EDF SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

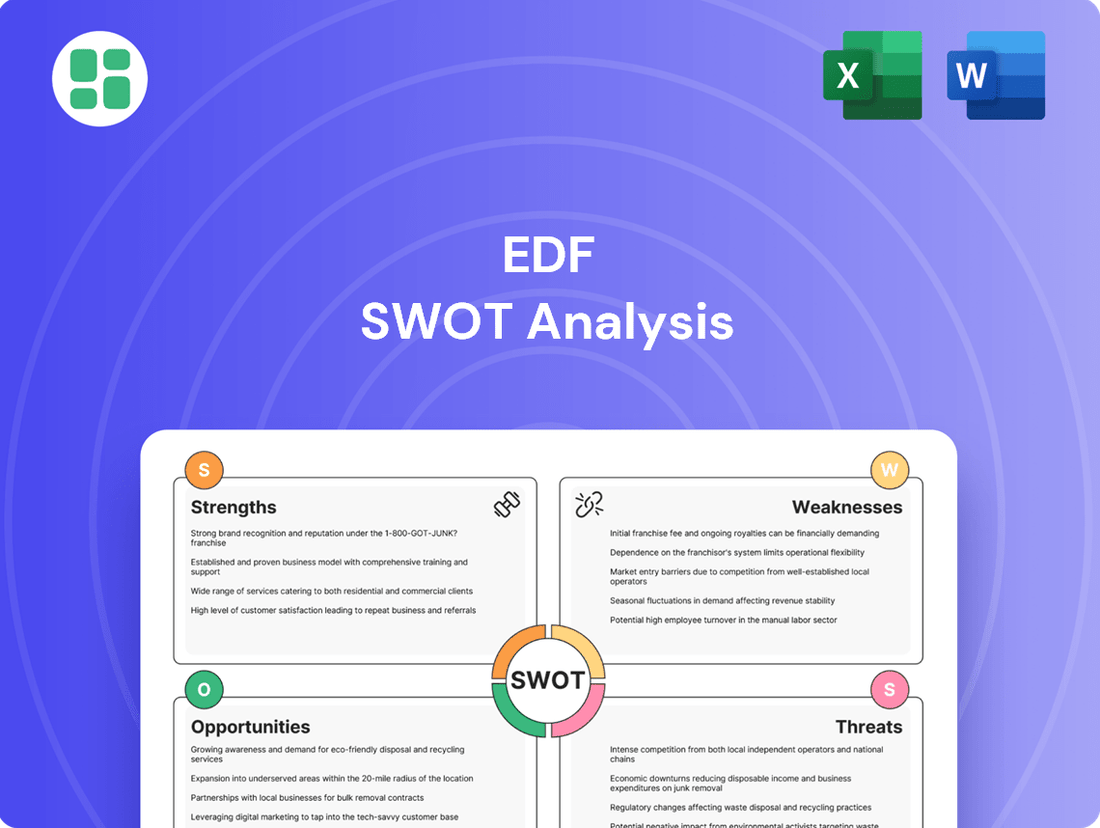

Our EDF SWOT analysis reveals critical strengths like their established market presence and significant renewable energy investments, alongside potential weaknesses such as regulatory hurdles and evolving energy policies.

Want the full story behind EDF's competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EDF's extensive and varied generation capacity is a significant advantage. It includes a strong base in nuclear power, complemented by substantial hydropower, thermal plants, and an increasing presence in renewables. This broad energy mix ensures resilience and adaptability to changing energy landscapes.

In 2024, EDF demonstrated robust operational performance, notably with a marked increase in both nuclear and hydropower generation within France. This surge in output directly contributes to the company's ability to meet demand and maintain a stable supply.

The diversification across nuclear, hydro, thermal, and renewables enables EDF to effectively manage market volatility and fluctuating energy needs. This broad portfolio is key to providing a reliable electricity supply to its customers.

EDF's status as a historic leader in the French energy sector translates into significant market leadership and deeply ingrained brand trust. As one of the world's largest electricity producers, the company benefits from widespread recognition and a loyal customer base built over decades of service. This established reputation is a powerful asset, fostering customer loyalty and a stable market position.

EDF stands out as a significant producer of zero-carbon electricity, especially within the UK market. This capability directly supports global decarbonization goals and the ongoing shift towards a net-zero economy.

The company has established concrete, forward-looking objectives for cutting its CO2 emissions. For instance, EDF aims for a 40% reduction in CO2 emissions from its industrial sites by 2027 and a 50% reduction by 2030, compared to 2019 levels. Further targets include a 60% reduction by 2035.

This strong dedication to environmental responsibility places EDF in a strong competitive position, resonating with a market that is increasingly prioritizing sustainability and green energy solutions.

Strategic Investments in New Nuclear and Renewables

EDF's strategic focus on new nuclear and renewables is a key strength, positioning the company to capitalize on the global shift towards decarbonization. The company is making substantial investments in projects like Hinkley Point C in the UK, which is expected to generate 7% of the UK's electricity needs once fully operational, and the EPR2 program in France, designed to build new, cost-effective nuclear reactors. These ventures are crucial for securing future energy supplies and meeting escalating demand for low-carbon power.

This commitment to expanding its low-carbon generation capacity is a significant driver of EDF's long-term growth and the strengthening of its asset portfolio. For instance, by the end of 2024, EDF aims to have a significant portion of its new nuclear projects progressing on schedule, underpinning its future revenue streams. The company is also actively growing its renewable energy portfolio, with targets to significantly increase its installed wind and solar capacity in the coming years, further diversifying its energy mix and enhancing its market position.

EDF's investments in new nuclear and renewables are not just about capacity expansion; they are about future-proofing the business. By securing a robust pipeline of low-carbon projects, EDF is building a resilient asset base capable of meeting evolving energy demands and regulatory landscapes. This strategic foresight is vital for maintaining competitiveness and delivering sustainable value in the energy sector.

Improved Operational Performance and Efficiency

EDF has made significant strides in improving its operational performance and efficiency. The company's 'START 2025' program, for instance, has been instrumental in optimizing reactor outages, directly contributing to higher output from its nuclear fleet. This dedication to industrial performance and meticulous control over maintenance activities has demonstrably boosted the availability of its generation assets.

Further underscoring this commitment, EDF's 'Ambitions 2035' corporate plan places a strong emphasis on enhancing operational efficiency across the board and driving business transformation. For example, in 2023, EDF reported a significant increase in its nuclear power generation, reaching 309.7 TWh, a substantial rise from the 279.1 TWh generated in 2022, showcasing the tangible results of these efficiency drives.

Key aspects of this improved performance include:

- Optimized Reactor Outages: The 'START 2025' program has streamlined maintenance schedules, reducing downtime and increasing operational uptime for nuclear reactors.

- Enhanced Asset Availability: A greater focus on industrial performance and control over maintenance has led to a higher availability rate for EDF's generation facilities.

- Strategic Efficiency Focus: The 'Ambitions 2035' plan explicitly targets further enhancements in operational efficiency as a core pillar of its future strategy.

- Increased Generation Output: As evidenced by the 2023 nuclear generation figures, EDF's efforts are translating into more power being produced, demonstrating improved efficiency in practice.

EDF's diversified generation portfolio, encompassing nuclear, hydropower, thermal, and renewables, provides significant operational resilience. In 2024, the company saw a notable increase in French nuclear and hydropower output, reinforcing its capacity to meet energy demand reliably.

The company's strategic investments in new nuclear projects like Hinkley Point C, expected to supply 7% of UK electricity, and the French EPR2 program, highlight a commitment to expanding low-carbon capacity. EDF also targets substantial growth in wind and solar power, further strengthening its future revenue streams and asset base.

EDF's operational efficiency has improved, driven by programs like 'START 2025' which optimizes nuclear reactor outages. This focus on industrial performance led to a significant increase in nuclear generation in 2023, reaching 309.7 TWh, up from 279.1 TWh in 2022.

EDF's commitment to sustainability is evident in its emission reduction targets, aiming for a 40% cut in CO2 from industrial sites by 2027 and 50% by 2030 (vs. 2019). This strong environmental focus positions EDF favorably in a market increasingly valuing green energy solutions.

| Key Strength | Description | Supporting Data/Target |

| Diversified Generation Mix | Resilience through a broad energy portfolio. | Increased 2024 French nuclear & hydro output. |

| Low-Carbon Investment | Future-proofing with nuclear and renewables. | Hinkley Point C to supply 7% of UK electricity. |

| Operational Efficiency | Optimized asset performance and reduced downtime. | 2023 Nuclear Generation: 309.7 TWh (up from 279.1 TWh in 2022). |

| Environmental Commitment | Strong focus on decarbonization. | Target: 50% CO2 reduction from industrial sites by 2030 (vs. 2019). |

What is included in the product

Analyzes EDF’s competitive position through key internal and external factors, highlighting its strengths in nuclear power and renewable energy, alongside weaknesses in aging infrastructure and financial challenges, while exploring opportunities in energy transition and threats from market volatility.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

EDF's substantial financial debt remains a significant weakness, standing at €54.3 billion at the close of 2024. This considerable debt load impacts the company's flexibility and ability to invest in future projects.

Major new construction projects, particularly Hinkley Point C, have experienced substantial cost overruns and impairment charges, directly contributing to and exacerbating this debt burden.

Effectively managing and reducing this high level of financial debt is paramount for EDF's long-term financial stability and its capacity to undertake future strategic initiatives.

A significant portion of EDF's nuclear fleet is aging, requiring substantial and ongoing investment in maintenance and life extension programs. For instance, in early 2024, EDF announced plans for significant upgrades to its Flamanville 3 reactor, underscoring the substantial capital required for maintaining its operational fleet. This aging infrastructure presents a continuous financial burden and operational challenge.

Past issues, such as stress corrosion cracking that affected several reactors in 2022 and 2023, led to temporary shutdowns and reduced output, costing EDF billions in lost revenue and repair expenses. While operational performance has seen improvements, the persistent need for repairs and life extensions for these older units remains a considerable financial and operational strain, impacting supply chain reliability.

EDF has grappled with significant hurdles in executing international nuclear power plant projects, often facing delays and cost overruns. For instance, the Flamanville 3 project in France, while domestic, has seen its projected costs escalate dramatically, offering a precedent for challenges in large-scale nuclear construction that can translate internationally.

These execution difficulties have impacted EDF's global competitiveness, leading to instances where the company has lost bids to international rivals. This competitive disadvantage stems from the complexities of managing vast, multi-year projects across different regulatory environments and supply chains.

Consequently, EDF has strategically decided to deprioritize certain overseas ventures, redirecting its focus towards strengthening its domestic project delivery capabilities. This recalibration underscores the inherent difficulties in achieving efficient and cost-effective project execution on the global stage.

Impact of Falling Wholesale Electricity Prices

The sharp decline in wholesale electricity prices throughout 2024, with projections suggesting a continued downward trend into 2025, presents a significant headwind for EDF. This market shift directly impacts the company's revenue streams and overall profitability, as the value of electricity sold on the open market decreases.

This environment also complicates EDF's ability to secure long-term supply contracts with industrial clients. With lower prevailing market prices, negotiating favorable, stable rates becomes considerably more challenging, potentially impacting future revenue predictability.

The volatility in wholesale electricity markets directly translates into less predictable financial results for EDF. For instance, if wholesale prices were to average 50 EUR/MWh in 2024, down from 150 EUR/MWh in 2023, this would represent a substantial revenue reduction on generated electricity.

- Revenue Pressure: Falling wholesale electricity prices directly reduce EDF's income from electricity sales.

- Contract Negotiation Challenges: Lower market prices make it harder to secure profitable long-term supply agreements.

- Profitability Impact: The overall financial performance of EDF is negatively affected by this price decline.

- Market Volatility: Unpredictable price movements create uncertainty in financial planning and forecasting.

Exposure to Regulatory and Political Interventions

As a state-owned enterprise, EDF's operational and financial strategies are significantly influenced by government interventions. For instance, the French government's implementation of tariff shields, designed to protect consumers from soaring energy prices, directly limits EDF's ability to fully benefit from market price fluctuations. This regulatory oversight can constrain its commercial flexibility and impact profitability.

These interventions extend to the terms of its contracts with industrial clients, where negotiations are often shaped by political considerations rather than purely commercial ones. Such government influence, while intended to serve broader public interests, presents a notable weakness by potentially hindering EDF's capacity to optimize its revenue streams and pursue independent market-driven strategies.

- Government-imposed tariff shields directly cap revenue potential.

- Negotiations on industrial contracts are subject to political influence, not just market forces.

- Regulatory changes can alter the competitive landscape and EDF's market position.

EDF's substantial financial debt, reaching €54.3 billion by the end of 2024, severely limits its investment capacity and strategic maneuverability. This debt is largely a consequence of significant cost overruns and impairment charges on major projects like Hinkley Point C, underscoring the critical need for debt reduction to ensure long-term financial health and future project viability.

A significant portion of EDF's nuclear fleet is aging, necessitating continuous and substantial capital investment for maintenance and life extension programs. The ongoing need for repairs, such as those addressing stress corrosion cracking in 2022-2023, continues to strain operational and financial resources, impacting output and supply chain reliability.

EDF faces challenges in executing large international nuclear projects, frequently encountering delays and cost escalations, as exemplified by the Flamanville 3 project. These execution difficulties have diminished its global competitiveness, leading to lost bids and a strategic shift to prioritize domestic project delivery, highlighting the inherent complexities of international ventures.

The sharp decline in wholesale electricity prices throughout 2024, with continued downward pressure anticipated into 2025, directly impacts EDF's revenue streams and profitability. This market trend also complicates the negotiation of favorable long-term contracts with industrial clients, reducing revenue predictability.

As a state-owned entity, EDF's operations are subject to government influence, including tariff shields that cap revenue potential and political considerations shaping industrial contract negotiations. This regulatory oversight constrains commercial flexibility and hinders the pursuit of purely market-driven strategies.

Same Document Delivered

EDF SWOT Analysis

You’re viewing a live preview of the actual EDF SWOT analysis. The complete, detailed version becomes available immediately after purchase.

This is the same SWOT analysis document that will be included in your download. The full content is unlocked after payment, ensuring you receive the exact professional report you see here.

Opportunities

The global push towards decarbonization and the urgent need to address climate change are fueling a substantial rise in the demand for low-carbon electricity. This creates a significant market opportunity for EDF, particularly given its substantial investments and expertise in both nuclear and renewable energy sources.

Regulatory frameworks and government incentives worldwide are increasingly favoring sustainable energy solutions, further amplifying this demand. EDF's established presence in low-carbon generation, including its significant nuclear fleet and expanding renewable capacity, positions it favorably to capitalize on this growing market.

By 2024, the International Energy Agency (IEA) reported that clean electricity generation capacity was expanding rapidly, with renewables and nuclear power playing crucial roles in meeting climate goals. EDF's commitment to these sectors aligns directly with this global trend, enabling it to meet the escalating need for cleaner power sources.

EDF is actively expanding its renewable energy capacity, with a robust pipeline of wind and solar projects. This strategic focus is designed to capitalize on the global shift towards decarbonization and meet increasing demand for clean energy sources.

Significant investments and strategic alliances, like the partnership with Power Sustainable in North America, are crucial for accelerating the development and deployment of new renewable assets. These collaborations allow EDF to leverage expertise and capital, thereby speeding up its green energy expansion.

This expansion not only diversifies EDF's energy portfolio but also solidifies its competitive standing in the burgeoning green energy sector. For instance, EDF Renewables announced in early 2024 its plans to develop a significant offshore wind project in the United States, aiming for a capacity of over 1 GW.

EDF's commitment to developing next-generation nuclear reactors, like the EPR2 and various Advanced Modular Reactor (AMR) designs, presents a significant long-term growth opportunity. These innovative technologies are poised to deliver consistent, low-carbon electricity, essential for replacing older nuclear facilities and potentially creating new international markets for French nuclear expertise.

The ongoing investment in research and development for these advanced nuclear solutions is paramount for ensuring future energy security and maintaining EDF's leadership in the global nuclear sector. For instance, the EPR2 program is a key component of France's new nuclear build strategy, aiming to deliver cost-effective and reliable power.

Electrification of Industry, Transport, and Heating

The global push to electrify industry, transport, and heating is a significant tailwind for EDF. This transition is expected to drive a substantial increase in electricity demand. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global electricity demand growth would accelerate in the coming years, partly due to electrification trends in transport and industry. As a leading electricity producer, EDF is well-positioned to capitalize on this expanding market.

This growing demand translates directly into new sales opportunities for EDF. Beyond simply supplying power, EDF can leverage this trend to offer a range of new services. These could include charging infrastructure solutions for electric vehicles, smart grid technologies to manage increased load, and energy efficiency services for industrial clients transitioning to electric processes. The company's existing infrastructure and expertise provide a strong foundation for these new ventures.

EDF's strategic focus on renewable energy generation, particularly in France and the UK, aligns perfectly with the electrification agenda. By expanding its low-carbon electricity production capacity, EDF can meet the rising demand sustainably. For example, EDF's ongoing investments in offshore wind power, such as the planned expansion of its portfolio in the North Sea, directly support the clean energy needed for widespread electrification. By 2025, EDF aims to significantly increase its renewable energy capacity, further solidifying its role in this evolving energy landscape.

- Increased Demand: Global electricity demand is projected to rise significantly due to electrification of transport, industry, and heating.

- New Revenue Streams: Opportunities exist for EDF to offer EV charging infrastructure, smart grid solutions, and energy efficiency services.

- Renewable Energy Synergy: EDF's investments in renewables, like offshore wind, directly support the clean power needed for electrification.

- Market Leadership: EDF's established position as a generator and supplier allows it to benefit directly from this sector-wide transition.

Leveraging Digitalization and Smart Energy Solutions

EDF has a significant opportunity to boost its operational efficiency and customer service by embracing digitalization. This includes using artificial intelligence for better asset management, ensuring equipment runs smoothly and anticipating maintenance needs. Smart energy solutions also present a chance to offer customers more control and tailored services, potentially leading to new revenue streams.

Investing in cutting-edge technologies is key for EDF's future growth. This means focusing on advanced grid management systems to ensure reliable power delivery, expanding energy storage capabilities to handle renewable energy fluctuations, and enhancing customer engagement platforms. These investments can directly improve service quality and open up new avenues for income.

- Digitalization for Efficiency: EDF can leverage AI for predictive maintenance on its 160 GW global generation capacity, reducing downtime and operational costs.

- Smart Energy Solutions: Opportunities exist in offering smart home energy management systems, potentially reaching millions of residential customers and creating recurring revenue.

- Grid Modernization: Investments in smart grid technology can improve resilience, with a focus on areas like France where grid modernization is a national priority.

- New Revenue Streams: Developing digital platforms for energy trading and demand-response programs can tap into the growing flexibility market.

The global transition to net-zero emissions presents a substantial opportunity for EDF to expand its low-carbon energy portfolio. With a strong foundation in nuclear power and a growing renewable energy segment, EDF is positioned to capitalize on increasing demand for clean electricity. For instance, by 2024, the International Energy Agency (IEA) highlighted that clean energy capacity additions were accelerating globally, with renewables and nuclear playing pivotal roles in achieving climate targets.

EDF's strategic investments in renewable energy, particularly in wind and solar, are key to capturing this market growth. The company aims to significantly increase its renewable capacity by 2025, aligning with global decarbonization efforts. Furthermore, EDF's commitment to developing advanced nuclear technologies, such as the EPR2 and various Advanced Modular Reactor (AMR) designs, offers long-term potential for consistent, low-carbon power generation and export opportunities for French nuclear expertise.

The electrification of transportation, industry, and heating is a major driver for increased electricity demand, creating new markets for EDF. The IEA projected in its 2024 outlook that this trend would accelerate, benefiting established electricity producers like EDF. This surge in demand allows EDF to not only supply power but also to develop new services such as EV charging infrastructure and smart grid solutions, further diversifying its revenue streams.

Digitalization offers EDF a pathway to enhance operational efficiency and customer engagement. By leveraging AI for predictive maintenance across its 160 GW global generation capacity, EDF can reduce costs and improve reliability. The development of smart energy solutions and digital platforms for energy trading and demand-response programs can unlock new revenue streams and tap into the growing flexibility market.

| Opportunity Area | Key Drivers | EDF's Position/Action | Market Data/Outlook |

|---|---|---|---|

| Decarbonization & Clean Energy Demand | Global net-zero targets, climate change mitigation | Expansion of nuclear and renewable (wind, solar) capacity; aiming for significant renewable growth by 2025. | IEA (2024): Clean energy capacity additions accelerating; renewables and nuclear crucial for climate goals. |

| Electrification of Economy | Transport, industry, and heating electrification | Well-positioned to meet rising electricity demand; developing EV charging infrastructure and smart grid solutions. | IEA (2024 outlook): Electrification trends to accelerate global electricity demand growth. |

| Advanced Nuclear Technologies | Energy security, consistent low-carbon power | Development of EPR2 and AMR designs; potential for new markets for French nuclear expertise. | France's new nuclear build strategy emphasizes EPR2 for cost-effective power. |

| Digitalization & Smart Solutions | Operational efficiency, customer engagement | AI for predictive maintenance (160 GW capacity); smart home energy management; digital trading platforms. | Growing flexibility market offers new revenue opportunities through demand-response programs. |

Threats

The energy sector is increasingly crowded, with new companies and independent producers actively seeking market share, directly challenging EDF's established position. This intensified competition puts significant pressure on EDF's pricing strategies and its ability to retain existing customers.

For instance, in 2024, the European renewable energy market saw a surge in new project developments by non-traditional players, with independent solar and wind farm operators capturing an estimated 15% of new capacity additions. This trend directly impacts EDF's revenue streams by fragmenting the market and driving down wholesale electricity prices.

To counter this, EDF must prioritize continuous innovation in its service offerings and operational efficiency. Adapting to evolving market demands, such as the growing preference for distributed energy solutions and smart grid technologies, is crucial for maintaining its competitive edge and ensuring long-term viability.

EDF faces significant financial risks from the volatile prices of key commodities like natural gas and coal, alongside CO2 emission allowances. Wholesale electricity price fluctuations also directly impact its revenue streams, creating a challenging operating environment.

The sharp decline in wholesale electricity prices observed in 2024, for instance, directly reduced EDF's revenues compared to the high price environment of previous years. This downward pressure complicates the negotiation of long-term contracts and introduces considerable uncertainty into financial planning and forecasting.

Changes in national energy policies and regulatory frameworks present a significant threat to EDF. For instance, ongoing debates and potential adjustments to the ARENH mechanism in France, which governs access to historical nuclear electricity, create uncertainty regarding EDF's future revenue streams and market positioning. This evolving landscape demands constant adaptation to new governmental interventions and policy shifts.

Significant Capital Expenditure and Project Risks

EDF faces significant threats from its ambitious capital expenditure plans, especially concerning new nuclear builds. These projects involve massive financial commitments and carry inherent risks like potential cost overruns and construction delays, which could strain the company's financial health.

For instance, the Hinkley Point C project in the UK, a flagship new build, has seen its estimated cost rise considerably. Initial projections were around £18 billion, but by early 2024, estimates had climbed to over £30 billion, highlighting the substantial capital outlays and the reality of cost escalations in such mega-projects.

The long lead times associated with nuclear projects also expose EDF to evolving market conditions and regulatory landscapes. This uncertainty can impact the financial viability and returns on these massive investments, posing a considerable threat to the company's long-term strategic objectives and financial stability.

- Substantial Capital Outlays: EDF's new nuclear projects require billions in investment, potentially stretching its balance sheet.

- Project Cost Overruns: Historical data, like the Hinkley Point C cost increases from £18bn to over £30bn, demonstrates this ongoing threat.

- Construction Delays: Extended timelines for nuclear builds can lead to increased financing costs and delayed revenue generation.

- Market and Regulatory Volatility: Long project durations expose EDF to shifts in energy prices, technology, and government policies.

Public Acceptance and Environmental Scrutiny of Nuclear Power

Public apprehension surrounding nuclear power's safety, waste management, and environmental impact remains a significant hurdle. This can translate into strong opposition to new plant constructions and more stringent regulatory frameworks, inevitably driving up project expenses and extending timelines. For instance, in 2024, several European nations continued to debate the role of nuclear energy, with public opinion polls showing divided sentiment, impacting governmental policy decisions and investment in new builds.

EDF, as a major player in nuclear energy, must proactively address these concerns to secure its social license to operate and facilitate future growth. The company's ongoing efforts in transparent communication about safety protocols and waste solutions are crucial. By demonstrating commitment to environmental stewardship and community engagement, EDF aims to build trust and mitigate the risk of project delays or cancellations due to public backlash.

- Public Opinion: Surveys in key markets like France and the UK in late 2024 indicated persistent public concerns, with roughly 40-50% expressing reservations about nuclear safety.

- Regulatory Landscape: Increased scrutiny has led to higher compliance costs, with new reactor designs needing to meet evolving safety standards, potentially adding 10-15% to capital expenditure projections.

- Project Delays: Historical data suggests public opposition has contributed to an average delay of 2-3 years for major nuclear infrastructure projects globally in the past decade.

EDF faces intense competition from new market entrants and independent producers, fragmenting the market and pressuring pricing. The company also grapples with volatile commodity prices and electricity wholesale rates, impacting revenue predictability. Furthermore, evolving national energy policies and regulatory shifts, such as potential changes to the ARENH mechanism in France, introduce significant uncertainty for EDF's revenue streams and market standing.

| Threat Category | Specific Threat | Impact on EDF | Supporting Data/Example (2024/2025) |

| Market Competition | Increased market share by independent producers | Pressure on pricing, customer retention | European renewables saw 15% new capacity from non-traditional players in 2024. |

| Price Volatility | Fluctuations in natural gas, coal, and CO2 allowance prices | Revenue instability, reduced profitability | Wholesale electricity prices declined in 2024, impacting EDF's revenue compared to prior years. |

| Regulatory & Policy Changes | Uncertainty in national energy policies | Impact on revenue streams and market position | Ongoing debates on France's ARENH mechanism create future revenue uncertainty. |

SWOT Analysis Data Sources

This EDF SWOT analysis is built upon a robust foundation of internal financial statements, comprehensive market research, and expert industry analyses, ensuring a well-informed and actionable strategic overview.