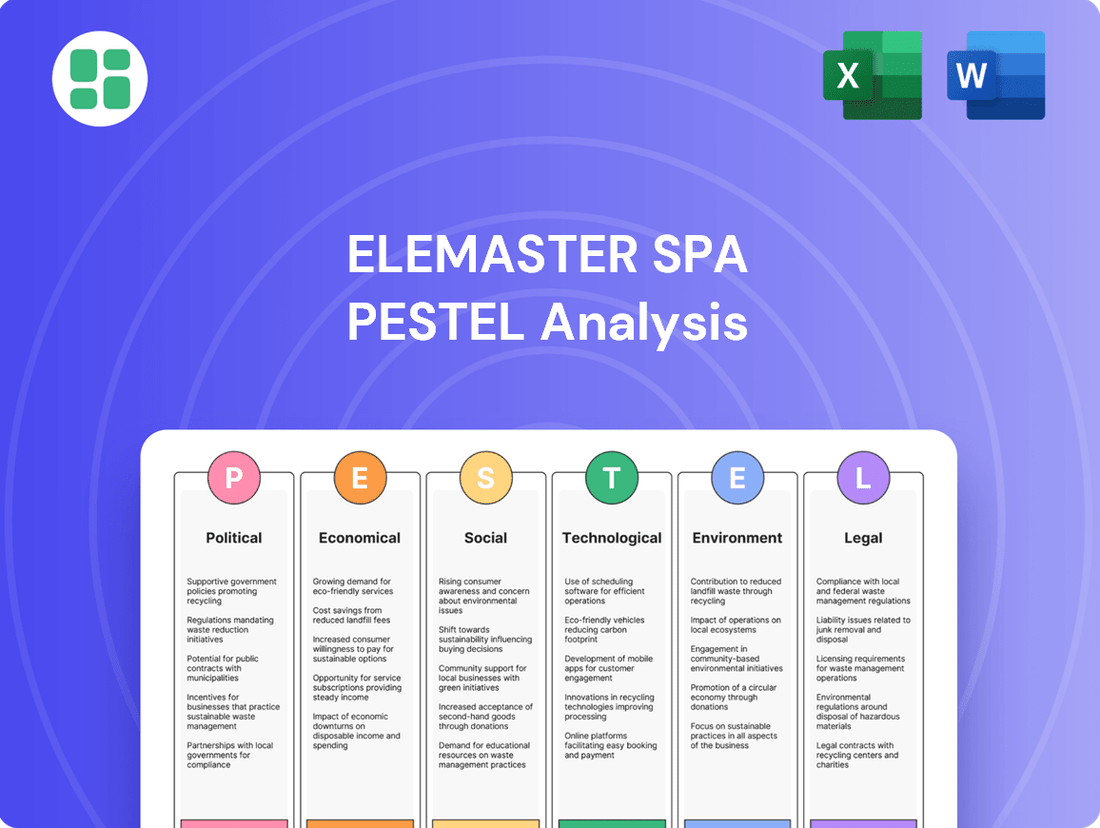

Elemaster SpA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elemaster SpA Bundle

Unlock the external forces shaping Elemaster SpA's destiny with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental landscapes that influence their operations and strategic decisions. Gain the crucial insights needed to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and empower your strategic planning.

Political factors

Ongoing geopolitical tensions, such as those impacting trade relations between major economies, directly affect the electronics supply chain. These disruptions can lead to increased costs and delays for components, a critical factor for companies like Elemaster SpA. For instance, in 2024, global trade friction has already contributed to a rise in shipping costs for electronic goods by an estimated 15% compared to the previous year.

To navigate these challenges, Elemaster SpA needs to consider diversifying its supplier network beyond single regions. This strategy helps mitigate risks associated with sudden policy changes or tariffs, which can significantly alter the cost of raw materials and finished products. Reports from late 2024 indicate that companies with diversified supply chains experienced 20% less impact from trade disputes than those relying on concentrated sourcing.

Global geopolitical tensions are escalating, leading many nations to significantly increase their defense budgets. This trend is particularly strong in 2024 and is projected to continue into 2025, creating a favorable environment for companies like Elemaster SpA that specialize in advanced electronic systems for the defense industry. Increased instability directly fuels demand for sophisticated military hardware and technology.

For Elemaster SpA, this heightened global defense spending presents a clear opportunity to secure new government contracts. The company's expertise in complex electronic manufacturing positions it well to supply critical components and systems for next-generation defense platforms. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 includes substantial allocations for advanced weapon systems and electronic warfare capabilities, areas where Elemaster could excel.

Governments and regulatory bodies are constantly updating rules for sectors like medical devices and aerospace. Elemaster SpA needs to stay on top of these changes, including new cybersecurity rules for defense suppliers and tougher certifications for medical equipment. For instance, the European Union's Medical Device Regulation (MDR) has significantly increased compliance burdens for manufacturers, with many needing to re-certify products by 2027, impacting development timelines and costs.

Reshoring and Local Manufacturing Incentives

Governments worldwide are increasingly promoting reshoring and nearshoring initiatives to bolster domestic manufacturing capabilities and secure supply chains. This shift, driven by geopolitical considerations and a desire for greater resilience, presents a significant opportunity for European-based Electronic Manufacturing Services (EMS) providers like Elemaster SpA. These policies often include financial incentives, tax breaks, and direct subsidies aimed at encouraging local production and innovation within the sector.

The trend is supported by substantial government investment. For instance, the European Union's Chips Act, launched in 2022, allocates over €43 billion in public and private funding to bolster semiconductor manufacturing and research within the bloc, directly benefiting companies involved in advanced electronics production. Similarly, national governments are enacting legislation to support domestic industries, potentially creating a more favorable operating environment for companies like Elemaster.

- Increased Government Support: Policies favoring domestic production can lead to direct financial aid and preferential treatment for local EMS providers.

- Supply Chain Resilience: Reshoring reduces reliance on overseas suppliers, mitigating risks associated with global disruptions, a key concern highlighted by events in recent years.

- Competitive Advantage: Elemaster SpA, with its European manufacturing base, is well-positioned to benefit from these reshoring trends and government incentives.

Political Stability in Key Markets

Elemaster SpA's operations are significantly influenced by the political stability of its key markets and sourcing regions. Political instability can directly impact supply chains, potentially disrupting the availability of essential raw materials and dampening overall market confidence. For instance, the medium-term effects of economic stimulus packages, such as those implemented in China, can ripple through global markets, affecting component costs and availability.

The geopolitical landscape remains a crucial consideration for Elemaster. Fluctuations in trade policies and international relations can create both opportunities and challenges. For example, the ongoing trade tensions between major economic blocs could necessitate diversification of sourcing strategies to mitigate risks.

- Geopolitical Risk: Monitoring political developments in regions like Southeast Asia, a key manufacturing hub for electronics components, is vital.

- Trade Agreements: Changes in trade agreements, such as potential renegotiations of existing pacts, could impact import/export costs for Elemaster.

- Government Regulations: Evolving environmental and labor regulations in operating countries can influence manufacturing processes and compliance costs.

- Economic Policies: Government fiscal and monetary policies, including interest rate adjustments and stimulus measures, directly affect consumer spending and business investment in Elemaster's target markets.

Elemaster SpA operates within a dynamic political landscape where government policies and geopolitical stability significantly shape its operational environment. Increased global defense spending, particularly evident in 2024 and projected into 2025, creates substantial opportunities for companies like Elemaster that provide advanced electronic systems for military applications. For example, the U.S. Department of Defense's 2025 budget request highlights significant investment in areas like electronic warfare, directly aligning with Elemaster's capabilities.

Government initiatives promoting reshoring and nearshoring, coupled with financial incentives like the EU's Chips Act (over €43 billion allocated), aim to bolster domestic manufacturing and supply chain resilience. This presents a strategic advantage for European EMS providers such as Elemaster, positioning them to benefit from preferential treatment and reduced reliance on potentially volatile overseas supply chains.

Navigating evolving regulations, such as the EU's Medical Device Regulation (MDR) which requires extensive re-certification, demands proactive compliance strategies. Furthermore, geopolitical tensions directly impact supply chains, with trade friction in 2024 contributing to an estimated 15% rise in shipping costs for electronics, underscoring the need for diversified sourcing to mitigate risks.

| Political Factor | Impact on Elemaster SpA | Supporting Data/Trend (2024/2025) |

| Defense Spending | Increased demand for advanced electronic systems | U.S. DoD FY2025 budget includes substantial allocations for electronic warfare. |

| Reshoring/Nearshoring Initiatives | Opportunity for domestic production and supply chain resilience | EU Chips Act: €43 billion+ in public/private funding for semiconductor manufacturing. |

| Trade Policy & Geopolitics | Supply chain disruption and cost increases | Global trade friction led to an estimated 15% rise in electronics shipping costs in 2024. |

| Regulatory Compliance | Increased compliance burdens and costs | EU MDR requires re-certification for medical devices, impacting development timelines. |

What is included in the product

This Elemaster SpA PESTLE analysis delves into the critical external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that shape its operational landscape.

It provides a comprehensive understanding of how these forces present both challenges and strategic advantages, enabling informed decision-making for future growth.

A clean, summarized version of the Elemaster SpA PESTLE analysis offers a pain point reliever by providing easy referencing during meetings and presentations, ensuring all stakeholders have a clear understanding of external factors impacting the business.

Economic factors

The global economic outlook significantly impacts demand for electronic components, a core area for Elemaster SpA. While the European Electronic Manufacturing Services (EMS) market saw a contraction in 2024, projections indicate a modest positive growth for 2025. This anticipated rebound is largely fueled by the escalating demand for advanced, high-technology products across various sectors.

The semiconductor industry is on a strong growth trajectory, with global sales anticipated to hit record highs, potentially exceeding $700 billion in 2025, largely fueled by the insatiable demand for AI and advanced computing. This surge presents opportunities but also highlights vulnerabilities for companies like Elemaster SpA.

Despite the overall expansion, the industry faces ongoing hurdles, including limited wafer fabrication capacity, which could extend lead times for essential chip components. Furthermore, potential disruptions in the supply chain for critical materials or specialized components, such as High Bandwidth Memory (HBM), could directly impact Elemaster SpA's production costs and delivery schedules.

Rising raw material costs, particularly for semiconductors and precious metals, are significantly impacting the electronics manufacturing sector. For instance, the average price of key semiconductor components saw an increase of approximately 15-20% in late 2023 and early 2024, directly affecting production expenses for companies like Elemaster SpA. This inflationary pressure, coupled with increased tariffs on certain imported components, forces Elemaster to implement robust cost management strategies to ensure competitive pricing while upholding product quality.

Investment in R&D and Innovation

Economic conditions directly impact Elemaster SpA's clients' appetite for investing in new product development and advanced technologies. When economies are robust, businesses are more likely to allocate capital towards innovation, which benefits Elemaster's demand for its services in areas like advanced electronics manufacturing.

For Elemaster SpA, sustained investment in Research & Development (R&D) and innovation is not just beneficial, it's essential for staying ahead. In high-tech sectors, the pace of technological change is rapid, and companies that don't innovate risk obsolescence. Elemaster's commitment to R&D allows it to offer cutting-edge solutions, ensuring its competitiveness and relevance in the market.

Global R&D spending is a key indicator. For instance, in 2024, global R&D expenditure was projected to reach approximately $2.9 trillion, with significant growth anticipated in sectors Elemaster serves, such as semiconductors and telecommunications. This trend underscores the importance of innovation for companies like Elemaster to capture market share and drive future revenue.

Key trends influencing R&D investment for Elemaster include:

- Increased government incentives for R&D: Many nations are offering tax credits and grants to stimulate innovation, making it more attractive for companies to invest.

- Growth in emerging technologies: The demand for solutions in AI, IoT, and advanced connectivity fuels client investment in R&D, creating opportunities for Elemaster.

- Focus on sustainability: Clients are increasingly investing in R&D for eco-friendly products and processes, a trend Elemaster can capitalize on.

- Digital transformation initiatives: Companies across industries are investing heavily in digital technologies, requiring advanced electronic manufacturing capabilities that Elemaster provides.

Currency Fluctuations and Exchange Rates

Elemaster SpA's profitability is significantly influenced by currency fluctuations, particularly as it operates internationally. Changes in exchange rates directly affect the value of its net sales when converted back to its reporting currency. For instance, if the Euro strengthens against currencies where Elemaster generates substantial revenue, its reported sales could appear lower, impacting financial performance metrics.

Effective financial management and the implementation of robust hedging strategies are crucial to mitigate these risks. By carefully monitoring currency markets and employing financial instruments, Elemaster can protect its earnings from adverse exchange rate movements. This proactive approach is essential for maintaining stable financial results in a volatile global economic landscape.

- Impact on Net Sales: A stronger Euro in 2024 could reduce the reported value of sales made in USD or GBP.

- Hedging Strategies: Elemaster likely utilizes forward contracts or options to lock in exchange rates for future transactions.

- Profitability Sensitivity: Even minor shifts in major currency pairs, like EUR/USD, can have a noticeable effect on Elemaster's bottom line due to international sales volume.

- 2024/2025 Outlook: Continued volatility in global currencies, driven by geopolitical events and differing monetary policies, presents ongoing challenges and opportunities for Elemaster's international business.

Global economic growth directly influences demand for Elemaster SpA's electronic manufacturing services. While the European EMS market contracted in 2024, a modest recovery is projected for 2025, driven by high-tech product demand. Semiconductor sales are expected to exceed $700 billion in 2025, a significant opportunity for Elemaster, though supply chain constraints for components like HBM and limited wafer capacity remain challenges.

Same Document Delivered

Elemaster SpA PESTLE Analysis

The preview you see of the Elemaster SpA PESTLE Analysis is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Elemaster SpA, providing valuable strategic insights. You'll gain a deep understanding of the external forces shaping the company's operations and future trajectory.

Sociological factors

The electronics manufacturing sector, including companies like Elemaster SpA, grapples with persistent shortages of skilled labor, especially for specialized engineers and technicians. This talent gap directly impacts production capacity and the ability to adopt new technologies.

To counter this, Elemaster SpA needs robust strategies for workforce development. This includes investing in training programs and fostering an environment that attracts and retains top talent, crucial for staying competitive in a rapidly evolving industry.

For instance, in 2024, the global electronics industry reported a deficit of over 1.5 million skilled workers, highlighting the urgency for companies to address these workforce challenges proactively.

Even though Elemaster SpA operates in the business-to-business (B2B) sector, evolving preferences among end-consumers significantly influence its operations. Consumers increasingly favor compact, personalized, and cutting-edge electronic gadgets. This trend directly translates into a higher demand for adaptable and agile manufacturing capabilities from Electronic Manufacturing Services (EMS) providers like Elemaster.

Consequently, Elemaster SpA must excel in delivering swift prototyping services and flexible production volumes to meet these dynamic market needs. For instance, the burgeoning market for wearable technology, projected to reach over $100 billion by 2025, exemplifies this shift toward smaller, customized devices, requiring specialized EMS support.

Societal expectations for workplace safety are growing, pushing manufacturers like Elemaster SpA to adopt more robust health and safety protocols. This heightened scrutiny, particularly in sectors like medical device manufacturing, means that compliance is no longer just a legal requirement but a critical factor for maintaining brand reputation and customer trust.

Elemaster SpA's commitment to stringent quality and safety management systems, such as ISO 13485, is essential for its medical device operations. This standard, updated in 2016 with ongoing amendments, ensures that medical devices are consistently produced and controlled according to quality standards appropriate to their intended use. For instance, in 2023, the global medical device market was valued at approximately $520 billion, underscoring the high stakes involved in maintaining safety and quality in this segment.

Ethical Sourcing and Labor Practices

Societal expectations regarding ethical sourcing and labor practices are increasingly shaping business operations. Consumers and investors alike are demanding greater transparency in supply chains, pushing companies like Elemaster SpA to demonstrate commitment to fair labor and responsible material sourcing. For instance, a 2024 survey indicated that 78% of consumers consider ethical labor practices when making purchasing decisions.

Elemaster SpA may encounter pressure to ensure its entire supply chain, from raw material acquisition to final product assembly, aligns with stringent ethical standards. This includes fair wages, safe working conditions, and the absence of child or forced labor. Failure to meet these evolving societal values could impact brand reputation and market access.

- Increased Consumer Scrutiny: Over 60% of global consumers reported actively seeking out brands with ethical supply chains in 2024.

- Investor ESG Focus: Environmental, Social, and Governance (ESG) investing continued its upward trend in 2024, with over $3.5 trillion in assets under management globally.

- Regulatory Trends: Emerging legislation, such as supply chain due diligence laws, is reinforcing the need for ethical labor practices.

- Reputational Risk: Negative publicity stemming from unethical labor practices can lead to significant financial and brand damage.

Demographic Shifts and Urbanization

Global demographic shifts, marked by a growing and aging population, coupled with increasing urbanization, are fundamentally reshaping demand for infrastructure. By 2050, it's projected that 68% of the world's population will live in urban areas, up from 55% in 2018. This surge in urban density directly fuels the need for efficient, modern public transportation systems.

Elemaster SpA's railway sector is well-positioned to capitalize on this trend. As cities worldwide invest heavily in upgrading and expanding their transit networks to accommodate burgeoning populations and reduce congestion, the demand for advanced digital railway solutions, including signaling and control systems, is on the rise. For instance, the global railway signaling market was valued at approximately USD 12.5 billion in 2023 and is expected to grow significantly in the coming years, driven by these demographic pressures and technological advancements.

- Urban Population Growth: The United Nations forecasts that urban areas will house 2.5 billion more people by 2050, increasing the demand for public transit.

- Infrastructure Investment: Governments globally are allocating substantial funds to modernize and expand railway networks to improve urban mobility and sustainability.

- Digitalization of Transport: The push for smart cities necessitates digital solutions in public transport, enhancing efficiency, safety, and passenger experience.

- Elemaster's Opportunity: Elemaster SpA's expertise in electronic components and systems for railways aligns directly with these growing market needs.

Societal expectations for ethical business practices are increasingly influencing Elemaster SpA's operations, particularly concerning supply chain transparency and labor conditions. A significant majority of consumers, over 60% in 2024, actively seek brands with ethical supply chains, while investor focus on ESG principles continues to grow, with over $3.5 trillion in global ESG assets under management in the same year.

Elemaster SpA faces pressure to ensure fair wages, safe working environments, and the absence of exploitative labor practices throughout its entire value chain, as reputational damage from non-compliance can be substantial.

The company's adherence to stringent quality and safety management systems, such as ISO 13485 for its medical device operations, is vital for maintaining trust and market access, especially given the high stakes in the approximately $520 billion global medical device market in 2023.

The persistent shortage of skilled labor in electronics manufacturing, with a global deficit of over 1.5 million skilled workers reported in 2024, necessitates robust workforce development strategies for companies like Elemaster SpA to maintain production capacity and technological adoption.

Technological factors

The electronics manufacturing sector is heavily investing in Industry 4.0, with advanced automation and AI becoming standard. This trend is driven by the need for greater precision and faster production cycles. For instance, the global industrial automation market was valued at over $200 billion in 2023 and is projected to grow significantly, reflecting this widespread adoption.

Elemaster SpA can capitalize on these technological shifts by integrating machine learning for predictive maintenance and IoT sensors for real-time production monitoring. This allows for enhanced operational efficiency, reduced downtime, and improved product quality, crucial for maintaining competitiveness in the fast-paced electronics market.

The relentless pursuit of smaller, more capable electronics, particularly in critical sectors like medical devices, automotive systems, and wearables, fuels the demand for miniaturization and sophisticated packaging. Elemaster SpA's strategy must therefore focus on advancing technologies such as System-in-Package (SiP) and 3D Integrated Circuits (ICs) to deliver the high-density interconnect solutions that these markets require.

Artificial intelligence is increasingly vital in electronics manufacturing, driving advancements like predictive maintenance and real-time quality control. For instance, AI solutions are projected to boost manufacturing efficiency by up to 20% by 2025, according to recent industry reports.

Digital twin technology is also gaining traction for production planning, allowing companies like Elemaster SpA to simulate and optimize complex manufacturing processes. This technology can lead to a 15% reduction in production downtime and a 10% improvement in yield, as demonstrated in pilot programs.

Cybersecurity in Manufacturing and Products

The increasing reliance on interconnected systems and data within manufacturing, particularly in sensitive sectors like defense, presents significant cybersecurity challenges. As of 2024, the manufacturing sector is a prime target for cyberattacks, with incidents often leading to production downtime and intellectual property theft. Elemaster SpA must prioritize embedding advanced cybersecurity protocols throughout its operational framework and product development lifecycle to safeguard its proprietary information and meet evolving regulatory demands.

The landscape of cyber threats continues to evolve, with ransomware and supply chain attacks posing persistent risks. For instance, a 2023 report indicated a substantial rise in attacks targeting industrial control systems (ICS) in the manufacturing sector. Elemaster SpA's strategic response should include continuous threat monitoring, employee training, and the implementation of zero-trust architectures to mitigate these growing vulnerabilities.

- Growing Threat Landscape: Manufacturing is increasingly targeted by cybercriminals, with the sector experiencing a significant increase in attacks in recent years.

- Intellectual Property Protection: Safeguarding sensitive design data and proprietary manufacturing processes is paramount to maintaining competitive advantage.

- Regulatory Compliance: Stricter data protection and cybersecurity regulations, such as those impacting defense contracts, necessitate robust security measures.

- Operational Resilience: Ensuring the continuity of manufacturing operations requires defenses against disruptions caused by cyber incidents.

Rapid Prototyping and Additive Manufacturing

Technologies like 3D printing are significantly accelerating the prototyping process. This allows for rapid iteration of product designs, directly translating to a shorter time-to-market. For instance, in 2024, the global additive manufacturing market was valued at approximately $20.5 billion, with projections indicating substantial growth as adoption increases across industries.

Elemaster SpA can strategically utilize additive manufacturing for the swift production of intricate components. This capability also extends to efficient small-batch runs, providing clients with enhanced flexibility and the ability to offer highly customized solutions. By embracing these advancements, Elemaster can solidify its position as an agile and responsive partner in the electronics manufacturing sector.

- Accelerated Design Cycles: 3D printing drastically cuts down the time needed for design validation and modification.

- Cost-Effective Small Batches: Additive manufacturing makes producing limited quantities of complex parts economically viable.

- Enhanced Customization: Elemaster can offer bespoke solutions tailored to individual client specifications.

- Market Responsiveness: Faster prototyping enables quicker adaptation to evolving market demands and technological shifts.

The electronics manufacturing sector is rapidly adopting Industry 4.0 technologies, including advanced automation and AI, to boost precision and production speed. The global industrial automation market exceeded $200 billion in 2023, underscoring this trend. Elemaster SpA can leverage AI for predictive maintenance, improving efficiency and reducing downtime. The demand for miniaturization in sectors like medical and automotive necessitates advancements in technologies such as System-in-Package (SiP) and 3D Integrated Circuits (ICs).

| Technology Trend | Impact on Electronics Manufacturing | Elemaster SpA Opportunity | 2024/2025 Data Point |

|---|---|---|---|

| Industry 4.0 & Automation | Increased precision, faster cycles, efficiency gains | Integrate AI for predictive maintenance, IoT for real-time monitoring | Global industrial automation market > $200B (2023) |

| Miniaturization & Advanced Packaging | Demand for smaller, more capable components | Focus on SiP and 3D ICs for high-density interconnects | Critical for medical, automotive, and wearable sectors |

| Artificial Intelligence (AI) | Predictive maintenance, real-time quality control, efficiency boost | Implement AI for operational optimization | AI projected to boost manufacturing efficiency by up to 20% by 2025 |

| Digital Twin Technology | Production planning simulation, process optimization, reduced downtime | Utilize for simulating and optimizing manufacturing processes | Potential for 15% reduction in production downtime |

| Additive Manufacturing (3D Printing) | Accelerated prototyping, rapid iteration, shorter time-to-market | Use for intricate components and cost-effective small batches | Global additive manufacturing market ~$20.5B (2024) |

Legal factors

Elemaster SpA's operations are heavily influenced by legal frameworks requiring adherence to industry-specific certifications and standards. For instance, its involvement in the medical device sector mandates compliance with ISO 13485, a standard crucial for ensuring product safety and regulatory approval. In 2024, the company's commitment to these quality management systems underpins its market access and reputation.

Furthermore, operating within the defense sector necessitates meeting stringent cybersecurity requirements, such as the Cybersecurity Maturity Model Certification (CMMC) 2.0. Failure to maintain these certifications, which are subject to regular audits and renewals, can directly impact Elemaster SpA's eligibility for government contracts and its ability to operate in these sensitive markets.

Protecting intellectual property (IP) is a critical legal consideration for Elemaster SpA, particularly within the high-tech electronics and defense sectors. Given the intricate nature of their product development and the global reach of their supply chain, robust IP protection strategies are paramount to prevent unauthorized use or replication of proprietary designs and technologies. This is a growing concern for regulators, especially in defense electronics, where national security implications are significant.

Elemaster SpA must navigate increasingly stringent product liability and safety regulations, especially concerning complex electronic systems used in critical sectors like automotive and medical devices. The evolving legal landscape, including new EU directives, necessitates robust testing protocols and unwavering quality assurance to ensure compliance and mitigate risks.

For instance, the EU’s General Product Safety Regulation (GPSR), which came into effect in December 2024, places greater emphasis on producer responsibility and supply chain transparency, impacting how Elemaster SpA must document and verify the safety of its electronic components.

Data Privacy and Digital Regulations (e.g., GDPR, AI Act)

Elemaster SpA operates in an environment increasingly shaped by data privacy and digital regulations. The European Union's General Data Protection Regulation (GDPR) sets strict rules for how personal data is collected, processed, and stored, impacting Elemaster's operations, particularly in customer interactions and supply chain management. The forthcoming EU AI Act will introduce specific compliance requirements for artificial intelligence systems, which are becoming integral to manufacturing processes and product development, including AI-supported medical devices. Failure to adhere to these regulations can result in significant fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher.

Navigating these legal landscapes is crucial for Elemaster SpA's continued success and reputation. Compliance ensures the company handles sensitive data responsibly, building trust with customers and partners. For AI-driven products, especially in the medical sector where patient data is paramount, rigorous adherence to the EU AI Act will be non-negotiable. This proactive approach mitigates legal risks and positions Elemaster as a responsible innovator in the digital age.

- GDPR Fines: Penalties can reach up to 4% of global annual turnover or €20 million.

- EU AI Act Impact: Specific compliance measures for AI in manufacturing and medical devices.

- Data Handling: Strict rules on collection, processing, and storage of personal data.

- Reputational Risk: Non-compliance can damage trust with customers and stakeholders.

Labor Laws and Workforce Regulations

Changes in labor laws, such as minimum wage adjustments and new regulations on working conditions, directly affect Elemaster SpA's operating expenses and recruitment strategies. For instance, in Italy, where Elemaster has significant operations, the national minimum wage was around €7.50 per hour in early 2024, with ongoing discussions about potential increases.

Furthermore, evolving rules around unionization and collective bargaining can influence Elemaster's employee relations and the cost of labor. Adapting to these legal frameworks, including those concerning employee benefits and workplace safety, is crucial for maintaining stable operations and compliance.

Elemaster SpA must stay abreast of legislative shifts impacting employment contracts, working hours, and potentially new mandates for employee training or social contributions.

Key areas of legal focus for Elemaster SpA in 2024-2025 include:

- Minimum Wage Adjustments: Monitoring and adapting to any national or regional increases in minimum wage rates that could impact labor costs.

- Workplace Safety Regulations: Ensuring full compliance with updated health and safety standards to prevent accidents and associated legal liabilities.

- Collective Bargaining Agreements: Navigating changes in union power and the terms of collective agreements that may affect wage structures and working conditions.

- Employee Benefits and Social Contributions: Staying updated on any new legal requirements for employee benefits, pensions, or social security contributions.

Elemaster SpA's adherence to legal and regulatory frameworks is paramount, especially concerning product safety and certifications in sectors like medical devices and defense. Compliance with standards such as ISO 13485 and CMMC 2.0 is essential for market access and contract eligibility. The company also faces increasing scrutiny over intellectual property protection, a critical concern given the sensitive nature of its technological advancements.

The evolving legal landscape, including the EU's General Product Safety Regulation (GPSR) effective December 2024, places greater emphasis on producer responsibility and supply chain transparency for electronic components. Furthermore, data privacy regulations like GDPR and the upcoming EU AI Act significantly shape how Elemaster handles personal data and implements AI in its operations, with substantial financial penalties for non-compliance, potentially up to 4% of global annual turnover.

Labor laws also present a dynamic legal challenge. Adjustments to minimum wage, as seen with potential increases in Italy (around €7.50 per hour in early 2024), alongside evolving rules on unionization and workplace safety, directly impact operating costs and employee relations. Staying compliant with these labor-related statutes is vital for stable operations and legal standing.

Environmental factors

The electronics sector is facing mounting pressure to embrace sustainability, a trend fueled by consumer demand, evolving regulations, and the need to stay competitive. Elemaster SpA is likely to integrate eco-design into its processes, focusing on materials that are both biodegradable and recyclable. This shift is crucial, as the global waste electrical and electronic equipment (WEEE) generation reached an estimated 53.6 million metric tonnes in 2019, a figure projected to rise significantly.

To mitigate its environmental footprint, Elemaster SpA is expected to implement closed-loop recycling systems. This approach aims to minimize waste by recovering and reusing materials throughout the product lifecycle. Companies that successfully adopt these circular economy principles are better positioned to meet stringent environmental standards and appeal to an increasingly eco-conscious market.

Manufacturing electronic components, particularly semiconductors, demands significant energy. Elemaster SpA, like many in its sector, is under increasing pressure to curb its energy footprint.

The global push towards net-zero emissions and climate change mitigation is driving this demand. By 2023, renewable energy sources accounted for approximately 30% of the global electricity generation, a figure expected to climb as companies like Elemaster explore cleaner alternatives.

Global environmental regulations are tightening, particularly concerning electronic waste and the disposal of hazardous materials. For instance, the European Union's WEEE Directive (Waste Electrical and Electronic Equipment) continues to evolve, with updated targets for collection and recycling rates, impacting companies like Elemaster SpA. Failure to comply can result in significant fines and reputational damage.

Elemaster SpA must therefore prioritize robust waste management strategies. This includes investing in advanced recycling technologies and establishing partnerships for the responsible disposal of components that cannot be reused. In 2024, the global e-waste generation was projected to reach 65.4 million metric tons, highlighting the scale of the challenge and the critical need for proactive compliance.

Material Sourcing and Supply Chain Traceability

Elemaster SpA faces growing pressure to ensure its material sourcing is environmentally sound. This means looking closely at where its raw materials, especially critical ones, come from and how they are extracted and processed. Increased scrutiny means companies like Elemaster need to be able to trace their supply chains to verify responsible practices.

To meet these demands, Elemaster SpA will likely need to implement stricter supplier vetting processes. This involves ensuring that its partners adhere to sustainable sourcing guidelines and demonstrate a commitment to environmental responsibility throughout their operations. A recent report from the European Environment Agency in early 2024 highlighted that over 60% of surveyed companies are increasing their focus on supply chain sustainability due to regulatory and consumer pressures.

- Supply Chain Transparency: Elemaster SpA must enhance visibility into its upstream supply chain to identify and mitigate environmental risks associated with material sourcing.

- Supplier Audits: Implementing regular audits for key suppliers to ensure compliance with environmental regulations and responsible sourcing standards is crucial.

- Critical Raw Materials: Particular attention needs to be paid to the sourcing of critical raw materials, where environmental impacts can be significant and regulatory focus is high.

- Sustainable Procurement Policies: Developing and enforcing robust sustainable procurement policies will guide material selection and supplier relationships.

Climate Change Impact and Resilience

The increasing occurrence of extreme weather events, a direct consequence of climate change, poses a significant threat to global supply chains and manufacturing processes. For Elemaster SpA, this translates to potential disruptions in sourcing raw materials and delivering finished products, impacting operational continuity and profitability.

Building robust supply chain resilience is paramount for Elemaster SpA to effectively manage the physical and operational risks stemming from environmental factors. This involves diversifying suppliers, exploring regional sourcing options, and investing in adaptable logistics networks. For instance, the World Economic Forum's 2024 Global Risks Report highlighted that climate action failure and extreme weather events are among the top global risks, underscoring the urgency for businesses to adapt.

- Supply Chain Vulnerability: Extreme weather events can damage infrastructure, leading to delays and increased costs.

- Operational Disruption: Factory shutdowns or reduced capacity due to environmental hazards can halt production.

- Resilience Strategies: Implementing measures like dual sourcing and inventory management can buffer against shocks.

- Economic Impact: The cost of climate-related disruptions to global supply chains was estimated to be trillions of dollars annually in recent years.

Elemaster SpA must navigate a landscape increasingly shaped by environmental concerns, from waste management to energy consumption. The company's commitment to sustainability is crucial, especially as global e-waste generation continues to climb, projected to reach 65.4 million metric tons in 2024. Embracing eco-design and closed-loop systems will be key to meeting evolving regulations and consumer expectations.

The drive for net-zero emissions is pushing companies like Elemaster to adopt cleaner energy sources. With renewable energy already accounting for around 30% of global electricity generation in 2023, the trend towards decarbonization in manufacturing is undeniable. This shift not only addresses environmental impact but also enhances operational efficiency and brand reputation.

Elemaster SpA faces stringent environmental regulations, particularly concerning e-waste and hazardous materials. Compliance with directives like the EU's WEEE Directive is essential to avoid penalties and maintain market access. Proactive waste management and responsible disposal strategies are therefore critical for the company's long-term viability.

Material sourcing also presents environmental challenges, requiring Elemaster SpA to ensure transparency and sustainability throughout its supply chain. With over 60% of surveyed companies increasing their focus on supply chain sustainability in early 2024, robust supplier vetting and adherence to responsible sourcing guidelines are paramount.

The increasing frequency of extreme weather events, a consequence of climate change, poses significant risks to Elemaster SpA's supply chain and operations. Building resilience through diversified sourcing and adaptable logistics is vital, especially as climate action failure and extreme weather are identified as top global risks in the 2024 World Economic Forum report.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Elemaster SpA is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.