Echo Global Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Echo Global Logistics Bundle

Echo Global Logistics possesses significant strengths in its technology platform and extensive network, but faces challenges in a competitive market. Understanding these dynamics is crucial for anyone looking to invest or strategize within the logistics sector.

Want the full story behind Echo Global Logistics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Echo Global Logistics stands out with its robust technology-enabled services, powered by proprietary platforms such as EchoSync, EchoShip, and EchoDrive. These systems are crucial for offering shippers and carriers real-time visibility, advanced analytics, and automation, which significantly simplifies complex logistics operations.

The company's commitment to innovation is evident in its substantial investments in artificial intelligence and machine learning. These advanced technologies are actively enhancing capabilities in critical areas like pricing optimization and demand forecasting, solidifying Echo's position as a technology frontrunner in the logistics sector.

Echo Global Logistics boasts a truly comprehensive multi-modal service offering, covering everything from full truckloads and less-than-truckload (LTL) to intermodal, temperature-controlled, and cross-border shipping. This breadth allows them to serve a wide array of customer requirements and fine-tune supply chains. For instance, in Q1 2024, Echo reported a 5% increase in its freight brokerage revenue, driven by strong demand across these diverse modes.

Echo Global Logistics excels by offering a robust value proposition centered on supply chain optimization, cost reduction, and enhanced efficiency for a diverse client base, from small businesses to large enterprises. This focus on tangible benefits directly addresses key pain points in logistics management.

The company's commitment to exceptional customer service, including dedicated account teams, fosters strong, supportive relationships. This client-centric philosophy is a significant differentiator, aiming to build loyalty and trust in a competitive market.

By integrating advanced technology with this personalized service, Echo Global Logistics simplifies the complexities of transportation management for its clients. This combination of human touch and technological prowess allows businesses to streamline operations and focus on their core competencies.

Established Market Presence and Reputation

Echo Global Logistics boasts an established market presence as a leading provider in the third-party logistics (3PL) industry, consistently ranking among the top players, especially within North America. This strong market position is a testament to its operational capabilities and widespread recognition.

The company's reputation is further solidified by significant industry accolades. For instance, in 2025, Echo Global Logistics was recognized by Newsweek as one of America's Greenest Companies and by SupplyTech Breakthrough as the 3PL of the Year. These awards underscore its commitment to both operational excellence and environmental stewardship, reinforcing its leadership image.

- Leading 3PL Provider: Consistently ranked among top providers, particularly in North America.

- Industry Recognition: Named Newsweek's America's Greenest Companies 2025.

- Operational Excellence Award: Recognized as SupplyTech Breakthrough's 2025 3PL of the Year.

- Strong Market Position: Demonstrates a robust and respected standing within the logistics sector.

Extensive Network and Data Analytics Capabilities

Echo Global Logistics boasts an impressive operational strength through its extensive network, partnering with over 50,000 transportation providers. This vast network allows them to effectively serve a client base of 35,000, granting significant leverage in securing capacity and a wide array of service options. This robust infrastructure is a key differentiator in the competitive logistics landscape.

Furthermore, Echo's prowess in data analytics is a critical asset. By analyzing the immense volume of data generated from its expansive network, the company provides clients with sophisticated decision-making tools. This capability translates directly into optimized transportation solutions, enhancing efficiency and fostering greater transparency throughout the supply chain.

- Extensive Network: Over 50,000 transportation providers and 35,000 clients.

- Data-Driven Optimization: Leveraging data analytics for informed decision-making and supply chain efficiency.

- Service Leverage: Significant capacity and service options due to the broad provider base.

Echo Global Logistics leverages its advanced technology platforms, like EchoSync, to provide unparalleled real-time visibility and data analytics, streamlining complex supply chains. Its commitment to AI and machine learning further enhances pricing and forecasting, positioning it as a technology leader.

The company's broad multi-modal service offering, from LTL to temperature-controlled and cross-border shipping, caters to diverse client needs, as evidenced by a 5% increase in freight brokerage revenue in Q1 2024. This comprehensive approach, combined with a focus on cost reduction and efficiency, delivers significant value.

Echo's strong market position as a top-tier North American 3PL is bolstered by industry accolades, including Newsweek's America's Greenest Companies 2025 and SupplyTech Breakthrough's 2025 3PL of the Year. Its extensive network of over 50,000 transportation providers and 35,000 clients grants significant service leverage.

| Strength | Description | Supporting Data/Examples |

|---|---|---|

| Technology & Innovation | Proprietary platforms (EchoSync, EchoShip, EchoDrive) for visibility, analytics, and automation; AI/ML investments. | Simplifies logistics; enhances pricing and demand forecasting. |

| Comprehensive Service Offering | Multi-modal capabilities including FTL, LTL, intermodal, temperature-controlled, and cross-border. | Q1 2024 freight brokerage revenue up 5%; serves diverse client needs. |

| Market Leadership & Reputation | Leading North American 3PL; recognized for operational excellence and sustainability. | Newsweek's America's Greenest Companies 2025; SupplyTech Breakthrough's 2025 3PL of the Year. |

| Extensive Network & Data Analytics | Partnerships with over 50,000 providers and serving 35,000 clients; data-driven optimization. | Significant capacity leverage; sophisticated decision-making tools for clients. |

What is included in the product

Delivers a strategic overview of Echo Global Logistics’s internal and external business factors, highlighting its strengths in technology and network, weaknesses in integration, opportunities in market expansion, and threats from competition and economic downturns.

Highlights Echo Global Logistics' competitive advantages and potential threats, enabling proactive risk mitigation.

Uncovers internal weaknesses and external opportunities, guiding strategic resource allocation for maximum impact.

Weaknesses

Echo Global Logistics, like many in the freight brokerage sector, faces significant headwinds from freight market volatility. The industry is inherently tied to economic cycles, meaning periods of robust demand can quickly shift to oversupply, driving down rates. This fluctuation directly impacts a brokerage's ability to secure favorable pricing and maintain consistent margins.

The freight market experienced a notable downturn, often termed a 'freight recession,' throughout 2024. Projections indicated this challenging environment would likely persist into early 2025, marked by stagnant freight volumes and an overabundance of available trucking capacity. This excess capacity puts downward pressure on rates, directly affecting Echo's gross profit per load and overall financial performance.

Echo Global Logistics operates within a highly fragmented third-party logistics (3PL) and freight brokerage market, facing intense competition from both established players and emerging digital disruptors. This crowded field, which saw the global 3PL market valued at approximately $1.15 trillion in 2023 and projected to grow, means Echo must constantly innovate to stand out.

The pressure on pricing is significant, as numerous providers vie for business, potentially squeezing profit margins. For instance, freight rates in the US trucking sector experienced considerable volatility throughout 2024, reflecting this competitive dynamic and impacting carrier profitability.

Furthermore, the entry of digitally native platforms and even asset-based carriers into the brokerage arena adds another layer of complexity. These new entrants often leverage technology to offer streamlined services, forcing traditional companies like Echo to enhance their digital capabilities and value propositions to remain competitive.

Echo Global Logistics' asset-light model, while offering flexibility, creates a significant reliance on its external carrier network for freight transportation. This dependence becomes a weakness when these relationships falter, leading to potential disruptions in capacity or service quality. For instance, during periods of extreme freight demand, like those seen in late 2021 and early 2022, securing adequate capacity from third-party carriers can become exceptionally challenging and costly, impacting Echo's ability to serve its clients effectively.

Vulnerability to Economic Slowdowns

Echo Global Logistics' performance is intrinsically linked to the overall economic climate. A slowdown in consumer spending and industrial production, which are key drivers of freight demand, poses a significant risk. For instance, if key economic indicators like the US Industrial Production Index, which has seen fluctuations, experiences a notable downturn in 2025, Echo's freight volumes could contract.

Potential headwinds such as a weakening labor market or declining consumer confidence in 2025 could further dampen demand for logistics services. This directly translates to fewer shipments for Echo, impacting its top-line revenue and overall profitability. The company must remain agile to navigate these economic uncertainties.

- Economic Sensitivity: Freight demand closely mirrors economic health, affecting consumer spending and industrial output.

- 2025 Outlook Concerns: Potential labor market slowdowns and reduced consumer confidence in 2025 could decrease freight volumes.

- Revenue Impact: Economic downturns directly threaten Echo's revenue streams and profitability.

Impact of Fuel Price Volatility and Rising Costs

Fuel costs are a major expenditure for trucking companies, and unpredictable diesel prices directly affect their earnings, subsequently influencing the rates they offer to brokers and customers. For instance, the U.S. average on-highway diesel price hovered around $3.95 per gallon in early 2024, a figure that can significantly impact a carrier's bottom line when it fluctuates. This volatility creates a challenging environment for maintaining consistent pricing and profitability.

The logistics sector is experiencing broad cost increases, encompassing not only energy but also labor and equipment. These escalating expenses can put considerable pressure on the profit margins of logistics providers like Echo Global Logistics. Rising wages, for example, are a persistent concern, with the average truck driver salary in the US seeing an upward trend.

While Echo's advanced technology assists in optimizing routes and loads, thereby mitigating some inefficiencies, it cannot completely shield the company from the pervasive external cost pressures stemming from volatile fuel markets and other operational expenses. The inherent nature of the transportation industry means that these macro-economic factors will always present a degree of risk.

- Significant Operational Expense: Fuel constitutes a substantial portion of a carrier's operating budget.

- Profitability Impact: Fluctuations in diesel prices directly affect carrier profitability and pricing power.

- Industry-Wide Cost Increases: Rising energy, labor, and equipment costs are squeezing margins across the logistics sector.

- Technological Limitations: While optimization technology helps, it cannot entirely eliminate the impact of external cost pressures.

Echo Global Logistics' asset-light model, while offering flexibility, creates a significant reliance on its external carrier network for freight transportation. This dependence becomes a weakness when these relationships falter, leading to potential disruptions in capacity or service quality. For instance, during periods of extreme freight demand, securing adequate capacity from third-party carriers can become exceptionally challenging and costly, impacting Echo's ability to serve its clients effectively.

The company's performance is intrinsically linked to the overall economic climate. A slowdown in consumer spending and industrial production, key drivers of freight demand, poses a significant risk. For example, if key economic indicators like the US Industrial Production Index experience a notable downturn in 2025, Echo's freight volumes could contract.

Potential headwinds such as a weakening labor market or declining consumer confidence in 2025 could further dampen demand for logistics services. This directly translates to fewer shipments for Echo, impacting its top-line revenue and overall profitability. The company must remain agile to navigate these economic uncertainties.

Full Version Awaits

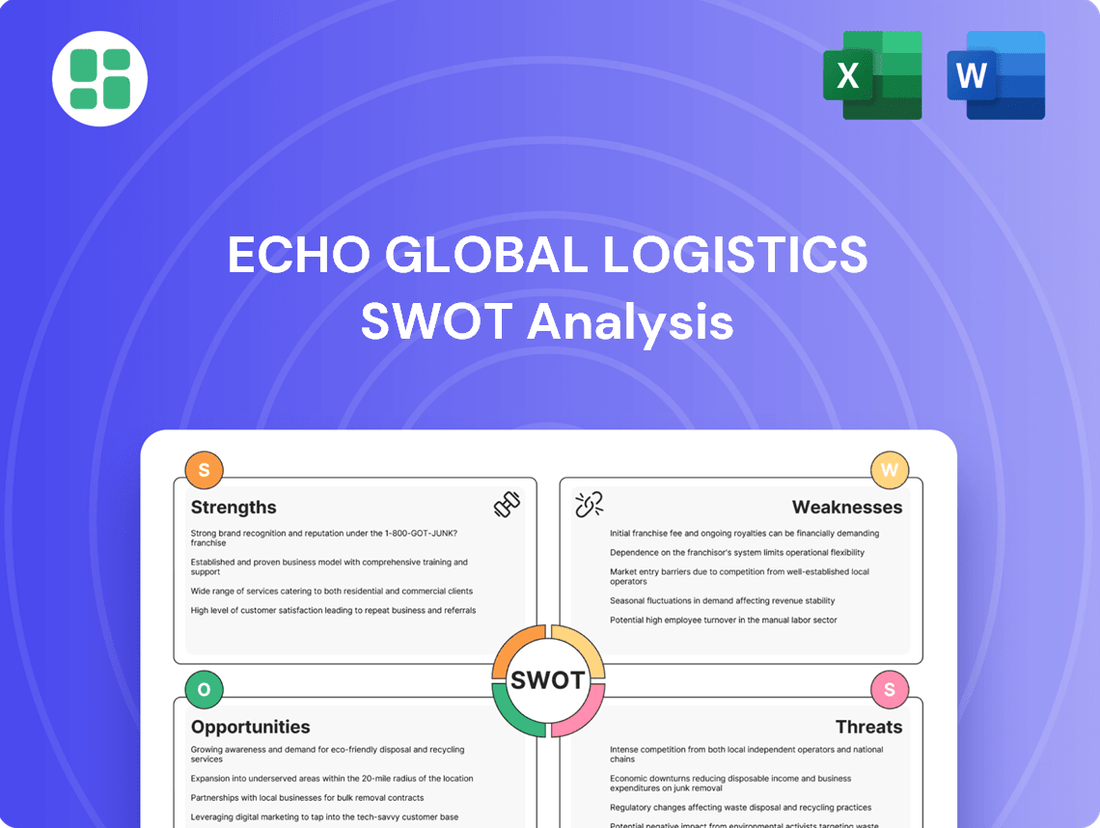

Echo Global Logistics SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Echo Global Logistics' Strengths, Weaknesses, Opportunities, and Threats. Gain a comprehensive understanding of their strategic position.

Opportunities

The logistics sector's accelerated digital transformation, particularly in AI and automation, presents a significant growth avenue. Echo Global Logistics, already a tech-forward company, can capitalize on this by deepening its AI integration for predictive analytics and optimized routing. This strategic move is expected to boost operational efficiency and solidify its market position.

The relentless expansion of e-commerce, projected to reach $8.1 trillion globally by 2024, fuels a significant need for outsourced logistics. This trend is amplified by increasingly intricate global supply chains, pushing companies to seek specialized partners for efficient freight management.

Echo Global Logistics is strategically positioned to benefit from this escalating demand, particularly for last-mile delivery and time-sensitive shipments. Businesses are actively looking for cost-effective solutions to navigate these complexities, making Echo's integrated service offerings a compelling proposition in the current market.

Echo Global Logistics is actively pursuing geographic expansion, as evidenced by its recent entry into the Mexican market to leverage cross-border shipping demand. This strategic move into Mexico is particularly timely, with U.S.-Mexico trade projected to remain robust, supporting freight volumes.

Further opportunities exist for Echo to deepen its presence in existing international corridors or explore new regions entirely, potentially targeting markets with growing e-commerce penetration and manufacturing bases. The company could also focus on developing specialized services for niche logistics segments, such as cold chain or hazardous materials transport, which often command premium pricing and offer less competition.

Expanding into these new territories and specialized niches can significantly diversify Echo's revenue sources, reducing reliance on any single market or service offering. This diversification is crucial for building resilience against economic downturns and increasing overall market share.

Enhanced Focus on Sustainability Initiatives

The growing emphasis on environmental, social, and governance (ESG) factors presents a clear opportunity for Echo Global Logistics. With regulatory bodies and consumers increasingly prioritizing sustainability, Echo can leverage its existing environmental initiatives to gain a competitive edge. This involves further investment in greener logistics solutions, such as electric vehicles and alternative fuels, alongside advanced route optimization to minimize carbon emissions.

Echo can also capitalize on this trend by offering enhanced carbon footprint reporting services to its clients. This transparency not only meets growing demand but also positions Echo as a leader in responsible supply chain management. For instance, as of early 2025, the global logistics industry is seeing a significant push towards net-zero targets, with many major corporations setting ambitious decarbonization goals for their supply chains. Echo's ability to support these goals through demonstrable sustainable practices will be a key differentiator.

- Increased demand for green logistics solutions

- Opportunity to attract ESG-focused clients

- Enhanced brand reputation and competitive advantage

- Potential for operational efficiencies through eco-friendly practices

Strategic Mergers and Acquisitions (M&A)

Echo Global Logistics can pursue strategic mergers and acquisitions to consolidate its position in the fragmented freight brokerage market. This approach allows for rapid expansion of service offerings, enhanced market penetration, and the integration of new technologies. For instance, by acquiring smaller, specialized brokers, Echo could bolster its capabilities in niche sectors or geographic regions.

The freight brokerage industry continues to see consolidation trends, creating ongoing opportunities for strategic M&A. While Echo made acquisitions in 2022, the market environment in 2024 and 2025 is expected to present further chances to acquire companies that align with Echo's growth objectives. These moves can provide access to new customer segments and proprietary technology platforms.

- Market Consolidation: The freight brokerage sector, characterized by numerous smaller players, offers fertile ground for M&A.

- Capability Expansion: Acquisitions can quickly add new services, such as specialized cold chain logistics or advanced TMS solutions.

- Access to New Markets: Buying companies with established networks in underserved regions can accelerate geographic expansion.

- Technological Integration: Acquiring tech-focused firms can bring innovative platforms for visibility, analytics, or automation into Echo's fold.

The ongoing digital transformation in logistics, especially with AI and automation, offers substantial growth. Echo can leverage this by enhancing AI for better route planning and predictive analytics, boosting efficiency. The e-commerce boom, projected to hit $8.1 trillion globally by 2024, continues to drive demand for outsourced logistics, with complex supply chains pushing businesses to seek specialized freight management partners.

Echo's expansion into Mexico taps into robust U.S.-Mexico trade, supporting freight volumes, and further geographic diversification into new international corridors or niche markets like cold chain logistics presents opportunities for premium pricing and reduced competition.

The increasing focus on ESG factors provides an avenue for Echo to differentiate itself by investing in greener logistics solutions and offering enhanced carbon footprint reporting, aligning with corporate net-zero targets prevalent in 2025.

Strategic mergers and acquisitions in the fragmented freight brokerage market, a trend continuing into 2024-2025, allow Echo to rapidly expand services, market reach, and integrate new technologies, potentially acquiring companies with established networks or proprietary platforms.

| Opportunity Area | Key Driver | Echo's Advantage | 2024-2025 Relevance |

|---|---|---|---|

| Digital Transformation (AI/Automation) | Increased efficiency, predictive analytics | Existing tech-forward approach | Accelerated adoption in industry |

| E-commerce Growth | Surging online sales, complex supply chains | Integrated service offerings | Continued robust demand for outsourced logistics |

| Geographic Expansion & Niche Services | Cross-border trade, demand for specialized transport | Entry into Mexico, potential for cold chain | Targeting growth corridors and high-margin segments |

| ESG Focus | Sustainability demand, regulatory pressure | Potential for greener solutions, carbon reporting | Corporate net-zero commitments increasing |

| Mergers & Acquisitions | Market consolidation, capability enhancement | Strategic acquisitions to gain market share | Ongoing M&A opportunities in brokerage |

Threats

Global economic slowdowns, amplified by persistent geopolitical tensions, present a significant threat to Echo Global Logistics. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, indicating reduced economic activity that directly impacts freight volumes. Shifting trade policies, such as ongoing trade disputes and the potential for new tariffs, further disrupt international trade flows, creating uncertainty and potentially decreasing demand for Echo's core services.

These macroeconomic and geopolitical headwinds can lead to a direct impact on Echo's revenue and profitability. A slowdown in manufacturing and consumer spending, often a consequence of economic downturns, translates into fewer goods needing transportation. For example, a 1% decrease in global trade volume could have a material effect on the company's top line, necessitating careful cost management and strategic adjustments to mitigate these risks.

The inherent uncertainty stemming from these global events demands that Echo Global Logistics maintain a high degree of operational agility and robust risk management frameworks. The ability to quickly adapt to changing trade patterns, fluctuating fuel costs, and evolving regulatory environments is crucial for navigating these turbulent times and ensuring business continuity.

The freight brokerage landscape is seeing a surge of new players, particularly tech startups with advanced digital platforms. Traditional carriers are also broadening their reach into brokerage, creating a more crowded and competitive environment.

This heightened competition is expected to put downward pressure on pricing. Companies like Echo Global Logistics will need to continually invest in technology and find unique ways to stand out to avoid losing ground.

The increasing sophistication of predictive analytics, coupled with significant venture capital investment in the sector, is accelerating the performance divide. This means companies that effectively leverage data and technology will likely pull ahead of those that don't.

Echo Global Logistics faces significant cybersecurity risks due to its reliance on proprietary technology and the handling of extensive sensitive client and carrier data. A successful cyberattack or system failure could result in substantial financial penalties and damage to its reputation, potentially eroding customer confidence.

The logistics sector, in general, is a prime target for cyber threats. In 2023, the average cost of a data breach in the transportation industry was estimated to be $4.08 million, highlighting the potential financial impact. Echo Global Logistics must continuously invest in robust cybersecurity measures to safeguard its digital infrastructure and ensure operational continuity against evolving threats.

Regulatory Changes and Compliance Burden

The logistics sector faces a constant barrage of evolving regulations. For instance, potential new rules from the U.S. Department of Transportation concerning freight brokers, or shifts in freight classification standards, could significantly impact operations. These regulatory shifts demand ongoing investment in compliance, potentially increasing operational expenses and overall complexity for companies like Echo Global Logistics.

Staying ahead of these changes is crucial. Failure to adapt swiftly to new mandates, such as those impacting driver hours or emissions, could lead to substantial penalties, disruptions in service, or even operational inefficiencies that erode profitability. For example, the Federal Motor Carrier Safety Administration (FMCSA) continues to refine its compliance and enforcement programs, requiring vigilant monitoring and proactive adjustments.

- Increased compliance costs: New regulations necessitate investments in technology, training, and personnel to ensure adherence.

- Potential for penalties: Non-compliance can result in fines, license suspensions, or other sanctions.

- Operational complexity: Adapting to new rules can complicate existing processes and supply chain management.

- Competitive disadvantage: Companies slower to adapt may face operational hurdles that competitors have already overcome.

Supply Chain Disruptions and Labor Issues

The global supply chain continues to be a significant concern, with ongoing vulnerabilities to events like natural disasters and potential labor actions, such as the International Longshoremen's Association (ILA) strike that was averted in early 2024 but remains a recurring threat. These disruptions directly impact freight movement, leading to delays and escalating costs. For instance, the disruptions experienced in 2022 and early 2023, stemming from port congestion and labor disputes, significantly increased shipping times and expenses for many companies.

Labor shortages across various sectors of the logistics industry, from truck drivers to warehouse personnel, further exacerbate these issues. This scarcity of workers can hinder the efficient processing and transportation of goods, making it harder for companies like Echo Global Logistics to meet client delivery expectations. The American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a figure that highlights the persistent labor gap.

- Vulnerability to Disruptions: Global supply chains remain susceptible to natural disasters, geopolitical events, and labor disputes, which can halt or slow down the movement of goods.

- Impact on Freight Movement: Disruptions lead to increased transit times, higher transportation costs, and a reduced capacity to fulfill customer orders promptly.

- Labor Shortages: A persistent lack of qualified workers in key logistics roles, such as truck drivers and warehouse staff, impedes operational efficiency and service delivery.

- Erosion of Efficiency: These combined factors challenge the overall resilience and efficiency of logistics networks, posing a constant operational risk.

The increasing competition from new tech-focused entrants and traditional carriers expanding into brokerage creates a more crowded market. This heightened competition is likely to drive down pricing, forcing Echo Global Logistics to invest further in technology and differentiation to maintain its market position.

Echo Global Logistics is exposed to significant cybersecurity risks given its reliance on technology and the sensitive data it handles. A breach could lead to substantial financial penalties, estimated at an average of $4.08 million for data breaches in the transportation sector in 2023, and severe reputational damage.

Evolving regulatory landscapes, such as potential new U.S. Department of Transportation rules for freight brokers, present a threat of increased compliance costs and operational complexity. Failure to adapt to new mandates, like those concerning driver hours or emissions, could result in penalties and inefficiencies.

Vulnerabilities in global supply chains, including natural disasters and labor disputes like the averted ILA strike in early 2024, continue to disrupt freight movement, causing delays and cost increases. Persistent labor shortages, such as the over 78,000 truck driver shortage reported in 2023, further strain operational capacity and service delivery.

SWOT Analysis Data Sources

The data sources for this Echo Global Logistics SWOT analysis include their publicly available financial statements, comprehensive industry market research reports, and expert analyses of the logistics sector to provide a robust and informed perspective.