Eletrobrás Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eletrobrás Bundle

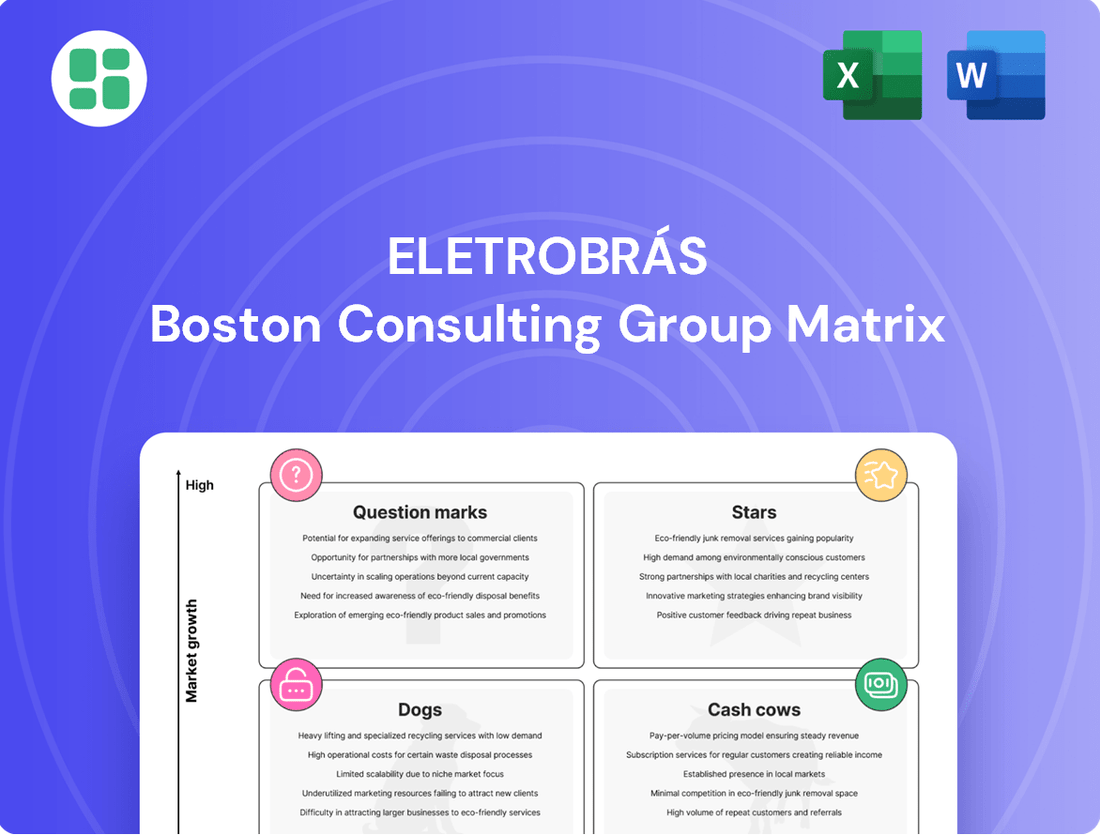

Explore Eletrobrás's strategic positioning with our insightful BCG Matrix preview, highlighting key product categories. Understand where its portfolio stands to make informed decisions.

This glimpse into Eletrobrás's BCG Matrix is just the beginning. Purchase the full report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Stars

Eletrobrás is actively expanding its wind power portfolio. The Coxilha Negra wind farm, a significant 302MW project, recently became operational in the first quarter of 2025, and the Casa Nova B facility, with 27MW, is nearing completion. These developments are in sync with Brazil's burgeoning renewable energy landscape.

Brazil's wind power sector saw substantial growth in 2024, adding 4.3 GW of capacity. This robust expansion highlights a dynamic market with considerable potential. Eletrobrás's strategic investments in these wind projects are designed to capitalize on this trend.

The company's growing wind energy capacity positions it favorably within the industry. While these investments require significant capital outlay, they represent a strong commitment to future growth and market leadership in renewable energy. This segment is likely to consume cash for expansion but promises substantial future returns.

Eletrobrás is making significant strides in strategic transmission expansion, dedicating over US$2 billion to 240 major projects and numerous smaller upgrades. This aggressive investment underscores the company's commitment to enhancing Brazil's energy infrastructure and integrating a growing renewable energy portfolio.

Key initiatives, like the crucial Manaus-Boa Vista transmission line, are designed to connect previously underserved regions to the national grid. These developments are fundamental for accommodating the increasing influx of renewable energy sources, positioning Eletrobrás as a central player in this high-growth sector.

The company is actively expanding its already dominant market share in transmission services. This strategic focus on transmission is vital for Brazil's energy security and economic development, reflecting Eletrobrás's role in modernizing the nation's power grid.

Eletrobrás's success in renewable energy auctions, capturing 20% of bids, highlights its strong market positioning. This achievement aligns with Brazil's National Energy Plan, which aims to boost renewable generation significantly by 2026, underscoring Eletrobrás's role in meeting these ambitious targets.

These wins are crucial for Eletrobrás as they signify a strategic expansion of its clean energy portfolio. The company is actively diversifying beyond its established hydroelectric base, embracing solar and wind power to secure future growth in a rapidly evolving energy landscape.

Modernization of Grid Infrastructure

Modernizing and reinforcing Eletrobrás's transmission grid is essential for meeting rising energy needs and incorporating a wider array of generation sources. The company is undertaking numerous projects to enhance its extensive network, aiming for superior reliability and efficiency. This focus solidifies Eletrobrás's prominent position in the expanding market for sophisticated grid technologies.

Eletrobrás's commitment to grid modernization is demonstrated by its significant investment in upgrading existing infrastructure. These efforts are vital for integrating renewable energy sources and ensuring the stable delivery of power across Brazil. By strengthening its transmission capabilities, Eletrobrás is well-positioned to capitalize on the growing demand for energy and advanced grid services.

- Grid Reinforcement: Eletrobrás is investing in strengthening its transmission lines to handle increased load and improve resilience.

- Technological Upgrades: The company is incorporating advanced technologies for better grid management and operational efficiency.

- Renewable Integration: Modernization efforts are key to seamlessly integrating diverse and intermittent renewable energy sources into the national grid.

- Reliability and Efficiency: These investments directly contribute to higher energy delivery reliability and operational efficiency, crucial for market growth.

Leadership in Brazil's Energy Transition

Eletrobrás stands as a pivotal player in Brazil's energy transition, leveraging its vast existing infrastructure to drive the nation's renewable energy expansion. Its strategic commitment to clean energy sources and decarbonization efforts places it at the forefront of a rapidly growing market. For instance, in 2023, Eletrobrás reported a significant increase in its renewable energy portfolio, contributing substantially to Brazil's overall clean energy targets.

The company's leadership is crucial for achieving Brazil's ambitious renewable energy goals, which aim to further reduce the country's carbon footprint. Eletrobrás's investments in solar and wind power, alongside its management of hydroelectric assets, underscore its central role in this transformation. By 2024, Eletrobrás is expected to further solidify its position through new projects and partnerships aimed at accelerating the energy transition.

- Eletrobrás's Role: Indispensable to Brazil's renewable energy goals due to existing infrastructure and scale.

- Strategic Focus: Prioritizing clean energy and decarbonization aligns with high-growth renewable markets.

- 2023 Impact: Reported substantial growth in its renewable energy portfolio, aiding national decarbonization targets.

- 2024 Outlook: Continued investment in solar and wind power to accelerate the energy transition.

Eletrobrás's expanding wind and solar operations, alongside its robust transmission network, position its renewable energy assets as potential Stars in the BCG matrix. These ventures are in high-growth markets, requiring significant investment but promising substantial future returns as Brazil pushes for greater renewable energy integration. The company's success in recent renewable energy auctions, securing 20% of bids, further solidifies this classification.

The company's proactive expansion into wind power, exemplified by projects like the 302MW Coxilha Negra wind farm becoming operational in Q1 2025, directly contributes to its Star status. These investments align with Brazil's goal to significantly increase renewable generation by 2026. Eletrobrás's commitment to these high-growth, capital-intensive sectors indicates a strategic move towards market leadership in clean energy.

Eletrobrás's significant investments in transmission infrastructure, exceeding US$2 billion for over 240 projects, are crucial for supporting its growing renewable portfolio. This expansion is vital for integrating new energy sources and ensuring grid stability, reinforcing the Star classification for its renewable energy business segments. The company's efforts to connect underserved regions, like the Manaus-Boa Vista line, enhance its market position.

The company's strategic focus on renewable energy, including solar and wind, alongside its established hydroelectric base, categorizes these segments as Stars. This is due to their operation in a high-growth market and the substantial investments required for expansion, which are expected to yield significant future returns. Eletrobrás's continued success in capturing renewable energy bids underscores this potential.

What is included in the product

The Eletrobras BCG Matrix provides strategic insights into its business units, highlighting which to invest in, hold, or divest based on market growth and share.

The Eletrobrás BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Eletrobrás's large-scale hydroelectric fleet represents a significant Cash Cow within its BCG Matrix. These assets are the backbone of Brazil's energy supply, with Eletrobrás operating a substantial portion of the country's hydroelectric capacity. In 2023, hydroelectric power accounted for approximately 62% of Brazil's total electricity generation, underscoring the importance of these assets.

These hydroelectric plants benefit from long-term concession contracts, typically lasting 50 years, which ensure stable and predictable revenue streams. This stability allows them to generate substantial cash flow with minimal need for further investment in marketing or expansion, as the market for electricity is well-established and demand is consistent.

Eletrobrás's extensive transmission network, a cornerstone of its operations, represents a significant Cash Cow. The company commands a dominant share of Brazil's electricity transmission infrastructure, boasting thousands of kilometers of lines and numerous substations. This vital asset operates within a regulated, low-growth market, which translates into consistently high profit margins and reliable cash flow generation.

The stability derived from these essential transmission assets is crucial for Eletrobrás. This consistent revenue stream provides the financial flexibility needed to support other strategic initiatives, such as investments in renewable energy, and to comfortably cover ongoing operational expenses. For instance, in 2023, Eletrobrás reported significant revenue from its transmission segment, underscoring its role as a primary cash generator.

Eletrobrás benefits from stable, regulated revenue streams thanks to its legal monopoly and concession contracts. These agreements ensure fixed remuneration, adjusted for inflation, providing a reliable income from its core generation and transmission operations, shielding it from market volatility.

These segments, characterized by low growth but high market share, are crucial for Eletrobrás's financial health. For instance, in 2023, Eletrobrás's transmission segment alone generated approximately R$25.5 billion in revenue, a testament to the stability of these regulated assets.

Optimized Operational Efficiency

Following its privatization in 2022, Eletrobrás has aggressively pursued optimized operational efficiency, a key factor in its Cash Cow strategy. This drive has translated into tangible cost reductions and streamlined processes across its mature business segments, particularly in hydroelectric generation and transmission. For instance, in 2023, Eletrobrás reported a significant reduction in its operating expenses, contributing to a stronger EBITDA margin.

This focus on organizational excellence directly enhances profit margins and maximizes cash flow from its established assets. The sustained efficiency gains are crucial for the financial health of these core business units, providing the necessary capital for investment and shareholder returns. Eletrobrás's commitment to operational improvements is a cornerstone of its post-privatization success.

- Cost Reduction Initiatives: Eletrobrás has implemented various programs to cut operational costs, improving the profitability of its mature assets.

- Streamlined Processes: Simplification of internal workflows and administrative functions has boosted overall efficiency.

- Enhanced Profit Margins: The combination of cost savings and optimized operations directly leads to higher profit margins in its hydroelectric and transmission businesses.

- Maximized Cash Flow: Efficient operations ensure a consistent and robust cash flow generation from Eletrobrás's established, market-leading assets.

Diversified Clean Energy Portfolio

Eletrobrás's diversified clean energy portfolio, largely comprised of mature hydroelectric assets, represents a significant Cash Cow. This existing base, already approximately 97% green energy as of 2024, offers a stable and predictable revenue stream. This dominance in the clean energy sector, particularly in a mature market, provides a strong competitive advantage and insulates the company from the price fluctuations inherent in fossil fuels.

The established clean energy infrastructure, primarily hydroelectric, underpins its Cash Cow status. This robust foundation minimizes exposure to volatile fossil fuel markets, ensuring more consistent and reliable earnings. Eletrobrás's commitment to maintaining this green energy dominance, even as it invests in new renewables, solidifies its position as a critical player in the energy transition.

- Dominant Green Energy Base: Approximately 97% of Eletrobrás's portfolio is green energy, primarily from mature hydroelectric sources.

- Stable Revenue Streams: The mature nature of its hydroelectric assets ensures predictable and consistent revenue generation.

- Reduced Market Volatility: Eletrobrás's clean energy focus minimizes exposure to the price swings of fossil fuel markets.

- Competitive Advantage: Its established green energy portfolio provides a significant edge in a market increasingly focused on sustainability.

Eletrobrás's hydroelectric generation segment is a prime example of a Cash Cow. These mature, high-capacity assets generate substantial and consistent cash flow due to their established market position and long-term contracts. In 2023, Eletrobrás's hydroelectric generation contributed significantly to its overall revenue, demonstrating its role as a stable income generator.

The transmission segment also functions as a Cash Cow, benefiting from regulated tariffs and a dominant market share in Brazil. This segment provides predictable earnings with limited need for significant capital reinvestment. For instance, Eletrobrás's transmission revenue in 2023 underscored its consistent cash-generating capabilities.

These Cash Cow segments are vital for funding Eletrobrás's strategic growth areas, such as expanding its renewable energy portfolio beyond hydro. The stable cash flow from these mature assets allows the company to invest in future opportunities while maintaining financial stability.

Eletrobrás's focus on operational efficiency across its mature businesses, particularly in hydroelectric generation and transmission, has further solidified their Cash Cow status. Cost reduction initiatives and streamlined processes in 2023 directly enhanced profit margins, maximizing cash flow from these established, market-leading assets.

| Segment | BCG Category | 2023 Revenue (R$ billion) | Key Characteristics |

|---|---|---|---|

| Hydroelectric Generation | Cash Cow | Significant contribution to total revenue | Mature assets, stable demand, long-term contracts |

| Transmission | Cash Cow | R$25.5 | Regulated market, dominant share, low growth, high margins |

Full Transparency, Always

Eletrobrás BCG Matrix

The preview you are viewing is the exact Eletrobrás BCG Matrix report you will receive upon purchase, offering a comprehensive strategic analysis of its business units. This document is fully formatted and ready for immediate use, providing clear insights into Eletrobrás's market position and growth potential. You'll gain access to a professionally designed report, meticulously crafted to aid in strategic decision-making and business planning. Rest assured, there are no watermarks or demo elements; only the complete, actionable BCG Matrix analysis for Eletrobrás.

Dogs

Eletrobrás has been actively divesting its thermal power plants, including coal and natural gas facilities, throughout 2024. These older, less efficient assets typically operate in low-growth markets and require substantial capital without generating commensurate returns, clearly positioning them as 'dogs' in the BCG matrix.

This strategic divestment, which includes assets like the Termelétrica de Cuiabá, helps Eletrobrás reduce its reliance on fossil fuels. For instance, the company's 2023 financial reports indicated ongoing efforts to streamline its portfolio, with thermal plants representing a shrinking portion of its operational capacity.

Eletrobrás has been divesting minority stakes in Special Purpose Entities (SPEs), primarily in generation and transmission. These are often ventures where Eletrobrás holds a limited influence or where the market's growth potential is modest, signaling a strategic move to simplify its asset base.

For instance, by the end of 2023, Eletrobrás had completed the sale of its 49% stake in the SPE Santo Antônio Energia, a significant move in its portfolio optimization strategy. This aligns with the company's broader goal of focusing on core, high-growth areas.

Legacy distribution assets within Eletrobrás, post-privatization, would likely be classified as dogs in a BCG matrix. These are assets in a mature, low-growth sector where Eletrobrás's market share is minimal, offering little strategic advantage.

For instance, if Eletrobrás retained any minor, non-core distribution operations, these would be in a market with limited expansion potential. Their contribution to overall revenue would be negligible, and they would require significant investment for maintenance rather than growth.

Outdated or Underutilized Infrastructure

Certain segments of Eletrobrás's older infrastructure, particularly those not slated for current modernization initiatives, might be classified as dogs. These assets often exhibit low utilization rates and incur substantial maintenance expenses without generating proportionate revenue. For instance, older thermal power plants with high operational costs and limited efficiency could fall into this category.

These underutilized or outdated infrastructure components are typically situated in low-growth markets. If not strategically managed or divested, they risk becoming significant cash drains for the company, diverting resources that could be better allocated to more promising ventures. Eletrobrás's 2024 financial reports may highlight specific divisions or assets with declining profitability or increasing operational burdens.

- Outdated Generation Assets: Older hydroelectric or thermal plants with lower efficiency and higher environmental compliance costs.

- Underutilized Transmission Lines: Portions of the transmission network with low power flow or redundancy, leading to inefficient capital deployment.

- Aging Distribution Networks: Segments of the distribution system experiencing high technical and non-technical losses, requiring frequent repairs.

Unprofitable Ancillary Services

Unprofitable ancillary services within Eletrobrás, such as certain minor maintenance contracts or specialized consulting that do not align with its core generation and transmission operations, could be categorized as Dogs. These units typically struggle with low market share in mature, stagnant sectors, yielding minimal returns. For instance, if a segment like specialized equipment repair for outdated power technologies consistently underperforms, it would fit this profile.

The company's strategic direction post-privatization in 2022, with a strong emphasis on operational efficiency and core business consolidation, indicates a deliberate effort to divest or restructure these underperforming units. Eletrobrás's focus is on optimizing its primary generation and transmission assets, which represent the bulk of its revenue and market presence.

- Low Market Share: Ancillary services often compete in niche or declining markets where Eletrobrás holds a small percentage of the overall business.

- Stagnant Market Growth: These services typically operate in sectors with little to no anticipated expansion, limiting potential for future profitability.

- Profitability Challenges: Consistently low margins or outright losses characterize these operations, draining resources without significant contribution.

- Strategic Divestment Potential: Eletrobrás's post-privatization strategy prioritizes shedding non-core, underperforming assets to enhance overall financial health.

Eletrobrás's divestment of older thermal power plants in 2024, like Termelétrica de Cuiabá, exemplifies its 'dog' assets. These are low-growth, capital-intensive operations with poor returns, a shrinking part of its portfolio as evidenced by 2023 financial reports. Similarly, any remaining minority stakes in Special Purpose Entities (SPEs) with modest market potential, such as the divested 49% stake in SPE Santo Antônio Energia by end-2023, also fall into this category, simplifying Eletrobrás's asset base.

Legacy distribution assets and underutilized transmission lines represent further 'dogs' within Eletrobrás's portfolio. These operate in mature, low-growth sectors where the company has minimal market share and offers little strategic advantage, often requiring maintenance over growth investment. For example, aging distribution networks with high losses and older infrastructure not slated for modernization are prime candidates for this classification.

Unprofitable ancillary services, such as specialized maintenance for outdated tech, are also classified as dogs. These units struggle with low market share in stagnant sectors, yielding minimal returns and presenting profitability challenges. Eletrobrás's post-privatization strategy actively aims to divest these non-core, underperforming assets to boost overall financial health.

| Asset Category | Description | Market Growth | Eletrobrás's Market Share | Profitability |

| Older Thermal Plants | Low efficiency, high operational costs | Low | Declining | Low/Negative |

| Minority SPE Stakes | Limited influence, modest market potential | Modest | Minor | Variable/Low |

| Legacy Distribution | High losses, mature sector | Low | Minimal | Low |

| Underutilized Transmission | Low power flow, redundancy | Low | Minor | Inefficient Capital |

| Ancillary Services | Niche, declining markets | Stagnant | Small | Challenging |

Question Marks

Eletrobrás's ventures into renewable hydrogen production, particularly through MoUs signed in May 2024, position it within a high-growth, emerging market. This strategic move aims to harness its substantial hydroelectric capacity for green hydrogen generation.

While the renewable hydrogen market shows significant future potential, Eletrobrás's current market share in this specific niche is minimal. This indicates a need for substantial capital infusion and strategic development to build a competitive presence.

As Brazil's energy landscape shifts towards renewables, advanced energy storage is emerging as a critical sector for grid reliability. Eletrobrás's participation, exemplified by its battery storage project at the Itumbiara hydroelectric plant, signifies an early-stage entry into this high-potential market. While current market share for these solutions is minimal, substantial investment could position Eletrobrás for significant future growth.

The global smart grid market is projected to reach over $100 billion by 2027, indicating significant growth potential. Eletrobrás, while a leader in Brazil's traditional energy transmission, is still developing its footprint in advanced smart grid technologies and digitalization, positioning these as question marks within its portfolio.

Strategic investment in these areas is crucial for Eletrobrás to capitalize on the increasing demand for efficient energy management and to maintain a competitive edge in the evolving energy landscape. For instance, the adoption of digital substation technologies is a key area where Eletrobrás can enhance operational efficiency and reliability.

International Market Expansion (New Regions)

Eletrobrás could consider expanding into new international markets, particularly in regions with rapidly growing energy demand and supportive regulatory frameworks. These new ventures would represent question marks in the BCG matrix, characterized by high potential growth but requiring substantial initial investment and a low initial market share.

For instance, exploring opportunities in Southeast Asia or parts of Africa, where energy infrastructure development is a priority, could offer significant upside. In 2024, many of these regions are experiencing GDP growth rates exceeding 5%, signaling robust economic activity and a corresponding increase in energy consumption. Eletrobrás's expertise in large-scale generation and transmission could be leveraged in these emerging markets.

- High Growth Potential: Emerging economies often exhibit faster electricity demand growth than mature markets.

- Initial Investment Needs: Establishing operations in new territories requires significant capital for infrastructure and market entry.

- Low Initial Market Share: Eletrobrás would be a new entrant, needing time and resources to build its presence.

- Strategic Partnerships: Collaborating with local entities could mitigate risks and accelerate market penetration in these question mark territories.

Innovative Energy Commercialization Models

The liberalization of Brazil's energy market, with the free energy market doubling in size in 2024, presents a significant opportunity for Eletrobrás to explore innovative commercialization models. This rapid expansion, driven by increased competition and consumer choice, creates a fertile ground for new approaches to energy sales and service delivery. Eletrobrás's presence in both regulated and free markets positions it uniquely to leverage these changes, but capturing a larger market share will necessitate strategic marketing and targeted investments in novel solutions.

Developing innovative commercialization models for Eletrobrás in this dynamic environment presents several key considerations:

- Customer-centric solutions: Offering tailored energy packages, smart grid integration services, and demand-side management programs to attract and retain customers in the competitive free market.

- Partnership strategies: Collaborating with technology providers, energy service companies, and industrial consumers to co-create value-added energy solutions.

- Digitalization and data analytics: Utilizing advanced analytics to understand consumer behavior, optimize energy distribution, and personalize service offerings.

- Sustainability-focused models: Promoting renewable energy sources and energy efficiency initiatives as key differentiators, aligning with growing environmental consciousness among consumers and businesses.

Eletrobrás's ventures into renewable hydrogen and advanced energy storage represent significant question marks, characterized by high growth potential but currently low market share. These emerging sectors require substantial investment to build a competitive presence, as seen with its early-stage battery storage project at Itumbiara. Similarly, its expansion into smart grid technologies and digitalization is still developing, despite the global market's projected growth to over $100 billion by 2027.

BCG Matrix Data Sources

Our Eletrobrás BCG Matrix leverages official financial disclosures, regulatory filings, and comprehensive market research reports. This ensures a robust foundation for strategic analysis.