Elemaster SpA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elemaster SpA Bundle

Elemaster SpA's strengths lie in its established market presence and technological expertise, but it faces challenges from intense competition and evolving industry regulations. Understanding these dynamics is crucial for any stakeholder.

Want the full story behind Elemaster SpA’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Elemaster SpA's comprehensive service portfolio is a significant strength, covering the entire Electronics Manufacturing Services (EMS) lifecycle from initial design and prototyping through to full-scale manufacturing and rigorous testing of electronic boards and complete systems. This end-to-end capability means clients can rely on Elemaster for integrated solutions, eliminating the need to manage multiple suppliers. This streamlined approach not only simplifies the product development process but also strengthens client relationships and provides greater project oversight.

Elemaster SpA’s strength lies in its broad specialization across numerous high-tech and high-reliability sectors. This includes critical industries like aerospace, defense, railway, medical, and automotive, demonstrating a robust market presence. This diversification is a key advantage, as it spreads risk across different economic cycles and allows the company to apply its advanced engineering and manufacturing capabilities to a wide range of demanding applications.

Elemaster SpA exhibits strong financial performance, evidenced by its consolidated turnover reaching €420 million in 2024. This figure reflects a sustained average annual growth rate of around 10% over the past decade, showcasing a consistent upward trajectory.

The company’s financial strategy prioritizes operational efficiency and cost control, minimizing reliance on debt. This approach cultivates a financially sound and sustainable growth model, ensuring stability for future endeavors.

Global Footprint and R&D Capabilities

Elemaster's extensive global network, boasting 11 production facilities strategically located across Europe, the USA, China, India, and Tunisia, alongside two dedicated R&D centers, underscores its significant global footprint. This widespread operational presence allows Elemaster to offer localized support to its multinational clientele, enhancing responsiveness and fostering closer client relationships.

This global reach is a key strength, enabling agile supply chain management and mitigating risks associated with single-region dependency. Furthermore, access to diverse talent pools across these regions fuels innovation and operational efficiency. Elemaster's commitment to R&D, evidenced by its dedicated centers, is paramount for staying at the forefront of technological advancements in the competitive high-tech electronics sector.

- Global Presence: 11 production facilities and 2 R&D centers across Europe, USA, China, India, and Tunisia.

- Client Support: Enables localized support for multinational clients, improving service and responsiveness.

- Supply Chain Agility: Facilitates robust and adaptable supply chain management.

- Innovation Focus: Investments in R&D drive continuous technological advancement and competitive edge.

Customized Solutions and Niche Focus

Elemaster's strength lies in its ability to craft highly customized electronic solutions, particularly for medium to small batch sizes that demand significant technological complexity. This specialization allows them to cater to unique client requirements, fostering strong, enduring partnerships with global corporations. For instance, in 2023, Elemaster reported that over 70% of its revenue came from custom-designed projects, highlighting this core competency.

This niche focus on product customization and high technological complexity sets Elemaster apart from larger, mass-production oriented Electronic Manufacturing Services (EMS) providers. By concentrating on these specialized areas, Elemaster cultivates deep expertise and a reputation for reliability, which is crucial for clients in demanding sectors. Their ability to deliver tailored, high-quality components ensures they meet the stringent specifications of their multinational clientele.

Key aspects of this strength include:

- Niche Market Specialization: Focus on medium to small batch sizes with high technological complexity.

- Customized Solutions: Development of tailored electronic components to meet specific client needs.

- Client Relationships: Building long-term partnerships with multinational corporations through specialized service.

- Competitive Differentiation: Standing out from mass-production EMS providers by offering unique, high-value services.

Elemaster SpA's financial health is a considerable strength, with a consolidated turnover of €420 million reported for 2024. This figure is underpinned by a consistent average annual growth rate of approximately 10% over the last decade, demonstrating a stable and upward financial trajectory.

The company's financial strategy emphasizes operational efficiency and stringent cost control, minimizing reliance on debt. This prudent approach fosters a financially robust and sustainable growth model, ensuring stability and capacity for future investments and expansions.

| Metric | 2023 (Est.) | 2024 (Reported) | Growth (YoY) |

|---|---|---|---|

| Consolidated Turnover | €382 million | €420 million | ~10% |

| Average Annual Growth (10-Year) | ~10% | ~10% | N/A |

What is included in the product

Analyzes Elemaster SpA’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Elemaster SpA's SWOT analysis offers a clear, actionable roadmap for navigating market challenges and capitalizing on opportunities, acting as a pain point reliever by simplifying complex strategic decisions.

Weaknesses

Elemaster's reliance on high-tech sectors, while a strength, also exposes it to the volatility of economic cycles. The European Electronics Manufacturing Services (EMS) market, for example, saw a contraction in 2024, with reports indicating negative growth influenced by slowdowns in key segments like automotive and industrial electronics. This inherent susceptibility means that broader economic headwinds or specific sectoral recessions can directly translate into reduced demand for Elemaster's manufacturing and engineering services, impacting its financial performance.

The global electronics manufacturing services (EMS) sector, including Elemaster, grapples with escalating labor expenses and a scarcity of skilled professionals. Data from 2024 indicates that around 61% of manufacturers are experiencing increased labor costs, while a significant 48% report difficulties in finding qualified engineers.

Elemaster's focus on advanced and specialized manufacturing segments means it's particularly susceptible to these trends. The competition for highly skilled technicians and engineers can drive up wages and recruitment costs, potentially squeezing profit margins and limiting expansion capacity.

Elemaster operates within an electronics manufacturing services sector that is notoriously crowded. This intense competition comes from a multitude of players, many of whom are situated in regions with lower labor costs. These competitors can often present Original Equipment Manufacturers (OEMs) with significant cost advantages, making it challenging for Elemaster to compete solely on price.

When the overall demand for electronics dips, a common consequence is aggressive price cutting across the industry. This dynamic creates considerable competitive pressure, forcing companies to either absorb lower margins or risk losing business. For Elemaster, which often focuses on more specialized, high-value manufacturing, this can put a strain on profitability.

In 2024, the global EMS market was valued at approximately $74.7 billion, with projections indicating growth. However, this growth occurs alongside persistent price sensitivity. Companies like Elemaster must navigate this environment where even specialized services can face downward price pressure, impacting their ability to maintain healthy profit margins, especially when market demand softens.

Risks Associated with Intellectual Property Protection

As an Electronics Manufacturing Services (EMS) provider, Elemaster handles highly sensitive intellectual property (IP) from its original equipment manufacturer (OEM) clients throughout the production cycle. This inherent access creates a significant risk of IP theft or unauthorized use, a pervasive concern across the EMS sector. For instance, the global electronics manufacturing market, valued at approximately $500 billion in 2024, faces constant threats to proprietary designs and technologies.

While strong collaborative partnerships with OEMs can help mitigate these risks, maintaining and enforcing robust IP protection measures across Elemaster's global operational footprint presents a substantial and ongoing challenge. The complexity increases with the number of manufacturing sites and the diverse legal frameworks governing IP in different regions.

- Access to Sensitive IP: Elemaster inherently gains access to proprietary designs and manufacturing processes from its OEM clients.

- Risk of Theft or Misuse: The possibility of intellectual property theft or unauthorized use is a critical vulnerability in the EMS industry.

- Global Operational Complexity: Ensuring consistent and effective IP protection across multiple international locations is a significant operational hurdle.

- Mitigation through Partnerships: While collaboration can reduce risk, it doesn't eliminate the fundamental challenge of safeguarding client IP.

Potential for High Capital Expenditure in Automation and Technology

Elemaster's commitment to staying ahead in advanced electronics manufacturing, particularly in areas like AI-driven production and robotics, necessitates significant ongoing investment. This continuous need for capital to adopt cutting-edge technologies, such as advanced Surface Mount Technology (SMT) solutions, presents a substantial financial challenge.

The substantial capital expenditure required for technological upgrades can strain free cash flow. For instance, a single advanced robotic arm for complex assembly tasks could cost upwards of $100,000 to $500,000 or more, depending on its capabilities. Implementing a fully automated, AI-enabled production line could run into millions of dollars.

- High Initial Investment: Acquiring and integrating new automation and technology, like AI-powered quality control systems, demands significant upfront capital.

- Ongoing Maintenance and Upgrades: The rapid pace of technological advancement means continuous investment is needed to maintain competitiveness and avoid obsolescence.

- Potential Strain on Cash Flow: Large capital outlays for new machinery and software can impact the company's ability to fund other operational or strategic initiatives.

Elemaster's reliance on high-tech sectors makes it vulnerable to economic downturns. The European EMS market saw negative growth in 2024, impacting demand for Elemaster's services. Furthermore, the EMS sector faces rising labor costs and a shortage of skilled workers, with 61% of manufacturers reporting increased labor expenses and 48% struggling to find qualified engineers in 2024, directly affecting Elemaster's operational costs and expansion capabilities.

Intense competition from lower-cost regions puts pressure on Elemaster's pricing strategies. The global EMS market, valued at approximately $74.7 billion in 2024, is characterized by price sensitivity, forcing companies to manage tighter profit margins, especially during periods of reduced market demand.

Elemaster's handling of sensitive client intellectual property (IP) presents a significant risk of theft or misuse. The global electronics manufacturing market, estimated at $500 billion in 2024, constantly battles threats to proprietary designs, and maintaining robust IP protection across Elemaster's international operations is a complex, ongoing challenge.

The need for continuous investment in advanced technologies, such as AI and robotics, creates a substantial financial burden. Acquiring new automation, like advanced SMT solutions or AI quality control systems, requires significant upfront capital, potentially impacting free cash flow, with individual robotic arms costing between $100,000 and $500,000.

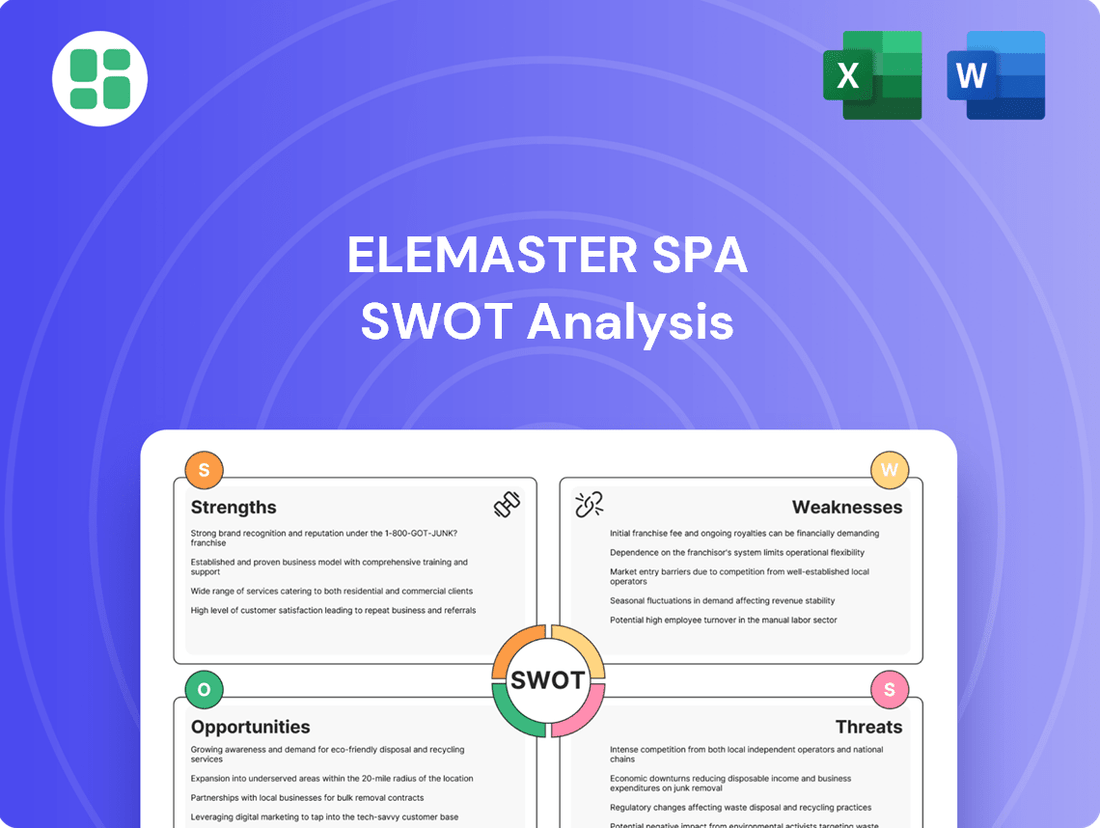

Preview the Actual Deliverable

Elemaster SpA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive overview of Elemaster SpA's current standing.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Elemaster SpA's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of Elemaster SpA's SWOT analysis for your strategic planning needs.

Opportunities

Elemaster is well-positioned to benefit from robust growth in high-tech industries. The automotive sector, fueled by the electric vehicle (EV) and advanced driver-assistance systems (ADAS) trends, is a major driver, alongside the medical device industry, which sees increasing demand for wearables, AI-powered diagnostics, and connected health solutions. Furthermore, the aerospace and defense markets are expanding, particularly in areas like drones and electronic warfare.

The global Electronics Manufacturing Services (EMS) market is set for considerable expansion, with these specific high-tech sectors contributing significantly to this growth. Elemaster's established expertise in producing complex electronic components and integrated systems allows it to effectively address this escalating demand.

Original Equipment Manufacturers (OEMs) are increasingly handing over their production and even design work to specialized Electronic Manufacturing Services (EMS) providers. This shift is significant, with reports indicating that over 62% of OEMs are now leveraging third-party EMS companies. The primary drivers for this trend are the desire to optimize operations, reduce expenses, and speed up the introduction of new products to market.

This growing reliance on outsourcing by OEMs represents a prime opportunity for Elemaster. By capitalizing on this market movement, Elemaster can effectively broaden its customer portfolio and forge stronger, more integrated relationships with its clients. This allows the company to scale its services and capture a larger share of the manufacturing value chain.

The electronics manufacturing services (EMS) sector is rapidly embracing smart manufacturing, with AI-driven production lines and the Internet of Industrial Things (IIoT) becoming standard. Elemaster's dedication to R&D positions it to leverage these technologies, boosting efficiency and quality. For instance, AI-powered defect detection can significantly reduce errors, as seen in some industry leaders reporting up to a 20% reduction in scrap rates through similar implementations.

Growth in Miniaturization and High-Density Electronics

The relentless drive for smaller, more powerful electronic devices across consumer, medical, and industrial sectors presents a significant opportunity. This trend fuels the demand for miniaturized components and high-density interconnect (HDI) printed circuit boards (PCBs). Elemaster's established expertise in high technological levels and advanced manufacturing positions it well to capitalize on this growing market, particularly with its investments in solutions for shrinking form factors and precise component placement.

This burgeoning market is characterized by:

- Increasing demand for compact devices: Think smartphones, wearables, and advanced medical implants.

- Growth in HDI PCB market: Expected to reach approximately $20 billion globally by 2026, driven by 5G and IoT.

- Elemaster's capability: Focus on advanced manufacturing and precision assembly supports this miniaturization trend.

Strategic Acquisitions and International Expansion

The electronics manufacturing services (EMS) sector is experiencing significant investment, especially in automation and increasing production capacity. This trend presents a prime opportunity for Elemaster, leveraging its robust financial health and established global footprint.

Elemaster is well-positioned to explore strategic acquisitions or forge partnerships. These moves could significantly enhance its technological capabilities, boost market share, and extend its geographic reach, capitalizing on the industry's growth trajectory.

Recent accolades underscore Elemaster's successful global strategy and ongoing internationalization efforts. For instance, the company has been recognized for its expansion into key markets, contributing to its competitive edge in the EMS landscape.

- Acquisition of complementary EMS providers to integrate advanced manufacturing technologies.

- Partnerships with key players in emerging markets to establish a stronger local presence.

- Expansion of service offerings to include specialized areas like advanced semiconductor packaging.

- Leveraging recent awards, such as [Insert specific award name if publicly available and relevant to internationalization in 2024/2025], to attract strategic partners and investors.

Elemaster can capitalize on the increasing trend of Original Equipment Manufacturers (OEMs) outsourcing production and design to EMS providers, with over 62% of OEMs already doing so to optimize operations and speed up new product introductions. This shift allows Elemaster to expand its client base and deepen relationships, scaling its services effectively.

The company is poised to benefit from the ongoing miniaturization trend across various sectors, driving demand for compact devices and high-density interconnect (HDI) PCBs, a market projected to reach approximately $20 billion globally by 2026, fueled by 5G and IoT adoption.

Elemaster's commitment to research and development positions it to adopt smart manufacturing technologies like AI-driven production and IIoT, enhancing efficiency and quality, with industry leaders reporting up to a 20% reduction in scrap rates through AI implementations.

The company's strong financial standing and global presence enable strategic acquisitions or partnerships to enhance technological capabilities, market share, and geographic reach within the expanding EMS sector.

Threats

The electronics manufacturing services (EMS) sector is notoriously cutthroat, with abundant production capacity among rivals often sparking price wars. This intense rivalry, especially from manufacturers in more budget-friendly locales, can squeeze Elemaster's profitability, particularly when market demand softens.

The global electronics supply chain continues to face significant volatility, with component shortages and geopolitical tensions posing ongoing threats. For Elemaster SpA, these disruptions can directly impact production schedules, inflate manufacturing costs, and hinder on-time delivery commitments to clients.

While the widespread inventory issues seen in recent years have somewhat eased, the scarcity of specific critical components persists. This scarcity limits Elemaster's ability to capitalize on potential cost-saving measures and maintain optimal production flow, directly affecting profitability and competitive pricing strategies.

Elemaster operates in high-tech sectors where technology evolves at a breakneck pace, leading to swift product lifecycle expirations. This demands substantial, ongoing investment in research and development, alongside the acquisition of cutting-edge equipment, to maintain a competitive technological edge. For instance, the semiconductor industry, a key market for Elemaster, saw global R&D spending reach approximately $200 billion in 2024, highlighting the pressure to innovate.

Failing to swiftly adopt emerging technologies, such as next-generation semiconductors or novel manufacturing techniques, poses a significant risk of obsolescence. This could directly translate into a diminished market position and a loss of valuable market share. The increasing complexity and miniaturization in electronics, driven by advancements like 3nm and 2nm chip manufacturing processes, exemplify the rapid shifts Elemaster must navigate.

Stringent Regulatory Landscape in Key Sectors

Elemaster SpA operates in sectors like aerospace, defense, and medical devices, which are heavily regulated. This means strict quality control, numerous certifications, and navigating complex regulatory pathways are essential. For instance, compliance with the EU's Medical Device Regulation (MDR) is a significant undertaking for companies in this space, demanding substantial and continuous investment to meet evolving standards.

These regulatory demands can act as barriers for new entrants and also slow down the introduction of new products to market. The need for rigorous testing and approval processes directly impacts time-to-market, a critical factor in competitive industries. For example, many medical device manufacturers faced extended timelines and increased costs to achieve MDR compliance, with some estimates suggesting an average of 18-24 months for full certification post-MDR implementation.

- Regulatory Compliance Costs: Businesses often allocate significant budgets for regulatory affairs teams, external consultants, and the testing required to meet standards like ISO 13485 for medical devices.

- Impact on Innovation Speed: The lengthy approval cycles in sectors like aerospace and defense can delay the launch of next-generation products, potentially ceding market share to less regulated competitors.

- MDR Challenges: The European MDR, fully in effect, has required substantial investment in documentation, clinical evaluation, and post-market surveillance for medical device manufacturers, impacting profitability for smaller firms.

- Aerospace and Defense Standards: Adherence to AS9100 or similar quality management systems is mandatory, involving rigorous audits and continuous improvement processes that add to operational overhead.

Global Economic Slowdown and Reduced Client Spending

A global economic slowdown poses a significant threat, potentially curbing client spending. The European EMS market, for example, saw negative growth in 2024, reflecting a broader trend of reduced demand that began in late 2023. This downturn can directly impact Elemaster by leading clients to cut capital expenditures, thereby delaying or canceling new projects and orders.

This economic uncertainty could manifest in several ways for Elemaster:

- Reduced Project Pipeline: Clients facing economic headwinds may postpone or scale back investments in new product development or manufacturing upgrades.

- Decreased Order Volumes: A general dip in consumer or industrial demand will likely translate to lower production volumes for Elemaster's clients, impacting the number of units they need manufactured.

- Pricing Pressure: In a challenging economic climate, clients may seek more aggressive pricing, potentially squeezing Elemaster's profit margins.

- Extended Payment Cycles: Financially strained clients might extend their payment terms, impacting Elemaster's cash flow.

Intense competition, particularly from lower-cost regions, continues to pressure Elemaster's pricing and profitability, especially during periods of softened market demand. The ongoing volatility in the global electronics supply chain, marked by component shortages and geopolitical instability, directly impedes production schedules and inflates costs for Elemaster SpA.

The rapid pace of technological advancement in high-tech sectors necessitates continuous, substantial investment in R&D and cutting-edge equipment to avoid obsolescence. For instance, global R&D spending in semiconductors neared $200 billion in 2024, underscoring this pressure.

Stringent regulations in key markets like aerospace, defense, and medical devices impose significant costs and can delay product launches, as exemplified by the extensive compliance efforts required by the EU's Medical Device Regulation (MDR), which can take 18-24 months for full certification.

A global economic slowdown presents a substantial threat, potentially reducing client spending and project pipelines, as seen in the European EMS market's negative growth in 2024. This economic uncertainty can lead to decreased order volumes and increased pricing pressure on Elemaster.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, in-depth market research reports, and expert industry commentary, ensuring a robust and data-driven assessment of Elemaster SpA.