Elemaster SpA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elemaster SpA Bundle

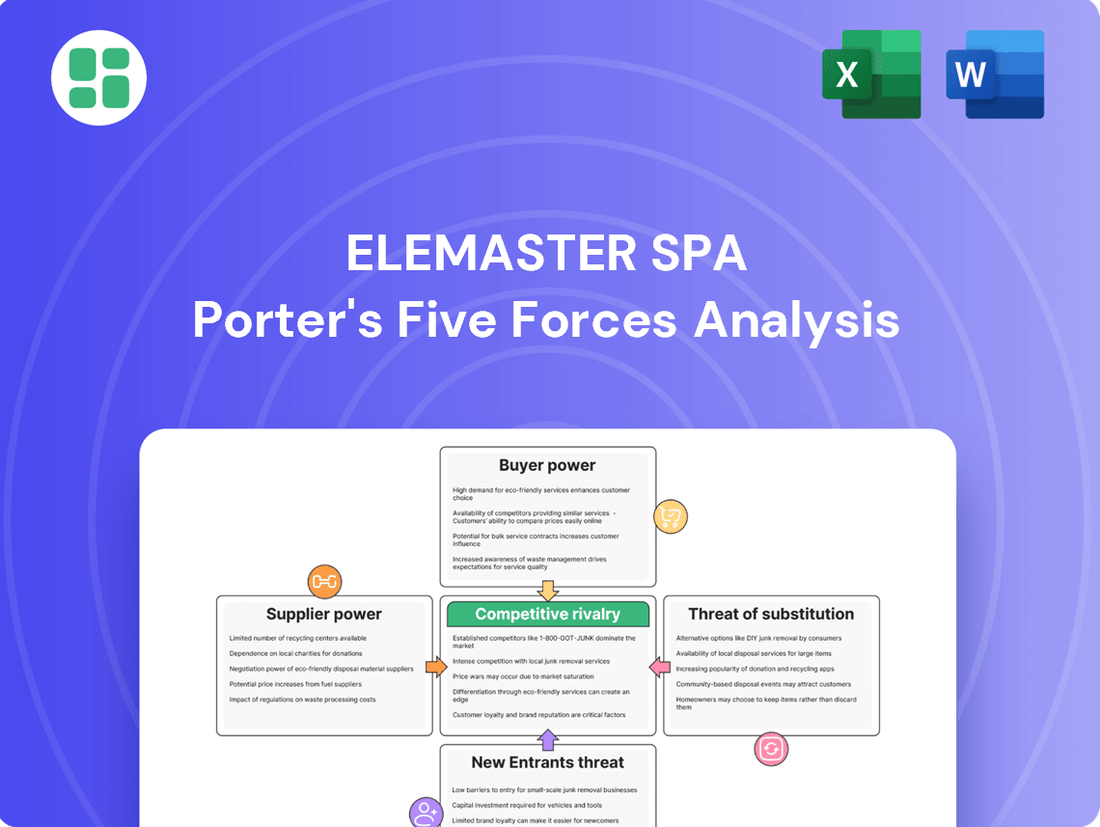

Elemaster SpA navigates a competitive landscape shaped by moderate buyer power and the looming threat of substitutes. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Elemaster SpA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Elemaster's deep involvement in high-tech sectors such as aerospace, defense, medical, and automotive means it often depends on highly specialized, sometimes custom-made electronic components. This specialization creates a scenario where only a handful of suppliers can meet the stringent quality and certification demands for these niche parts.

The limited supplier pool for these critical, niche components grants them significant leverage over Elemaster, potentially driving up prices or extending delivery times. For instance, in 2024, the global semiconductor shortage, a key component for many of Elemaster's target industries, continued to highlight supplier power, with lead times for certain advanced chips extending to over a year.

Furthermore, supply chain disruptions, whether due to geopolitical tensions or natural disasters, can amplify this supplier bargaining power. Elemaster's reliance on these specialized inputs makes it vulnerable to cost increases or production delays when global supply chains face instability, a trend observed throughout 2023 and continuing into 2024.

The global electronics manufacturing sector, including Electronic Manufacturing Services (EMS) providers like Elemaster, is grappling with persistent cost increases for critical inputs such as semiconductors and other raw materials. This upward pressure on material expenses directly impacts profitability and operational stability.

A significant factor contributing to this is the concentrated nature of the semiconductor supply chain. For advanced components, many EMS providers rely on a limited number of dominant suppliers. This dependence grants these suppliers considerable bargaining power, allowing them to dictate pricing and influence delivery schedules, which can disrupt production for companies like Elemaster.

Elemaster faces significant challenges when switching suppliers for its highly specialized electronic components. These challenges stem from complex qualification procedures, potential redesign necessities, and stringent testing requirements to meet industry standards, all of which translate into substantial costs and time investments.

The intricate nature of qualifying new suppliers, often involving extensive validation and integration processes, can take months. For instance, a single component qualification might involve upwards of 100 hours of engineering time, directly impacting Elemaster's operational efficiency and increasing reliance on existing, trusted suppliers.

This difficulty in switching suppliers grants considerable leverage to incumbent component providers. Their specialized knowledge and established integration within Elemaster's manufacturing processes mean that disruptions from a supplier change could lead to production delays and increased unit costs, thereby strengthening the suppliers' bargaining position.

Geopolitical and Reshoring Impact

Geopolitical shifts and the move towards reshoring manufacturing are significantly reshaping global supply chains. This trend can consolidate supplier power in specific regions, potentially increasing costs for components sourced internationally and limiting Elemaster's supplier options.

For instance, the ongoing trade disputes and the push for localized production in key markets could lead to fewer, more dominant suppliers for critical electronic components. In 2024, many electronics manufacturers reported increased lead times and price volatility for semiconductors due to these supply chain realignments.

- Regional concentration of suppliers: Geopolitical instability can lead to a smaller number of suppliers in politically stable regions, increasing their leverage.

- Increased sourcing costs: Reshoring initiatives, while aiming for resilience, can initially drive up component prices as new, potentially less efficient, domestic supply chains are established.

- Limited negotiation leverage: Elemaster may find its ability to negotiate favorable terms diminished if it becomes reliant on a reduced pool of suppliers due to these global trends.

Supplier's Forward Integration Threat

The threat of a component supplier integrating forward into Electronic Manufacturing Services (EMS) is a theoretical concern that could bolster supplier power, especially if they offer proprietary components. However, this scenario is generally less probable given the intricate and diverse service portfolio required by an EMS provider like Elemaster. The broader EMS industry inherently depends on a wide array of external component suppliers, making such a move a significant undertaking for most.

While the general reliance of the EMS sector on external component sourcing limits this threat, a supplier with unique, high-demand components might consider such a strategy. For instance, a specialized semiconductor manufacturer could potentially offer direct assembly services for their chips, bypassing traditional EMS channels. This would allow them to capture more value and exert greater control over the end-product. However, the capital investment and expertise needed to operate as a full-service EMS provider are substantial, often outweighing the benefits for component specialists.

- Limited Forward Integration: Component suppliers typically lack the broad service capabilities and infrastructure of established EMS providers.

- Proprietary Component Advantage: The threat is most potent when a supplier's components are critical and difficult to substitute.

- Industry Dependence: The EMS market’s structure relies on a diverse supplier base, making widespread forward integration by component makers unlikely.

Elemaster's reliance on specialized electronic components, often sourced from a limited number of suppliers, grants these suppliers significant bargaining power. This is amplified by the high switching costs associated with qualifying new vendors, which can involve extensive testing and potential redesigns. For example, in 2024, the ongoing global semiconductor shortage continued to demonstrate this supplier leverage, with extended lead times for advanced chips impacting production schedules.

The concentration of suppliers for critical, niche parts, coupled with the difficulty Elemaster faces in finding and integrating alternatives, strengthens the position of existing providers. This dynamic means suppliers can often dictate terms, impacting Elemaster's costs and operational flexibility, a situation exacerbated by global supply chain instabilities observed throughout 2023 and 2024.

The bargaining power of suppliers is a considerable force for Elemaster due to the specialized nature of its components and the high costs associated with switching. This reliance on a select few providers, especially for critical parts like semiconductors, allows suppliers to influence pricing and delivery. In 2024, the semiconductor market's dynamics underscored this, with lead times for certain advanced chips stretching beyond a year, directly impacting Elemaster's ability to secure necessary materials efficiently.

| Factor | Impact on Elemaster | 2024 Data/Trend |

| Supplier Concentration | Limited supplier options increase leverage | Continued reliance on key semiconductor manufacturers |

| Switching Costs | High costs and time for vendor qualification | Qualification processes can exceed 100 engineering hours per component |

| Component Specialization | Few suppliers meet stringent industry demands | Niche aerospace and medical components have very few qualified sources |

| Supply Chain Disruptions | Geopolitical events and reshoring amplify supplier power | Increased lead times and price volatility for semiconductors reported |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Elemaster SpA's position in the electronics manufacturing services sector.

Instantly visualize the competitive landscape with a dynamic, interactive five forces model, allowing Elemaster SpA to pinpoint and address key strategic pressures with clarity.

Customers Bargaining Power

Elemaster SpA's strength lies in its diverse customer base, spanning critical sectors like aerospace, defense, railway, medical, and automotive. This broad reach significantly dilutes the bargaining power of any single customer.

For instance, in 2023, Elemaster reported that no single industry segment accounted for more than 25% of its total revenue, a testament to its diversified market penetration. This spread ensures that the loss or reduced business from one client does not disproportionately impact the company.

By serving multiple high-tech industries, Elemaster avoids over-reliance on any one sector, which inherently limits the leverage individual customers can exert. This strategic diversification is a key factor in managing customer bargaining power.

Elemaster SpA's deep integration into its customers' product development and manufacturing processes significantly raises switching costs. When clients rely on Elemaster for tailored electronic system design, prototyping, and complex manufacturing, the effort and expense to transition to a new provider become substantial.

This dependency, stemming from Elemaster's comprehensive service offering that spans the entire product lifecycle, effectively limits the bargaining power of customers. For instance, a company that has Elemaster involved from the initial concept and testing phases of a critical electronic component would face considerable disruption and cost in re-qualifying a new supplier, impacting their own production timelines and product integrity.

In sectors like aerospace and defense, where electronic components are mission-critical, customers prioritize unwavering quality and reliability above all else. For instance, the aerospace industry's demand for fault-tolerant systems means that even minor deviations in component performance can have severe consequences. This inherent need for absolute dependability significantly reduces their leverage to negotiate purely on price, as the cost of failure far outweighs any potential savings from cheaper alternatives.

Outsourcing Trend Empowers EMS Providers

The increasing trend of Original Equipment Manufacturers (OEMs) outsourcing their electronics manufacturing services is a significant factor influencing the bargaining power of customers. This shift allows OEMs to concentrate on their core strengths, such as research and development and marketing, which in turn fuels substantial demand for Electronic Manufacturing Services (EMS) providers. This growing demand, particularly for specialized and adaptable manufacturing solutions, can bolster the standing of EMS companies like Elemaster in their dealings with customers.

This outsourcing trend directly impacts customer bargaining power. As more OEMs rely on EMS providers, their ability to negotiate terms can increase due to the sheer volume of business available. However, for EMS providers that offer unique capabilities or operate in niche markets, this dynamic can shift. For instance, the global EMS market was valued at approximately $79.6 billion in 2023 and is projected to grow, indicating a robust demand that can empower capable EMS providers.

- Increased OEM focus on core competencies drives demand for EMS.

- Specialized and scalable solutions strengthen EMS provider positions.

- The global EMS market's growth indicates strong demand for outsourcing.

Customization and Niche Focus

Elemaster SpA's strategy of concentrating on highly customized, niche markets significantly bolsters its position against customer bargaining power. By delivering solutions tailored to specific, often technologically advanced, client requirements, Elemaster creates a high switching cost for its customers.

This deep level of customization, frequently involving proprietary intellectual property, makes it difficult for clients to find alternative suppliers capable of replicating the same bespoke solutions. In 2024, Elemaster continued to emphasize these specialized segments, where clients value unique engineering and production capabilities over price alone.

- Niche Market Dominance: Elemaster's focus on high-tech, custom niches limits the pool of comparable competitors.

- High Switching Costs: Bespoke solutions and intellectual property integration make it costly and time-consuming for customers to change providers.

- Reduced Price Sensitivity: Clients in these specialized markets prioritize performance and unique features over minor price differences.

Elemaster SpA's diverse customer base across critical sectors like aerospace, defense, and automotive significantly dilutes the bargaining power of any single client. For instance, in 2023, no single industry segment represented more than 25% of Elemaster's revenue, showcasing a broad market penetration that limits individual customer leverage.

The company's deep integration into customer product development, coupled with high switching costs for bespoke electronic systems, further constrains customer negotiation power. In mission-critical sectors like aerospace, where reliability is paramount, customers prioritize performance over minor price concessions, as the cost of failure far exceeds potential savings.

The growing trend of Original Equipment Manufacturers (OEMs) outsourcing electronics manufacturing services, a market valued at approximately $79.6 billion in 2023, fuels demand for EMS providers. Elemaster's focus on highly customized, niche markets, where clients value unique capabilities and intellectual property, strengthens its position against customer bargaining power.

| Factor | Impact on Customer Bargaining Power | Elemaster's Mitigation Strategy |

| Customer Diversification | Lowers individual customer leverage | Serves multiple high-tech industries, avoiding sector over-reliance. |

| Switching Costs | Increases costs and disruption for customers to change suppliers | Deep integration in product development and manufacturing of tailored systems. |

| Industry Requirements | Prioritizes reliability and performance over price in critical sectors | Focus on quality and dependability in aerospace, defense, and medical sectors. |

| Outsourcing Trend | Potentially increases customer leverage due to volume | Concentrates on niche, customized solutions where unique capabilities are valued. |

What You See Is What You Get

Elemaster SpA Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Elemaster SpA, providing an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and readiness for your strategic planning. Gain immediate access to this valuable resource, which details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Elemaster SpA's industry.

Rivalry Among Competitors

The Electronic Manufacturing Services (EMS) sector is poised for robust expansion, with forecasts indicating substantial growth from 2025 through 2035. This expanding market size naturally accommodates a larger number of participants, thereby mitigating the intensity of direct, head-to-head competition among them.

Elemaster carves out a distinct competitive advantage by focusing on sophisticated, high-complexity, and tailored manufacturing solutions for niche industrial sectors. This strategic specialization effectively differentiates Elemaster from competitors primarily engaged in high-volume, standardized production, reducing direct rivalry.

Elemaster distinguishes itself through significant investments in research and development, focusing on advanced manufacturing techniques like miniaturization and AI-driven automation. This commitment to technological differentiation is crucial in the competitive Electronic Manufacturing Services (EMS) sector.

In 2024, the EMS market continued to see companies that prioritize innovation, particularly in areas like advanced semiconductor packaging and complex circuit board assembly, capture greater market share. Elemaster's ability to offer cutting-edge solutions in these domains directly impacts its competitive standing.

The European EMS market, Elemaster's operational theater, is notably fragmented. Unlike the global landscape dominated by giants like Foxconn and Jabil, Europe features a multitude of companies, many of which are small to medium-sized enterprises. This creates a diverse competitive environment where Elemaster's specialization in high-quality, precision manufacturing carves out its niche.

Stringent Regulatory and Certification Requirements

Elemaster operates in sectors with exceptionally high regulatory hurdles and certification demands, such as aerospace, defense, and medical devices. Companies must meet rigorous quality standards, including certifications like ISO 13485 for medical devices and AS9100 for aerospace. These requirements act as significant barriers to entry, protecting incumbent firms like Elemaster.

The need for continuous compliance and the substantial investment in achieving and maintaining these certifications create a strong competitive advantage for established players. This makes it considerably more challenging for new or less specialized competitors to penetrate these lucrative market segments. For instance, in 2024, the global medical device market was valued at over $600 billion, with stringent regulations playing a key role in market structure.

- Stringent Quality Standards: Adherence to AS9100 and ISO 13485 is mandatory for key Elemaster markets.

- High Barriers to Entry: Certification processes are lengthy and costly, deterring new entrants.

- Competitive Advantage: Established players like Elemaster benefit from their long-standing compliance and expertise.

- Market Segmentation: These requirements segment the market, favoring specialized and experienced firms.

Geographical and Supply Chain Resilience

Geopolitical shifts and the drive for localized production are significantly influencing competitive dynamics. Elemaster's established European footprint and its proficiency in navigating intricate supply chains for sectors like industrial automation and medical technology provide a distinct advantage. This capability addresses the growing market imperative for supply chain resilience.

The demand for localized manufacturing is accelerating, with many companies re-evaluating global sourcing strategies. For instance, in 2024, several major automotive manufacturers announced plans to increase domestic or regional production of key components to mitigate risks exposed by past disruptions. This trend directly benefits contract manufacturers like Elemaster that can offer geographically proximate solutions.

- Geopolitical Realignment: Companies are actively seeking to de-risk their supply chains, favoring regionalization over distant, single-source suppliers.

- Localized Manufacturing Demand: A growing number of industries are prioritizing suppliers with manufacturing capabilities closer to their end markets.

- Elemaster's Differentiator: Its European presence and expertise in managing complex, localized supply chains are key competitive strengths in this evolving landscape.

Elemaster faces a moderately intense competitive rivalry, largely due to its strategic focus on high-complexity, niche markets within the EMS sector. While the overall EMS market is growing, Elemaster's specialization in areas like aerospace, defense, and medical devices creates a more concentrated competitive landscape where quality and technical expertise are paramount. This segmentation limits the number of direct competitors capable of meeting the stringent requirements. For example, in 2024, the demand for specialized medical electronics manufacturing continued to rise, attracting players with specific certifications.

The barriers to entry, particularly the rigorous certifications like AS9100 for aerospace and ISO 13485 for medical devices, significantly curb the number of new entrants. These certifications are not only costly but also time-consuming to obtain, requiring substantial investment in quality management systems and processes. Companies that have already invested in and maintained these standards, such as Elemaster, possess a distinct advantage, making it difficult for less experienced firms to compete effectively in these high-value segments.

Geopolitical shifts and the trend towards supply chain regionalization are also shaping competitive dynamics. Companies are increasingly prioritizing localized manufacturing to enhance resilience and mitigate risks associated with global disruptions. Elemaster's established European footprint and its ability to manage complex, localized supply chains provide a competitive edge in this evolving market, as demonstrated by the 2024 trend of automotive manufacturers increasing regional production of critical components.

| Key Factor | Impact on Rivalry | Elemaster's Position |

| Market Specialization | Moderate Intensity | Focus on high-complexity, niche sectors limits direct competition. |

| Barriers to Entry | Lowers Rivalry | Stringent certifications (AS9100, ISO 13485) deter new entrants. |

| Technological Differentiation | Reduces Rivalry | Investment in R&D for advanced manufacturing creates a competitive moat. |

| Supply Chain Regionalization | Favorable for Elemaster | European presence aligns with demand for localized production and supply chain resilience. |

SSubstitutes Threaten

The threat of substitutes for electronics manufacturing services (EMS) providers like Elemaster is significantly influenced by Original Equipment Manufacturers (OEMs) choosing to manufacture in-house. While the trend generally favors outsourcing for cost savings and access to specialized skills, large OEMs with substantial capital and existing expertise may opt for internal production, especially for high-volume or strategically critical products.

In 2024, global EMS market revenues were projected to reach approximately $700 billion, highlighting the significant scale of outsourcing. However, a substantial portion of this market still involves OEMs maintaining some level of in-house capability, particularly for core technologies or early-stage product development, representing a persistent competitive pressure.

While direct substitutes for electronic manufacturing services (EMS) are scarce, the threat of alternative technologies achieving similar product functionalities is a growing concern. For instance, the increasing integration within System-on-Chip (SoC) designs can streamline product development, potentially reducing the need for extensive board-level assembly that EMS providers specialize in.

The trend towards software-defined hardware further complicates this, as it allows for greater flexibility and functionality to be implemented through code rather than dedicated hardware components. This could lead to simpler product architectures, diminishing the demand for complex manufacturing processes that have historically been the core offering of EMS companies like Elemaster.

The growing trend towards modular and standardized electronic solutions poses a significant threat. For less complex applications, customers might opt for readily available, off-the-shelf modules, bypassing the need for Elemaster's highly specialized and customized design and manufacturing services. This shift could directly impact demand for their core offerings.

Emerging Manufacturing Processes

Emerging manufacturing processes, particularly advanced additive manufacturing like 3D printing of electronic components and integrated systems, represent a potential threat of substitutes for traditional electronics manufacturing. While currently limited for highly complex or mission-critical applications, these novel methods could offer alternative pathways for production.

These evolving paradigms could disrupt established supply chains by providing on-demand, localized manufacturing capabilities. For instance, the global 3D printing market was valued at approximately USD 15.2 billion in 2023 and is projected to grow significantly, indicating increasing investment and development in these substitute technologies.

- Potential for Decentralized Production: Additive manufacturing could enable smaller, more agile production runs, reducing reliance on large-scale traditional assembly lines.

- Material Innovation: Advances in printable materials, including conductive inks and specialized polymers, are continuously expanding the scope of what can be manufactured additively.

- Cost Reduction in Niche Applications: For low-volume or highly customized electronic devices, 3D printing might eventually offer a more cost-effective alternative to traditional tooling and assembly.

Shifting Value Chain towards Software/Services

The increasing integration of software and services into electronic products presents a significant threat of substitution for traditional hardware manufacturers like Elemaster. As devices become 'smart' and connected, the core value proposition increasingly shifts from the physical components to the embedded software, data analytics capabilities, and ongoing service offerings. For instance, by 2024, the global market for Internet of Things (IoT) platforms, which are heavily software-driven, was projected to reach over $30 billion, highlighting this trend.

This evolution means customers may prioritize investments in software ecosystems and data-driven insights over the intricacies of hardware manufacturing. Companies excelling in software development and service provision can offer compelling alternatives or enhancements that diminish the perceived value of hardware alone. Consider the automotive sector, where software updates and connected car services are becoming key differentiators, potentially reducing the reliance on traditional automotive hardware suppliers.

This shift can lead to a commoditization of hardware, as the true competitive advantage moves to the intangible aspects of a product. Consequently, firms heavily invested in complex hardware production might find their offerings less attractive if they cannot seamlessly integrate or compete with superior software and service packages. This dynamic forces a re-evaluation of value chains and strategic focus for companies operating in the electronics manufacturing space.

- Software-Centric Value: The value of electronic products is increasingly derived from software, data analytics, and services, not just hardware.

- Customer Priority Shift: Customers may shift their investment focus from hardware manufacturing to these intangible, software-based offerings.

- Market Data: The global IoT platform market, a proxy for software-driven connectivity, was expected to exceed $30 billion in 2024.

- Competitive Landscape: Companies strong in software and services can offer attractive alternatives, potentially devaluing standalone hardware.

The threat of substitutes for Elemaster's services is multifaceted, encompassing both in-house manufacturing by Original Equipment Manufacturers (OEMs) and the emergence of alternative technologies. While outsourcing remains prevalent, large OEMs with significant resources may choose to produce certain components internally, particularly for strategic or high-volume items. Furthermore, advancements in areas like System-on-Chip (SoC) integration and software-defined hardware can simplify product architectures, potentially reducing the need for complex, traditional assembly processes.

Emerging manufacturing techniques, such as additive manufacturing (3D printing) for electronics, present another layer of substitution. While still developing for highly complex applications, these methods offer potential for localized, on-demand production. The global 3D printing market, valued at approximately $15.2 billion in 2023, demonstrates significant investment and growth in these alternative production pathways.

The increasing emphasis on software, data analytics, and connected services within electronic products also acts as a substitute threat. As the core value shifts from hardware to these intangible elements, customers may prioritize software ecosystems over traditional manufacturing capabilities. The global Internet of Things (IoT) platform market, projected to exceed $30 billion in 2024, underscores this trend towards software-centric value propositions.

| Threat Category | Key Factors | Impact on Elemaster | Market Data/Trends |

| In-house OEM Manufacturing | Large OEM capital & expertise | Reduced outsourcing demand for specific products | Ongoing trend, particularly for core technologies |

| Technological Simplification | SoC integration, Software-defined hardware | Decreased need for complex assembly services | Streamlining product development |

| Additive Manufacturing (3D Printing) | On-demand, localized production | Potential alternative for niche/low-volume production | Global 3D printing market ~$15.2B (2023) |

| Software & Services Dominance | Shift in value to intangible assets | Commoditization of hardware; reduced perceived value of manufacturing alone | IoT platform market >$30B (2024) |

Entrants Threaten

The high-tech electronics manufacturing services (EMS) sector demands significant upfront capital. Companies like Elemaster SpA must invest heavily in cutting-edge machinery, specialized cleanroom environments, sophisticated testing equipment, and robust research and development capabilities. For instance, a single advanced surface-mount technology (SMT) line can cost upwards of $1 million, and a comprehensive facility requires multiple such lines, plus extensive testing and inspection gear.

New entrants face a substantial barrier due to the demand for advanced technological expertise. This includes deep knowledge in electronic design, sophisticated manufacturing like miniaturization, and stringent quality control measures. Companies like Elemaster SpA invest heavily in R&D to maintain their edge, making it difficult for newcomers to compete without similar capital outlay.

Entering highly regulated sectors such as aerospace, defense, railway, and medical requires new entrants to comply with extremely rigorous quality standards and obtain specialized certifications. For instance, AS9100 for aerospace and ISO 13485 for medical devices are critical, demanding significant investment and a proven history of operational excellence.

The process of securing these certifications is not only lengthy and costly but also necessitates demonstrating a consistent track record of quality and reliability. This creates a substantial hurdle for potential new competitors, effectively limiting the threat of new entrants by making market entry a complex and resource-intensive endeavor.

Difficulty in Building Customer Trust and Relationships

Elemaster operates in sectors where long-standing relationships, demonstrated reliability, and profound trust are paramount. The mission-critical nature of electronic components means clients are inherently risk-averse, making it difficult for new players to gain a foothold.

New entrants struggle to establish the reputation and client confidence needed to win contracts. Building these essential strategic partnerships takes considerable time and investment, presenting a significant barrier.

- Reputation is Key: Industries like aerospace and defense prioritize suppliers with a proven track record, making it hard for newcomers to break in.

- Long Sales Cycles: Securing contracts in these fields often involves lengthy qualification processes, testing, and audits, which new entrants may not be able to navigate quickly.

- Switching Costs: For established clients, the cost and risk associated with switching to a new, unproven supplier for critical electronic components can be prohibitive.

Complex Global Supply Chain Management

The threat of new entrants for Elemaster SpA, particularly concerning complex global supply chain management, is relatively low. Building the intricate networks and robust logistics required to source electronic components globally, especially in light of recent disruptions and geopolitical tensions, presents a formidable barrier. For instance, the semiconductor shortage experienced in 2021-2022 highlighted the critical importance of established supplier relationships and diversified sourcing strategies, which new players would find exceedingly difficult and costly to replicate quickly.

Newcomers would face significant challenges in establishing the extensive supplier relationships and logistical infrastructure that Elemaster has cultivated over years of operation. The ability to navigate international trade regulations, manage inventory across multiple geographies, and ensure timely delivery of sensitive electronic components requires deep expertise and substantial investment. In 2024, the ongoing recalibration of global supply chains, with companies seeking greater resilience and regionalization, further complicates entry for those without pre-existing, adaptable frameworks.

- High Capital Investment: New entrants require significant upfront capital to establish global sourcing networks and logistics operations.

- Established Supplier Relationships: Elemaster benefits from long-standing partnerships, offering preferential terms and reliable supply.

- Geopolitical and Regulatory Complexity: Navigating diverse international trade laws and geopolitical risks adds a substantial barrier for new companies.

- Logistical Expertise: Managing a complex, global supply chain demands specialized knowledge in transportation, warehousing, and customs clearance.

The threat of new entrants for Elemaster SpA is generally low due to substantial barriers. High capital investment for advanced manufacturing technology, stringent regulatory compliance in sectors like aerospace and medical, and the critical importance of established client relationships and trust present significant hurdles. Furthermore, the complexity of global supply chain management, requiring deep expertise and long-standing supplier partnerships, makes it difficult for newcomers to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in advanced machinery, cleanrooms, and R&D. | Limits ability of new firms to match technological capabilities. |

| Technological Expertise | Need for deep knowledge in electronic design and miniaturization. | Requires significant investment in talent and ongoing development. |

| Regulatory Compliance | Strict certifications (e.g., AS9100, ISO 13485) and quality standards. | Lengthy and costly processes, demanding proven operational excellence. |

| Brand Reputation & Trust | Long-standing relationships and proven reliability are paramount. | Difficult for new players to gain client confidence in mission-critical sectors. |

| Supply Chain Complexity | Establishing global sourcing networks and robust logistics. | Requires deep expertise, substantial investment, and adaptable frameworks. |

Porter's Five Forces Analysis Data Sources

Our Elemaster SpA Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Elemaster's annual reports, industry-specific market research from firms like Gartner and IDC, and financial data from Bloomberg and Refinitiv. This blend ensures a robust assessment of competitive intensity and strategic positioning within the electronics manufacturing services sector.