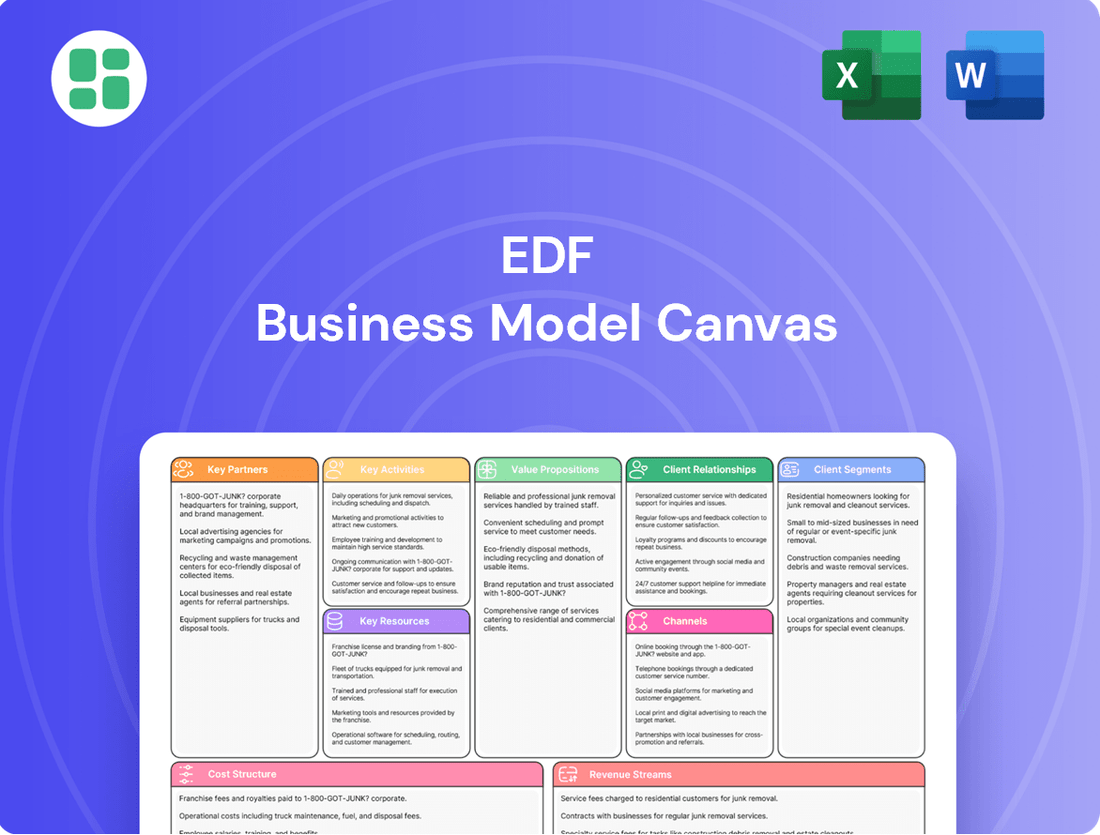

EDF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

Curious about EDF's strategic engine? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. This comprehensive tool is essential for anyone aiming to understand or replicate success in the energy sector.

Ready to dissect EDF's winning formula? Dive into the full Business Model Canvas to uncover their unique value proposition, cost structure, and competitive advantages. This detailed, actionable document is your key to unlocking strategic insights for your own ventures.

Partnerships

EDF's relationship with government and regulatory bodies is paramount, especially given its significant state ownership in France. These entities are key to obtaining operating licenses and defining energy tariffs, directly impacting EDF's revenue streams and market position.

These partnerships are vital for aligning EDF's strategic direction with national energy policies, including ambitious decarbonization targets. For instance, France's commitment to building new nuclear reactors, a core area for EDF, necessitates close collaboration with governmental bodies to secure approvals and funding.

In 2023, EDF's revenue was €75.4 billion, a figure heavily influenced by the regulated tariff structures set by French authorities. The company's ongoing nuclear new build program, a strategic priority, relies on government support and regulatory frameworks to proceed effectively.

EDF relies heavily on technology and equipment suppliers to power its operations. Collaborations with firms like Framatome for nuclear reactor components and Vestas for wind turbines are crucial for maintaining and expanding its energy generation capacity. These partnerships provide access to specialized expertise and advanced technology, essential for both existing infrastructure and new build projects.

EDF actively partners with universities and research institutions to foster innovation in critical energy sectors. These collaborations are vital for advancing nuclear technology, developing next-generation renewable energy storage solutions like advanced battery systems, and enhancing smart grid capabilities. For instance, EDF's ongoing research with institutions like the French Alternative Energies and Atomic Energy Commission (CEA) directly contributes to improving nuclear reactor efficiency and safety, a key focus as the company plans for new builds and life extensions of existing plants.

Energy Service Providers and Integrators

EDF strategically collaborates with energy service providers and integrators to broaden its customer value proposition. This includes integrating acquired entities like Pod Point, now operating as Pod, which strengthens EDF's electric vehicle (EV) charging infrastructure capabilities. These alliances are crucial for offering holistic energy solutions that extend beyond traditional electricity provision, actively assisting customers in their decarbonization journeys.

These partnerships are vital for EDF’s expansion into integrated energy services.

- EV Charging Infrastructure: Partnerships with companies like Pod Point (now Pod) enhance EDF's ability to offer end-to-end EV charging solutions, a key growth area.

- Energy Efficiency Solutions: Collaborations with providers of energy efficiency technologies and services allow EDF to bundle these offerings, providing customers with comprehensive decarbonization pathways.

- Expanded Service Portfolio: By integrating these external capabilities, EDF moves beyond being solely an electricity supplier to becoming a full-service energy partner.

- Customer Decarbonization Support: These alliances directly support EDF's mission to help customers reduce their carbon footprint through innovative energy services.

International Energy Companies and Joint Ventures

EDF actively forms strategic alliances with international energy giants and participates in joint ventures to undertake massive energy infrastructure projects. These collaborations are crucial for developing complex undertakings like offshore wind farms and new nuclear power stations, such as the significant Hinkley Point C and Sizewell C projects in the UK.

These partnerships enable EDF to distribute the substantial financial risks associated with such large-scale developments. Furthermore, they facilitate the pooling of specialized knowledge and technological capabilities from various partners, enhancing project execution and innovation. This cooperative approach also bolsters EDF's ability to expand its operational reach and influence across international markets.

- Risk Sharing: Collaborations on projects like Hinkley Point C, which involves an estimated total investment of £32 billion as of early 2024, allow for the distribution of considerable financial exposure among partners.

- Expertise Leverage: EDF partners with companies possessing complementary skills, such as advanced engineering or specific construction techniques, vital for complex projects.

- Global Footprint Expansion: Joint ventures provide a framework for EDF to enter new geographical markets and strengthen its presence in existing ones, increasing its international market share.

EDF's key partnerships are essential for its operational success and strategic growth in the energy sector. These alliances span government bodies, technology suppliers, research institutions, and international energy companies, each contributing unique value.

Collaborations with government and regulatory bodies are critical for licensing, tariff setting, and aligning with national energy policies, such as France's nuclear new build program. Partnerships with technology providers like Framatome and Vestas ensure access to specialized components and advanced energy generation technologies.

Research collaborations with institutions like the CEA drive innovation in nuclear technology and renewable energy solutions, while strategic alliances with service providers enhance EDF's integrated energy offerings, particularly in EV charging through entities like Pod.

Joint ventures with international energy giants are vital for managing the financial risks and leveraging expertise in large-scale projects like the UK's Hinkley Point C and Sizewell C nuclear power stations, underscoring EDF's global reach and project execution capabilities.

What is included in the product

A structured framework detailing EDF's approach to energy generation, distribution, and customer service, built upon key partnerships and cost structures to deliver reliable energy solutions.

The EDF Business Model Canvas offers a structured approach to pinpoint and address strategic weaknesses, effectively alleviating the pain of unfocused business planning.

Activities

EDF's primary role is generating electricity, a complex process managed across a wide spectrum of energy sources. This includes leveraging nuclear power, a significant contributor to their low-carbon output, alongside hydroelectric, thermal, and increasingly, renewable sources such as wind and solar farms.

The company operates and maintains an extensive network of power generation facilities. In 2023, EDF's gross electricity generation reached 304.5 TWh, with nuclear power accounting for a substantial portion, demonstrating their commitment to reliable, low-carbon energy production.

EDF actively manages its transmission and distribution networks, ensuring the reliable flow of electricity across France. While its subsidiary Enedis handles the public distribution network, EDF's oversight is critical for grid stability and operational efficiency.

In 2024, EDF continued its investments in modernizing and reinforcing its electricity grids. These efforts are essential for integrating renewable energy sources, such as wind and solar power, which are increasingly contributing to the energy mix.

The company's focus on smart grid technologies aims to enhance network resilience and optimize energy distribution. This includes deploying advanced metering infrastructure and digital solutions to better manage demand and supply, especially with the rise of electric vehicles and decentralized energy production.

EDF actively trades electricity and related products across various markets, a crucial activity for optimizing its vast generation portfolio and hedging against price fluctuations. In 2024, the European electricity market saw continued volatility, with EDF leveraging its trading expertise to navigate these dynamics. This includes managing risks associated with renewable energy intermittency and ensuring reliable supply.

Beyond trading, EDF directly sells electricity and natural gas to a diverse customer base, ranging from industrial clients to households. This sales segment is increasingly focused on offering flexible supply contracts and value-added services to meet evolving customer needs. The company's sales efforts in 2024 aimed to secure long-term agreements and enhance customer loyalty through tailored energy solutions.

Energy Services and Solutions Development

EDF goes beyond simply supplying energy, actively developing and offering a suite of services designed to help customers manage their energy use and environmental impact. This includes tailored energy efficiency solutions, the deployment of electric vehicle charging infrastructure, and the integration of smart home technologies.

These services empower customers to lower their carbon footprint and gain better control over their energy consumption. For instance, in 2024, EDF continued its expansion of EV charging points across France, aiming to reach over 100,000 public charging stations by the end of the year, supporting the transition to electric mobility.

- Energy Efficiency Programs: EDF offers audits and retrofitting services for homes and businesses to reduce energy waste.

- Electric Vehicle Charging: Development and operation of public and private EV charging networks, including smart charging solutions.

- Smart Home Integration: Providing connected devices and platforms that enable remote energy management and optimization.

Research, Development, and Innovation

EDF's commitment to Research, Development, and Innovation (R&D&I) is central to its strategy, ensuring it remains at the forefront of the energy sector. This involves significant, ongoing investment to develop and refine technologies that will power the future. For instance, EDF is heavily invested in advancing its nuclear portfolio, with a particular focus on the EPR2 reactor design and the exploration of Small Modular Reactors (SMRs). These efforts are crucial for maintaining a robust, low-carbon energy supply.

Beyond nuclear, EDF's R&D&I efforts are equally dedicated to the expansion and improvement of renewable energy sources. This includes developing more efficient methods for wind and solar power generation, as well as pioneering advancements in energy storage solutions. The company is also actively exploring emerging technologies such as carbon capture utilization and storage (CCUS) and the production and distribution of hydrogen, positioning itself to meet evolving global energy demands and climate objectives.

- Nuclear Advancement: EDF is developing the EPR2, a new generation of pressurized water reactor, and is actively researching Small Modular Reactors (SMRs) to offer flexible and scalable nuclear power solutions.

- Renewable Energy Focus: Investments are channeled into enhancing the efficiency and deployment of offshore wind farms and solar power technologies, alongside developing advanced battery storage systems.

- Future Energy Exploration: EDF is exploring new frontiers in clean energy, including carbon capture technologies and the production and use of green hydrogen, aligning with its net-zero ambitions.

- Innovation Investment: In 2023, EDF announced plans to invest €3 billion annually in R&D and innovation to support its energy transition strategy and maintain technological leadership.

EDF's key activities center on electricity generation from diverse sources, including nuclear, hydro, thermal, and renewables, ensuring a stable low-carbon energy supply. The company also manages extensive transmission and distribution networks, vital for grid stability and integrating new energy technologies.

EDF actively trades electricity to optimize its portfolio and mitigate market risks, while directly selling energy and innovative services to a broad customer base. Its commitment to R&D fuels advancements in nuclear power, renewables, and emerging clean energy solutions.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Electricity Generation | Producing electricity from nuclear, hydro, thermal, wind, and solar sources. | Gross generation of 304.5 TWh in 2023. Continued investment in nuclear fleet and renewables. |

| Network Management | Operating and maintaining transmission and distribution grids. | Investing in grid modernization for renewable integration and smart grid deployment. |

| Energy Trading & Sales | Trading electricity in markets and selling to industrial and residential customers. | Navigating European market volatility; expanding customer offerings with flexible contracts. |

| Services & Innovation | Offering energy efficiency, EV charging, and smart home solutions; investing in R&D. | Expanding EV charging network, investing €3 billion annually in R&D for nuclear and renewables. |

Delivered as Displayed

Business Model Canvas

The EDF Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can trust that what you see is precisely what you will get, ready for your strategic planning needs.

Resources

EDF's power generation assets are its bedrock, encompassing a diverse fleet of nuclear, hydroelectric, wind, and solar facilities. These physical assets are the engine driving its electricity production, representing billions in capital investment and forming the core of its operational strength.

As of 2024, EDF operates a substantial nuclear fleet, contributing significantly to low-carbon electricity. Its hydroelectric capacity remains a crucial component, particularly in France, providing flexible and renewable power. The company is also actively expanding its renewable portfolio, with ongoing investments in wind and solar projects to meet evolving energy demands and decarbonization goals.

EDF's transmission and distribution infrastructure, including extensive networks of power lines and substations, represents a fundamental physical asset for delivering electricity. These networks are vital for connecting generation sources to consumers. In 2024, EDF continued to invest in modernizing these assets, particularly through smart grid technologies aimed at improving efficiency and reliability.

EDF's business model relies heavily on its highly specialized workforce. This includes nuclear engineers, renewable energy experts, and skilled grid operators, all crucial for managing complex energy infrastructure. In 2024, EDF continued to invest in training and development for these vital roles, recognizing their indispensable contribution to both existing operations and future energy innovations.

Financial Capital and Investment Capacity

EDF's operational success and ambitious growth plans, particularly in areas like new nuclear builds and large-scale renewables, necessitate significant financial capital. This financial muscle is crucial not only for day-to-day operations and maintenance but also for the substantial upfront investments required for future energy projects and grid modernization. EDF's ability to secure and manage these funds directly impacts its capacity to execute its strategy and maintain its position in the evolving energy landscape.

For 2024, EDF's financial capacity is underpinned by its access to capital markets and its overall financial strength. The company has been actively managing its debt and equity to fund its extensive investment program. For instance, in 2023, EDF's net financial debt stood at approximately €64.4 billion, reflecting ongoing investments and operational needs. The company's strategy involves leveraging both debt financing and equity raises, alongside asset management, to ensure it has the necessary investment capacity.

- Financial Capital Requirements: Essential for operations, maintenance, and substantial investments in new nuclear, large-scale renewables, and grid modernization.

- Access to Capital Markets: EDF's financial strength and ability to tap into debt and equity markets are critical enablers for its investment capacity.

- 2023 Net Financial Debt: Approximately €64.4 billion, indicating the scale of financial resources managed for ongoing and future projects.

- Funding Strategy: A combination of debt financing, equity raises, and asset management is employed to meet investment capacity needs.

Intellectual Property and Proprietary Technologies

EDF's intellectual property portfolio, including patents and proprietary designs like its EPR reactor technology, is a cornerstone of its business model. This deep well of specialized knowledge and innovation is vital for developing and deploying advanced, safe, and efficient energy solutions, particularly in the nuclear sector.

This intellectual property creates a significant competitive advantage. For instance, the EPR design, a third-generation pressurized water reactor, represents a substantial technological leap, offering enhanced safety features and improved fuel efficiency. EDF's ongoing research and development efforts continuously build upon this foundation, ensuring its continued leadership in complex energy systems.

- Patented Technologies: EDF holds numerous patents covering various aspects of nuclear reactor design, operation, and fuel management, underpinning its technological leadership.

- Proprietary Designs: The EPR reactor design, a key asset, incorporates advanced safety systems and operational efficiencies that differentiate EDF in the global market.

- Operational Know-How: Decades of experience in managing complex energy infrastructure have resulted in specialized operational knowledge, a critical intangible asset.

- R&D Investment: Continuous investment in research and development, exceeding €1 billion annually in recent years, ensures the ongoing enhancement and expansion of its intellectual property assets.

EDF's key resources are multifaceted, encompassing its extensive physical generation assets like nuclear and hydroelectric plants, its robust transmission and distribution networks, and its highly skilled workforce. These elements are complemented by significant financial capital, vital for operations and future investments, and a strong portfolio of intellectual property, particularly in advanced reactor designs like the EPR. These resources collectively enable EDF to produce and deliver electricity reliably and to pursue innovation in the energy sector.

| Key Resource | Description | 2024 Relevance/Data |

| Physical Assets | Diverse generation fleet (nuclear, hydro, wind, solar) and extensive transmission/distribution networks. | Continued modernization of grids with smart technologies. Substantial nuclear fleet operational. |

| Human Capital | Specialized workforce including nuclear engineers, renewable energy experts, and grid operators. | Ongoing investment in training and development for critical roles. |

| Financial Capital | Access to capital markets and overall financial strength for operations and investments. | Net financial debt around €64.4 billion in 2023, requiring ongoing capital management. |

| Intellectual Property | Patents and proprietary designs, notably the EPR reactor technology. | EPR design offers enhanced safety and fuel efficiency; R&D investment supports ongoing innovation. |

Value Propositions

EDF guarantees a dependable and uninterrupted flow of electricity, a critical need for households, businesses, and industries alike. This reliability is a cornerstone of their value proposition, ensuring customers have power when they need it most.

The company's diverse energy generation portfolio, notably its significant reliance on nuclear power, plays a crucial role in bolstering energy security and maintaining the stability of the national grid. In 2023, EDF's nuclear fleet generated approximately 300 TWh of electricity, underscoring its substantial contribution to baseload power.

EDF's value proposition centers on providing a significantly decarbonized electricity supply, a key advantage for customers and nations striving to meet ambitious climate goals. This is underpinned by a substantial portfolio of nuclear and renewable energy sources.

In 2023, EDF's electricity generation in France was approximately 85% low-carbon, primarily driven by its nuclear fleet and growing renewable capacity. This positions EDF as a leader in offering clean energy solutions.

Beyond its core supply, EDF actively develops and deploys innovative low-carbon technologies and services. This includes areas like energy efficiency, electric mobility solutions, and carbon capture technologies, further enhancing its value in the decarbonization journey.

EDF goes beyond basic electricity provision, offering a suite of integrated energy services designed to empower customers. This includes advanced smart metering for real-time consumption tracking, personalized energy efficiency advice, and the development of electric vehicle (EV) charging infrastructure. They also provide comprehensive heating solutions, enabling clients to manage their energy usage more effectively and embrace sustainable practices. In 2024, EDF continued its expansion of smart meter installations across France, aiming to reach over 35 million homes by the end of the year, facilitating better energy management for millions of households.

Competitive and Regulated Pricing

EDF's value proposition centers on offering a blend of regulated and competitive pricing. For many, particularly in France, this means access to electricity at regulated tariffs, which translates to predictable costs and affordability. This stability is a significant draw for households and businesses alike.

In more liberalized markets, EDF aims to provide rates that stand up against competitors. The company emphasizes that this competitive pricing is not at the expense of service quality. They strive to deliver reliable energy and customer support, even as they adjust pricing to market dynamics.

For instance, in 2024, EDF's regulated tariffs in France, known as the Tarif Réglementé de Vente (TRV), continued to be a benchmark for many consumers. While specific rates fluctuate based on regulatory decisions, the TRV provides a crucial anchor of price stability. In parallel, EDF's offers on the competitive market are designed to attract customers seeking different service levels or contract terms, reflecting a dual strategy to cater to diverse customer needs.

- Regulated Tariffs: Offering price stability and affordability, especially for residential customers in France.

- Competitive Offers: Providing market-aligned rates in liberalized energy sectors.

- Service Quality: Maintaining high standards of reliability and customer support across all pricing structures.

Innovation and Future Energy Leadership

EDF is actively investing in and deploying cutting-edge energy technologies. This includes developing advanced nuclear reactors like the EPR2 and Small Modular Reactors (SMRs), alongside significant investments in large-scale renewable energy projects. These initiatives are bolstered by integrated battery storage solutions and carbon capture technologies, solidifying EDF's role in shaping the future energy landscape.

This commitment to innovation is reflected in EDF's strategic focus on decarbonization and energy transition. By 2030, the company aims to significantly increase its renewable energy capacity and reduce its carbon emissions. For instance, EDF's investments in offshore wind projects are substantial, with a growing pipeline of developments across Europe, aiming to contribute gigawatts of clean energy.

- Next-Generation Nuclear: Continued development and deployment of EPR2 and SMR technologies to provide reliable, low-carbon baseload power.

- Renewable Energy Expansion: Aggressively increasing solar, wind (onshore and offshore), and hydropower capacity. EDF Renewables, for example, has a robust project pipeline globally.

- Energy Storage Solutions: Integrating battery storage systems with renewable generation to enhance grid stability and flexibility.

- Carbon Capture Initiatives: Exploring and implementing carbon capture, utilization, and storage (CCUS) technologies for hard-to-abate industrial sectors.

EDF's value proposition includes providing a secure and stable energy supply, crucial for national infrastructure and economic activity. This reliability is further enhanced by their commitment to a low-carbon energy mix, primarily through nuclear power and expanding renewables.

The company offers a dual pricing strategy: regulated tariffs for price predictability and competitive offers in liberalized markets, balancing affordability with market responsiveness. In 2024, EDF continued its significant rollout of smart meters across France, aiming for widespread adoption to improve customer energy management.

Innovation is a core element, with EDF investing heavily in advanced nuclear technologies like EPR2 and Small Modular Reactors, alongside substantial growth in renewable energy projects. They also focus on integrated services like energy efficiency and EV charging infrastructure.

| Value Proposition Area | Key Elements | Supporting Data/Focus (2024/Recent) |

|---|---|---|

| Reliable & Secure Energy Supply | Uninterrupted electricity flow, grid stability | Nuclear generation remains a cornerstone, contributing significantly to baseload power. |

| Decarbonized Energy Mix | Low-carbon electricity generation | Continued expansion of renewable capacity; focus on nuclear as a key low-carbon source. |

| Pricing Strategy | Regulated tariffs, competitive offers | Ongoing management of regulated tariffs in France; development of market-competitive products. |

| Innovative Energy Solutions | Advanced nuclear, renewables, storage, efficiency services | Investment in EPR2 and SMR development; expansion of smart meter deployment; growth in EV charging infrastructure. |

Customer Relationships

For major industrial, commercial, and public sector clients, EDF assigns dedicated account managers. These professionals deliver customized energy solutions, expert advice, and comprehensive support for intricate energy requirements, cultivating robust, enduring partnerships through direct interaction.

EDF's digital self-service platforms, including online portals and mobile apps, empower customers to manage accounts, monitor energy usage, and pay bills conveniently. In 2024, EDF reported a significant increase in digital engagement, with over 70% of customer interactions occurring through these channels, highlighting their importance in providing accessible and efficient service.

EDF utilizes a multi-channel approach to customer service, integrating traditional call centers with digital platforms like online chat and mobile apps. This ensures customers can reach out for support regarding inquiries, billing, and technical assistance through their preferred method, enhancing accessibility and responsiveness. In 2023, EDF reported handling millions of customer interactions across these various channels, demonstrating a significant commitment to customer support.

Community Engagement and Education

EDF actively fosters community relationships through dedicated engagement programs. In 2024, the company continued its focus on transparent communication regarding nuclear safety, with over 50 community liaison meetings held across its operational sites in France. These sessions provide direct channels for addressing local concerns and sharing updates on safety protocols and environmental performance.

Educational initiatives are a cornerstone of EDF's community outreach. The company invested €15 million in 2024 for educational programs aimed at promoting understanding of renewable energy technologies and the broader energy transition. This includes support for school visits to renewable energy installations and the development of online resources detailing EDF's commitment to a low-carbon future.

- Community Liaison Meetings: Over 50 meetings in 2024 to discuss nuclear safety and environmental performance.

- Educational Investment: €15 million allocated in 2024 for renewable energy and energy transition education.

- Public Awareness Campaigns: Ongoing campaigns in 2024 focused on the benefits and safety of nuclear power and renewables.

Partnerships for Decarbonization and Innovation

EDF actively cultivates partnerships with customers committed to decarbonization and embracing innovative energy solutions. This collaborative approach is central to their strategy for fostering a sustainable energy future.

These relationships are built on offering tailored programs and incentives designed to encourage the adoption of low-carbon technologies. For instance, EDF provides dedicated support for customers transitioning to solutions like heat pumps and electric vehicle (EV) charging infrastructure.

- Customer Engagement: EDF engages customers through specialized programs and incentives to support their decarbonization efforts.

- Low-Carbon Technology Adoption: Support is provided for the implementation of technologies such as heat pumps and EV charging.

- Innovation Focus: Partnerships encourage the development and uptake of novel energy solutions.

- Carbon Footprint Reduction: The core objective is to assist customers in minimizing their environmental impact.

EDF maintains diverse customer relationships, from dedicated account management for large clients to accessible digital platforms for individual users. This multi-channel approach ensures efficient service delivery and fosters engagement through various touchpoints.

| Relationship Type | Key Features | 2024 Data/Focus |

|---|---|---|

| Dedicated Account Management | Customized solutions, expert advice, comprehensive support for major clients. | Cultivating robust, enduring partnerships through direct interaction. |

| Digital Self-Service | Online portals, mobile apps for account management, usage monitoring, and payments. | Over 70% of customer interactions via digital channels, highlighting accessibility and efficiency. |

| Multi-Channel Support | Integration of call centers, online chat, and mobile apps for inquiries and technical assistance. | Millions of customer interactions handled across channels in 2023, demonstrating commitment. |

| Community Engagement | Transparent communication on safety, environmental performance, and local concerns. | Over 50 community liaison meetings held in 2024 regarding nuclear safety. |

| Educational Initiatives | Programs promoting understanding of renewable energy and the energy transition. | €15 million invested in 2024 for educational programs and school outreach. |

| Decarbonization Partnerships | Tailored programs and incentives for customers adopting low-carbon technologies. | Support for heat pumps and EV charging infrastructure adoption. |

Channels

EDF employs a dedicated direct sales force and key account teams to serve its larger clients, including industrial enterprises, major corporations, and public sector organizations. These specialized teams act as direct liaisons, fostering close relationships to deeply understand each client's unique energy requirements and operational contexts.

This direct engagement allows EDF to craft bespoke energy contracts and innovative solutions tailored precisely to the needs of these significant customers. For instance, in 2024, EDF continued to focus on securing long-term power purchase agreements (PPAs) with industrial clients, aiming to provide price stability and predictable energy costs amidst market volatility.

These teams are crucial for managing complex negotiations and ensuring that EDF's offerings align with the strategic objectives and sustainability goals of its key accounts. Their work directly contributes to EDF's revenue streams from these high-value segments, often involving multi-year commitments and substantial energy volumes.

Online portals and mobile apps are crucial for EDF, acting as the main touchpoints for residential and small business customers. Through these digital channels, customers can easily sign up for services, manage their accounts, pay bills, and access detailed information about their energy usage and available services, offering unparalleled convenience and broad reach.

In 2024, EDF continued to enhance its digital offerings, with a significant portion of its customer interactions occurring online. For instance, EDF's UK operations reported that over 70% of customer service queries were handled digitally, demonstrating the platform's effectiveness in providing self-service options and reducing operational costs.

Call centers and customer service hotlines are vital for EDF, offering a direct line for customers needing assistance with inquiries, technical support, and resolving complex energy-related issues. In 2024, approximately 70% of customer interactions for utility companies still involved phone calls, highlighting the enduring importance of this channel for personalized support and emergency situations.

Physical Offices and Retail Locations

While EDF primarily operates digitally, physical offices or retail locations can serve crucial roles. These spaces are often utilized for in-person consultations, particularly for complex energy solutions or when addressing specific customer concerns that benefit from face-to-face interaction. They also act as information hubs, especially in regions where digital access might be less prevalent or for customers who prefer a tangible point of contact. For instance, EDF has maintained a presence in various European countries with customer service centers that handle inquiries and provide support.

- Customer Support Hubs: Physical locations offer a direct channel for customers to resolve issues or receive guidance on energy services, fostering trust and accessibility.

- Specialized Service Centers: Certain offices might be dedicated to specialized services like solar panel installations or smart home energy management, requiring expert consultation.

- Regional Presence: Maintaining physical touchpoints can be vital for market penetration and customer engagement in specific geographic areas, adapting to local needs and preferences.

Smart Meters and Integrated Energy Devices

Smart meters serve as a crucial channel for EDF, facilitating direct, two-way communication with customers. This allows for remote meter readings, real-time consumption monitoring, and the deployment of advanced smart grid services. By enabling flexible tariffs and demand-response programs, these devices integrate customers more deeply into the energy ecosystem, fostering engagement and efficiency. For instance, by mid-2024, EDF had installed millions of smart meters across its operational regions, with ongoing deployment targeting the vast majority of its customer base.

These integrated energy devices are key to offering value-added services and optimizing energy distribution. They enable EDF to better manage grid load, reduce operational costs associated with manual readings, and provide customers with greater control and transparency over their energy usage. This channel also supports the rollout of new products and services, such as electric vehicle charging optimization and home energy management solutions, directly impacting customer loyalty and revenue streams.

- Two-way communication: Enables remote meter reading and consumption monitoring.

- Smart grid services: Facilitates flexible tariffs and demand-response programs.

- Customer integration: Deepens customer involvement in the energy system.

- Operational efficiency: Reduces costs and improves energy management.

Channels within EDF's business model are diverse, catering to different customer segments. This includes direct sales for large industrial clients, digital platforms for residential and small businesses, and traditional call centers for support. Smart meters also act as a key communication channel, enabling data exchange and advanced services.

These channels are designed for both broad reach and personalized service. Digital tools offer convenience and efficiency, while direct sales and customer support hubs ensure complex needs are met. The strategic use of each channel is vital for customer acquisition, retention, and overall operational effectiveness.

EDF's channel strategy in 2024 emphasized digital transformation, with a significant increase in online customer interactions. For instance, over 70% of customer service inquiries in its UK operations were handled digitally. Simultaneously, the company continued to invest in its direct sales force for key accounts, securing long-term power purchase agreements.

The company also leverages smart meters as a critical channel, facilitating two-way communication and enabling services like demand-response programs. By mid-2024, millions of smart meters were deployed, enhancing customer engagement and operational efficiency.

| Channel Type | Primary Customer Segment | Key Functions | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales Force / Key Account Teams | Industrial Enterprises, Major Corporations, Public Sector | Bespoke contracts, long-term PPAs, complex negotiations | Secured long-term PPAs with industrial clients for price stability. |

| Online Portals & Mobile Apps | Residential, Small Businesses | Account management, billing, service sign-up, usage information | Over 70% of UK customer service queries handled digitally. |

| Call Centers & Hotlines | All Customer Segments | Inquiries, technical support, issue resolution | Approximately 70% of utility customer interactions still involve phone calls. |

| Physical Offices/Retail Locations | All Customer Segments (for specific needs) | In-person consultations, information hubs, local engagement | Maintained customer service centers for direct support and local needs. |

| Smart Meters | Residential, Businesses (with smart meter deployment) | Remote readings, consumption monitoring, smart grid services | Millions of smart meters deployed by mid-2024, enhancing engagement. |

Customer Segments

Residential Customers are individual households that use electricity and potentially gas for their homes. They are looking for energy that is dependable, reasonably priced, and becoming more environmentally friendly. Many also want services that help them keep track of and control their energy usage and bills.

In 2024, EDF served millions of residential customers across its operating regions. For instance, in France, EDF is a primary energy provider for a vast number of households, with a significant portion of the national residential electricity market share. This segment is increasingly prioritizing green energy options, with a growing demand for renewable energy tariffs and smart home solutions to optimize energy efficiency.

Small and Medium-Sized Enterprises (SMEs) are a vital customer segment for EDF, representing a significant portion of the business landscape. These businesses require reliable and cost-effective electricity and gas supplies, often seeking tailored energy efficiency solutions to manage their operational expenses. In 2024, SMEs continue to be a primary focus, with many actively seeking ways to reduce their carbon footprint and improve energy management.

SMEs typically value straightforward billing processes and accessible, dedicated customer support to address their specific energy needs. They are often looking for partners who can simplify the complexities of energy procurement and management, allowing them to concentrate on their core business activities. This segment is particularly receptive to bundled services that offer both competitive pricing and practical advice on energy saving.

Large industrial and commercial clients, such as manufacturing plants and major retail chains, represent a significant customer segment for EDF due to their substantial and consistent energy needs. In 2024, these businesses are increasingly focused on securing reliable energy supplies and reducing operational costs, with energy expenditure often being a major factor in their profitability. For example, a large manufacturing facility might consume millions of kilowatt-hours annually, making energy efficiency and price stability paramount to their business model.

This segment actively seeks customized solutions to meet their unique operational demands, including on-site generation, energy storage, and advanced grid management services. Many are also driven by sustainability goals and regulatory pressures to decarbonize their operations, leading them to procure green energy solutions and expert advice on reducing their carbon footprint. By 2025, the demand for integrated energy management and decarbonization strategies from these large clients is projected to grow substantially, reflecting a broader market shift towards net-zero targets.

Public Sector and Local Authorities

Public sector entities, including national governments, municipalities, and various public institutions, represent a significant customer segment for energy providers like EDF. These organizations have substantial energy demands to power public infrastructure, schools, hospitals, and administrative buildings, often requiring reliable and consistent supply. In 2024, the public sector continues to be a major consumer of electricity and gas, with government spending on public services and infrastructure remaining a key economic driver.

A defining characteristic of this segment is their commitment to specific environmental targets and sustainability goals, often driven by policy mandates. This leads to a preference for renewable energy solutions and energy efficiency programs. For instance, many local authorities in the UK, as of early 2024, have set ambitious net-zero targets for their operations, influencing their procurement decisions towards greener energy sources and smart grid technologies.

- Government bodies and municipalities: These entities manage vast public infrastructure requiring significant energy.

- Environmental targets: Public sector clients often have mandated sustainability goals, influencing energy choices.

- Procurement processes: Their purchasing is typically governed by formal tenders and regulations, requiring tailored proposals.

- Infrastructure development: Investments in public services like street lighting, public transport, and building retrofits create ongoing energy demand.

Energy Service Companies (ESCOs) and Developers

EDF extends its reach to other crucial players in the energy sector, including Energy Service Companies (ESCOs) and renewable energy project developers. These partnerships are vital for driving the energy transition. For instance, ESCOs often require a reliable source of wholesale electricity to power their energy efficiency projects, and EDF can fulfill this need.

In 2024, the demand for wholesale electricity from ESCOs is projected to remain robust, driven by increasing investments in building retrofits and industrial energy optimization. EDF's role here is to provide that foundational energy supply, enabling ESCOs to deliver their services effectively.

Furthermore, EDF actively collaborates with renewable energy project developers. This collaboration can manifest in various ways, such as providing grid connection services, which are essential for integrating new solar or wind farms into the national grid.

- Wholesale Electricity Supply: EDF provides a stable and competitive wholesale electricity supply to ESCOs, supporting their energy efficiency initiatives.

- Grid Connection Services: EDF offers critical grid connection services to renewable energy project developers, facilitating the integration of new clean energy sources.

- Strategic Partnerships: EDF partners with ESCOs and developers on specific energy transition projects, leveraging shared expertise and resources to accelerate decarbonization efforts.

EDF's customer segments span residential, small and medium-sized enterprises (SMEs), large industrial and commercial clients, and public sector entities. Each segment has distinct needs regarding reliability, cost, and sustainability, influencing EDF's service offerings and strategic focus.

Cost Structure

Fuel and energy procurement is a significant expense for EDF, driven by the need to acquire natural gas and, historically, coal for its thermal power generation. These costs are directly tied to volatile global commodity prices, impacting overall operational expenditure. In 2024, EDF's strategy is to further reduce reliance on coal, shifting more towards natural gas and other sources.

EDF's cost structure heavily relies on the operation and maintenance (O&M) of its extensive power plant portfolio. This includes managing a diverse fleet, particularly its nuclear facilities, which demand substantial investment in staffing, specialized repairs, and planned downtime for safety and efficiency. For instance, the START 2025 program, focused on enhancing the performance and lifespan of its nuclear fleet, represents a significant O&M commitment.

In 2024, O&M costs are a critical component of EDF's overall expenditure. These costs encompass everything from routine upkeep and minor repairs to major overhauls and scheduled refueling outages, which are essential for maintaining the high availability and safety standards of its nuclear and thermal power generation assets. The efficient management of these ongoing expenses is vital for profitability.

EDF's capital expenditures are significant, particularly for constructing new nuclear reactors such as Hinkley Point C, which has seen its estimated cost rise to £32.7 billion as of early 2024. This reflects the immense financial commitment required for such large-scale, long-term infrastructure projects.

Beyond nuclear, EDF invests heavily in renewable energy, including offshore wind farms and solar projects, alongside crucial upgrades to its transmission and distribution networks. These investments are essential for modernizing energy infrastructure and supporting the energy transition.

Personnel and Labor Costs

EDF's cost structure is heavily influenced by its personnel and labor expenses. As a global energy giant, the company employs a vast workforce, necessitating significant outlays for salaries, comprehensive benefits packages, ongoing training programs, and recruitment efforts to attract and retain specialized technical talent.

These costs are particularly pronounced given the highly skilled nature of roles within the nuclear, renewable, and grid infrastructure sectors. In 2024, personnel costs represented a substantial portion of EDF's operational expenditures, reflecting the critical human capital required to manage its complex operations and ambitious development projects.

- Salaries and Wages: Direct compensation for EDF's extensive employee base across all operational segments.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other social contributions for employees.

- Training and Development: Investment in upskilling and reskilling the workforce, especially for advanced technical and safety-critical roles.

- Recruitment and Retention: Expenses incurred in attracting, hiring, and retaining specialized talent in a competitive global market.

Regulatory and Decommissioning Costs

EDF faces significant expenses related to adhering to strict environmental and safety regulations governing its nuclear operations. These compliance costs are ongoing and essential for maintaining operational licenses and public trust.

The long-term financial commitment for managing nuclear waste and safely decommissioning retired power plants represents a substantial and unavoidable cost. These provisions are critical for responsible energy production and future site restoration.

- Environmental Compliance: EDF's commitment to meeting evolving environmental standards, including emissions monitoring and waste handling protocols, incurs continuous operational expenditure.

- Decommissioning Provisions: The company sets aside significant funds to cover the eventual dismantling and site remediation of its nuclear facilities, a process that can span decades and cost billions. For instance, the decommissioning of the Fessenheim nuclear power plant in France, which ceased operations in 2020, is estimated to cost several billion euros over its multi-decade dismantling timeline.

- Nuclear Waste Management: Costs associated with the interim storage and ultimate disposal of spent nuclear fuel are substantial, reflecting the specialized infrastructure and long-term security required.

EDF's cost structure is a complex interplay of fuel, operations, capital investment, personnel, and regulatory compliance. Fuel procurement, particularly for natural gas, is a major variable expense influenced by global markets. Significant ongoing operational and maintenance costs are tied to its vast nuclear and thermal power fleet, requiring substantial investment in upkeep and safety. The company also incurs considerable capital expenditures for new projects, like nuclear reactor construction and renewable energy development, alongside essential network upgrades.

Personnel costs, encompassing salaries, benefits, and training for a highly skilled workforce, represent a substantial fixed expense. Furthermore, stringent environmental regulations and the long-term liabilities of nuclear waste management and decommissioning add significant, unavoidable costs to EDF's financial framework. These elements collectively shape the company's overall cost base and strategic financial planning.

| Cost Category | Key Components | 2024 Considerations/Data |

|---|---|---|

| Fuel and Energy Procurement | Natural Gas, Coal (decreasing) | Volatile commodity prices; reduced coal reliance. |

| Operation and Maintenance (O&M) | Nuclear fleet upkeep, thermal plant maintenance, staffing | START 2025 program for nuclear fleet enhancement. |

| Capital Expenditures | New nuclear construction (Hinkley Point C), renewables, network upgrades | Hinkley Point C estimated cost: £32.7 billion (early 2024). |

| Personnel and Labor | Salaries, benefits, training, recruitment | High costs for specialized technical talent; substantial portion of operational expenditures. |

| Regulatory and Decommissioning | Environmental compliance, nuclear waste management, plant decommissioning | Fessenheim decommissioning estimated cost: several billion euros; ongoing provisions for waste. |

Revenue Streams

EDF's core revenue is generated by selling electricity directly to a broad customer base, encompassing households, businesses, and industrial facilities. This is achieved through diverse pricing models, including regulated tariffs, market-driven rates, and fixed-price agreements, offering flexibility to consumers.

In 2024, EDF's electricity sales to end-users remained a critical component of its financial performance. The company's extensive network and diverse generation portfolio allowed it to serve millions of customers across its operating regions, contributing significantly to its overall revenue figures.

EDF generates revenue by selling specialized energy services and solutions beyond basic electricity supply. This includes offering energy efficiency audits to help customers reduce consumption, and installing and maintaining renewable energy systems like solar panels and heat pumps. For example, in 2023, EDF's renewable energy segment saw significant growth, contributing to a diversified revenue stream.

EDF generates revenue by selling electricity it produces to other energy suppliers and large industrial consumers through wholesale markets. This strategy allows EDF to capitalize on fluctuations in energy demand and prices, optimizing its financial returns. For instance, in 2023, EDF's wholesale electricity sales contributed significantly to its overall revenue, reflecting its substantial generation capacity across various energy sources.

Capacity Payments and Grid Services

EDF secures revenue through capacity payments in markets where it guarantees generation availability, crucial for grid stability and ensuring a consistent power supply. These payments compensate EDF for maintaining its infrastructure and readiness to produce electricity when needed, even if not actively generating.

Beyond capacity, EDF also earns revenue by providing ancillary services. These services are vital for the day-to-day operation of the electricity grid, helping to balance supply and demand in real-time and maintain voltage and frequency. For example, in 2023, the European electricity market saw significant activity in ancillary services, with prices fluctuating based on grid conditions and the need for flexibility.

- Capacity Payments: Revenue received for ensuring generation units are available to meet peak demand and maintain grid security.

- Ancillary Services: Income generated from providing services like frequency regulation, voltage control, and reserve capacity to stabilize the grid.

- Market Dynamics: Payments are influenced by market design, regulatory frameworks, and the overall need for grid flexibility, which can vary significantly by region and over time.

Network Access Charges and Regulated Fees

While Enedis, a subsidiary, operates France's electricity distribution network, the broader EDF group can generate revenue through network access charges and regulated fees. These payments are often levied on other energy providers or users who leverage EDF's extensive infrastructure for electricity transmission and distribution, bolstering its financial stability.

These charges are a crucial component of EDF's revenue, reflecting the essential nature of its grid infrastructure. For instance, in 2024, regulated tariffs for network access, such as those managed by Enedis, are a significant contributor to the overall electricity price for consumers, indirectly benefiting EDF's revenue streams.

- Network Access Fees: Charges paid by other energy suppliers to use EDF's distribution and transmission networks.

- Regulated Tariffs: Government-set fees that cover the costs of maintaining and operating the electricity grid, ensuring fair pricing for services.

- Infrastructure Utilization: Revenue derived from allowing third parties to access and utilize EDF's physical electricity infrastructure.

- Contribution to Revenue Base: These fees form a stable and predictable part of EDF's income, supporting its operational activities and investments.

EDF's revenue streams are multifaceted, extending beyond direct electricity sales. The company benefits from wholesale market transactions, capacity payments for grid availability, and income from ancillary services that ensure grid stability.

In 2024, EDF's diversified revenue model continued to be a cornerstone of its financial strategy, with significant contributions from both regulated tariffs and market-based operations.

Network access fees, collected through its subsidiary Enedis, provide a stable revenue base, reflecting the essential role of its infrastructure in delivering electricity to consumers.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Electricity Sales (End-Users) | Direct sales to residential, commercial, and industrial customers. | Millions of customers served across operating regions in 2024. |

| Wholesale Market Sales | Selling electricity to other suppliers and large industrial users. | Significant contribution to overall revenue in 2023 due to substantial generation capacity. |

| Specialized Energy Services | Energy efficiency audits, renewable system installation and maintenance. | Renewable energy segment saw significant growth in 2023. |

| Capacity Payments | Revenue for ensuring generation availability and grid security. | Key component for maintaining infrastructure readiness. |

| Ancillary Services | Income from grid stabilization services (frequency, voltage control). | European market activity in ancillary services was significant in 2023. |

| Network Access Fees | Charges for using EDF's distribution and transmission networks. | Regulated tariffs for network access contributed significantly to overall electricity prices in 2024. |

Business Model Canvas Data Sources

The EDF Business Model Canvas is built upon a foundation of internal operational data, historical financial performance, and extensive market research. This comprehensive approach ensures all aspects of the business model are grounded in factual insights.