Element PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

Unlock the critical external factors shaping Element's strategic landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting its operations and future growth. Equip yourself with actionable intelligence to navigate these forces and gain a competitive advantage. Download the full PESTLE analysis now for a deeper dive.

Political factors

Governments across North America, Australia, and New Zealand are tightening rules on vehicle emissions and safety. For instance, Canada's proposed Clean Fuel Regulations aim to reduce the carbon intensity of transportation fuels, impacting fleet choices. These evolving standards directly shape client acquisition preferences and maintenance practices.

Stricter emission mandates, like those being adopted in California and other US states, push fleets towards electric vehicles (EVs) and lower-emission alternatives. This trend can increase demand for Element's fleet management services focused on transitioning to greener vehicles, while also requiring adjustments to their vehicle sourcing and maintenance strategies. For example, many jurisdictions are setting targets for zero-emission vehicle sales by 2030 or 2035.

Changes in international trade policies, including the imposition of tariffs on imported vehicles or parts, directly affect the cost of acquiring vehicles for Element Fleet Management and its customers. For instance, a hypothetical 10% tariff on imported vehicle components could add thousands of dollars to the price of a new fleet vehicle, impacting overall acquisition budgets.

These policy shifts can destabilize supply chains and affect vehicle availability across various regions. For example, if a major trading partner imposes retaliatory tariffs, it could disrupt the flow of vehicles or critical parts, leading to longer wait times and increased operational costs for fleets relying on timely vehicle replacements.

Governments worldwide are actively promoting electric vehicle (EV) adoption through a mix of financial incentives. For instance, in 2024, the U.S. federal government continued to offer tax credits of up to $7,500 for qualifying new EVs and up to $4,000 for used EVs, stimulating consumer demand.

These policies directly impact fleet management companies like Element Fleet Management by encouraging the transition of commercial fleets to EVs. This shift presents opportunities for new service offerings in charging infrastructure management and specialized EV maintenance, while also posing challenges related to the initial investment in electrified vehicles and the need for updated technician training.

Geopolitical Stability and Economic Sanctions

Geopolitical stability is a critical consideration for Element Fleet Management. For instance, ongoing conflicts in Eastern Europe, which intensified in 2022 and continued through 2024, have disrupted global supply chains, including automotive manufacturing. This instability can lead to extended vehicle delivery times and increased costs, directly impacting Element's ability to service its clients efficiently.

Economic sanctions, often imposed in response to geopolitical events, can further complicate operations. As of early 2024, sanctions against Russia and certain other nations have restricted trade and financial transactions. While Element Fleet Management's direct exposure might be limited, these sanctions can indirectly affect its clients who operate internationally or rely on global suppliers, potentially impacting their financial health and their need for fleet services.

- Supply Chain Disruptions: Geopolitical tensions can lead to shortages of critical vehicle components, extending lead times for new vehicles. For example, the semiconductor shortage, exacerbated by geopolitical factors and increased demand, impacted vehicle production significantly throughout 2022-2023 and continued to be a concern into 2024.

- Client Financial Health: Clients operating in regions affected by instability or sanctions may face financial strain, potentially leading to reduced fleet orders or delayed payments, impacting Element's revenue streams.

- Operational Risk: Political instability in key markets can pose direct operational risks, including disruptions to logistics, maintenance services, and employee safety.

- Regulatory Changes: Evolving political landscapes can result in new regulations affecting vehicle emissions, fuel standards, or international trade, requiring Element to adapt its fleet strategies and offerings.

Taxation Policies on Corporate Fleets and Fuel

Changes in corporate taxation policies, such as deductions for fleet expenses or increased fuel taxes, directly impact the operational costs for Element Fleet Management's clients. For instance, in 2024, many countries are reviewing or implementing higher fuel excise duties to encourage greener transportation, which could increase fleet operating expenses by an estimated 5-10% for non-electric vehicles.

These fiscal policies can significantly influence how clients allocate their budgets for fleet services. A reduction in tax deductibility for certain fleet expenses might lead businesses to seek more cost-optimization solutions, boosting demand for comprehensive fleet management services that Element offers, particularly those focused on fuel efficiency and alternative fuel adoption.

- Increased Fuel Taxes: Several nations are raising fuel taxes in 2024-2025, potentially adding $0.05-$0.15 per gallon to fuel costs for businesses.

- Vehicle Registration Taxes: Some regions are introducing or revising vehicle registration taxes, with new tiered systems based on emissions or vehicle weight, impacting fleet acquisition costs.

- Deduction Limitations: Changes to the deductibility of certain fleet-related expenses, like mileage or depreciation, could reduce tax benefits for companies, pushing them towards more efficient fleet management.

Governments are increasingly prioritizing sustainability, leading to stricter emissions standards and mandates for electric vehicle adoption. For example, many European countries are targeting 2035 for the phase-out of new internal combustion engine vehicle sales, directly influencing fleet composition. These regulatory shifts necessitate strategic planning for fleet electrification and the management of charging infrastructure.

Geopolitical instability and trade policies significantly impact vehicle supply chains and operational costs. For instance, ongoing trade disputes or regional conflicts can lead to tariffs on vehicle components or disruptions in manufacturing, as seen with the semiconductor shortages that extended into 2023-2024. Such factors can increase vehicle acquisition costs and lead times for fleet managers.

Fiscal policies, including changes in fuel taxes and vehicle-related deductions, directly affect fleet operating expenses and client budgets. With many nations aiming to increase fuel excise duties by an average of $0.05-$0.15 per gallon by 2025 to encourage greener transport, businesses face rising operational costs for non-electric fleets.

What is included in the product

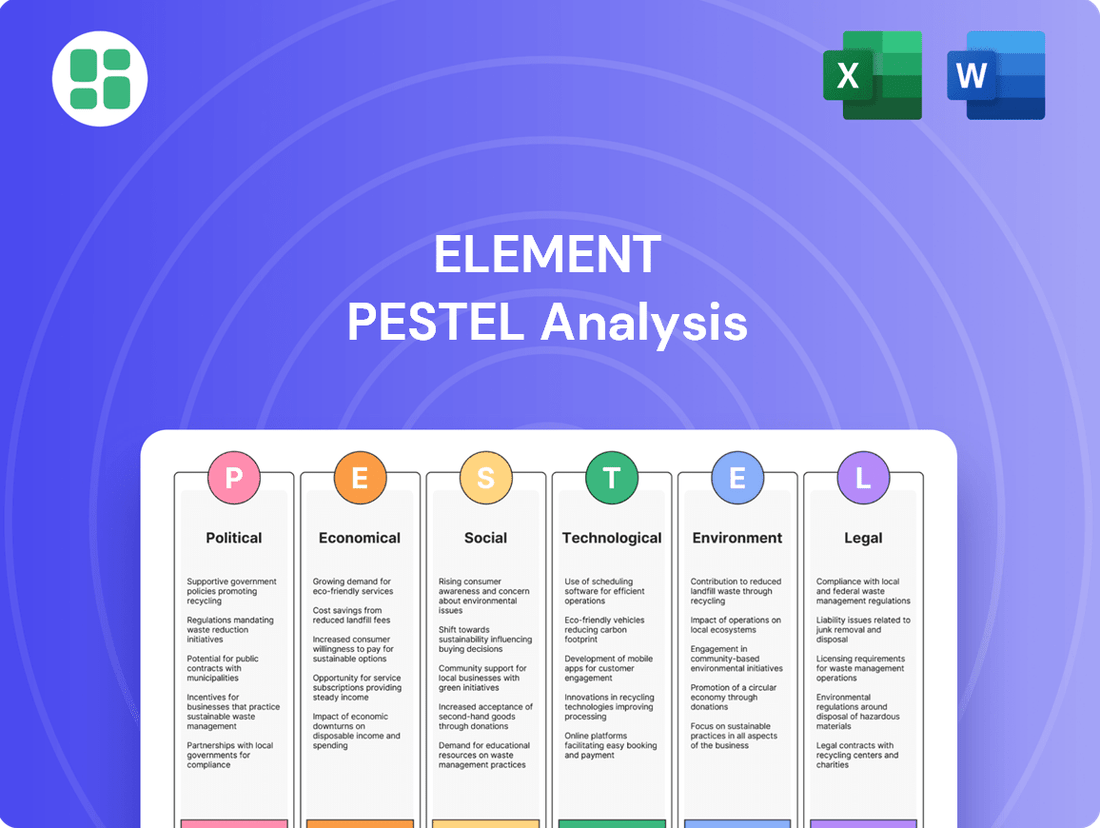

The Element PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing a business, providing a comprehensive understanding of the external landscape.

The Element PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating market uncertainties and potential disruptions by offering clarity on the forces shaping your business environment.

Economic factors

Changes in benchmark interest rates set by central banks significantly influence Element Fleet Management's expenses for acquiring and leasing vehicles. For instance, if the Federal Reserve raises the federal funds rate, Element's borrowing costs for its extensive fleet portfolio will likely increase. This directly affects their ability to offer competitive financing rates to clients.

Higher interest rates can also make fleet ownership more expensive for Element's customers. This might lead to a slowdown in demand for new vehicle acquisitions or a preference for leasing over purchasing, impacting Element's service offerings and revenue streams. For example, a 1% increase in interest rates could add millions to the cost of financing a large fleet.

In 2024, many central banks, including the Federal Reserve and the European Central Bank, have maintained elevated interest rates to combat inflation. This environment means Element Fleet Management and its clients continue to face higher financing costs, a key consideration in fleet management strategies throughout the year and into 2025.

Persistent inflation continues to be a significant headwind, with the US Consumer Price Index (CPI) showing a 3.3% increase year-over-year as of May 2024. This directly translates to higher operational costs for Element Fleet Management, impacting everything from vehicle acquisition and maintenance to fuel expenses, thereby squeezing profit margins.

Supply chain disruptions, a lingering effect of global economic volatility, are still causing vehicle shortages and extended delivery timelines. For instance, the average wait time for new vehicle orders in the US fleet market remained elevated throughout 2024, impacting Element's ability to fulfill client needs promptly and potentially affecting client satisfaction.

Economic growth in North America, Australia, and New Zealand directly impacts commercial vehicle fleet investment. For instance, in 2024, the US economy was projected to grow by approximately 2.3%, fostering an environment where businesses are more likely to expand operations and thus invest in new or upgraded fleets.

Conversely, economic slowdowns, such as the anticipated 1.1% GDP growth in Australia for 2025, can prompt businesses to postpone fleet expansions or even reduce fleet sizes due to decreased demand for goods and services. This cautious approach is a common response to economic uncertainty.

Fuel Price Volatility

Fluctuations in global oil prices directly impact Element Fleet Management's clients, especially those with significant fuel consumption. For instance, Brent crude oil prices saw considerable swings in late 2023 and early 2024, impacting operating costs. While Element's fuel management services help clients navigate these changes, extreme volatility can strain budgets and steer purchasing decisions towards more fuel-efficient or alternative fuel vehicles.

The unpredictable nature of fuel costs presents a challenge for fleet operators. Consider the average price of gasoline in the US, which can fluctuate by tens of cents per gallon within weeks, affecting the total cost of ownership for a fleet. This volatility can influence client demand for:

- Fuel-efficient vehicle acquisition.

- Adoption of electric or hybrid vehicle fleets.

- Investment in alternative fueling infrastructure.

- Utilization of Element's fuel card programs for cost control.

Currency Exchange Rate Movements

Currency exchange rate movements present a significant factor for Element Fleet Management, given its operations in Canada, the United States, Australia, and New Zealand. Fluctuations between the Canadian Dollar (CAD), US Dollar (USD), Australian Dollar (AUD), and New Zealand Dollar (NZD) can directly impact Element's reported earnings and the cost of its international vehicle procurement. For instance, a stronger USD against the CAD could increase the cost of vehicles sourced from the US, affecting profit margins.

These currency dynamics also influence Element's competitive positioning in different markets. If the CAD strengthens considerably, Element's services priced in CAD might become relatively more expensive for clients in countries with weaker currencies, potentially impacting demand. Conversely, a weaker CAD could make its services more attractive internationally.

- Impact on Reported Earnings: For example, in Q1 2024, Element reported that adverse foreign currency movements negatively impacted its net income by approximately $3 million.

- Vehicle Acquisition Costs: A 10% appreciation of the USD against the CAD could increase the cost of US-sourced vehicles by a similar percentage, impacting Element's cost of goods sold.

- Geographic Competitiveness: If the AUD weakens by 5% against the CAD, Element's Australian operations might see a reduction in the reported value of their earnings when translated back to CAD.

- Hedging Strategies: Element may employ currency hedging strategies to mitigate some of these risks, but these also incur costs and may not fully offset all potential losses.

Elevated interest rates, maintained by central banks like the Federal Reserve through 2024 and into 2025, increase Element Fleet Management's borrowing costs for vehicle financing. Persistent inflation, evidenced by a 3.3% CPI increase year-over-year in May 2024, raises operational expenses for Element, from vehicle acquisition to fuel. Economic growth projections, such as the 2.3% for the US in 2024, positively influence fleet investment, while slowdowns, like Australia's projected 1.1% growth in 2025, can dampen it.

Fluctuations in global oil prices directly affect clients' fuel budgets and purchasing decisions, steering them towards more efficient vehicles. Currency exchange rate movements, such as the USD against the CAD, impact Element's reported earnings and international vehicle procurement costs, with adverse currency movements costing Element approximately $3 million in Q1 2024.

| Economic Factor | Impact on Element Fleet Management | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Increases borrowing costs, affects client financing affordability. | Elevated rates maintained by Fed and ECB through 2024. |

| Inflation | Raises operational costs (acquisition, maintenance, fuel). | US CPI at 3.3% YoY (May 2024); persistent inflationary pressures. |

| Economic Growth | Drives fleet investment (growth) or postpones it (slowdown). | US projected 2.3% growth (2024); Australia projected 1.1% growth (2025). |

| Oil Prices | Influences client fuel budgets and vehicle preference. | Volatile Brent crude prices in late 2023/early 2024; significant gasoline price swings. |

| Currency Exchange Rates | Impacts reported earnings and international procurement costs. | Adverse movements cost Element ~$3M in Q1 2024; USD strength vs CAD increases US vehicle costs. |

What You See Is What You Get

Element PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Element PESTLE Analysis template provides a structured framework to explore the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business. Gain actionable insights to inform your strategic decision-making.

Sociological factors

Societal priorities are increasingly leaning towards environmental consciousness, pushing businesses to embrace greener transportation solutions. This shift is evident in the growing demand for electric vehicles (EVs) and hybrid models within corporate fleets. For Element Fleet Management, this presents a significant opportunity to broaden its service offerings, focusing on EV integration, charging station development, and sustainability reporting to align with clients' escalating corporate social responsibility objectives.

Demographic shifts are significantly reshaping the workforce, with an aging population leading to a greater number of experienced workers retiring. This trend, coupled with a persistent shortage of qualified commercial drivers, directly impacts the operational efficiency and cost structure for companies managing client fleets. For instance, in 2024, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure projected to grow.

Element Fleet Management can address these challenges by offering advanced solutions like telematics. These systems enable detailed driver behavior analysis, allowing clients to optimize routes and driving practices. This not only helps mitigate the impact of driver shortages but also improves overall fleet utilization by maximizing the productivity of existing personnel.

Increasing urbanization continues to strain infrastructure, leading to significant traffic congestion in major metropolitan areas globally. For Element Fleet Management, this translates directly to challenges for their clients’ fleets, impacting everything from fuel efficiency to delivery schedules. For instance, in 2024, cities like Los Angeles and London consistently ranked among the worst for traffic delays, costing businesses billions annually in lost productivity and increased operational expenses.

This persistent congestion is a key driver for the adoption of advanced fleet management technologies. Demand is rising for sophisticated route optimization software, real-time GPS tracking, and specialized urban delivery solutions. These tools are crucial for Element’s clients to navigate dense urban environments effectively, ensuring timely deliveries and minimizing the costly effects of traffic gridlock, a trend expected to accelerate as more populations shift to cities.

Changing Consumer and Business Mobility Expectations

Societal expectations are rapidly shifting towards on-demand and flexible services, directly impacting how businesses manage their transportation needs. This trend encourages a move away from traditional ownership models towards more adaptable solutions.

Element Fleet Management is seeing increased client interest in shared fleet arrangements, short-term leasing options, and comprehensive mobility packages. For instance, a significant portion of the commercial vehicle leasing market is exploring flexible terms, with some reports indicating a 15% year-over-year increase in inquiries for such services in late 2024.

- On-Demand Culture: Consumers and businesses alike now expect immediate access to services, including transportation, influencing fleet management strategies.

- Flexibility Demand: Clients are seeking adaptable leasing agreements and fleet solutions that can scale with their changing operational requirements.

- Shared Mobility Growth: The rise of car-sharing and ride-sharing platforms is normalizing the idea of shared vehicle usage, extending to business fleets.

- Integrated Solutions: Businesses are looking for providers who can offer end-to-end mobility management, encompassing acquisition, maintenance, and disposal, often through technology-driven platforms.

Emphasis on Driver Safety and Well-being

Societal expectations and regulatory mandates are intensifying the focus on driver safety and well-being. This trend is pushing companies to allocate more resources towards advanced safety features in vehicles, comprehensive driver training programs, and effective fatigue management solutions. For instance, the National Highway Traffic Safety Administration (NHTSA) reported that in 2023, preliminary data indicated a slight decrease in traffic fatalities compared to 2022, yet the number remained significantly higher than pre-pandemic levels, underscoring the ongoing need for safety improvements.

Element Fleet Management is well-positioned to assist clients by providing fleets equipped with state-of-the-art safety technologies. Furthermore, they can integrate crucial safety-related data derived from telematics systems directly into their fleet management strategies, offering actionable insights to enhance driver performance and reduce risks. The adoption of Advanced Driver-Assistance Systems (ADAS) is becoming a standard expectation, with studies showing that features like automatic emergency braking can reduce rear-end crashes by up to 20%.

- Increased societal demand for safer roads and healthier drivers.

- Regulatory bodies are implementing stricter safety standards and enforcement.

- Companies are investing in ADAS, driver training, and fatigue monitoring technologies.

- Fleet managers are leveraging telematics data to proactively address safety concerns.

Societal shifts toward sustainability are driving demand for eco-friendly fleet options, with electric vehicles (EVs) gaining significant traction. Element Fleet Management is adapting by expanding its EV integration services and charging infrastructure support. Furthermore, demographic changes, including an aging workforce and a persistent commercial driver shortage, are impacting operational costs and efficiency, with over 78,000 drivers lacking in 2024 according to the American Trucking Associations.

Urbanization continues to fuel traffic congestion, increasing operational expenses for fleets and highlighting the need for advanced route optimization and real-time tracking solutions. The growing expectation for on-demand and flexible services is also reshaping fleet management, with a notable increase in interest for adaptable leasing and shared mobility arrangements, with some market segments seeing a 15% rise in such inquiries by late 2024.

Societal focus on driver safety is intensifying, leading to greater investment in advanced safety features and training. Element Fleet Management is responding by offering fleets equipped with state-of-the-art safety technologies and leveraging telematics data to improve driver performance, aiming to reduce risks on the road.

| Sociological Factor | Impact on Fleet Management | Element's Response/Opportunity | Relevant Data (2024/2025) |

|---|---|---|---|

| Environmental Consciousness | Increased demand for EVs and sustainable practices. | Expanding EV charging infrastructure and fleet electrification services. | EV sales projected to continue strong growth through 2025. |

| Demographic Shifts | Driver shortages and aging workforce impact operations. | Offering telematics for driver behavior analysis and route optimization. | ATA reported 78,000+ driver shortage in 2024. |

| Urbanization | Traffic congestion increases costs and delays. | Providing advanced route optimization and urban delivery solutions. | Major cities consistently face billions in annual losses due to congestion. |

| On-Demand Culture | Demand for flexible and adaptable fleet solutions. | Offering flexible leasing and shared mobility options. | 15% year-over-year increase in inquiries for flexible fleet services (late 2024). |

| Driver Safety Focus | Emphasis on safety features and driver well-being. | Equipping fleets with ADAS and integrating safety telematics. | NHTSA data shows ongoing need for safety improvements despite slight fatality decrease in 2023. |

Technological factors

The rapid evolution of telematics and data analytics presents significant opportunities for Element Fleet Management to enhance its services. These technologies are crucial for real-time vehicle tracking, predictive maintenance scheduling, and monitoring driver behavior, all of which contribute to improved fleet efficiency and cost reduction.

For instance, by leveraging advanced analytics on telematics data, Element can provide clients with actionable insights. This allows for better route optimization, which in 2024, is estimated to reduce fuel consumption by up to 15% for fleets that adopt these strategies. Furthermore, predictive maintenance, powered by data analytics, can decrease unexpected breakdowns by an estimated 20-30%, significantly lowering downtime and repair costs.

The electric vehicle (EV) market is experiencing rapid growth, with global EV sales projected to reach over 16 million units in 2024, a significant jump from around 14 million in 2023. This surge necessitates that Element Fleet Management adapt its services to accommodate EV fleets, including specialized maintenance and charging infrastructure solutions.

Element Fleet Management's strategy must evolve to address the unique operational demands of EVs, such as battery lifecycle management and the integration of charging solutions into fleet operations. By 2025, it's estimated that over 30% of new vehicle sales in some key markets could be electric, underscoring the urgency for adaptation.

The ongoing development of autonomous vehicle technology, while still in its nascent stages for widespread commercial deployment, holds significant long-term implications for fleet management. Element Fleet Management must closely track these advancements, as autonomous capabilities are poised to influence key operational aspects such as vehicle uptime, driver staffing models, accident reduction, and the fundamental cost structures associated with fleet operations.

Digitalization of Fleet Operations and AI Integration

The fleet management industry is rapidly embracing digitalization. Element Fleet Management, for instance, can enhance its operational efficiency by adopting online portals for managing vehicle fleets, digitizing maintenance records, and implementing AI-driven tools for predictive maintenance and route optimization. This digital transformation is key to streamlining operations and improving client service.

By integrating AI, Element can offer more advanced fleet optimization solutions. For example, AI can analyze vast amounts of data to predict vehicle breakdowns, optimize fuel consumption, and improve driver safety. This not only reduces operational costs but also enhances the overall value proposition for clients.

- Digitalization of Maintenance: Moving from paper-based to digital maintenance logs can reduce administrative overhead by an estimated 20-30% for fleet operators.

- AI in Route Optimization: AI-powered routing can lead to fuel savings of up to 15% and reduce delivery times.

- Client Portal Enhancements: Real-time data access through online portals improves client satisfaction and transparency in fleet management.

Cybersecurity Risks for Connected Fleets

As vehicles increasingly rely on data exchange for operations and management, cybersecurity risks present a major challenge for Element Fleet Management and its clientele. Protecting sensitive fleet data, ensuring the operational integrity of vehicle systems, and actively mitigating potential cyber threats are critical for maintaining trust and operational security in today's technologically advanced fleet landscape.

The increasing sophistication of cyberattacks means that fleets are vulnerable to disruptions, data breaches, and even unauthorized control of vehicles. For instance, a 2024 report indicated that the average cost of a data breach in the automotive sector reached $5.13 million, highlighting the significant financial implications of inadequate cybersecurity measures. Element Fleet Management must therefore invest heavily in robust security protocols and continuous monitoring to safeguard its clients' assets and data.

- Increased Attack Surface: Connected vehicles, with their numerous sensors, communication modules, and software updates, present a broader range of potential entry points for cyber attackers.

- Data Breach Vulnerabilities: Sensitive data, including driver behavior, vehicle location, and maintenance records, is at risk of being intercepted or stolen, leading to privacy violations and competitive disadvantages.

- Operational Disruption: Cyberattacks could potentially disable vehicle systems, disrupt fleet operations, or even lead to physical safety hazards, impacting efficiency and potentially causing significant financial losses.

Technological advancements are reshaping fleet management, with telematics and AI driving efficiency. The global market for fleet management software is projected to grow significantly, reaching an estimated $45 billion by 2027, up from around $27 billion in 2023, indicating strong adoption of these digital tools.

The rise of electric vehicles (EVs) is a key technological factor, with EV sales expected to constitute over 20% of the global automotive market by 2025. Element Fleet Management must integrate EV charging solutions and specialized maintenance into its offerings to remain competitive.

Autonomous driving technology, while still developing, will eventually impact fleet operations by potentially reducing labor costs and improving safety. The cybersecurity landscape also demands attention, as connected vehicles increase the risk of data breaches, with the automotive cybersecurity market expected to reach $10 billion by 2027.

Legal factors

Vehicle safety and roadworthiness regulations are a significant legal factor for Element Fleet Management. These rules dictate the standards vehicles must meet to operate legally, covering everything from braking systems to emissions control. For instance, in the US, the Federal Motor Carrier Safety Administration (FMCSA) sets stringent safety standards for commercial vehicles, with regular inspections to ensure compliance.

Adherence to these regulations is non-negotiable for Element, as it directly impacts client operations and Element's own licensing. Failure to comply can result in hefty fines, operational disruptions, and damage to reputation. In 2024, the automotive industry saw increased scrutiny on safety features, with new mandates for advanced driver-assistance systems (ADAS) becoming more prevalent in many jurisdictions, influencing procurement decisions.

These legal requirements shape Element's vehicle procurement, maintenance schedules, and driver training programs. By ensuring fleets are always roadworthy and compliant, Element mitigates risks for its clients and maintains its operational integrity. The ongoing evolution of these laws, such as stricter emissions standards being introduced in the EU for 2025, requires continuous adaptation of fleet management strategies.

Legislation concerning vehicle emissions, fuel efficiency, and waste disposal, such as end-of-life vehicle recycling mandates, directly shapes the vehicle acquisition strategies and environmental service offerings for companies like Element Fleet Management. For instance, the European Union's CO2 emission performance standards for new passenger cars and vans, with targets progressively tightening towards 2030, influence the availability and cost of compliant vehicles in their fleet portfolios.

Failure to adhere to these environmental regulations can result in substantial financial penalties and considerable damage to a company's public image, underscoring the critical need for Element to champion and implement sustainable fleet management solutions. In 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent emissions standards, with proposed rules for heavy-duty vehicles aiming for significant reductions in nitrogen oxides and greenhouse gas emissions by 2027.

Element Fleet Management faces a growing challenge with data privacy and security laws as telematics and connected vehicle data become more prevalent. Regulations similar to GDPR are increasingly being implemented across its operating regions, demanding stringent handling, storage, and usage protocols for client and vehicle data. For instance, the California Consumer Privacy Act (CCPA), which went into effect in 2020 and was further amended by the California Privacy Rights Act (CPRA) effective January 1, 2023, grants consumers significant rights over their personal information, impacting how companies like Element manage data collected from connected vehicles.

Labor Laws and Driver Regulations

Labor laws significantly impact Element Fleet Management's clients by dictating how their commercial drivers operate. These regulations, such as the Federal Motor Carrier Safety Administration's (FMCSA) Hours of Service (HOS) rules, limit driving time to prevent fatigue. For instance, in 2024, the FMCSA continues to enforce strict HOS regulations, impacting delivery schedules and driver availability for fleets.

Element's role is to facilitate client compliance with these driver-specific laws. This often involves providing telematics solutions that track driving hours, monitor vehicle maintenance, and ensure proper licensing. The company’s services must align with evolving safety standards and reporting requirements mandated by authorities like the FMCSA, which are crucial for maintaining operational legality and safety.

- Hours of Service (HOS): Regulations limit driving and on-duty time to prevent driver fatigue, with violations leading to significant fines for carriers.

- Driver Licensing and Endorsements: Commercial drivers require specific licenses and endorsements (e.g., CDL, Hazmat) that must be current and appropriate for the cargo transported.

- Workplace Safety: Employers must adhere to Occupational Safety and Health Administration (OSHA) standards, ensuring safe working conditions for drivers, including proper training and equipment.

- Drug and Alcohol Testing: Mandated testing programs are in place to ensure driver fitness for duty, with strict protocols for compliance and reporting.

Contractual and Financial Regulations

Element Fleet Management's operations are deeply intertwined with contractual and financial regulations. The company's core business relies on intricate financing and service agreements, making adherence to contract law paramount for both Element and its clientele. This necessitates a thorough understanding and implementation of leasing standards and fair lending practices to ensure transparency and protection.

Navigating the regulatory landscape is critical for maintaining trust and operational integrity. For instance, in 2024, the financial services sector continues to see increased scrutiny on data privacy and consumer protection, impacting how fleet management contracts are structured and managed. Element's commitment to clear contractual terms safeguards against disputes and ensures compliance with evolving financial regulations.

- Compliance with Leasing Standards: Ensuring all lease agreements meet current industry and legal standards for transparency and fairness.

- Fair Lending Practices: Adhering to regulations that govern financing terms and client relationships, particularly concerning credit and repayment.

- Contractual Clarity: Maintaining explicit and legally sound terms within all service and financing agreements to protect both parties.

- Regulatory Adherence: Staying updated with and implementing changes in financial and consumer protection laws relevant to fleet management services.

Legal factors significantly influence Element Fleet Management's operations, encompassing vehicle standards, environmental mandates, and data protection. Compliance with evolving regulations, such as stricter emissions targets and advanced safety feature requirements introduced in 2024 and projected for 2025, is crucial for maintaining operational legality and client trust.

The company must navigate complex labor laws affecting its clients' drivers, including Hours of Service regulations, and ensure adherence to workplace safety standards. Additionally, robust data privacy laws, like the CCPA/CPRA, necessitate careful management of telematics data. Financial and contractual regulations also play a vital role, demanding transparency and fairness in all agreements.

| Legal Area | Key Regulations/Considerations | Impact on Element Fleet Management | 2024/2025 Focus |

|---|---|---|---|

| Vehicle Safety & Roadworthiness | FMCSA standards, ADAS mandates | Fleet procurement, maintenance, risk mitigation | Increased ADAS integration, stricter inspections |

| Environmental Regulations | Emissions standards (EU, EPA), recycling mandates | Vehicle acquisition, sustainability services | Tightening CO2 targets, proposed heavy-duty emission rules |

| Data Privacy & Security | GDPR, CCPA/CPRA | Telematics data handling, client data protection | Enhanced data protection protocols for connected vehicles |

| Labor & Driver Regulations | FMCSA Hours of Service, OSHA standards | Driver compliance, telematics solutions | Enforcement of HOS, driver safety training |

| Contractual & Financial Regulations | Leasing standards, fair lending practices | Agreement structure, client relationships | Scrutiny on data privacy in financial contracts |

Environmental factors

Governments worldwide are intensifying efforts to curb climate change, with many setting aggressive carbon emission reduction targets. For instance, the European Union aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, and the United States has rejoined the Paris Agreement, targeting a 50-52% reduction from 2005 levels by 2030. These commitments translate into increasingly stringent legislation impacting the transportation sector, a key area for fleet management.

Element Fleet Management plays a crucial role in assisting clients navigate this evolving regulatory landscape. By offering a growing portfolio of low-emission and zero-emission vehicle (ZEV) options, such as electric vehicles (EVs) and hydrogen fuel cell vehicles, Element helps clients transition to more sustainable fleets. Furthermore, providing robust data analytics to track and report on carbon footprints empowers clients to demonstrate compliance and identify areas for further emission reduction, aligning with mandates like California's Advanced Clean Cars II regulation, which phases out gasoline-powered vehicle sales by 2035.

The environmental impact of vehicle disposal is a significant concern, driving stricter regulations for responsible end-of-life management. For instance, in 2024, the European Union's End-of-Life Vehicles Directive continues to push for higher recycling rates, aiming for at least 95% of vehicle weight to be recovered or reused. Element Fleet Management's remarketing services must therefore prioritize sustainable practices, ensuring vehicles are either responsibly recycled or disposed of, thereby minimizing landfill waste and adhering to these evolving environmental standards.

Climate change poses significant physical risks to Element Fleet Management's operations and its clients' supply chains. Extreme weather events, like increased hurricane intensity or prolonged droughts affecting transportation routes, can directly disrupt vehicle delivery, maintenance schedules, and overall fleet availability. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each exceeding $1 billion in damages, highlighting the increasing frequency and cost of such events.

Element Fleet Management must integrate climate resilience into its strategic planning, anticipating potential disruptions to transportation infrastructure and vehicle uptime. This includes developing contingency plans for weather-related delays and advising clients on fleet strategies that can withstand or adapt to changing environmental conditions, thereby minimizing operational downtime and associated costs.

Demand for Sustainable Fleet Solutions from Clients

Clients are increasingly prioritizing sustainability, actively seeking fleet management solutions that support their corporate environmental goals and ESG commitments. This trend directly influences the demand for services that go beyond traditional fleet operations.

Element Fleet Management, for instance, sees this reflected in client requests for electric vehicles (EVs), optimized routing to minimize fuel usage, and comprehensive environmental impact reporting. For example, in 2024, a significant portion of new vehicle acquisition requests from Element's clients focused on alternative fuel vehicles, indicating a clear shift in priorities.

This growing client demand for greener solutions means companies like Element must adapt by expanding their offerings to include:

- Electric Vehicle (EV) fleet integration and management services.

- Advanced telematics for route optimization and fuel efficiency improvements.

- Transparent reporting on fleet emissions and overall environmental footprint.

- Consulting services to help clients achieve their sustainability targets.

Resource Scarcity and Raw Material Sourcing

Concerns over resource scarcity, particularly for critical minerals essential for electric vehicle (EV) batteries like lithium and cobalt, are directly impacting vehicle production costs and availability. For instance, the price of lithium carbonate surged by over 400% between early 2021 and late 2022, creating significant cost pressures. Element Fleet Management must closely monitor these trends to ensure consistent vehicle supply and competitive pricing for its clients, navigating potential disruptions by securing diverse and ethically sourced vehicle options.

The geopolitical landscape further complicates raw material sourcing. Many critical mineral reserves are concentrated in a few countries, raising concerns about supply chain stability. As of early 2024, China dominates the processing of many key battery materials, accounting for approximately 75% of lithium processing and 85% of cobalt processing globally. This concentration requires Element Fleet Management to actively seek out and vet suppliers with robust supply chains and a commitment to responsible sourcing practices to mitigate risks.

These environmental factors directly translate into operational considerations for fleet management. Fluctuations in raw material prices can lead to unpredictable vehicle acquisition costs, impacting budgeting and long-term fleet planning. Element Fleet Management needs to build flexibility into its procurement strategies, potentially exploring alternative fuel vehicles or longer-term leasing agreements to buffer against price volatility and ensure client access to necessary transportation solutions.

- Lithium Price Volatility: Lithium carbonate prices saw an unprecedented rise, more than quadrupling from early 2021 to late 2022, impacting EV manufacturing costs.

- Geographic Concentration of Minerals: China's significant control over critical mineral processing, handling around 75% of lithium and 85% of cobalt, highlights supply chain vulnerabilities.

- Impact on Fleet Costs: Unpredictable raw material prices directly influence vehicle acquisition costs, necessitating adaptive procurement strategies for fleet managers.

- Ethical Sourcing Imperative: Ensuring access to diverse and ethically sourced vehicle options is crucial for fleet management companies like Element in the face of resource scarcity and geopolitical risks.

Governments worldwide are implementing stricter environmental regulations, pushing for reduced emissions and sustainable practices. For example, the EU aims for a 55% net greenhouse gas reduction by 2030, while the US targets a 50-52% reduction from 2005 levels by 2030. These policies directly influence fleet management, driving demand for greener vehicle options.

Element Fleet Management assists clients in adopting these changes by offering electric and hydrogen fuel cell vehicles, alongside data analytics for tracking carbon footprints. This aligns with regulations like California's Advanced Clean Cars II, which will phase out gasoline vehicle sales by 2035.

The environmental impact of vehicle disposal is also under scrutiny, with directives like the EU's End-of-Life Vehicles Directive pushing for higher recycling rates. Element's remarketing services must prioritize responsible recycling and reuse to meet these standards.

Extreme weather events, exacerbated by climate change, pose significant physical risks to supply chains and operations. In 2023 alone, the US experienced 28 weather and climate disasters exceeding $1 billion in damages, according to NOAA, underscoring the need for resilient fleet planning.

Clients are increasingly prioritizing sustainability, with a growing demand for electric vehicles and optimized routing for fuel efficiency. This trend is evident in 2024, where a substantial portion of new vehicle acquisition requests from Element's clients focused on alternative fuel vehicles.

Resource scarcity, particularly for EV battery minerals like lithium and cobalt, impacts vehicle production costs. Lithium carbonate prices surged over 400% between early 2021 and late 2022, creating cost pressures. Geopolitical factors, such as China's dominance in mineral processing (around 75% of lithium and 85% of cobalt), further complicate sourcing and necessitate robust supply chain management.

| Environmental Factor | Impact on Fleet Management | Example/Data Point (2021-2025) |

|---|---|---|

| Climate Change Regulations | Increased demand for low/zero-emission vehicles; stricter disposal rules. | EU target: 55% GHG reduction by 2030. California's Advanced Clean Cars II by 2035. |

| Extreme Weather Events | Disruptions to vehicle delivery, maintenance, and uptime. | 28 US climate disasters >$1B in damages in 2023 (NOAA). |

| Client Sustainability Demands | Shift in vehicle acquisition towards EVs and fuel-efficient options. | Significant portion of 2024 client requests for alternative fuel vehicles. |

| Raw Material Scarcity & Pricing | Higher vehicle acquisition costs; supply chain vulnerabilities. | Lithium carbonate prices rose >400% (early 2021-late 2022). China processes ~75% of lithium. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources such as the World Economic Forum, national statistical offices, and leading financial news outlets. We ensure each factor, from political stability to technological advancements, is supported by current and authoritative information.