EirGenix Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EirGenix Bundle

EirGenix operates within a dynamic biotech landscape, where the threat of new entrants is moderate, and the bargaining power of buyers, primarily pharmaceutical companies, is significant. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping EirGenix’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biologics manufacturing sector, including companies like EirGenix, depends heavily on highly specialized raw materials. Think of things like cell culture media, particular enzymes, and single-use technologies such as bioreactor bags – these are not off-the-shelf items.

Often, there's a small group of companies that can produce these critical inputs, especially for unique biological components. This scarcity gives these suppliers considerable leverage, or bargaining power, over contract development and manufacturing organizations (CDMOs) like EirGenix.

This supplier concentration can translate into higher prices for EirGenix or less favorable contract terms. For example, in 2024, the biologics CDMO market experienced supply chain constraints for certain critical raw materials, with some specialized media components seeing price increases of up to 15% year-over-year, directly impacting EirGenix's cost structure and potentially their profit margins.

EirGenix faces significant supplier bargaining power when its suppliers offer unique technologies or proprietary cell lines. For instance, if a key supplier provides a specialized bioreactor or a patented cell culture medium, switching to an alternative can be incredibly costly.

These high switching costs for EirGenix can manifest as substantial R&D investments to validate new materials, potential operational downtime during the transition, and the expense of retraining personnel on unfamiliar processes or equipment. This dependency limits EirGenix's negotiation leverage, allowing suppliers to dictate terms more effectively.

The biopharmaceutical contract development and manufacturing organization (CDMO) industry is grappling with a worldwide deficit of highly skilled talent. This includes crucial roles like bioprocess engineers, quality control specialists, and regulatory affairs experts, all vital for operations like EirGenix.

This scarcity directly amplifies the bargaining power of this specialized workforce. Consequently, companies face escalating labor expenses and significant hurdles in attracting and retaining qualified personnel.

For instance, a 2024 industry report indicated that demand for bioprocess engineers outstripped supply by nearly 20%, driving average salaries up by an estimated 8% year-over-year in the CDMO sector.

Proprietary Technology and Intellectual Property of Suppliers

Suppliers possessing proprietary technology or intellectual property crucial for bioprocessing, like specialized purification resins or viral vectors for gene therapies, wield significant bargaining power. This exclusivity means EirGenix might be reliant on their unique products, potentially facing increased costs or limited availability. For instance, in 2024, the market for high-performance chromatography resins saw continued innovation, with key players investing heavily in R&D for next-generation materials, further solidifying their competitive advantage.

This dependence can translate into suppliers dictating terms, impacting EirGenix's operational flexibility and cost structure. The ability to control access to these critical components allows suppliers to command premium pricing.

- Supplier Exclusivity: Critical components like advanced viral vectors are often held by a limited number of suppliers.

- R&D Investment: Suppliers with substantial R&D budgets can continuously innovate, creating new dependencies.

- Market Concentration: In niche bioprocessing markets, a few suppliers may dominate, increasing their leverage.

- Intellectual Property Protection: Patents and trade secrets surrounding these technologies create barriers to entry for competitors, strengthening the incumbent suppliers' position.

Regulatory Compliance Requirements for Supplier Materials

Suppliers of critical components for biologics manufacturing must meet rigorous regulatory standards, such as current Good Manufacturing Practices (cGMP). This compliance ensures the quality and safety of materials vital for EirGenix's operations.

Suppliers demonstrating a strong history of regulatory adherence and superior material quality possess enhanced bargaining power. Their certified products are indispensable for EirGenix to sustain its own regulatory approvals and market access.

- cGMP Compliance: Suppliers must meet cGMP standards, a baseline requirement for all pharmaceutical raw materials.

- Quality Assurance: A proven track record in quality management systems directly impacts a supplier's leverage.

- Regulatory Approvals: Suppliers whose materials are pre-approved by relevant health authorities (e.g., FDA, EMA) hold significant sway.

- Supply Chain Security: Suppliers offering robust traceability and supply chain integrity are more valuable and thus possess greater bargaining power.

The bargaining power of suppliers for EirGenix is substantial due to the specialized nature of biologics manufacturing inputs. Key suppliers often control proprietary technologies, intellectual property, and meet stringent regulatory requirements, creating high switching costs for EirGenix.

This leverage allows suppliers to influence pricing and contract terms, impacting EirGenix's operational costs and flexibility. For example, in 2024, the market for specialized cell culture media saw price increases of up to 15% due to supply chain constraints and high demand.

Furthermore, the scarcity of skilled labor in bioprocessing, with demand for bioprocess engineers outstripping supply by nearly 20% in 2024, also empowers specialized workforce suppliers. This situation drives up labor costs and presents challenges in talent acquisition for companies like EirGenix.

| Factor | Impact on EirGenix | 2024 Data/Example |

|---|---|---|

| Supplier Exclusivity/Proprietary Tech | High dependence, limited alternatives | Key suppliers of viral vectors or purification resins |

| Market Concentration | Few dominant players increase leverage | Niche bioprocessing markets |

| R&D Investment & Innovation | Creates ongoing dependencies | Next-generation chromatography resins |

| Regulatory Compliance (cGMP) | Essential for EirGenix's own approvals | Suppliers with strong quality assurance and regulatory track records |

| Skilled Labor Scarcity | Increased labor costs, retention challenges | 8% average salary increase for bioprocess engineers |

What is included in the product

This analysis details EirGenix's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

EirGenix's Porter's Five Forces Analysis offers a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making.

Customers Bargaining Power

EirGenix serves a diverse customer base, including pharmaceutical and biotechnology companies of all sizes, from emerging SMEs to established giants. Larger clients, particularly those with substantial drug development pipelines or multiple ongoing projects, can wield significant bargaining power. This is because their substantial business volume allows them to negotiate for more favorable pricing and contract terms, potentially impacting EirGenix's profit margins.

While contract development and manufacturing organizations (CDMOs) can incur costs when switching suppliers, customers also face substantial hurdles when moving between CDMOs. These include expenses for technology transfer, re-validation of processes, and the potential for significant delays in crucial drug development timelines. For instance, a single tech transfer can cost hundreds of thousands, even millions, of dollars depending on the complexity of the biologic and the stage of development. This financial and operational burden effectively diminishes a customer's bargaining power once a strong working relationship with a CDMO like EirGenix is cemented.

Large pharmaceutical companies often possess the financial and technical resources to establish or enhance their own in-house manufacturing facilities. This capability serves as a significant deterrent, representing a credible threat of backward integration for Contract Development and Manufacturing Organizations (CDMOs) such as EirGenix.

The potential for self-sufficiency empowers these major players. If the costs associated with outsourcing production to a CDMO like EirGenix become prohibitive, or if quality standards are not consistently met, these companies can readily shift manufacturing operations back to their own facilities. This flexibility directly influences their bargaining power.

For instance, in 2024, the global pharmaceutical contract manufacturing market was valued at approximately $160 billion, with significant growth driven by the increasing reliance of many companies on outsourcing. However, the strategic imperative for large pharma to maintain control over critical manufacturing processes, particularly for high-value or proprietary products, remains a constant consideration.

Price Sensitivity and Cost Efficiency Demands

Customers, particularly those in the biosimilar development space or facing significant healthcare cost pressures, exhibit high price sensitivity. This directly translates into a demand for cost-efficient manufacturing solutions from Contract Development and Manufacturing Organizations (CDMOs) like EirGenix.

This intense price sensitivity compels customers to engage in aggressive price negotiations, seeking the best possible value. Consequently, this dynamic amplifies the price pressure exerted on EirGenix, as clients actively leverage competitive offerings to secure lower rates.

- Customer Price Sensitivity: The global biosimilar market, projected to reach over $68 billion by 2030, highlights the intense competition and cost-consciousness among developers.

- Cost Efficiency Demands: Healthcare systems worldwide are prioritizing cost containment, pushing pharmaceutical companies to seek manufacturing partners offering demonstrable cost savings.

- Negotiation Leverage: The availability of multiple CDMOs with varying pricing structures empowers customers to negotiate more effectively, demanding lower per-unit costs from EirGenix.

- Value Proposition Focus: Customers are not just looking for low prices but also for comprehensive value, including speed to market, quality assurance, and regulatory support, which EirGenix must integrate into its cost-efficiency arguments.

Importance of Speed-to-Market and Regulatory Expertise

For pharmaceutical and biotech companies, getting new drugs to market quickly is paramount. EirGenix, as a Contract Development and Manufacturing Organization (CDMO), can significantly enhance its value proposition by offering rapid development timelines and robust regulatory support. Their cGMP facilities are a key asset here, enabling them to navigate complex approval processes efficiently.

The ability of a CDMO like EirGenix to deliver speed and scale, coupled with deep regulatory knowledge, directly impacts customer bargaining power. If EirGenix consistently demonstrates superior capabilities in these areas, it can reduce the leverage customers have, as they become reliant on EirGenix's specialized expertise to achieve their market entry goals.

- Speed-to-Market: Pharmaceutical companies aim to reduce the time from drug discovery to commercialization, often measured in years.

- Regulatory Expertise: Navigating agencies like the FDA and EMA requires specialized knowledge, with approval timelines varying significantly by drug type and complexity.

- cGMP Facilities: Compliance with current Good Manufacturing Practices is non-negotiable for drug production, and EirGenix's adherence provides a competitive advantage.

- Customer Reliance: When a CDMO consistently meets demanding timelines and regulatory hurdles, customers are less likely to switch providers, thus reducing their bargaining power.

Customers, particularly large pharmaceutical firms and those in cost-sensitive sectors like biosimil development, possess significant bargaining power. Their ability to switch CDMOs, though costly, and their potential for in-house manufacturing, especially in 2024 where the global contract manufacturing market neared $160 billion, exert downward pressure on pricing and terms for EirGenix.

The intense price sensitivity within markets like biosimil development, which is projected to exceed $68 billion by 2030, forces customers to aggressively negotiate for cost-efficient solutions from CDMOs. This demand for value, encompassing speed, quality, and regulatory support, empowers clients to leverage competitive offerings and secure lower rates from EirGenix.

While switching CDMOs involves substantial costs for customers, including tech transfers potentially costing millions, this does not entirely negate their leverage. The threat of backward integration, where large pharma companies can develop their own manufacturing capabilities, remains a key factor influencing their negotiation stance with EirGenix.

| Factor | Impact on EirGenix | Customer Leverage |

|---|---|---|

| Customer Size & Volume | Higher volume clients can negotiate better pricing. | Significant for large pharmaceutical companies. |

| Switching Costs | High costs for customers to switch CDMOs. | Reduces customer bargaining power once established. |

| Threat of Backward Integration | Customers can potentially bring manufacturing in-house. | Credible threat for large, well-resourced clients. |

| Price Sensitivity | Demand for cost-effective solutions. | Amplifies price pressure on EirGenix. |

What You See Is What You Get

EirGenix Porter's Five Forces Analysis

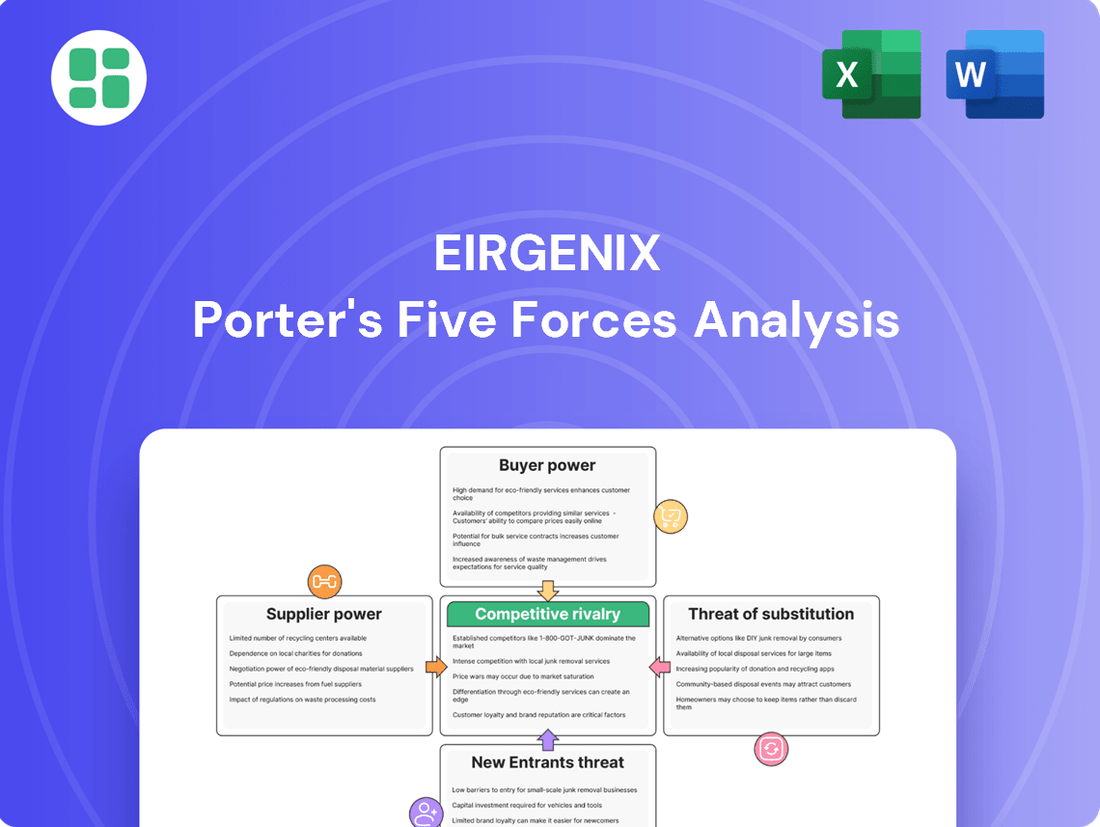

This preview showcases the comprehensive EirGenix Porter's Five Forces Analysis, detailing competitive rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can expect to receive this exact, professionally formatted analysis immediately after your purchase, providing actionable insights into EirGenix's competitive landscape without any hidden elements or placeholders.

Rivalry Among Competitors

The biologics contract development and manufacturing organization (CDMO) market is booming, drawing in a vast array of companies. This includes major global players with extensive capabilities alongside smaller, highly specialized firms focusing on specific niches. This crowded field means intense competition as everyone is trying to capture a piece of the growing market.

With over 100 companies operating in this space, the biologics CDMO landscape is quite fragmented. This sheer number and variety of competitors, from giants to specialists, fuels a fierce rivalry. Companies are constantly battling for contracts across different service areas and for various types of biologic products.

The biologics manufacturing sector, including companies like EirGenix, is inherently capital-intensive. Building and maintaining specialized facilities for drug production, such as advanced bioreactors and sterile cleanrooms, demands significant upfront investment. For instance, establishing a state-of-the-art biologics manufacturing plant can easily cost hundreds of millions of dollars, with some estimates for large-scale facilities reaching over $500 million.

This high capital requirement creates a substantial barrier for new entrants, thereby limiting the number of direct competitors. However, for established players, these fixed costs mean a constant pressure to operate at high capacity. Companies must strive for maximum utilization of their expensive assets to achieve economies of scale and cover their substantial investments, leading to intense competition, often driven by price and efficiency.

Contract Development and Manufacturing Organizations (CDMOs) actively vie for market share by carving out unique service offerings. This specialization often centers on particular therapeutic modalities, like the complex manufacturing of cell and gene therapies, or specialized areas such as process optimization and sterile fill-finish operations. EirGenix distinguishes itself by providing a comprehensive suite of services, encompassing both biosimilar development and the creation of novel biologics, further enhanced by its robust capabilities in both mammalian and microbial expression systems.

Industry Growth Rate and Capacity Expansion

The biologics Contract Development and Manufacturing Organization (CDMO) market is experiencing substantial growth, with projections indicating continued expansion. This robust growth fuels significant capacity expansion across the industry as companies vie for market share. For instance, the global biologics CDMO market was valued at approximately $19.5 billion in 2023 and is expected to reach over $45 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 12.9%.

This expansion creates intense competition. Companies are making substantial investments in increasing their bioreactor capacity and adopting cutting-edge technologies. This arms race for advanced capabilities intensifies rivalry as firms aim to attract and retain clients by offering state-of-the-art manufacturing solutions and faster turnaround times. The demand for outsourced biologics manufacturing services is also on the rise, further exacerbating competitive pressures.

- Market Growth: The biologics CDMO market is projected for strong growth, with significant investments in capacity expansion.

- Increased Demand: Outsourced services for biologics manufacturing are seeing a surge in demand.

- Competitive Landscape: Growth fuels aggressive competition as companies invest in advanced technologies and bioreactor capacity.

- Market Share Focus: Firms are actively seeking to capture a larger portion of the expanding market through strategic investments.

Strategic Partnerships and Consolidation Trends

The contract development and manufacturing organization (CDMO) sector is experiencing significant consolidation. Companies are actively pursuing mergers, acquisitions, and strategic alliances to broaden their service offerings and expand their international presence. This wave of M&A activity is intensifying competitive pressures, as larger, more integrated CDMOs are emerging, capable of providing comprehensive, end-to-end solutions.

These consolidated entities present a more substantial competitive threat to smaller, specialized CDMOs. For instance, in 2024, the CDMO market saw several notable deals. Lonza’s acquisition of a Danish cell and gene therapy facility, and Catalent’s ongoing integration following its acquisition of Metrics, exemplify this trend. These moves allow larger players to offer a wider array of services, from early-stage development to commercial manufacturing, thereby increasing their market leverage and challenging standalone competitors who may lack such breadth.

- Industry Consolidation: The CDMO market is actively consolidating through M&A and partnerships.

- Enhanced Capabilities: Consolidation aims to improve service portfolios and global reach for CDMOs.

- Increased Rivalry: The emergence of larger, integrated CDMOs intensifies competition for standalone players.

- End-to-End Solutions: Integrated CDMOs offer a comprehensive suite of services, creating a competitive advantage.

The biologics CDMO market is characterized by intense competitive rivalry due to its fragmented nature and rapid growth. With over 100 companies, including global giants and niche specialists, the battle for contracts is fierce, fueled by significant investments in advanced technologies and capacity expansion. This dynamic environment means companies like EirGenix must continuously innovate and optimize operations to maintain market share.

The high capital expenditure required for biologics manufacturing, often exceeding hundreds of millions of dollars, acts as a barrier to new entrants but intensifies competition among established players. These firms are driven to maximize asset utilization, leading to price and efficiency-based competition. Strategic specialization in areas like cell and gene therapies or specific expression systems further defines competitive positioning.

Industry consolidation through mergers and acquisitions, evident in 2024 with deals involving major players, is creating larger, integrated CDMOs. These expanded entities offer end-to-end solutions, increasing competitive pressure on smaller, specialized firms and demanding greater strategic agility from all market participants.

| Key Competitive Factors | Description | Impact on Rivalry |

| Market Fragmentation | Over 100 companies, from large players to specialists. | High; intense competition for contracts. |

| Capital Intensity | High upfront investment for facilities (>$500M for large plants). | Limits new entrants, pressures existing firms for utilization. |

| Service Specialization | Focus on modalities (e.g., cell/gene therapy) or processes (e.g., fill-finish). | Differentiates offerings, intensifies rivalry in specific niches. |

| Industry Consolidation | M&A activity creating larger, integrated CDMOs. | Increases competitive threat from comprehensive service providers. |

SSubstitutes Threaten

A significant threat to contract development and manufacturing organizations (CDMOs) like EirGenix comes from biopharmaceutical companies choosing to manufacture their products in-house. This is particularly true for larger companies that possess the resources and expertise to build and operate their own facilities.

For instance, many major pharmaceutical players have been investing in expanding their internal manufacturing capabilities. This strategic move aims to gain greater control over their supply chains and potentially reduce costs associated with outsourcing, especially for commercial-scale production runs. This can directly divert business away from CDMOs.

While EirGenix specializes in biologics, the broader pharmaceutical landscape presents small molecule drugs and generic medications as viable substitutes for treating many conditions. These alternatives, frequently possessing lower development and production expenses, can temper the overall market appetite for intricate biologic treatments, thereby indirectly affecting the Contract Development and Manufacturing Organization (CDMO) sector.

For instance, the global small molecule drug market was valued at approximately $1.3 trillion in 2023 and is projected to grow steadily. Similarly, the generic drug market continues to be a significant force, offering cost-effective treatment options that can divert patients and healthcare spending away from more expensive biologic therapies.

The threat of substitutes for EirGenix, a contract development and manufacturing organization (CDMO), is significantly influenced by the burgeoning biosimilar market. As biosimilars gain traction, they offer more affordable alternatives to innovator biologics, thereby exerting downward pressure on pricing across the entire biologics sector. This dynamic directly impacts CDMOs like EirGenix, as the increased availability of cost-effective biosimilar options can influence the pricing of their own development and manufacturing services.

Advances in Non-Biological Therapies

The threat of substitutes for biologics manufacturing services is intensifying due to rapid advancements in non-biological therapies. Ongoing research and development in gene editing, RNA therapies, and other novel treatment modalities could yield alternatives that directly compete with traditional biologics.

If these emerging non-biological approaches demonstrate superior efficacy or cost-effectiveness, they could significantly diminish the demand for biologics manufacturing. For instance, the global gene therapy market was projected to reach USD 10.5 billion in 2024 and is expected to grow substantially, indicating a shift in therapeutic landscapes.

- Gene Editing: Technologies like CRISPR are creating new avenues for treating genetic diseases, potentially replacing biologic treatments in some cases.

- RNA Therapies: mRNA vaccines and therapeutics, proven effective during the COVID-19 pandemic, offer a platform for a wide range of treatments, posing a substitute threat.

- Small Molecule Drugs: Continued innovation in small molecule drug discovery can also offer more targeted and cost-efficient treatments for conditions historically managed by biologics.

Shift to Different Outsourcing Models

Customers increasingly explore alternative outsourcing models that could diminish the reliance on fully integrated Contract Development and Manufacturing Organizations (CDMOs) like EirGenix. For instance, a shift towards fee-for-service arrangements with highly specialized providers or engaging multiple niche CDMOs presents a viable substitute. This fragmented approach might offer perceived flexibility or cost benefits, directly challenging EirGenix's comprehensive service model.

This trend is supported by market observations where companies seek to optimize specific stages of their development and manufacturing processes. For example, a 2024 report indicated a growing segment of the biopharmaceutical outsourcing market focused on specialized analytical services, suggesting a move away from single-source, end-to-end providers for certain projects.

- Shift to Specialized Providers: Clients may opt for fee-for-service models with niche CDMOs focusing on specific capabilities like cell line development or sterile fill-finish.

- Multi-CDMO Engagement: Companies might contract with several smaller, specialized CDMOs to manage different project phases, bypassing the need for a single integrated partner.

- Cost and Flexibility Drivers: The appeal of these substitute models often stems from potential cost savings and greater adaptability compared to the more rigid structures of integrated CDMOs.

The threat of substitutes for EirGenix is multifaceted, encompassing both alternative therapeutic modalities and evolving outsourcing strategies. The rise of biosimilars, for instance, directly challenges the market for innovator biologics, potentially impacting demand for CDMO services. Furthermore, advancements in gene editing and RNA therapies present new treatment paradigms that could supplant traditional biologics.

The increasing viability of small molecule drugs and generic medications also poses a substitute threat, offering more cost-effective treatment options. For example, the global small molecule drug market's significant valuation underscores its continued relevance. Additionally, companies are increasingly exploring fragmented outsourcing models, engaging multiple specialized CDMOs instead of integrated providers, driven by potential cost savings and flexibility.

| Substitute Category | Example | Market Relevance (2023/2024 Data) | Impact on CDMOs |

|---|---|---|---|

| Alternative Therapies | Gene Therapy | Global market projected to reach USD 10.5 billion in 2024. | Potential reduction in demand for traditional biologics manufacturing. |

| RNA Therapies | Proven efficacy in vaccines, expanding therapeutic applications. | Emerging manufacturing needs, but potentially different from biologics. | |

| Cost-Effective Alternatives | Small Molecule Drugs | Market valued at approximately $1.3 trillion in 2023. | Diversion of healthcare spending and R&D focus away from biologics. |

| Generic Drugs | Significant market share offering lower-cost treatments. | Reduces the overall market size for higher-cost biologic treatments. | |

| Outsourcing Models | Specialized CDMOs | Growing segment focused on specific services (e.g., analytical). | Fragmented demand, potentially reducing reliance on integrated CDMOs. |

Entrants Threaten

Establishing a biologics contract development and manufacturing organization (CDMO) like EirGenix demands substantial initial capital. We're talking hundreds of millions, even billions, of dollars for cutting-edge cGMP facilities, highly specialized equipment, and the latest advanced technologies.

These enormous financial barriers significantly deter new entrants. For instance, building a new, fully compliant biologics manufacturing plant can easily cost upwards of $500 million, making it incredibly challenging for smaller or less-funded companies to enter the competitive landscape and directly challenge established players.

The biopharmaceutical sector is deeply entrenched in a web of stringent regulations, with agencies like the FDA and EMA setting the bar exceptionally high. Adherence to current Good Manufacturing Practices (cGMP), meticulous documentation, and complex validation protocols are non-negotiable, creating a formidable barrier for any newcomers.

For instance, the cost of bringing a new drug to market, including the extensive clinical trials and regulatory submissions, can easily exceed $2 billion, a figure that significantly deters potential entrants without deep pockets and established expertise in navigating these complex pathways.

New companies must invest heavily in building and maintaining facilities that not only meet current but also anticipate evolving regulatory standards, demanding substantial capital for robust quality systems and specialized personnel, thereby limiting the threat of new entrants.

The biologics CDMO sector, including companies like EirGenix, requires a deeply specialized workforce. This includes PhD-level scientists for research and development, experienced process engineers for scale-up, and meticulous quality assurance professionals. The demand for these highly skilled individuals significantly outstrips supply globally.

For instance, a 2024 report indicated a projected shortage of over 100,000 skilled biopharmaceutical professionals in the next five years, impacting areas from R&D to manufacturing. This scarcity translates into higher recruitment costs and longer lead times for new entrants to build a competent team, acting as a substantial barrier to entry.

Long Lead Times for Facility Construction and Validation

The significant hurdle of constructing and validating cGMP-compliant biologics manufacturing facilities, a process that can easily span several years, acts as a substantial barrier to entry. This extended timeline prevents new players from rapidly scaling up to meet market demand.

Established Contract Development and Manufacturing Organizations (CDMOs) benefit immensely from their existing operational capacity, which allows them to respond to market needs far more swiftly than any newcomer. For instance, the lead time for building a new cell culture facility can extend to 3-5 years, including process validation. This delay means that even with substantial capital, a new entrant might miss critical market windows.

- Extended Timelines: Building and validating cGMP facilities can take 3-5 years.

- Capital Intensive: Significant upfront investment is required for construction and regulatory compliance.

- Expertise Required: Specialized knowledge in engineering, quality assurance, and regulatory affairs is essential.

- Market Responsiveness: Long lead times limit the ability of new entrants to quickly capitalize on emerging market opportunities.

Established Customer Relationships and Reputation

Established customer relationships and reputation act as a significant barrier to entry for new players in the Contract Development and Manufacturing Organization (CDMO) sector. Companies like EirGenix have cultivated deep, trust-based partnerships with pharmaceutical and biotech firms over years of consistent, high-quality service and successful project execution.

New entrants find it challenging to penetrate this market without a proven track record and an existing client portfolio. The high switching costs associated with changing CDMOs, due to regulatory validation, process transfer complexities, and the sheer time investment, further solidify the position of incumbents.

- Long-term Partnerships: EirGenix, like other established CDMOs, benefits from multi-year contracts and repeat business from major pharmaceutical clients, fostering loyalty.

- Reputational Capital: A strong reputation for quality, reliability, and regulatory compliance is paramount; new CDMOs must invest heavily to build this trust.

- High Switching Costs: For pharmaceutical companies, changing a CDMO involves extensive validation, process re-optimization, and potential regulatory hurdles, making continuity a priority.

- Client Retention: In 2024, the CDMO market continued to see strong client retention for established players, as demonstrated by ongoing collaborations with top-tier biopharma companies.

The threat of new entrants for biologics CDMOs like EirGenix is significantly mitigated by the immense capital required to establish compliant manufacturing facilities. Building a state-of-the-art cGMP biologics plant can easily cost upwards of $500 million, creating a substantial financial hurdle for any aspiring competitor. Furthermore, the lengthy process of facility construction and validation, often taking 3-5 years, delays market entry and limits the ability of newcomers to quickly respond to demand shifts, a challenge that established players like EirGenix have already overcome.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High cost of building cGMP facilities and acquiring specialized equipment. | Deters new entrants due to substantial upfront investment. | Estimated $500M+ for a new biologics manufacturing plant. |

| Regulatory Hurdles | Strict adherence to cGMP, FDA, and EMA regulations requires extensive documentation and validation. | Creates a complex and costly compliance pathway for newcomers. | The cost of bringing a new drug to market can exceed $2 billion, including regulatory processes. |

| Skilled Workforce Scarcity | Demand for specialized talent (scientists, engineers, QA) outstrips supply. | Increases recruitment costs and lead times for new entrants to build a competent team. | Projected shortage of over 100,000 biopharmaceutical professionals by 2029. |

| Incumbent Relationships & Reputation | Established CDMOs have long-term client partnerships and proven track records. | New entrants face challenges in gaining trust and securing clients due to high switching costs for pharma companies. | Strong client retention observed in 2024 for established CDMOs with multi-year contracts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EirGenix is built upon a foundation of comprehensive data, including EirGenix's own annual reports and investor presentations, alongside industry-specific market research from reputable firms. We also incorporate insights from regulatory filings and relevant trade publications to capture a nuanced understanding of the competitive landscape.