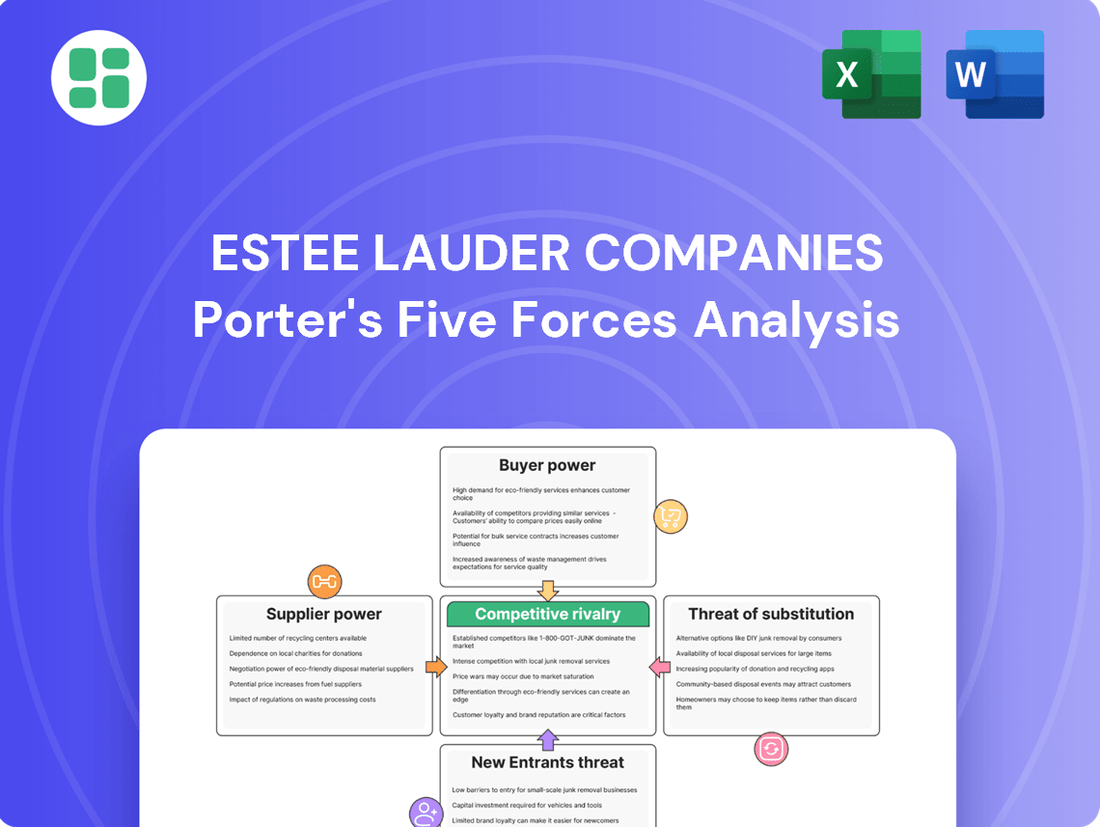

Estee Lauder Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

Estee Lauder Companies navigates a beauty industry characterized by intense rivalry and significant buyer power, as consumers have numerous choices and readily available information. The threat of new entrants is moderate, balanced by high brand loyalty and capital requirements, while the threat of substitutes is also a consideration with the rise of DIY beauty and wellness trends.

The complete report reveals the real forces shaping Estee Lauder Companies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Estée Lauder's dependence on specialized ingredient providers, particularly those with proprietary or patented formulations, significantly influences its bargaining power. These unique components are crucial for differentiating Estée Lauder's prestige product lines, giving suppliers considerable leverage. For instance, if a key active ingredient in a best-selling serum is exclusive to a single provider, that supplier can dictate terms and pricing, potentially increasing Estée Lauder's cost of goods sold.

While these specialized suppliers hold power, Estée Lauder's substantial purchasing volume can mitigate this to some extent. The company's scale allows for negotiation leverage, potentially securing more favorable pricing or supply agreements than smaller competitors. However, the inherent uniqueness of these ingredients means that finding alternative suppliers, if even possible, could be a costly and time-consuming process, limiting Estée Lauder's ability to switch easily.

The bargaining power of packaging and component manufacturers for Estée Lauder is significant, as the aesthetic and quality of packaging are paramount for prestige beauty products. Specialized suppliers offering advanced printing, molding, or sustainable packaging solutions hold considerable sway.

Estée Lauder's substantial order volumes and established long-term relationships help to temper this power. However, the company's dependence on a select few suppliers for high-end, unique components means these suppliers can still exert influence, especially when unique materials or advanced design capabilities are required.

Fragrance houses and formulators hold significant bargaining power due to their specialized knowledge and proprietary formulations. Estée Lauder relies on these suppliers for unique scents and complex product development, which can drive up costs if these suppliers are few or possess essential intellectual property. For instance, a successful signature fragrance developed with a particular house can create a strong dependency.

Logistics and Distribution Partners

Logistics and distribution partners hold a degree of bargaining power, especially for a global beauty giant like Estée Lauder Companies (ELC). Efficiently moving products worldwide, often requiring specialized handling for temperature-sensitive items, means ELC relies on these partners. In 2023, ELC's global supply chain operations were a significant factor in its ability to meet demand across diverse markets.

- Specialized Services: Suppliers offering niche logistics, like cold chain storage or expedited international freight, can command higher prices due to the specialized nature of their services and the critical need for timely, safe delivery of beauty products.

- Global Reach: The bargaining power of logistics providers is amplified when they possess extensive global networks that can reliably serve ELC's numerous international markets.

- Diversification Strategy: ELC mitigates supplier power by cultivating relationships with multiple logistics providers, thereby fostering competition and securing more favorable pricing and service terms. This strategy is crucial for managing operational costs, which are a key component of ELC's overall financial performance.

Technology and Digital Solutions Providers

Technology and digital solutions providers hold significant bargaining power as the beauty industry increasingly relies on advanced tools. Estée Lauder's commitment to digital transformation, including investments in AI for R&D and sophisticated e-commerce platforms, amplifies the importance of these suppliers. For instance, companies offering specialized AI software for formulation or advanced data analytics for consumer insights can command higher prices due to the unique value they bring to product innovation and market understanding.

The leverage of these tech suppliers stems from their ability to enhance Estée Lauder's operational efficiency and product development cycles. Suppliers of cutting-edge manufacturing equipment or cloud-based data management systems that streamline production or improve customer engagement can exert considerable influence. This is particularly true as Estée Lauder aims to optimize its supply chain and personalize customer experiences, making reliable and innovative tech partners crucial.

- Key Technology Dependencies: Estée Lauder’s reliance on advanced manufacturing equipment, AI-driven R&D, e-commerce platforms, and data analytics solutions is growing.

- Supplier Leverage: Providers of innovative tech that boost product development or operational efficiency gain leverage, potentially increasing costs for Estée Lauder.

- Strategic Partnerships: While reliance is increasing, Estée Lauder's strategic partnerships with tech providers are vital for managing costs and securing access to essential innovations.

Suppliers of unique, patented ingredients and proprietary formulations hold significant bargaining power over Estée Lauder, as these components are vital for product differentiation and brand prestige. Fragrance houses and specialized formulators, in particular, can command higher prices due to their intellectual property and expertise. For instance, a successful signature scent developed with a specific fragrance house can create a strong dependency, impacting Estée Lauder's cost of goods sold.

The bargaining power of packaging manufacturers is also considerable, given the importance of high-quality, aesthetically pleasing packaging in the luxury beauty market. Suppliers offering advanced printing, unique materials, or sustainable solutions can exert influence, especially when specialized capabilities are required for Estée Lauder's premium product lines. While Estée Lauder's scale provides some negotiation leverage, the specialized nature of these suppliers limits easy substitution.

Logistics and technology providers also wield significant power. For example, specialized logistics for temperature-sensitive products or advanced AI for R&D can lead to higher costs for Estée Lauder. In 2023, Estée Lauder's global supply chain operations were critical, highlighting the reliance on these partners and their inherent leverage.

What is included in the product

Tailored exclusively for Estee Lauder Companies, this analysis dissects the competitive forces shaping the beauty industry, examining buyer and supplier power, new entrant threats, substitute products, and the intensity of rivalry.

Easily identify and mitigate competitive threats with a visual breakdown of buyer power, supplier power, and the threat of new entrants and substitutes.

Customers Bargaining Power

Estée Lauder's impressive portfolio boasts brands like Estée Lauder, Clinique, and MAC, which have cultivated significant consumer loyalty. This strong brand equity means customers are less likely to switch to competitors, even if prices increase slightly, as they perceive high quality and proven efficacy. For example, in fiscal year 2023, Estée Lauder reported net sales of $15.6 billion, underscoring the market's continued demand for its premium offerings.

While Estée Lauder benefits from strong brand loyalty, the prestige beauty sector is brimming with high-caliber alternatives. Competitors like L'Oréal, Shiseido, and Coty, along with a growing number of independent luxury brands, offer consumers a rich selection of premium products.

This abundance of choice empowers customers. They can readily compare product quality, ingredient innovation, and pricing across numerous prestige brands. For instance, in 2024, the global luxury cosmetics market was valued at over $70 billion, indicating significant consumer choice and a dynamic competitive landscape.

If customers perceive better value, superior efficacy, or more exciting innovation from another brand, they have the flexibility to switch. This broad availability of comparable high-end options inherently increases the bargaining power of the customer.

The bargaining power of customers for Estee Lauder is amplified by the pervasive influence of digital reviews and social media. In 2024, the beauty industry continues to see consumers heavily relying on platforms like Reddit, TikTok, and Instagram for product recommendations and validation. A significant portion of consumers, often exceeding 70% in surveys, report that online reviews and influencer opinions directly impact their purchasing choices, making it crucial for Estee Lauder to manage its online reputation actively.

Diverse Retail Channels and Direct-to-Consumer (DTC) Options

Estée Lauder's customers benefit from a wide array of purchasing avenues, ranging from traditional department stores and specialty beauty retailers to Estée Lauder's own e-commerce platforms and physical stores. This diverse retail landscape means consumers have ample choice in how and where they acquire products.

The increasing prevalence of direct-to-consumer (DTC) models, adopted by Estée Lauder and its rivals alike, further amplifies customer bargaining power. DTC channels often allow for more competitive pricing, exclusive promotions, and a more personalized shopping experience, giving consumers greater leverage.

This multi-channel accessibility directly translates to enhanced customer choice and convenience. For instance, in 2023, Estée Lauder reported that its online sales, a significant component of its DTC efforts, continued to grow, reflecting the consumer shift towards digital purchasing and the power this gives them to compare and select the best options.

- Diverse Distribution: Customers can access Estée Lauder products through department stores, specialty retailers, e-commerce, and company-owned stores.

- DTC Growth: The rise of direct-to-consumer channels provides consumers with more choices, potentially better pricing, and exclusive offers.

- Enhanced Choice: This multi-channel availability significantly increases customer options and shopping convenience.

- 2023 Online Sales: Estée Lauder's continued growth in online sales underscores the importance of digital channels in empowering consumer purchasing decisions.

Price Sensitivity for Certain Segments

While customers in the prestige beauty market are typically less swayed by price, economic shifts can heighten sensitivity. For instance, during periods of economic contraction, consumers might become more discerning, particularly for everyday essentials versus purely luxury items. Estée Lauder’s 2023 fiscal year saw net sales increase by 5% to $15.91 billion, indicating resilience, but ongoing economic pressures could still influence purchasing decisions.

To counter potential price sensitivity, Estée Lauder leverages promotional strategies, product bundling, and loyalty programs. These initiatives are crucial for retaining customers who might otherwise opt for lower-priced alternatives or seek out discounts. The company's ability to offer perceived value through these programs is key to maintaining customer loyalty in a competitive landscape.

Balancing premium pricing with competitive offers is a strategic imperative for Estée Lauder. This approach aims to preserve the brand's luxury image while simultaneously ensuring market share is not eroded by competitors offering more aggressive pricing. In 2023, Estée Lauder's gross margin was 60.3%, demonstrating their capacity to maintain strong pricing power.

- Price Sensitivity: Prestige beauty consumers are generally less price-sensitive, but economic downturns can increase it, especially for staple products.

- Retention Strategies: Promotions, bundles, and loyalty programs are vital for keeping customers who might otherwise switch to cheaper options.

- Market Share: Estée Lauder must carefully balance its premium pricing strategy with competitive offers to protect its market share.

- Financial Performance: The company's 2023 fiscal year net sales reached $15.91 billion, with a gross margin of 60.3%, reflecting its pricing power.

The bargaining power of customers in the prestige beauty market, while generally moderate due to brand loyalty, is significantly influenced by the vast array of choices available. In 2024, the global cosmetics market continues to offer consumers a wealth of premium brands, making it easier for them to switch if they perceive better value or innovation elsewhere.

The rise of digital channels and direct-to-consumer (DTC) models further empowers consumers. In 2023, Estée Lauder saw continued growth in its online sales, highlighting how digital platforms facilitate price and product comparisons, giving customers greater leverage.

While Estée Lauder maintains strong brand equity, the competitive landscape, coupled with the influence of online reviews and social media in 2024, means customer choice and the ability to switch are key considerations. This dynamic necessitates a careful balance between premium positioning and responsive market strategies.

| Factor | Impact on Estée Lauder | Supporting Data (2023/2024) |

|---|---|---|

| Brand Loyalty | Reduces customer power, but not absolute. | Net sales of $15.6 billion (FY23) indicate strong demand. |

| Availability of Alternatives | Increases customer power due to choice. | Global luxury cosmetics market valued over $70 billion (2024). |

| Digital Influence | Amplifies customer power through reviews and social media. | Over 70% of consumers influenced by online reviews (2024). |

| Distribution Channels | Offers convenience and choice, enhancing customer power. | Continued growth in Estée Lauder's online sales (2023). |

Same Document Delivered

Estee Lauder Companies Porter's Five Forces Analysis

This preview showcases the Estee Lauder Companies Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the beauty industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The prestige beauty sector is incredibly crowded, featuring major global players such as L'Oréal, Shiseido, and Coty alongside a rising tide of nimble independent and specialized brands. This sheer volume of competitors, all competing for consumer attention and market share, fuels a dynamic environment characterized by aggressive marketing campaigns and rapid product innovation.

Estée Lauder constantly faces pressure to stand out and preserve its prominent standing in this competitive landscape. For instance, in 2023, the global beauty market was valued at approximately $470 billion, with the prestige segment representing a significant portion, highlighting the intense battle for dominance.

The beauty industry is a whirlwind of change, driven by fast-moving trends like clean beauty and personalization, alongside significant technological leaps. Companies like Estee Lauder must continuously innovate, not just with new products but also with digital engagement and marketing, to keep pace. This relentless innovation cycle intensifies competition as everyone vies for a slice of emerging market opportunities.

The prestige beauty sector thrives on significant marketing and advertising, with Estée Lauder Companies (ELC) facing intense rivalry. In fiscal year 2023, ELC reported net sales of $15.6 billion, with a substantial portion allocated to marketing and advertising to fuel brand visibility and consumer engagement.

Competition is fierce, driven by extensive brand building, celebrity endorsements, and broad advertising across all media channels. This necessitates substantial marketing budgets for ELC to maintain its competitive edge against well-funded rivals who possess strong brand recognition.

Product Differentiation and Brand Equity

Success in the prestige beauty market, where Estée Lauder operates, is deeply tied to how well products stand out. This means having unique formulations and compelling brand stories that resonate with consumers. For instance, in 2023, the global beauty market was valued at approximately $500 billion, with the prestige segment showing robust growth, underscoring the importance of differentiation.

Competitors are always striving to carve out their own unique selling propositions and build strong emotional bonds with their customer base. This constant innovation is crucial for capturing market share. In 2024, many brands are focusing on ingredient transparency and personalized beauty solutions as key differentiators.

Estée Lauder benefits from its extensive portfolio of well-established brands and a significant investment in research and development. However, the challenge lies in continuously maintaining that sense of distinctiveness in a crowded and dynamic marketplace. The company's commitment to R&D is reflected in its substantial spending, which often exceeds billions annually, enabling the creation of innovative products that support brand equity.

- Product Differentiation: The ability to offer unique formulations, advanced technologies, and distinct product benefits is paramount in the prestige beauty sector.

- Brand Equity: Estée Lauder's strength lies in its portfolio of iconic brands, each with a loyal customer base and a strong emotional connection built over years of marketing and product quality.

- R&D Investment: Continuous investment in research and development allows Estée Lauder to introduce innovative products and maintain a competitive edge through scientific advancements.

Global Reach and Distribution Network

Estée Lauder's competitive rivalry is intensified by the need for a strong global distribution network. This includes a presence in department stores, specialty beauty retailers, direct-to-consumer e-commerce, and the lucrative travel retail sector. Companies that can effectively manage this multi-channel approach across numerous countries gain significant advantages.

Having an extensive global reach allows for greater economies of scale in manufacturing and marketing. It also enables deeper penetration into diverse consumer markets, which is vital for sustained growth. In 2023, Estée Lauder reported net sales of $15.91 billion, underscoring the importance of its vast distribution capabilities in achieving such revenue.

- Global Presence: Estée Lauder operates in over 150 countries, providing access to a wide array of consumer bases.

- Multi-Channel Strategy: The company leverages department stores, specialty beauty stores, e-commerce, and travel retail to maximize market access.

- Economies of Scale: A broad international footprint supports cost efficiencies in production and supply chain management.

- Competitive Advantage: A well-established network is critical for competing against both large multinational corporations and agile regional players.

The competitive rivalry within the prestige beauty sector is exceptionally high, with Estée Lauder Companies (ELC) facing a dynamic landscape populated by global giants and emerging niche brands. This intense competition necessitates substantial investments in marketing and product innovation to maintain market share and brand relevance. For instance, in fiscal year 2023, ELC's net sales reached $15.6 billion, a figure reflecting the scale of operations and the competitive pressures driving its performance.

Key competitive factors include product differentiation, brand equity, and robust research and development. Estée Lauder's strength lies in its diversified portfolio of well-recognized brands, each cultivated to foster strong consumer loyalty. However, the continuous need to innovate and stand out in a market driven by trends like clean beauty and personalization, as highlighted by a global beauty market valuation nearing $500 billion in 2023, demands ongoing strategic adaptation.

The company's extensive global distribution network, spanning over 150 countries and utilizing multiple channels like e-commerce and travel retail, is a critical asset. This broad reach not only facilitates economies of scale but also allows ELC to compete effectively against both large multinational corporations and agile regional players, ensuring its products are accessible to a wide consumer base.

| Competitor Type | Key Strategies | Example Brands (Illustrative) | Market Share Impact |

| Global Conglomerates | Broad portfolios, extensive R&D, global marketing | L'Oréal, Shiseido, Coty | Significant market share, high brand recognition |

| Niche & Indie Brands | Specialization, unique formulations, direct-to-consumer engagement | Glossier, Drunk Elephant (acquired), Pat McGrath Labs | Growing influence, trendsetting, challenging incumbents |

| Private Label & Retailer Brands | Value pricing, private label development | Sephora Collection, Ulta Beauty brands | Capturing price-sensitive segments, increasing retail power |

SSubstitutes Threaten

The threat of substitutes is significant for Estée Lauder, particularly from mass-market and affordable premium alternatives. Consumers are increasingly seeking value, and many are turning to more budget-friendly options that offer comparable results. For instance, the global beauty market saw a notable shift towards value-driven purchases in 2023, with the mass-market segment showing resilience.

Affordable premium brands, often referred to as 'dupes,' present a direct challenge by mimicking the performance and appeal of Estée Lauder's higher-priced products. This trend is fueled by social media influencers and online reviews that highlight these cost-effective alternatives. In 2024, the demand for such products is expected to continue its upward trajectory, potentially diverting sales from Estée Lauder’s luxury portfolio, especially if economic conditions tighten.

Consumers increasingly view medical aesthetic procedures, like injectables and laser treatments, as viable alternatives to traditional skincare. These clinical options can deliver faster or more pronounced results for issues such as aging or acne. For instance, the global medical aesthetics market was valued at approximately $15.9 billion in 2023 and is projected to grow significantly.

This presents a threat to Estée Lauder as these advanced treatments can bypass the need for their topical products. However, Estée Lauder addresses this by focusing on high-performance, clinically-proven formulations designed to offer visible improvements, bridging the gap between traditional beauty and medical interventions.

The rise of Do-It-Yourself (DIY) beauty and natural remedies presents a subtle but growing threat. Consumers increasingly embrace natural living and personalization, leading some to craft their own beauty products from raw ingredients or turn to simple, homemade remedies. This trend, while not directly challenging Estée Lauder's sophisticated formulations, signals a significant shift in consumer attitudes towards authenticity and ingredient transparency.

Estée Lauder is actively responding to this by integrating more natural ingredients into its product lines and championing transparency in its sourcing and manufacturing processes. This strategic move aims to align with consumer desires for natural efficacy and build trust in its offerings. For instance, the company's commitment to clean beauty initiatives and ingredient disclosure directly addresses the consumer curiosity that fuels the DIY movement.

Lifestyle Changes and Minimalist Beauty Trends

The rise of minimalist beauty and lifestyle changes poses a significant threat of substitution for Estée Lauder. Consumers are increasingly adopting a less-is-more philosophy, which can lead to reduced overall product consumption. This trend, amplified by a growing interest in natural ingredients and simplified routines, directly challenges the traditional multi-product purchase model.

This shift means consumers might opt for fewer, higher-quality items or even DIY solutions, bypassing conventional beauty brands. For instance, reports in 2024 indicated a growing segment of consumers actively seeking out brands with fewer ingredients or those that offer multi-use products, impacting the volume of Estée Lauder's diverse product lines.

- Minimalist Beauty Trend Impact: Reduced demand for a wide range of individual beauty products as consumers simplify routines.

- Consumer Behavior Shift: Growing preference for multi-functional items and natural, less-processed beauty solutions.

- Estée Lauder's Adaptation: Focus on developing and marketing versatile products and highlighting the value of comprehensive, long-term skincare regimens to counteract declining unit sales.

Focus on Overall Wellness and Health

The growing consumer awareness of the connection between internal health and external appearance presents a threat of substitutes for Estée Lauder. As individuals increasingly prioritize holistic wellness, they might opt for nutritional supplements, specialized diets, or fitness programs over traditional beauty products to achieve desired outcomes. This shift in focus means that Estée Lauder faces indirect competition from industries that cater to overall health and well-being.

For example, the global dietary supplements market was valued at approximately $150 billion in 2023 and is projected to grow significantly. This expanding market directly competes for consumer spending that might otherwise be allocated to skincare and beauty items. While Estée Lauder can weave wellness narratives into its brand, the direct substitute offerings in the health and wellness sector pose a tangible challenge.

- Holistic Health Trend: Consumers are linking diet, lifestyle, and internal wellness to skin health and appearance.

- Prioritizing Internal Wellness: This can lead consumers to invest in supplements and wellness programs instead of topical beauty products.

- Indirect Competition: Nutritional supplements and wellness programs act as substitutes, diverting consumer spend and attention.

- Market Growth: The global dietary supplements market, valued at $150 billion in 2023, highlights the scale of this competitive landscape.

The threat of substitutes for Estée Lauder is multifaceted, ranging from affordable beauty brands and DIY solutions to advancements in medical aesthetics and a growing focus on holistic wellness. Consumers are increasingly seeking value, leading them to explore cost-effective alternatives that mimic the performance of luxury products. For instance, the mass-market beauty segment showed resilience in 2023, indicating a consumer shift towards more budget-friendly options.

Medical aesthetic procedures are also emerging as significant substitutes, offering rapid and pronounced results that can bypass traditional skincare. The global medical aesthetics market, valued at approximately $15.9 billion in 2023, underscores the scale of this alternative. Furthermore, the rise of minimalist beauty and a focus on internal wellness, supported by a global dietary supplements market worth around $150 billion in 2023, presents indirect competition by diverting consumer spending towards health and lifestyle choices over topical beauty treatments.

| Substitute Category | Examples | 2023 Market Value (Approx.) | Impact on Estée Lauder |

| Affordable Premium/Mass Market | Budget-friendly skincare and makeup brands | Significant portion of global beauty market | Diverts sales from luxury portfolio, pressure on pricing |

| Medical Aesthetics | Injectables, laser treatments, chemical peels | $15.9 billion (Global Medical Aesthetics) | Reduces reliance on topical skincare for certain concerns |

| DIY & Natural Remedies | Homemade masks, natural ingredients | Growing consumer interest | Challenges ingredient transparency and efficacy claims |

| Holistic Wellness & Supplements | Nutritional supplements, specialized diets | $150 billion (Global Dietary Supplements) | Competes for consumer spend, shifts focus from external to internal solutions |

Entrants Threaten

Launching a new prestige beauty brand demands significant upfront capital. Estee Lauder, for instance, invests heavily in research and development, as evidenced by their consistent R&D spending, which reached $1.2 billion in fiscal year 2023. This investment covers everything from innovative product formulations to rigorous safety testing, creating a high financial hurdle for newcomers.

Beyond product creation, building brand equity and consumer trust in the competitive beauty landscape is an expensive and lengthy endeavor. Companies like Estee Lauder allocate substantial marketing budgets, often exceeding hundreds of millions annually, to establish brand presence through advertising, influencer collaborations, and in-store experiences. This extensive marketing spend acts as a formidable barrier, making it difficult for new entrants to gain traction without comparable financial resources.

Estée Lauder and its competitors have cultivated immense brand equity over decades, fostering deep consumer trust and loyalty. New entrants face a significant hurdle in replicating this ingrained recognition, needing to invest heavily in unique value propositions to persuade consumers to shift from their preferred, trusted brands.

Newcomers face significant hurdles in securing prime shelf space within department stores, specialty multi-brand retailers, and crucial travel retail outlets globally. These coveted locations often demand established relationships, a track record of strong sales performance, and robust logistical capabilities, which new entrants typically lack.

While the rise of e-commerce has undeniably lowered the barrier to entry for online sales, a strong physical retail presence remains indispensable for luxury and prestige brands like those in Estee Lauder's portfolio. This physical visibility is key for brand building and reaching a broad consumer base.

Regulatory Hurdles and Compliance Costs

The beauty industry faces a complex web of regulations globally, covering everything from product safety and ingredient approval to precise labeling and advertising claims. For instance, in 2024, the European Union continued to enforce its stringent cosmetic regulations, requiring extensive safety assessments for all products sold within its borders.

Navigating these diverse and often changing regulatory environments demands significant investment in specialized expertise and robust compliance systems. New entrants must allocate substantial resources to understand and adhere to these rules, which can easily run into millions of dollars for global market access.

These regulatory hurdles act as a considerable barrier, particularly for smaller companies or those aspiring to compete on an international scale. The sheer cost and complexity involved in ensuring compliance can deter potential new competitors from entering the market, thereby protecting established players like Estee Lauder.

- Global Regulatory Landscape: The beauty sector is heavily regulated across different regions, impacting product formulation, testing, and marketing.

- Compliance Costs: Adhering to regulations like REACH in Europe or the FDA's requirements in the US involves substantial financial outlays for testing, documentation, and legal counsel.

- Barrier to Entry: The intricate and costly nature of regulatory compliance creates a significant challenge for new companies seeking to establish a foothold in the market.

- Expertise Requirement: Successfully navigating these regulations necessitates specialized knowledge in toxicology, chemistry, and international trade law, which new entrants may lack.

Expertise in Formulation, Supply Chain, and Marketing

The threat of new entrants for Estee Lauder Companies (ELC) in the prestige beauty sector is significantly mitigated by the immense expertise required in formulation, supply chain, and marketing. Developing cutting-edge, high-quality beauty products demands specialized knowledge in areas like chemistry, dermatology, and fragrance development. This deep scientific and creative know-how is not easily replicated.

New players must either invest heavily in acquiring or developing this talent, a process that is both time-consuming and expensive. For instance, ELC's extensive research and development efforts, which are crucial for product innovation, represent a substantial barrier. In 2023, ELC reported investing billions in R&D to maintain its competitive edge.

Furthermore, the intricate nature of managing a global supply chain, from sourcing rare ingredients to ensuring product integrity and timely delivery across diverse markets, presents another formidable challenge. The sophisticated marketing and brand-building required to establish a presence in the prestige segment also demand significant resources and established networks. These combined complexities create a high barrier to entry.

- Formulation Expertise: Requires deep knowledge in chemistry, dermatology, and fragrance creation.

- Supply Chain Complexity: Managing global sourcing, manufacturing, and distribution is intricate.

- Marketing and Brand Building: Establishing prestige in the beauty market demands substantial investment and expertise.

- Talent Acquisition: New entrants must either hire specialized talent or build it internally, a costly endeavor.

The threat of new entrants in the prestige beauty market, where Estee Lauder operates, is considerably low due to the substantial capital required for research, development, and marketing. For example, Estee Lauder's fiscal year 2023 R&D spending reached $1.2 billion, highlighting the significant investment needed to create innovative products and maintain brand appeal.

Building brand loyalty and recognition is a lengthy and costly process, with established players like Estee Lauder allocating hundreds of millions annually to marketing efforts. New entrants struggle to match this extensive brand-building expenditure, making it difficult to capture consumer attention and trust in a crowded market.

Securing prime retail shelf space in department stores and specialty beauty retailers presents another significant barrier. These prime locations often require proven sales performance and established relationships, which new companies typically lack, further limiting their market access.

Navigating the complex global regulatory landscape for cosmetics, which includes stringent product safety and labeling requirements, demands considerable financial resources and specialized expertise. In 2024, the EU's continued enforcement of its cosmetic regulations exemplifies the high compliance costs that deter many potential new entrants.

| Barrier | Description | Example for Estee Lauder |

| Capital Requirements | High upfront investment for R&D, product development, and marketing. | $1.2 billion in R&D spending (FY 2023). |

| Brand Equity & Loyalty | Decades of building trust and recognition are difficult to replicate. | Strong brand portfolio including Estee Lauder, Clinique, MAC. |

| Distribution Channels | Access to prime retail shelf space in department stores and specialty retailers. | Extensive global retail partnerships. |

| Regulatory Compliance | Meeting diverse and stringent global regulations for product safety and marketing. | Adherence to EU cosmetic regulations and FDA requirements. |

Porter's Five Forces Analysis Data Sources

Our Estee Lauder Companies Porter's Five Forces analysis is built upon a robust foundation of data, including comprehensive annual reports, detailed industry research from firms like Mintel and Euromonitor, and publicly available SEC filings. This blend of internal and external information allows for a thorough examination of competitive dynamics.