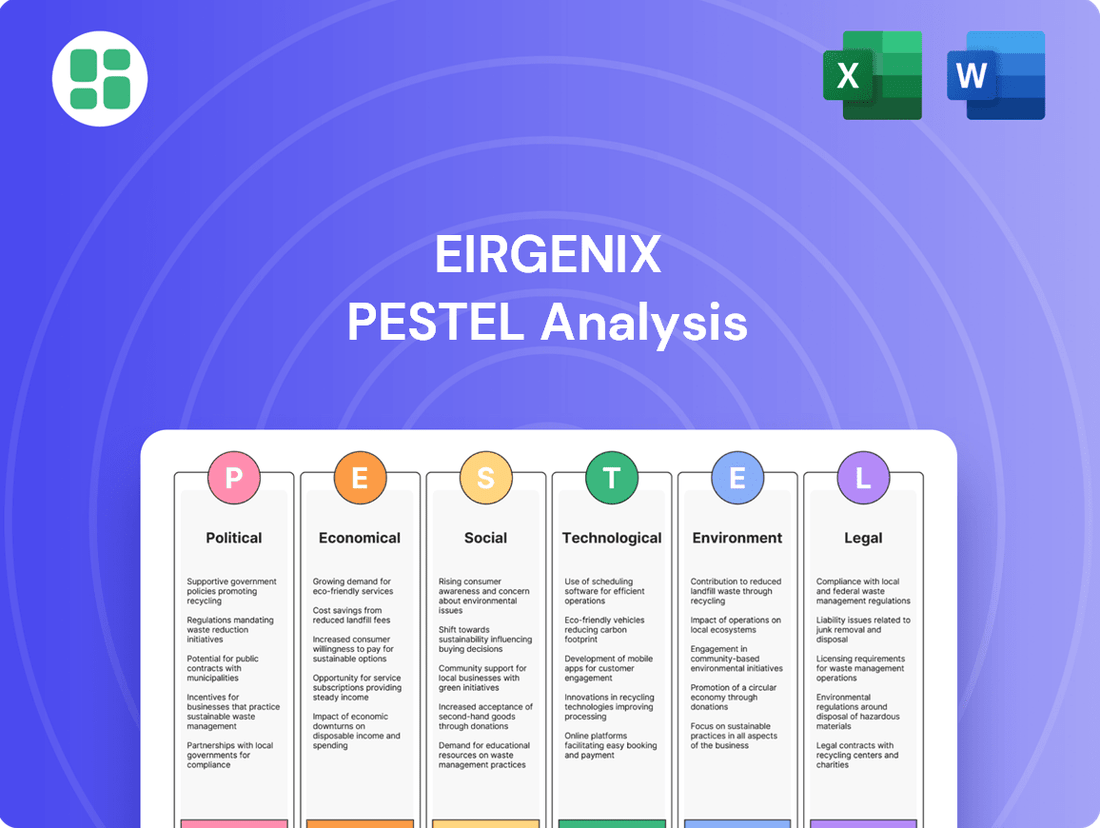

EirGenix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EirGenix Bundle

Uncover the critical political, economic, and technological forces shaping EirGenix's trajectory with our comprehensive PESTLE analysis. Gain a strategic advantage by understanding these external influences and their potential impact on your own market strategy. Download the full version now for actionable intelligence that will empower your decision-making.

Political factors

Government healthcare spending and policy decisions are a significant driver for companies like EirGenix. In the US, for example, the Inflation Reduction Act of 2022 aims to lower prescription drug costs, which could impact the R&D budgets of EirGenix's clients, potentially affecting demand for contract development and manufacturing organization (CDMO) services. This legislation, enacted in August 2022, is a key policy to watch for its downstream effects on the pharmaceutical industry's investment in new biologics.

Policies that encourage biosimilar adoption, such as those promoting market entry and competition, can directly benefit EirGenix. Increased biosimilar development means a greater need for specialized CDMO services to bring these complex biological products to market. For instance, the US Food and Drug Administration (FDA) continues to streamline its biosimilar approval pathway, fostering growth in this segment.

The overall willingness of pharmaceutical companies to invest in new drug development is closely tied to government incentives and regulatory environments. Favorable policies for biologic innovation, coupled with robust healthcare spending, create a more fertile ground for EirGenix's clients to expand their pipelines, thereby increasing the demand for EirGenix's expertise in manufacturing these advanced therapies.

The biopharmaceutical sector, including companies like EirGenix, operates within a dynamic regulatory environment shaped by agencies such as the FDA and EMA. These bodies continuously update guidelines impacting the development and approval of both novel biologics and biosimilars, covering everything from clinical trial design to manufacturing standards. For instance, the FDA's proposed 'biologics modernization' efforts and ongoing reviews of user fee programs like the Biosimilar User Fee Act (BsUFA) are set to redefine pathways for market entry and product lifecycle management in the coming years.

International trade policies and geopolitical stability are critical for EirGenix, a Contract Development and Manufacturing Organization (CDMO). Fluctuations in trade agreements, the imposition of tariffs, and escalating geopolitical tensions can significantly disrupt the global supply chains that EirGenix relies on for sourcing raw materials and distributing its clients' biologics. For instance, the ongoing discussions and potential implementation of policies like the BIOSECURE Act in 2024-2025 could directly impact sourcing strategies and partnership decisions for CDMOs serving global markets.

These evolving trade landscapes introduce considerable uncertainty, compelling EirGenix to prioritize supply chain resilience. Building robust and adaptable supply networks is essential to mitigate risks associated with trade disputes or political instability, ensuring the consistent delivery of critical biopharmaceutical products. The global biopharmaceutical market, valued at an estimated $576 billion in 2023 and projected to grow, makes navigating these political factors even more crucial for sustained operational success.

Government Funding for Biotech Innovation

Government funding and incentives play a crucial role in advancing biotechnology research and development. Programs supporting advanced therapies and biomanufacturing infrastructure directly benefit Contract Development and Manufacturing Organizations (CDMOs) like EirGenix, by stimulating the pipeline of new biopharmaceutical candidates. This increased demand for outsourced development and manufacturing services is a significant positive factor.

For example, the United States government, through agencies like the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA), has allocated billions of dollars to R&D, with a notable focus on areas like mRNA technology and cell and gene therapies. In 2024, the NIH budget alone was over $47 billion, with a substantial portion directed towards biomedical innovation.

Furthermore, investments in national biomanufacturing capabilities, such as those seen in Canada's National Strategy for Biomanufacturing and Life Sciences, aim to bolster domestic production capacity. This can translate into new regional opportunities for CDMOs by fostering a more robust and supportive ecosystem for drug development and manufacturing.

- Increased Demand: Government R&D funding fuels a greater number of biopharmaceutical projects, directly boosting the need for CDMO services.

- Technological Advancement: Incentives for advanced therapies encourage innovation, creating new service opportunities for companies like EirGenix.

- Infrastructure Investment: Support for biomanufacturing infrastructure strengthens the overall industry, benefiting CDMOs by providing a more stable and capable supply chain.

- Regional Growth: National strategies for biomanufacturing can create localized growth opportunities and partnerships for CDMOs operating within those regions.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are paramount in the biologics sector, directly impacting research and development investments and shaping the competitive environment for both novel biologics and their biosimilar counterparts. EirGenix, operating within this dynamic, relies on a robust IP framework to safeguard its innovations and explore opportunities in the growing biosimilar market.

Patent protection is a cornerstone of biopharmaceutical innovation. For instance, the global biologics market, valued at approximately $470 billion in 2023, is heavily influenced by patent lifecycles. Patent expirations for blockbuster biologics, which are anticipated to reach over $200 billion in lost revenue between 2025 and 2030, create significant market entry points for biosimilar manufacturers like EirGenix.

- Global Biologics Market Value (2023): ~$470 billion.

- Projected Patent Expirations Impact (2025-2030): Over $200 billion in lost revenue from blockbuster biologics.

- Biosimilar Market Growth: Expected to reach $100 billion by 2028, indicating substantial opportunity.

Any shifts in IP legislation, such as changes to patentability criteria or enforcement strategies, could profoundly alter the market dynamics for biopharmaceutical products. This includes the potential for extended patent terms or challenges to existing patents, which would directly affect EirGenix's strategic planning and market access for its product pipeline.

Government healthcare policies significantly influence EirGenix's operational landscape. The Inflation Reduction Act of 2022, aiming to lower drug costs, could affect R&D spending by EirGenix's clients, potentially impacting demand for CDMO services. Furthermore, government initiatives supporting biosimilar adoption, like the FDA's streamlined approval pathways, directly benefit EirGenix by increasing the need for specialized manufacturing services for these complex biologics.

Government funding and incentives are vital for biopharmaceutical R&D, directly benefiting CDMOs like EirGenix by stimulating the pipeline of new biopharmaceutical candidates. For instance, the NIH's substantial budget, exceeding $47 billion in 2024, directs significant funds towards biomedical innovation, including advanced therapies. National strategies, such as Canada's focus on biomanufacturing, also bolster domestic capacity, creating regional opportunities for CDMOs.

Intellectual property (IP) laws are critical for EirGenix, shaping R&D investments and the competitive environment for biologics and biosimilars. Patent expirations for major biologics, projected to result in over $200 billion in lost revenue between 2025 and 2030, create market entry points for biosimilar manufacturers. The biosimilar market itself is expected to reach $100 billion by 2028, highlighting substantial growth potential.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing EirGenix, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats for EirGenix.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining EirGenix's strategic discussions by offering a digestible overview of external factors.

Economic factors

The global biologics CDMO market is on a significant upward trajectory. It's expected to grow from an estimated $21.3 billion in 2024 to $24.37 billion in 2025, indicating robust expansion. This growth is fueled by a rising demand for advanced biologic treatments and the increasing development of biosimilars.

Furthermore, the trend of pharmaceutical companies outsourcing complex manufacturing processes is a key driver. This outsourcing allows them to focus on research and development, leveraging specialized expertise. EirGenix, with its capabilities, is strategically positioned to benefit from this expanding market opportunity.

By 2029, the market is projected to reach $42.33 billion, underscoring the sustained demand for biologics manufacturing services. This presents a substantial opportunity for companies like EirGenix to scale their operations and capture a larger market share.

The pharmaceutical and biotechnology sectors' commitment to research and development is a direct driver for contract development and manufacturing organizations (CDMOs) like EirGenix. In 2024, the biotech industry experienced a notable increase in investment, with projections for 2025 suggesting continued, albeit cautious, optimism. This upward trend, however, is tempered by uneven capital availability, particularly for smaller biotechs.

EirGenix's value proposition hinges on its capacity to provide cost-effective and adaptable manufacturing solutions, which is paramount for securing clients across the diverse funding spectrum. As of early 2025, the global pharmaceutical R&D spending is estimated to exceed $250 billion annually, with a significant portion allocated to drug discovery and early-stage development, areas where CDMO partnerships are increasingly vital. Companies that can navigate the funding landscape effectively will be best positioned to leverage these CDMO capabilities.

The pharmaceutical and biotech sectors are increasingly relying on Contract Development and Manufacturing Organizations (CDMOs) to cut costs, improve efficiency, and speed up the introduction of new biologics. This shift, fueled by the demand for specialized skills and facilities, directly benefits companies like EirGenix that offer these services.

The global CDMO market is projected to reach approximately $320 billion by 2027, showcasing a significant upward trend in outsourcing. This growth highlights the strategic advantage for EirGenix as more firms opt for this model to manage complex development and manufacturing.

An 'asset-light outsourcing' approach is particularly appealing to small and medium-sized enterprises (SMEs) in biotech, allowing them to conserve capital. EirGenix's ability to provide these flexible solutions positions it well to capture a larger share of this expanding market.

Inflation and Interest Rate Environment

The prevailing inflation and interest rate environment significantly impacts EirGenix's operational costs and its clients' investment capabilities. For instance, while interest rates remained relatively low in early 2024, fostering a more optimistic climate for biotech investments and easing capital access for research and development, persistent inflation presents a counter-challenge.

Inflationary pressures, particularly evident in supply chain disruptions and raw material costs throughout 2023 and into 2024, directly translate to higher manufacturing expenses for EirGenix. This can erode profit margins if not effectively managed through pricing strategies or operational efficiencies. Conversely, a sustained period of lower interest rates, as anticipated by many economic forecasts for the latter half of 2024, could further stimulate investment appetite in the capital-intensive biotechnology sector, potentially benefiting EirGenix's funding prospects.

- Inflationary Impact: Rising costs for raw materials and energy in 2023-2024 have increased operational expenditures for biotech firms like EirGenix.

- Interest Rate Influence: Lower interest rates in early 2024 have historically encouraged investment in growth sectors like biotechnology, improving capital availability.

- Investment Climate: Projections for continued moderate interest rates through 2025 suggest a potentially favorable environment for EirGenix to secure funding for its drug development pipeline.

Emergence of Biosimilars and Biobetters

The expanding market for biosimilars and biobetters is a key economic force, designed to increase worldwide healthcare availability and reduce expenses. For instance, the global biosimilars market was valued at approximately $17.8 billion in 2023 and is projected to reach $57.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 18.2% during this period.

EirGenix's strategic emphasis on both biosimilars and innovative biologics places it favorably to capitalize on this growth. The development and manufacturing of these complex biological products demand specialized expertise, particularly in navigating stringent regulatory processes and achieving successful market entry.

- Market Growth: The biosimilars market is experiencing robust expansion, indicating increasing demand for more affordable biologic treatments.

- Cost Reduction: Biosimilars are crucial for lowering healthcare expenditures, making advanced therapies accessible to a broader patient population.

- EirGenix's Position: The company's dual focus allows it to serve both the established biologics sector and the rapidly growing biosimilar segment.

- Regulatory Navigation: Successfully bringing biosimilars to market requires significant investment in regulatory affairs and quality control, areas where specialized CDMOs like EirGenix can provide essential support.

Economic factors significantly shape the biologics CDMO landscape. The global biologics CDMO market is projected to grow from an estimated $21.3 billion in 2024 to $24.37 billion in 2025, driven by increased demand for advanced therapies and biosimilars.

Inflationary pressures, particularly in raw material and energy costs throughout 2023 and 2024, directly impact manufacturing expenses for companies like EirGenix. Conversely, forecasts for moderate interest rates through 2025 suggest a potentially favorable environment for securing investment in the capital-intensive biotechnology sector.

The expanding biosimilars market, valued at approximately $17.8 billion in 2023 and projected to reach $57.3 billion by 2030, presents a substantial opportunity for EirGenix, given its focus on both biosimilars and innovative biologics.

| Market Segment | 2023 Value (USD Billion) | 2024 Projection (USD Billion) | 2025 Projection (USD Billion) | CAGR (2023-2030) |

|---|---|---|---|---|

| Global Biologics CDMO Market | N/A | 21.3 | 24.37 | N/A |

| Global Biosimilars Market | 17.8 | N/A | N/A | 18.2% |

Preview the Actual Deliverable

EirGenix PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EirGenix PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape EirGenix operates within.

Sociological factors

The world's population is getting older, and with that comes more chronic illnesses. This trend directly fuels the need for sophisticated biologic treatments, creating a significant opportunity for companies like EirGenix, a Contract Development and Manufacturing Organization (CDMO). As more people require complex biologic therapies, the demand for EirGenix's specialized development and manufacturing services grows.

Globally, the proportion of people aged 65 and over is projected to reach 16% by 2050, up from 10% in 2022. This demographic shift means a larger patient pool needing treatments for conditions like cancer, autoimmune disorders, and persistent infections. EirGenix is well-positioned to capitalize on this, as these very areas are experiencing substantial growth in demand for advanced biologic solutions.

The healthcare landscape is rapidly evolving with a significant surge in demand for personalized medicine and advanced therapies like cell and gene therapies. This trend is directly fueling the need for specialized biomanufacturing capabilities, a core strength of EirGenix.

EirGenix's established expertise in biologics manufacturing is ideally suited to support the intricate development and production pipelines of these highly customized treatments. For instance, the global cell and gene therapy market was valued at approximately $12.1 billion in 2023 and is projected to reach $45.6 billion by 2030, showcasing substantial growth potential for biomanufacturers like EirGenix.

Meeting the unique requirements of personalized medicine necessitates manufacturing solutions that are not only flexible but also scalable. EirGenix's ability to adapt its processes to cater to individualized patient needs positions it favorably to capitalize on this expanding market segment.

Public perception significantly shapes the market for biotechnology products. For instance, a 2024 survey indicated that while 65% of the public expressed optimism about gene therapies' potential to treat rare diseases, a notable 20% remained concerned about long-term safety and ethical implications.

This sentiment directly impacts EirGenix's clients, as widespread public acceptance can accelerate regulatory approvals and market penetration for novel biologics and gene therapies. Positive media coverage and patient success stories, like the reported 90% improvement in a specific genetic disorder following a 2025 trial, bolster this acceptance.

Conversely, negative public discourse surrounding issues like data privacy in genetic research or perceived inequities in access to advanced treatments could create significant hurdles. Such controversies might lead to stricter regulations or reduced investment, impacting EirGenix's business development opportunities.

Healthcare Access and Affordability

Societal demand for accessible and affordable healthcare, especially for high-cost biologic drugs, is a significant driver in shaping pharmaceutical pricing strategies and fostering the growth of biosimilars. This pressure is evident as global healthcare spending continues to rise, with the biopharmaceutical sector representing a substantial portion. For instance, the global biologics market was valued at approximately USD 390 billion in 2023 and is projected to grow significantly, underscoring the cost challenges.

EirGenix plays a crucial role in this landscape by expediting the development and manufacturing of novel biologic medicines and supporting the creation of biosimilars. This dual focus directly addresses the public health imperative to broaden access to life-saving treatments. By enabling more cost-effective production pathways, EirGenix contributes to making advanced therapies available to a larger patient population, a trend that is expected to gain momentum through 2025 as more biologics come off patent.

- Societal Demand: Growing public expectation for equitable access to advanced medical treatments, particularly biologics.

- Market Influence: Pressure on drug pricing and increased investment in biosimilar development to enhance affordability.

- EirGenix's Contribution: Accelerating new biologics to market and facilitating biosimilar production to improve accessibility.

- Cost-Effectiveness: EirGenix's work directly supports public health goals by making treatments more financially viable for patients and healthcare systems.

Talent Shortage in Biopharma

The biopharmaceutical industry, despite some recent workforce adjustments, continues to grapple with a significant talent deficit. This shortage is particularly acute in highly specialized areas such as Good Manufacturing Practice (GMP) production, artificial intelligence (AI) applications, and advanced data analytics. For contract development and manufacturing organizations (CDMOs) like EirGenix, this scarcity of skilled professionals presents a considerable hurdle in attracting and keeping the necessary expertise.

This ongoing 'brain drain' impacts EirGenix's ability to scale operations and maintain its competitive edge. For instance, a 2024 industry survey indicated that over 60% of biopharma companies reported difficulty filling roles requiring specialized scientific and technical skills. Addressing this requires proactive strategies focused on talent development and robust training programs.

To counter this, EirGenix and similar CDMOs must invest heavily in workforce development. This includes:

- Expanding internal training programs to upskill existing employees in areas like advanced biologics manufacturing and digital technologies.

- Collaborating with academic institutions to foster a pipeline of future talent, potentially offering internships and co-op opportunities in specialized fields.

- Implementing competitive compensation and benefits packages to attract and retain top-tier talent in high-demand scientific and technical roles.

Societal expectations for equitable access to advanced medical treatments, particularly biologics, are a significant driver in the pharmaceutical landscape. This demand pressures drug pricing and spurs investment in biosimilar development to improve affordability. EirGenix plays a crucial role by expediting new biologics to market and facilitating biosimilar production, thereby enhancing treatment accessibility and contributing to public health goals by making therapies more financially viable.

Technological factors

The biologics contract development and manufacturing organization (CDMO) sector is experiencing significant growth, fueled by rapid advancements in manufacturing technologies. Innovations such as improved cell lines, the widespread adoption of single-use bioreactors, and the emergence of continuous manufacturing processes are key drivers. These technological leaps are crucial for enhancing production efficiency, scalability, and the overall flexibility of cGMP manufacturing.

EirGenix's ability to integrate these cutting-edge innovations directly impacts its competitiveness. By adopting these advancements, the company can optimize its processes for producing complex therapeutics like monoclonal antibodies and other advanced biologics. This adoption is vital for ensuring enhanced product potency and meeting the evolving demands of the biopharmaceutical industry, particularly as the global biologics CDMO market is projected to reach over $30 billion by 2027, growing at a CAGR of approximately 12%.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the biologics sector. These technologies are accelerating the discovery, design, and manufacturing of biopharmaceuticals, significantly shortening development timelines and boosting overall efficiency. For EirGenix, this presents a substantial opportunity to enhance its operations.

EirGenix can harness AI-powered tools to refine its process development, pinpoint promising new drug targets, and elevate the quality and output of its biopharmaceutical manufacturing. This technological advancement is becoming crucial for bringing novel treatments to market more rapidly and at a reduced cost. For instance, in 2024, the biopharmaceutical industry saw increased investment in AI-driven drug discovery, with some reports suggesting AI can reduce early-stage drug discovery timelines by up to 40%.

Process intensification and automation are key for EirGenix to lower production expenses and ensure uniform quality in biopharmaceutical manufacturing. Technologies like automated bioreactor controls, smart pumps, and predictive analytics are boosting efficiency and minimizing mistakes. For instance, the global biopharmaceutical automation market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards these advancements.

By integrating sophisticated automation into its current Good Manufacturing Practice (cGMP) facilities, EirGenix can capitalize on these efficiencies. This move aligns with the broader industry push to streamline operations, reduce batch variability, and ultimately enhance the cost-effectiveness of producing complex biological medicines. The increasing demand for biologics necessitates scalable and reliable manufacturing processes, which advanced automation directly supports.

Emergence of Advanced Therapy Platforms

The biopharmaceutical landscape is rapidly evolving with the rise of advanced therapies like cell and gene therapies, demanding highly specialized manufacturing infrastructure. EirGenix, as a Contract Development and Manufacturing Organization (CDMO), must proactively invest in and adapt to the unique technological requirements for these complex modalities. This includes developing robust solutions for scalable logistics, overcoming intricate manufacturing challenges, and integrating purpose-built automation and advanced analytical technologies to meet the stringent quality and efficiency demands of these cutting-edge treatments.

The market for cell and gene therapies is experiencing exponential growth. For instance, the global cell and gene therapy market was valued at approximately $15.7 billion in 2023 and is projected to reach $69.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 23.8% during this period. This surge underscores the critical need for CDMOs like EirGenix to possess advanced capabilities.

- Scalable Logistics: Ensuring the seamless and temperature-controlled transport of sensitive biological materials from patient to manufacturing site and back is paramount.

- Manufacturing Hurdles: Addressing the complexities of cell expansion, genetic modification, and purification processes requires specialized bioreactors and containment systems.

- Automation and Analytics: Implementing advanced automation for process control and sophisticated analytical tools for quality assurance are essential for consistent and compliant production.

Digitalization and Data Analytics

The biopharmaceutical sector is rapidly embracing digitalization and sophisticated data analytics, fundamentally reshaping operational processes. This shift is crucial for companies like EirGenix to stay competitive.

By integrating digital tools and advanced analytics, biopharma firms can expect substantial improvements. For instance, a McKinsey report highlighted that advanced analytics can reduce process deviations by up to 30% and boost plant capacity by as much as 15%. These technologies enable real-time process monitoring, allowing for immediate adjustments and proactive problem-solving.

EirGenix can leverage these capabilities for predictive maintenance, minimizing unexpected downtime and ensuring consistent production. Furthermore, optimizing workflows through data analysis can lead to more efficient resource allocation and enhanced overall operational performance, directly impacting cost-effectiveness and output.

Key applications for EirGenix include:

- Real-time monitoring of critical process parameters to ensure product quality and consistency.

- Predictive maintenance scheduling for manufacturing equipment, reducing costly unplanned outages.

- Data-driven optimization of batch production cycles, leading to increased throughput.

- Enhanced compliance through automated data collection and reporting.

Technological advancements are a significant driver in the biologics CDMO sector, with innovations like single-use bioreactors and continuous manufacturing boosting efficiency and scalability. EirGenix's ability to adopt these technologies is crucial for its competitiveness in a market projected to exceed $30 billion by 2027.

The integration of AI and ML is accelerating biopharmaceutical development and manufacturing, offering EirGenix opportunities to refine processes and identify new drug targets, potentially cutting early-stage discovery timelines by up to 40% as seen in 2024 industry trends.

Process intensification and automation, including automated controls and predictive analytics, are key to lowering production costs and ensuring quality, with the biopharmaceutical automation market valued at approximately $4.5 billion in 2023.

The rise of advanced therapies like cell and gene therapies, a market expected to reach $69.2 billion by 2030, necessitates specialized manufacturing capabilities and investment in automation and advanced analytics for CDMOs like EirGenix.

Legal factors

EirGenix, as a biologics CDMO, must strictly adhere to current Good Manufacturing Practices (cGMP) and ever-changing quality standards. Regulatory bodies like the FDA and EMA regularly update their requirements, and failure to comply can result in severe penalties, production halts, or even product recalls. For instance, in 2023, the FDA issued numerous warning letters to drug manufacturers for cGMP violations, highlighting the critical nature of compliance.

EirGenix's success hinges on its clients navigating the Biologics License Application (BLA) and Investigational New Drug (IND) processes. The U.S. Food and Drug Administration (FDA) continues to refine BLA requirements, with recent updates in 2024 focusing on enhanced data integrity and expedited review pathways for certain therapies.

Staying abreast of evolving regulatory guidance, such as new stipulations on promotional labeling and post-approval changes, is critical. For instance, the FDA's increased scrutiny on biosimilar interchangeability, a key area for biologics, directly impacts EirGenix's clients and their market access strategies.

Intellectual property laws, especially patents, are crucial for biopharma companies like EirGenix. Navigating patents for new biologics and biosimilars is essential, and EirGenix may need to support clients with patent data. As of early 2024, the biopharmaceutical sector continues to see significant patent expirations, with several major blockbuster drugs facing or having recently faced their patent cliffs, opening doors for biosimilar competition.

Clinical Trial Regulations

Regulations governing clinical trials, encompassing design, data collection, and patient safety, are paramount for drug development and directly affect EirGenix's upstream services. These frameworks ensure the integrity and ethical conduct of research, influencing the timeline and expense involved in bringing new biologics to market. For instance, evolving guidelines on real-world evidence (RWE) trials are reshaping how efficacy and safety data are gathered and presented to regulatory bodies.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key regulators whose evolving stances on clinical trial methodologies, including the acceptance of decentralized clinical trials (DCTs) and the use of digital health technologies, directly impact service providers like EirGenix. In 2024, the global clinical trials market was valued at an estimated $22.5 billion, with ongoing regulatory adjustments expected to influence its growth trajectory.

- Regulatory Scrutiny: Stricter oversight on data integrity and patient consent processes can increase operational costs and complexity for EirGenix.

- RWE Integration: Adaptations to regulations allowing greater use of real-world data in submissions can create new opportunities for EirGenix's data management services.

- Global Harmonization: Efforts towards harmonizing clinical trial regulations across different regions, such as through the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), aim to streamline development but require continuous compliance updates.

Data Privacy and Security Regulations

EirGenix operates in a landscape increasingly shaped by data privacy and security regulations. As biopharmaceutical development relies heavily on sensitive client and patient information, compliance with frameworks like GDPR and HIPAA is paramount. Failure to secure this data can lead to significant fines and reputational damage.

Ensuring robust data handling practices throughout EirGenix's development and manufacturing processes is crucial for maintaining client trust and regulatory adherence. This includes secure storage, transmission, and processing of all proprietary and personal health information. For instance, in 2023, the global cost of data breaches averaged $4.45 million, highlighting the financial implications of non-compliance.

- GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

- HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums of $1.5 million for repeat offenders.

- The biopharmaceutical sector is a prime target for cyberattacks due to the high value of intellectual property and patient data.

EirGenix must navigate a complex web of international and national regulations governing drug development, manufacturing, and distribution. Adherence to current Good Manufacturing Practices (cGMP) remains a cornerstone, with regulatory bodies like the FDA and EMA continuously updating standards. For example, in 2024, the FDA emphasized stricter data integrity requirements for biologics manufacturing.

The evolving landscape of intellectual property law, particularly patent protection for biologics and biosimilars, directly impacts EirGenix's clients and their market strategies. With several blockbuster biologics facing patent expirations in the early 2020s, the demand for biosimilar development services is increasing, making patent navigation crucial for EirGenix's business pipeline.

Data privacy and security regulations, such as GDPR and HIPAA, are critical considerations for EirGenix, given the sensitive nature of client and patient data handled. The average cost of a data breach in 2023 reached $4.45 million globally, underscoring the financial and reputational risks associated with non-compliance.

| Regulatory Area | Key Considerations for EirGenix | Impact/Data Point (2023-2024) |

|---|---|---|

| cGMP Compliance | Adherence to evolving manufacturing standards, data integrity | FDA issued numerous warning letters in 2023 for cGMP violations. |

| Intellectual Property | Patent protection for biologics and biosimilars | Significant patent expirations for major biologics creating biosimilar opportunities. |

| Data Privacy & Security | GDPR, HIPAA compliance for sensitive data | Global average cost of data breach in 2023: $4.45 million. |

| Clinical Trial Regulations | Design, data collection, patient safety, RWE integration | Global clinical trials market valued at $22.5 billion in 2024, influenced by regulatory shifts. |

Environmental factors

The biopharmaceutical sector, including companies like EirGenix, is under growing pressure to implement sustainable biomanufacturing. This is largely due to escalating concerns about global warming and increasingly stringent environmental regulations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting supply chains across industries.

To address this, EirGenix must prioritize green chemistry principles, focusing on reducing hazardous waste generation, such as solvent use and byproducts. Optimizing resource consumption, particularly water and energy, is also critical. Globally, the pharmaceutical industry's water usage can be substantial; for example, some bioprocesses require millions of liters of purified water per batch.

Furthermore, a transition to renewable energy sources is essential for minimizing EirGenix's environmental footprint. Many leading biopharma companies are setting ambitious targets, with some aiming for 100% renewable electricity usage by 2030. This shift not only aligns with industry-wide sustainability goals but also offers potential long-term cost savings and enhanced brand reputation.

EirGenix faces significant environmental challenges in pharmaceutical manufacturing, with waste generation being a major concern. The industry produces substantial amounts of hazardous materials and single-use plastics, contributing to pollution.

To address this, EirGenix must prioritize robust waste management strategies. This includes actively exploring the adoption of biodegradable materials and implementing zero-liquid discharge (ZLD) processes to minimize environmental impact and ensure regulatory compliance. The significant contribution of single-use items to pharmaceutical plastic waste, accounting for nearly 50%, underscores the critical need for innovation in this area.

The energy-intensive nature of biomanufacturing means EirGenix likely has a substantial carbon footprint. This is a growing concern for the industry, with many companies actively seeking ways to become more sustainable.

To address this, EirGenix should prioritize reducing its energy consumption and exploring a shift towards renewable energy sources like solar and wind power. This move is crucial for lowering its Scope 1 and 2 greenhouse gas emissions, aligning with broader industry trends.

Indeed, the commitment to sustainability is evident, as over 25% of biopharmaceutical companies are already establishing medium-term emission reduction targets that are consistent with a 1.5°C global warming pathway.

Water Usage and Conservation

Water is absolutely essential for biopharmaceutical manufacturing, and EirGenix relies on it heavily for everything from cleaning equipment to the actual production processes. As global water demand continues to climb, especially with increasing industrial needs, focusing on smart water management becomes a strategic imperative for companies like EirGenix.

To ensure sustainable operations and minimize their environmental footprint, EirGenix should really look into implementing advanced water conservation strategies. This includes investing in sophisticated water recycling systems that can reuse water multiple times within the facility. Additionally, exploring zero-liquid discharge (ZLD) technologies, which aim to eliminate liquid waste entirely by recycling and reusing water and solids, could significantly reduce their impact and reliance on fresh water sources.

Consider these key areas for EirGenix:

- Water Scarcity Projections: By 2050, it's estimated that over 5 billion people could face water scarcity, underscoring the urgency for industries to adopt conservation measures.

- Biopharma Water Intensity: The biopharmaceutical sector is known for its high water consumption; some estimates suggest that producing a kilogram of biopharmaceutical product can require thousands of liters of water.

- ZLD Technology Advancements: Innovations in ZLD are making these systems more efficient and cost-effective, with global market growth projected to continue steadily through the next decade.

- Regulatory Pressures: Increasingly stringent environmental regulations worldwide are pushing companies to adopt more sustainable water practices, often with financial incentives or penalties tied to water usage and discharge.

Supply Chain Environmental Impact

EirGenix's environmental footprint is significantly shaped by its supply chain, encompassing everything from raw material sourcing to the final delivery of its products. The extraction of raw materials, often involving mining or agricultural processes, can have substantial impacts on land use, water consumption, and biodiversity. For instance, the pharmaceutical industry's reliance on certain chemical precursors can be tied to energy-intensive production processes and potential waste generation at the source.

Addressing these upstream impacts is crucial for EirGenix's sustainability efforts. Decarbonizing the supply chain, a key objective for many businesses by 2025, involves evaluating and reducing emissions associated with logistics and supplier operations. Favoring local sourcing, where feasible, can dramatically cut down on transportation-related emissions. Globally, the push for Scope 3 emissions reductions is gaining momentum, with companies aiming to influence their entire value chain's environmental performance.

- Supply Chain Emissions: The pharmaceutical sector's Scope 3 emissions, often related to purchased goods and services, can represent a significant portion of its total carbon footprint.

- Transportation Impact: Global shipping and air freight, commonly used in pharmaceutical supply chains, contribute substantially to greenhouse gas emissions. A study by the International Air Transport Association (IATA) in 2023 highlighted that aviation accounts for approximately 2.5% of global CO2 emissions.

- Local Sourcing Benefits: Reducing reliance on distant suppliers can lower transportation costs and emissions, as well as potentially improve supply chain resilience.

- Industry Initiatives: Many pharmaceutical companies are joining alliances like the Sustainable Procurement Pledge to collectively address supply chain environmental challenges.

EirGenix must navigate increasing environmental pressures, from waste management to resource efficiency. The biopharmaceutical sector's substantial water and energy needs, coupled with a growing demand for sustainable practices, necessitate proactive strategies. For instance, the European Union's goal of climate neutrality by 2050 signals a tightening regulatory landscape for all industries, including biopharma.

Focusing on green chemistry and reducing hazardous waste, such as solvents, is paramount. The industry's significant water usage, with some bioprocesses consuming millions of liters per batch, highlights the need for advanced water conservation and recycling systems. Furthermore, adopting renewable energy sources is crucial to minimize EirGenix's carbon footprint, aligning with industry trends where over 25% of biopharmaceutical companies are setting emission reduction targets consistent with a 1.5°C warming pathway.

Addressing the environmental impact of its supply chain is also critical for EirGenix. This includes evaluating and reducing emissions from logistics and raw material sourcing, as the pharmaceutical sector's Scope 3 emissions can be substantial. Initiatives like favoring local sourcing and joining industry alliances for sustainable procurement are key to mitigating these upstream impacts and enhancing overall supply chain resilience.

| Environmental Factor | EirGenix Relevance | Key Data/Trend (2024-2025) | Actionable Insight |

| Waste Management | Significant generation of hazardous materials and single-use plastics. | Pharmaceutical plastic waste from single-use items accounts for nearly 50% of total plastic waste. | Prioritize biodegradable materials and zero-liquid discharge (ZLD) processes. |

| Water Consumption | High reliance on water for manufacturing and cleaning. | Over 5 billion people projected to face water scarcity by 2050; biopharma can use thousands of liters per kg of product. | Invest in advanced water recycling and ZLD technologies. |

| Energy Use & Emissions | Energy-intensive biomanufacturing processes. | Over 25% of biopharma companies setting 1.5°C pathway emission targets; aviation (key for global shipping) accounts for ~2.5% of global CO2. | Transition to renewable energy sources and reduce Scope 1 & 2 emissions. |

| Supply Chain Impact | Environmental footprint from raw material sourcing to logistics. | Scope 3 emissions are significant; global shipping's carbon intensity is a major concern. | Decarbonize supply chain, explore local sourcing, and join sustainability initiatives. |

PESTLE Analysis Data Sources

Our EirGenix PESTLE Analysis is meticulously constructed using data from leading financial institutions, government regulatory bodies, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape.