Element Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

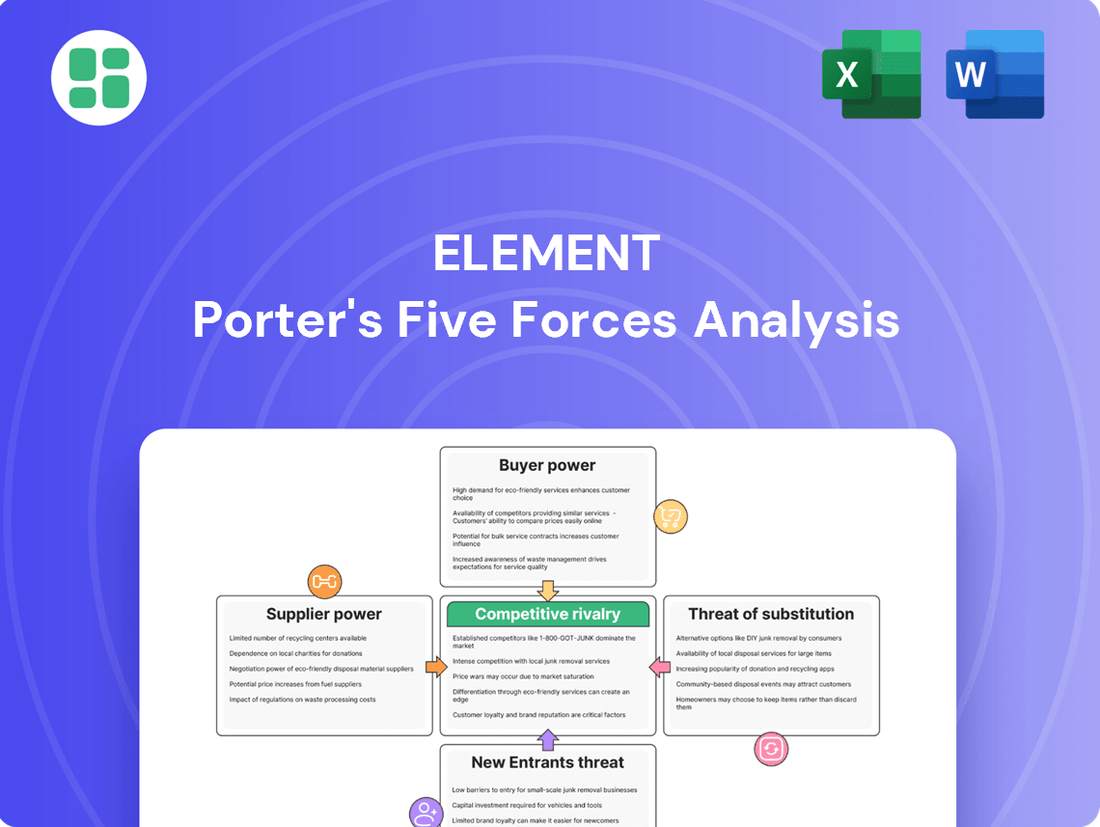

Porter's Five Forces reveals the competitive landscape for Element, highlighting the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes. Understanding these forces is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Element’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers to Element Fleet Management is significantly shaped by how concentrated the supplier market is and how unique their products are. Major vehicle manufacturers, for example, hold considerable sway because their vehicles are highly specialized, and the capital outlay for acquiring them is substantial. This concentration means fewer alternatives for Element.

However, Element's sheer scale in ordering vehicles, often acquiring thousands annually, grants it some leverage. In 2023, Element reported managing a fleet of over 2.4 million vehicles, a volume that allows for negotiation on pricing and terms, partially offsetting the suppliers' inherent power.

Element's bargaining power with suppliers is significantly influenced by switching costs, which vary greatly depending on the nature of the supply. For critical technology providers, such as those offering telematics or sophisticated data analytics platforms, the expense and effort involved in migrating data and re-integrating systems can be substantial, thereby increasing Element's dependence on these suppliers.

Conversely, for more standardized supplies, like fuel, the switching costs are minimal. This low barrier allows Element to readily compare prices and negotiate favorable terms, leveraging its considerable purchasing volume to secure competitive rates. For instance, in 2024, the global fleet management market, a key area for Element, saw continued growth, underscoring the importance of managing supplier relationships across diverse cost structures.

When suppliers offer highly specialized or proprietary technologies, their bargaining power significantly increases. For instance, companies relying on unique EV charging infrastructure solutions or advanced AI-driven fleet optimization software find themselves with fewer alternatives, giving those suppliers leverage. This was a key consideration for Element, as evidenced by their acquisition of Autofleet in 2023, a move designed to bring specialized software capabilities in-house and diminish dependence on external providers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Element's core business, such as full-service fleet management, is generally low. This is primarily due to the highly specialized and integrated nature of Element's offerings, which cover the entire fleet lifecycle. For instance, a tire manufacturer or a financing company would find it challenging to replicate Element's end-to-end service model.

While theoretically possible, for a major automotive manufacturer or a large financial institution to move into fleet management, the complexity and breadth of services Element provides present a substantial hurdle. These services include vehicle acquisition, maintenance management, fuel programs, and remarketing, all requiring distinct expertise and infrastructure.

Element's robust service ecosystem, built over years of operation, creates a significant barrier to entry for suppliers looking to integrate forward. This comprehensive approach, which includes data analytics and customized fleet solutions, is difficult for a single supplier to replicate effectively.

- Low Likelihood of Forward Integration: Suppliers typically focus on their core competencies, making a move into Element's complex, multi-faceted fleet management services improbable.

- High Barriers to Entry: The specialized knowledge and infrastructure required for end-to-end fleet lifecycle management, as offered by Element, represent significant deterrents.

- Element's Competitive Advantage: Element's integrated service model, encompassing acquisition, maintenance, fuel, and remarketing, is a key differentiator that suppliers would struggle to match.

Importance of Supplier's Input to Element's Business

The criticality of a supplier's input to Element's core operations significantly impacts their bargaining power. For instance, in 2024, Element's ability to acquire and lease vehicles is heavily reliant on vehicle financing providers and major vehicle manufacturers. These entities dictate terms, interest rates, and vehicle availability, directly influencing Element's cost of goods sold and overall profitability.

This dependence grants significant leverage to these key suppliers. If financing providers or manufacturers impose unfavorable terms, such as increased interest rates or reduced vehicle allocations, Element's business model and profitability can be severely impacted. For example, a 1% increase in financing costs on a large fleet could translate to millions in additional annual expenses.

- Vehicle Financing Providers: Crucial for securing capital to purchase fleets, impacting interest expenses.

- Major Vehicle Manufacturers: Essential for sourcing vehicles, influencing acquisition costs and model availability.

- Impact on Profitability: Supplier terms directly affect Element's cost structure and pricing strategies.

- Strategic Importance: Strong supplier relationships are vital for maintaining competitive pricing and operational efficiency.

The bargaining power of suppliers is a key factor in Element's operational costs and strategic flexibility. Suppliers with unique products or services, or those in highly concentrated markets, can exert significant influence over pricing and terms. For Element, this is particularly true for specialized technology providers and major vehicle manufacturers. In 2024, the automotive industry continued to navigate supply chain complexities, which can amplify supplier leverage.

Element's scale as a fleet manager, overseeing millions of vehicles, provides a counterbalancing force against supplier power. This volume allows for negotiation on pricing and favorable contract terms. For instance, in 2023, Element managed over 2.4 million vehicles, a substantial number that gives them considerable purchasing clout. However, high switching costs for specialized inputs, like advanced telematics, can still anchor Element to specific suppliers.

| Supplier Type | Impact on Element's Bargaining Power | Example Factors (2024) |

|---|---|---|

| Major Vehicle Manufacturers | High Power (Concentrated Market, Specialized Products) | Vehicle availability, pricing, model innovation |

| Financing Providers | High Power (Capital Intensive, Interest Rate Sensitivity) | Interest rates, loan terms, capital availability |

| Technology Providers (e.g., Telematics) | Moderate to High Power (Switching Costs, Proprietary Tech) | Data integration, software updates, customization |

| Fuel Suppliers | Low Power (Commoditized Product, Low Switching Costs) | Fuel prices, network access, volume discounts |

What is included in the product

This analysis dissects the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and quantify competitive threats with pre-built templates, eliminating the guesswork in market analysis.

Customers Bargaining Power

Element serves a broad spectrum of commercial vehicle fleets, encompassing both major corporations and smaller businesses. The size and concentration of these customer groups significantly influence their bargaining power.

Larger corporate clients, due to their substantial fleet volumes, typically wield more influence. For instance, a fleet operator managing thousands of vehicles can negotiate more favorable pricing or demand tailored service packages, directly impacting Element's profitability on those accounts.

Element's comprehensive suite of services, encompassing vehicle acquisition, financing, maintenance, fuel management, and accident management, inherently raises the barriers for customers looking to switch providers. This integrated approach means a client isn't just moving a single service, but an entire operational ecosystem.

The sheer operational disruption involved in migrating a fleet's management is substantial. Consider the complexities of transferring vast amounts of data, re-integrating systems with new vendors, and retraining staff on different platforms. This process alone can represent a significant financial and time investment, often outweighing the perceived benefits of a switch.

For instance, a large enterprise fleet might have thousands of vehicles, each with its own maintenance history, fuel card data, and financing agreements. In 2024, the average cost for a business to switch fleet management providers can range from $500 to $2,000 per vehicle, depending on the complexity of services utilized. This highlights how deeply embedded Element's services become, making a unilateral move costly and challenging.

Financially-literate decision-makers, Element's target audience, are well-informed about market prices and alternative solutions. This transparency heightens their price sensitivity, pushing Element to consistently prove its value and cost-saving benefits. For instance, in 2024, Element highlighted $1.5 billion in fleet operating cost savings opportunities for its clients.

Availability of Substitute Services for Customers

Customers possess significant bargaining power when they have numerous alternative options for fleet management. These alternatives include managing their fleets internally or engaging with more basic services offered by vehicle manufacturers or specialized leasing firms. This availability of substitutes directly challenges Element's market position.

Element actively counters this threat by offering bundled services designed to simplify fleet management and highlight a reduction in the total cost of ownership for its clients. This integrated approach aims to dissuade customers from pursuing fragmented or in-house solutions by demonstrating clear value and convenience.

For instance, in 2024, the fleet management industry saw continued innovation in service offerings. Companies like Element are investing in technology platforms that provide real-time data analytics, predictive maintenance, and optimized routing, which are difficult for individual companies to replicate internally. This focus on value-added services is crucial for retaining customers in a competitive landscape where alternatives are readily available.

- Customer Choice: The presence of in-house fleet management and basic services from manufacturers or leasing companies provides customers with viable alternatives to Element's comprehensive offerings.

- Element's Mitigation Strategy: Element leverages bundled services and a total cost of ownership reduction approach to make its integrated solutions more attractive than fragmented or self-managed options.

- Industry Trend: In 2024, the competitive environment emphasized integrated technology solutions and cost-saving strategies as key differentiators in the fleet management sector.

Differentiation of Element's Services

Element's strong differentiation significantly curtails customer bargaining power. By offering an end-to-end suite of services, Element provides a comprehensive solution that is not easily replicated by competitors. This integrated approach, coupled with a focus on technological innovation, allows Element to deliver unique value propositions to its clients.

Element's strategic advisory capabilities further solidify its market position and mitigate customer leverage. These advisory services are designed to optimize fleet performance and drive down operational costs for clients, creating a sticky relationship. For instance, Element's commitment to innovation is evident in new offerings like Element Risk Solutions, and a planned digital driver app for 2025, demonstrating a forward-thinking approach to client needs.

- End-to-End Service Suite: Element offers a complete spectrum of fleet management services, from acquisition and financing to maintenance and remarketing, reducing the need for customers to manage multiple vendors.

- Technological Innovation: Investments in technology, such as advanced telematics and data analytics, provide clients with actionable insights for cost savings and operational efficiency.

- Strategic Advisory: Element's expert advice helps clients navigate complex fleet challenges, optimize vehicle lifecycle management, and achieve their business objectives.

- New Service Development: Initiatives like Element Risk Solutions and a digital driver app for 2025 highlight a proactive strategy to enhance customer value and loyalty, thereby diminishing customer bargaining power.

Customers' bargaining power is amplified when they have numerous alternative providers or can manage services internally. Element's integrated, end-to-end service model, supported by technological innovation and strategic advisory, significantly reduces this power by creating high switching costs and demonstrating superior value. For example, in 2024, Element's focus on reducing total cost of ownership for clients, highlighted by $1.5 billion in identified savings opportunities, directly countered customer price sensitivity.

| Factor | Impact on Customer Bargaining Power | Element's Counter-Strategy |

|---|---|---|

| Number of Alternatives | High if many providers exist; low if few specialized options. | Bundled services, integrated technology, and strategic advisory. |

| Switching Costs | High due to data migration, system integration, and retraining. | Comprehensive service suite makes migration complex and costly. |

| Price Sensitivity | High for informed buyers seeking cost savings. | Demonstrating total cost of ownership reduction and value-added services. |

| Product Differentiation | Low if services are commoditized; high if unique value is offered. | End-to-end solutions, technological innovation, and proactive service development. |

Full Version Awaits

Element Porter's Five Forces Analysis

This preview displays the exact, comprehensive Porter's Five Forces Analysis you will receive immediately upon purchase. You can trust that the insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products are all present and professionally formatted. No placeholders or sample content; what you see is precisely what you'll download and utilize.

Rivalry Among Competitors

The North American fleet management sector, Element's core market, is characterized by intense competition. Element itself stands as a prominent leader within this landscape.

Key rivals vying for market share include Verizon Connect, Geotab, and Samsara, all significant players. ARI Fleet Management and Donlen also represent substantial competition.

While Arval-Element operates as a global alliance, Element functions as a pure-play entity, highlighting its distinct market position and competitive focus.

The global fleet management market is projected to grow at a substantial compound annual growth rate (CAGR) ranging from 10.20% to 20.07% between 2024 and 2032-2034. This robust expansion, fueled by rising commercial vehicle demand and technological innovation, naturally intensifies competition among existing players and attracts new entrants seeking to capture market share in this dynamic sector.

Competitive rivalry is intensifying as companies increasingly differentiate through technology and sustainability. For instance, in the automotive sector, investments in AI for driver assistance, telematics for fleet management, and EV integration are becoming key differentiators, moving beyond basic leasing and maintenance services. This focus on advanced features and eco-friendly solutions allows businesses to carve out unique market positions.

Sustainability initiatives are a major driver of differentiation, with companies highlighting their commitment to environmental, social, and governance (ESG) principles. This can include offering electric vehicle fleets or implementing carbon-neutral operational practices. Such efforts resonate with a growing segment of customers prioritizing responsible business conduct, thereby shaping competitive landscapes.

Comprehensive service offerings, including predictive maintenance powered by data analytics and AI, are also crucial for standing out. By leveraging technology to anticipate and address potential issues before they arise, companies can offer superior uptime and reliability. This advanced service model provides a distinct advantage over competitors relying on traditional reactive maintenance approaches.

Switching Costs for Customers

High customer switching costs, often a result of deeply integrated systems and binding long-term contracts, significantly dampen competitive rivalry. These barriers make it considerably more difficult for rivals to lure away established clientele. For instance, in the enterprise software sector, companies like SAP and Oracle often report that the majority of their revenue comes from existing customers, with switching costs estimated to be in the tens of thousands to millions of dollars depending on the scale of implementation.

- Customer Retention: High switching costs foster greater customer loyalty and reduce churn.

- Competitive Advantage: Companies with high switching costs can command premium pricing.

- Market Dynamics: New client acquisition becomes the primary battleground for market share.

- Service & Cost Focus: Competitors must aggressively differentiate on cost savings and service quality to attract new business.

Strategic Objectives of Competitors

Competitors are heavily investing in digital innovation and automation, much like Element. For instance, in 2024, major players in the automotive sector, a key market for Element, allocated an average of 15% of their R&D budgets to digital transformation initiatives, aiming to enhance customer experience and operational efficiency.

Sustainability is another key battleground, with companies like Element pushing for fleet electrification. Many competitors are setting ambitious targets, such as electrifying 30% of their fleets by 2027, a move that intensifies competition for charging infrastructure and battery technology advancements.

The alignment in strategic objectives means that competition is increasingly about execution and speed in adopting new technologies. Companies that can most effectively leverage data analytics for predictive maintenance and optimize fleet management through AI are gaining a significant competitive edge.

- Digital Innovation: Competitors are channeling significant resources into digital platforms and AI-driven solutions.

- Automation: Investment in automated processes, from manufacturing to customer service, is a shared priority.

- Sustainability Focus: A strong emphasis on fleet electrification and reducing carbon footprints is evident across the industry.

- Data Analytics: The strategic use of data for operational improvements and customer insights is a key differentiator.

Competitive rivalry in the North American fleet management sector is intense, with Element facing strong opposition from major players like Verizon Connect, Geotab, and Samsara. This rivalry is amplified by a projected global fleet management market growth of 10.20% to 20.07% CAGR between 2024 and 2032-2034, driven by increased commercial vehicle demand and technological advancements.

Differentiation is increasingly occurring through technological innovation and sustainability initiatives. Companies are investing heavily in AI for driver assistance, telematics, and electric vehicle (EV) integration, alongside a growing emphasis on ESG principles and carbon-neutral operations to attract environmentally conscious customers.

The competitive landscape is further shaped by high customer switching costs, often due to integrated systems and long-term contracts, which foster customer loyalty and reduce churn. This makes new client acquisition the primary battleground, where competitors must excel in cost savings and service quality to gain market share.

| Competitor | Key Differentiators | 2024 Focus Areas |

|---|---|---|

| Verizon Connect | Telematics, IoT solutions | AI integration, sustainability reporting |

| Geotab | Data analytics, fleet safety | EV fleet management, predictive maintenance |

| Samsara | Connected operations platform | Automation, IoT security |

| ARI Fleet Management | Full-service leasing, maintenance | Digital customer portals, efficiency gains |

| Donlen | Customized fleet solutions | Data-driven insights, driver behavior monitoring |

SSubstitutes Threaten

In-house fleet management presents a direct substitute to outsourcing to providers like Element. Larger corporations, in particular, might opt to handle vehicle acquisition, maintenance, and regulatory compliance internally. This approach can offer greater control but often struggles to match the cost efficiencies and specialized knowledge found with dedicated fleet management services.

While internal management can seem appealing, it frequently misses out on the economies of scale and advanced technological integration that specialized providers offer. For instance, many companies find that the capital investment and ongoing operational costs of managing a fleet internally can be significantly higher than outsourcing, especially when considering the sophisticated telematics and data analytics capabilities that leading fleet management firms provide.

By 2024, the demand for efficient fleet operations continues to grow, pushing businesses to evaluate the total cost of ownership. Companies that choose in-house management may face challenges in keeping pace with evolving vehicle technologies and environmental regulations, areas where external specialists often maintain a competitive edge through continuous investment and expertise.

Companies might bypass full-service fleet management by directly leasing or purchasing vehicles from manufacturers or specialized leasing firms, managing operations internally. This strategy, however, often means foregoing the extensive cost optimization and efficiency gains that a provider like Element offers.

For instance, in 2024, the automotive industry saw continued direct sales initiatives from major manufacturers, aiming to capture a larger share of the fleet market. While this offers customization, it typically lacks the integrated telematics, maintenance scheduling, and fuel management that full-service providers deliver, potentially leading to higher per-vehicle operating costs for businesses that opt for direct arrangements.

The growing popularity of alternative transportation, including ride-sharing services and subscription models for vehicle access, poses a potential substitute threat to traditional car rental. While currently a minor concern for business travel, these emerging mobility solutions could gain traction. For instance, in 2024, the global ride-sharing market was valued at approximately $135 billion, indicating significant consumer adoption of these alternatives.

Technological Advancements Enabling Self-Management

Technological advancements, particularly in telematics and artificial intelligence, are indeed paving the way for more sophisticated in-house fleet management. This could theoretically reduce reliance on external providers.

However, the practicalities of developing and integrating these complex systems present a significant hurdle. For instance, the global fleet management market was valued at approximately $27.2 billion in 2023 and is projected to reach $62.1 billion by 2030, indicating substantial investment in specialized solutions. The sheer capital and expertise required to build and maintain cutting-edge AI-driven fleet management software often make outsourcing to established specialists like Element a more attractive and financially prudent choice for many businesses.

- High Development Costs: Building proprietary AI and telematics systems can cost millions, diverting capital from core business operations.

- Integration Complexity: Seamlessly integrating new technologies with existing IT infrastructure is a major challenge.

- Specialized Expertise: Managing advanced fleet technology requires a dedicated team of data scientists and software engineers.

- Rapid Technological Evolution: Keeping pace with fast-changing technological landscapes necessitates continuous, costly upgrades.

Focus on Reducing Fleet Size

Businesses increasingly explore reducing their fleet size by enhancing asset utilization and adopting remote work. This trend directly threatens fleet management service providers by diminishing the demand for their core offerings. For instance, companies are leveraging telematics and advanced route optimization software to get more out of fewer vehicles.

Element addresses this threat by shifting its focus to maximizing the efficiency and cost-effectiveness of existing fleets. Instead of just managing a large number of vehicles, Element emphasizes optimizing every aspect of fleet operations. This includes proactive maintenance to minimize downtime and fuel management solutions that can lead to significant savings.

- Reduced Fleet Demand: A growing number of companies are aiming to shrink their vehicle fleets.

- Efficiency Focus: Element counters by prioritizing optimization of current fleet assets.

- Cost Reduction: Strategies include improved logistics and remote work adoption to lower fleet needs.

- Service Adaptation: Element's strategy involves offering solutions that make smaller fleets more viable and efficient.

The threat of substitutes for fleet management services like Element comes from businesses managing their fleets in-house or utilizing alternative transportation methods. While internal management offers control, it often lacks the economies of scale and technological sophistication that specialized providers deliver. For example, in 2024, the automotive industry continued to see direct sales from manufacturers, which can bypass full-service providers, though often at the cost of integrated telematics and maintenance optimization.

Emerging mobility solutions, such as ride-sharing, also represent a growing, albeit currently smaller, substitute threat, particularly for certain types of business travel. The significant growth in the ride-sharing market, valued at approximately $135 billion globally by 2024, highlights a shift in transportation preferences that could impact traditional fleet usage.

Furthermore, companies are increasingly focused on optimizing asset utilization and embracing remote work, which can lead to reduced fleet sizes. This trend directly challenges fleet management providers by lowering the overall demand for their services. Element's strategy to counter this involves emphasizing efficiency and cost-effectiveness for the fleets that remain, rather than simply managing volume.

The development of sophisticated in-house fleet management systems, powered by AI and advanced telematics, is another potential substitute. However, the substantial capital investment and specialized expertise required to build and maintain these systems often make outsourcing to established providers like Element a more practical and financially sound decision for most businesses. The global fleet management market's projected growth to $62.1 billion by 2030 underscores the ongoing demand for specialized solutions.

| Substitute Type | Key Characteristics | Impact on Element | 2024 Relevance |

|---|---|---|---|

| In-house Fleet Management | Greater control, potential for higher upfront/ongoing costs, requires specialized expertise | Reduced demand for outsourcing services | Continued focus on cost-efficiency drives some internal evaluation |

| Direct Vehicle Leasing/Purchasing | Bypasses full-service providers, offers customization, may lack integrated management | Loss of service revenue, potential for customer churn | Manufacturers actively pursuing direct fleet sales |

| Alternative Mobility (Ride-sharing, Subscriptions) | Flexibility, pay-per-use, evolving consumer preference | Potential long-term reduction in business travel fleet needs | Significant growth in ride-sharing market ($135 billion by 2024) |

| Reduced Fleet Size (Asset Optimization, Remote Work) | Lower operational overhead, increased efficiency per vehicle | Decreased overall volume of fleet management contracts | Companies actively seeking to downsize fleets through efficiency gains |

Entrants Threaten

Entering the fleet management sector, particularly to rival a player like Element, demands substantial financial backing. This includes the considerable expense of acquiring a large vehicle fleet, establishing robust financing mechanisms, and investing in cutting-edge technology to manage operations efficiently.

Element's strong financial performance in 2024, marked by record results and sound capital management, underscores the high capital barrier to entry. Such financial strength indicates the scale of investment necessary for new competitors to gain meaningful traction and compete effectively in this capital-intensive industry.

Element, as an established leader in fleet management, leverages significant economies of scale. This means they can negotiate better prices for vehicle purchases and maintenance due to their sheer volume. For instance, in 2024, major fleet management companies often manage fleets exceeding tens of thousands of vehicles, allowing for substantial per-unit cost savings that new entrants simply cannot replicate initially.

The threat of new entrants is therefore mitigated by these scale advantages. A new player would face immense difficulty in matching Element's purchasing power and the efficiency of its integrated service network, which spans acquisition, financing, maintenance, and remarketing. Building a comparable infrastructure and supplier relationships from scratch would require massive upfront investment and time, creating a significant barrier.

The fleet management industry faces substantial regulatory hurdles that can deter new entrants. Companies must comply with stringent vehicle safety standards, evolving emissions regulations, and complex driver compliance requirements. For instance, in North America, the Federal Motor Carrier Safety Administration (FMCSA) mandates specific hours of service for drivers, impacting operational efficiency for all fleet operators.

Navigating these diverse and often geographically specific regulations presents a significant barrier to entry. A new player would need considerable resources and expertise to understand and adhere to compliance frameworks in markets like the United States, Canada, Australia, and New Zealand, where rules can differ substantially. This complexity acts as a powerful deterrent, protecting established firms with existing compliance infrastructure.

Brand Loyalty and Established Relationships

Element has cultivated deep-seated brand loyalty and enduring client relationships, often spanning decades. These connections are built on a foundation of demonstrable cost savings and consistently reliable service delivery, making it difficult for newcomers to replicate this level of trust.

New entrants must overcome the significant hurdle of establishing a comparable brand reputation and building the necessary trust to win over large commercial clients who value proven performance and established partnerships.

- Established Trust: Element's long history fosters client confidence, a difficult asset for new competitors to acquire quickly.

- Proven Value Proposition: Demonstrable cost savings and reliable service create a sticky customer base resistant to switching.

- High Switching Costs: For large commercial clients, the operational disruption and potential risks associated with changing service providers can be substantial, further entrenching Element's position.

Access to Distribution Channels and Technology

Established players in many industries, particularly those reliant on physical networks or complex technological integration, possess significant advantages in accessing distribution channels and technology. For instance, in the automotive sector, major manufacturers have decades-old relationships with dealerships and a deep understanding of supply chain logistics. In 2024, the cost of establishing a comparable dealership network and the associated infrastructure can run into hundreds of millions of dollars, creating a substantial barrier.

New entrants face the daunting task of replicating these extensive networks. Beyond physical distribution, established firms often boast integrated technological platforms for telematics, data analytics, and digital customer solutions. Building or acquiring such advanced fleet technology and the necessary data analytics capabilities requires immense capital investment and considerable time, often years, to achieve parity with incumbents. For example, developing a proprietary fleet management software suite with real-time tracking and predictive maintenance capabilities could cost upwards of $50 million.

- Distribution Channel Investment: Building a national dealership or service network can cost established automotive companies billions, a prohibitive sum for most new entrants.

- Technology Development Costs: Creating advanced telematics and data analytics platforms for fleet management can exceed $50 million, a significant hurdle for startups.

- Integrated Solutions: Existing players benefit from seamless integration of hardware, software, and service offerings, a complex and costly undertaking for newcomers to replicate.

- Brand Trust and Loyalty: Established brands have cultivated trust over years, making it difficult for new entrants to gain market share without comparable service reliability and customer support infrastructure.

The threat of new entrants into the fleet management sector, particularly challenging established players like Element, is significantly constrained by high capital requirements. These costs encompass acquiring substantial vehicle fleets and investing heavily in advanced management technology. Element's robust financial standing in 2024, with strong capital management, highlights the immense investment needed for new competitors to gain a foothold.

Economies of scale enjoyed by incumbents like Element present another formidable barrier. By managing vast fleets, they secure lower per-unit costs for vehicles and services, a price advantage new entrants struggle to match. For instance, in 2024, top fleet management firms often oversee fleets exceeding tens of thousands of vehicles, enabling substantial cost savings that are out of reach for newcomers.

Regulatory compliance adds another layer of difficulty, as new entrants must navigate complex vehicle safety, emissions, and driver regulations across different jurisdictions. The significant investment in expertise and infrastructure to ensure adherence to rules, such as those enforced by the FMCSA in North America, deters many potential competitors.

Furthermore, established brand loyalty and long-standing client relationships, built on proven reliability and cost savings, create high switching costs for commercial clients. New entrants must invest heavily in building comparable trust and demonstrating superior value to disrupt these entrenched partnerships.

| Barrier | Description | Estimated Cost/Impact for New Entrant |

|---|---|---|

| Capital Requirements | Acquisition of fleet, technology investment, financing infrastructure | Hundreds of millions to billions of dollars |

| Economies of Scale | Negotiating power for vehicle purchases and maintenance | Inability to match per-unit cost savings of fleets >10,000 vehicles |

| Regulatory Compliance | Adherence to safety, emissions, driver regulations (e.g., FMCSA) | Significant investment in legal, compliance, and operational adjustments |

| Brand Loyalty & Switching Costs | Building trust, overcoming client inertia | Years of consistent service delivery and significant marketing investment required |

| Distribution & Technology | Establishing service networks, developing integrated software platforms | Tens to hundreds of millions for networks; $50M+ for advanced software |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and expert analyst opinions to provide a comprehensive view of competitive dynamics.