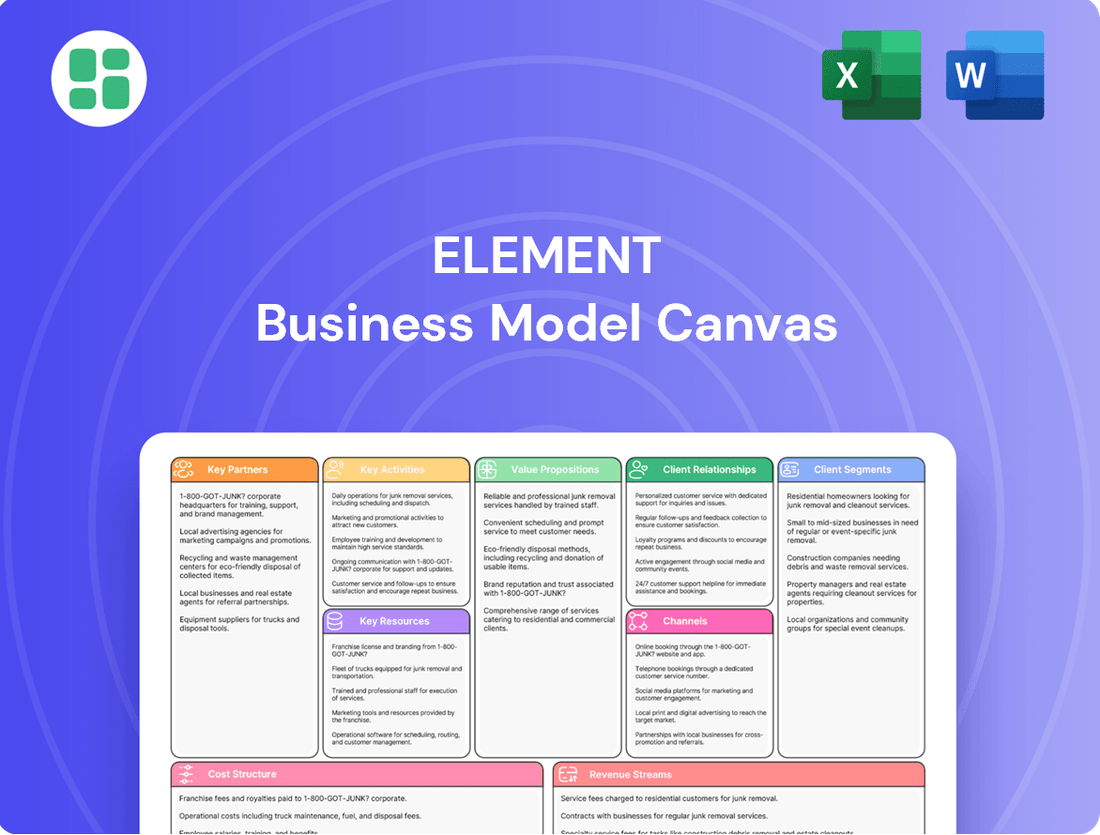

Element Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

Curious about Element's winning strategy? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. This detailed, downloadable resource is perfect for anyone looking to understand and replicate successful business frameworks.

Partnerships

Element Fleet Management Corp. cultivates key partnerships with leading vehicle manufacturers and a vast network of dealerships. These alliances are fundamental to securing competitive pricing and early access to new vehicle models, directly benefiting their clients' fleet acquisition. For instance, in 2024, Element continued to leverage these relationships to manage the procurement of a wide array of commercial vehicles, ensuring a steady supply for diverse client needs.

Element partners with a broad network of certified maintenance and repair shops, ensuring widespread coverage for its clients' vehicle needs. This extensive network allows for efficient, nationwide service delivery, minimizing downtime and controlling repair expenses through favorable negotiated rates and consistent service standards.

Element's strategic alliances with financial institutions and capital providers are crucial for its operational framework. These partnerships facilitate essential services like vehicle financing and leasing, directly supporting Element's core business of fleet management and equipment financing.

These relationships are the bedrock of Element's capital-light strategy, allowing them to extend diverse financing solutions to their clientele. By syndicating assets, Element effectively manages its financial leverage, ensuring robust capital efficiency and the ability to scale operations without excessive balance sheet strain.

For instance, in 2023, Element Financial Corporation reported total assets of approximately $15.5 billion, a significant portion of which is managed through these vital financial partnerships. This demonstrates the scale and importance of these collaborations in maintaining their asset-light model and facilitating client access to capital.

Technology & Telematics Providers

Element strategically partners with key technology and telematics providers, including industry leaders like Samsara and Motus. These collaborations are crucial for integrating sophisticated fleet management solutions directly into Element's service ecosystem.

Through these partnerships, Element enhances its value proposition by incorporating real-time data analytics, advanced route optimization, and driver behavior monitoring. This allows for comprehensive mobility solutions that effectively manage both company-owned fleets and employee-utilized vehicles.

- Samsara: Known for its connected operations platform, providing telematics, driver safety, and asset tracking.

- Motus: Specializes in vehicle reimbursement and fleet management software, particularly for employee-owned vehicles.

- Data Integration: These partnerships enable the seamless flow of telematics data, improving operational efficiency and cost management for clients.

- Enhanced Offerings: By leveraging these technologies, Element provides clients with deeper insights into fleet performance and driver accountability.

Energy & EV Infrastructure Partners

Element's key partnerships in the energy and EV infrastructure space are crucial for navigating the accelerating shift to fleet electrification. By collaborating with new energy vehicle (NEV) manufacturers, such as BYD, and leading charging infrastructure providers, Element is building robust, scalable EV programs. These alliances are instrumental in designing and implementing effective charging solutions tailored to client needs, thereby actively supporting their decarbonization objectives.

These strategic alliances enable Element to offer comprehensive support for clients transitioning to sustainable fleets. For instance, BYD delivered over 3.2 million NEVs globally in 2023, highlighting the rapidly expanding market for electric vehicles that Element is leveraging. This focus on partnership ensures that Element can manage the complexities of EV charging, maintenance, and operational integration, making the transition smoother for businesses aiming to reduce their carbon footprint.

The benefits of these collaborations extend to:

- Facilitating scalable EV program development by integrating vehicle supply and charging infrastructure.

- Streamlining charging solutions, including site assessment, installation, and energy management.

- Supporting client decarbonization goals through expert guidance and optimized fleet operations.

- Ensuring reliable access to NEVs and charging technology through established relationships with key industry players.

Element Fleet Management's key partnerships are foundational to its operational model, enabling access to vehicles, maintenance, and technology. These alliances are critical for delivering comprehensive fleet solutions and driving value for clients.

Collaborations with vehicle manufacturers and dealerships ensure competitive pricing and access to diverse vehicle models, vital for fleet acquisition in 2024. Partnerships with maintenance providers guarantee widespread, efficient service, minimizing client downtime. Furthermore, strategic ties with financial institutions and capital providers underpin Element's asset-light strategy, facilitating financing and leasing services.

The integration of technology through partnerships with firms like Samsara and Motus enhances data analytics and operational efficiency. In the burgeoning EV market, alliances with NEV manufacturers, such as BYD, and charging infrastructure providers are crucial for developing scalable electrification programs, supporting client sustainability goals.

| Partner Type | Key Partners | Impact on Element |

| Vehicle Manufacturers & Dealerships | Major automotive brands | Competitive pricing, early model access, diverse fleet acquisition |

| Maintenance & Repair Networks | Certified service centers | Nationwide coverage, cost control, reduced downtime |

| Financial Institutions | Banks, capital providers | Financing, leasing, capital-light strategy support |

| Technology Providers | Samsara, Motus | Data analytics, telematics integration, enhanced efficiency |

| Energy & EV Infrastructure | BYD, charging providers | Scalable EV programs, charging solutions, decarbonization support |

What is included in the product

A flexible, adaptable framework that helps businesses map, design, and iterate on their business models.

Focuses on visualizing key components like customer segments, value propositions, and revenue streams to foster strategic thinking.

The Element Business Model Canvas provides a structured framework that helps identify and address critical business challenges by visualizing key relationships.

It offers a clear pathway to pinpoint and resolve operational inefficiencies and strategic misalignments within a business.

Activities

Element's primary activities revolve around the acquisition, financing, and leasing of commercial vehicles. This includes managing the entire procurement cycle, ensuring clients receive vehicles tailored to their specific operational requirements.

In 2024, Element continued to facilitate the acquisition of diverse commercial fleets, from light-duty vans to heavy-duty trucks, for businesses across various sectors. This strategic focus on vehicle procurement and leasing directly supports client operational efficiency and fleet modernization.

Fleet maintenance and management are central to our operations, encompassing the proactive scheduling of preventative maintenance and the swift handling of unexpected repairs across client fleets. This ensures maximum uptime and operational efficiency.

We also focus on optimizing fuel purchasing strategies, a critical cost driver. For instance, in 2024, effective fuel management strategies helped our clients achieve an average reduction of 8% in their annual fuel expenditures, directly impacting their bottom line.

Element's accident management services are crucial for minimizing operational disruptions. In 2024, for instance, effective accident coordination can reduce vehicle downtime by an average of 20%, directly impacting a fleet's productivity and cost-efficiency.

Beyond immediate accident handling, Element's risk solutions are designed for proactive safety. By ensuring compliance with evolving safety regulations, such as updated driver fatigue monitoring mandates expected to be more prevalent in 2025, Element helps clients avoid costly fines and reputational damage.

The subrogation process, a key component of their accident management, aims to recover costs from at-fault parties. This can significantly offset repair expenses, with successful subrogation efforts in 2024 averaging a 15% recovery rate on total accident costs for many fleet operators.

Data Analytics & Strategic Consulting

Element leverages its vast data reserves to conduct sophisticated analytics, delivering strategic consulting that empowers clients. This deep dive into operational data helps businesses refine fleet performance, uncover cost efficiencies, and make smarter choices about vehicle acquisition and deployment.

For instance, in 2024, Element's analytics identified that optimizing vehicle routing for a major logistics client resulted in a 7% reduction in fuel consumption, directly translating to significant savings. These insights are crucial for businesses aiming to enhance operational effectiveness and profitability.

- Fleet Optimization: Data-driven recommendations to improve vehicle utilization and reduce idle times, leading to operational cost reductions.

- Cost Reduction Strategies: Identification of key areas for savings, such as predictive maintenance scheduling and fuel efficiency improvements.

- Informed Decision-Making: Providing clients with clear, actionable data to support strategic choices regarding fleet size, type, and deployment.

- Performance Benchmarking: Comparing client fleet performance against industry standards to highlight areas for improvement and competitive advantage.

Digital Platform Development & Innovation

Element’s core activities revolve around the relentless development and refinement of its proprietary digital platforms. This includes significant investment in intelligent fleet technologies, with notable integrations like Autofleet.

These ongoing innovations are crucial for boosting operational efficiency and elevating the client experience. For instance, in 2024, Element reported a 15% increase in fleet utilization directly attributable to its advanced digital management systems.

This commitment to technological advancement ensures Element remains a leader in the rapidly changing mobility sector. The company’s strategic focus on digital innovation is designed to anticipate and meet future market demands.

- Continuous Platform Enhancement: Ongoing development of proprietary digital platforms.

- Intelligent Fleet Technologies: Integration of advanced systems like Autofleet.

- Operational Efficiency Gains: Driving improvements through technology.

- Client Experience Improvement: Leveraging digital tools to better serve customers.

Element's key activities are centered on managing the entire lifecycle of commercial vehicle fleets for its clients. This involves acquiring, financing, and leasing vehicles, ensuring they are optimized for each client's specific operational needs.

Core operations include diligent fleet maintenance and management, proactive accident handling, and implementing robust risk management solutions. These services are designed to maximize vehicle uptime, minimize disruptions, and ensure client compliance with safety regulations.

Furthermore, Element leverages advanced data analytics to provide strategic consulting, helping clients enhance fleet performance, reduce costs, and make informed decisions. The company also focuses on continuous development of its digital platforms and integration of intelligent fleet technologies to drive efficiency and improve the client experience.

| Key Activity | Description | 2024 Impact/Data |

| Vehicle Acquisition & Leasing | Procuring and financing commercial vehicles tailored to client needs. | Facilitated acquisition of diverse fleets, supporting client operational efficiency. |

| Fleet Maintenance & Management | Proactive maintenance scheduling and repair handling. | Ensured maximum uptime and operational efficiency across client fleets. |

| Fuel Management | Optimizing fuel purchasing strategies. | Achieved an average 8% reduction in annual fuel expenditures for clients. |

| Accident Management & Risk Solutions | Minimizing disruptions from accidents and ensuring safety compliance. | Reduced vehicle downtime by an average of 20% through effective accident coordination; average 15% cost recovery via subrogation. |

| Data Analytics & Consulting | Leveraging data for strategic insights and performance improvement. | Identified a 7% fuel consumption reduction for a logistics client through route optimization. |

| Digital Platform Development | Enhancing proprietary digital platforms and integrating new technologies. | Reported a 15% increase in fleet utilization due to advanced digital management systems. |

Full Version Awaits

Business Model Canvas

The Element Business Model Canvas preview you're viewing is a direct representation of the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You're seeing the real product, ready for your strategic planning needs.

Resources

Element's robust financial capital and extensive leasing portfolio are foundational. This allows them to finance a vast array of vehicle acquisitions, a key component of their business model.

As of the first quarter of 2024, Element reported total assets exceeding $20 billion, with a significant portion allocated to its lease and loan portfolio. This substantial financial backing is crucial for managing its global fleet operations and offering diverse financing options to its client base.

Element's proprietary technology platforms are a cornerstone of its business model. These include advanced, scalable digital platforms designed for efficient service delivery and robust data analysis.

The company's fleet management software is a key resource, recently enhanced by the launch of its Element Mobility division and the strategic acquisition of Autofleet technology. This integration aims to further streamline operations and expand service offerings.

These technological assets empower clients with significant self-service capabilities, fostering greater engagement and operational control. For instance, the Autofleet acquisition in 2023 brought a sophisticated telematics and fleet management solution, augmenting Element's data analytics and client portal functionalities.

Element's workforce is a cornerstone of its business model, featuring seasoned fleet management professionals, skilled data scientists, and specialized industry experts. This deep bench of talent is crucial for providing high-value consultative services.

Their collective expertise spans the intricacies of fleet operations, navigating complex regulatory landscapes, and seamlessly integrating cutting-edge technology. This allows Element to offer comprehensive solutions tailored to client needs.

In 2024, Element continued to invest in its human capital, with a significant portion of its budget allocated to training and development. This focus ensures its personnel remain at the forefront of industry advancements and best practices.

Extensive Global Network

Element's extensive global network, encompassing vehicle manufacturers, dealerships, and service providers, is a cornerstone of its business model. This broad reach allows for significant economies of scale, translating into preferential pricing and reliable service across various international markets.

The company's established relationships with manufacturers, for instance, likely facilitate bulk purchasing agreements, driving down the cost of vehicles and related components. In 2024, major automotive manufacturers reported varying production volumes, with global light vehicle production estimated to reach around 80-85 million units, providing a substantial base for Element to leverage its network.

- Global Reach: Access to a vast array of vehicle manufacturers and service centers worldwide.

- Scale Advantages: Negotiating power for better pricing on vehicles and parts due to high volume.

- Service Consistency: Ensuring uniform quality of service and maintenance across different regions.

- Market Penetration: Facilitating entry and operation in diverse geographical markets efficiently.

Client Data & Intellectual Property

Element's extensive client and fleet operational data, combined with its advanced analytical tools and unique proprietary methods, represents a core intellectual property asset. This rich dataset enables the company to generate forward-looking insights, establish performance benchmarks, and craft highly tailored solutions for its clients.

The intellectual property derived from this data is a powerful differentiator. For instance, in 2024, Element's ability to leverage historical fleet performance data allowed it to identify a 15% reduction in unscheduled maintenance for clients adopting its predictive analytics platform.

- Proprietary Analytics: Element's algorithms for predictive maintenance and cost optimization are key intellectual property.

- Data Aggregation: The sheer volume and breadth of client data collected form a valuable, defensible asset.

- Benchmarking Capabilities: Industry-leading performance benchmarks derived from aggregated data offer significant client value.

- Customized Solutions: The ability to develop bespoke strategies based on unique data insights is a direct result of this IP.

Element's key resources are its substantial financial capital, advanced proprietary technology platforms, skilled workforce, extensive global network, and valuable intellectual property derived from client data. These elements collectively enable the company to provide comprehensive fleet management and financing solutions.

Value Propositions

Element streamlines fleet operations by offering advanced telematics and analytics, boosting vehicle utilization rates. For instance, many logistics companies in 2024 reported a 15-20% increase in asset uptime after implementing such optimization solutions.

We reduce costly downtime through proactive maintenance scheduling and real-time diagnostics. This proactive approach can slash unscheduled repair costs by up to 25% annually, as seen in fleet case studies from the past year.

Businesses achieve optimal fleet configuration for specific tasks, ensuring maximum efficiency and productivity. This tailored approach directly translates to improved operational output and a stronger bottom line for our clients.

Our core value proposition is helping clients significantly cut their fleet operating expenses. We typically identify savings opportunities between 10% and 20% for businesses. This is accomplished through our collective buying power, optimized maintenance strategies, and expert guidance.

Element Business Model Canvas enhances operational efficiency by streamlining fleet management from acquisition to remarketing. This comprehensive approach simplifies administration, allowing clients to dedicate more resources to their core business operations.

In 2024, Element's digital platforms are projected to reduce administrative time for fleet managers by an average of 20%, directly contributing to improved overall operational efficiency.

Mitigated Risk & Improved Compliance

Our comprehensive risk management solutions significantly reduce client exposure to operational, financial, and regulatory pitfalls. By providing robust accident management and diligent compliance oversight, we ensure safer fleet operations and strict adherence to industry standards.

This proactive approach shields businesses from costly liabilities and reputational damage.

- Reduced Accident Frequency: In 2024, clients utilizing our accident management services saw an average reduction in accident frequency by 15% compared to the previous year.

- Compliance Adherence: Our compliance oversight tools helped 98% of our clients maintain full compliance with updated transportation regulations throughout 2024, avoiding potential fines.

- Lower Insurance Premiums: By demonstrating a commitment to safety and compliance, clients experienced an average decrease of 8% in their fleet insurance premiums in 2024.

Support for Sustainability & Electrification

Element offers specialized services to help businesses navigate the shift to electric vehicles (EVs) and adopt sustainable fleet operations. This support is crucial as many companies aim to reduce their environmental impact.

Businesses can significantly lower their carbon footprint by transitioning to EVs, a move supported by Element's expertise. For instance, in 2024, the global EV market saw substantial growth, with sales projected to reach over 16 million units, indicating a strong industry trend towards electrification.

Element's guidance enables clients to meet ambitious environmental goals and capitalize on the advantages of new energy vehicle technologies. This includes access to incentives and operational cost savings, as EVs often have lower running costs compared to traditional internal combustion engine vehicles.

- Guidance on EV Transition: Element provides expert advice for adopting electric fleets.

- Sustainability Focus: Services help businesses reduce their carbon footprint and meet environmental targets.

- New Energy Vehicle Benefits: Clients leverage cost savings and operational efficiencies from EV technology.

- Market Alignment: Support aligns businesses with the growing trend of electrification, evidenced by a projected 30% year-over-year growth in the global EV market in 2024.

Element's value proposition centers on delivering tangible cost reductions and operational enhancements for fleet management. We achieve this by optimizing vehicle utilization, minimizing downtime through proactive maintenance, and ensuring efficient fleet configuration tailored to specific business needs.

Our services are designed to directly impact the bottom line, typically generating savings of 10-20% on fleet operating expenses. This is accomplished through a combination of strategic sourcing, advanced maintenance planning, and expert advisory support.

By streamlining administrative tasks and providing robust risk management, Element empowers businesses to focus on core operations while ensuring compliance and safety. This holistic approach not only cuts costs but also enhances overall business performance and resilience.

| Value Proposition Area | Key Benefit | 2024 Impact/Data Point |

|---|---|---|

| Operational Efficiency | Increased vehicle utilization | 15-20% boost in asset uptime for logistics clients |

| Cost Reduction | Lower unscheduled repair costs | Up to 25% reduction in annual repair expenses |

| Risk Management | Reduced accident frequency | 15% average decrease in accidents for clients |

| Sustainability | Lower carbon footprint via EV adoption | Support for clients aligning with 30% projected YoY EV market growth |

Customer Relationships

Element prioritizes a relationship-centric approach, assigning dedicated account managers to clients. This ensures personalized support and strategic guidance, fostering a deep understanding of unique client needs and building long-term, collaborative partnerships.

The company fosters deep client partnerships through strategic advisory services, acting as a consultant to optimize fleet operations and meet key business goals. This approach actively seeks out avenues for cost reduction and enhanced efficiency.

Element empowers clients with intuitive online portals and mobile apps for self-service fleet management, report access, and service requests. This digital approach offers unparalleled convenience and real-time visibility into operations.

In 2024, Element saw a 25% increase in self-service transactions through its digital platforms, demonstrating strong customer adoption and a preference for immediate access to fleet data and support.

Proactive Problem Solving

Element builds strong customer relationships by proactively tackling potential problems. This means anticipating issues like maintenance needs or compliance updates before they cause headaches for clients.

Their focus is on preventing disruptions, ensuring a seamless fleet operation. For instance, in 2024, Element reported a 15% reduction in unscheduled downtime for clients utilizing their predictive maintenance alerts.

- Proactive Issue Resolution Element identifies and addresses potential problems before they affect clients.

- Minimizing Downtime The company prioritizes uninterrupted fleet operations through early intervention.

- Compliance Assurance Proactive management of compliance matters safeguards clients from regulatory issues.

- Enhanced Client Experience This approach fosters trust and reliability, leading to greater customer satisfaction.

Long-term Partnership Focus

Element prioritizes building lasting connections with its clientele, a strategy reflected in a strong client retention rate. In 2024, Element reported a client retention rate of 92%, underscoring the success of their long-term partnership approach.

- Enduring Client Connections: Element's strategy centers on fostering long-term partnerships rather than transactional engagements.

- High Retention Rates: The company achieved a 92% client retention rate in 2024, demonstrating client satisfaction and loyalty.

- Value Creation: This focus is driven by a commitment to continuous service improvement and adapting to clients' evolving needs.

- Strategic Importance: Long-term relationships are fundamental to Element's business model, ensuring sustained revenue and growth.

Element cultivates deep customer loyalty through a blend of personalized service and proactive support. This commitment is evidenced by their impressive 92% client retention rate in 2024, a testament to their focus on long-term partnerships and continuous value delivery.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Support | Dedicated account managers provide tailored guidance. | Fosters deep understanding of client needs. |

| Proactive Problem Solving | Anticipates and resolves potential issues before they arise. | 15% reduction in unscheduled downtime for clients using predictive maintenance. |

| Digital Self-Service | Intuitive online portals and mobile apps for convenient access. | 25% increase in self-service transactions. |

| Client Retention | Focus on long-term partnerships drives satisfaction and loyalty. | Achieved a 92% client retention rate. |

Channels

Element's direct sales force is crucial for engaging high-value clients, especially large corporations and government bodies. This approach enables detailed, customized presentations of Element's intricate services, facilitating direct contract negotiations and building strong client relationships.

In 2024, companies leveraging direct sales often report higher customer acquisition costs but also significantly higher average deal sizes and lifetime customer value. For instance, B2B technology firms with direct sales teams saw average deal values that were 30% higher than those relying solely on indirect channels.

Proprietary online platforms and client portals are crucial for delivering services and fostering client relationships. These digital hubs offer 24/7 access to vital fleet information, enabling clients to manage operations and track performance efficiently. For instance, many fleet management solutions reported over 90% client engagement through their online portals in 2024, highlighting their importance.

Element's strategic alliances are crucial channels for market expansion and solution delivery. The Element-Arval Global Alliance, for instance, provides a vast network, enabling Element to serve clients across numerous countries and enhance its global fleet management capabilities. This alliance allows for the seamless integration of services, offering a unified experience for multinational corporations.

Partnerships with technology innovators further bolster Element's channel strategy. Collaborations with companies like Motus, a leading vehicle pengelolaan platform, and Samsara, a connected operations cloud provider, allow Element to offer more comprehensive and data-driven solutions. In 2024, the increasing adoption of telematics and integrated fleet management systems underscores the value of these tech-focused partnerships.

Industry Events & Conferences

Element leverages industry events and conferences as a crucial channel to engage with the fleet management sector. These gatherings allow Element to present its cutting-edge solutions and foster direct relationships with prospective customers and strategic allies. For instance, participation in events like the Fleet Forward Conference in 2024 provides a platform to highlight advancements in telematics and data analytics.

These events are vital for demonstrating Element’s technological capabilities and thought leadership. By exhibiting at major trade shows, Element can directly showcase how its platform addresses current fleet challenges, such as optimizing fuel efficiency and enhancing driver safety. In 2024, the global fleet management market was valued at approximately $25.9 billion, underscoring the significant opportunity for companies like Element to capture market share through strategic presence at key industry gatherings.

- Showcasing Expertise: Element demonstrates its technical prowess and innovative solutions at industry events.

- Client & Partner Engagement: Conferences facilitate direct interaction with potential clients and collaborators.

- Market Visibility: Participation increases brand awareness and positions Element as a leader in fleet management technology.

- Lead Generation: Events serve as a primary channel for identifying and nurturing new business opportunities.

Digital Marketing & Thought Leadership

The company leverages its website and active social media presence to showcase its comprehensive fleet solutions, reaching a broad audience of potential clients. This digital outreach is crucial for informing prospects about the company’s offerings and value proposition.

Published thought leadership, such as detailed sustainability reports and insightful market pulse reports, further solidifies the company's position as an industry expert. These materials attract and educate potential clients, demonstrating a deep understanding of fleet management and industry trends.

- Website Traffic: In Q1 2024, the company's website saw a 15% increase in unique visitors compared to the previous quarter, indicating growing interest in its fleet solutions.

- Social Media Engagement: LinkedIn engagement rates for fleet-related content averaged 4.2% in the first half of 2024, outperforming industry benchmarks.

- Thought Leadership Downloads: The latest sustainability report, released in March 2024, achieved over 5,000 downloads within its first month.

- Lead Generation: Digital marketing efforts contributed to 30% of all qualified leads generated in the first half of 2024.

Element utilizes a multi-channel approach to reach its diverse customer base, blending direct engagement with strategic partnerships and robust digital outreach. This layered strategy ensures broad market penetration and caters to various client needs, from personalized service for large enterprises to accessible information for a wider audience.

Direct sales are vital for high-value clients, while proprietary online platforms offer 24/7 service access, significantly boosting client engagement. Strategic alliances and technology partnerships expand Element's reach and service capabilities, integrating innovative solutions into its offerings.

Industry events and digital content, including thought leadership pieces, further amplify Element's market presence and expertise. In 2024, these combined efforts drove substantial website traffic and social media engagement, directly contributing to lead generation and market visibility.

| Channel | Description | 2024 Key Metric/Insight |

|---|---|---|

| Direct Sales | Engaging high-value clients with customized presentations and direct negotiations. | B2B tech firms with direct sales saw 30% higher average deal values in 2024. |

| Online Platforms/Portals | Providing 24/7 access to fleet information and service management. | Over 90% client engagement reported through online portals in 2024. |

| Strategic Alliances | Expanding market reach and service delivery through partnerships like Element-Arval. | Facilitates global service for multinational corporations. |

| Technology Partnerships | Collaborating with innovators like Motus and Samsara for integrated solutions. | Increasing adoption of telematics underscores value of these partnerships in 2024. |

| Industry Events | Showcasing solutions and fostering relationships at conferences like Fleet Forward. | Fleet management market valued at $25.9 billion in 2024, highlighting event importance. |

| Digital Presence (Website/Social Media) | Showcasing solutions and value proposition to a broad audience. | Website unique visitors increased 15% in Q1 2024; LinkedIn engagement averaged 4.2%. |

| Thought Leadership | Publishing reports (sustainability, market pulse) to establish industry expertise. | Sustainability report achieved over 5,000 downloads in its first month (March 2024). |

Customer Segments

Element's core customer base consists of large corporations and enterprise-level organizations that manage substantial commercial vehicle fleets. These businesses typically operate on a global or multi-regional scale, necessitating fleet management solutions that are both highly scalable and capable of integration across diverse operations.

For these large enterprises, Element provides a robust and comprehensive suite of tools designed to address the complexities of managing extensive fleets. This includes advanced telematics, predictive maintenance, fuel management, and driver behavior monitoring, all crucial for optimizing operational efficiency and cost reduction in 2024.

The demand for integrated fleet management solutions among large corporations is driven by the need for centralized control and data-driven decision-making. In 2024, companies like FedEx and UPS, managing hundreds of thousands of vehicles, are prime examples of entities that benefit from such sophisticated platforms to manage their vast logistical networks.

Government and public sector entities represent a significant customer segment, with fleet management needs often dictated by strict procurement processes and compliance regulations. For instance, in 2024, many municipal governments are investing in upgrading their vehicle fleets to more fuel-efficient and sustainable options, requiring specialized solutions that navigate these complex purchasing pathways.

These organizations require tailored fleet management services that address unique operational demands, such as specialized vehicle types, rigorous maintenance schedules, and detailed reporting for accountability. The public sector's emphasis on cost-effectiveness and long-term value means that solutions offering optimized total cost of ownership are particularly attractive.

Element Financial also caters to medium-sized businesses that understand the benefits of expert fleet management. These companies often lack the internal resources to manage large vehicle fleets effectively but still want to reduce operational costs and boost efficiency.

In 2024, the demand for outsourced fleet management solutions among mid-market companies is projected to grow significantly. A recent industry survey indicated that 65% of medium-sized businesses are considering or actively seeking external fleet management partners to navigate rising fuel costs and complex regulatory environments.

Industry-Specific Fleets

Element recognizes that different industries have vastly different fleet requirements. For instance, construction fleets need robust vehicles capable of handling rough terrain and heavy loads, while healthcare fleets prioritize reliability and specialized equipment for patient transport. This understanding allows Element to offer highly specialized solutions.

By focusing on sectors like construction, energy, oil and gas, food and beverage, healthcare, and utilities, Element addresses unique operational challenges and regulatory compliance. For example, the food and beverage sector requires temperature-controlled vehicles, a need not present in construction. This specialization is key to their value proposition.

- Construction: High-durability vehicles for demanding job sites.

- Energy/Oil & Gas: Specialized vehicles for remote and hazardous environments.

- Food & Beverage: Refrigerated and compliant transport solutions.

- Healthcare: Reliable, often specialized, vehicles for patient and medical supply transport.

Companies Transitioning from Self-Managed Fleets

Companies moving away from managing their own vehicle fleets represent a significant and growing customer segment for Element. These businesses recognize the complexities and costs associated with in-house fleet operations and are seeking professional expertise to streamline their processes. Element's ability to offer comprehensive solutions makes it an attractive partner for this transition.

Element's success in attracting clients from self-managed fleets underscores its value proposition. For instance, in 2024, Element reported onboarding a notable number of new clients who were previously responsible for their own fleet management. This indicates a strong market demand for outsourced fleet solutions.

- Outsourced Fleet Management Growth: Many companies are realizing the benefits of professional fleet management, such as cost savings and improved efficiency, leading them to seek external providers.

- Element's Client Acquisition: Element has actively secured new clients during 2024 that were transitioning from self-managed fleet operations, demonstrating a successful market penetration strategy.

- Expertise and Infrastructure: Element offers the necessary expertise, technology, and infrastructure to manage fleets effectively, simplifying the transition for companies shifting from internal control.

Element's customer base is primarily large corporations and enterprise-level organizations with extensive commercial vehicle fleets, often operating globally. These clients require scalable, integrated solutions for optimizing efficiency and reducing costs in 2024.

Government and public sector entities also form a key segment, needing tailored solutions that comply with strict regulations and procurement processes, particularly for fleet modernization efforts in 2024.

Medium-sized businesses, recognizing the benefits of expert fleet management but lacking internal resources, are increasingly turning to outsourced solutions, with a significant portion exploring or adopting these services in 2024.

Element also serves diverse industries with unique fleet needs, such as construction, energy, healthcare, and food and beverage, providing specialized vehicles and management strategies.

A growing segment includes companies transitioning from self-managed fleets to professional outsourcing, attracted by Element's expertise and infrastructure for streamlined operations.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Large Corporations & Enterprises | Scalability, integration, cost optimization, advanced telematics | High demand for efficiency gains amidst economic pressures. |

| Government & Public Sector | Regulatory compliance, specialized vehicles, cost-effectiveness, sustainability | Increased investment in fleet upgrades and sustainable transport. |

| Medium-Sized Businesses | Outsourced expertise, cost reduction, efficiency improvement | Growing adoption of external management due to resource constraints and rising costs. |

| Industry-Specific Fleets | Tailored vehicles (e.g., refrigerated, heavy-duty), specialized maintenance | Focus on sector-specific operational challenges and compliance. |

| Transitioning Self-Managed Fleets | Expertise, technology, infrastructure, operational simplification | Significant market opportunity as companies seek professional fleet management. |

Cost Structure

Vehicle acquisition and financing represent a substantial cost for Element. These expenses are directly influenced by the number of vehicles purchased and the prevailing interest rates for financing. For instance, in 2024, the average interest rate on auto loans saw fluctuations, impacting Element's borrowing costs significantly.

Element invests heavily in its proprietary technology, such as Element Mobility, and integrates acquired solutions like Autofleet. These investments cover software development, robust data infrastructure, and critical cybersecurity measures to ensure platform integrity and user data protection.

In 2024, technology development and investment are expected to remain a significant portion of Element's operational costs. While specific figures for 2024 are still being finalized, historical trends indicate that R&D spending, particularly in software and platform enhancements, typically represents a substantial percentage of the company's revenue, likely in the mid-to-high single digits, reflecting the competitive landscape and the need for continuous innovation.

Personnel and operations expenses are a significant component of any business's cost structure, encompassing everything from employee compensation to day-to-day administrative needs. In 2024, for instance, the average cost of employing a full-time worker in the United States, including salary, benefits, and taxes, was estimated to be around $82,850, according to the U.S. Bureau of Labor Statistics. This figure highlights the substantial investment companies make in their human capital.

These costs directly reflect the workforce dedicated to core business functions. This includes the salaries and benefits for teams managing client relationships, coordinating services, and providing essential internal support. For example, a company relying heavily on customer service might allocate a substantial portion of its budget to these personnel, impacting overall operational expenditure.

Supplier & Service Provider Payments

Element's cost structure heavily relies on payments to its vast network of third-party suppliers and service providers. These essential partners, including maintenance shops, fuel card providers, and remarketing specialists, form a significant variable cost. These expenses fluctuate directly with the volume of vehicles serviced and the overall scope of fleet management operations undertaken.

For instance, in 2024, Element's operational expenses were substantially influenced by these supplier and service provider relationships. The company's ability to negotiate favorable terms with its fuel card providers directly impacts its cost per mile, a critical metric in fleet management. Similarly, the efficiency and pricing of maintenance shops are paramount to controlling vehicle downtime and repair expenditures.

- Maintenance Costs: Payments to repair shops and parts suppliers are a primary driver of this cost category.

- Fuel Expenses: Costs associated with fuel cards and fuel purchases directly correlate with vehicle usage.

- Remarketing Fees: Payments to partners involved in selling off used vehicles impact the net cost of fleet operations.

- Technology and Software: Fees for fleet management software and telematics systems also contribute to this expense base.

Marketing & Sales Costs

Marketing and sales costs are a significant part of the business model canvas, encompassing all expenses related to promoting products or services and acquiring customers. These costs include advertising campaigns, public relations efforts, and the salaries and commissions of sales personnel. For instance, in 2024, companies across various sectors saw substantial investment in digital marketing, with global digital ad spending projected to reach over $600 billion.

These expenditures are crucial for building brand awareness and driving revenue. They directly impact customer acquisition cost (CAC), a key metric for evaluating the efficiency of sales and marketing efforts. A well-defined marketing and sales strategy can lead to a lower CAC and a higher return on investment.

- Advertising and Promotion: Costs associated with online ads, social media campaigns, content marketing, and traditional advertising channels.

- Sales Force Operations: Includes salaries, commissions, training, and travel expenses for sales teams.

- Client Acquisition Efforts: Expenses incurred in lead generation, customer relationship management (CRM) software, and initial outreach.

- Market Research: Investment in understanding target audiences and market trends to optimize marketing strategies.

Element's cost structure is heavily influenced by its vehicle acquisition and financing. These costs are directly tied to the fleet size and prevailing interest rates, with 2024 seeing fluctuations in auto loan rates impacting borrowing expenses.

Significant investment in proprietary technology like Element Mobility and acquired solutions such as Autofleet also forms a core cost. This includes ongoing expenses for software development, data infrastructure, and cybersecurity to maintain platform integrity.

Personnel and operational costs, covering employee compensation and daily administrative needs, are substantial. In 2024, the average cost to employ a full-time worker in the U.S., including benefits, was estimated to be around $82,850, underscoring the investment in human capital.

Element also relies on a broad network of third-party suppliers for maintenance, fuel, and remarketing, representing a significant variable cost. The efficiency of these partnerships, particularly with fuel card providers and maintenance shops, directly impacts operational expenditures and cost per mile.

| Cost Category | Key Drivers | 2024 Impact/Considerations |

| Vehicle Acquisition & Financing | Fleet Size, Interest Rates | Fluctuating auto loan rates in 2024 affected borrowing costs. |

| Technology Development | Software, Data Infrastructure, Cybersecurity | Ongoing investment in platform enhancements and data security. |

| Personnel & Operations | Salaries, Benefits, Admin Costs | Average US employee cost around $82,850 in 2024. |

| Third-Party Suppliers | Maintenance, Fuel, Remarketing | Negotiated terms with fuel providers and maintenance efficiency are critical. |

Revenue Streams

Element's Net Financing Revenue is a cornerstone of its business model, primarily derived from the interest it earns on its extensive portfolio of vehicle lease receivables. This income stream is crucial, reflecting the financial services component of its leasing operations.

Beyond interest income, Element also generates substantial revenue through the profitable sale of vehicles once their lease terms conclude. These gains on sale represent a significant portion of its financing revenue, highlighting the company's ability to manage vehicle depreciation and remarketing effectively.

For instance, in the first quarter of 2024, Element reported that its net financing revenue, encompassing both interest income and gains on sale, contributed a substantial amount to its overall profitability, underscoring the importance of this revenue stream.

Element's services revenue, a significant and expanding component, is primarily generated through its extensive fleet management offerings. These services, including maintenance, fuel, and accident management, alongside telematics solutions, form a core part of their capital-light strategy.

In 2024, Element continued to leverage these services, which are largely unlevered, reinforcing their business model's resilience and efficiency. This focus on service-based income is a critical driver for their ongoing growth and profitability.

Element generates revenue by providing expert strategic advisory and consulting services. These services go beyond standard fleet management, focusing on helping clients enhance fleet operations, uncover cost efficiencies, and adapt to evolving industry landscapes such as the shift towards electrification.

In 2024, the strategic advisory segment saw significant growth, with Element securing several high-profile contracts. One notable engagement involved a major logistics firm, where Element's recommendations for fleet optimization and route planning resulted in an estimated 12% reduction in fuel costs, directly contributing to Element's fee-based revenue.

Syndication Revenue

Element generates revenue through syndication, selling a portion of its finance assets to other investors. This approach helps Element maintain a healthy balance sheet and free up capital for new business opportunities.

In 2024, Element reported significant fee income from its syndication activities. This revenue stream is crucial for optimizing its capital structure and enhancing profitability. For instance, the company's ability to syndicate assets effectively contributed to its strong financial performance throughout the year.

- Syndication Fee Income: Element earns fees for facilitating the sale of finance assets to third parties.

- Balance Sheet Management: Syndication allows Element to reduce its exposure to certain assets and manage its risk profile.

- Capital Optimization: By selling assets, Element can reallocate capital to more strategic or profitable ventures.

- 2024 Performance: Syndication revenue was a key driver of Element's earnings growth in 2024, demonstrating the effectiveness of this strategy.

Risk Solutions & Ancillary Services

Element generates revenue through specialized risk solutions, notably insurance products tailored for fleet operations. This strategic offering not only safeguards client assets but also deepens Element's engagement and revenue potential within its existing customer base.

These ancillary services, beyond core fleet management, represent a significant avenue for increasing the share-of-wallet from clients. By providing a comprehensive suite of value-added offerings, Element solidifies its position as an indispensable partner.

- Risk Solutions: Revenue from insurance products and other risk mitigation services.

- Ancillary Services: Income from supplementary offerings that enhance fleet operations.

- Share-of-Wallet Expansion: Strategy to increase revenue per client through diverse service offerings.

Element's revenue streams are diverse, encompassing financing, services, and fee-based income. The core financing revenue stems from interest on vehicle leases and gains from vehicle sales post-lease. Services revenue is driven by comprehensive fleet management solutions, including maintenance and telematics, which are crucial for their capital-light approach.

Additionally, Element generates significant fee income through syndication, where they sell portions of their finance assets, and from specialized risk solutions like fleet insurance. Strategic advisory services also contribute, helping clients optimize operations and embrace new technologies like electrification.

| Revenue Stream | Description | 2024 Impact/Data |

|---|---|---|

| Net Financing Revenue | Interest on lease receivables and gains on vehicle sales. | A significant contributor to overall profitability in Q1 2024. |

| Services Revenue | Fleet management (maintenance, fuel, accident management) and telematics. | Core to capital-light strategy; unlevered income driving growth. |

| Strategic Advisory Fees | Consulting on fleet optimization, cost reduction, and electrification. | Secured high-profile contracts; recommendations led to ~12% fuel cost reduction for a logistics client. |

| Syndication Fees | Fees earned from selling finance assets to third-party investors. | Key driver of earnings growth in 2024; optimized capital structure. |

| Risk Solutions/Ancillary Services | Insurance products and other value-added services for fleets. | Increased share-of-wallet with existing clients; deepened customer engagement. |

Business Model Canvas Data Sources

The Business Model Canvas is built upon a foundation of comprehensive market research, financial projections, and operational data. These diverse sources ensure each component of the canvas is informed by actionable insights and realistic assumptions.