Estee Lauder Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

The Estée Lauder Companies boasts a powerful brand portfolio and global reach, but faces intense competition and evolving consumer preferences. Our analysis reveals how these strengths and weaknesses shape their opportunities and threats in the dynamic beauty market.

Want the full story behind Estée Lauder's market position, growth drivers, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Estée Lauder Companies commands a powerful position with over 25 prestigious beauty brands, featuring globally recognized names such as Estée Lauder, Clinique, M∙A∙C, La Mer, and Jo Malone London. This extensive and diverse brand lineup, spanning skincare, makeup, fragrance, and hair care, ensures the company can effectively reach a broad spectrum of consumers worldwide.

Estée Lauder holds a commanding position as the second-largest entity in the global prestige beauty sector. Its operations span over 150 countries, achieving a remarkably balanced revenue stream across the Americas, EMEA, and Asia/Pacific regions, demonstrating significant global penetration.

The company's strength lies in its sophisticated multi-channel distribution network. This includes a strong presence in department stores, specialty retailers, its own branded stores, robust e-commerce platforms, and the lucrative travel retail segment, ensuring widespread consumer accessibility and market reach.

Estée Lauder Companies exhibits notable financial discipline, even amidst recent sales headwinds. A key indicator of this strength is their consistent maintenance of healthy supplier payment practices, which fosters strong relationships within their supply chain. Furthermore, the company has consistently achieved impressive gross margins, with a figure of 76.1% reported in Q2 FY2025, showcasing their ability to manage costs effectively and maintain strong profitability on their products.

This robust gross margin, a testament to their pricing power and operational efficiency, provides a solid foundation for financial stability. It allows Estée Lauder to navigate market fluctuations and strategically invest in future growth initiatives. The ongoing Profit Recovery and Growth Plan (PRGP) further underscores this commitment to financial health, aiming to streamline operations and enhance long-term profitability, thereby reinforcing their capacity for strategic investment and resilience.

Commitment to Innovation and R&D

Estee Lauder Companies demonstrates a strong commitment to innovation, consistently investing in research and development to maintain its competitive edge. The company is actively leveraging advanced technologies, including artificial intelligence, to significantly accelerate its product development cycles, aiming to triple innovation speed. This strategic focus on cutting-edge research, exemplified by collaborations with institutions like Stanford University, fuels a robust pipeline of new products, particularly in high-growth areas such as skincare and premium fragrances, thereby reinforcing consumer loyalty.

Key aspects of this commitment include:

- Investment in AI: Utilizing artificial intelligence for enhanced trend forecasting, consumer marketing, and product development.

- Accelerated Innovation: A strategic objective to triple the speed of innovation for new product launches.

- Strategic Partnerships: Collaborations with leading academic institutions like Stanford University to foster cutting-edge research.

- Robust Product Pipeline: A strong focus on developing new offerings within skincare and high-end fragrances, key growth categories.

Strategic Digital Transformation and AI Adoption

Estée Lauder is actively pursuing a comprehensive digital transformation, with a significant focus on integrating generative AI. This strategic move is designed to streamline operations across the board.

The company is leveraging AI to enhance its supply chain and integrated business planning processes, aiming for greater efficiency and faster market responsiveness. This digital pivot is crucial in the current beauty industry landscape, which is increasingly dominated by digital channels.

Key areas of AI implementation include personalized marketing campaigns and the development of virtual try-on experiences. These initiatives are intended to deepen consumer engagement and provide a more tailored shopping journey.

- AI Integration: Generative AI is being deployed across various business functions.

- Operational Efficiency: Focus on supply chain and integrated business planning improvements.

- Consumer Engagement: Enhancing personalized marketing and virtual try-on features.

- Market Responsiveness: Accelerating the company's ability to adapt to market trends.

Estée Lauder Companies' extensive portfolio of over 25 prestige beauty brands, including globally recognized names like Estée Lauder, Clinique, and M∙A∙C, provides a significant competitive advantage. This diverse offering across skincare, makeup, fragrance, and hair care allows the company to cater to a wide range of consumer preferences and market segments, ensuring broad appeal and resilience.

The company's financial health is a notable strength, as evidenced by its impressive gross margins. For the second quarter of fiscal year 2025, Estée Lauder reported a gross margin of 76.1%, demonstrating exceptional cost management and pricing power. This robust margin underpins their ability to invest in growth and weather market volatility.

Estée Lauder's commitment to innovation, particularly its investment in artificial intelligence to accelerate product development, is a key differentiator. The goal to triple innovation speed, supported by collaborations with institutions like Stanford University, ensures a continuous pipeline of relevant and desirable products, especially in high-demand categories like skincare.

Their sophisticated multi-channel distribution strategy, encompassing department stores, specialty retailers, direct-to-consumer channels, and travel retail, ensures widespread accessibility. This expansive reach, combined with a strong digital presence, allows Estée Lauder to connect with consumers effectively across various touchpoints.

| Metric | Q2 FY2025 | Significance |

|---|---|---|

| Gross Margin | 76.1% | Indicates strong pricing power and cost efficiency. |

| Brand Portfolio Size | Over 25 | Diversifies revenue and market reach. |

| Innovation Speed Goal | Triple | Aims to accelerate product launches and market responsiveness. |

What is included in the product

Delivers a strategic overview of Estee Lauder Companies’s internal and external business factors, highlighting its strong brand portfolio and global reach while acknowledging challenges in evolving consumer preferences and market competition.

Offers a clear, actionable framework to address Estee Lauder's competitive pressures and market shifts.

Weaknesses

Estée Lauder's significant exposure to the Chinese market and the travel retail sector presents a notable weakness. These segments have faced ongoing challenges, including fluctuating consumer demand and economic uncertainties, directly impacting the company's sales performance.

The company's financial results in recent periods, such as the reported net sales decline in fiscal year 2023, were heavily influenced by the underperformance in these key markets. For instance, Greater China and the travel retail channel were specifically cited as areas contributing to the overall sales softness.

Estee Lauder Companies has faced a challenging period, reporting a net sales decline of 10% to $15.51 billion for fiscal year 2024. This downturn continued into the first quarter of fiscal 2025, with net sales falling 14% year-over-year, and the second quarter of fiscal 2025 saw a 5% decrease in net sales, reaching $3.57 billion.

The company's profitability has also taken a hit, with operating income decreasing significantly in fiscal year 2024. This trend has resulted in a reported net loss of $2.24 billion for fiscal year 2024, a stark contrast to the $2.46 billion net earnings in fiscal year 2023, raising investor concerns about its financial health and market position.

The US beauty market is a battlefield, and Estée Lauder faces fierce competition, especially from e-commerce titans like Amazon. This shift towards online sales can be a hurdle, as Estée Lauder has historically thrived in brick-and-mortar settings like department stores, which are seeing declining foot traffic. For instance, by the end of fiscal year 2023, Estée Lauder's net sales saw a decline, partly attributed to challenges in the travel retail and mainland China markets, signaling broader retail headwinds.

To stay relevant, Estée Lauder must pivot its distribution and marketing to excel in digital spaces. This means significant investment in online platforms, digital advertising, and potentially new e-commerce partnerships, which could put pressure on their profit margins in the short term. The company's ongoing efforts to streamline its operations and invest in digital capabilities are crucial for navigating this evolving retail landscape and maintaining its competitive edge.

Execution Challenges and Organizational Restructuring Impacts

Estée Lauder has encountered execution hurdles, prompting investor concerns about its capacity to reliably meet market forecasts. This has led to a degree of skepticism regarding the company's operational effectiveness.

The company's strategic initiative, 'Beauty Reimagined,' while designed for future expansion, involves substantial organizational changes. This includes a significant workforce reduction, with plans for up to 7,000 job cuts, which could introduce short-term instability and negatively affect employee morale.

- Execution Challenges: Past performance has raised questions about Estée Lauder's ability to consistently deliver on its financial targets.

- Restructuring Impact: The 'Beauty Reimagined' plan, including up to 7,000 job cuts, poses risks of operational disruption and diminished employee engagement.

- Investor Confidence: These execution and restructuring issues can erode investor trust, potentially affecting the company's valuation and stock performance.

Potential Underperformance of Cosmetics Portfolio

The Estee Lauder Companies faces a notable weakness in the underperformance of its cosmetics portfolio, particularly when contrasted with the resilience seen in its skincare and fragrance segments. This disparity in performance across key product categories presents a challenge, especially given that makeup continues to be a substantial segment within the broader beauty market.

For instance, during fiscal year 2023, while the company saw growth in certain areas, the makeup category experienced a decline, impacting overall revenue figures. This underperformance can be attributed to various factors, including shifts in consumer preferences and increased competition within the makeup segment.

- Underperforming Makeup Segment: Reports indicate that the cosmetics portfolio has lagged behind other categories, contributing to financial headwinds for the company.

- Market Share Concerns: The makeup segment, a historically strong performer, is showing signs of weakness, potentially impacting Estee Lauder's overall market share in this crucial area.

- Need for Strategic Repositioning: Addressing the underperformance requires a strategic review and potential repositioning of the cosmetics offerings to better align with current consumer demands and competitive pressures.

Estée Lauder's reliance on specific geographic regions and sales channels, such as China and travel retail, creates a significant vulnerability. These areas have experienced considerable turbulence, directly impacting the company's revenue streams. The fiscal year 2024 saw a 10% net sales decrease to $15.51 billion, with the first quarter of fiscal 2025 continuing this trend with a 14% year-over-year drop.

The company's financial performance has been notably impacted by these market challenges, with operating income declining in fiscal year 2024 and resulting in a net loss of $2.24 billion for the same period. This financial strain, coupled with execution difficulties, has led to a degree of investor skepticism regarding Estée Lauder's ability to consistently meet market expectations.

Furthermore, the company's restructuring efforts, including the 'Beauty Reimagined' initiative and planned job cuts of up to 7,000 employees, introduce the risk of short-term operational disruptions and potential impacts on employee morale, which could further hinder performance.

The makeup segment within Estée Lauder's portfolio has also shown underperformance compared to skincare and fragrance. This lag in a historically strong category, as evidenced by declines in fiscal year 2023, necessitates a strategic repositioning to better align with evolving consumer preferences and competitive pressures in the beauty market.

What You See Is What You Get

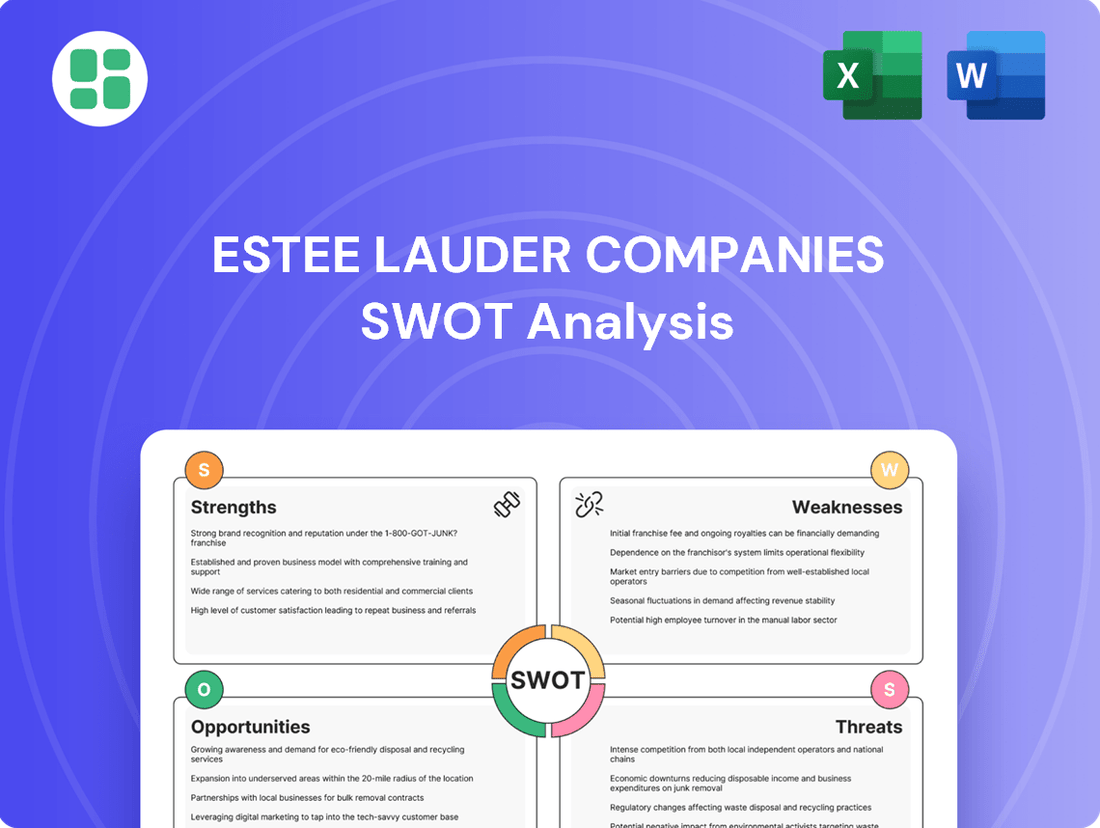

Estee Lauder Companies SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Estee Lauder Companies, providing a clear overview of their Strengths, Weaknesses, Opportunities, and Threats. The complete, in-depth report, including detailed strategies, is unlocked upon purchase.

Opportunities

Estée Lauder sees a prime opportunity in expanding its reach within emerging and high-growth markets beyond its established bases. This includes actively pursuing growth in regions like Japan, Southeast Asia, India, Mexico, Latin America, and Africa, which are demonstrating robust consumer spending potential.

A critical strategic objective for the company is to diversify its geographic sales, moving beyond a heavy reliance on China. This diversification aims to reduce exposure to regional economic fluctuations and tap into the burgeoning consumer demand present in these developing economies, potentially boosting overall revenue streams.

For instance, in fiscal year 2024, Estée Lauder highlighted the resilience and growth potential in markets like Southeast Asia and India, with sales in these regions showing double-digit increases. This performance underscores the strategic importance of these emerging markets in the company's long-term growth strategy.

Estée Lauder can capitalize on the surge in online shopping, with e-commerce representing a significant growth avenue. The company's digital sales saw a notable increase, contributing to its overall revenue stream.

Expanding through platforms like Amazon Premium Beauty and emerging channels such as TikTok Shop offers a direct path to new customer segments and increased market penetration. These digital marketplaces are crucial for reaching a wider, digitally-native audience.

Investing in advanced digital tools, like virtual try-on features and personalized AI marketing, can significantly boost customer engagement and conversion rates. These innovations are key to driving online sales and acquiring new customers in the competitive beauty landscape.

Estée Lauder's 'Beauty Reimagined' strategy aggressively targets innovation, aiming to triple the speed of product development to quickly seize on evolving consumer desires and market trends. This focus on rapid deployment of on-trend items is key to staying ahead.

The company is actively exploring a wider array of beauty subcategories, unique product benefits, and new usage occasions. This diversification extends to pioneering advanced solutions, such as developing skincare ingredients grown in laboratories and creating highly personalized beauty routines for consumers.

Strategic Partnerships and Acquisitions

Strategic partnerships offer a significant avenue for Estée Lauder to bolster its innovation and market reach. For instance, collaborations like the one with Microsoft for AI development are crucial for leveraging advanced technologies in areas such as personalized beauty recommendations and supply chain optimization. Such tech integrations are becoming increasingly vital in the beauty sector, with companies investing heavily in digital transformation to meet evolving consumer expectations.

Potential collaborations with leading research institutions, like MIT for biotech advancements, could unlock new frontiers in skincare and cosmetic science. This aligns with the industry trend of integrating scientific innovation into product development to create high-performance, science-backed beauty solutions. The global beauty market, valued at over $500 billion in 2023, continues to see growth driven by innovation and science-led products.

While Estée Lauder’s recent merger and acquisition (M&A) activity has been measured, the opportunity for selective acquisitions of smaller, disruptive brands remains. Acquiring brands with strong digital presences, unique product formulations, or access to niche markets can accelerate portfolio diversification and capture emerging consumer trends. For example, the acquisition of niche brands has been a successful strategy for competitors seeking to expand their offerings and appeal to a wider demographic.

- AI Partnership: Collaboration with Microsoft for AI development enhances Estée Lauder's digital capabilities.

- Biotech Potential: Exploring partnerships with institutions like MIT can drive scientific innovation in beauty products.

- M&A Strategy: Selective acquisitions of smaller, innovative brands can diversify the portfolio and tap into new market segments.

- Market Growth: The global beauty market’s continued expansion provides fertile ground for strategic growth initiatives.

Enhancing Sustainability and ESG Initiatives

Estée Lauder's commitment to sustainability and Environmental, Social, and Governance (ESG) initiatives is a significant opportunity. Aligning with growing consumer demand for environmentally responsible products, the company can bolster its brand image and appeal to eco-conscious demographics. This includes efforts in responsible sourcing, reducing packaging waste, and pursuing carbon neutrality targets.

By integrating ESG principles throughout its operations and supply chain, Estée Lauder can foster greater resilience and build stronger trust with stakeholders. For instance, in 2023, Estée Lauder reported a 20% reduction in greenhouse gas emissions intensity compared to its 2018 baseline, demonstrating tangible progress in its environmental goals.

- Consumer Alignment: Capitalize on the increasing consumer preference for sustainable and ethically produced beauty products.

- Brand Reputation: Enhance brand loyalty and attract new customers by showcasing genuine commitment to ESG principles.

- Operational Efficiency: Drive cost savings and innovation through eco-friendly packaging and reduced carbon footprint.

- Stakeholder Relations: Strengthen relationships with investors, employees, and communities by demonstrating responsible corporate citizenship.

Estée Lauder is strategically expanding into high-growth emerging markets such as Southeast Asia and India, where double-digit sales increases were observed in fiscal year 2024, diversifying its revenue base beyond China.

The company is leveraging e-commerce and digital platforms like TikTok Shop to reach new customer segments, enhancing engagement through AI-powered personalization and virtual try-on features, driving online sales growth.

Innovation is a key focus, with a strategy to triple product development speed and explore new beauty categories and advanced solutions like lab-grown skincare ingredients, supported by strategic tech partnerships.

Selective acquisitions of smaller, disruptive brands with strong digital presences offer opportunities to diversify the portfolio and capture emerging consumer trends, complementing organic growth initiatives.

Estée Lauder's commitment to sustainability and ESG principles presents an opportunity to resonate with environmentally conscious consumers and enhance brand reputation, evidenced by a 20% reduction in greenhouse gas emissions intensity by 2023.

Threats

The persistent weakness in China, a key growth engine for many luxury brands, continues to cast a shadow over Estée Lauder. Subdued consumer sentiment there, coupled with ongoing challenges in the Asia travel retail segment, directly impacts the company's sales trajectory.

This slowdown in crucial Asian markets is a significant threat, directly affecting Estée Lauder's financial outlook. For fiscal year 2025, the company anticipates these headwinds to weigh on its performance, highlighting the vulnerability of its business to regional economic conditions.

The beauty sector is a hotbed of competition, with legacy brands and nimble startups alike quick to adapt to emerging trends. This dynamic landscape means Estée Lauder faces constant pressure to stay ahead.

The rise of e-commerce behemoths and the relentless pace of innovation are significant threats, particularly impacting Estée Lauder's market share and ability to maintain pricing power, especially within the crucial US market. For instance, in fiscal year 2023, Estée Lauder's net sales declined by 5%, highlighting the impact of these market pressures.

Global economic volatility, including rising inflation and potential recessions, poses a significant threat. For instance, in early 2024, many economies grappled with persistent inflation, impacting discretionary spending on premium goods like Estee Lauder's products. This variability can directly dampen demand for prestige beauty items.

Shifting consumer sentiment, particularly in key markets like China, presents another challenge. Reports from late 2023 and early 2024 indicated a more cautious consumer outlook in China, leading to reduced spending and lower conversion rates for beauty brands. This sentiment shift can translate into lower sales and overall revenue for Estee Lauder.

Supply Chain Disruptions and Geopolitical Risks

Despite Estee Lauder's focus on supply chain resilience, ongoing global uncertainties and geopolitical tensions pose a significant threat. These factors can disrupt manufacturing processes, logistics networks, and the sourcing of essential raw materials, impacting production timelines and costs. For instance, the ongoing conflicts in Eastern Europe and the Middle East continue to create volatility in shipping routes and energy prices, which directly affect the cost of goods sold.

Challenges within the travel retail sector, a key distribution channel for Estee Lauder, are exacerbated by policy shifts and geopolitical instability. This segment, which historically contributed significantly to sales, faces headwinds from reduced international travel and changing consumer purchasing habits in travel hubs. In 2024, many regions experienced a slower-than-expected recovery in international tourism, impacting Estee Lauder's performance in duty-free and airport locations.

- Supply Chain Vulnerability: Geopolitical events and global uncertainties can interrupt the flow of raw materials and finished goods, increasing operational costs and lead times.

- Travel Retail Headwinds: Policy changes and geopolitical factors continue to create uncertainty in the crucial travel retail market, affecting sales volumes and profitability.

- Input Cost Volatility: Fluctuations in energy prices and raw material availability, driven by geopolitical events, can negatively impact Estee Lauder's profit margins.

Rapidly Evolving Consumer Preferences and Digital Trends

The beauty industry is experiencing a seismic shift, with consumer preferences and digital trends evolving at an unprecedented pace. Social media platforms like TikTok and Instagram are now the primary drivers of emerging beauty trends, demanding that brands like Estee Lauder adapt swiftly to maintain relevance. For instance, the surge in demand for 'clean' beauty and personalized skincare solutions, fueled by influencer marketing and user-generated content, requires constant innovation and agile marketing strategies. Failure to quickly identify and capitalize on these shifts can lead to brand fatigue, particularly among younger demographics such as Gen Z, who are highly attuned to authenticity and rapidly changing aesthetics.

Estee Lauder's ability to navigate these rapidly evolving consumer preferences is critical for its future success. In 2023, digital sales accounted for a significant portion of the beauty market, with some reports indicating over 30% of total sales for leading brands originating online. This underscores the imperative for Estee Lauder to not only understand but also anticipate the next wave of beauty trends, whether it's the continued rise of sustainable packaging, the demand for AI-driven personalized recommendations, or the growing influence of micro-influencers. The company's investment in direct-to-consumer channels and digital engagement strategies will be key to staying ahead of the curve.

- Rapid Trend Cycles: Beauty trends now have a significantly shorter lifespan, often driven by viral social media content, requiring faster product development and marketing cycles.

- Digital Platform Dominance: Platforms like TikTok and Instagram are not just marketing channels but also trend incubators, necessitating deep engagement and understanding of user behavior.

- Personalization and Clean Beauty: Consumers increasingly seek personalized beauty solutions and products with transparent, ethically sourced ingredients, impacting formulation and marketing.

- Gen Z Influence: This demographic, with its distinct values and digital fluency, represents a significant growth opportunity but also demands authentic brand engagement and rapid adaptation to their evolving preferences.

The beauty industry's rapid evolution, particularly driven by social media trends and the demand for personalization, poses a significant challenge for Estée Lauder. For instance, the accelerated trend cycles, often fueled by viral content on platforms like TikTok, necessitate quicker product development and marketing responses, a pace that can strain established brands. Furthermore, the growing consumer emphasis on clean beauty and ethically sourced ingredients requires continuous adaptation in product formulation and supply chain management.

SWOT Analysis Data Sources

This Estee Lauder Companies SWOT analysis is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insightful expert commentary from industry analysts.