Eletrobrás Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eletrobrás Bundle

Eletrobrás operates in a dynamic energy sector where supplier power is moderate, influenced by specialized equipment manufacturers and fuel providers. The threat of new entrants, while present, is tempered by high capital requirements and regulatory hurdles inherent in the utility industry.

The complete report reveals the real forces shaping Eletrobrás’s industry—from buyer power of large industrial consumers to the threat of substitute energy sources. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Eletrobrás is significantly influenced by the concentration of key manufacturers for specialized equipment. For critical components like large turbines, generators, and high-voltage transmission systems, the market often features a limited number of global players. This scarcity of specialized suppliers grants them considerable leverage in negotiating prices and contract terms.

Switching costs for Eletrobrás are generally high for critical infrastructure and advanced technology. For instance, replacing large-scale power generation equipment or core grid management systems requires substantial capital investment and can lead to prolonged operational downtime, reinforcing the leverage of existing suppliers.

However, Eletrobrás may face lower switching costs for more commoditized inputs. For example, procuring standard office supplies or basic raw materials from different vendors typically involves minimal disruption and financial commitment, thereby diminishing the bargaining power of suppliers in these categories.

The uniqueness of inputs is a significant factor in supplier bargaining power for Eletrobrás. For instance, specialized components crucial for maintaining and upgrading its extensive hydroelectric dam infrastructure, or advanced technologies for its growing wind power portfolio, can be sourced from a limited number of suppliers. This scarcity of alternatives for critical, proprietary technologies or unique services directly enhances the leverage these suppliers hold over pricing and contract terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Eletrobrás's business, meaning suppliers becoming electricity generators themselves, is quite low. This is because the core businesses of equipment manufacturers and fuel providers are very different from running a large-scale, regulated utility like Eletrobrás.

For instance, major power equipment suppliers in Brazil, such as those providing turbines or transmission infrastructure, generally lack the expertise and capital required to operate power generation plants and manage the complex regulatory environment. Their focus remains on manufacturing and technology, not on the operational and market risks associated with electricity production and distribution.

- Low Likelihood of Forward Integration: Suppliers like Siemens Energy or GE Vernova, key players in Brazil's energy infrastructure, are unlikely to venture into direct electricity generation due to distinct business models and high capital requirements.

- Capital Intensity Barrier: Entering the electricity generation sector requires massive, ongoing capital investment, far exceeding the typical investment profiles of equipment manufacturers.

- Regulatory Hurdles: The Brazilian electricity market is heavily regulated, demanding specialized knowledge and compliance that is outside the usual operational scope of suppliers.

- Focus on Core Competencies: Suppliers concentrate on their strengths in engineering and manufacturing, rather than the complex operational management of power plants and grid integration.

Importance of Eletrobrás to Suppliers

Eletrobrás's substantial presence in Brazil's electricity market makes it a crucial customer for numerous suppliers. This significant demand typically weakens supplier bargaining power, as losing Eletrobrás as a client would represent a considerable financial impact for many. For instance, in 2023, Eletrobrás's operational expenditures included substantial procurement from various industrial sectors, highlighting its role as a key buyer.

However, the dynamic shifts for suppliers offering specialized or high-technology components. For these niche providers, Eletrobrás's reliance on their unique offerings can partially offset the company's sheer size. This creates a more balanced negotiation environment where the supplier's limited alternatives are counteracted by Eletrobrás's specific need for their advanced products.

- Significant Customer Base: Eletrobrás's large-scale operations translate into substantial purchasing volumes across various supply chains.

- Revenue Dependence: For many suppliers, Eletrobrás represents a significant portion of their annual revenue, increasing their vulnerability to losing this business.

- Niche Supplier Leverage: Suppliers providing specialized equipment or technology may hold stronger bargaining positions due to Eletrobrás's dependence on their unique capabilities.

- Market Position Impact: In 2023, Eletrobrás's capital expenditures indicated a strong demand for advanced grid technologies, benefiting specialized suppliers.

The bargaining power of suppliers for Eletrobrás is moderate, influenced by the concentration of specialized equipment manufacturers and high switching costs for critical components. While Eletrobrás's sheer size as a customer can dilute supplier power for commoditized goods, its reliance on unique, high-technology inputs from a limited number of providers grants these suppliers significant leverage. The threat of forward integration by suppliers remains low due to the distinct nature of their core businesses and the capital-intensive, regulated environment of electricity generation.

| Factor | Eletrobrás Impact | Supplier Leverage |

| Supplier Concentration (Specialized Equipment) | High reliance on few global players | High |

| Switching Costs (Critical Components) | Very high due to capital and downtime | High |

| Uniqueness of Inputs | High for advanced grid and renewable tech | High |

| Eletrobrás's Customer Size | Weakens power for commoditized inputs | Low |

| Forward Integration Threat | Low due to business model differences | Low |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Eletrobrás's position in the Brazilian energy sector.

Eletrobrás's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making in the dynamic energy sector.

Customers Bargaining Power

Eletrobrás's customer base is largely composed of significant industrial users and electricity distribution companies, which in turn supply power to a broader range of end-consumers. This concentration of large-volume buyers is a key factor in their bargaining power.

Because these major clients purchase substantial quantities of electricity, they possess considerable leverage to negotiate advantageous pricing and contract terms. For instance, in 2023, Eletrobrás's revenue from the regulated market, which includes distribution companies, represented a significant portion of its overall income, highlighting the importance of these relationships.

The ability of these concentrated customers to demand better conditions can directly influence Eletrobrás's financial performance, impacting revenue streams and overall profitability through negotiated rates and service level agreements.

For Eletrobrás's major industrial clients and distribution partners, the costs associated with switching electricity providers are generally moderate to high. This is largely due to existing contractual agreements and the intricate regulatory environment governing energy supply.

While the fundamental infrastructure for electricity connection is already in place, the process of changing suppliers involves navigating complex contractual terms, ensuring grid stability, and securing dependable long-term energy sources. These factors contribute to a significant barrier, thereby somewhat mitigating the bargaining power of customers.

Customers, particularly large industrial users and distribution firms, possess significant market intelligence concerning electricity pricing, available supply sources, and evolving regulations. This heightened transparency within Brazil's energy sector, bolstered by regulatory oversight, empowers customers to make well-informed choices, thereby amplifying their leverage in negotiations with Eletrobrás.

Price Sensitivity of Customers

Customers in the electricity sector, especially major industrial consumers, are acutely aware of price changes because electricity is a substantial part of their operational expenses. In 2023, industrial electricity consumption in Brazil accounted for a significant portion of the total demand, making these users powerful negotiators.

Distribution companies also actively seek the most favorable prices to control their own expenses and the tariffs passed on to their end consumers. This persistent drive for cost efficiency among buyers directly amplifies their leverage over suppliers like Eletrobrás.

The high price sensitivity observed across the customer base forces Eletrobrás to adopt and maintain competitive pricing strategies. This, in turn, strengthens the bargaining power of these customers.

- High Price Sensitivity: Industrial users, a key customer segment, view electricity as a major operating cost, making them highly responsive to price variations.

- Cost Management for Distributors: Electricity distributors prioritize securing competitive prices to manage their own operational budgets and retail tariffs.

- Competitive Pressure: Eletrobrás faces pressure to offer competitive rates due to the significant bargaining power derived from customer price sensitivity.

Threat of Backward Integration by Customers

The threat of backward integration by Eletrobrás's customers is a significant consideration. Large industrial consumers, for instance, are increasingly exploring distributed generation, such as rooftop solar or co-generation facilities. This allows them to produce a portion of their own electricity, thereby reducing their dependence on Eletrobrás.

- Growing Trend in Distributed Generation: In 2024, Brazil saw a continued surge in distributed generation, with solar photovoltaic systems leading the charge. By the end of Q1 2024, the installed capacity for distributed generation in Brazil surpassed 38 GW, with a significant portion attributed to commercial and industrial consumers.

- Reduced Reliance and Increased Leverage: Even partial self-generation by these customers can diminish their reliance on Eletrobrás's grid services. This shift in power dynamics naturally increases their bargaining leverage when negotiating electricity supply contracts or tariffs.

- Cost-Effectiveness of Self-Generation: The declining costs of renewable energy technologies, particularly solar PV, make self-generation a more economically viable option for many industrial players. This economic incentive further fuels the threat of backward integration.

- Impact on Eletrobrás's Market Share: As more customers opt for self-generation, Eletrobrás could face a reduction in its customer base and, consequently, its market share and revenue streams, particularly from its industrial segment.

Eletrobrás faces considerable bargaining power from its customer base, primarily due to the concentration of large industrial users and distribution companies. These major buyers, accounting for substantial electricity consumption, can negotiate favorable pricing and contract terms, directly impacting Eletrobrás's revenue. In 2023, the regulated market, dominated by distribution companies, represented a significant portion of Eletrobrás's income, underscoring the importance of these relationships.

Customers' ability to switch providers is somewhat mitigated by moderate to high switching costs, stemming from existing contracts and regulatory complexities. However, their access to market intelligence regarding pricing and supply, coupled with high price sensitivity, amplifies their leverage. For instance, industrial consumers in Brazil in 2023 represented a substantial part of total electricity demand, making them powerful negotiators focused on managing significant operational expenses.

The increasing trend of distributed generation, particularly solar PV, among industrial clients in 2024 further strengthens customer bargaining power. By mid-2024, Brazil's distributed generation capacity exceeded 40 GW, with commercial and industrial sectors being major contributors. This self-generation reduces customer reliance on Eletrobrás, potentially impacting its market share and revenue.

| Customer Segment | Key Bargaining Factors | Impact on Eletrobrás |

|---|---|---|

| Industrial Users | High price sensitivity, significant consumption volume, growing self-generation capacity | Pressure on pricing, potential reduction in demand |

| Distribution Companies | Large purchase volumes, ability to pass costs to end-consumers, contractual leverage | Negotiation of tariffs and service agreements, influence on revenue |

Preview the Actual Deliverable

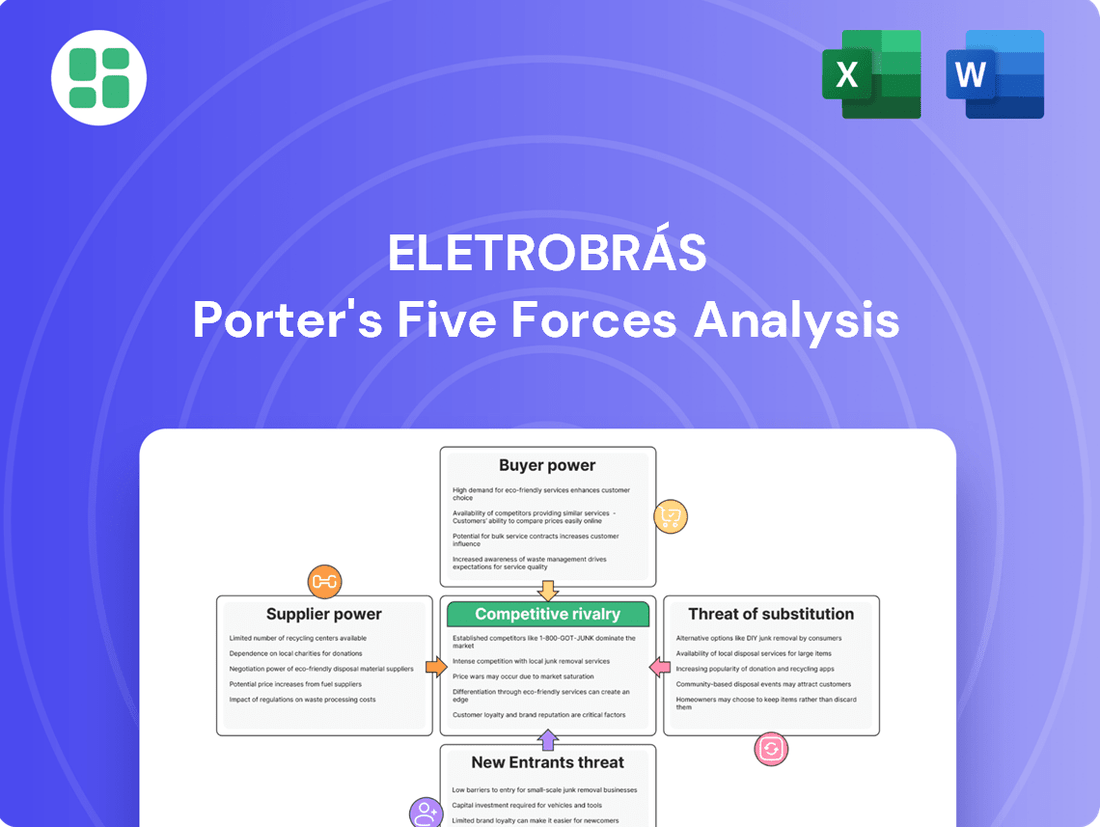

Eletrobrás Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, offering a comprehensive Porter's Five Forces analysis of Eletrobrás. You'll gain immediate insight into the competitive landscape, including buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, all presented in a professionally formatted and ready-to-use file. This detailed analysis will equip you with the strategic understanding needed to navigate Eletrobrás's market dynamics effectively.

Rivalry Among Competitors

The Brazilian electricity sector, especially post-Eletrobrás privatization in 2022, has experienced a significant influx of both domestic and international private players in generation and transmission. This has naturally led to a more fragmented market landscape.

This increased competition means Eletrobrás now faces a more diverse set of rivals, ranging from established energy companies to newer, specialized entities, all vying for market share in a sector that saw significant investment in renewable energy in 2023, with Brazil adding over 2.7 GW of solar and wind power capacity.

Brazil's electricity sector is booming, with substantial capacity additions, particularly in renewable sources like solar and wind power. In 2023, Brazil added approximately 13.8 GW of new power generation capacity, with renewables accounting for the vast majority of this expansion.

This robust growth, while generally positive for the industry, intensifies competitive rivalry. As new players enter and existing ones like Eletrobrás aggressively expand, the competition for market share becomes more pronounced. Companies must continually invest in new projects and upgrades to maintain their competitive edge in this dynamic and increasingly crowded market.

Electricity is fundamentally a commodity, making it inherently difficult for companies like Eletrobrás to truly differentiate their core product. However, differentiation is possible through aspects like the reliability of their power supply, how efficiently they transmit electricity, the quality of their customer service, and their dedication to renewable or clean energy sources. These are key battlegrounds in the competitive landscape.

Eletrobrás benefits from its extensive transmission network, a significant asset that allows for broad reach and potentially more reliable delivery. Furthermore, its substantial portfolio of clean energy generation, particularly hydroelectric power, offers a strong point of differentiation. In 2023, Eletrobrás reported a significant portion of its generation coming from renewable sources, contributing to its clean energy image.

Despite these advantages, Eletrobrás faces intense rivalry as competitors are also actively promoting their own reliability, transmission efficiency, and clean energy initiatives. For instance, other major players in the Brazilian energy sector are investing heavily in solar and wind power, directly challenging Eletrobrás's clean energy leadership. This means Eletrobrás must continuously innovate and highlight its unique strengths to stand out.

Exit Barriers in the Industry

Exit barriers in the electricity sector are substantial, largely due to the immense capital required for power plants and transmission infrastructure, which often have lifespans exceeding several decades. This makes it incredibly difficult and costly for companies to leave the market once they've invested.

These high exit barriers compel existing players to remain competitive even in unfavorable market conditions, as abandoning such significant investments is often not a viable option. Consequently, this can lead to prolonged periods of intense rivalry among established companies.

- Massive Capital Investments: Eletrobras, for instance, operates extensive hydroelectric, thermal, and transmission assets, representing billions of dollars in sunk costs.

- Long Asset Lifecycles: Power generation and transmission equipment are built to last for 30-60 years or more, locking companies into long-term operational commitments.

- Specialized Infrastructure: The highly specialized nature of power generation and transmission assets means they have little to no alternative use outside the energy sector, further increasing exit costs.

Cost Structure and Economies of Scale

The electricity sector inherently involves substantial fixed costs, particularly in generation infrastructure and transmission networks, leading to significant economies of scale. Eletrobrás, as a major player in Brazil, leverages its extensive installed capacity and vast transmission grid to spread these high fixed costs over a larger output, thereby reducing its average cost per unit of electricity produced and delivered. This scale advantage is a critical component of its cost structure.

However, the competitive landscape is evolving. The emergence of new, more efficient generation technologies, such as advanced solar and wind power, along with the growth of smaller-scale distributed generation, presents a challenge to the traditional cost advantages enjoyed by large incumbents like Eletrobrás. These distributed systems can operate with lower upfront capital requirements and may not bear the same transmission infrastructure costs as centralized power plants.

For instance, in 2024, Brazil continued to see robust growth in renewable energy sources. The distributed generation solar segment alone added significant capacity, often bypassing the need for extensive grid upgrades that are a major cost for traditional utilities. This shift means that while Eletrobrás benefits from its existing scale, the marginal cost advantage of new, smaller, and often cleaner technologies is becoming increasingly competitive, influencing the overall intensity of rivalry within the sector.

- High Fixed Costs: The electricity industry requires massive initial investments in power plants and transmission lines, creating a high barrier to entry and favoring established players with existing infrastructure.

- Economies of Scale: Larger operational capacity allows companies like Eletrobrás to spread fixed costs over more units of electricity, leading to lower per-unit production costs.

- Emerging Technologies: Advances in renewable energy and distributed generation offer more modular and scalable solutions, potentially reducing the cost advantage of large-scale, centralized systems.

- Competitive Pressure: The increasing viability of smaller, more efficient energy sources challenges the cost dominance of traditional utilities, intensifying competition and potentially impacting pricing power.

Competitive rivalry within Brazil's electricity sector is intense, driven by Eletrobrás's privatization and the subsequent influx of new players. This heightened competition is fueled by significant investments in renewable energy, with Brazil adding substantial capacity in solar and wind power throughout 2023 and continuing this trend into 2024. While Eletrobrás leverages its vast transmission network and clean energy portfolio, competitors are also aggressively pursuing similar strategies, making differentiation crucial.

The commodity nature of electricity means Eletrobrás must focus on reliability, transmission efficiency, and its clean energy credentials to stand out. Despite these efforts, rivals are investing heavily in renewables, directly challenging Eletrobrás's market position. The high capital requirements and long asset lifecycles in the sector create substantial exit barriers, compelling companies to remain competitive even when facing challenging market conditions, thus perpetuating intense rivalry.

Economies of scale benefit Eletrobrás through its extensive infrastructure, but emerging technologies like distributed solar generation are altering the cost landscape. These newer, often cleaner, energy sources present a growing challenge to traditional utilities, intensifying competition and potentially impacting pricing power as the market evolves.

| Metric | Eletrobrás (as of 2023/2024 data) | Key Competitors (General Trend) |

| Market Share (Generation) | Significant, but facing dilution | Increasing, particularly in renewables |

| Renewable Capacity Growth (Brazil, 2023) | Substantial contribution from hydro | Rapid growth in solar and wind (over 13.8 GW added in 2023) |

| Transmission Network Size | Largest in Brazil | Expanding, but often more localized |

| Investment in New Technologies | Ongoing focus on modernization and renewables | Aggressive investment in solar, wind, and distributed generation |

SSubstitutes Threaten

The primary substitute for Eletrobrás's large-scale grid electricity is distributed generation. This includes rooftop solar photovoltaic systems for homes and businesses, as well as on-site co-generation plants for industries. These alternatives offer consumers more control and can reduce reliance on the traditional grid.

Brazil has experienced a notable surge in renewable energy capacity, particularly in solar and wind power, including distributed generation. By the end of 2023, Brazil's installed solar capacity, encompassing both centralized and distributed generation, reached approximately 38 GW, demonstrating a significant shift towards alternative energy sources that directly challenges centralized supply models.

The price-performance trade-off for renewable substitutes like solar and wind power is rapidly improving, making them strong contenders against traditional grid electricity. In 2024, the levelized cost of electricity (LCOE) for utility-scale solar PV continued its downward trend, with some projects achieving costs as low as $20-30 per megawatt-hour, significantly narrowing the gap with conventional sources.

While Eletrobrás benefits from established grid infrastructure and consistent supply, the increasing affordability of distributed solar generation, coupled with advancements in battery storage technology, presents a growing threat. By 2025, the cost of residential battery storage is projected to fall by another 10-15%, enhancing the economic viability of self-generation for a broader consumer base, even in regions with reliable grid access.

Customer propensity to substitute for Eletrobrás's services is influenced by several key drivers. Cost savings remain a primary motivator, with consumers actively seeking ways to reduce their energy bills. Furthermore, growing environmental awareness and a desire for greater energy independence are pushing individuals and businesses towards alternative energy sources. In Brazil, regulatory incentives specifically aimed at promoting distributed generation are increasingly encouraging consumers to explore and adopt these alternative solutions, potentially impacting the long-term demand for Eletrobrás's traditional offerings.

Impact of Energy Efficiency Measures

Energy efficiency measures, like smarter appliances and industrial process upgrades, reduce the need for electricity. These efforts act as indirect substitutes, potentially slowing demand growth for Eletrobrás. For instance, Brazil's National Electric Energy Agency (ANEEL) has promoted energy efficiency programs, aiming to reduce consumption. While not a direct replacement for Eletrobrás's services, these initiatives can influence Eletrobrás's revenue projections and strategic planning.

The threat of substitutes is amplified as consumers and industries become more conscious of energy usage and costs. Improvements in building insulation and the adoption of energy-saving technologies directly lower electricity consumption, thereby reducing the volume of electricity Eletrobrás needs to supply. As of early 2024, the ongoing push for sustainability and cost reduction across sectors continues to drive the adoption of these efficiency measures.

- Reduced Demand Growth: Energy efficiency measures directly curb electricity consumption, impacting the overall market size for Eletrobrás.

- Technological Advancements: Innovations in smart grids and appliance technology make it easier and more cost-effective for end-users to reduce their reliance on traditional electricity supply.

- Policy Support: Government incentives and regulations promoting energy efficiency further bolster the threat of these substitutes.

- Cost Savings for Consumers: The primary driver for adoption is the direct financial benefit to consumers and businesses through lower electricity bills.

Emerging Technologies and Grid Independence

Emerging technologies are indeed presenting a growing threat of substitution for traditional utility models. Advanced battery storage solutions, for instance, are becoming more efficient and affordable, allowing consumers to store solar energy generated on-site. This reduces their immediate need for electricity drawn from the grid. In 2023, global investment in energy storage systems reached an estimated $150 billion, a significant increase from previous years, indicating the rapid development and adoption of these technologies.

Microgrids, which can operate independently or connected to the main grid, further amplify this threat. They enable localized energy generation and distribution, offering greater resilience and control to consumers. This shift towards distributed energy resources means that companies like Eletrobrás, which rely on large-scale, centralized infrastructure, could see a gradual erosion of their customer base as more consumers opt for self-sufficiency or localized energy networks. While complete grid defection remains a distant prospect for most, the increasing viability of these alternatives poses a clear strategic challenge.

- Technological Advancement Battery storage and microgrid technology are improving rapidly.

- Consumer Empowerment These innovations allow for greater energy independence and localized solutions.

- Investment Growth Global investment in energy storage systems saw substantial growth in 2023, reaching approximately $150 billion.

- Market Shift A gradual move towards distributed energy resources could impact reliance on centralized utilities.

The threat of substitutes for Eletrobrás is significant, primarily driven by the rise of distributed generation, especially solar photovoltaic systems. These alternatives offer consumers greater control and can reduce their dependence on the traditional grid. By late 2023, Brazil’s solar capacity, including distributed generation, neared 38 GW, highlighting a strong shift towards these alternatives.

The improving cost-effectiveness of renewable substitutes, like solar power, directly challenges Eletrobrás. In 2024, the levelized cost of electricity for utility-scale solar PV continued to fall, with some projects achieving costs around $20-30 per megawatt-hour, making it increasingly competitive.

Energy efficiency measures also act as indirect substitutes by reducing overall electricity demand. Brazil’s ANEEL promotes efficiency programs, aiming to lower consumption. As of early 2024, the focus on sustainability and cost reduction continues to drive the adoption of these measures, impacting Eletrobrás’s potential revenue growth.

Emerging technologies like advanced battery storage and microgrids further amplify this threat by enabling greater energy independence and localized solutions. Global investment in energy storage systems reached an estimated $150 billion in 2023, underscoring the rapid development and adoption of these alternatives.

| Substitute Type | Key Drivers | Impact on Eletrobrás | 2023/2024 Data Point |

|---|---|---|---|

| Distributed Generation (Solar PV) | Cost reduction, energy independence, environmental concerns | Reduced demand for grid electricity, potential customer churn | Brazil's solar capacity ~38 GW (end of 2023) |

| Energy Efficiency | Cost savings, sustainability goals, regulatory support | Lower overall electricity consumption, slower demand growth | ANEEL promoting efficiency programs |

| Battery Storage & Microgrids | Technological advancements, affordability, grid resilience | Increased self-sufficiency for consumers, potential grid disintermediation | Global energy storage investment ~$150 billion (2023) |

| Renewable Energy LCOE | Technological innovation, economies of scale | Increased competitiveness against traditional sources | Utility-scale solar PV LCOE ~$20-30/MWh (2024) |

Entrants Threaten

The electricity generation and transmission sectors, Eletrobrás's primary domains, demand immense capital outlays for constructing power plants, transmission networks, and related infrastructure. For instance, a single large-scale hydroelectric project can cost billions of dollars, a figure far beyond the reach of most aspiring companies.

This significant financial hurdle acts as a powerful deterrent, effectively limiting the pool of potential new entrants to only those with substantial financial backing or the ability to form robust consortia capable of meeting these high capital requirements.

The Brazilian electricity sector presents a formidable barrier to new entrants due to extensive regulatory hurdles and complex licensing requirements. Agencies like ANEEL (Agência Nacional de Energia Elétrica) oversee a stringent approval process, demanding adherence to intricate technical standards, environmental impact assessments, and long-term concession agreements.

Navigating this labyrinth of regulations is a significant challenge, often requiring substantial upfront investment in legal counsel and compliance expertise. For instance, obtaining the necessary permits and licenses can extend over several years, delaying market entry and increasing overall project costs, thereby discouraging potential new competitors.

Existing players like Eletrobrás leverage substantial economies of scale in electricity generation and transmission. This scale allows them to spread fixed costs over a larger output, resulting in lower per-unit costs. For instance, Eletrobrás's extensive network and diverse generation portfolio in 2024 provide a cost advantage that is difficult for newcomers to replicate.

New entrants face a significant hurdle in achieving comparable cost efficiencies. They would require massive upfront capital investment to build similar-scale infrastructure and gain the operational experience that Eletrobrás has accumulated over decades. This initial disadvantage makes it challenging for them to compete on price and profitability from the outset.

Access to Transmission and Distribution Networks

For new electricity generation companies looking to enter the market, securing access to Eletrobrás's extensive transmission and distribution networks is a fundamental hurdle. This access is non-negotiable for delivering power to consumers.

While Brazil's regulatory framework generally supports open access to these essential grids, the practicalities of obtaining reliable and affordable connection points can be a significant challenge. This process often involves intricate negotiations and can be time-consuming, effectively acting as a deterrent for potential new players.

For instance, in 2024, the expansion and maintenance of Brazil's transmission lines, managed by entities like Eletrobrás, continue to be a critical factor in integrating new generation capacity. The cost and timeline associated with new grid connections are directly influenced by the ongoing investments and regulatory approvals for these infrastructure projects.

- Network Access Complexity: New entrants face challenges in navigating the technical and administrative requirements for connecting to existing transmission and distribution infrastructure.

- Cost and Time Barriers: Securing timely and cost-effective connection points can significantly impact the financial viability and launch speed of new generation projects.

- Regulatory Environment: While regulations promote open access, the implementation and interpretation of these rules can create practical barriers for new market participants.

Government Policy and Concessions

The Brazilian government's policy regarding long-term concessions and auction mechanisms significantly shapes the threat of new entrants in the energy sector. These government-controlled processes determine the terms and availability of opportunities for new players, directly impacting the sector's attractiveness.

For instance, in 2024, the government continued to manage energy auctions, a key avenue for new capacity. The success and structure of these auctions, which Eletrobrás actively participates in, dictate the ease with which new companies can enter and compete for generation or distribution rights.

- Concession Terms: Government-issued concessions for energy generation and transmission often have specific requirements and durations, acting as a barrier or facilitator for new entrants.

- Auction Mechanisms: The design and outcomes of energy auctions, a primary method for awarding new capacity, directly influence the competitive landscape and the potential for new companies to secure market access.

- Regulatory Environment: Changes in energy policy and regulation by the government can either open up or restrict market access, thereby altering the threat of new entrants.

The threat of new entrants for Eletrobrás is generally low due to substantial capital requirements and complex regulatory landscapes in Brazil's electricity sector. For example, building a new power plant can cost billions, a sum few new companies can readily access. This financial barrier, coupled with stringent licensing and long approval processes managed by agencies like ANEEL, significantly deters potential competitors.

Existing players like Eletrobrás benefit from significant economies of scale, allowing them to offer lower per-unit costs, a competitive advantage difficult for newcomers to match. Accessing Eletrobrás's extensive transmission infrastructure, crucial for delivering power, also presents practical and time-consuming challenges for new entrants, further limiting their market entry potential.

Government policies, including concession terms and energy auction designs, also play a critical role in shaping the competitive environment. In 2024, the structure of these auctions, which Eletrobrás actively participates in, directly influences how easily new companies can gain access to generation or distribution rights, thereby managing the overall threat.

| Factor | Impact on New Entrants | Eletrobrás's Position |

|---|---|---|

| Capital Requirements | Extremely High (Billions for new plants) | Established infrastructure and financial capacity |

| Regulatory Hurdles | Complex and time-consuming (ANEEL approvals, licensing) | Experienced in navigating regulations |

| Economies of Scale | Difficult to replicate (lower per-unit costs) | Significant cost advantage due to large operational scale |

| Network Access | Challenging (negotiations, connection costs) | Owns and operates extensive transmission network |

| Government Policy (Auctions/Concessions) | Influences market entry opportunities | Active participant and beneficiary of current policies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eletrobrás is built upon a foundation of publicly available financial reports, regulatory filings from the Brazilian Electricity Regulatory Agency (ANEEL), and industry-specific data from energy sector research firms. This ensures a comprehensive understanding of the competitive landscape.