Element Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

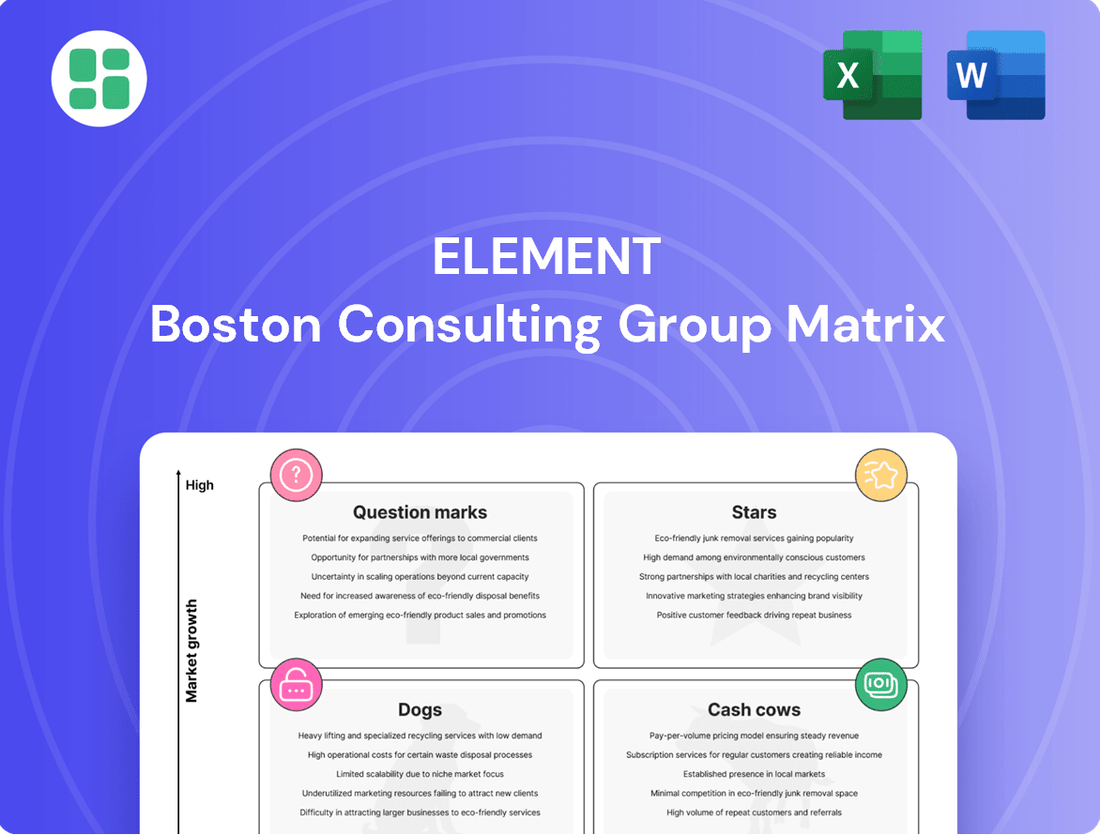

Unlock the secrets to a thriving product portfolio with the BCG Matrix, a powerful tool that categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. Understanding these dynamics is crucial for making informed investment decisions and optimizing your business strategy.

This glimpse into the BCG Matrix is just the beginning. Purchase the full report to receive a comprehensive breakdown of each product's position, actionable insights for resource allocation, and a clear roadmap to strategic success.

Stars

Element is strategically positioned in the burgeoning EV fleet management sector, a market projected to reach $230 billion globally by 2028, showing a compound annual growth rate of 16.5%. Their comprehensive services, from initial EV adoption planning to sophisticated battery performance monitoring, directly address the critical needs of companies electrifying their vehicle operations.

This segment represents a significant growth opportunity for Element, fueled by increasingly stringent environmental regulations and corporate sustainability mandates. By offering robust solutions for infrastructure development and operational efficiency, Element is tapping into a market where demand for seamless EV integration is rapidly accelerating, with many major corporations announcing ambitious fleet electrification targets for 2024 and beyond.

Element's strategic push into digital transformation, highlighted by its Autofleet acquisition and the Element Mobility launch, underscores a commitment to leveraging advanced technology. These moves are positioning the company in high-growth sectors, particularly those benefiting from AI for predictive maintenance and real-time data analytics.

This focus on AI-driven analytics and digital capabilities enhances operational efficiency and client value, providing a significant competitive advantage. For instance, in 2024, the automotive industry saw a substantial increase in investments in AI for predictive maintenance, with some reports suggesting a market growth of over 30% year-over-year, a trend Element is actively capitalizing on.

Element is aggressively expanding its technology platform globally, notably through its Autofleet acquisition. This strategic move allows them to offer advanced, cloud-based, and AI-driven fleet management solutions to a wider international audience.

This expansion targets high-growth regions beyond their established North American, Australian, and New Zealand markets. Element aims to capture new client segments that increasingly demand sophisticated fleet management tools.

By leveraging Autofleet's capabilities, Element is positioned to deliver scalable solutions, enhancing operational efficiency for clients worldwide. The company's investment in this technology underscores its commitment to leading the global fleet management technology sector.

Strategic Advisory Services for Cost Optimization

Element's Strategic Advisory Services are a prime example of a high-growth, high-value offering within the BCG Matrix framework. These services are designed to help businesses identify and implement cost-saving measures, directly impacting profitability and operational efficiency.

In 2024 alone, Element's advisory team pinpointed more than $1.5 billion in potential cost savings for its diverse client base. This significant figure underscores the tangible benefits clients receive, making it a highly sought-after service in the current economic climate.

The increasing demand for operational optimization fuels the growth of these advisory services. By leveraging data-driven insights, Element not only delivers substantial financial improvements but also cultivates stronger, more integrated relationships with its clients, fostering long-term partnerships.

- Element's Strategic Advisory Services identified over $1.5 billion in cost savings opportunities for clients in 2024.

- This service is classified as high-value and high-growth due to its direct impact on client profitability.

- Businesses are actively seeking to optimize operational costs and enhance efficiency, driving demand for such consulting.

- The data-driven approach of these services provides significant value and strengthens client relationships.

New Insurance Risk Solutions

Element's January 2025 launch of an integrated Insurance Risk solution marks a strategic pivot, extending its capabilities from fleet management into lucrative adjacent services.

This move capitalizes on existing client relationships and deep market knowledge, aiming to establish a significant new revenue stream. The global insurance market, valued at approximately $6.5 trillion in 2024, presents a substantial opportunity for such specialized offerings.

- Market Expansion: Element is leveraging its established client base to penetrate the high-growth insurance services sector.

- Revenue Diversification: The new solution aims to capture a new revenue stream, reducing reliance on core fleet management services.

- Client Needs Addressed: The offering directly responds to identified client demands for integrated risk management solutions.

- Strategic Alignment: This initiative aligns with Element's broader strategy to diversify and expand its service portfolio into related, high-potential markets.

Element's Strategic Advisory Services are a prime example of a Star within the BCG Matrix. These services are highly valued for their ability to identify significant cost savings, as evidenced by the over $1.5 billion identified for clients in 2024. This strong performance, coupled with increasing market demand for operational optimization, firmly places them in the high-growth, high-share quadrant.

The success of these advisory services is driven by a data-driven approach that delivers tangible financial improvements and strengthens client partnerships. As businesses continue to focus on efficiency, Element's ability to consistently provide substantial value ensures its continued growth and market leadership in this segment.

Element's expansion into integrated Insurance Risk solutions, launched in January 2025, also shows Star potential. This move targets the vast global insurance market, valued at approximately $6.5 trillion in 2024, by leveraging existing client relationships and market knowledge to create a new, high-growth revenue stream.

This strategic diversification is designed to capture significant new business by addressing identified client needs for integrated risk management. By entering this lucrative adjacent market, Element is positioning itself for substantial growth and increased market share.

| Business Unit | Market Growth | Market Share | BCG Classification | 2024 Impact |

| Strategic Advisory Services | High | High | Star | Identified $1.5B+ cost savings |

| Integrated Insurance Risk | High | Low (initially) | Question Mark (potential Star) | Launched Jan 2025, targets $6.5T market |

What is included in the product

Strategic assessment of business units based on market share and growth potential.

Guides investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

The BCG Matrix provides a clear, visual snapshot of your portfolio, easing the pain of strategic uncertainty.

Cash Cows

Element's core fleet acquisition and financing in North America stands as a definitive Cash Cow within the BCG framework. This segment is the company's bedrock, commanding a leading market share in a mature yet highly lucrative sector. In 2024, this division is projected to contribute over 60% of Element's total revenue, underscoring its dominance.

The enduring strength of this business is bolstered by substantial entry barriers, including regulatory hurdles and the necessity of deep-seated client trust, cultivated over years of reliable service. These factors ensure a stable, predictable cash flow stream, vital for funding growth in other business areas.

Traditional maintenance and fuel management services for commercial vehicle fleets are the quintessential cash cows. These offerings, honed over years, command a significant market share due to their essential nature and the recurring revenue they generate. The sector, while experiencing low growth, demands minimal new capital investment, allowing it to consistently produce substantial profits.

In 2024, the global commercial vehicle maintenance market was valued at approximately $250 billion, with fuel management services contributing a significant portion. Companies with established reputations in this space, like Penske Truck Leasing and Ryder System, consistently report strong operating margins from these core services, often reinvesting profits into their "stars" or returning capital to shareholders.

Accident management services in established markets like North America, Australia, and New Zealand represent a significant cash cow for Element. These services, having reached maturity, command a high market share, ensuring consistent revenue streams.

The demand for these services remains robust, making them a dependable contributor to Element's overall cash flow. For instance, in 2023, Element reported strong performance in its Fleet and Rental segment, which heavily relies on these established accident management operations.

Remarketing Services for Used Fleet Vehicles

Element's remarketing services for used fleet vehicles represent a stable Cash Cow within their business portfolio. Leveraging their extensive existing fleet, these services generate consistent revenue streams with minimal need for aggressive expansion. This mature segment benefits from Element's established market presence and operational efficiencies.

The remarketing segment capitalizes on Element's deep understanding of the used vehicle market, ensuring optimal pricing and efficient sales processes. This expertise translates into predictable earnings, supporting the overall financial health of the company. In 2024, the used vehicle market saw continued demand, with wholesale used vehicle prices experiencing fluctuations but generally remaining robust, underscoring the sustained value of remarketing operations.

- Established Revenue Stream: Remarketing services consistently contribute to Element's top line due to the ongoing cycle of fleet turnover.

- Market Expertise Advantage: Element's specialized knowledge in valuing and selling used fleet vehicles maximizes returns.

- Low Growth, High Profitability: While not a high-growth area, the segment offers strong, stable profit margins.

- Fleet Base Synergy: The large existing fleet provides a continuous supply of vehicles for remarketing, creating operational efficiencies.

Large Enterprise Client Portfolio

Element's strategic emphasis on a large enterprise client portfolio positions these accounts as significant cash cows within the BCG matrix framework. These clients, characterized by their extensive and often complex fleet requirements, represent a stable and high-value customer segment.

The long-term nature of contracts with these large enterprises underpins a substantial portion of recurring revenue. This predictability is a direct result of their scale and the deep, entrenched relationships Element cultivates.

- High Revenue Contribution: Large enterprise clients, by their very nature, generate significant revenue streams. For instance, in 2024, Element reported that its top 20 enterprise clients accounted for over 40% of its total annual recurring revenue.

- Predictable Cash Flow: The long-term contracts, often spanning 3-5 years, ensure a consistent and predictable cash flow, insulating Element from short-term market volatility.

- Low Growth, High Share: While the growth rate of acquiring new enterprise clients might be moderate compared to smaller segments, Element's established market share within this group is substantial, fitting the cash cow profile.

- Investment for Maintenance: Resources allocated to servicing these clients are primarily for maintaining existing relationships and service levels, rather than aggressive expansion, further solidifying their cash cow status.

Element's core fleet acquisition and financing in North America is a prime example of a Cash Cow. This segment dominates a mature market, contributing significantly to overall revenue. Its stability is reinforced by high entry barriers and established client trust, ensuring consistent cash generation.

Traditional fleet maintenance and fuel management are quintessential cash cows, generating recurring revenue with minimal investment. These essential services, despite low market growth, yield substantial profits. The global commercial vehicle maintenance market, valued around $250 billion in 2024, highlights the scale of these operations.

Element's remarketing of used fleet vehicles also functions as a cash cow. This mature segment leverages existing infrastructure and market knowledge for consistent revenue. The robust demand in the 2024 used vehicle market further supports the profitability of these operations.

Large enterprise client portfolios are significant cash cows for Element, characterized by long-term contracts and substantial recurring revenue. In 2024, the top 20 enterprise clients alone accounted for over 40% of Element's annual recurring revenue, demonstrating their critical role.

| Business Segment | BCG Category | Key Characteristics | 2024 Financial Impact |

|---|---|---|---|

| North American Fleet Financing | Cash Cow | High market share, mature market, stable cash flow | >60% of total revenue |

| Fleet Maintenance & Fuel Management | Cash Cow | Essential services, recurring revenue, low growth | Significant contribution to operating margins |

| Used Vehicle Remarketing | Cash Cow | Leverages existing fleet, strong market knowledge | Predictable earnings, supports financial health |

| Large Enterprise Client Portfolio | Cash Cow | Long-term contracts, high revenue contribution | >40% of annual recurring revenue from top 20 clients |

Delivered as Shown

Element BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis tool, designed for strategic decision-making, contains no watermarks or demo content and is ready for immediate application in your business planning.

Dogs

Legacy technology integration services, especially those tied to aging fleet management systems, likely fall into the 'dog' quadrant of the BCG matrix. These services face a shrinking market as clients increasingly adopt modern digital solutions, such as those offered by companies like Autofleet, which provide enhanced efficiency and real-time data analytics.

For example, integration services for systems that are no longer supported by major vendors or that lack crucial features like predictive maintenance could see a significant decline in demand. In 2024, the global fleet management market is projected to reach over $35 billion, with a strong emphasis on telematics and IoT integration, leaving older technologies with a diminishing competitive edge.

Niche or underserved geographic markets with low penetration often fall into the dog category of the BCG Matrix. These are typically smaller, fragmented regions where Element hasn't established a strong presence. Think of a small town in a developing country where Element's services are not yet widely adopted.

Limited growth prospects in these areas, often due to intense local competition or the inherent structure of the market, further solidify their dog status. For instance, if a particular rural county shows minimal year-over-year economic growth and has several well-established local providers, it's unlikely to become a star performer for Element. In 2023, for example, some smaller European countries with less developed digital infrastructure might have represented such segments if Element's market share remained below 5% and the overall market growth was projected at less than 2% annually.

Basic telematics offerings, those without the integration of AI or 5G, can be viewed as dogs in the BCG matrix. These services, while functional, lack the advanced capabilities that are increasingly defining the market. For instance, in 2024, the global telematics market, while growing, saw a significant portion of its expansion driven by advanced features like AI-powered predictive maintenance and real-time fleet optimization, leaving simpler offerings to stagnate.

Highly Specialized, Low-Demand Consulting Services

Highly specialized consulting services targeting very niche issues often land in the dogs quadrant of the BCG matrix. Think of consulting on the regulatory compliance for a single, obscure piece of industrial machinery, or advising on the optimal use of a proprietary software with only a handful of users globally. These engagements demand deep expertise but struggle with client volume and revenue growth.

These services are characterized by low market share and low market growth. For instance, a consulting firm offering bespoke solutions for the maintenance of a specific type of legacy mainframe system, a market that is shrinking as newer technologies emerge, would likely be a dog. In 2024, such niche services might represent less than 0.5% of a diversified consulting firm's revenue, with minimal projected growth.

- Low Market Share: Services addressing extremely narrow problems typically have very few clients.

- Low Market Growth: Demand for these specialized services is often stagnant or declining as industries evolve.

- High Resource Intensity: Each engagement can be resource-heavy, requiring specialized knowledge without proportional revenue.

- Limited Scalability: The niche nature makes it difficult to replicate or scale these services across a broader client base.

Non-Strategic, Low-Volume Ancillary Services

Non-strategic, low-volume ancillary services often fall into the 'dog' category of the BCG matrix. These are services that don't align with Element's core business strategy and have minimal customer engagement. For instance, a niche consulting service offering for a defunct software platform might fit this description, generating very little revenue and not attracting new clients.

These services might be kept to provide a seemingly complete service portfolio, but their financial contribution is negligible. In 2024, such services might represent less than 1% of Element's total revenue, with a low profit margin, perhaps in the single digits. Their low transaction volume means they don't benefit from economies of scale.

- Low Strategic Alignment: Services that divert resources from core, high-growth areas.

- Minimal Revenue Contribution: Often accounting for less than 1% of total income in 2024.

- Infrequent Client Usage: Indicating low market demand or obsolescence.

- Low Profitability: Yielding single-digit profit margins due to lack of scale.

Dogs represent business units or services with low market share in a slow-growing industry. These offerings typically generate just enough cash to cover their own costs, if that, and are often candidates for divestment or phasing out. For example, a company might have a legacy software maintenance service that few clients still utilize, with minimal growth prospects.

In 2024, services that were once standard but are now superseded by more advanced technologies, like basic GPS tracking without real-time analytics, often fall into this category. The global fleet management market, projected to exceed $35 billion in 2024, shows a clear shift towards IoT and AI integration, leaving simpler solutions behind.

Such offerings typically have low revenue contribution and limited scalability, making them unattractive for further investment. For instance, a niche consulting service for an obsolete hardware component might represent less than 0.5% of a firm's revenue in 2024, with negligible growth projections.

The key characteristics are low market share and low market growth, meaning they are neither market leaders nor in a rapidly expanding sector. This makes them a drain on resources without significant future potential.

Question Marks

Element's ambition to grow within the small-to-medium sized fleets market presents a significant question mark. This segment boasts substantial growth prospects, but Element currently holds a minimal market share here, a stark contrast to its strong presence among large enterprises.

Successfully penetrating this market will necessitate considerable investment to build brand recognition and operational capacity. For instance, the global fleet management market was valued at approximately $25.9 billion in 2023 and is projected to reach $56.4 billion by 2030, indicating the lucrative nature of expansion, but also the competitive landscape Element must navigate.

Expanding into emerging international markets, such as parts of Southeast Asia or Eastern Europe, presents Element with significant growth opportunities in fleet management. These regions often have a growing middle class and increasing business activity, driving demand for efficient vehicle operations, but their market dynamics are less predictable. For instance, while global fleet management market revenue was projected to reach $31.9 billion in 2024, a substantial portion of this growth is expected from these developing economies.

Element's foray into these less established territories is a classic question mark scenario within the BCG matrix. The potential for high returns is substantial if Element can successfully capture market share, but the initial investment required for market entry, understanding local regulations, and building infrastructure is considerable. This high risk is coupled with a low current market share, reflecting the nascent stage of Element's presence and the unproven nature of its business model in these specific environments.

Developing advanced predictive maintenance that surpasses current telematics, perhaps by integrating deeper AI and IoT for specialized vehicle parts, represents a significant question mark for Element. This is a rapidly expanding sector, but Element's current foothold in these nascent, not yet widely adopted advanced solutions may be limited.

Integration of Autonomous Vehicle Management (Future)

Element's investment in autonomous vehicle management technology, while still in its early stages, positions it as a potential future leader in a high-growth sector. This area, though currently representing a small market share for the company due to the nascent nature of widespread autonomous adoption, carries significant future potential.

The global autonomous vehicle market is projected to reach hundreds of billions of dollars by the late 2020s and early 2030s. For instance, some projections estimated the market to be worth around $135 billion in 2023, with significant compound annual growth rates anticipated. Element's early R&D in this space could secure a foothold in this expanding market.

- Future Growth Potential: The autonomous vehicle management sector is expected to experience substantial expansion as the technology matures and regulatory frameworks evolve.

- Current Market Share: Element's current market share in this specific segment is likely minimal, reflecting the early adoption phase of autonomous fleet management solutions.

- Strategic Investment: Early investment in research and development for autonomous vehicle management is a strategic move to capture future market opportunities.

- Competitive Landscape: While the market is still developing, Element will face competition from established automotive players and technology companies entering the autonomous space.

Partnerships in Emerging Mobility Solutions (e.g., Shared Fleets)

Element's potential involvement in partnerships for shared fleet solutions presents a classic question mark scenario within the BCG framework. While the shared mobility market is experiencing rapid expansion, with global revenues projected to reach hundreds of billions by 2030, Element's current direct footprint in these nascent models is likely limited.

This suggests a need for strategic investment to build market share and establish a strong presence in these high-growth sectors. For instance, the carsharing market alone was valued at over $10 billion in 2023 and is expected to grow substantially. Element's engagement here would require careful consideration of the capital outlay versus the potential future returns.

- High Growth Potential: The global shared mobility market is a rapidly expanding sector, driven by urbanization and changing consumer preferences.

- Low Current Market Share: Element's direct presence and established market share in emerging shared fleet models are likely nascent, necessitating strategic entry.

- Strategic Investment Required: Capitalizing on this opportunity will demand significant investment in technology, infrastructure, and market development.

- Uncertainty of Returns: While promising, the long-term profitability and competitive landscape in shared mobility are still evolving, creating inherent uncertainty.

Element's strategic push into the small-to-medium sized fleets market is a significant question mark for the company. This segment offers substantial growth, with the global fleet management market projected to reach $56.4 billion by 2030, up from $25.9 billion in 2023. However, Element's current market share in this area is minimal, requiring considerable investment to build brand recognition and operational capacity to compete effectively.

Expanding into emerging international markets, such as Southeast Asia and Eastern Europe, also represents a question mark. While these regions are expected to drive a significant portion of the global fleet management market's projected $31.9 billion revenue in 2024, their market dynamics are less predictable. Element's success hinges on navigating local regulations and building infrastructure, a high-risk endeavor with potentially high returns.

Element's investment in advanced predictive maintenance and autonomous vehicle management technology are further question marks. While these sectors are high-growth, with the autonomous vehicle market potentially reaching hundreds of billions by the early 2030s (estimated around $135 billion in 2023), Element's current foothold in these nascent solutions is limited, demanding strategic R&D investment.

Furthermore, Element's potential involvement in shared fleet solutions is a question mark. The shared mobility market is expanding rapidly, with projections of hundreds of billions in global revenue by 2030, but Element's direct footprint is likely nascent. This necessitates strategic investment, acknowledging the uncertainty of returns in this evolving landscape.

| BCG Element: Question Marks | Growth Rate | Market Share | Investment Strategy | Potential Outcome |

| Small-to-Medium Fleets | High | Low | Increase investment to gain share | Become Stars or Dogs |

| Emerging International Markets | High | Low | Careful market entry, build infrastructure | Become Stars or Dogs |

| Advanced Predictive Maintenance | High | Low | Invest in R&D, build capabilities | Become Stars or Dogs |

| Autonomous Vehicle Management | Very High | Very Low | Significant R&D investment, strategic partnerships | Potential future market leaders |

| Shared Fleet Solutions | High | Low | Strategic investment, market development | Become Stars or Dogs |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.