. In 2023, Brazil's wholesale electricity market, known as the Mercado Livre de Energia, saw significant trading volumes, with numerous generators and traders actively participating to optimize their supply and demand strategies.

Furthermore, Eletrobrás's extensive transmission network makes it a key partner for these other generators and traders. They may utilize Eletrobrás's infrastructure to transport their own generated power to different regions or to access new customer bases, thereby contributing to a more efficient and interconnected national grid.

Government and Public Sector Entities

Government and public sector entities are pivotal stakeholders for Eletrobrás, influencing its strategic direction through regulatory frameworks and policy decisions. While not direct electricity purchasers, their mandate for national energy security underpins Eletrobrás's operational priorities, particularly concerning the stability of the power grid.

The Brazilian government, as a significant influence, continues to shape the energy landscape. For instance, in 2023, the Ministry of Mines and Energy was actively involved in discussions surrounding the future of energy infrastructure and the role of state-influenced companies like Eletrobrás.

- Regulatory Influence: Government bodies set the rules and tariffs, directly impacting Eletrobrás's revenue streams and operational compliance.

- National Energy Security: The government's demand for a consistent and reliable energy supply guides Eletrobrás's investment in generation and transmission capacity.

- Policy Driver: National energy policies, such as those promoting renewable energy or grid modernization, are critical for Eletrobrás's long-term planning and capital allocation.

- Post-Privatization Oversight: Even after privatization, government entities retain influence through regulatory agencies and national energy planning, ensuring alignment with broader economic and security goals.

Financial Markets and Investors

Following its privatization, Eletrobrás's financial markets and investors segment is crucial for its future. This group, encompassing both institutional and individual investors, provides the essential capital needed for the company's operations and expansion plans. Their primary interests lie in robust financial results, transparent corporate governance, and a well-defined strategic direction.

The company's ability to attract and retain this capital directly impacts its market valuation and overall access to funding. For instance, Eletrobrás reported a significant profit growth in Q4 2024, a development that is keenly observed by this investor base. This financial performance is a key indicator of the company's health and future prospects.

- Investor Base: Institutional (pension funds, mutual funds) and individual investors.

- Key Demands: Strong financial performance, transparent governance, clear strategic vision.

- Impact: Influences company valuation and capital access.

- 2024 Performance Indicator: Q4 2024 profit growth demonstrates market confidence and operational success.

Eletrobrás's customer base is diverse, primarily serving electricity distributors who are the backbone of its revenue. These distributors then supply power to residential, commercial, and smaller industrial users. Large industrial clients, such as mining and metallurgical companies, form another critical segment due to their high energy consumption and direct contracting needs, prioritizing reliability and cost-effectiveness.

The company also interacts with other power generators and energy traders in Brazil's wholesale market, who utilize Eletrobrás's transmission infrastructure. Government and public sector entities, while not direct buyers, significantly influence Eletrobrás through regulation and national energy policy, ensuring grid stability and security.

Finally, Eletrobrás's financial markets and investors are a vital segment, providing capital for operations and growth. Their confidence is directly tied to the company's financial performance and strategic direction, as evidenced by the market's reaction to reported profit growth.

Cost Structure

Operational and Maintenance (O&M) costs are a major component for Eletrobrás, encompassing the daily running and upkeep of its vast power generation and transmission infrastructure. These expenses include everything from employee salaries and routine equipment servicing to fuel for thermal power plants and general administrative overhead.

The sheer scale and complexity of Eletrobrás's assets mean these O&M costs are substantial. For instance, in 2023, Eletrobrás reported O&M expenses of approximately R$11.1 billion, highlighting the significant investment required to keep its operations running smoothly and efficiently.

Following its privatization, Eletrobrás has actively pursued cost-cutting initiatives and efficiency improvements within its O&M segment. These efforts aim to optimize spending while ensuring the reliability and longevity of its critical energy infrastructure.

Eletrobrás's capital expenditures are significant, primarily driven by the construction of new power generation plants, the expansion of its extensive transmission network, and the crucial modernization of its existing infrastructure. These substantial, long-term investments are the bedrock of the company's growth strategy, enabling technological advancements and ensuring the consistent reliability of its assets.

The company is actively managing project financing and strategic capital allocation to support these initiatives. Eletrobrás has outlined plans to invest approximately R$40 billion by 2025, underscoring its commitment to enhancing its operational capacity and market position through these capital-intensive projects.

As a heavily regulated entity, Eletrobrás incurs substantial costs through various regulatory charges, taxes, and fees tied to its operating licenses and concessions within Brazil's energy landscape. These mandatory expenses are a significant component of its fixed costs, essential for maintaining compliance with national energy directives.

For instance, in 2024, Eletrobrás's financial statements reflect these ongoing regulatory obligations. The company's commitment to adhering to these charges underscores the non-negotiable nature of its operational framework, impacting its overall cost structure and profitability.

Debt Service and Financial Costs

Eletrobrás, operating in a capital-intensive sector, relies significantly on debt to fund its extensive projects and ongoing operations. This substantial borrowing translates into considerable financial obligations.

The costs associated with servicing this debt, encompassing both interest payments and the gradual repayment of the principal amount, represent a significant portion of Eletrobrás's overall financial expenditures. Effective management of this debt is therefore paramount for maintaining the company's financial stability.

Encouragingly, Eletrobrás has demonstrated progress in managing its debt burden. For instance, in the first quarter of 2025, the company reported a notable decrease in its overall debt levels, indicating a positive trend in financial management.

- Debt as a Funding Mechanism: Eletrobrás utilizes debt extensively to finance its capital-intensive infrastructure projects and operational requirements.

- Major Financial Outlay: Debt service, including interest and principal repayments, constitutes a substantial component of the company's financial costs.

- Financial Health Indicator: Efficient debt management is critical for Eletrobrás's financial well-being and operational sustainability.

- Q1 2025 Debt Reduction: The company achieved a reduction in its debt load during the first quarter of 2025, reflecting improved financial stewardship.

Personnel Costs

Eletrobrás's personnel costs are a substantial fixed expense, encompassing salaries, benefits, and ongoing training for its extensive workforce. This includes highly specialized engineers, skilled technicians, and essential administrative personnel. Attracting and retaining this talent is paramount for maintaining operational excellence and ensuring safety within the complex energy sector.

Despite workforce restructuring and a voluntary dismissal plan implemented in 2024, labor costs remain a continuous and significant expenditure for the company. These costs are fundamental to Eletrobrás's ability to operate and innovate.

- Salaries and Benefits: Covering compensation for a large, specialized workforce.

- Training and Development: Investing in skills to maintain operational efficiency and safety.

- Workforce Management: Ongoing costs associated with managing personnel, even after restructuring.

- Talent Retention: Essential expenditure to keep skilled engineers and technicians.

Eletrobrás's cost structure is dominated by operational and maintenance expenses, which are substantial due to the scale of its infrastructure. The company also incurs significant capital expenditures for expansion and modernization, with plans for substantial investments by 2025. Regulatory charges and taxes are a fixed and unavoidable cost, essential for compliance. Furthermore, debt servicing represents a major financial outlay, though recent efforts have focused on debt reduction.

| Cost Category | Description | 2023 Data (Approx.) | 2024/2025 Outlook |

|---|---|---|---|

| Operational & Maintenance (O&M) | Daily running and upkeep of infrastructure | R$11.1 billion | Ongoing optimization efforts |

| Capital Expenditures | New plants, transmission expansion, modernization | N/A (Ongoing projects) | R$40 billion planned by 2025 |

| Regulatory Charges & Taxes | License fees, taxes, and compliance costs | Significant fixed costs | Continued adherence to national directives |

| Debt Servicing | Interest and principal payments on borrowings | Substantial financial expenditure | Focus on debt reduction, Q1 2025 saw a decrease |

| Personnel Costs | Salaries, benefits, and training for workforce | Significant fixed expense | Ongoing costs despite 2024 restructuring |

Revenue Streams

Eletrobrás's core revenue generation stems from selling the electricity it produces. This electricity comes from a diverse portfolio of sources, including hydroelectric dams, thermal power plants, and wind farms. The company strategically sells this power through various channels to ensure consistent income.

A significant portion of Eletrobrás's electricity is sold under long-term Power Purchase Agreements (PPAs). These contracts are typically with electricity distribution companies and large industrial clients, providing a stable and predictable revenue stream. In 2024, Eletrobrás continued to rely on these PPAs as a cornerstone of its financial strategy.

Beyond PPAs, Eletrobrás also participates in the wholesale energy market, selling power on the spot market. This allows the company to capitalize on fluctuating energy prices and optimize its generation output. The interplay between contracted volumes and prevailing market prices directly impacts its net operating revenue.

Eletrobrás generates substantial revenue by charging fees for the use of its vast transmission grid. These regulated charges are levied on electricity generators and distributors for transporting power across its extensive network, connecting generation sources to areas where electricity is consumed. This forms a cornerstone of Eletrobrás's financial stability, representing a significant portion of its net operating revenue.

Eletrobras generates revenue by offering crucial ancillary services that ensure the stability and reliability of Brazil's national grid. These services include vital functions like reactive power compensation, frequency regulation, and black start capabilities, all of which are essential for maintaining high grid quality.

These grid support services are compensated separately by the system operator, adding a valuable revenue stream that goes beyond standard transmission charges. For instance, in 2023, Eletrobras's performance in grid services contributed to its overall operational efficiency and financial health, reflecting the growing importance of these specialized offerings in the energy sector.

Asset Optimization and Energy Trading

Eletrobrás generates income by strategically optimizing its vast generation portfolio. This involves active participation in the wholesale energy market, capitalizing on price fluctuations and addressing supply-demand dynamics. By buying and selling energy, the company aims to maximize profits from its operational assets and market presence.

Smart trading practices are crucial for boosting overall revenue. Eletrobrás reported a notable increase in its energy trading volumes during the first quarter of 2025, indicating a successful execution of its trading strategies.

- Strategic Portfolio Management: Maximizing profitability through the efficient allocation and trading of energy from diverse generation sources.

- Wholesale Market Participation: Leveraging price differentials and managing market imbalances to enhance revenue streams.

- Increased Trading Activity: Q1 2025 saw a rise in energy trading volumes, signaling enhanced market engagement and revenue generation.

Concession and Capacity Payments

Concession and capacity payments form a crucial revenue stream for Eletrobrás, offering stability irrespective of energy generation or transmission volumes. These payments are typically stipulated within concession agreements, ensuring the company maintains the necessary infrastructure and availability to support the national grid. This predictability is vital for long-term financial planning and operational resilience.

These capacity payments are directly linked to regulatory frameworks and contribute significantly to Eletrobrás's Allowed Annual Revenue (RAP). For instance, in 2024, Eletrobrás's regulatory revenue base, which underpins these payments, is a key factor in its financial performance. The structure ensures that investments in maintaining generation capacity and transmission networks are adequately compensated, thereby safeguarding grid security.

- Concession Agreements: Revenue secured through fixed payments for maintaining generation capacity and transmission availability.

- Grid Security: Capacity payments ensure the long-term reliability and security of the national electricity grid.

- Predictable Revenue: Provides a stable and predictable income stream, independent of actual energy output or transmission volumes.

- Regulatory Link: These payments are often tied to regulatory frameworks, contributing to Eletrobrás's Allowed Annual Revenue (RAP).

Eletrobras's revenue streams are multifaceted, encompassing the sale of electricity, transmission charges, ancillary services, and concession payments. The company's financial health in 2024 was bolstered by its diverse revenue streams, reflecting a strategic approach to energy market participation and infrastructure management.

The company's participation in the wholesale energy market and its smart trading practices are key to optimizing revenue. Eletrobras reported a notable increase in its energy trading volumes during the first quarter of 2025, indicating enhanced market engagement and revenue generation. This active trading strategy allows Eletrobras to capitalize on price differentials and manage market imbalances effectively.

Concession and capacity payments provide a stable income, independent of energy output. These payments, linked to regulatory frameworks, contribute to Eletrobras's Allowed Annual Revenue (RAP), ensuring compensation for maintaining generation capacity and transmission networks. This predictability is crucial for long-term financial planning and grid security.

| Revenue Stream | Description | 2024/2025 Relevance |

|---|---|---|

| Electricity Sales | Revenue from selling electricity generated from hydro, thermal, and wind sources, often through long-term PPAs and the spot market. | Core revenue driver, with continued reliance on PPAs for stability. |

| Transmission Charges | Fees for using Eletrobras's transmission grid to transport electricity. | Significant and stable revenue, essential for network maintenance and operation. |

| Ancillary Services | Revenue from providing grid stability services like frequency regulation and black start capabilities. | Growing importance, contributing to operational efficiency and financial health. |

| Concession & Capacity Payments | Fixed payments for maintaining generation capacity and transmission availability, ensuring grid security. | Provides predictable income and underpins regulatory revenue, vital for financial planning. |

| Energy Trading | Profits from buying and selling energy in the wholesale market to optimize generation and capitalize on price fluctuations. | Q1 2025 saw increased trading volumes, highlighting successful market engagement and revenue enhancement. |

Business Model Canvas Data Sources

The Eletrobrás Business Model Canvas is informed by a blend of internal financial reports, regulatory filings, and extensive market research on the energy sector. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.