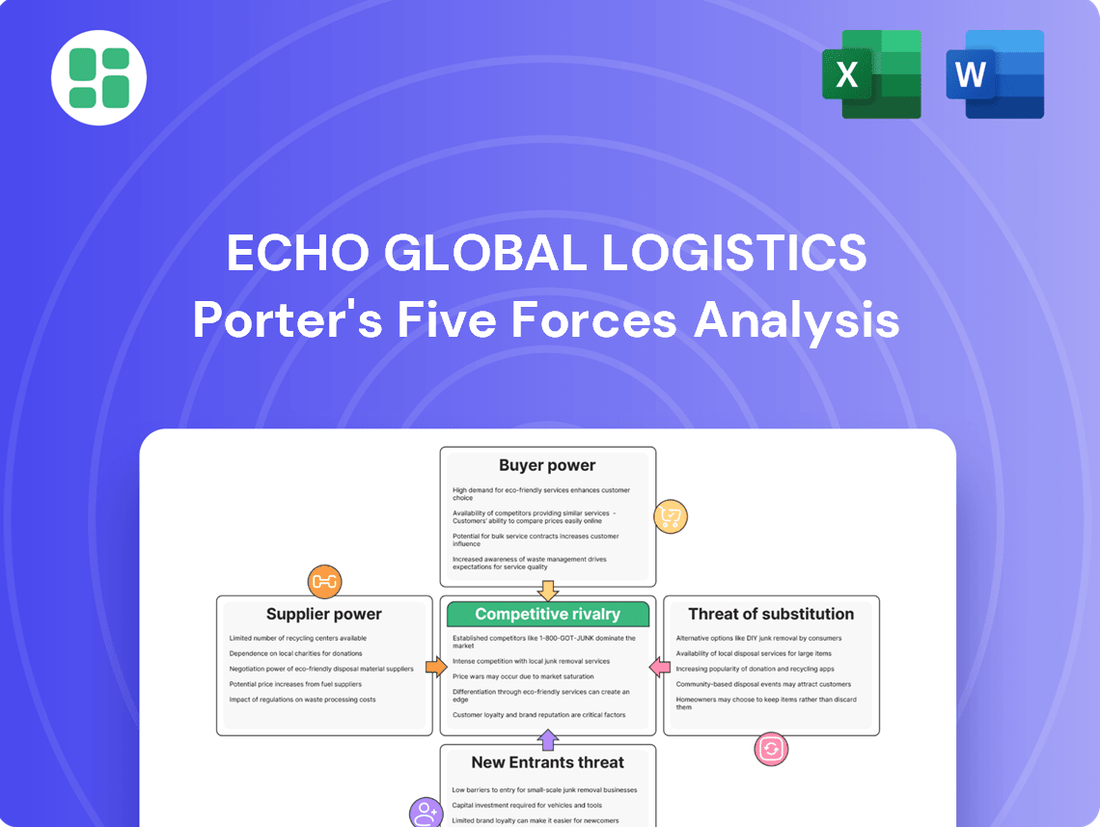

Echo Global Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Echo Global Logistics Bundle

Echo Global Logistics operates in a dynamic transportation and logistics sector, where bargaining power of buyers and suppliers can significantly impact profitability. The threat of substitutes is moderate, as various shipping methods exist, but the threat of new entrants is relatively low due to capital intensity and established networks.

The complete report reveals the real forces shaping Echo Global Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Echo Global Logistics operates within a highly fragmented carrier market, drawing on a diverse network of trucking companies, rail providers, and ocean lines. This vast pool of suppliers generally limits the individual bargaining power of any single carrier.

However, this fragmentation isn't absolute. Specialized carriers or those dominating specific, high-demand routes can exert more influence on pricing for those particular services. For instance, a carrier with exclusive access to a critical port or a unique intermodal solution might command higher rates.

While Echo benefits from numerous carrier options, securing capacity for niche or challenging transportation lanes can shift leverage towards suppliers. This is particularly true for lanes with limited carrier availability or specialized equipment needs, where Echo might face increased pricing pressure.

Carriers, the backbone of freight movement, are grappling with substantial operational cost increases. In 2024, fuel prices saw significant fluctuations, impacting trucking companies directly. Alongside this, rising driver wages and the escalating cost of equipment maintenance are squeezing carrier margins.

These mounting expenses grant carriers greater leverage when negotiating rates with freight brokers, including Echo Global Logistics. To safeguard their profitability, carriers are increasingly able to demand higher freight charges.

Consequently, Echo's ability to absorb or pass on these increased carrier costs directly influences its own profit margins and its competitiveness in securing business from shippers.

The balance between freight demand and available carrier capacity is a key driver of supplier power for Echo Global Logistics. When demand outstrips available trucks, as was seen in certain freight segments during late 2024 and early 2025, carriers can command higher prices. This tight capacity environment allows them to negotiate more favorable contract terms and push for increased spot rates, directly impacting Echo's operational costs.

Conversely, periods of oversupply in the carrier market shift the leverage back towards logistics providers like Echo. With more trucks chasing fewer loads, carriers become more competitive on pricing to secure business. This dynamic can lead to reduced transportation costs for Echo, enhancing its margins, especially when the market experiences a surplus of available freight capacity.

Technology Adoption by Carriers

Carriers embracing technologies like real-time tracking and telematics are boosting their service efficiency and transparency. This technological advancement strengthens their position, particularly when their systems integrate smoothly with platforms such as Echo Global Logistics. For instance, in 2024, the adoption of AI-powered route optimization in the trucking industry is projected to reduce fuel consumption by up to 10%, directly impacting carrier costs and their ability to negotiate rates.

This enhanced value proposition allows carriers to command better terms, especially if they provide superior data insights or offer seamless integration with broker systems. Echo's strategic investment in technology, aiming for greater operational efficiencies, directly addresses this evolving landscape. By fostering such integrations, Echo seeks to create a more balanced ecosystem where both carriers and the brokerage benefit from technological advancements.

- Increased Carrier Efficiency: Technologies like telematics can improve fuel efficiency and reduce downtime.

- Enhanced Transparency: Real-time tracking offers greater visibility for shippers and brokers.

- Data-Driven Negotiations: Carriers with advanced analytics can better justify their pricing.

- Platform Integration: Seamless integration with broker platforms is key to carrier value.

Switching Costs for Strategic Partnerships

While Echo Global Logistics can readily switch individual carriers for single shipments, the real cost lies in cultivating and maintaining a robust, long-term network of reliable partners. These established relationships, vital for ensuring consistent service and securing necessary capacity, inherently carry switching costs.

The investment in building trust and operational synergy with preferred carriers means that altering this network isn't a simple transactional change. This gives these key partners, particularly high-performing ones, a degree of leverage in negotiating pricing and contract terms.

Echo's demonstrated commitment to supporting its top-tier carriers underscores the significant value placed on these strategic alliances. This often translates into preferred treatment and potentially more favorable terms for carriers who consistently meet Echo's demanding service standards.

- Switching Costs: Building and maintaining a diverse, reliable carrier network involves significant investment in relationship management and operational integration, making abrupt changes costly.

- Carrier Leverage: Long-term partnerships and consistent performance grant preferred carriers greater influence over pricing and terms.

- Relationship Value: Echo's focus on honoring top carriers highlights the strategic importance and associated switching costs of maintaining these crucial relationships.

The bargaining power of suppliers, primarily carriers, for Echo Global Logistics is influenced by market dynamics and carrier operational costs. In 2024, rising fuel prices and increased driver wages significantly impacted carrier profitability, leading to higher rate demands. While Echo benefits from a fragmented market, specialized carriers or those on high-demand routes can exert more leverage, especially during periods of tight capacity. The integration of advanced technologies by carriers also strengthens their negotiating position.

| Factor | Impact on Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Carrier Operational Costs | Increases supplier power | Fuel prices fluctuated; driver wages and equipment costs rose. |

| Market Fragmentation | Generally lowers individual supplier power | Echo utilizes a diverse network of trucking, rail, and ocean carriers. |

| Capacity vs. Demand | Tight capacity increases supplier power | Certain freight segments experienced tight capacity in late 2024. |

| Carrier Technology Adoption | Enhances supplier value and power | Increased use of telematics and AI for route optimization. |

| Switching Costs for Echo | Strengthens power of established partners | Building and maintaining carrier relationships involves significant investment. |

What is included in the product

This analysis dissects the competitive forces impacting Echo Global Logistics, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics industry.

Effortlessly visualize competitive intensity across all five forces, enabling rapid identification of key strategic vulnerabilities and opportunities for Echo Global Logistics.

Customers Bargaining Power

Echo Global Logistics operates within a crowded third-party logistics (3PL) landscape, featuring a multitude of freight brokers and asset-based carriers. This abundance of choices significantly bolsters the bargaining power of shippers, Echo's clientele. They can readily compare offerings and secure more advantageous pricing and service agreements.

The sheer volume of available logistics providers grants shippers considerable leverage. For instance, the freight brokerage market in the U.S. is highly fragmented, with thousands of registered brokers. This competitive environment means customers can easily switch providers if terms are not met, pushing down margins for companies like Echo.

Shippers who consistently move large volumes of freight wield considerable influence over logistics providers like Echo Global Logistics. These major clients can negotiate for better pricing and customized service offerings, as their business is highly valuable. For instance, in 2024, the freight volume handled by the top 10% of Echo's clients likely represented a disproportionately large percentage of its total revenue, granting them enhanced bargaining leverage.

Shippers are becoming much more tech-savvy, with many now possessing their own transportation management systems (TMS) and advanced data analytics tools. This allows them to track shipments in real-time and manage more logistics internally.

This increased technological capability directly translates into greater bargaining power for customers. By having better visibility and control over their supply chains, shippers can more effectively negotiate rates and terms with logistics providers like Echo Global Logistics.

For instance, a significant portion of large shippers now utilize sophisticated TMS platforms, enabling them to directly tender loads to carriers and bypass traditional broker intermediaries. This trend, particularly evident in 2024, directly challenges the value proposition of brokers by reducing shipper reliance and enhancing their negotiating leverage.

Low Switching Costs for Standard Services

For many standardized freight services, the cost and complexity for a shipper to switch from one logistics provider to another are relatively low. This ease of switching means customers have significant leverage, as they can readily move their business to competitors offering more favorable pricing or terms. In 2024, the intensely competitive nature of the freight brokerage market, with numerous providers offering similar services, further amplifies this customer bargaining power.

Shippers are highly price-sensitive and actively seek out the best deals, often obtaining multiple quotes for the same shipment. This dynamic intensifies competition among brokers like Echo Global Logistics, who must constantly strive to offer competitive rates to retain and attract business. For instance, a significant portion of the freight market involves less-than-truckload (LTL) and truckload (TL) services where differentiation can be minimal, making price a primary decision factor.

- Low Switching Costs: Shippers can easily change logistics providers for standard freight services.

- Price Sensitivity: Customers are highly influenced by pricing and readily switch for better rates.

- Intensified Competition: Numerous providers offering similar services empower customers to demand lower prices.

- Market Dynamics: In 2024, the freight market's competitiveness underscores the significant bargaining power held by shippers.

Demand for Supply Chain Resilience and Efficiency

Customers are increasingly demanding supply chain resilience and real-time visibility, a trend amplified by recent global disruptions. This focus means shippers are more inclined to work with logistics providers that offer advanced technology and comprehensive managed transportation services.

While cost remains a significant factor, the willingness to invest in solutions that enhance operational efficiency and mitigate risk is growing. For instance, shippers are prioritizing partners who can demonstrate robust tracking capabilities and proactive problem-solving, even if it means a slightly higher upfront cost.

- Resilience Focus: Shippers are actively seeking partners who can ensure continuity of operations amidst potential disruptions.

- Visibility Demand: Real-time tracking and transparency throughout the supply chain are becoming non-negotiable requirements.

- Efficiency Gains: Customers are willing to pay for services that demonstrably improve speed, reduce errors, and optimize logistics costs.

- Technology Integration: Providers offering advanced digital platforms and analytics are gaining a competitive edge in securing customer loyalty.

The bargaining power of customers for Echo Global Logistics is substantial due to the fragmented nature of the freight brokerage market and the increasing sophistication of shippers. Customers can easily switch providers, especially for standardized services, and are highly price-sensitive. This dynamic forces logistics companies to offer competitive rates and value-added services to retain business.

In 2024, the trend of shippers leveraging technology, such as transportation management systems (TMS), further amplified their negotiating power. Many large shippers now possess the tools to manage logistics more independently, reducing their reliance on brokers and strengthening their position to demand better pricing and customized solutions.

The demand for supply chain resilience and real-time visibility also plays a role. While customers are price-conscious, they are increasingly willing to partner with providers offering advanced technology and robust solutions that ensure operational efficiency and mitigate risks, influencing their choice of logistics partners.

| Factor | Impact on Echo Global Logistics | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High customer bargaining power | Thousands of freight brokers in the U.S. |

| Shipper Technology Adoption (TMS) | Reduced reliance on brokers, increased negotiation leverage | Significant portion of large shippers utilize TMS for direct load tendering. |

| Price Sensitivity | Pressure on margins, need for competitive pricing | Standardized freight services (LTL/TL) are highly price-driven. |

| Switching Costs | Low for standard services, empowering customer choice | Ease of moving business to competitors offering better terms. |

Preview Before You Purchase

Echo Global Logistics Porter's Five Forces Analysis

This preview shows the exact, professionally written Echo Global Logistics Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications. You'll gain a comprehensive understanding of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics sector. This is the complete, ready-to-use analysis file; what you're previewing is what you get.

Rivalry Among Competitors

The freight brokerage and third-party logistics (3PL) sector is incredibly crowded, with a vast number of companies competing for business. This includes everything from tiny, local operations to massive international providers, making it a very intense landscape. Echo Global Logistics, therefore, contends with thousands of rivals all striving to capture a piece of the market.

This high level of fragmentation means that Echo Global Logistics faces constant pressure from a multitude of competitors. In 2024, the U.S. freight brokerage market alone is estimated to be worth tens of billions of dollars, with numerous smaller firms contributing to the overall competitive intensity. Such a saturated environment typically leads to price sensitivity and a continuous need for differentiation.

Competitive rivalry in the logistics industry is intense, with pricing and service quality being key battlegrounds. Echo Global Logistics, like its peers, faces pressure to offer competitive rates. For instance, the freight brokerage market, where Echo operates, saw significant fluctuations in spot rates throughout 2024, driven by capacity changes and demand.

While Echo leverages technology for differentiation, many fundamental brokerage services are perceived as similar. This commoditization often forces companies into aggressive pricing to secure business. The average U.S. truckload spot rate for dry van freight, a key indicator, experienced volatility in 2024, reflecting this intense price competition among logistics providers.

Technological innovation is a major battleground in the logistics industry, with companies like Echo Global Logistics heavily investing in areas such as artificial intelligence, automation, and advanced data analytics. These investments are crucial for optimizing supply chain efficiency and improving the customer experience, directly impacting competitive positioning. For instance, Echo's commitment to technology is evident in its proprietary platforms, which have earned it innovation awards, setting it apart from competitors who are also adopting sophisticated digital solutions.

Presence of Large, Established Competitors

Echo Global Logistics operates in a highly competitive landscape, contending with formidable players like C.H. Robinson, Coyote Logistics (a UPS subsidiary), and XPO. These established giants boast expansive operational networks, deeply ingrained brand loyalty, and significant financial muscle, allowing them to aggressively compete across diverse transportation modes and client sectors.

The intense rivalry from these large competitors means Echo must constantly innovate and optimize its services to maintain market share. For instance, C.H. Robinson, a major force in freight brokerage, reported over $22 billion in revenue for 2023, highlighting the scale Echo is up against. This competitive pressure can impact pricing power and necessitate substantial investment in technology and infrastructure.

- Intense Rivalry: Echo Global Logistics faces significant competition from large, established logistics firms.

- Key Competitors: C.H. Robinson, Coyote Logistics (UPS), and XPO are major players with extensive resources.

- Competitive Advantages of Rivals: Competitors possess broad networks, strong brand recognition, and substantial financial backing.

- Impact on Echo: This rivalry pressures Echo on pricing, service innovation, and investment in technology.

Industry Consolidation and Mergers & Acquisitions

The logistics sector has been actively consolidating, with significant merger and acquisition (M&A) activity. For instance, in 2023, the global logistics market saw substantial M&A deals as companies sought to gain scale and new capabilities. This ongoing consolidation means fewer, but often larger and more dominant, players emerge.

This trend directly impacts competitive rivalry. When larger logistics firms acquire smaller ones or merge, they gain expanded service portfolios and broader geographical footprints. This creates more formidable competitors for companies like Echo Global Logistics, necessitating continuous adaptation to remain competitive.

- Industry Consolidation: The logistics industry experienced a notable increase in M&A activity throughout 2023, with several major players acquiring smaller competitors to enhance their market position.

- Increased Scale and Capabilities: These mergers often result in companies with significantly larger operational scales and a wider array of service offerings, including advanced technology integration and expanded global networks.

- Intensified Rivalry: The creation of these larger, more integrated logistics providers intensifies competition, forcing companies like Echo Global Logistics to innovate and adapt their strategies to maintain market share and profitability.

- Strategic Adaptation: Echo Global Logistics must continually evaluate its service offerings, technological investments, and geographic coverage to effectively compete against these increasingly powerful consolidated entities.

Echo Global Logistics faces intense competitive rivalry in the freight brokerage and 3PL sector, characterized by a crowded market with numerous players ranging from small local firms to large international providers. This high degree of market saturation, with the U.S. freight brokerage market valued in the tens of billions of dollars in 2024, leads to significant price pressures and a constant need for differentiation.

Key competitors like C.H. Robinson, Coyote Logistics, and XPO possess extensive networks, strong brand recognition, and substantial financial resources, intensifying the competition. For instance, C.H. Robinson's 2023 revenue exceeded $22 billion, illustrating the scale Echo must contend with. This rivalry forces Echo to continually invest in technology and service innovation to maintain its market position.

The logistics industry's trend towards consolidation, with notable M&A activity in 2023, further intensifies rivalry by creating larger, more capable competitors. These consolidated entities often boast expanded service portfolios and broader geographic reach, compelling companies like Echo to strategically adapt their offerings and investments to remain competitive.

| Competitor | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| C.H. Robinson | $22+ Billion | Extensive Network, Brand Recognition, Financial Muscle |

| Coyote Logistics (UPS) | N/A (Subsidiary) | UPS Integration, Large Fleet Access, Technology Investment |

| XPO | $13.5 Billion (Logistics Segment) | Diversified Services, Global Reach, Technological Advancements |

SSubstitutes Threaten

A significant threat to Echo Global Logistics comes from shippers bringing logistics in-house. This means companies handling their own transportation, warehousing, and staffing. For large corporations with predictable shipping needs, this can sometimes be more economical or offer them tighter control over their entire supply chain.

In 2024, many larger businesses are evaluating the total cost of ownership for outsourced logistics versus internal management. For example, a company might consider the capital expenditure for a dedicated fleet and the ongoing operational costs like maintenance, fuel, and driver salaries against the fees paid to a third-party logistics provider like Echo. This internal capability acts as a direct substitute, potentially reducing the demand for Echo's services.

The rise of online digital freight matching platforms and direct booking portals from asset-based carriers presents a significant threat. These innovations empower shippers to bypass traditional brokers, directly connecting with carriers for services, especially in the spot market. This disintermediation can erode the necessity of brokerage services.

The threat of substitutes for Echo Global Logistics' services is amplified by the growing sophistication of Advanced Transportation Management Systems (TMS). These platforms, increasingly incorporating AI and IoT, allow shippers to gain granular control over their logistics operations. For instance, many large enterprises are investing heavily in in-house TMS solutions, aiming to optimize routing and carrier selection internally, thereby reducing reliance on third-party providers like Echo. This trend, evident across various industries, presents a significant alternative to outsourcing transportation management.

Hybrid Logistics Models

Shippers increasingly explore hybrid logistics models, a significant threat of substitution for companies like Echo Global Logistics. These models allow businesses to outsource specific, often complex or high-volume, logistics functions to third-party logistics (3PL) providers while keeping core transportation management in-house. This selective outsourcing enables them to tap into specialized expertise for certain needs without relinquishing complete control over their entire supply chain.

This trend means shippers can gain the benefits of 3PL capabilities without a full commitment, potentially reducing their reliance on providers for all their freight needs. For instance, a large retailer might use a 3PL for international freight or specialized warehousing but manage its domestic trucking fleet internally. This flexibility allows them to optimize costs and service levels across different segments of their logistics operations.

The rise of these hybrid approaches is driven by a desire for greater control and the ability to leverage internal capabilities where they are strongest. As of early 2024, many businesses are re-evaluating their supply chain strategies post-pandemic, leading to a more nuanced approach to outsourcing. This strategic shift can impact the revenue streams of 3PLs as they compete not only with other 3PLs but also with the in-house capabilities of their potential clients.

- Hybrid models offer shippers flexibility by allowing them to outsource specific logistics functions while retaining core operations internally.

- Specialized expertise can be leveraged for complex or overflow needs without full external management of all freight.

- This selective outsourcing reduces complete reliance on 3PLs, impacting their market share and revenue potential.

- The trend reflects a strategic re-evaluation of supply chains, with businesses seeking optimal cost and service through a mix of in-house and outsourced capabilities.

Alternative Transportation Modes and Delivery Methods

While Echo Global Logistics excels in providing multimodal transportation solutions, the threat of substitutes remains a key consideration. Shippers can indeed switch between different modes of transport. For instance, a business might shift from traditional truckload shipping to intermodal transport for long-haul routes, seeking potential cost savings. In 2024, intermodal freight volume saw continued growth, with a significant portion of long-distance freight moving via rail and truck combinations, demonstrating this substitution trend.

Furthermore, emerging delivery methods present another layer of substitution. For specific, often high-value or time-sensitive, last-mile deliveries, companies might explore options like drone delivery. While still in nascent stages for widespread commercial use, the ongoing investment and development in this area by major logistics players suggest a future where these alternatives could reduce reliance on traditional freight brokerage services for certain segments of the market.

- Mode Substitution: Shippers can opt for intermodal transport over pure truckload for cost efficiencies on longer distances, a trend supported by increasing intermodal volumes in 2024.

- Emerging Technologies: Drone delivery and other advanced last-mile solutions offer potential substitutes for traditional freight movement in specific niche applications.

- Cost Sensitivity: The primary driver for modal substitution is often cost optimization, making price a critical factor in shipper decisions.

The threat of substitutes for Echo Global Logistics is multifaceted, encompassing both direct operational alternatives and evolving technological solutions. Shippers increasingly consider bringing logistics functions in-house or adopting hybrid models that blend internal capabilities with outsourced services. This allows for greater control and cost optimization, as seen in 2024 evaluations of total logistics ownership costs.

Digital freight matching platforms and direct carrier booking portals are also significant substitutes, disintermediating traditional brokerage services. Furthermore, advancements in Transportation Management Systems (TMS), incorporating AI and IoT, empower shippers to manage logistics internally, reducing reliance on third parties. These trends collectively present viable alternatives to comprehensive outsourcing with providers like Echo.

| Substitute Type | Description | Impact on Echo Global Logistics | 2024 Trend/Data Point |

|---|---|---|---|

| In-house Logistics | Companies managing their own transportation, warehousing, and staffing. | Reduces demand for outsourced services. | Increased evaluation of total cost of ownership for internal vs. outsourced models. |

| Hybrid Logistics Models | Outsourcing specific functions while retaining core operations internally. | Limits the scope of services required from 3PLs. | Growing adoption driven by desire for control and flexibility. |

| Digital Freight Matching | Online platforms directly connecting shippers with carriers. | Bypasses traditional brokerage, eroding commission revenue. | Continued growth in spot market transactions via these platforms. |

| Advanced TMS | In-house systems with AI/IoT for logistics optimization. | Enables internal management of routing and carrier selection. | Significant enterprise investment in proprietary TMS solutions. |

Entrants Threaten

The barrier to entry for establishing a basic freight brokerage operation is surprisingly low, demanding little more than sales acumen, a computer, and a phone. This contrasts sharply with asset-heavy logistics models, meaning significant capital investment in trucks or warehouses isn't a prerequisite. This accessibility allows smaller, agile players to emerge, potentially fragmenting the market.

While establishing a basic freight brokerage operation might not demand immense capital, truly differentiating through technology, as Echo Global Logistics does, requires significant investment. Newcomers aiming to match Echo's efficiency and visibility must commit substantial funds to proprietary software development, data analytics teams, and advanced AI platforms. For instance, in 2024, the average cost for developing a custom logistics management system can range from $50,000 to over $200,000, not including ongoing maintenance and upgrades.

New entrants into the logistics sector, like Echo Global Logistics operates within, face substantial hurdles in establishing the extensive networks and strong reputations that are crucial for success. Building a reliable carrier base and cultivating trust with a broad customer segment takes considerable time, substantial investment, and persistent effort. For instance, in 2024, the global logistics market, valued at trillions, sees established players like Echo leverage decades of relationship-building, making it a steep climb for newcomers to match this reach and credibility.

Brand Recognition and Customer Loyalty of Incumbents

Established logistics providers like Echo Global Logistics benefit from strong brand recognition, a proven track record, and existing customer loyalty. New entrants struggle to overcome these established advantages, as shippers often prefer to work with trusted partners for their critical supply chain needs.

In 2024, the logistics industry continued to see shippers prioritize reliability and established relationships. For instance, a significant portion of freight spend is still concentrated with a smaller number of large, well-known carriers and brokers, indicating a high barrier to entry for newcomers seeking to build trust and market share quickly.

- Brand Equity: Incumbents have invested heavily in building brand awareness and a reputation for dependable service, making it difficult for new entrants to gain traction.

- Customer Loyalty: Existing relationships and contracts with shippers create a sticky customer base, requiring new entrants to offer substantial incentives or superior value propositions to win business.

- Switching Costs: Shippers often face operational complexities and potential disruptions when switching logistics providers, further reinforcing loyalty to established players.

- Market Perception: The perception of stability and financial health associated with established brands can be a significant deterrent for shippers considering newer, less proven companies.

Regulatory and Compliance Complexities

The transportation and logistics sector is heavily regulated, with rules governing everything from driver hours and vehicle safety to environmental emissions and cross-border customs. New companies must invest significant capital and time to understand and comply with these requirements, a hurdle that established players like Echo Global Logistics have already overcome. For instance, in 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued its focus on safety compliance, impacting operational costs for all carriers, especially those just entering the market.

Navigating these intricate regulations, which vary by country and even by state or province, demands specialized knowledge and robust internal systems. Established firms possess dedicated compliance departments and years of experience in managing these complexities. This expertise acts as a substantial barrier, making it difficult and expensive for new entrants to establish a compliant and competitive operation. The ongoing evolution of these regulations, such as new data privacy laws affecting shipment tracking, further complicates market entry.

Consider the following key regulatory areas that pose challenges:

- Safety Regulations: Compliance with hours-of-service rules, vehicle maintenance standards, and driver qualifications.

- Environmental Standards: Adherence to emissions controls and fuel efficiency mandates, which can require significant investment in newer fleets.

- Cross-Border Compliance: Understanding and meeting customs, tariffs, and import/export documentation requirements for international shipments.

- Data Security and Privacy: Protecting sensitive customer and shipment data in line with evolving global regulations.

While the initial capital for a basic freight brokerage is low, truly competing with established players like Echo Global Logistics demands significant investment in technology and network building. New entrants in 2024 face the challenge of matching the efficiency and visibility offered by advanced proprietary software and data analytics, with custom logistics system development costing upwards of $200,000. Furthermore, building the trust and carrier relationships that underpin the multi-trillion dollar global logistics market requires years of effort and substantial resources, making rapid market penetration difficult.

The logistics industry in 2024 continues to favor established providers due to strong brand equity, customer loyalty, and high switching costs for shippers. New entrants must overcome the inertia of existing relationships and demonstrate superior value to gain market share. Regulatory compliance, from safety standards to cross-border customs, also presents a substantial hurdle, requiring significant investment and expertise that established firms like Echo Global Logistics have already mastered.

| Barrier | Description | 2024 Relevance/Cost Example |

| Technology Investment | Developing proprietary software, AI, and data analytics for efficiency and visibility. | Custom logistics system development: $50,000 - $200,000+ |

| Network & Reputation | Building a reliable carrier base and cultivating customer trust. | Global logistics market value: Trillions; requires years of relationship building. |

| Brand Equity & Loyalty | Overcoming established brand recognition and existing shipper contracts. | Shippers often prioritize reliability and proven track records. |

| Regulatory Compliance | Meeting diverse safety, environmental, and customs regulations. | FMCSA focus on safety compliance impacts operational costs for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Echo Global Logistics Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including Echo Global Logistics' own annual reports and SEC filings, alongside industry-specific market research reports from firms like Armstrong & Associates.