EirGenix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EirGenix Bundle

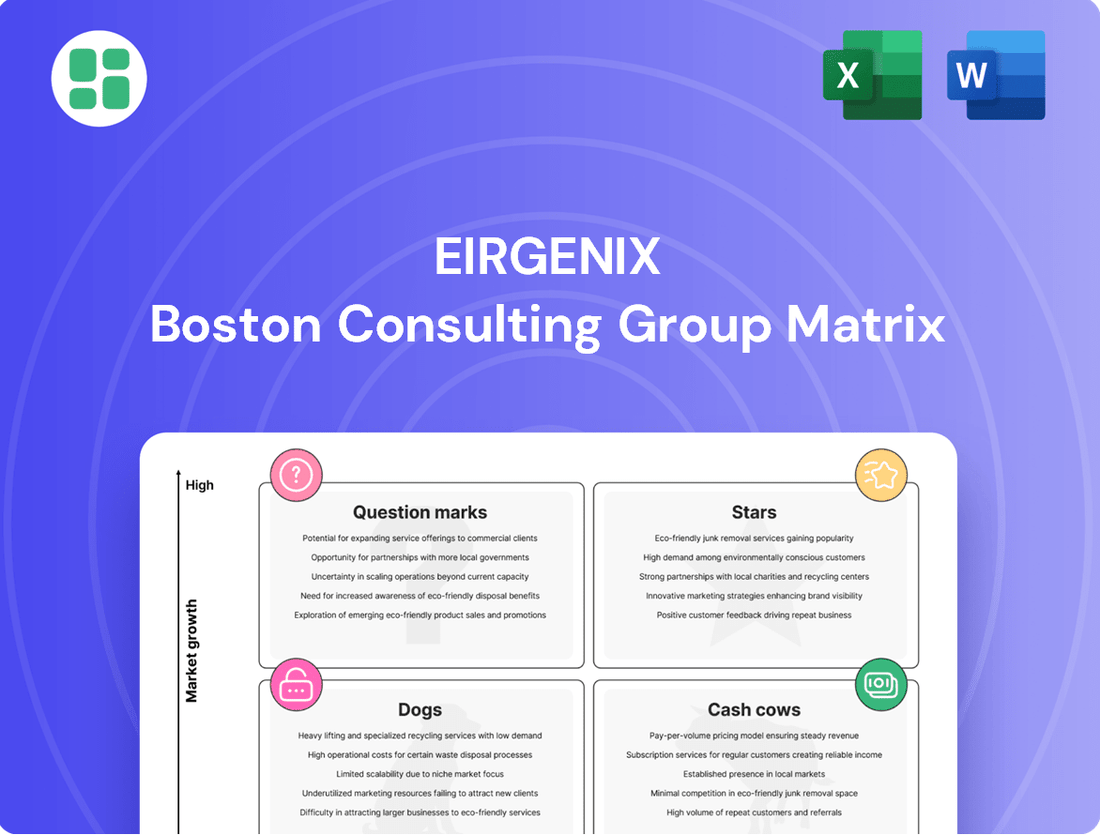

Uncover the strategic positioning of EirGenix's product portfolio with this insightful BCG Matrix preview. See which products are driving growth and which might need a closer look.

To truly unlock EirGenix's competitive advantage, dive into the full BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and receive actionable insights to optimize your investment strategy.

Don't just see the surface; understand the depth of EirGenix's market performance. Purchase the complete BCG Matrix for a detailed breakdown and a clear roadmap to capitalize on opportunities and mitigate risks.

Stars

EirGenix's dedication to novel biologics and advanced therapies, including complex antibody-drug conjugates (ADCs) and novel therapeutic proteins, places them squarely in a rapidly expanding market. This focus on cutting-edge modalities is a key driver of their star potential within the BCG matrix.

The broader biologics contract development and manufacturing organization (CDMO) market is experiencing robust growth, with projections indicating a compound annual growth rate of 15.7% from 2025 to 2034. This surge is fueled by the increasing demand for sophisticated and innovative therapeutic solutions.

EirGenix's established expertise in mammalian cell culture systems, the predominant platform for biologics production, further solidifies their position as a star. Their integrated CDMO services are well-suited to meet the complex manufacturing needs of these high-value biological products.

EirGenix's integrated end-to-end Contract Development and Manufacturing Organization (CDMO) solutions, covering everything from cell line development to commercial cGMP manufacturing, position it strongly in the biopharmaceutical outsourcing market. This comprehensive approach addresses the growing need for streamlined drug development pathways, allowing clients to accelerate their time-to-market.

The biopharmaceutical outsourcing market is expanding rapidly, with projections indicating continued robust growth through 2024 and beyond. Companies like EirGenix, offering these all-encompassing services, are highly sought after as they simplify the complex development process for their clients.

EirGenix's EG12014 (Trastuzumab Biosimilar) is a strong performer, boasting European Commission marketing authorization and a positive CHMP opinion. This signifies robust market acceptance and regulatory achievement for their breast cancer biosimilar.

With global marketing and supply licensing agreements in place, EG12014 is poised for significant market penetration in the expanding biosimilars sector. This strategic positioning points to a substantial market share or a very promising outlook.

The substantial revenue generated by EG12014 is a testament to its commercial success, firmly establishing EirGenix as a significant entity within the biosimilar landscape.

Large-Scale Mammalian Cell Culture Manufacturing Capacity

EirGenix is a prominent player in Taiwan's biologics CDMO market, especially in large-scale mammalian cell culture manufacturing. The company has made substantial investments to boost its capacity, including plans for twelve 2,000L single-use bioreactors. This expansion is projected to enable the production of up to 1,000kg of antibodies annually, positioning EirGenix as a leader in this specialized field.

Mammalian cell culture technology is the cornerstone of biologics CDMO demand because it's crucial for producing complex proteins. This makes it a high-growth, high-share segment for EirGenix, reflecting its strategic focus on a critical and expanding area of biopharmaceutical manufacturing.

- Investment in Capacity: EirGenix is investing significantly in expanding its mammalian cell cGMP manufacturing capacity.

- Bioreactor Fleet: Plans include twelve 2,000L single-use bioreactors.

- Annual Production Potential: This expansion aims for an annual production capacity of up to 1,000kg of antibodies.

- Market Position: EirGenix is a leader in Taiwan for this technology, driven by the dominance of mammalian cell culture in biologics CDMO.

Strategic Global Partnerships and Regulatory Approvals

EirGenix's strategic global partnerships are a cornerstone of its market position. Collaborations with giants like Sandoz and Clarity Pharmaceuticals, announced in 2023 and early 2024, have significantly expanded EirGenix's reach and service offerings in the biopharmaceutical sector.

These alliances are bolstered by EirGenix's robust regulatory compliance. Their current Good Manufacturing Practice (cGMP) facilities have achieved certifications from major regulatory bodies including the US FDA, Taiwan FDA, and Japan PMDA. This multi-jurisdictional approval, notably confirmed by recent successful FDA inspections in late 2023, is critical for global market access.

- Sandoz Partnership: Focused on the development and manufacturing of biosimilars, contributing to EirGenix's growing pipeline in high-demand therapeutic areas.

- Clarity Pharmaceuticals Collaboration: Centers on radiopharmaceutical manufacturing, a rapidly expanding niche market with significant growth potential projected through 2025.

- Regulatory Certifications: US FDA, Taiwan FDA, and Japan PMDA approvals underscore EirGenix's commitment to quality and enable seamless market entry into key global territories.

- Market Access: These partnerships and certifications collectively facilitate broad market penetration, reinforcing EirGenix's status as a trusted Contract Development and Manufacturing Organization (CDMO).

EirGenix's EG12014 (Trastuzumab Biosimilar) is a standout product, demonstrating strong market acceptance with European Commission marketing authorization and a positive CHMP opinion. This success, coupled with global marketing and supply licensing agreements, positions it as a significant revenue generator and a key component of EirGenix's star portfolio, reflecting its substantial market share in the growing biosimilars sector.

The company's strategic focus on novel biologics and advanced therapies, such as antibody-drug conjugates and therapeutic proteins, places it in a high-growth market segment. EirGenix's established expertise in mammalian cell culture systems, the primary platform for biologics, further solidifies its position as a star performer within its product offerings.

EirGenix's investment in expanding its mammalian cell cGMP manufacturing capacity, including twelve 2,000L single-use bioreactors, aims for an annual production potential of up to 1,000kg of antibodies. This expansion reinforces its leadership in Taiwan's biologics CDMO market, driven by the critical demand for mammalian cell culture technology.

Strategic global partnerships, like those with Sandoz for biosimilars and Clarity Pharmaceuticals for radiopharmaceuticals, significantly broaden EirGenix's reach. Coupled with robust regulatory compliance, evidenced by recent successful US FDA inspections in late 2023 and certifications from Taiwan FDA and Japan PMDA, these collaborations enable broad market penetration.

| Product | Market Status | Growth Potential | EirGenix Contribution |

| EG12014 (Trastuzumab Biosimilar) | European Commission Authorization, Positive CHMP Opinion | High (Biosimilars Market Growth) | Significant Revenue Generator, Market Leader |

| Novel Biologics & Advanced Therapies | Emerging & Expanding Market | Very High | Core Strategic Focus, Expertise in Mammalian Cell Culture |

| Contract Development & Manufacturing Services | Robust Growth (15.7% CAGR projected 2025-2034) | High | Integrated End-to-End Solutions, Capacity Expansion |

What is included in the product

The EirGenix BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

A clear, visual BCG Matrix showing EirGenix's portfolio, simplifying complex strategic decisions.

Cash Cows

EirGenix's established biosimilar Contract Development and Manufacturing Organization (CDMO) services likely represent a Cash Cow within its BCG Matrix. These services focus on the routine production of already approved biosimilar products, generating stable and predictable revenue streams.

The biosimilar market is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030, reaching hundreds of billions of dollars. EirGenix's established manufacturing processes for these mature biosimilars require minimal incremental investment in research and development, allowing for efficient cash generation.

This consistent cash flow from biosimilar CDMO services is vital for covering EirGenix's operational expenses and providing the necessary capital to invest in higher-growth potential areas of its business, such as novel biologic development or expanding its service offerings.

EirGenix's routine cGMP manufacturing for stable biologics acts as a significant cash cow. These services cater to commercialized biologics with consistent market demand, providing a reliable income stream for the company. The mature nature of these products means less investment is needed for promotion, and production processes are highly optimized for efficiency.

EirGenix's standard process development and routine analytical services act as its cash cows. These foundational offerings, crucial for less complex biopharmaceutical candidates, generate a steady revenue stream due to their essential nature in the industry. The company's established expertise in these areas allows for high profit margins, as significant new capital investment isn't typically required for these mature services.

Pilot-Scale and Early-Phase Manufacturing Services

EirGenix's Pilot-Scale and Early-Phase Manufacturing Services, particularly at its Xizhi facility, represent a significant Cash Cow. This segment consistently generates revenue by supporting a steady stream of biopharmaceutical companies in their pre-clinical and pilot-scale production needs. The demand for these early-stage services remains robust, ensuring stable income through service fees. For instance, in 2024, EirGenix reported that its early-phase manufacturing services contributed significantly to its overall revenue, with a substantial portion of its client base utilizing these capabilities for initial drug development. This is further supported by the fact that the biopharmaceutical industry continues to invest heavily in R&D, driving consistent demand for these foundational manufacturing steps.

The Xizhi facility is a prime example of leveraging existing infrastructure efficiently. By focusing on pre-clinical and pilot-scale projects, EirGenix optimizes operational costs while meeting a critical market need. This strategic focus allows for predictable revenue streams, as these early-stage services are essential for virtually all new drug candidates. The company's ability to offer these services reliably makes it a go-to partner for emerging biotech firms. In 2024, EirGenix highlighted its capacity utilization for pilot-scale manufacturing, indicating a high level of activity and client engagement in this segment.

- Consistent Revenue Generation: The Xizhi facility's focus on pre-clinical and pilot-scale manufacturing provides a stable and predictable revenue stream through service fees for early-stage biopharmaceutical projects.

- Leveraging Existing Infrastructure: Optimized operational costs are achieved by utilizing existing facilities for small-batch production, enhancing profitability.

- High Demand in R&D: The continuous investment in biopharmaceutical research and development ensures sustained demand for these essential early-phase manufacturing services.

- 2024 Performance Indicator: EirGenix's 2024 reports indicated strong client engagement and capacity utilization in its early-phase manufacturing segment, underscoring its Cash Cow status.

Microbial System Manufacturing Capabilities

EirGenix's microbial system manufacturing capabilities represent a significant asset, particularly for producing less complex proteins and certain vaccines. This platform offers a cost-effective and efficient alternative to the more prevalent mammalian systems for specific biologic manufacturing.

While mammalian cell culture often takes center stage for advanced therapies, microbial fermentation provides a robust and economically viable route for a range of biologics. Companies with well-established and optimized microbial lines can leverage this for consistent revenue generation.

The lower research and development intensity associated with microbial systems, compared to novel mammalian-based therapies, allows them to function as stable cash cows for a company like EirGenix. This efficiency translates into predictable returns.

- Cost-Effectiveness: Microbial systems are generally less expensive to operate and scale than mammalian systems.

- Efficiency for Specific Biologics: Ideal for producing recombinant proteins, enzymes, and certain vaccines where microbial expression is highly effective.

- Lower R&D Intensity: Compared to developing complex mammalian cell-based therapies, microbial production pathways often require less intensive upfront R&D.

- Steady Revenue Stream: A strong microbial manufacturing arm can provide a consistent and reliable source of income, supporting investment in more novel, higher-risk projects.

EirGenix's established biosimilar CDMO services are a prime example of a Cash Cow. These services focus on the routine production of already approved biosimilar products, generating stable and predictable revenue streams with minimal ongoing R&D investment.

The biosimilar market's projected growth, with a CAGR exceeding 15% through 2030, ensures sustained demand for these mature products. EirGenix's optimized manufacturing processes for these biosimilars allow for efficient cash generation, covering operational costs and funding newer ventures.

This consistent cash flow is crucial for EirGenix's financial stability and its ability to invest in higher-growth areas. The company's expertise in manufacturing these established biologics provides a reliable income stream, making it a core contributor to its overall business strategy.

What You’re Viewing Is Included

EirGenix BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after your purchase. This ensures complete transparency, as there are no hidden watermarks, demo content, or altered sections; what you see is precisely what you get, ready for immediate strategic application.

Dogs

Underperforming legacy service offerings at EirGenix would fall into the Dogs quadrant of the BCG Matrix. These are services operating in markets with little to no growth or where EirGenix has lost its competitive edge. For instance, if EirGenix still offers a basic contract research organization (CRO) service that has become a commodity, facing intense price wars, it would likely be a dog.

Such offerings often struggle with low demand and profitability, as seen in the broader CRO market where specialized services are increasingly favored. In 2024, the global CRO market is expected to grow, but older, less differentiated services might see stagnation or decline, potentially leading to negative growth rates for specific EirGenix offerings.

These legacy services can drain valuable resources, including personnel and capital, without yielding substantial returns. For example, if a particular older diagnostic assay service requires significant ongoing maintenance and regulatory oversight but generates only a fraction of the revenue of newer, more advanced genetic testing services, it represents a classic dog.

Manufacturing facilities or processes that haven't kept pace with modern efficiencies, like single-use technologies or continuous manufacturing, can be classified as Dogs in the BCG Matrix. These outdated lines often face higher operational costs and lower output, impacting competitiveness and profitability.

For instance, a biopharmaceutical company like EirGenix might have older batch production lines that are more labor-intensive and generate more waste compared to newer continuous flow systems. In 2024, the biomanufacturing industry is seeing a significant push towards continuous manufacturing, with some estimates suggesting it could reduce production costs by up to 50% for certain biologics.

Such older, inefficient lines can struggle to meet evolving regulatory standards, further diminishing their value. Investment in upgrading these areas typically offers poor returns, making them prime candidates for divestment or significant restructuring rather than further capital allocation.

Niche services with limited client uptake represent EirGenix's potential Dogs in the BCG Matrix. These are highly specialized capabilities that, despite investment, haven't attracted significant market demand. For example, if EirGenix invested heavily in a novel gene therapy delivery system that has seen minimal adoption by 2024, it would likely be classified as a Dog.

These underperforming offerings can become resource drains, diverting funds and attention from more promising ventures. For instance, if a particular analytical service, costing EirGenix an estimated $5 million annually in R&D and specialized personnel, only generated $500,000 in revenue in 2024, its status as a Dog becomes clear.

Strategic consideration would involve evaluating the feasibility of revitalizing these niche services or, more likely, divesting or discontinuing them to reallocate resources. A decision to discontinue a service that represented only 0.5% of EirGenix's total 2024 revenue of $1 billion might be a prudent move.

Unsuccessful Internal Product Pipeline Candidates

EirGenix's internal product pipeline, featuring antibody products and a carrier protein, is subject to the inherent risks of biopharmaceutical development. Should any of these internally developed candidates falter in clinical trials, encounter insurmountable regulatory challenges, or fail to secure crucial licensing agreements, they would be categorized as 'dogs' within the BCG matrix.

These 'dog' products represent significant sunk costs in research and development, offering little to no prospect of future commercialization or a profitable return on investment. For instance, in 2024, the biopharmaceutical industry saw an average R&D expenditure of $2.6 billion per approved drug, highlighting the substantial capital at risk for each pipeline candidate.

- Pipeline Failure: Products that do not meet clinical trial success criteria or face severe regulatory setbacks are reclassified as dogs.

- Licensing Challenges: Inability to attract licensing partners for promising but uncommercialized candidates also leads to 'dog' status.

- R&D Investment: These candidates have consumed significant R&D funds, estimated to be in the hundreds of millions for early-stage biopharma products, without a clear path to profitability.

Services in Highly Saturated, Low-Differentiation Markets

EirGenix should carefully consider whether to engage in CDMO sub-segments that are highly saturated and offer minimal differentiation. These segments often resemble 'Dogs' in the BCG matrix, characterized by intense price competition and slim profit margins. For instance, the global CDMO market, while growing, sees intense competition in areas like small molecule API manufacturing, where many players offer similar services.

In 2023, the global Contract Development and Manufacturing Organization (CDMO) market was valued at approximately $220 billion, with projections indicating continued growth. However, within this vast market, certain niches face significant oversupply and commoditization. For example, basic formulation development for well-established drug classes can attract a multitude of providers, leading to price erosion.

- Market Saturation: Many CDMO sub-segments, particularly those involving standard small molecule manufacturing or generic drug formulation, are crowded with numerous competitors.

- Low Differentiation: In these saturated markets, services often become commoditized, making it difficult for any single CDMO to stand out based on unique capabilities or value propositions.

- Thin Profit Margins: Intense price wars are common, squeezing profit margins to levels that may not justify the investment required to gain or maintain market share.

- Limited Growth Potential: Without substantial, potentially unfeasible, investment in proprietary technology or niche specialization, market share in these 'Dog' segments is likely to remain stagnant or decline.

EirGenix's 'Dogs' are its underperforming legacy services or products in low-growth markets where it lacks a competitive edge. These offerings often consume resources without generating significant returns, necessitating strategic decisions for divestment or restructuring. For instance, a basic CRO service facing intense price competition, or an older manufacturing line with high operational costs, exemplifies a 'Dog'.

In 2024, EirGenix might identify niche services with minimal client uptake, such as a novel gene therapy delivery system with low adoption, as Dogs. These can drain R&D funds and personnel, like an analytical service costing $5 million annually but yielding only $500,000 in revenue. Such underperformers, representing a small fraction of total revenue, are candidates for discontinuation.

Pipeline candidates that fail clinical trials or face regulatory hurdles also become Dogs, representing sunk R&D costs with no commercialization prospects. The biopharmaceutical industry's average R&D expenditure of $2.6 billion per approved drug in 2024 underscores the capital risk for each candidate.

Highly saturated CDMO sub-segments with low differentiation, like standard small molecule manufacturing, also fall into the 'Dog' category. These areas face intense price wars and thin profit margins, limiting growth potential without substantial investment in specialization.

| EirGenix BCG Matrix: Dogs | Description | Market Dynamics | Financial Implication | Strategic Action |

| Legacy CRO Services | Commoditized, low-differentiation contract research offerings. | Low growth, intense price competition. | Low profitability, potential cash drain. | Divestment or repositioning to specialized niches. |

| Outdated Manufacturing Lines | Older batch production facilities with higher costs and lower efficiency. | Stagnant or declining demand, higher operational expenses. | Reduced competitiveness, negative ROI. | Upgrade, outsource, or decommission. |

| Unadopted Niche Services | Specialized capabilities with minimal market uptake. | Limited client base, slow adoption rates. | High R&D investment, low revenue generation. | Discontinue or seek strategic partnerships for revival. |

| Failed Pipeline Candidates | Biopharmaceutical products failing clinical trials or regulatory approval. | No future commercialization prospects. | Significant sunk R&D costs, no return. | Write-off, re-evaluate research focus. |

| Saturated CDMO Segments | Commoditized services in crowded markets like small molecule manufacturing. | Intense price wars, slim profit margins. | Low market share growth, unsustainable margins. | Focus on value-added services or exit. |

Question Marks

The cell and gene therapy CDMO market is booming, with forecasts showing a 24.5% compound annual growth rate between 2025 and 2034. EirGenix's expansion into this area positions them to capture a slice of this rapidly expanding, yet still emerging, sector. This move represents a significant investment in a high-growth, high-risk segment of the biologics manufacturing landscape.

Investing in cell and gene therapy capabilities is a strategic bet for EirGenix. While the company possesses broad expertise in biologics, building a robust presence in these highly specialized and capital-intensive fields requires dedicated resources and cutting-edge technology. Success here, however, could yield substantial rewards as these therapies gain wider adoption.

EirGenix's foray into advanced radiopharmaceutical manufacturing services, underscored by its recent supply agreement for a trastuzumab biosimilar in this space, places it squarely in the question mark quadrant of the BCG matrix. This niche demands specialized manufacturing capabilities and intricate regulatory understanding, areas where EirGenix is actively investing to secure future market positioning.

The radiopharmaceutical sector represents a high-growth, innovative area, but it also comes with significant upfront investment and uncertain returns, characteristic of a question mark. EirGenix's commitment here signifies a strategic bet on capturing future market share in a field that could potentially transform its product portfolio, but it currently consumes resources with a speculative outcome.

The biomanufacturing sector is seeing a significant push towards AI and digital integration, aiming to boost efficiency and optimize processes. This trend presents a substantial growth avenue for Contract Development and Manufacturing Organizations (CDMOs) like EirGenix.

Currently, EirGenix's presence and offerings specifically in AI-driven biomanufacturing are likely minimal, placing it in the question mark quadrant of the BCG matrix. However, substantial investment in building these advanced capabilities could propel it towards becoming a future star performer in this evolving market.

New Geographic Market Penetration

EirGenix's expansion into new geographic markets, like a more direct sales presence in North America, represents a significant question mark within its BCG Matrix. While the company holds global certifications and partnerships, establishing a robust direct footprint in high-growth regions where its current market share is nascent demands considerable upfront investment. This includes building local infrastructure, hiring specialized talent, and undertaking dedicated market development efforts, all of which carry inherent risks regarding the speed and extent of market share capture.

- Investment Required: Expanding direct sales operations into new territories often necessitates substantial capital for establishing offices, distribution networks, and marketing campaigns. For instance, setting up a new sales office in a major North American city could easily cost hundreds of thousands of dollars in initial setup and ongoing operational expenses.

- Market Uncertainty: The success of penetrating these new markets is not guaranteed. Factors such as local competition, regulatory hurdles, and cultural nuances can impact adoption rates. A 2024 report by Statista indicated that the success rate for new market entries for biotech firms can vary widely, with some studies suggesting only a 30-40% success rate in the first three years without strong local partnerships.

- Growth Potential: Despite the uncertainties, the potential rewards are significant. Capturing even a small percentage of a large, untapped market can translate into substantial revenue growth. If EirGenix can successfully navigate these challenges, these new geographic markets could become major contributors to its overall portfolio.

- Strategic Focus: EirGenix's decision to prioritize these markets will depend on its strategic assessment of risk versus reward, competitive landscape analysis, and its capacity to allocate resources effectively for sustained market penetration efforts.

Development of Highly Innovative, Early-Stage Novel Biologics (as a CDMO partner)

EirGenix's involvement with highly innovative, early-stage novel biologics positions them as a potential player in the "Question Marks" category of the BCG matrix. This segment is characterized by high growth potential but also significant risk, mirroring the landscape of groundbreaking drug development where market viability is yet to be proven.

Engaging with clients on these nascent candidates requires substantial investment in research and development, consuming considerable resources. However, the payoff for successful projects can be substantial, translating into lucrative, long-term manufacturing contracts. For instance, the global biologics market is projected to reach over $600 billion by 2027, with early-stage innovation being a key driver of this growth.

- High Risk, High Reward: Early-stage novel biologics offer significant upside if they navigate clinical trials and gain market approval, but face a high probability of failure.

- Resource Intensive: These projects demand substantial R&D investment and specialized expertise from CDMOs like EirGenix.

- Future Growth Engine: Successful development can secure long-term, high-value manufacturing partnerships, driving future revenue streams.

- Strategic Selection is Crucial: EirGenix must carefully vet projects to mitigate the inherent high attrition rates common in early-stage drug discovery.

EirGenix's engagement with advanced radiopharmaceutical manufacturing and AI-driven biomanufacturing places them in the question mark quadrant. These areas offer high growth potential but require significant upfront investment and carry inherent market uncertainties, characteristic of new ventures with unproven market acceptance.

The company's strategic expansion into new geographic markets, particularly North America, also falls into the question mark category. While these regions represent substantial growth opportunities, establishing a direct presence involves considerable investment and faces the risk of slower-than-anticipated market penetration, as evidenced by the varied success rates of new market entries in the biotech sector.

Investing in early-stage novel biologics further solidifies EirGenix's position in the question mark quadrant. These projects are resource-intensive and carry a high risk of failure, yet successful development can lead to lucrative, long-term manufacturing contracts, highlighting the high-risk, high-reward nature of this segment.

| EirGenix BCG Matrix: Question Marks | Characteristics | Investment & Risk | Potential Reward | Example Areas |

| Radiopharmaceutical Manufacturing | High growth, innovative niche | Significant upfront investment, specialized capabilities, regulatory complexity | Future market leadership, high-value contracts | Trastuzumab biosimilar supply |

| AI-Driven Biomanufacturing | Emerging technology integration, efficiency gains | Requires substantial investment in advanced capabilities, currently minimal presence | Future star performer, optimized processes | Digital integration in biomanufacturing |

| New Geographic Markets (e.g., North America) | Untapped market share, revenue growth | High initial capital for infrastructure, market penetration uncertainty (e.g., 30-40% success rate in first 3 years for biotech firms) | Substantial revenue contribution if successful | Direct sales presence, local infrastructure |

| Early-Stage Novel Biologics | Groundbreaking drug development, unproven market viability | Resource-intensive R&D, high attrition rates in early stages | Lucrative long-term manufacturing contracts, significant upside | Nascent candidate development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive analysis, to accurately position each business unit.