Estee Lauder Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

Unlock the strategic blueprint behind Estee Lauder Companies's success with our comprehensive Business Model Canvas. Discover how they leverage diverse customer segments and powerful brand partnerships to deliver premium beauty products. This detailed analysis reveals their key resources and revenue streams, offering invaluable insights for your own business strategy.

Partnerships

Estée Lauder strategically collaborates with key global prestige retailers and department stores, including prominent names like Nordstrom, Macy's, and Sephora. These alliances are fundamental to their distribution strategy, providing prime physical and digital shelf space for their luxury beauty products.

These partnerships are crucial for Estée Lauder to cultivate a premium brand image and reach a wide demographic of consumers actively seeking high-end beauty solutions. For instance, in 2023, Estée Lauder's net sales in the EMEA region, heavily influenced by European department store performance, saw significant growth, underscoring the importance of these retail relationships.

Estee Lauder Companies actively partners with key e-commerce platforms and digital marketplaces, including giants like Amazon and the increasingly influential TikTok Shop. This strategy is designed to significantly broaden their digital footprint and tap into the ever-expanding online consumer base.

These collaborations are fundamental to driving direct-to-consumer sales and executing targeted digital marketing initiatives. By leveraging these platforms, Estee Lauder can more effectively engage with younger demographics who are native to the digital space.

In 2023, Estee Lauder's online sales saw continued growth, with digital channels contributing a substantial portion of their revenue. For instance, their net sales reached $16.04 billion in fiscal year 2023, with online channels playing a vital role in this performance.

Estée Lauder Companies (ELC) relies on a robust network of supply chain and manufacturing partners to deliver its diverse product portfolio. These partnerships are crucial for sourcing high-quality raw materials, securing innovative packaging components, and ensuring efficient, global manufacturing. For instance, in 2023, ELC continued its focus on sustainable packaging, including collaborations aimed at increasing the use of recycled materials, reflecting a growing industry trend towards environmental responsibility.

Key collaborations in this sector emphasize both quality assurance and operational efficiency. ELC's partnerships are designed to maintain consistent product standards across its brands and facilitate timely delivery to consumers worldwide. A notable example of innovation is the company's work with partners on advanced recycling technologies, such as their collaboration with Strategic Materials to enhance glass recycling efforts, underscoring a commitment to circular economy principles in 2024.

Research and Development Collaborations

Estée Lauder Companies actively engages in research and development collaborations, partnering with biotechnology firms, scientific institutions, and research organizations. These alliances are crucial for driving innovation in product formulation and the development of novel ingredients. For instance, a notable collaboration involved Serpin Pharma, Inc., focusing on exploring anti-inflammatory research to enhance advanced skincare ingredients.

These strategic partnerships allow Estée Lauder to tap into cutting-edge scientific advancements, accelerating their ability to bring scientifically backed and effective products to market. In 2023, the company reported significant investment in R&D, underscoring the importance of these external collaborations in their innovation pipeline.

- Biotechnology Firm Partnerships: Accessing specialized expertise for ingredient discovery and advanced formulation techniques.

- Scientific Institution Alliances: Leveraging academic research and clinical studies to validate product efficacy and explore new scientific frontiers.

- Research Organization Collaborations: Co-developing novel ingredients and technologies, as exemplified by the work with Serpin Pharma on anti-inflammatory research.

Influencers, Celebrities, and Media Partnerships

Estée Lauder Companies actively cultivates partnerships with a wide array of influencers, celebrities, and media entities to amplify its brand presence and connect with consumers. In 2024, the company continued to invest in these collaborations, recognizing their power in driving engagement and building brand loyalty. For instance, strategic alliances with prominent beauty influencers on platforms like Instagram and TikTok allow Estée Lauder to showcase product efficacy and generate authentic user-generated content, reaching millions of potential customers.

These partnerships are crucial for Estée Lauder's marketing initiatives, enabling the creation of compelling narratives and targeted campaigns. Collaborations with media giants, such as NBCUniversal, further expand reach, integrating brands into popular programming and digital content. This multi-faceted approach ensures that Estée Lauder's message resonates across diverse demographics and media channels, fostering deeper brand affinity and driving sales.

- Influencer Marketing Spend: In 2024, the global influencer marketing industry was projected to reach over $21 billion, with beauty brands being significant contributors, highlighting the scale of Estée Lauder's potential reach through these channels.

- Celebrity Endorsements: The effectiveness of celebrity endorsements remains high; studies indicate that celebrity-backed campaigns can increase brand awareness by up to 4% and purchase intent by 13%.

- Media Integration: Partnerships with media companies provide platforms for product placement and sponsored content, offering Estée Lauder opportunities to integrate its brands into highly viewed television shows and digital series, thereby enhancing visibility.

Estée Lauder Companies actively cultivates strategic alliances with a diverse range of technology providers and digital platforms to enhance its e-commerce capabilities and data analytics. These partnerships are vital for optimizing online customer experiences and leveraging data-driven insights for personalized marketing. In 2024, the company continued to invest in cloud solutions and AI-powered tools, aiming to streamline operations and deepen consumer engagement.

These technological collaborations are fundamental to staying competitive in the digital landscape, enabling Estée Lauder to adapt to evolving consumer behaviors and preferences. By integrating advanced analytics, the company can better understand market trends and tailor its product offerings and marketing strategies accordingly. For instance, in fiscal year 2023, Estée Lauder's digital net sales continued to show strong performance, a testament to the effectiveness of these strategic tech partnerships.

| Partner Type | Purpose | Example/Impact |

| Retailers (Nordstrom, Sephora) | Distribution & Brand Presence | Prime physical/digital shelf space, reaching broad consumer base. |

| E-commerce Platforms (Amazon, TikTok Shop) | Digital Footprint & Sales | Broaden online reach, tap into online consumer base, drive DTC sales. |

| Supply Chain & Manufacturing | Product Delivery & Quality | Source materials, ensure efficient manufacturing, focus on sustainable packaging. |

| R&D Collaborators (Biotech Firms) | Innovation & Product Development | Ingredient discovery, advanced formulation, explore scientific frontiers. |

| Influencers & Media | Brand Amplification & Engagement | Generate user-generated content, expand reach through sponsored content. |

What is included in the product

The Estée Lauder Companies leverages a premium brand portfolio targeting diverse luxury and prestige beauty consumers, distributed through a mix of online and offline channels, emphasizing innovation and global reach.

Estee Lauder's Business Model Canvas acts as a pain point reliever by consolidating complex brand portfolios and global distribution networks into a clear, actionable framework.

This allows for efficient strategic alignment and resource allocation, mitigating the pain of managing a vast and diverse beauty empire.

Activities

Estée Lauder Companies dedicates significant resources to research, development, and innovation, fueling its ability to launch cutting-edge beauty products. In fiscal year 2023, the company reported $1.1 billion in net sales from new products, underscoring the commercial success of its R&D efforts.

This investment spans skincare, makeup, fragrance, and hair care, focusing on advanced formulations and novel scientific discoveries. The company's commitment ensures a robust pipeline of both new and enhanced offerings, keeping it at the forefront of the beauty industry.

Estée Lauder Companies operates a sophisticated global manufacturing network, producing its wide array of prestige beauty products. This involves managing numerous facilities worldwide to ensure efficient production and maintain the high standards expected of its brands.

Key activities center on optimizing production processes, implementing rigorous quality control measures across all product lines, and streamlining supply chain operations. This intricate dance ensures products reach consumers globally in a timely and pristine condition.

In 2023, Estée Lauder reported net sales of $15.91 billion, underscoring the scale of its manufacturing and production output. The company continues to invest in advanced manufacturing technologies to enhance efficiency and sustainability in its operations.

Estée Lauder Companies champions strategic global marketing and precise brand management to uphold its premium positioning and stimulate demand. This involves significant investment in digital marketing, broad advertising across diverse media channels, and tailored customer interactions to cultivate brand loyalty and recognition on a worldwide scale.

In fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, underscoring the reach and impact of their global marketing efforts. Their approach emphasizes building emotional connections with consumers through compelling storytelling and aspirational imagery, ensuring consistent brand messaging across all touchpoints.

Supply Chain and Distribution Management

Estee Lauder's key activities heavily rely on managing a sophisticated global supply chain. This involves everything from procuring raw materials to ensuring products reach consumers in roughly 150 countries. In 2024, the company continued its focus on optimizing this intricate network, which is crucial for its extensive product portfolio.

A significant aspect is inventory management and the efficient logistics required to distribute a wide range of beauty products. This global reach necessitates robust distribution strategies to cater to diverse retail channels, including department stores, specialty beauty stores, and e-commerce platforms.

The company is actively investing in supply chain transformation, with artificial intelligence playing a key role. This AI integration aims to boost efficiency and enhance sustainability efforts throughout their operations, a trend expected to accelerate in 2024 and beyond.

- Global Sourcing & Procurement: Securing high-quality raw materials from diverse international suppliers.

- Inventory Optimization: Balancing stock levels across numerous markets to meet demand while minimizing waste.

- Logistics & Transportation: Managing the movement of goods through complex international shipping and distribution networks.

- AI-Driven Supply Chain Transformation: Implementing advanced technologies to improve forecasting, reduce lead times, and enhance sustainability.

Sales and Customer Experience Management

Estée Lauder Companies actively manages its sales across a diverse retail landscape, encompassing traditional department stores, specialized beauty retailers, their own branded stores, and a significant e-commerce presence. This multi-channel approach is crucial for reaching a broad customer base.

A core tenet of their strategy is delivering a personalized, high-touch customer experience. This focus aims to build lasting customer relationships and drive sales conversions by making each interaction memorable and tailored to individual needs.

- Channel Diversity: Sales are generated through department stores, specialty retailers, freestanding stores, and direct-to-consumer e-commerce.

- Personalized Service: Emphasis on high-touch customer interactions to foster loyalty and repeat purchases.

- E-commerce Growth: Significant investment in digital platforms to capture online sales, with e-commerce accounting for a substantial portion of revenue.

- Brand Experience: Ensuring a consistent and premium brand experience across all touchpoints, from in-store consultations to online browsing.

Estée Lauder Companies' key activities also encompass robust customer relationship management and brand building. This involves engaging consumers through personalized digital experiences and cultivating brand loyalty across its diverse portfolio.

The company actively invests in data analytics to understand consumer behavior, enabling targeted marketing campaigns and product development. This data-driven approach is vital for maintaining its competitive edge in the dynamic beauty market.

In fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, reflecting the success of its integrated marketing and sales strategies aimed at enhancing customer engagement and driving brand equity.

Full Document Unlocks After Purchase

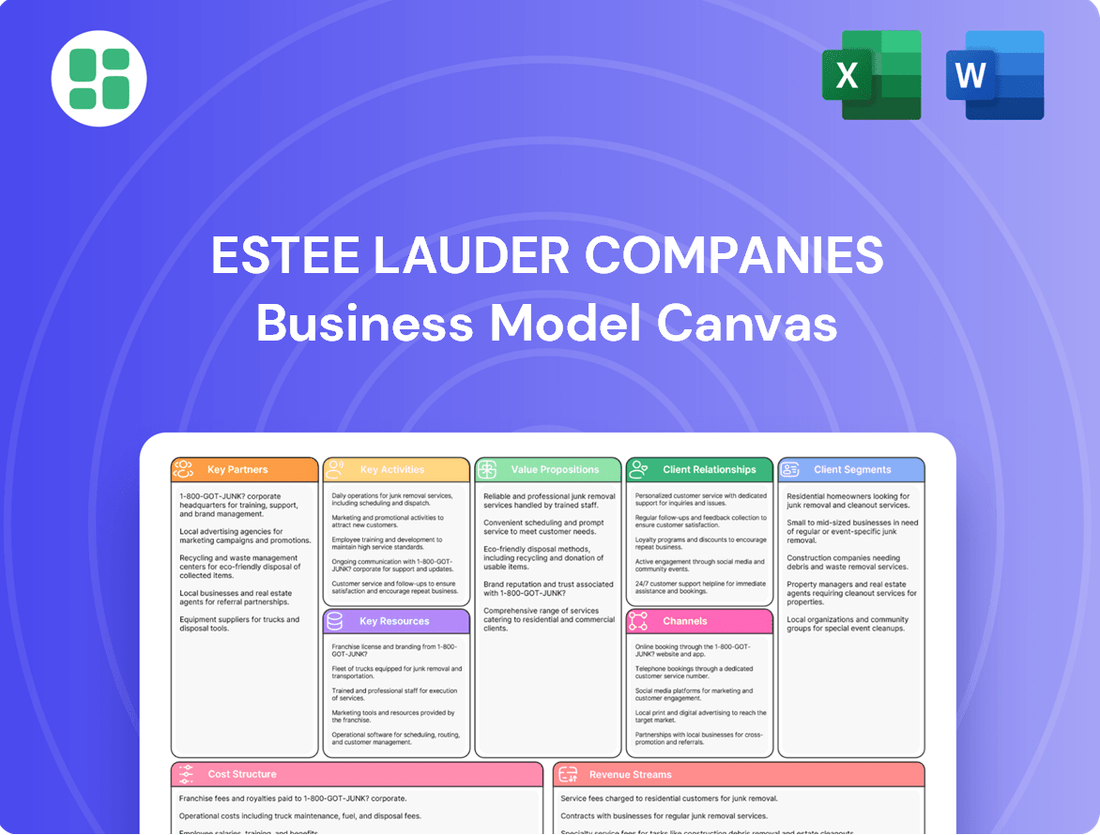

Business Model Canvas

The Estee Lauder Companies Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the comprehensive analysis of their operations, customer segments, value propositions, and revenue streams. Once your order is complete, you will gain full access to this same, professionally structured document, ready for your in-depth review.

Resources

Estée Lauder's core strength lies in its diverse stable of over 20 prestigious beauty brands, such as Estée Lauder, Clinique, MAC, La Mer, and Jo Malone London. These brands are not just names; they represent significant equity built through decades of consumer trust and product innovation.

The company's intellectual property, encompassing proprietary formulas, unique trademarks, and valuable patents, forms a critical foundation for its competitive advantage. This IP protects its innovations and ensures brand distinctiveness in a crowded market.

In fiscal year 2023, Estée Lauder's net sales reached $15.91 billion, a testament to the enduring appeal and market penetration of its brand portfolio. The company consistently invests in R&D to maintain and enhance this valuable IP.

Estee Lauder Companies leverages a global network of state-of-the-art research and development centers, staffed by leading scientists and technical experts. These facilities are the engine for innovation, driving the creation of advanced beauty solutions and high-performance products. For instance, in fiscal year 2023, the company continued to invest heavily in R&D to fuel its pipeline of new products and technologies, ensuring it stays ahead of evolving consumer preferences.

These robust R&D capabilities are fundamental to Estee Lauder's strategy, allowing them to consistently deliver scientifically advanced formulations that address diverse consumer needs and maintain a significant competitive advantage in the beauty market. Their commitment to scientific exploration ensures that products not only meet but often exceed consumer expectations for efficacy and quality.

Estee Lauder Companies boasts an extensive global distribution network, a cornerstone of its business model. This vast infrastructure, encompassing manufacturing facilities, strategically located warehouses, and sophisticated logistics, enables the company to effectively serve consumers in roughly 150 countries and territories.

This robust network is critical for ensuring efficient product delivery across a multitude of retail channels, from department stores and specialty beauty retailers to e-commerce platforms. In fiscal year 2024, Estee Lauder leveraged this network to maintain its strong market presence, adapting to evolving consumer purchasing habits and ensuring product availability.

Skilled Talent and Human Capital

Estee Lauder Companies' skilled talent is a cornerstone of its business model. This includes a vast global workforce comprising scientists, chemists, marketers, brand managers, and retail associates. Their collective expertise is crucial for driving innovation in product development, upholding the prestige of its diverse brands, and delivering the personalized customer service that defines the luxury beauty experience.

The company's investment in human capital is evident in its focus on continuous learning and development, ensuring its employees remain at the forefront of industry trends and scientific advancements. For instance, in fiscal year 2023, Estee Lauder Companies continued to invest in training programs aimed at enhancing the skills of its retail associates to further elevate the in-store customer journey.

- Scientific and Research Expertise: Talented scientists and chemists are vital for developing cutting-edge formulations and product innovations, underpinning the company's competitive edge.

- Brand Management and Marketing Prowess: Skilled marketers and brand managers are essential for crafting compelling brand narratives and executing effective global marketing campaigns.

- Customer-Facing Excellence: Retail associates and beauty advisors play a critical role in direct customer engagement, providing expert advice and personalized experiences that build loyalty.

- Global Operational Acumen: A diverse workforce with international experience ensures effective management of global supply chains, distribution networks, and varying market demands.

Financial Capital and Strong Balance Sheet

Estee Lauder Companies leverages significant financial capital, bolstered by consistent revenue streams and a robust balance sheet. This financial muscle allows for substantial investments in crucial areas like research and development, driving innovation in their product lines. For instance, in fiscal year 2023, the company reported net sales of $15.91 billion, demonstrating its capacity to fund growth initiatives.

This financial strength provides the necessary stability and flexibility for Estee Lauder to pursue its long-term growth objectives. It underpins their ability to invest heavily in marketing campaigns to build brand equity and reach a global consumer base. Furthermore, it supports strategic acquisitions that can expand their market reach and product portfolio.

- Financial Strength: Consistent revenue generation and a strong balance sheet provide significant financial resources.

- Investment Capacity: Enables substantial funding for R&D, marketing, and strategic acquisitions.

- Global Expansion: Financial stability supports efforts to expand market presence worldwide.

- Long-Term Growth: Provides the flexibility and resources needed for sustained future growth.

Estée Lauder's key resources are its extensive portfolio of over 20 prestigious beauty brands, each with significant consumer recognition and loyalty. This brand equity is further protected and enhanced by the company's substantial intellectual property, including proprietary formulas and patents. In fiscal year 2023, the company's net sales reached $15.91 billion, reflecting the market's strong reception of its brand offerings.

The company's global distribution network, encompassing manufacturing, warehousing, and logistics, is a critical asset, enabling reach into approximately 150 countries. This infrastructure ensures product availability across diverse retail channels, from traditional department stores to burgeoning e-commerce platforms. In fiscal year 2024, Estee Lauder continued to optimize this network to meet evolving consumer purchasing behaviors.

Estée Lauder Companies relies on its highly skilled global workforce, comprising scientists, marketers, and retail associates, whose expertise drives innovation and customer engagement. The company actively invests in talent development, as seen in its fiscal year 2023 focus on training retail associates to enhance the customer experience.

Significant financial capital, evidenced by $15.91 billion in net sales for fiscal year 2023, empowers Estée Lauder to invest in R&D, marketing, and strategic growth opportunities. This financial strength supports global expansion and the continuous development of its diverse brand portfolio.

Value Propositions

Estée Lauder's commitment to high-quality, innovative prestige products forms a core value proposition. They consistently deliver superior skincare, makeup, fragrance, and hair care that not only show tangible results but also provide a truly luxurious user experience.

This dedication to excellence is underpinned by significant investment in advanced science and the careful selection of premium ingredients. This focus directly supports their prestige positioning and fosters deep consumer trust in the brand's efficacy and exclusivity.

For fiscal year 2023, Estée Lauder Companies reported net sales of $15.91 billion, reflecting the enduring demand for their high-quality beauty offerings. Innovation is a key driver, with the company continuously introducing new formulations and technologies to maintain its competitive edge in the premium beauty market.

Estee Lauder Companies offers consumers a vast array of highly recognized and cherished luxury brands, each possessing a distinct character and specialized product lines. This broad range ensures that a wide spectrum of consumer tastes, skin concerns, and demographic requirements are met, enabling individuals to discover products that truly connect with them.

For instance, in fiscal year 2023, Estee Lauder’s net sales reached $15.51 billion, a testament to the enduring appeal and broad market penetration of its diverse brand portfolio, which includes names like MAC, Clinique, and La Mer.

Estée Lauder Companies excels in offering expert, personalized beauty advice, a cornerstone of their value proposition. This high-touch service, available both in physical stores and via digital platforms, ensures each customer receives recommendations perfectly suited to their individual needs and preferences.

This personalized approach significantly elevates the shopping experience, fostering stronger, more loyal customer relationships. For instance, in fiscal year 2023, Estée Lauder's direct-to-consumer channels, which heavily feature personalized consultations, saw continued growth, contributing to their overall revenue stream and customer engagement metrics.

Global Accessibility and Omni-channel Experience

Estee Lauder Companies ensures its diverse product portfolio is accessible to consumers across the globe. This is achieved through a carefully designed omnichannel strategy that integrates various retail touchpoints.

Products can be found in traditional channels like department stores and specialty retailers, alongside Estee Lauder's own freestanding stores. This physical presence is complemented by a strong digital footprint, with robust e-commerce platforms offering convenient online shopping experiences.

This multi-channel approach caters to a wide range of consumer preferences, ensuring ease of access no matter how a customer chooses to shop. For instance, in fiscal year 2023, Estee Lauder reported that its online sales continued to be a significant growth driver, reflecting the success of its digital investments.

- Global Reach: Products are available in over 150 countries and territories, demonstrating extensive worldwide accessibility.

- Omnichannel Integration: Seamless integration of physical stores (department, specialty, freestanding) and e-commerce platforms enhances customer convenience.

- E-commerce Growth: Online sales represent a substantial and growing portion of revenue, highlighting the importance of digital channels.

- Brand Experience: The curated omnichannel experience aims to deliver a consistent and premium brand encounter across all touchpoints.

Commitment to Sustainability and Social Impact

Estée Lauder Companies actively integrates sustainability into its core operations, from eco-friendly packaging solutions to responsible ingredient sourcing. In 2024, the company continued to advance its "Green Mission" initiatives, aiming to reduce its environmental footprint across its global supply chain. This commitment resonates with a growing consumer base that prioritizes brands demonstrating genuine care for the planet.

Beyond environmental efforts, Estée Lauder champions significant social impact programs. These initiatives, often focused on women's health and empowerment, build strong brand loyalty. For instance, their Breast Cancer Campaign, a long-standing pillar, has raised over $106 million globally since 1992, demonstrating a tangible commitment to social well-being that extends far beyond product sales.

- Sustainable Packaging: Estée Lauder is investing in recyclable, reusable, and refillable packaging options, with a goal to make 100% of its packaging recyclable, or reusable, or compostable by 2025.

- Responsible Sourcing: The company is focused on ethical sourcing of key ingredients, ensuring fair labor practices and environmental protection in its agricultural supply chains.

- Social Impact Programs: Initiatives like the Breast Cancer Campaign and efforts supporting women's economic empowerment highlight a dedication to broader societal betterment.

- Consumer Appeal: These commitments directly address the values of ethically-minded consumers, driving preference and loyalty for Estée Lauder brands in 2024 and beyond.

Estée Lauder Companies offers a diverse portfolio of prestige beauty brands, catering to a wide range of consumer needs and preferences. This breadth ensures broad market appeal and allows consumers to connect with brands that resonate with their individual lifestyles and aspirations.

The company's commitment to innovation and science-backed formulations underpins its reputation for high-quality, efficacious products. This focus on tangible results, combined with luxurious user experiences, fosters deep consumer trust and loyalty across its extensive brand lineup.

Estée Lauder's value proposition is further enhanced by its personalized customer service, offering expert advice across various touchpoints. This high-touch approach, integrated with a seamless omnichannel strategy, ensures accessibility and a premium brand experience, driving engagement and repeat purchases.

Customer Relationships

Estée Lauder cultivates strong customer connections through personalized consultations and expert guidance, available both in-store and online. This high-touch strategy, evident in their dedicated beauty advisors, fosters trust and loyalty, making clients feel genuinely valued.

Estee Lauder Companies actively cultivates customer loyalty through well-structured programs. These initiatives offer repeat purchasers privileged early access to upcoming product launches, special price reductions, and tailored suggestions based on their purchase history. For instance, in fiscal year 2023, the company's focus on customer retention contributed to a significant portion of its revenue from existing clientele.

Estée Lauder actively cultivates customer relationships through robust digital engagement strategies. This includes a strong presence on social media platforms, personalized email marketing, and the development of interactive digital content designed to build brand loyalty and foster a sense of community.

By directly communicating with consumers via these channels, Estée Lauder gathers valuable feedback and creates immersive online experiences. For instance, in fiscal year 2023, the company reported that its digital channels represented a significant portion of its net sales, demonstrating the effectiveness of its online engagement efforts in driving both connection and commerce.

Customer Service and Support

Estee Lauder Companies prioritizes responsive customer service across multiple touchpoints. This includes readily available online chat, phone support, and in-person assistance within their retail locations. Their commitment ensures customer questions and issues are handled efficiently, boosting overall satisfaction and loyalty.

In 2024, Estee Lauder continued to invest in digital customer support. For instance, their proactive engagement strategies through social media and personalized email campaigns aimed to resolve potential issues before they escalated. This focus on omnichannel support is key to maintaining strong customer relationships in a competitive beauty market.

- Omnichannel Support: Offering seamless assistance via online chat, phone, and in-store interactions.

- Proactive Engagement: Utilizing social media and personalized communications to address customer needs.

- Efficiency in Resolution: Aiming for prompt and effective handling of inquiries and concerns.

- Customer Satisfaction Focus: Enhancing loyalty through positive service experiences.

Educational Content and Beauty Tutorials

Estée Lauder enhances customer relationships by providing valuable educational content and beauty tutorials. These resources, available through online platforms and in-store events, empower customers to better understand and utilize Estée Lauder products, ultimately improving their personal beauty routines.

This strategy positions Estée Lauder as a trusted authority and go-to resource in the beauty industry, fostering deeper engagement and loyalty. For instance, during fiscal year 2023, Estée Lauder saw significant digital engagement, with their online tutorials and educational content contributing to a strong customer base seeking expert advice.

- Educational Content: Estée Lauder offers extensive online tutorials and articles detailing product application and ingredient benefits.

- Beauty Tutorials: Live and pre-recorded video tutorials demonstrate techniques for various looks and skincare routines.

- Expert Tips: Skincare and makeup artists share professional advice, enhancing the customer's experience and product efficacy.

- In-Store Events: Workshops and personalized consultations provide hands-on learning opportunities, reinforcing brand value.

Estée Lauder Companies fosters deep customer loyalty through a multi-faceted approach, blending personalized service with robust digital engagement. Their commitment to customer satisfaction is evident in their omnichannel support and proactive communication strategies, aiming to resolve issues efficiently and enhance the overall brand experience.

In 2024, Estée Lauder continued to leverage its loyalty programs, offering exclusive benefits like early access to new products and personalized recommendations. This focus on rewarding repeat customers, coupled with valuable educational content and tutorials, solidifies their position as a trusted beauty authority and drives sustained engagement.

| Customer Relationship Aspect | Description | 2023/2024 Impact/Focus |

|---|---|---|

| Personalized Service | In-store consultations, expert guidance, and online beauty advisors. | Fosters trust and loyalty, making clients feel valued. |

| Loyalty Programs | Early access, special pricing, tailored suggestions based on purchase history. | Drives repeat purchases and strengthens customer retention. |

| Digital Engagement | Social media, personalized emails, interactive content, online tutorials. | Builds brand loyalty and community, significant contributor to net sales. |

| Customer Support | Omnichannel assistance (online chat, phone, in-store) for efficient issue resolution. | Enhances satisfaction and loyalty through responsive service. |

| Educational Content | Tutorials, articles, expert tips on product use and skincare. | Positions brand as an authority, improves customer experience and product efficacy. |

Channels

Department stores and luxury retailers are crucial for Estée Lauder, offering a premium environment that enhances brand perception and allows for expert customer interaction. These channels provide significant brand visibility, reaching a discerning customer base.

In 2023, Estée Lauder's net sales reached $15.91 billion, with a substantial portion attributed to its strong presence in these high-end retail environments. The company leverages these partnerships to showcase its diverse portfolio, from prestige skincare to luxury fragrances.

Estée Lauder Companies operates its own brand-dedicated freestanding stores, offering customers an immersive experience with the full range of products. This direct channel provides complete control over brand presentation and customer interaction, ensuring a consistent and high-quality experience.

As of fiscal year 2023, Estée Lauder's retail segment, which includes these freestanding stores, generated $6.1 billion in net sales. This segment is crucial for building brand loyalty and showcasing the breadth of their offerings, allowing for direct engagement with consumers.

Estée Lauder leverages its extensive network of brand-specific e-commerce websites to connect directly with consumers worldwide. This robust online infrastructure is crucial for expanding its reach and delivering tailored digital experiences, a strategy that has seen significant growth. For instance, in the fiscal year ending June 30, 2023, Estée Lauder reported that its online channel accounted for a substantial portion of its net sales, reflecting the increasing importance of direct-to-consumer engagement.

Specialty Multi-Retailers (e.g., Sephora, Ulta)

Specialty beauty retailers like Sephora and Ulta are crucial partners for Estée Lauder, offering a direct avenue to a broad consumer base actively seeking new beauty innovations. These channels provide prime real estate for product placement and sampling, significantly boosting brand visibility and encouraging trial. For instance, in fiscal year 2023, Estée Lauder's net sales saw a notable contribution from its performance in the prestige beauty retail channel, underscoring the importance of these partnerships.

These retailers serve as more than just sales points; they are discovery hubs where consumers engage with beauty trends and expert advice. This environment allows Estée Lauder to effectively showcase its diverse portfolio, from established heritage brands to newer, innovative lines. The accessibility and curated experience offered by specialty multi-retailers are key drivers for driving traffic and fostering brand loyalty.

- Broad Demographic Reach: Access to consumers actively exploring beauty trends.

- Enhanced Visibility: Prominent displays and merchandising opportunities.

- Consumer Engagement: In-store experiences and expert recommendations drive trial.

- Sales Channel Performance: Significant contributor to overall revenue, as seen in fiscal year 2023 results.

Travel Retail (Duty-Free Shops and Airports)

Travel retail, encompassing duty-free shops in airports and onboard cruise ships, represents a crucial distribution avenue for Estée Lauder. This channel specifically caters to global travelers looking for premium beauty products, often taking advantage of tax-free pricing.

This segment is vital for achieving substantial sales volumes and broad international brand visibility. For instance, in fiscal year 2023, Estée Lauder reported that its travel retail segment experienced robust growth, driven by the rebound in international travel.

- Global Reach: Airports and cruise terminals provide direct access to a diverse, international customer base.

- High Sales Potential: Travelers often purchase multiple items and premium products in this environment.

- Brand Exposure: Prime locations within travel hubs offer significant visibility for Estée Lauder's extensive portfolio of brands.

Estée Lauder's channels are diverse, encompassing department stores, luxury retailers, freestanding stores, e-commerce, specialty beauty retailers, and travel retail. These channels are strategically chosen to align with brand positioning and target consumer demographics, ensuring premium product presentation and accessibility. The company's extensive online presence, including brand-specific websites, plays a pivotal role in direct-to-consumer engagement and global reach.

In fiscal year 2023, Estée Lauder's net sales reached $15.91 billion. The company's direct-to-consumer (DTC) channels, including its own e-commerce sites and freestanding stores, are increasingly significant. For instance, the retail segment, which includes freestanding stores, generated $6.1 billion in net sales in fiscal year 2023, highlighting the importance of direct customer relationships and brand control.

| Channel Type | Fiscal Year 2023 Significance | Key Attributes |

|---|---|---|

| Department Stores & Luxury Retailers | Crucial for premium brand perception and expert customer interaction. Contributed significantly to overall net sales of $15.91 billion. | Brand visibility, discerning customer base, premium environment. |

| Freestanding Stores | Generated $6.1 billion in net sales for the retail segment. Offers immersive brand experience and direct customer engagement. | Full product range, controlled brand presentation, customer loyalty building. |

| E-commerce (Brand Websites) | Substantial portion of net sales, reflecting growing DTC importance. Expands global reach and offers tailored digital experiences. | Direct connection, personalized experiences, expanded accessibility. |

| Specialty Beauty Retailers (e.g., Sephora, Ulta) | Key partners for broad consumer access and driving trial of new innovations. Significant contributor to prestige beauty retail channel performance. | Discovery hubs, expert advice, prime product placement, consumer engagement. |

| Travel Retail | Experienced robust growth in fiscal year 2023, driven by travel rebound. Vital for international brand visibility and high sales volumes. | Global reach, tax-free purchasing, premium product accessibility for travelers. |

Customer Segments

The affluent and prestige beauty consumer segment is a cornerstone for Estée Lauder Companies. These individuals actively seek out premium beauty products, valuing superior formulations and an elevated brand experience that justifies a higher price point. They often gravitate towards well-established brands with a rich history and a proven track record.

In 2023, Estée Lauder reported net sales of $15.6 billion, with its prestige beauty segment consistently driving a significant portion of this revenue. This demonstrates the strong demand and willingness of this consumer group to invest in luxury beauty offerings.

Estée Lauder Companies serves a vast global consumer base, reaching customers in roughly 150 countries and territories. This expansive reach necessitates a nuanced approach, tailoring product assortments and marketing campaigns to resonate with diverse regional tastes and cultural backgrounds.

Key geographical markets driving Estée Lauder's growth include the Americas, Europe, the Middle East, and Africa (EMEA), and the rapidly expanding Asia-Pacific region. The company places a particular emphasis on high-potential markets such as China and Japan, recognizing their significant contribution to global beauty trends and sales.

In fiscal year 2023, Estée Lauder reported net sales of $15.6 billion, underscoring the immense scale of its global consumer engagement. The company's strategy involves deep market penetration, leveraging local insights to ensure its premium beauty products appeal to a wide demographic spectrum worldwide.

Beauty Enthusiasts and Innovators are Estee Lauder's core demographic, constantly seeking the latest in skincare and makeup. These consumers are highly engaged with emerging trends, often being the first to try new formulations and technologies. In 2024, Estee Lauder saw continued growth in its prestige beauty segment, driven by this segment's appetite for innovation, especially in areas like advanced skincare ingredients and personalized beauty solutions.

Specific Demographic Segments (e.g., Age, Skin Concerns)

Estée Lauder Companies effectively targets a broad range of customers by segmenting its market based on age and specific skin concerns. This approach allows them to leverage their diverse brand portfolio to meet varied consumer needs, from addressing the signs of aging to managing acne or soothing sensitive skin.

For instance, brands like Clinique are known for their dermatologist-developed, allergy-tested products, appealing to consumers with sensitive skin or those seeking a gentle yet effective skincare regimen. Conversely, brands such as The Ordinary have gained significant traction by offering science-backed, ingredient-focused formulations at accessible price points, attracting a younger demographic and those who are ingredient-savvy.

- Age Segmentation: The company's brands cater to a wide age spectrum, from Gen Z consumers interested in preventative skincare and acne solutions to mature consumers focused on anti-aging and firming treatments.

- Skin Concern Targeting: Estée Lauder's portfolio includes specialized lines addressing concerns like hyperpigmentation, dryness, oiliness, and redness, ensuring a tailored product for almost every skin type and issue.

- Brand Differentiation: Brands like MAC focus on makeup artistry for a broad age range, while La Mer targets luxury consumers seeking advanced anti-aging and restorative benefits, showcasing distinct demographic appeals.

- Market Reach: In 2023, Estée Lauder's net sales reached $15.61 billion, demonstrating the significant market penetration achieved by effectively serving these diverse customer segments.

Travelers and Duty-Free Shoppers

International travelers represent a key customer segment for Estée Lauder Companies, particularly within the travel retail channel. These consumers often seek out beauty products at duty-free shops, motivated by perceived value or the availability of exclusive travel retail sets. This segment is vital for driving significant sales volumes and enhancing brand presence in airports and other transit hubs worldwide.

In 2024, Estée Lauder's travel retail segment continued to be a strong performer. The company reported robust growth in this channel, benefiting from the rebound in global travel. For instance, during fiscal year 2024, travel retail was a notable contributor to the company's overall net sales, reflecting the segment's resilience and importance.

- Travel Retail Growth: The travel retail channel experienced a significant uplift in 2024, driven by increased international passenger traffic.

- Consumer Behavior: Travelers often purchase premium beauty products as gifts or personal indulgences while in transit.

- Exclusive Offerings: Estée Lauder leverages travel retail by offering specialized sets and sizes not available in domestic markets, appealing to the gifting and discovery mindset of travelers.

- Brand Visibility: Duty-free locations provide high-traffic visibility, acting as a crucial touchpoint for brand awareness and trial among a global audience.

Estée Lauder Companies targets a diverse global consumer base, with a significant focus on affluent and prestige beauty consumers who value premium formulations and brand experience. The company's extensive reach across approximately 150 countries requires tailored strategies for regional preferences.

Beauty enthusiasts and innovators are also key, driving demand for new technologies and ingredients, particularly in skincare. Estée Lauder also caters to specific age groups and skin concerns, utilizing its broad brand portfolio to meet varied needs, from anti-aging to sensitive skin solutions.

International travelers form another crucial segment, often purchasing premium products in travel retail for gifting or personal indulgence, with exclusive sets enhancing appeal. In fiscal year 2023, Estée Lauder reported net sales of $15.6 billion, reflecting the broad market penetration across these varied customer segments.

| Customer Segment | Key Characteristics | 2023 Net Sales Contribution (Illustrative) |

|---|---|---|

| Affluent & Prestige Beauty Consumers | Seek premium quality, brand heritage, elevated experience | High (Significant portion of $15.6B) |

| Beauty Enthusiasts & Innovators | Early adopters, trend-focused, ingredient-savvy | Strong Growth Driver |

| Age & Skin Concern Focused | Targeted needs (anti-aging, acne, sensitivity), brand loyalty | Broad Demographic Appeal |

| International Travelers | Travel retail purchases, gift-givers, seekers of exclusive sets | Key Growth Channel |

Cost Structure

Estee Lauder Companies dedicates substantial resources to Research and Development, a critical component of their cost structure. This investment fuels innovation, covering everything from initial scientific exploration and sophisticated product formulation to rigorous clinical testing and the protection of intellectual property. For the fiscal year 2023, Estee Lauder reported Selling, General and Administrative expenses, which include R&D, at $5.68 billion.

Manufacturing and production expenses are a significant part of Estee Lauder's cost structure. These costs encompass everything from the raw materials and sophisticated packaging needed for their diverse product lines to the day-to-day operations of their global factories. In fiscal year 2023, Estee Lauder reported Cost of Goods Sold at $7.58 billion, reflecting these substantial outlays.

The company invests heavily in maintaining its extensive network of production facilities worldwide, ensuring efficiency and adherence to high quality standards. This also includes the growing investment in sustainable manufacturing practices, which adds to operational costs but aligns with consumer demand and corporate responsibility goals. Labor costs for skilled workers involved in production and rigorous quality control are also a considerable factor.

Estee Lauder's cost structure heavily features global marketing, advertising, and promotion. This includes significant investment in broad media campaigns, targeted digital marketing, and strategic influencer partnerships to cultivate brand desirability and boost sales volume.

In fiscal year 2023, Estee Lauder Companies reported selling, general, and administrative expenses of $5.4 billion. A substantial portion of this figure is allocated to the extensive marketing and promotional activities essential for maintaining its premium brand image and competitive market position across its diverse product portfolio.

Selling, General, and Administrative (SG&A) Expenses

Estee Lauder’s Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, encompassing everything from employee compensation to the upkeep of its vast retail presence. These costs are essential for driving sales, managing operations, and supporting the brand's global image. For instance, in fiscal year 2023, Estee Lauder reported SG&A expenses of approximately $5.4 billion, reflecting investments in its workforce, marketing efforts, and the extensive network of stores and corporate facilities.

The company is strategically focused on streamlining these expenditures to enhance profitability. Initiatives are underway to optimize the cost structure through various means:

- Salaries and Benefits: This includes compensation for a global workforce of approximately 32,000 employees as of 2023, covering sales, marketing, R&D, and corporate functions.

- Retail and Corporate Real Estate: Costs associated with maintaining a significant physical footprint, including flagship stores, distribution centers, and administrative offices worldwide.

- IT and Digital Infrastructure: Investments in technology to support e-commerce, supply chain management, and internal operations.

- Marketing and Advertising: Substantial spending to promote its diverse portfolio of brands across various channels.

Distribution and Logistics Costs

Estee Lauder's distribution and logistics costs are substantial, reflecting the global nature of their operations. These expenses encompass warehousing, freight, customs duties, and the intricate management of inventory across numerous distribution channels, from direct-to-consumer online sales to traditional retail partnerships. In fiscal year 2023, the company reported significant investments in supply chain enhancements to improve efficiency and responsiveness.

- Warehousing and Storage: Costs associated with maintaining a global network of warehouses to store raw materials, finished goods, and facilitate order fulfillment.

- Transportation and Freight: Expenses incurred for shipping products worldwide via air, sea, and land, including fuel surcharges and carrier fees.

- Customs and Duties: Payments made to governments for importing and exporting goods across international borders, which can vary significantly by region.

- Inventory Management: Costs related to tracking, managing, and optimizing inventory levels to minimize holding costs while ensuring product availability.

Estee Lauder's cost structure is heavily influenced by its extensive marketing and advertising efforts, which are crucial for maintaining brand appeal and driving sales. These expenditures cover a wide array of activities, from large-scale media campaigns to digital marketing and collaborations with influencers. For the fiscal year 2023, the company reported Selling, General and Administrative expenses at $5.4 billion, a significant portion of which is dedicated to these promotional activities.

The company also incurs substantial costs related to manufacturing and production, including raw materials, packaging, and the operation of its global factories. In fiscal year 2023, Estee Lauder's Cost of Goods Sold was $7.58 billion, reflecting these significant operational outlays. This includes investments in maintaining high-quality production standards and increasingly, sustainable manufacturing practices.

Research and Development is another key area of investment, with fiscal year 2023 R&D expenses reported within the $5.4 billion SG&A figure. These investments are vital for product innovation, formulation, testing, and intellectual property protection. Additionally, distribution and logistics costs are considerable, encompassing warehousing, transportation, customs, and inventory management to support its worldwide operations.

| Cost Category | Fiscal Year 2023 (in billions USD) |

|---|---|

| Cost of Goods Sold | $7.58 |

| Selling, General & Administrative (including R&D and Marketing) | $5.40 |

Revenue Streams

Skincare products, encompassing moisturizers, serums, cleansers, and advanced anti-aging treatments, are the bedrock of Estée Lauder Companies' revenue. This segment consistently outperforms others, fueled by the company's relentless pursuit of innovation and the enduring consumer appetite for premium, scientifically-backed formulations. For fiscal year 2023, skincare generated approximately $6.1 billion in net sales, highlighting its dominant position within the company's portfolio.

Estée Lauder Companies generates significant revenue from the sale of a wide array of makeup products, including foundations, lipsticks, mascaras, and eye shadows. This core revenue stream is bolstered by the enduring popularity and strong market presence of its iconic brands, such as MAC and Clinique. For the fiscal year ending June 30, 2023, Estée Lauder reported net sales of $15.91 billion, with its makeup category playing a crucial role in this performance, though specific segment breakdowns are not always publicly detailed.

The sales of fragrance products, particularly luxury and artisanal scents from brands such as Jo Malone London and Le Labo, represent a substantial revenue stream for Estée Lauder Companies. This category has demonstrated notable resilience and consistent growth, especially within the premium and niche fragrance markets.

Sales of Hair Care Products

The Estée Lauder Companies generates revenue through the sale of a diverse range of hair care products, notably under its premium brands like Aveda and Bumble and bumble. This segment, while smaller than its prestige beauty or skincare offerings, plays a crucial role in diversifying the company's overall product portfolio and addressing specialized consumer demands within the hair care market.

For fiscal year 2023, Estée Lauder reported net sales of $15.61 billion. While specific segment breakdowns for hair care are not always explicitly detailed in summary financial reports, the company has consistently highlighted the contribution of its hair care brands to its global beauty business. These brands often command higher price points due to their specialized formulations and brand positioning.

- Brand Strength: Aveda and Bumble and bumble are recognized for their high-quality, often natural-ingredient-focused hair care solutions, appealing to a discerning customer base.

- Market Niche: This segment allows Estée Lauder to capture market share in the premium and professional hair care segments, complementing its broader beauty offerings.

- Portfolio Diversification: The inclusion of hair care products helps mitigate risks associated with over-reliance on any single beauty category, providing a more resilient revenue stream.

E-commerce and Direct-to-Consumer Sales

E-commerce and direct-to-consumer (DTC) sales are increasingly vital for Estee Lauder Companies. This channel offers a direct connection with customers, fostering brand loyalty and providing valuable data. In fiscal year 2023, online sales represented a significant portion of the company's net sales, demonstrating its growing importance.

This DTC approach allows Estee Lauder to maintain greater control over its brand image, pricing strategies, and promotional activities. It also facilitates a more personalized customer experience, from product recommendations to targeted marketing campaigns. The company actively invests in its digital infrastructure to enhance these online capabilities.

- Growing Online Presence: Estee Lauder's e-commerce platforms, including its own brand websites and partnerships with major online retailers, are a key revenue driver.

- Direct Customer Engagement: This channel provides direct access to customer data, enabling more personalized marketing and product development.

- Brand Control and Pricing Power: DTC sales allow the company to manage its brand narrative and pricing more effectively compared to relying solely on third-party distributors.

- Fiscal Year 2023 Performance: While specific online sales figures are often embedded within broader reporting, the company has consistently highlighted the strength and growth of its digital channels in recent financial disclosures.

Estee Lauder Companies' revenue is significantly driven by its extensive wholesale distribution network, which includes department stores, specialty beauty retailers, and travel retail locations globally. This broad reach ensures widespread product availability and accessibility to a diverse customer base. For fiscal year 2023, the company reported net sales of $15.61 billion, with wholesale channels forming a substantial part of this total, though the exact percentage is not typically broken out separately in summary reports.

The company also generates revenue through licensing agreements, allowing other businesses to use its brand names on specific products or in certain markets. This strategy expands brand presence without direct operational investment. Additionally, Estee Lauder benefits from licensing deals for fragrances and other beauty-related items, contributing to its overall financial performance.

Travel retail, encompassing sales in airports and duty-free shops, is another crucial revenue stream, particularly for its prestige brands. This segment capitalizes on global travel trends and consumer spending habits of travelers. The company's strong portfolio of luxury fragrances and skincare is well-suited for this high-traffic, gift-oriented market.

| Revenue Stream | Key Brands/Products | Fiscal Year 2023 Significance |

| Wholesale Distribution | All major brands (e.g., Estée Lauder, MAC, Clinique, La Mer) | Substantial contributor to $15.61 billion net sales; broad market access |

| Licensing Agreements | Fragrances, specific product lines | Brand expansion and revenue diversification |

| Travel Retail | Luxury fragrances, skincare, makeup | Capitalizes on global travel spending; high-margin potential |

Business Model Canvas Data Sources

The Estee Lauder Companies Business Model Canvas is constructed using a blend of internal financial reports, extensive market research on consumer behavior and beauty trends, and competitive analysis of key players in the beauty industry.