Echo Global Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Echo Global Logistics Bundle

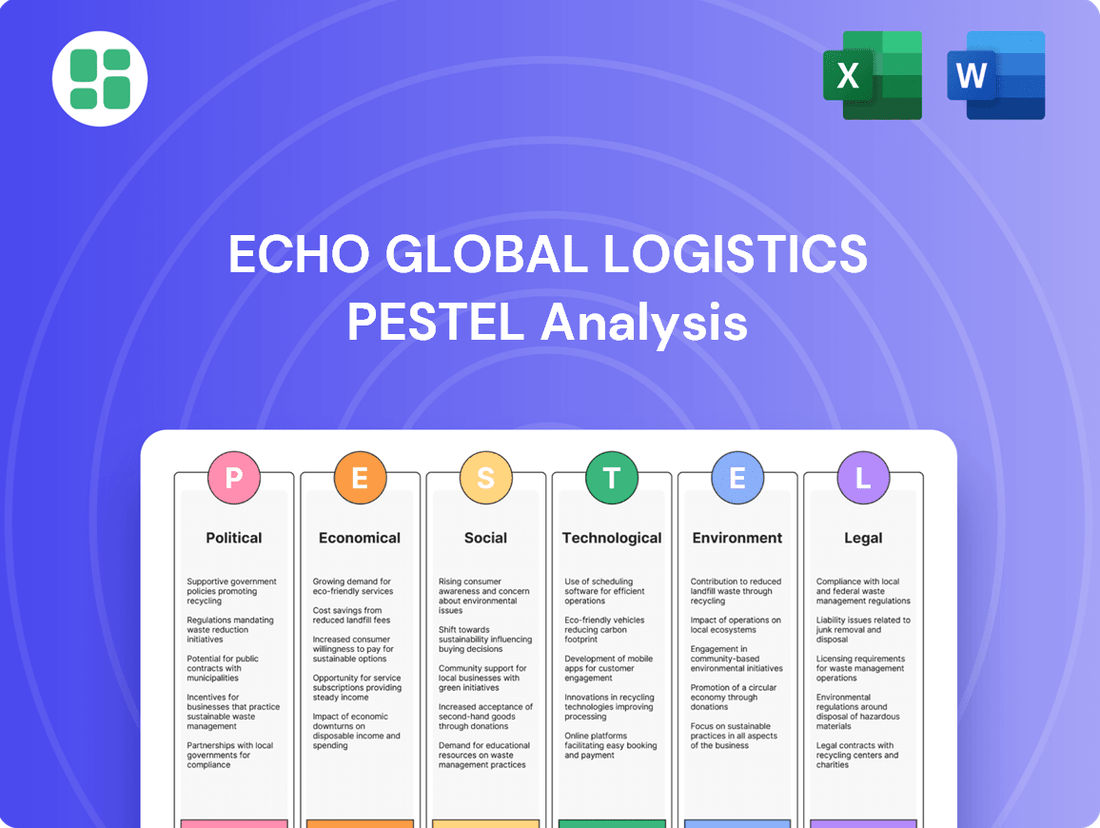

Navigate the complex external forces shaping Echo Global Logistics with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting their operations and future growth. This expert-crafted report is your key to unlocking strategic advantages. Download the full version now for actionable intelligence that can inform your investment decisions and market strategies.

Political factors

Government regulations significantly shape Echo Global Logistics' operations. New rules, like those impacting the FMCSA's Drug & Alcohol Clearinghouse and medical certification processes, are fully rolling out in 2025, directly affecting driver compliance and potentially operational capacity. These changes can influence everything from driver hiring to the costs associated with maintaining a compliant fleet.

Global and regional trade policies, including tariffs and trade agreements, directly influence freight volumes and costs for companies like Echo Global Logistics. For instance, ongoing discussions around potential tariffs on imports from key trading partners such as Canada, Mexico, and China in 2024 and 2025 could significantly increase operational expenses and disrupt established supply chains.

The de minimis exemption, a threshold below which imported goods can enter a country without duties, is also facing increased scrutiny. Changes to this exemption could alter the economics of international shipping, forcing logistics providers to re-evaluate their cross-border strategies and potentially impacting the cost structure for e-commerce shipments.

Government investment in transportation infrastructure, such as roads, bridges, ports, and rail, directly impacts the efficiency and capacity of logistics networks like Echo Global Logistics. Significant federal funding, exemplified by the $134 billion allocated in 2025 for infrastructure projects under the Bipartisan Infrastructure Law, aims to bolster the nation's transportation systems.

These substantial investments are designed to reduce transit times, thereby enhancing supply chain resilience and potentially opening up new avenues for growth and operational improvements for logistics providers. Such developments can lead to more predictable delivery schedules and a greater ability to handle increased freight volumes, directly benefiting companies like Echo Global Logistics.

Geopolitical Stability and Supply Chain Resilience

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impact global supply chains. For Echo Global Logistics, this means increased operational costs and the need for agile route planning. In 2024, the cost of ocean freight, already volatile, saw further upward pressure due to disruptions in key shipping lanes, impacting overall logistics efficiency.

The imperative for supply chain resilience is driving significant investment. Businesses are actively seeking to diversify their supplier bases away from single-source dependencies, a trend that benefits logistics providers capable of managing complex, multi-regional networks. This strategic shift is crucial for mitigating risks associated with potential trade disputes or localized conflicts that could halt freight movement.

- Diversification: Companies are actively reducing reliance on single manufacturing hubs, increasing demand for logistics partners with global reach and diverse operational capabilities.

- Risk Mitigation: Investments in technology for real-time tracking and predictive analytics are becoming standard for logistics firms to navigate unpredictable geopolitical events.

- Route Optimization: The need to bypass conflict zones or areas with trade restrictions necessitates sophisticated network design and alternative transportation solutions.

Government Support for Green Logistics

Governments globally are actively promoting green logistics through supportive policies. For instance, the EU's Fit for 55 package sets ambitious targets for reducing greenhouse gas emissions, impacting transportation sectors significantly. This includes measures like the expansion of the EU Emissions Trading System (ETS) to maritime transport, which began covering emissions from large ships in 2024.

These initiatives create a strong incentive for logistics companies like Echo Global Logistics to invest in sustainable technologies and practices. Compliance with stricter environmental regulations, such as those mandating the use of lower-sulfur fuels or the adoption of electric or alternative-fuel vehicles, is becoming a necessity. The FuelEU Maritime Regulation, for example, aims to increase the uptake and use of sustainable alternative fuels in shipping, with targets set to rise over time.

The push for sustainability is not just about compliance; it's a driver for innovation.

- Carbon Reduction Targets: Many nations have established legally binding carbon reduction goals, directly influencing logistics operations.

- Emissions Trading Systems: The implementation and expansion of ETS, like the EU ETS, place a financial cost on carbon emissions, encouraging efficiency.

- Incentives for Green Technology: Governments are offering subsidies and tax breaks for adopting electric vehicles, alternative fuels, and energy-efficient infrastructure.

- Stricter Fuel Standards: Regulations like FuelEU Maritime are pushing for the adoption of cleaner fuels, requiring significant investment and operational changes.

Government policies and regulatory changes are pivotal for Echo Global Logistics. The 2025 rollout of FMCSA Drug & Alcohol Clearinghouse rules, for instance, directly impacts driver compliance and fleet management costs. Trade policies, including potential tariffs in 2024-2025 on goods from key partners like China, can significantly alter freight volumes and operational expenses.

Infrastructure investment is a key political factor. The Bipartisan Infrastructure Law's $134 billion allocation for 2025 projects aims to improve transit times and supply chain efficiency, directly benefiting logistics providers. Geopolitical events, such as conflicts in Eastern Europe and the Middle East, continue to influence shipping costs and necessitate agile route planning, with ocean freight costs seeing upward pressure in 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Echo Global Logistics, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, threats, and opportunities within the logistics industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into the political, economic, social, technological, legal, and environmental factors impacting Echo Global Logistics.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key PESTLE drivers relevant to Echo Global Logistics' operations and strategy.

Economic factors

The overall health of the economy, measured by Gross Domestic Product (GDP) growth and consumer spending, is a primary driver for the logistics sector. When the economy is robust, businesses expand, and consumers purchase more goods, directly increasing the need for transportation and warehousing services.

While 2024 offered a degree of economic stability, the logistics industry navigates a more uncertain landscape heading into 2025. Projections for U.S. GDP growth, such as the Congressional Budget Office's forecast of 1.7% for 2025, will significantly shape freight volumes and demand for Echo Global Logistics' services.

A strong economic environment generally correlates with higher demand for shipping across all modes, from trucking to air and ocean freight. Conversely, economic slowdowns or recessions typically lead to reduced freight volumes and tighter margins for logistics providers.

Fluctuations in fuel prices, especially diesel, are a significant cost driver for Echo Global Logistics. For instance, in early 2024, diesel prices saw considerable swings, impacting operational expenses. This volatility directly affects freight rates and the company's ability to maintain healthy profit margins.

Logistics providers like Echo Global must actively manage these unpredictable fuel costs. Strategies such as fuel surcharges, hedging, and optimizing fleet efficiency are crucial for mitigating the financial impact. The company's financial reports for 2024 will likely detail these cost management efforts.

Furthermore, potential regulatory shifts in the oil and gas sector, such as changes in environmental policies or production quotas, could introduce further uncertainty into future fuel price trends. This makes proactive planning and adaptability essential for sustained profitability.

Interest rate shifts directly impact Echo Global Logistics' operational costs and investment capacity. Higher rates in late 2024 increased the expense of financing new equipment or expanding warehouse space. For instance, a 1% increase on a $10 million loan could add $100,000 annually to interest payments.

Looking ahead to 2025, the market anticipates a period of interest rate adjustments, with potential cuts by central banks. This could ease borrowing burdens, making it more attractive for Echo Global Logistics to pursue capital-intensive projects like fleet modernization or technology integration, potentially boosting efficiency and service offerings.

However, analysts suggest that even with anticipated cuts, interest rates in 2025 are unlikely to revert to the ultra-low levels seen in prior years. This means that while borrowing costs may decrease, they will likely remain a significant factor in strategic financial planning for Echo Global Logistics.

Inflationary Pressures and Operational Costs

Inflationary pressures, especially concerning wage increases and escalating operational expenses, remain a significant challenge for the logistics industry. These rising costs directly influence how freight brokers and carriers set their prices and impact overall profitability. For instance, the US Bureau of Labor Statistics reported a 4.1% increase in average hourly earnings for transportation and warehousing workers in the year leading up to April 2024, a key driver of these pressures.

These cost hikes can force adjustments in pricing strategies, potentially making services less competitive if not managed effectively. Carriers are particularly vulnerable as fuel prices, a major operational cost, saw volatility throughout 2024, with Brent crude oil futures fluctuating significantly. Successfully navigating these inflationary headwinds is paramount for maintaining market position and ensuring sustained profitability.

- Wage Inflation: Average hourly earnings in transportation and warehousing rose 4.1% year-over-year as of April 2024.

- Operational Costs: Fluctuations in fuel prices, a key expense, impacted carrier margins throughout 2024.

- Pricing Strategy Impact: Increased costs necessitate careful pricing to avoid losing competitiveness.

- Profitability Concerns: Managing these pressures is vital for maintaining healthy profit margins in the sector.

E-commerce Growth and Market Demand

The relentless expansion of e-commerce is a primary catalyst for the logistics sector, fueling a heightened need for sophisticated last-mile delivery and fulfillment operations. This trend directly translates into increased demand for services offered by companies like Echo Global Logistics.

The global e-commerce logistics market saw robust growth throughout 2024, with projections indicating continued upward momentum into 2025. This sustained expansion underscores the critical requirement for adaptable and scalable transportation networks.

- E-commerce sales are expected to reach $7.4 trillion globally by the end of 2024.

- The compound annual growth rate (CAGR) for e-commerce logistics is anticipated to be around 15% from 2024 to 2025.

- Last-mile delivery accounts for over 50% of total shipping costs in e-commerce.

Economic growth directly fuels demand for logistics services. As the U.S. economy is projected to grow at 1.7% in 2025, Echo Global Logistics can anticipate steady freight volumes. However, fluctuations in fuel prices, a significant cost for carriers, will continue to impact operational expenses and profit margins.

Interest rate adjustments in 2025 may ease borrowing costs for Echo Global Logistics, potentially encouraging investment in fleet modernization. Yet, rates are unlikely to return to previous lows, meaning financing costs will remain a key consideration for strategic planning.

Inflationary pressures, particularly rising wages in the transportation sector, which saw a 4.1% increase in average hourly earnings by April 2024, will continue to challenge logistics providers. Managing these increased operational costs is vital for maintaining competitive pricing and profitability.

The ongoing surge in e-commerce, projected to reach $7.4 trillion globally in 2024 with a 15% CAGR in logistics through 2025, presents a significant opportunity for Echo Global Logistics, especially in last-mile delivery services.

| Economic Indicator | 2024/2025 Data Point | Impact on Echo Global Logistics |

|---|---|---|

| U.S. GDP Growth Projection | 1.7% (2025) | Supports steady freight volumes. |

| Diesel Price Volatility | Significant swings in early 2024 | Impacts operational costs and profit margins. |

| Interest Rate Outlook | Potential cuts, but not to prior lows | May ease borrowing costs, but financing remains a key factor. |

| Wage Inflation (Transp. & Warehousing) | 4.1% increase (year-over-year as of April 2024) | Increases operational expenses, necessitates pricing adjustments. |

| Global E-commerce Sales Projection | $7.4 trillion (end of 2024) | Drives demand for last-mile delivery and fulfillment. |

Same Document Delivered

Echo Global Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Echo Global Logistics covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this in-depth report upon completing your purchase.

Sociological factors

Consumers now demand quicker, more transparent, and adaptable delivery services, largely fueled by the surge in e-commerce. For instance, by 2024, a significant percentage of online shoppers in major markets expect same-day or next-day delivery, a trend that directly impacts logistics providers like Echo Global Logistics.

This escalating need for speed and dependability compels logistics firms to invest heavily in advanced technologies. Think real-time tracking systems, a wider array of delivery alternatives, and smooth, integrated customer journeys, all aimed at enhancing the overall experience.

Successfully meeting these elevated consumer expectations is paramount for fostering customer satisfaction and building lasting loyalty. Companies that excel in this area are better positioned to retain customers and gain a competitive edge in the market.

Echo Global Logistics, like much of the transportation sector, grapples with persistent labor shortages, especially for truck drivers and warehouse staff. This scarcity directly impacts operational costs, as companies face increasing pressure to raise wages and improve benefits to attract and retain talent. For instance, the American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a figure expected to grow.

The demographic shift, with an aging driver population retiring and fewer younger individuals entering the field, exacerbates this issue. Competition for skilled logistics professionals is fierce, forcing companies to invest more heavily in training programs, retention initiatives, and exploring technological solutions like automation to fill critical gaps.

There's a significant, growing demand from both society and consumers for supply chains that are ethical and sustainable. This means people are paying more attention to how companies operate beyond just the product itself.

A company's environmental impact and its commitment to social responsibility are now major factors influencing what people buy and how they view a brand. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when making purchasing decisions.

Consequently, logistics providers like Echo Global Logistics face increasing pressure to implement greener operational practices. This includes reducing emissions and waste, and being open about their progress in sustainability reporting to build trust and maintain a positive public image.

Impact of Urbanization and Last-Mile Delivery

The continuing trend of urbanization, with more people flocking to cities, is significantly reshaping logistics. This concentration of populations, especially when combined with the boom in online shopping, creates substantial challenges for last-mile delivery operations. For instance, by 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, according to UN data. This density means more packages need to reach more people in geographically smaller, often more congested, areas.

To effectively navigate these urban complexities and meet rising consumer demands for speed, companies are exploring innovative solutions. The development of urban micro-fulfillment centers (MFCs) is a key strategy, allowing for inventory to be stored closer to end consumers. Furthermore, the exploration of novel delivery methods, such as using electric cargo bikes or even drones in certain urban environments, is becoming increasingly crucial to ensure efficient and timely service in these densely populated zones.

- Urban Population Growth: Global urban population is expected to reach 60% by 2030, increasing delivery density.

- E-commerce Surge: Online retail sales are projected to continue their upward trajectory, amplifying last-mile demand. In 2024, global e-commerce sales were estimated to be around $6.3 trillion, a significant increase from previous years.

- Micro-Fulfillment Centers (MFCs): Companies are investing in MFCs to reduce delivery times and costs in urban areas.

- Delivery Method Innovation: Exploration of alternative delivery methods like electric vehicles and cargo bikes to combat urban congestion and emissions.

Adaptation to Flexible Work Patterns

The logistics sector's need for continuous operation, especially in warehousing and distribution, fuels a strong demand for adaptable work schedules. This means logistics professionals are increasingly expected to embrace varied shifts, including nights and weekends, a trend that employers are addressing with various incentives to attract and retain talent in these crucial roles.

Employers are responding to this need for flexibility by offering enhanced compensation and benefits for non-traditional hours. For instance, many logistics companies now provide shift differentials, sign-on bonuses for weekend work, and improved work-life balance programs to make these demanding schedules more appealing.

- 24/7 Operations Demand: Warehousing and distribution centers often operate continuously, requiring staff availability outside standard business hours.

- Shift System Acceptance: Logistics workers are increasingly expected to be open to night, weekend, and rotating shift patterns.

- Employer Incentives: Companies are offering financial bonuses and other benefits to attract employees willing to work flexible or non-traditional hours.

- Workforce Adaptability: The modern logistics workforce needs to be agile and responsive to fluctuating operational demands and customer needs.

Societal expectations for faster, more transparent, and adaptable delivery are intensifying, driven by e-commerce growth. By 2024, a significant portion of online shoppers anticipate same-day or next-day delivery, directly impacting logistics providers like Echo Global Logistics.

Labor shortages, particularly for truck drivers, remain a critical challenge. The American Trucking Associations reported a deficit of over 78,000 drivers in 2023, a number projected to increase, driving up operational costs due to wage pressures.

There's a growing societal demand for ethical and sustainable supply chains, with over 60% of consumers in a 2024 survey considering sustainability in their purchasing decisions.

Urbanization, with over 57% of the global population living in cities by 2023, complicates last-mile delivery, necessitating innovations like micro-fulfillment centers and electric cargo bikes.

| Sociological Factor | Impact on Logistics | Key Data/Trend |

|---|---|---|

| Consumer Demand for Speed | Increased pressure for rapid delivery, investment in technology | Expectation of same-day/next-day delivery by significant % of online shoppers in 2024 |

| Labor Shortages | Rising operational costs, competition for talent | Over 78,000 truck driver shortage in the US (2023), projected to grow |

| Sustainability Expectations | Need for greener operations, transparency in reporting | Over 60% of consumers consider sustainability in purchasing (2024 survey) |

| Urbanization | Challenges for last-mile delivery, need for new solutions | Over 57% of global population in urban areas (2023), projected to reach 60% by 2030 |

Technological factors

Artificial intelligence (AI) and machine learning (ML) are rapidly becoming indispensable for optimizing logistics. These technologies are crucial for sophisticated predictive analytics, which are vital for accurate demand forecasting, efficient route planning, and effective inventory management. For instance, by 2025, the global AI in logistics market is projected to reach over $10 billion, indicating significant industry adoption and investment.

As a technology-forward company, Echo Global Logistics is well-positioned to harness these AI and ML advancements. This adoption can lead to substantial improvements in operational efficiency, a reduction in overall costs, and the delivery of enhanced service levels to clients. Companies leveraging AI in logistics are reporting an average of 15-20% reduction in transportation costs.

The transformative power of AI is set to automate many routine tasks within the logistics sector, freeing up human resources for more strategic activities. Furthermore, it will provide invaluable real-time insights, allowing for quicker and more informed decision-making. This shift is expected to redefine industry standards for speed and responsiveness.

Echo Global Logistics benefits from the increasing integration of Internet of Things (IoT) sensors and sophisticated software. These technologies offer unparalleled real-time visibility across the entire supply chain, allowing for precise tracking of shipments and inventory levels. This enhanced transparency is vital for anticipating and resolving issues swiftly, leading to better operational decisions and fulfilling customer demands for up-to-the-minute delivery information.

Automation, particularly with the rise of collaborative robots (cobots) and advanced automated systems, is significantly reshaping warehouse operations and helping to mitigate persistent labor shortages. These technologies are directly boosting productivity, enhancing efficiency, and improving the accuracy of critical tasks like material handling and order fulfillment.

The increasing integration of automation is also driving a shift in the logistics workforce, creating a demand for more specialized and higher-skilled roles. For instance, by 2025, the International Federation of Robotics (IFR) projected a global installation of 1.5 million new industrial robots, with a significant portion expected in logistics and warehousing sectors, underscoring this trend.

Cybersecurity and Data Privacy

Cybersecurity is a paramount concern for Echo Global Logistics, especially with its increasing reliance on digital platforms for operations. Protecting sensitive customer and operational data from cyber threats is critical for maintaining trust and business continuity. The company must continually invest in advanced security measures to combat evolving cyber risks.

The financial impact of cyber incidents can be substantial. For instance, a 2023 report indicated that the average cost of a data breach for companies in the logistics sector could reach millions of dollars, impacting operational uptime and recovery expenses. Echo Global Logistics, like its peers, faces the imperative to allocate significant resources to cybersecurity infrastructure and training.

Key considerations for Echo Global Logistics include:

- Implementing multi-factor authentication across all systems.

- Conducting regular vulnerability assessments and penetration testing.

- Providing ongoing cybersecurity awareness training for all employees.

- Developing and testing a comprehensive incident response plan.

Data privacy regulations, such as GDPR and CCPA, also impose strict requirements on how companies handle personal information. Non-compliance can lead to significant fines, further underscoring the need for robust data protection strategies within Echo Global Logistics' operations.

Emerging Delivery Technologies

The evolution of delivery technologies, particularly autonomous vehicles, drones, and delivery bots, is set to redefine last-mile logistics for companies like Echo Global Logistics. These innovations offer a potential solution to capacity limitations and the growing demand for faster deliveries.

While widespread implementation is still developing, these technologies, often zero-emission, hold significant promise. They could contribute to decongesting urban environments, lowering transportation-related carbon footprints, and bolstering the resilience of supply chains against disruptions.

By 2024, the global autonomous last-mile delivery market was valued at an estimated $15.9 billion, with projections indicating substantial growth. For instance, the drone delivery segment alone is expected to reach over $40 billion by 2030, according to various market analyses.

- Autonomous Vehicles: Expected to improve efficiency and reduce labor costs in long-haul and urban delivery.

- Drones: Offering rapid delivery for smaller packages, especially in remote or congested areas.

- Delivery Bots: Designed for short-distance, sidewalk-based deliveries, particularly in urban centers.

- Zero-Emission Potential: These technologies align with increasing environmental regulations and corporate sustainability goals.

Technological advancements are fundamentally reshaping the logistics landscape, presenting both opportunities and challenges for Echo Global Logistics. The integration of artificial intelligence (AI) and machine learning (ML) is crucial for optimizing operations, with the global AI in logistics market projected to exceed $10 billion by 2025. Furthermore, the increasing adoption of automation, including robots in warehousing, is boosting productivity and addressing labor shortages, with the International Federation of Robotics anticipating 1.5 million new industrial robots in logistics by 2025.

Legal factors

Echo Global Logistics, like all transportation providers, must navigate a stringent regulatory landscape. Key agencies like the Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT) set forth rules that directly impact operations and driver qualifications. Failure to comply can result in significant fines and operational disruptions.

Looking ahead to 2025, several regulatory shifts will demand attention. These include updated requirements for the Drug & Alcohol Clearinghouse, the electronic submission of medical examination results for drivers, and new mandates concerning English proficiency for commercial vehicle operators. These changes aim to enhance overall transportation safety and driver competency.

Adherence to these evolving regulations is not merely a matter of compliance but a critical component of risk management for Echo Global Logistics. For instance, the FMCSA's Compliance, Safety, Accountability (CSA) program tracks carrier safety performance, with violations directly impacting a company's safety rating and, consequently, its business prospects.

As Echo Global Logistics increasingly digitizes its operations, adherence to data privacy laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) becomes critical for managing sensitive customer and operational data. These regulations, which have seen significant enforcement actions in recent years, mandate strict protocols for data collection, storage, and usage.

Maintaining secure and transparent data handling is more than just a legal obligation; it's fundamental to building and preserving customer trust. For instance, the European Union's GDPR, implemented in 2018, has led to substantial fines for non-compliance, with reports indicating millions of euros in penalties levied against various organizations for data breaches or mishandling. Echo Global Logistics must ensure its data practices align with these evolving legal landscapes to avoid similar repercussions and maintain its reputation.

Evolving international customs procedures and trade regulations present a significant legal factor for logistics providers like Echo Global Logistics. For instance, the Federal Motor Carrier Safety Administration's (FMCSA) discontinuation of MC Numbers necessitates updates to operational documentation and compliance strategies.

The phased introduction of the Import Control System 2 (ICS2) within the European Union is another critical development. This system aims to enhance security and streamline cross-border freight by requiring more detailed pre-arrival cargo information, impacting how logistics companies manage data submission and verification for shipments entering the EU.

These regulatory shifts, designed to reduce fraud and improve the efficiency of international freight movements, demand continuous adaptation in documentation, data management, and operational processes for companies like Echo Global Logistics to maintain seamless cross-border operations.

Environmental Regulations and Emissions Standards

The logistics sector is navigating increasingly stringent environmental regulations designed to curb emissions and foster sustainability. For instance, the U.S. Environmental Protection Agency (EPA) is actively reconsidering emissions standards for heavy-duty vehicles, impacting fleet operations. Similarly, the European Union's FuelEU Maritime Regulation is progressively mandating reductions in the greenhouse gas intensity of maritime transport.

Adhering to these evolving environmental mandates requires significant capital outlay for cleaner technologies and strategic shifts in operational practices. These investments are crucial for maintaining compliance and mitigating potential penalties. The industry's commitment to sustainability is becoming a key differentiator.

- EPA's proposed rule for heavy-duty vehicles could require manufacturers to meet stricter emission standards starting in model year 2027.

- The FuelEU Maritime Regulation aims for a 6% greenhouse gas intensity reduction by 2030, escalating to 80% by 2050.

- Compliance costs for new, lower-emission vehicles and alternative fuels are a significant factor for logistics providers.

Labor Laws and Employment Standards

Logistics firms like Echo Global Logistics must meticulously adhere to a complex web of labor laws. These regulations govern critical aspects such as driver working hours, minimum wage requirements, and the often-debated classification of drivers as employees versus independent contractors. Staying compliant is paramount to fostering fair employment and sidestepping costly legal challenges.

The ongoing dialogue surrounding detention pay reforms presents a significant factor. For example, proposed changes could directly influence how drivers are compensated for waiting times at facilities. In 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued to monitor driver hours of service, with potential adjustments impacting scheduling and operational efficiency for companies like Echo Global.

- Driver Hours of Service: Regulations limit daily and weekly driving times to ensure safety, impacting route planning and delivery schedules.

- Wage and Hour Laws: Compliance with minimum wage and overtime rules is essential, especially concerning the distinction between employee and independent contractor status.

- Independent Contractor Misclassification: Misclassifying drivers can lead to substantial penalties and back-pay liabilities, as seen in various industry lawsuits.

- Detention Pay: Evolving discussions around fair compensation for driver detention time can affect operational costs and driver retention strategies.

Echo Global Logistics operates within a dynamic legal framework, with evolving regulations impacting everything from driver qualifications to data handling. For instance, the Federal Motor Carrier Safety Administration (FMCSA) continually updates its rules, with new mandates for the Drug & Alcohol Clearinghouse and English proficiency for drivers expected to be fully implemented by 2025, aiming to bolster safety standards.

Data privacy laws, such as the California Consumer Privacy Act (CCPA) and the EU's GDPR, are increasingly critical as logistics operations become more digitized. Non-compliance can result in significant financial penalties, with GDPR fines potentially reaching 4% of global annual revenue. Echo Global must maintain robust data protection protocols to safeguard sensitive information and customer trust.

International trade and customs regulations also present ongoing legal challenges. The EU's Import Control System 2 (ICS2), for example, requires more detailed pre-arrival cargo information, necessitating streamlined data management for cross-border shipments. Echo Global's ability to adapt to these changes directly influences its efficiency in global markets.

Labor laws, particularly concerning driver hours of service and contractor classification, remain a focal point. The FMCSA's continued monitoring of driver hours in 2024 and ongoing discussions around detention pay reforms highlight the need for strict adherence to wage and hour laws to avoid liabilities and ensure fair driver compensation.

| Regulatory Area | Key Compliance Aspect | Potential Impact/Data Point |

|---|---|---|

| Driver Qualifications | English Proficiency Mandate | Enhances safety; requires verification processes. |

| Data Privacy | CCPA/GDPR Compliance | Fines up to 4% of global annual revenue for GDPR violations; builds customer trust. |

| International Trade | EU Import Control System 2 (ICS2) | Requires detailed pre-arrival data; impacts cross-border efficiency. |

| Labor Laws | Driver Hours of Service | Limits driving time; affects route planning and scheduling. |

Environmental factors

The logistics industry faces growing pressure to cut carbon emissions, spurred by government-imposed regulations and targets. For instance, the US Environmental Protection Agency's (EPA) Clean Trucks Plan aims to reduce nitrogen oxide emissions from heavy-duty vehicles, while the EU Emissions Trading System (ETS) places a price on carbon for sectors including transport, encouraging a shift towards cleaner operations.

These regulatory shifts necessitate investments in more fuel-efficient fleets and the exploration of alternative fuels like electric or hydrogen power. Companies like Echo Global Logistics must adapt to these evolving standards to maintain compliance and operational efficiency, impacting fleet acquisition strategies and operational costs.

There's a significant and growing push across the logistics industry, fueled by both businesses and consumers, for more sustainable practices. This isn't just about meeting regulations anymore; it's becoming a fundamental part of how companies operate. For instance, a 2024 survey by Statista indicated that 72% of consumers are willing to pay more for products delivered using sustainable methods.

Companies are actively looking at ways to cut down on their environmental impact. This includes smart route optimization to minimize miles driven, which directly reduces fuel consumption and emissions. Investing in warehouses powered by renewable energy or designed for energy efficiency is also a key trend. Furthermore, the adoption of eco-friendly packaging materials is on the rise, moving away from traditional plastics.

These sustainable initiatives are increasingly seen as a crucial differentiator in the market. Businesses that prioritize environmental responsibility are finding it enhances their brand image and attracts a wider customer base. In 2025, early adopters of these practices are reporting improved operational efficiencies and stronger customer loyalty, suggesting that sustainability is evolving from a cost center to a competitive advantage.

The logistics industry is seeing a major push towards electric, hybrid, and hydrogen-powered vehicles, aiming to cut down on CO2 emissions from transport. This shift, while presenting initial hurdles, is steadily advancing and promises significant long-term savings on fuel and upkeep for companies like Echo Global Logistics.

As of early 2024, the adoption of electric trucks, for instance, is accelerating. Major manufacturers are expanding their offerings, and pilot programs are demonstrating feasibility. For example, by 2025, it's projected that a notable percentage of new heavy-duty truck sales will be electric or alternative fuel, driven by both regulatory pressure and corporate sustainability goals.

Eco-Friendly Packaging and Waste Reduction

The logistics industry is seeing a significant push towards eco-friendly packaging and waste reduction. This involves a move away from single-use plastics and over-packaging, favoring biodegradable, recyclable, and reusable materials. This shift is driven by both regulatory pressures and growing consumer demand for sustainable practices.

Companies like Echo Global Logistics are increasingly integrating reverse logistics to manage product returns and facilitate recycling, thereby minimizing waste across their operations. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products with sustainable packaging. This consumer preference directly influences how logistics providers handle goods throughout the supply chain.

Key developments in this area include:

- Increased adoption of recycled content: Many companies are now sourcing packaging materials with a higher percentage of recycled content, aiming for circular economy principles.

- Innovation in biodegradable materials: Research and development into plant-based and compostable packaging alternatives are accelerating.

- Focus on reusable shipping containers: The use of durable, reusable totes and pallets is growing, reducing the need for disposable materials.

- Optimized packaging design: Logistics firms are investing in technology to design packaging that is both protective and minimizes material usage.

Climate Change Impact on Supply Chain Resilience

Climate change poses a significant threat to supply chain resilience for companies like Echo Global Logistics. The increasing frequency and intensity of extreme weather events, such as severe droughts impacting crucial waterways or intensified storms damaging infrastructure, can directly disrupt transportation routes and logistics operations. For instance, the prolonged drought in the Panama Canal in late 2023 and early 2024 led to significant shipping delays and capacity reductions, impacting global trade flows and increasing transit times for many goods.

Logistics providers must proactively build resilience into their supply chains to navigate these environmental challenges. This involves implementing robust strategies such as detailed scenario planning to anticipate potential disruptions and diversifying transportation routes to reduce reliance on single, vulnerable pathways. Companies are also investing in more adaptable infrastructure and exploring alternative transport modes to ensure continuity of service and mitigate the financial and operational impacts of environmental volatility.

- Increased Frequency of Disruptions: Extreme weather events are becoming more common, leading to more frequent supply chain interruptions.

- Infrastructure Vulnerability: Transportation networks, including ports, roads, and rail lines, are increasingly susceptible to damage from climate-related events.

- Mitigation Strategies: Logistics companies are focusing on scenario planning, route diversification, and investing in resilient infrastructure to maintain operational continuity.

- Economic Impact: Supply chain disruptions due to climate change can lead to increased costs, longer delivery times, and potential revenue losses for businesses.

Environmental regulations are increasingly shaping the logistics landscape, pushing companies like Echo Global Logistics towards cleaner operations and sustainable practices. For example, the US EPA's Clean Trucks Plan and the EU Emissions Trading System are directly influencing fleet upgrades and operational strategies to reduce emissions.

Consumer demand for sustainability is also a major driver, with a significant percentage of consumers willing to pay more for environmentally friendly deliveries, as highlighted by a 2024 Statista survey showing 72% willingness. This trend encourages investments in route optimization, renewable energy for facilities, and eco-friendly packaging.

The shift towards electric, hybrid, and hydrogen-powered vehicles is accelerating, with manufacturers expanding offerings and pilot programs demonstrating feasibility. By 2025, a notable portion of new heavy-duty truck sales are expected to be alternative fuel, driven by both regulations and corporate goals.

Climate change presents tangible risks, with extreme weather events like the Panama Canal drought in late 2023-early 2024 causing significant shipping delays. This necessitates robust resilience strategies, including scenario planning and route diversification, to mitigate disruptions and maintain operational continuity.

| Factor | Impact on Logistics | Examples/Data (2024-2025) |

|---|---|---|

| Emissions Regulations | Increased operational costs, need for fleet modernization | US EPA Clean Trucks Plan, EU ETS; Investment in electric/hydrogen fleets |

| Consumer Demand for Sustainability | Competitive advantage, brand enhancement | 72% of consumers willing to pay more for sustainable delivery (Statista, 2024) |

| Climate Change Events | Supply chain disruptions, increased transit times | Panama Canal drought (late 2023-early 2024) caused significant delays |

| Sustainable Packaging | Reduced waste, improved brand perception | Growing use of recycled content, biodegradable materials; focus on reusable containers |

PESTLE Analysis Data Sources

Our PESTLE analysis for Echo Global Logistics is built upon a robust foundation of data from official government publications, international economic organizations, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the logistics sector.