Estee Lauder Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

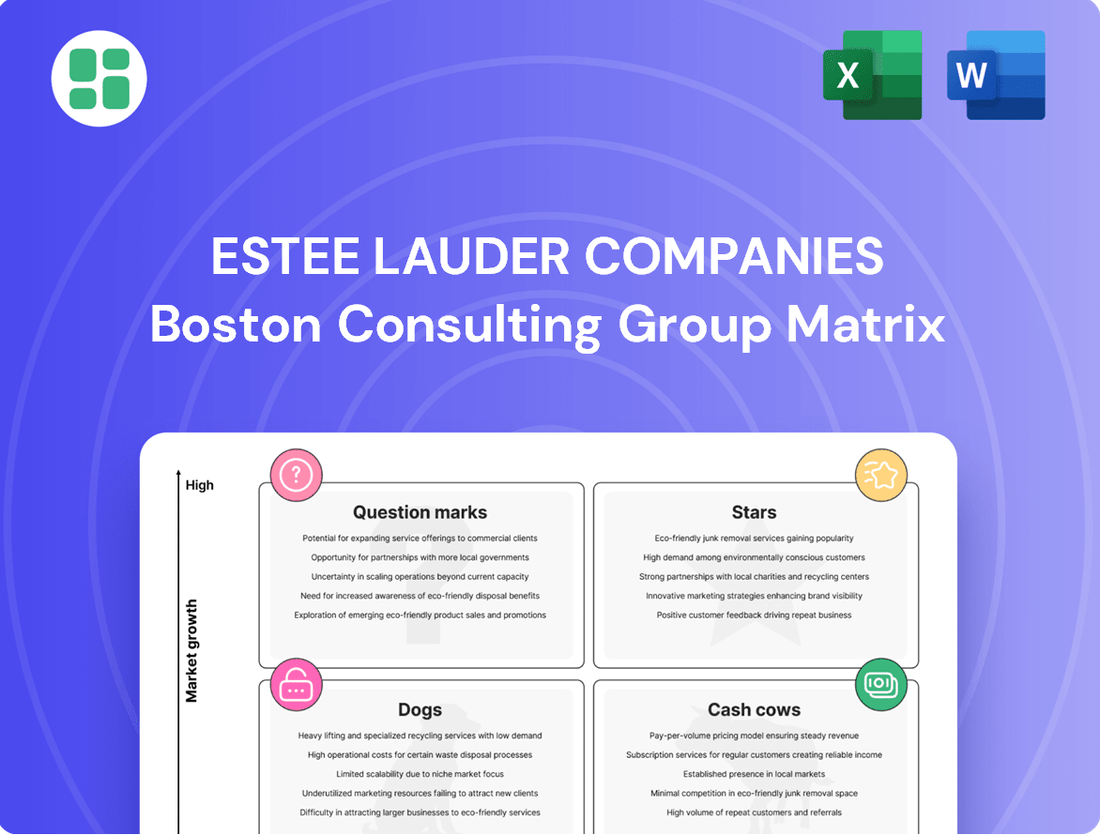

Uncover the strategic positioning of Estee Lauder's diverse portfolio with our comprehensive BCG Matrix analysis. See which brands are driving growth as Stars, which are generating consistent revenue as Cash Cows, and which require careful consideration as Dogs or Question Marks.

Don't miss out on the full picture! Purchase the complete Estee Lauder Companies BCG Matrix to gain actionable insights into their market share and growth potential, enabling you to make informed investment decisions and optimize your product strategy.

This is your opportunity to understand the engine behind Estee Lauder's success. Get the full BCG Matrix report today and unlock a clear, data-driven roadmap for navigating the competitive beauty landscape.

Stars

La Mer stands out as a star performer within The Estée Lauder Companies' portfolio, showcasing exceptional organic net sales growth in fiscal year 2024. This luxury skincare brand achieved impressive double-digit growth, particularly in the vital Asia/Pacific region. This success was fueled by strategic expansions, enhancing both its online footprint and physical retail presence.

Despite facing some headwinds in the Asia travel retail sector, primarily due to necessary inventory adjustments, La Mer's robust overall performance solidifies its position. The brand's strategic emphasis on revitalizing its skincare offerings continues to resonate with consumers, making it a significant engine for future growth for Estée Lauder.

Le Labo is a shining star within Estee Lauder Companies' (ELC) portfolio, consistently delivering robust double-digit growth. This stellar performance is particularly evident in the Asia/Pacific and Japan regions, fueled by the enduring popularity of its signature Santal 33 fragrance and successful new product launches.

The brand's strategic global expansion, including its recent entry into the Philippines market, has significantly broadened its consumer base. Le Labo's impressive growth trajectory makes it a key driver of the overall strong performance observed in ELC's fragrance division, reinforcing its position as a high-performing asset.

The Ordinary, a standout brand from DECIEM, is a significant disruptor in the prestige skincare market. Its impressive growth trajectory is evident as it secured a position among the leading brands in Canada and the U.S.

The brand’s strong performance extends to key European markets, further solidifying its market presence. This expansion into major geographies highlights its ability to capture significant market share in a rapidly expanding industry segment.

Jo Malone London

Jo Malone London is a shining star within Estee Lauder Companies' (ELC) portfolio, demonstrating impressive growth and a strong market position. Its expansion, particularly in Asia, with double-digit growth in China and significant gains in Japan after a flagship store opening, highlights its star quality. The brand's increasing global presence through new stores reinforces its role as a key contributor to ELC's successful luxury fragrance segment.

The brand's performance is a testament to its high market share in a thriving fragrance market. In 2024, ELC reported robust sales growth, with luxury fragrances being a significant driver, and Jo Malone London was a key player in this success.

- Significant Growth in Asia: Jo Malone London experienced double-digit growth in China and substantial market share gains in Japan in 2024.

- Global Distribution Expansion: The brand opened new freestanding stores worldwide, enhancing its global reach and contributing to ELC's luxury fragrance success.

- Strong Market Position: Its performance indicates a high market share within the expanding fragrance category.

- Contribution to ELC: Jo Malone London is a vital part of ELC's luxury portfolio, driving overall company performance.

Clinique

Clinique is a shining star within Estee Lauder Companies' portfolio, showcasing impressive growth and market penetration. The brand has consistently increased its market share, achieving this for 11 consecutive months in the U.S. up to the third quarter of 2025. This sustained growth highlights its strong competitive position.

The brand's financial performance in the first quarter of 2025 was exceptional, with double-digit net sales growth reported across all geographical areas. This surge was fueled by the enduring popularity of its core lip and mascara products, alongside the successful expansion onto new sales channels such as Amazon.

- Consistent Market Share Gains: Clinique has secured market share increases for 11 consecutive months in the U.S. through Q3 2025.

- Strong Double-Digit Growth: The brand experienced robust double-digit net sales growth in Q1 2025 across all regions.

- Key Product Performance: Growth was driven by hero products in lip and mascara, alongside successful new platform launches.

- Star Performer: Clinique's ability to gain ground in established markets solidifies its status as a star in the BCG matrix.

Brands like La Mer, Le Labo, Jo Malone London, and Clinique are currently positioned as Stars in Estée Lauder Companies' BCG Matrix. These brands exhibit high growth and high market share, demanding significant investment to maintain their momentum. For instance, Clinique has achieved 11 consecutive months of market share gains in the U.S. through Q3 2025, demonstrating its strong competitive edge. La Mer, meanwhile, saw double-digit organic net sales growth in fiscal year 2024, particularly in the Asia/Pacific region.

Le Labo's robust double-digit growth, especially in Asia/Pacific and Japan, and Jo Malone London's double-digit growth in China and gains in Japan further underscore their star status. The Ordinary, a DECIEM brand, is also a significant disruptor, showing impressive growth and capturing market share in key European markets as well as Canada and the U.S.

| Brand | Growth Rate | Market Share | Key Drivers |

|---|---|---|---|

| La Mer | Double-digit (FY24) | High | Asia/Pacific expansion, skincare revitalization |

| Le Labo | Double-digit | High | Asia/Pacific & Japan popularity, Santal 33, new launches |

| Jo Malone London | Double-digit (China) | High | Asia expansion, store openings, luxury fragrance demand |

| Clinique | Double-digit (Q1 2025) | High (11 consecutive months gain in US) | Lip/mascara performance, Amazon expansion |

| The Ordinary | High | Growing | Disruptive skincare, European & North American expansion |

What is included in the product

The Estee Lauder Companies BCG Matrix offers a strategic overview of its diverse brand portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions and resource allocation.

Estee Lauder's BCG Matrix provides a clear, one-page overview of their brand portfolio, simplifying strategic decisions.

This optimized layout allows for easy sharing and printing, streamlining communication of brand performance.

Cash Cows

Estée Lauder, the company's foundational brand, holds a dominant position in the prestige beauty market. Despite challenges in key Asian markets, it continues to generate substantial cash flow, a testament to its enduring global appeal and dedicated customer base. For fiscal year 2023, Estée Lauder’s net sales reached $15.91 billion, with the brand itself contributing significantly to this overall performance.

M·A·C, a cornerstone of Estée Lauder Companies, operates as a prime example of a cash cow within their portfolio. Its global recognition and strong brand equity translate into consistent, high revenue generation.

Despite some fluctuations in the broader makeup market, M·A·C's extensive distribution network and dedicated customer base ensure it remains a significant contributor to Estée Lauder's overall cash flow. For instance, in fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, with brands like M·A·C playing a vital role in this performance.

The brand actively pursues innovation, exemplified by recent launches like the MACximal Sleek Satin Lipstick, to defend its market share and continue its robust performance in an increasingly competitive landscape.

Origins, a brand deeply rooted in natural-based skincare, stands as a cornerstone within Estée Lauder's diverse portfolio. Its consistent generation of substantial cash flow underscores its established position.

Operating within a mature segment of the skincare market, Origins benefits from a loyal customer base and predictable demand patterns. This stability allows the brand to function as a reliable revenue generator for the company.

In 2023, Estée Lauder reported that its skincare segment, which includes brands like Origins, saw continued strength, contributing significantly to overall net sales. While specific figures for Origins are not always broken out individually, its performance is a key driver in this robust category.

Bobbi Brown Cosmetics

Bobbi Brown Cosmetics, a stalwart in the prestige makeup and skincare sector, functions as a reliable cash cow within the Estée Lauder Companies' portfolio. Its reputation for classic, high-quality products resonates with a consistent customer base, ensuring stable demand.

The brand maintains a robust position in the competitive prestige makeup market. This enduring popularity, coupled with established distribution networks, allows Bobbi Brown to consistently contribute to Estée Lauder's overall profitability, even amidst shifts in the broader beauty industry.

- Established Brand Equity: Bobbi Brown's legacy of quality and natural-looking makeup appeals to a loyal demographic.

- Market Stability: Despite category fluctuations, the brand benefits from consistent demand in the premium segment.

- Profitability Driver: Its established channels and product appeal ensure a steady revenue stream for the parent company.

Aveda

Aveda, a prominent brand within Estée Lauder Companies (ELC), operates as a cash cow, primarily due to its deep roots in the professional hair care sector and its strategic expansion into skincare and body care. Its established network of salons and a strong foothold in a specific market niche contribute significantly to its consistent revenue generation. ELC reported net sales of $16.0 billion for the fiscal year ended June 30, 2023, with its Hair Care segment, which includes Aveda, demonstrating resilience.

Despite some broader challenges within the hair care category for ELC, Aveda's distinct brand identity and a loyal following among both professionals and consumers solidify its position as a reliable source of cash flow. The brand's emphasis on natural ingredients and its commitment to sustainability further appeal to a dedicated customer base, ensuring stable financial performance.

- Niche Market Dominance: Aveda commands a strong share in the premium, naturally-derived hair care market.

- Loyal Customer Base: The brand benefits from a dedicated following among salon professionals and environmentally conscious consumers.

- Consistent Revenue: Aveda's established product lines and salon partnerships generate predictable and stable cash flows for ELC.

- Brand Resilience: Despite category fluctuations, Aveda's core values and product efficacy maintain its market relevance and profitability.

Within Estée Lauder Companies' portfolio, brands like Estée Lauder, M·A·C, Origins, Bobbi Brown Cosmetics, and Aveda are recognized as cash cows. These brands possess strong market positions and established customer loyalty, allowing them to generate significant and consistent cash flow for the company. Their mature status means they require less investment for growth, contributing reliably to overall profitability.

| Brand | Category | BCG Status | Key Strengths | Fiscal Year 2023 Performance Indicator |

| Estée Lauder | Prestige Beauty | Cash Cow | Enduring global appeal, dedicated customer base | Contributed significantly to $15.91 billion in net sales |

| M·A·C | Prestige Makeup | Cash Cow | Global recognition, strong brand equity, extensive distribution | Vital contributor to overall net sales performance |

| Origins | Skincare (Natural-based) | Cash Cow | Loyal customer base, predictable demand, mature market segment | Key driver in the strong skincare segment performance |

| Bobbi Brown Cosmetics | Prestige Makeup & Skincare | Cash Cow | Classic product appeal, consistent customer base, established channels | Steady revenue stream and profitability driver |

| Aveda | Hair Care, Skincare, Body Care | Cash Cow | Niche market dominance, loyal following, sustainability focus | Resilient contributor to $16.0 billion in net sales (Hair Care segment) |

What You’re Viewing Is Included

Estee Lauder Companies BCG Matrix

The Estee Lauder Companies BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, crafted by industry experts, provides actionable insights into Estee Lauder's product portfolio, categorizing brands as Stars, Cash Cows, Question Marks, and Dogs without any watermarks or demo content.

Dogs

Smashbox, a makeup brand under the Estée Lauder Companies umbrella, is currently positioned as a potential 'Dog' in the BCG Matrix. Its market share is understood to be low, with its current valuation reportedly falling short of Estée Lauder's initial investment, signaling a challenging market environment.

The competitive landscape of the makeup industry presents significant hurdles for brands like Smashbox, contributing to its stagnant or declining growth trajectory. Estée Lauder is actively evaluating its brand portfolio, and Smashbox is being considered for divestiture due to its underperformance.

Too Faced, much like Smashbox, is currently positioned as a struggling brand within Estee Lauder Companies' portfolio. Its acquired value has notably decreased, reflecting challenges in the fast-paced makeup market that have impacted Estee Lauder's overall makeup category performance.

The brand's low growth rate and shrinking market share suggest it may be a prime candidate for strategic reassessment. This could potentially lead to divestment as part of Estee Lauder's broader restructuring initiatives aimed at optimizing its brand lineup.

Dr. Jart+ experienced substantial non-deductible goodwill impairment charges totaling $150 million in fiscal year 2024. This financial event strongly suggests the brand is underperforming against its projected revenue and profitability benchmarks, positioning it as a 'Dog' in Estee Lauder's portfolio.

The impairment charge indicates a clear struggle for Dr. Jart+ to gain market share and drive growth, a critical factor for its classification. Estee Lauder's ongoing strategic review, aimed at optimizing its brand portfolio and addressing underperforming assets, places Dr. Jart+ under significant scrutiny for potential restructuring or divestment.

Clinique Happy Product Franchise

While the Clinique brand generally performs well, the Clinique Happy product franchise has faced challenges. Specifically, it contributed to a decline in Clinique's overall fragrance sales in the third quarter of 2025. This suggests that within the broader, successful Clinique brand, Happy is a product line experiencing low or negative growth.

This situation often means the product has a low market share within the competitive fragrance market. Such underperforming product lines can divert valuable resources and investment that could be better utilized elsewhere, impacting overall profitability.

- Brand Performance: Clinique is categorized as a Star in the BCG Matrix, indicating strong growth and market share.

- Product Franchise Issue: Clinique Happy, however, is showing signs of underperformance within the fragrance segment.

- Sales Impact: This franchise was cited for contributing to declines in Clinique's fragrance sales in Q3 2025.

- Strategic Implication: The franchise likely represents a low market share product with low or negative growth, potentially requiring strategic review.

Aramis

Aramis, an established fragrance brand within Estee Lauder Companies (ELC), is experiencing a downturn. In the first quarter of fiscal year 2025, Aramis contributed to a decline in ELC's overall fragrance sales, even though the fragrance category itself was generally robust. This performance suggests Aramis holds a low market share and faces significant challenges in a dynamic fragrance market.

The brand's declining net sales indicate it may be a cash trap, demanding more resources than it generates in returns. This situation positions Aramis as a potential candidate for a 'Dog' in the BCG Matrix, a strategic tool used to analyze a company's product portfolio.

- Brand Performance: Aramis has seen a decline in net sales in Q1 2025.

- Market Position: The brand likely possesses a low market share in the competitive fragrance sector.

- Category Context: Its struggles contrast with the generally positive performance of ELC's broader fragrance category.

- BCG Matrix Implication: Aramis's situation points towards it being a 'Dog' due to low growth and market share, potentially requiring divestment or significant restructuring.

Brands like Smashbox, Too Faced, Dr. Jart+, Clinique Happy, and Aramis are currently identified as 'Dogs' within Estée Lauder Companies' portfolio. These brands exhibit low market share and low or negative growth, indicating they are not performing well relative to their respective markets. Their struggles are reflected in financial metrics such as goodwill impairment charges, declining net sales, and contributions to negative category performance. Estée Lauder is actively reviewing these underperforming assets, with potential outcomes including divestiture or significant restructuring to optimize the overall brand lineup.

| Brand | BCG Category | Key Indicators | Fiscal Year Impact |

|---|---|---|---|

| Smashbox | Dog | Low market share, declining valuation | Ongoing strategic review |

| Too Faced | Dog | Decreased acquired value, low growth | Impact on makeup category performance |

| Dr. Jart+ | Dog | $150 million goodwill impairment | FY2024 |

| Clinique Happy | Dog (Product Franchise) | Contributed to Q3 2025 fragrance sales decline | Q3 2025 |

| Aramis | Dog | Declining net sales, low market share | Q1 2025 |

Question Marks

BALMAIN Beauty, launched in fiscal year 2025, is a new player in Estée Lauder Companies' (ELC) luxury fragrance lineup. As a recent entrant, it naturally commands a small market share. However, it operates within the high-growth luxury fragrance market, a sector ELC is actively prioritizing for expansion.

The brand's current position suggests it's a question mark in the BCG matrix. Significant investment in marketing and distribution is anticipated to fuel its growth and capture a more substantial market share. For instance, ELC's overall fragrance sales reached $2.2 billion in fiscal year 2023, indicating the lucrative nature of this segment.

NIOD, a brand within Estee Lauder Companies' DECIEM acquisition, is positioned as a star in the BCG matrix. Its focus on tech-led skin science carves out an innovative, high-growth niche in the competitive skincare market. While its sister brand, The Ordinary, dominates market share, NIOD's specialized approach means it currently holds a lower, though promising, market share.

Estee Lauder Companies can leverage NIOD's pioneering status to drive significant growth. By investing in expanding NIOD's reach and consumer awareness, ELC can capitalize on its potential in a rapidly evolving beauty sector. For instance, the global skincare market was valued at approximately $145.3 billion in 2023 and is projected to grow, offering substantial room for specialized brands like NIOD to capture market share.

AERIN Beauty, a luxury lifestyle brand within Estee Lauder Companies (ELC), offers fragrance, home, and beauty products. It targets a discerning, high-end consumer base, fitting into the stars or question marks quadrant of the BCG matrix due to its position in a growing but niche luxury market. While its market share is currently lower than ELC's broader prestige brands, its strong potential for growth, particularly if it captures a larger segment of the affluent consumer market, suggests it could be a future star.

Editions de Parfums Frédéric Malle

Editions de Parfums Frédéric Malle operates as a star in Estée Lauder Companies' BCG Matrix. This ultra-luxury, artisanal fragrance brand commands premium pricing and exclusive distribution within the high-growth luxury fragrance segment. Its niche positioning, while contributing to its star status, also means it holds a relatively low overall market share, necessitating strategic investment to fully capitalize on its significant growth potential.

- Brand Positioning: Ultra-luxury, artisanal fragrance.

- Market Segment: High-growth luxury fragrance.

- BCG Matrix Classification: Star.

- Strategic Imperative: Targeted investment to increase market share within a high-growth category.

KILIAN PARIS

Kilian Paris fits into Estée Lauder Companies (ELC) BCG Matrix as a question mark, reflecting its position in the burgeoning luxury fragrance market. ELC's strategic aim to bolster its high-end scent offerings directly includes Kilian Paris. While the overall luxury fragrance sector is robust, Kilian Paris, with its specialized and premium market standing, likely holds a modest share of the total market.

ELC is actively investing in Kilian Paris's distribution and marketing efforts. This investment is geared towards unlocking its considerable growth potential within the exclusive luxury segment. The brand's unique positioning and artistic approach are key drivers for this strategic focus.

- Market Growth: The global luxury fragrance market was valued at approximately $15.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030.

- Niche Positioning: Kilian Paris targets a discerning clientele, which, while lucrative, represents a smaller segment of the broader fragrance market.

- Investment Strategy: ELC's commitment to expanding Kilian Paris's reach signifies a belief in its future revenue-generating capabilities, justifying its question mark status.

- Brand Potential: The brand’s distinctive olfactory creations and opulent packaging contribute to its premium appeal and potential for increased market penetration.

Question marks in Estée Lauder Companies' (ELC) portfolio represent brands with low market share in high-growth markets, requiring careful consideration for investment. BALMAIN Beauty and Kilian Paris are prime examples, operating in the expanding luxury fragrance segment but currently holding modest market positions. ELC's strategic decision to invest in these brands aims to elevate their market share and capitalize on the lucrative nature of these high-growth categories.

The success of these question marks hinges on ELC's ability to effectively allocate resources for marketing, distribution, and brand development. For instance, the global luxury beauty market, which includes fragrances, is projected to reach $75 billion by 2027, underscoring the significant opportunity for brands like BALMAIN Beauty and Kilian Paris to grow their presence.

ELC's approach involves nurturing these brands to potentially transition them into stars within the BCG matrix. This strategic investment is crucial for future revenue generation and maintaining ELC's competitive edge in the dynamic beauty industry.

BCG Matrix Data Sources

Our Estee Lauder Companies BCG Matrix is built on robust market intelligence, integrating financial disclosures, industry growth rates, and competitive landscape analysis to provide strategic clarity.