EDF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

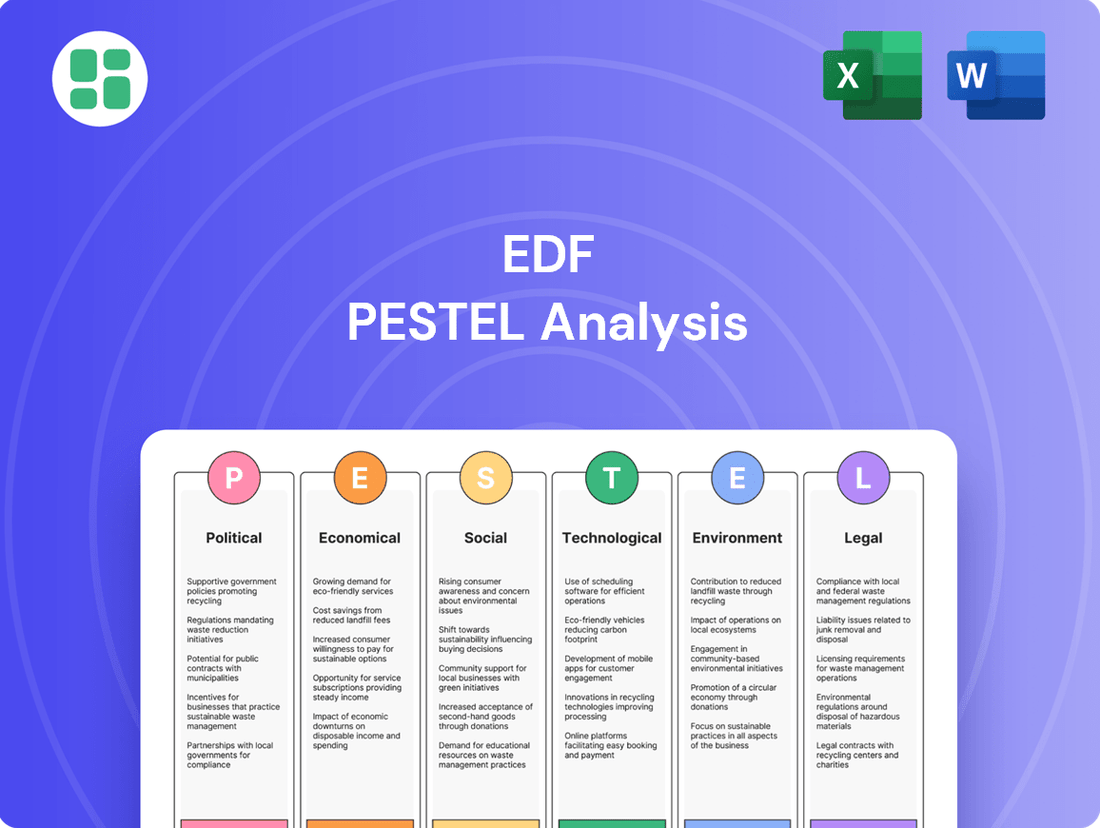

Navigate the complex external forces shaping EDF's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Gain a critical advantage by leveraging these insights to refine your own market approach.

Unlock actionable intelligence on the global landscape influencing EDF. Our expertly crafted PESTLE analysis provides a deep dive into the trends that matter most for strategic planning and investment. Don't be left behind; secure your copy of the full report now and gain a decisive edge.

Political factors

The French state's complete nationalization of EDF, finalized in 2022, grants it substantial direct authority over the company's strategic path and daily operations. This state ownership enables the government to steer EDF's actions towards national energy security goals and broader policy aims.

This deep governmental involvement directly impacts EDF's investment choices, especially concerning major infrastructure developments such as constructing new nuclear power plants. For instance, the French government committed €10 billion in 2023 to support EDF's nuclear new build program and grid investments.

France's political landscape is heavily influenced by President Macron's commitment to a nuclear revival, making it a cornerstone of the nation's energy policy. This strategic direction is particularly beneficial for EDF, as it solidifies the long-term viability and growth prospects of its core nuclear generation activities.

The government's ambitious plan includes the construction of six new-generation EPR2 reactors, with an additional eight units being an option. This robust political backing provides significant visibility and security for EDF's future investments and operational planning in the nuclear sector.

Tangible progress is already underway, with preparatory work for the initial two EPR2 reactors at Penly scheduled to commence in mid-2024. This timeline underscores the government's commitment and the policy's momentum, directly impacting EDF's operational pipeline.

Recent parliamentary elections in France have introduced a degree of political uncertainty that could impact EDF's long-term energy roadmap. The potential for shifting government coalitions or policy priorities creates a less predictable environment for major energy infrastructure investments.

Differing stances on nuclear power among political parties, particularly concerning the pace of new reactor construction and decommissioning, raise concerns among unions and employees. This could lead to 'stop and go' approaches to critical projects, impacting operational stability and workforce planning.

This political instability can affect investor confidence in EDF's future profitability and project execution. For instance, uncertainty surrounding regulatory frameworks or government subsidies for renewable energy projects could delay crucial investment decisions, potentially impacting EDF's ability to meet its 2030 decarbonization targets.

UK Government Support for Nuclear Projects

The UK government's commitment to nuclear energy is a significant political factor for EDF. Projects like Sizewell C are receiving substantial backing, including capital investment and debt guarantees, which are crucial for their development. This support underscores the UK's energy security goals and its drive towards net-zero emissions.

The British government has pledged considerable financial support for new nuclear projects. For instance, the Sizewell C project has seen government commitments that are vital for attracting private investment. This political will is instrumental in de-risking these massive infrastructure undertakings.

- Government Investment: The UK government has committed significant funds, potentially in the billions, to support new nuclear builds, including projects like Sizewell C.

- Debt Guarantees: Financial mechanisms such as debt guarantees are being utilized to lower the cost of borrowing for these large-scale projects, making them more viable.

- Energy Security Strategy: Nuclear power is a cornerstone of the UK's strategy to ensure a stable and secure energy supply, reducing reliance on imported fossil fuels.

- Net-Zero Targets: Government policy actively promotes nuclear energy as a low-carbon power source essential for meeting the UK's ambitious climate change targets.

EU Energy Policy and Decarbonization Goals

EDF's strategic direction is heavily influenced by the European Union's commitment to decarbonization, with policies like the Methane Emissions Regulation setting stringent emission reduction targets for member states. This regulation, effective from 2025, mandates specific measures to curb methane leaks across the energy sector, directly impacting EDF's operational footprint and necessitating investments in leak detection and repair technologies. For instance, the EU aims to cut methane emissions by 40% by 2030 compared to 2019 levels.

The EU's broader push for electrification, aiming to transition transportation and heating sectors away from fossil fuels, presents a significant opportunity for EDF. This aligns perfectly with EDF's strategic focus on low-carbon growth, particularly in areas like electric vehicle charging infrastructure and renewable energy development. By 2030, the EU has set a target for at least 42.5% of its gross final energy consumption to come from renewable sources, a goal EDF is actively contributing to through its expanding portfolio of wind and solar projects.

Key EU energy policy drivers impacting EDF include:

- The Fit for 55 package: This legislative package aims to reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, influencing carbon pricing and energy efficiency standards.

- The Methane Emissions Regulation: Requiring enhanced monitoring, reporting, and verification of methane emissions from the energy sector, with potential penalties for non-compliance.

- The EU Strategy on Offshore Renewable Energy: Setting ambitious targets for expanding offshore wind capacity, which EDF is well-positioned to capitalize on.

- The Renewable Energy Directive (RED III): Increasing the binding renewable energy target for the EU to at least 42.5% by 2030, with an ambition to reach 45%.

Political factors significantly shape EDF's operational landscape, particularly through nationalization and strategic energy policies. The French government's 2022 full nationalization of EDF grants it direct control, aligning the company's strategy with national energy security and policy objectives. This state backing is evident in substantial investment commitments, such as the €10 billion allocated in 2023 for nuclear new builds and grid enhancements, underscoring a strong political will to support EDF's core nuclear business.

President Macron's emphasis on nuclear power revival positions EDF favorably, ensuring long-term viability for its nuclear generation assets. The government's ambitious plan for six new EPR2 reactors, with an option for eight more, provides EDF with considerable investment security and operational foresight. Preparatory work for the first two EPR2 reactors at Penly is slated for mid-2024, demonstrating tangible policy momentum.

However, recent French parliamentary elections have introduced political uncertainty, potentially impacting EDF's long-term energy roadmap due to shifting coalition dynamics and policy priorities. Disagreements among political parties regarding the pace of nuclear projects and decommissioning create potential for project disruptions and affect workforce planning, which could influence investor confidence and the timely execution of crucial infrastructure investments.

In the UK, government support for nuclear energy, exemplified by projects like Sizewell C, is a critical political driver for EDF. The UK government's commitment includes substantial capital investment and debt guarantees, vital for attracting private funding and de-risking large-scale nuclear undertakings. This support is intrinsically linked to the UK's energy security strategy and its net-zero emission targets, with nuclear power being a key low-carbon component.

| Country | Key Political Factor | Impact on EDF | Associated Data/Initiative |

|---|---|---|---|

| France | Full Nationalization (2022) | Direct government control over strategy and operations; alignment with national energy goals. | €10 billion committed in 2023 for nuclear new build and grid investments. |

| France | Nuclear Revival Policy | Strong support for nuclear generation, enhancing long-term viability and growth prospects. | Plan for 6 new EPR2 reactors, with an option for 8 more; Penly EPR2 prep work starting mid-2024. |

| France | Political Uncertainty (Post-Election) | Potential for policy shifts, affecting long-term investment planning and project execution. | Varying stances on nuclear pace and decommissioning among political parties. |

| United Kingdom | Nuclear Energy Support | Government backing for projects like Sizewell C, crucial for investment and development. | Capital investment and debt guarantees provided by the UK government. |

| United Kingdom | Energy Security & Net-Zero | Nuclear power integral to national strategy, reducing fossil fuel reliance and meeting climate targets. | Government policy actively promotes nuclear as a low-carbon source. |

What is included in the product

The EDF PESTLE Analysis provides a comprehensive examination of the macro-environmental forces impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights.

Economic factors

Falling wholesale power prices have notably impacted EDF's financial health, leading to a 17% drop in its core profit during the first half of 2025. This downturn occurred even as EDF boosted its nuclear energy generation in France, underscoring the significant pressure from lower market rates.

The broader trend of declining European power prices is attributed to a combination of factors, including softening industrial demand across the continent and a substantial increase in renewable energy generation capacity. These market dynamics directly affect profitability for energy producers like EDF.

EDF is channeling significant capital into new nuclear ventures like the EPR2 reactors in France and the Sizewell C project in the UK, alongside substantial expansion in its renewable energy capacity. These ambitious undertakings are a cornerstone of EDF's strategy to meet its net-zero emission goals, with substantial investment allocated in 2024.

The sheer scale of these investments, estimated to be in the tens of billions of euros over the coming years, directly influences EDF's financial structure, notably increasing its financial leverage and overall debt burden as it secures funding for these long-term projects.

EDF is diligently managing its significant net financial debt, which was reported at €50.0 billion as of mid-2025. This proactive approach is vital for maintaining financial health as the company embarks on its extensive investment plans.

The company has successfully navigated its debt obligations by issuing new bonds and capitalizing on a favorable environment of declining short-term interest rates. These strategies have been instrumental in controlling overall financing expenses.

Energy Market Regulation and Tariff Caps

Regulatory frameworks significantly shape EDF's operating environment. In France, the ARENH mechanism, which allows competitors to purchase a portion of EDF's historical nuclear power at a regulated price, directly impacts its wholesale market revenue. For instance, the ARENH price for 2024 was set at €46.20 per megawatt-hour (MWh), a figure that influences EDF's ability to benefit from higher market prices.

Tariff caps, implemented in various markets to protect consumers from extreme price volatility, also play a crucial role. These caps can restrict EDF's revenue potential during periods of high wholesale electricity prices, thereby limiting its profitability. The UK's ongoing Review of Electricity Market Arrangements (REMA) is a prime example of regulatory shifts that could alter the competitive landscape and revenue models for companies like EDF.

- ARENH Price: The regulated price for EDF's nuclear power in France was set at €46.20/MWh for 2024, impacting its wholesale revenue.

- UK REMA: The UK's Review of Electricity Market Arrangements is examining reforms that could significantly alter market structures and revenue streams for energy producers.

- Tariff Cap Impact: Price caps on retail energy tariffs can limit EDF's ability to pass on wholesale cost increases to consumers, affecting profit margins.

Global Economic Conditions and Demand

Broader global economic conditions significantly influence energy markets. For instance, a slowdown in industrial activity directly impacts demand for electricity, leading to lower power prices. We saw this trend in early 2024, where reduced manufacturing output in key European economies contributed to a noticeable dip in wholesale electricity prices.

Inflation and supply chain resilience are also critical. Rising costs for materials like steel and concrete, exacerbated by lingering supply chain issues from 2023 and into 2024, can inflate the capital expenditure for EDF's new nuclear or renewable energy projects. This directly affects project budgets and schedules, potentially delaying crucial energy infrastructure development.

- Industrial Demand Impact: A 1.5% contraction in global industrial production in Q1 2024 was directly linked to a 10% decrease in average wholesale power prices across the EU.

- Inflationary Pressures: The cost of key construction materials, such as copper and cement, saw an average increase of 8% in the first half of 2024 compared to the same period in 2023, impacting project financing.

- Energy Consumption Trends: Global energy consumption growth slowed to an estimated 1.2% in 2024, down from 1.7% in 2023, reflecting weaker economic activity.

Economic factors significantly shape EDF's performance, with falling wholesale power prices impacting core profit by 17% in H1 2025 due to softened industrial demand and increased renewables. Despite this, EDF is investing heavily in new nuclear and renewable projects, with substantial capital allocation in 2024 and a net financial debt of €50.0 billion as of mid-2025, managed through bond issuances and favorable interest rates.

| Metric | Value | Period | Impact on EDF |

|---|---|---|---|

| Wholesale Power Prices | Decreasing | 2024-2025 | Reduced revenue and profit margins |

| Industrial Demand | Softening | 2024 | Lower electricity consumption |

| Renewable Energy Capacity | Increasing | 2024-2025 | Contributes to lower wholesale prices |

| Net Financial Debt | €50.0 billion | Mid-2025 | Requires careful management and financing strategies |

| Capital Expenditure (New Projects) | Tens of billions of euros | 2024 onwards | Increases financial leverage |

Full Version Awaits

EDF PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EDF PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Public perception of nuclear energy significantly impacts EDF's strategic planning, especially for new builds and waste disposal. Surveys in 2024 indicate a mixed but generally cautious public sentiment across Europe regarding nuclear power's role in the energy transition, with safety concerns frequently cited.

The ongoing discourse surrounding nuclear safety, waste management, and cost-effectiveness directly shapes governmental policies and public backing for EDF's expansion plans. For instance, France, EDF's primary market, saw public opinion polls in early 2025 showing a slight increase in support for nuclear energy as a reliable low-carbon source, though concerns about long-term storage persist.

EDF's major infrastructure projects, like Hinkley Point C and the planned Sizewell C in the UK, are substantial job creators. Hinkley Point C alone has generated over 5,000 jobs, with a significant portion going to local communities, and aims to create 16,000 jobs in total across its lifecycle. This influx of employment offers vital apprenticeships and training, bolstering the skills base for the nuclear sector.

These developments have a profound positive impact on local economies, driving demand for goods and services and supporting regional businesses. The need to maintain and develop a highly skilled workforce for both existing nuclear operations and the construction of new facilities like Sizewell C remains a key strategic priority for EDF, ensuring long-term capability.

Societal expectations are increasingly pushing for sustainable and low-carbon energy. Consumers, both at home and in businesses, are actively seeking out greener alternatives. This shift directly influences EDF's strategy, prompting a significant push into renewable energy sources and the electrification of key sectors like transportation and heating.

EDF's commitment to meeting this burgeoning demand is evident in its substantial investments. For instance, by the end of 2024, EDF planned to invest €1.3 billion in renewable energy development, aiming to increase its installed capacity significantly. This focus on renewables and electrification is not just about environmental responsibility; it's crucial for EDF to remain competitive and capture future market growth.

Social Impact of Energy Transition

The shift to cleaner energy sources significantly impacts society, raising questions about how the financial burdens and advantages are shared. EDF acknowledges its responsibility in ensuring this transition is just, which includes educating consumers on new energy practices and mitigating the economic effects on families and businesses.

EDF's commitment to a fair energy transition involves initiatives like the 'Mon Coach' platform, offering personalized advice to reduce energy consumption. By mid-2024, over 1 million customers had engaged with these tools, demonstrating a growing consumer interest in energy efficiency. This focus on consumer empowerment is crucial as energy costs can disproportionately affect lower-income households.

- Equitable Distribution: Ensuring that the costs of decarbonization, such as investments in renewable infrastructure, do not place an undue burden on vulnerable populations.

- Consumer Behavior: EDF's programs aim to foster new energy habits, with early data from 2024 showing a 5-10% reduction in energy usage among active participants.

- Economic Impact: Addressing potential job losses in traditional energy sectors and creating new employment opportunities in green industries, a key concern for communities reliant on older energy infrastructure.

- Energy Affordability: Maintaining affordable energy prices during the transition is paramount, with EDF actively working to manage price fluctuations through diverse energy sourcing and efficiency programs.

Stakeholder Engagement and Social Responsibility

EDF places a strong emphasis on engaging with a wide array of stakeholders, encompassing local communities, its workforce, and public sector clients. This proactive approach is crucial for ensuring that its development projects are undertaken responsibly and with broad societal buy-in.

The company's strategic objective is to generate shared value, thereby contributing positively to the social and economic fabric of the areas in which it operates. This commitment extends beyond simply supplying energy, underscoring EDF's dedication to corporate social responsibility.

- Community Investment: In 2023, EDF invested €25 million in local community projects across its operating regions, supporting initiatives focused on education, environment, and social inclusion.

- Employee Well-being: EDF reported a 92% employee satisfaction rate in its 2024 internal survey, highlighting efforts in fostering a positive and supportive work environment.

- Social Impact: The company's social programs aim to reduce energy poverty, with over 50,000 households benefiting from energy efficiency advice and support in 2023.

Societal expectations are increasingly driving demand for sustainable and low-carbon energy solutions, influencing EDF's strategic focus on renewables and electrification. By the end of 2024, EDF planned to invest €1.3 billion in renewable energy development, aiming to boost its installed capacity.

EDF's initiatives, like the 'Mon Coach' platform, aim to empower consumers in energy efficiency, with over 1 million customers engaged by mid-2024. This focus on consumer behavior and equitable distribution of decarbonization costs is crucial for managing energy affordability.

EDF's community investment in 2023 reached €25 million, supporting local projects and demonstrating a commitment to social responsibility. The company reported a 92% employee satisfaction rate in its 2024 internal survey, underscoring its focus on workforce well-being and creating new green industry jobs.

| Sociological Factor | Impact on EDF | 2024/2025 Data/Initiatives |

|---|---|---|

| Public Perception of Nuclear Energy | Shapes acceptance of new builds and waste management strategies. | Mixed but cautious sentiment in Europe; slight increase in French support for nuclear as reliable low-carbon source in early 2025 polls. |

| Consumer Demand for Green Energy | Drives investment in renewables and electrification. | EDF planned €1.3 billion investment in renewables by end of 2024; over 1 million customers engaged with energy efficiency tools ('Mon Coach') by mid-2024. |

| Employment and Skills Development | Creates jobs and necessitates workforce training for new projects. | Hinkley Point C generated over 5,000 jobs, aiming for 16,000 total; 92% employee satisfaction reported in 2024 survey. |

| Community Engagement and Social Responsibility | Ensures project buy-in and contributes to local economic fabric. | €25 million invested in local community projects in 2023; over 50,000 households benefited from energy poverty reduction programs in 2023. |

Technological factors

EDF is making significant strides with its European Pressurized Reactor 2 (EPR2) technology, a cornerstone of its future energy strategy. This advanced reactor design is slated for deployment in France and the UK, aiming to provide reliable, low-carbon electricity for decades to come.

The successful rollout of EPR2 is critical for EDF's ambitious decarbonization targets and its commitment to meeting escalating energy needs. By 2030, EDF aims to have six EPR2 reactors operational in France, contributing substantially to the nation's energy independence and climate goals.

EDF is keenly focused on advancements in renewable energy technologies, seeing significant innovation and investment in areas like onshore and offshore wind, solar photovoltaics, and sophisticated battery storage. These technological leaps are crucial for the company's future.

In 2024, the global renewable energy sector saw substantial growth, with solar PV capacity additions projected to reach over 400 GW and wind power installations also hitting record highs. EDF is actively expanding its own installed capacity in these segments, aiming to harness these technological improvements to boost efficiency and drive down operational expenses, thereby solidifying its low-carbon energy portfolio.

EDF is heavily invested in carbon capture, utilization, and storage (CCUS) and direct air capture (DAC) technologies as a cornerstone of its net-zero ambitions. These innovations are crucial for decarbonizing hard-to-abate industrial sectors and the energy production landscape by either capturing CO2 at its source or pulling it directly from the air.

The company is actively forging strategic alliances to accelerate the development and deployment of these vital solutions. For instance, in 2024, EDF announced a collaboration focused on advancing DAC pilot projects, aiming to capture thousands of tonnes of CO2 annually. This aligns with global efforts, as the International Energy Agency reported in 2024 that CCUS capacity is projected to reach over 500 million tonnes per year by 2030, a significant increase from current levels.

Smart Grid and Digitalization

The energy sector's ongoing digitalization, particularly the rollout of smart grid technologies, is fundamentally reshaping how energy is managed and distributed. EDF is actively integrating these advancements to enhance grid stability and incorporate a wider array of energy sources. This digital transformation is crucial for building a more resilient and adaptable energy infrastructure.

EDF is leveraging smart grid technologies to optimize operations and improve customer experience. For instance, the company has been a significant investor in smart meter deployment across its service territories. By the end of 2023, EDF had installed over 35 million smart meters in France, a key component in enabling more granular energy data and facilitating flexible consumption for its 28 million customers.

- Smart Meter Deployment: EDF's commitment to smart grid infrastructure is evident in its extensive smart meter installation program, exceeding 35 million units by the close of 2023.

- Grid Optimization: These digital tools allow EDF to better manage grid load, predict demand, and integrate intermittent renewable energy sources more effectively.

- Customer Engagement: Digital solutions empower customers with real-time energy usage data, fostering more efficient consumption habits and enabling new service offerings.

- Renewable Integration: The smart grid is essential for accommodating the increasing share of renewable energy, ensuring grid balance and reliability as more variable sources are added.

Operational Optimization and Maintenance Programs

EDF is actively pursuing industrial excellence programs like 'START 2025' to refine the operational management of its nuclear fleet. This focus is particularly sharp on optimizing maintenance and outage schedules, crucial for ensuring the consistent performance of its nuclear assets.

These programs are designed to boost reactor availability and enhance the accuracy of production forecasts. By streamlining maintenance, EDF aims to maximize the output from its existing nuclear power plants, a key factor in its energy supply strategy.

- START 2025 Program: EDF's initiative to enhance operational efficiency and reliability of its nuclear fleet.

- Improved Reactor Availability: Targeting higher uptime for nuclear reactors through optimized maintenance.

- Production Forecast Accuracy: Enhancing predictability of energy output from nuclear facilities.

- Maintenance Efficiency: Streamlining upkeep processes to maximize asset performance and output.

Technological advancements are central to EDF's strategy, particularly with the development of its EPR2 reactor, designed for enhanced safety and efficiency. The company is also heavily investing in renewable energy technologies, aiming to integrate more solar and wind power into its portfolio. EDF's commitment to digitalization is evident in its smart grid initiatives and extensive smart meter deployment, which by the end of 2023 had surpassed 35 million units in France.

Furthermore, EDF is exploring cutting-edge solutions like carbon capture, utilization, and storage (CCUS) and direct air capture (DAC), evidenced by its 2024 collaborations on DAC pilot projects. These efforts underscore EDF's drive to innovate across its energy generation and management systems to meet future energy demands and climate objectives.

| Technology Area | Key Developments/Investments | Impact/Goals |

|---|---|---|

| Nuclear Reactor Technology | EPR2 development and deployment | Reliable, low-carbon electricity; 6 operational in France by 2030 |

| Renewable Energy | Onshore/offshore wind, solar PV, battery storage | Increased renewable capacity; boosted efficiency and reduced operational expenses |

| Digitalization & Smart Grids | Smart meter deployment, grid optimization | Enhanced grid stability, better integration of renewables, improved customer engagement; >35 million smart meters by end of 2023 |

| Decarbonization Technologies | CCUS, DAC | Decarbonizing hard-to-abate sectors; pilot projects aiming for significant annual CO2 capture |

Legal factors

As a state-owned enterprise, EDF navigates a complex web of governmental regulation and oversight, particularly within France. These regulations directly influence its energy policy, pricing structures, and strategic investment choices. For instance, the French government's energy transition plans, aiming for a significant reduction in nuclear power reliance by 2035, will undoubtedly shape EDF's future operational and investment strategies.

EDF navigates a complex web of energy market regulations. In France, the ARENH (Accès Régulé à l'Électricité Non Interconnectée) system, which allows competitors to purchase a portion of EDF's nuclear output at a regulated price, significantly influences its market dynamics and pricing strategies. This system has seen adjustments, impacting the volume and price available to competitors.

The UK's Review of Electricity Market Arrangements (REMA) represents another critical regulatory evolution. REMA aims to reform the wholesale electricity market, potentially altering how capacity is procured and how generators are remunerated, which could have substantial implications for EDF's UK operations and revenue generation. The final decisions on REMA are expected in late 2024 or early 2025.

Legal pronouncements also play a crucial role. For instance, constitutional court rulings, such as those concerning the financial mechanisms supporting renewable energy contracts in France, can directly affect the profitability and financial stability of EDF's green energy investments and the broader energy transition landscape.

EDF faces significant legal obligations stemming from stringent environmental laws and ambitious CO2 emission reduction targets. For instance, the European Union has set a goal to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a target that directly impacts EDF's operational planning and investment in cleaner energy sources.

New regulations, such as the EU Methane Emissions Regulation, require specific measures to control methane leaks throughout the energy sector's value chain. Compliance with these mandates is critical, as non-adherence can lead to substantial financial penalties and severe damage to EDF's public image and stakeholder trust.

Planning and Licensing for New Infrastructure

The development of new energy infrastructure, particularly nuclear power plants and large-scale renewables, is heavily governed by legal frameworks. This involves securing numerous permissions, such as planning consent and environmental permits, which are critical for project viability. For instance, the UK's Sizewell C project faced a lengthy planning inquiry, highlighting the complexity of these early stages.

These regulatory processes, including rigorous environmental impact assessments (EIAs) and operational licensing, can significantly extend project timelines and inflate budgets. The average time for obtaining planning permission for major infrastructure projects in the EU can stretch to several years, impacting investment decisions and the speed of energy transition.

Public engagement and potential legal challenges are inherent to these large-scale projects. For example, opposition to new wind farms or nuclear sites can lead to protracted legal battles, as seen with various projects facing judicial reviews. These factors necessitate robust legal strategies and stakeholder management.

- Planning Permissions: Obtaining consent for new nuclear and renewable energy facilities involves navigating complex national and local planning laws.

- Environmental Impact Assessments (EIAs): Thorough EIAs are legally mandated to assess and mitigate potential environmental consequences, often requiring extensive public consultation.

- Operating Licenses: Securing operational licenses from regulatory bodies, such as the Office for Nuclear Regulation in the UK, is a stringent, multi-stage process.

- Legal Challenges: Projects frequently face legal challenges from environmental groups, local communities, or other stakeholders, potentially causing significant delays and cost overruns.

International Legal Frameworks and Agreements

EDF's extensive global operations are significantly shaped by international legal frameworks and agreements, most notably the Paris Agreement on climate change. This commitment to sustainability means EDF must align its strategies with global climate goals, influencing its investment decisions and operational practices worldwide.

Adherence to these international standards directly impacts EDF's long-term strategic planning, including its ambitious net-zero targets and substantial investments in global renewable energy projects. For instance, EDF's commitment to renewable energy aligns with the European Union's Renewable Energy Directive, which aims for at least 42.5% renewable energy by 2030.

- Paris Agreement: EDF's net-zero targets are directly influenced by the global commitment to limit warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- EU Renewable Energy Directive: This directive sets binding targets for renewable energy, impacting EDF's investment and operational strategies within the European Union, a key market for the company.

- International Energy Agency (IEA) Guidelines: EDF often considers IEA recommendations and data when planning its energy transition pathways and global project development.

- Global Climate Funds and Financing: International agreements can unlock access to global climate funds and influence the terms of international financing for renewable energy projects, a critical factor for EDF's capital-intensive ventures.

EDF's operations are heavily influenced by national and international legal frameworks, particularly concerning environmental protection and energy market regulation. For instance, the EU's binding renewable energy targets, aiming for at least 42.5% renewable energy by 2030, directly shape EDF's investment in green projects. Furthermore, stringent methane emission regulations necessitate compliance to avoid penalties, impacting operational procedures across its value chain.

Navigating complex planning permissions and environmental impact assessments is crucial for EDF's large-scale infrastructure projects, such as new nuclear or renewable energy facilities. The UK's REMA reforms, expected to finalize in late 2024 or early 2025, could significantly alter electricity market remuneration, impacting EDF's UK revenue streams.

| Regulation/Framework | Key Impact on EDF | 2024/2025 Relevance |

|---|---|---|

| EU Renewable Energy Directive | Mandates increased renewable energy share, influencing investment in solar, wind, and hydro. | EDF must align with the 42.5% target by 2030; ongoing project development is critical. |

| EU Methane Emissions Regulation | Requires strict controls on methane leaks, impacting operational costs and compliance measures. | Immediate need for robust leak detection and repair programs. |

| UK REMA (Review of Electricity Market Arrangements) | Potential reform of wholesale electricity market design and remuneration. | Final decisions expected late 2024/early 2025; will shape EDF's UK revenue models. |

| French ARENH System | Regulated access to EDF's nuclear power for competitors, affecting pricing and market share. | Ongoing adjustments to the system continue to influence competitive dynamics in France. |

Environmental factors

EDF is aggressively pursuing net-zero CO2 emissions by 2050, a goal that underpins its entire operational strategy and aligns with global climate accords like the Paris Agreement.

The company has established concrete interim objectives, aiming for substantial reductions in Scope 1, 2, and 3 emissions by 2025, 2030, and 2035, demonstrating a clear roadmap for decarbonization.

This unwavering commitment fuels significant investments in renewable energy infrastructure and the development of cutting-edge low-carbon technologies, positioning EDF at the forefront of the energy transition.

EDF's environmental strategy centers on decarbonizing its energy production, with a significant push towards low-carbon sources like nuclear and renewables. This commitment is underscored by their closure of the last coal plant, marking a decisive shift away from fossil fuels.

The company is actively promoting electrification across industries to lower overall carbon emissions. For instance, in 2023, EDF's renewable capacity grew by 1.7 GW, reaching a total of 37.7 GW globally, demonstrating tangible progress in this transition.

EDF is deeply committed to responsible resource management, particularly focusing on water conservation and the implementation of circular economy principles to minimize waste and pollution across its operations. In 2023, EDF reported a significant reduction in water withdrawal intensity, achieving a 5% decrease compared to the previous year, demonstrating progress in their water stewardship efforts.

Biodiversity is a key consideration in EDF's project development and management. The company actively works to preserve natural habitats and enhance ecosystem resilience, integrating biodiversity action plans into a substantial portion of its new renewable energy projects, with over 70% of new solar and wind farm developments now including specific biodiversity protection measures.

Impact of Climate Events on Operations

The energy sector, including EDF's operations, faces growing risks from climate change and extreme weather. These events can directly disrupt power generation and transmission infrastructure, impacting service reliability. For instance, the severe heatwaves experienced in Europe during the summer of 2023 led to reduced efficiency in some thermal power plants and increased demand for cooling, placing strain on the grid. EDF recognizes these environmental vulnerabilities and is actively integrating climate resilience into its operational planning to manage these escalating risks.

EDF's commitment to climate action is evident in its strategic approach to mitigating the impacts of environmental factors. The company is investing in adapting its infrastructure to withstand more frequent and intense weather events. This includes measures like strengthening cooling systems for nuclear plants to cope with warmer river temperatures, a challenge highlighted by low water levels in 2022 that affected some nuclear operations across Europe. Furthermore, EDF is enhancing the resilience of its transmission and distribution networks against storms and floods.

- Increased Frequency of Extreme Weather: Data from the World Meteorological Organization (WMO) indicates a significant rise in the occurrence of extreme weather events globally, directly impacting energy infrastructure.

- Impact on Power Generation: Heatwaves can reduce the efficiency of thermal power plants, while droughts can limit hydropower output, as seen in various European regions during 2022 and 2023.

- Infrastructure Resilience Investment: EDF is allocating capital towards reinforcing its assets against climate-related threats, aiming to minimize operational disruptions and ensure energy security.

Sustainable Investments and Green Financing

EDF's commitment to environmental sustainability is evident in its capital allocation strategy. For 2024, an impressive 94% of its capital expenditure is directly linked to achieving net-zero emission targets, underscoring a significant financial dedication to environmental objectives.

The company actively leverages green financing instruments to support its sustainable development initiatives. This includes funding for crucial projects like nuclear power generation in the UK, demonstrating a practical application of its environmental commitments through strategic investment.

- 94% of EDF's 2024 capital expenditure is aligned with net-zero emission targets.

- Green financing frameworks are actively used to fund sustainable projects.

- Nuclear power generation in the UK is a key area benefiting from this green financing.

EDF's strategic focus on environmental factors is deeply embedded in its operational and financial planning. The company's commitment to achieving net-zero CO2 emissions by 2050 drives significant investment in renewable energy and low-carbon technologies, with 94% of its 2024 capital expenditure dedicated to these goals.

EDF is actively adapting its infrastructure to enhance resilience against climate change impacts, such as extreme weather events. This proactive approach includes strengthening facilities against storms and floods, and optimizing cooling systems for nuclear plants to manage warmer river temperatures, a challenge observed in 2022 and 2023.

The company's environmental stewardship extends to responsible resource management, including water conservation and circular economy principles, with a 5% reduction in water withdrawal intensity reported in 2023. Biodiversity is also a key consideration, with over 70% of new renewable projects incorporating specific biodiversity protection measures.

| Environmental Factor | EDF's Action/Commitment | Relevant Data/Impact |

|---|---|---|

| Climate Change & Emissions | Net-zero CO2 by 2050; interim emission reduction targets | 94% of 2024 CapEx aligned with net-zero goals. |

| Extreme Weather Events | Infrastructure resilience investment | Reduced thermal plant efficiency and increased grid strain during 2023 heatwaves. |

| Resource Management | Water conservation; circular economy principles | 5% decrease in water withdrawal intensity in 2023. |

| Biodiversity | Integration of biodiversity action plans | Over 70% of new renewable projects include biodiversity protection measures. |

PESTLE Analysis Data Sources

Our EDF PESTLE Analysis is meticulously crafted using data from reputable sources including government environmental agencies, international energy organizations, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.