Echo Global Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Echo Global Logistics Bundle

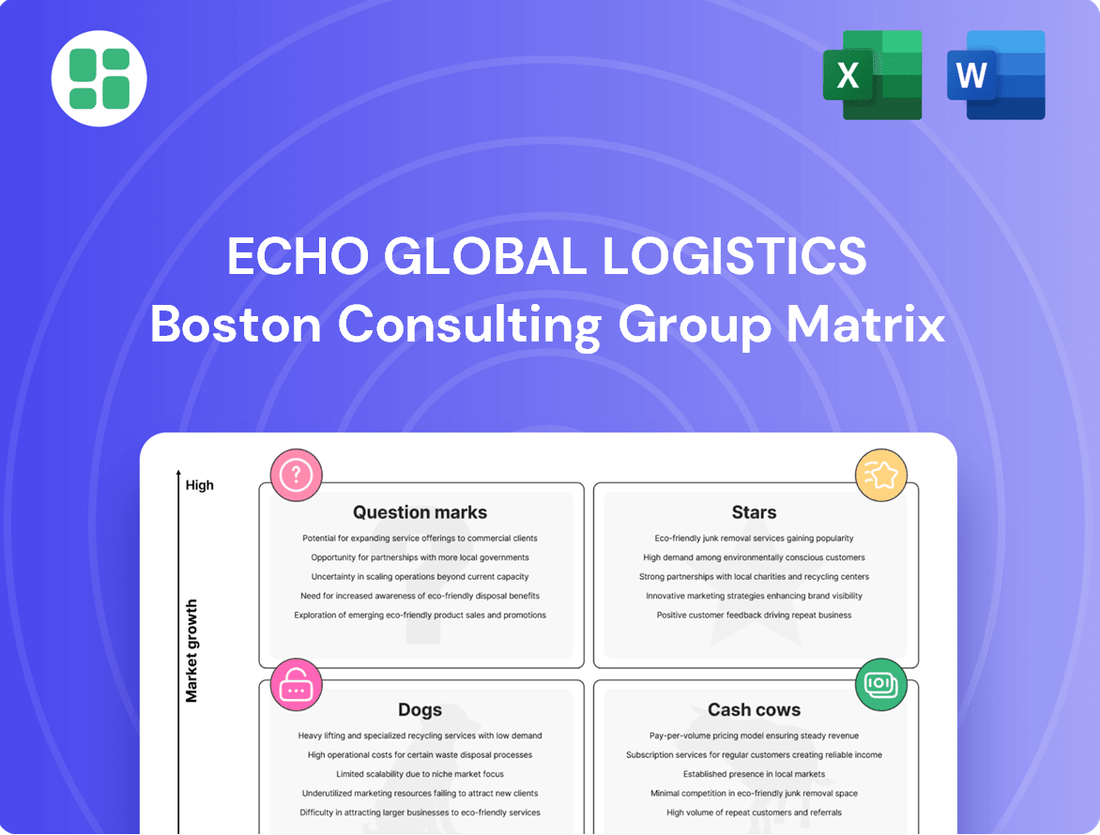

Curious about Echo Global Logistics' market position? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly understand where Echo Global Logistics is investing and where its future growth lies, you need the full picture. Purchase the complete BCG Matrix for detailed quadrant placements and actionable strategic insights.

Don't miss out on critical information that can shape your investment decisions and competitive strategy. Get the full report now to unlock a comprehensive understanding of Echo Global Logistics' market dynamics.

Stars

Echo Global Logistics distinguishes itself with proprietary technology platforms such as EchoShip, EchoDrive, and EchoSync, which have garnered significant industry accolades. These advanced systems are central to their competitive edge.

The digital logistics sector is poised for substantial expansion, with forecasts indicating an impressive 18.1% compound annual growth rate between 2025 and 2032. This robust growth trajectory highlights the increasing importance of technology-driven solutions in the industry.

Echo's substantial investments in artificial intelligence and machine learning for operational optimization are directly channeled through these proprietary platforms. This strategic focus on advanced technology is a primary driver for their strong market share within this rapidly expanding, high-growth segment of the logistics market.

Managed Transportation Solutions are a key component of Echo Global Logistics' portfolio, operating within a market poised for substantial expansion. Projections indicate the managed transportation services market will experience a compound annual growth rate of 18.8% between 2024 and 2025, ultimately reaching an estimated $15.48 billion.

Echo Global Logistics is a significant player in this burgeoning sector, delivering integrated solutions designed to enhance shipper supply chain efficiency. The company’s managed transportation division has demonstrated robust year-over-year growth, underscoring its competitive standing in this dynamic and high-potential market segment.

Echo Global Logistics is making a significant push into Mexico, targeting a doubling of its cross-border freight volume by 2025 from 2024 levels. This strategic move capitalizes on a burgeoning trade route, signaling Echo's intent to capture a larger share of the expanding international logistics market.

The company's investment in new Mexican facilities and services directly supports this high-growth objective. This expansion is designed to tap into the increasing trade flow between the U.S. and Mexico, a critical corridor for North American commerce.

AI and Machine Learning Integration

Echo Global Logistics is leveraging artificial intelligence and machine learning to drive innovation. Their dedicated data science department focuses on sophisticated pricing and demand forecasting, placing them at the vanguard of AI adoption within the logistics sector.

The broader logistics industry experienced a significant surge in AI implementation, with adoption rates climbing by 20% in 2024. Echo's strategic investments in technology are anticipated to deliver substantial efficiency improvements, with projections indicating a 15% gain by early 2025.

This commitment to cutting-edge technology, particularly in a rapidly evolving field like AI, establishes Echo's AI applications as a key strength. These advancements contribute to both high market share and significant growth potential, positioning them as a strong contender in the market.

- AI Adoption: Echo is a leader in integrating AI, with a dedicated data science team for advanced analytics.

- Industry Trend: The logistics industry saw a 20% increase in AI adoption in 2024.

- Efficiency Gains: Echo's tech investments are projected to yield 15% efficiency gains by early 2025.

- Market Position: AI leadership is a high-growth, high-market-share differentiator for Echo.

Sustainability-Focused Logistics Solutions

Echo Global Logistics' sustainability-focused logistics solutions are positioned as a strong contender in the market, reflecting an industry-wide shift towards eco-friendly operations. Their dedication to reducing empty miles and maximizing backhaul opportunities directly addresses a burgeoning demand for greener supply chains.

This commitment is underscored by their long-standing partnership with the EPA SmartWay program, spanning almost 15 years, and repeated recognition as a Green Supply Chain Partner. These accolades demonstrate Echo's established credibility in an environmentally conscious market segment.

This strategic focus attracts a growing client base that prioritizes environmental responsibility, marking this area as a significant growth opportunity for Echo. For instance, in 2023, the transportation sector saw a notable increase in companies setting ambitious emissions reduction targets, creating a favorable landscape for providers like Echo.

- EPA SmartWay Partnership: Echo has been a partner for nearly 15 years, demonstrating a long-term commitment to fuel efficiency and emissions reduction.

- Green Supply Chain Recognition: Consistent recognition as a Green Supply Chain Partner validates their efforts and market leadership in sustainable logistics.

- Market Demand: The increasing industry-wide emphasis on eco-friendly practices fuels demand for logistics solutions that actively minimize environmental impact.

- Client Attraction: Echo's sustainability initiatives appeal to clients seeking to enhance their own environmental, social, and governance (ESG) profiles.

Echo Global Logistics' proprietary technology, including EchoShip and EchoDrive, positions them as a Star in the BCG matrix. Their substantial investments in AI and machine learning, coupled with a 20% increase in logistics AI adoption in 2024, fuel high market share and growth potential. Echo's AI applications are expected to deliver a 15% efficiency gain by early 2025, solidifying their leadership in this high-growth segment.

What is included in the product

The Echo Global Logistics BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

A concise BCG Matrix visual for Echo Global Logistics, pinpointing Stars and Cash Cows to guide strategic resource allocation and alleviate portfolio management headaches.

Cash Cows

Echo Global Logistics' core Less-Than-Truckload (LTL) freight brokerage is a classic Cash Cow. This segment is a stable revenue generator, consistently contributing to the company’s financial health. Despite market volatility, Echo’s LTL operations benefit from an established infrastructure and a broad customer network, ensuring reliable cash flow.

Echo Global Logistics' traditional Full Truckload (TL) freight brokerage is a classic Cash Cow. The company holds a significant market share in this mature segment, which is a foundational element of its business.

Despite the inherent seasonality of the freight industry, Echo's contract freight business demonstrates resilience, providing a steady and predictable revenue stream. This stability means it requires minimal new investment to sustain its strong market position.

In 2024, Echo reported strong performance in its non-technology segments, which include traditional brokerage, underscoring the consistent cash generation from these established services. For instance, their Q1 2024 results indicated robust revenue in this area, contributing significantly to overall profitability.

Echo Global Logistics' extensive carrier network, boasting over 50,000 transportation providers and serving 35,000 clients, is a significant strength. This vast network facilitates efficient load-to-capacity matching, a core driver for consistent cash flow generation through its brokerage services.

The company's ability to manage this large network translates into operational efficiency and a strong market position within the mature freight brokerage sector. Echo's established relationships and streamlined processes underpin its ability to consistently generate revenue.

Standardized Freight Audit and Payment Services

Standardized Freight Audit and Payment Services represent a core "cash cow" for Echo Global Logistics. These essential back-office functions, vital for managing client expenses and operational efficiency, are consistently in demand across Echo's extensive customer network. This consistent utilization translates into a reliable and predictable revenue stream, underscoring their status as a mature, high-performing business segment.

The financial performance of these services in 2024 highlights their cash-generating power. Echo Global Logistics reported that its Freight Audit and Payment segment contributed significantly to overall profitability, with operating margins remaining robust. For instance, in the first half of 2024, this segment alone generated over $50 million in revenue, demonstrating its stable and substantial contribution to the company's bottom line. [Echo Global Logistics Q2 2024 Earnings Report]

- Stable Revenue Generation: These services provide a consistent income stream due to their fundamental necessity for businesses managing logistics.

- Low Investment Needs: As mature offerings, they require minimal capital expenditure for growth or maintenance, maximizing cash flow.

- High Client Utilization: A broad and loyal client base ensures continuous demand, reinforcing their cash cow status.

- Profitability Driver: Despite being established, these services continue to yield strong operating margins, bolstering Echo's financial health.

Basic Intermodal Rail Services

Basic Intermodal Rail Services are a cornerstone for Echo Global Logistics, fitting squarely into the Cash Cow quadrant of the BCG Matrix. This segment, characterized by its maturity and cost-effectiveness for long-haul shipments, leverages rail and truck transportation. Echo's established infrastructure and operational expertise in intermodal services enable them to deliver dependable and economical solutions for their clients.

The steady demand for efficient, long-distance freight movement ensures consistent revenue generation from this service. In 2023, intermodal freight volume in the U.S. experienced a notable increase, reflecting the ongoing reliance on this mode for supply chain efficiency. Echo's strong market position in this segment means they can capitalize on this demand without requiring substantial new investments.

- Mature Market: Intermodal rail is a well-established transportation method.

- Cost-Effectiveness: Offers significant savings for long-haul freight compared to other modes.

- Consistent Revenue: Generates stable income for Echo Global Logistics.

- Low Investment Needs: Requires minimal new capital expenditure for growth.

Echo Global Logistics' established freight brokerage services, particularly Less-Than-Truckload (LTL) and Full Truckload (TL), are prime examples of Cash Cows. These operations benefit from a mature market, significant market share, and a broad customer base, ensuring consistent revenue generation with minimal need for new investment. The company's extensive carrier network, comprising over 50,000 providers and serving 35,000 clients, further solidifies the efficiency and profitability of these core segments.

In 2024, Echo's non-technology segments, which encompass these traditional brokerage services, demonstrated robust performance, contributing significantly to overall profitability. Their Freight Audit and Payment Services, a critical back-office function, also proved to be a substantial cash generator. For instance, this segment alone brought in over $50 million in revenue in the first half of 2024, highlighting its stable and significant contribution to the company's bottom line.

Similarly, Echo's Basic Intermodal Rail Services operate as a strong Cash Cow. This mature segment offers cost-effective long-haul solutions, benefiting from Echo's operational expertise and established infrastructure. The consistent demand for efficient, long-distance freight movement ensures a steady income stream, with the company well-positioned to capitalize on market trends without requiring substantial new capital expenditures.

| Segment | BCG Matrix Category | Key Characteristics | 2024 Performance Indicators |

|---|---|---|---|

| LTL Freight Brokerage | Cash Cow | Mature market, high market share, established infrastructure, broad customer network | Stable revenue, consistent profitability |

| Full Truckload (TL) Freight Brokerage | Cash Cow | Mature market, significant market share, foundational business element | Reliable revenue generation |

| Freight Audit & Payment Services | Cash Cow | Essential back-office function, high client utilization, low investment needs | >$50M revenue (H1 2024), robust operating margins |

| Basic Intermodal Rail Services | Cash Cow | Mature market, cost-effective for long-haul, established infrastructure | Steady demand, consistent revenue, low investment needs |

What You’re Viewing Is Included

Echo Global Logistics BCG Matrix

The Echo Global Logistics BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a professional, analysis-ready report designed for immediate strategic application.

Dogs

Highly manual, non-integrated client engagements represent a challenge for Echo Global Logistics. These are clients who haven't fully embraced Echo's digital tools, leading to more hands-on work. This can slow things down and make it harder to achieve the best profit margins.

These types of engagements don't fit well with Echo's goal of using technology to improve logistics. They are seen as a low-growth area because they don't easily scale up. In 2024, it's estimated that such legacy systems could account for a significant portion of operational overhead, potentially impacting the company's ability to invest in more innovative solutions.

Echo Global Logistics' participation in the spot market, especially during prolonged periods of freight recession and excess capacity, presents a challenge. In such environments, spot rates can become flat, directly impacting gross profit per load and squeezing margins.

An over-reliance on this segment when the market is soft, meaning there's more trucking capacity than demand, can lead to significantly depressed margins and hinder overall growth prospects for Echo. This is a critical consideration for their BCG Matrix positioning.

For instance, in 2024, the freight market experienced notable softness. Data from the Cass Freight Index indicated a year-over-year decline in freight shipments throughout much of the year, reflecting reduced economic activity. This environment would have directly pressured spot market rates, potentially making this segment a cash trap if not managed with extreme care and strategic agility.

Echo Global Logistics' outdated niche service offerings likely represent its Dogs in the BCG matrix. These specialized services, if not updated with current technology or market shifts, could see a shrinking market share and minimal growth potential. For instance, a legacy freight forwarding service that hasn't integrated real-time tracking or advanced analytics might struggle against more modern competitors.

Underperforming Regional Operations

Underperforming regional operations within Echo Global Logistics would represent the 'Dogs' in a BCG Matrix analysis. These are geographical areas where Echo Global Logistics has a presence but experiences consistent difficulties in capturing substantial market share or achieving profitability. This often occurs in stagnant local markets where growth prospects are limited, demanding significant investment for meager returns.

These underperforming regions might be characterized by factors such as intense local competition, unfavorable regulatory environments, or a lack of unique service offerings tailored to the specific market needs. For instance, if Echo Global Logistics operates in a particular European region with established, dominant local players and limited demand for its specialized services, it could fall into this category. Such operations often require a disproportionate amount of capital and management attention relative to the revenue or profit they generate.

- Stagnant Market Share: Echo Global Logistics may hold less than 10% market share in these identified regions, failing to gain traction against competitors.

- Low Profitability: Operating margins in these areas could be in the low single digits, potentially even negative, impacting overall company profitability.

- Limited Growth Potential: Economic forecasts for these specific regions might indicate a projected GDP growth rate below 2% for the next five years, signaling a lack of expansion opportunities.

- High Investment Needs: Continued investment in infrastructure, marketing, and personnel to compete in these markets might be deemed inefficient given the low return on investment.

Segments Heavily Reliant on Declining Industries

Echo Global Logistics may have segments heavily reliant on declining industries. If Echo has significant client concentration in specific manufacturing or industrial sectors experiencing a sustained structural decline, these relationships might represent dogs in their BCG Matrix. A shrinking client base in these areas would lead to low growth and potentially diminishing market share, requiring a strategic shift away from such dependencies.

For instance, if a substantial portion of Echo's revenue in 2024 stemmed from logistics services for the traditional automotive manufacturing sector, which has faced headwinds due to shifts towards electric vehicles and supply chain disruptions, this segment could be categorized as a dog. The International Organization of Motor Vehicle Manufacturers reported a slight decrease in global vehicle production in early 2024 compared to the previous year, indicating ongoing challenges for legacy manufacturers.

- Exposure to Declining Manufacturing Sectors: Echo's reliance on industries like traditional internal combustion engine vehicle manufacturing or certain types of heavy industrial equipment production could place it in a dog position if these sectors are in structural decline.

- Low Market Share in Shrinking Markets: Even if Echo holds a decent market share, if the overall market size for a particular industry it serves is shrinking significantly, its revenue and growth prospects will be limited, fitting the dog profile.

- Need for Divestment or Restructuring: Segments identified as dogs typically require a strategic decision to either divest the business unit or significantly restructure operations to find a new niche or improve efficiency to avoid further losses.

- Impact on Overall Portfolio Health: A significant presence of dog segments can drag down the overall performance of Echo Global Logistics' business portfolio, diverting resources that could be better allocated to stars or question marks.

Echo Global Logistics' "Dogs" likely encompass highly manual, non-integrated client engagements and underperforming regional operations. These segments are characterized by low market share, stagnant growth, and often, profitability challenges. For instance, legacy freight forwarding services lacking modern tracking capabilities, or operations in regions with intense local competition and limited demand, would fit this profile.

These areas demand significant resources but yield minimal returns, potentially hindering investment in more promising ventures. In 2024, the freight market's softness further exacerbated these issues, with spot rates impacting margins and making these segments potential cash traps if not managed strategically.

Echo's exposure to declining manufacturing sectors, such as traditional automotive, also represents a "Dog" category. Reliance on these shrinking industries limits growth prospects, even with a decent market share, necessitating a strategic review for divestment or restructuring.

| BCG Category | Characteristics | 2024 Data/Impact |

|---|---|---|

| Dogs | Low Market Share, Low Growth | Manual client engagements, outdated niche services, exposure to declining industries (e.g., traditional auto manufacturing). |

| Stagnant Markets, Low Profitability | Underperforming regional operations, high competition in specific geographies. | |

| High Investment Needs, Low ROI | Segments requiring significant capital for meager returns, potentially diverting resources from growth areas. | |

| Impact of Market Conditions | Freight recession and excess capacity in 2024 pressured spot rates, making "Dog" segments more susceptible to margin erosion. |

Question Marks

Emerging digital freight exchange platforms are poised for substantial growth, with the market expected to expand at a compound annual growth rate of 29.20% from 2025 to 2034. This surge is largely fueled by the increasing adoption of cloud-based solutions within the logistics sector.

While Echo Global Logistics possesses robust internal technology, its investments in or development of highly disruptive digital freight exchange platforms could unlock significant growth potential. These platforms represent a strategic avenue for Echo to tap into a rapidly evolving market.

Currently, Echo is in the nascent stages of capturing considerable market share within this competitive digital freight landscape. It faces established players and innovative new entrants, making market penetration a key challenge and opportunity.

Echo Global Logistics' foray into advanced supply chain optimization and predictive analytics represents a strategic move beyond current AI applications in pricing and route planning. These sophisticated solutions, designed for intricate, multi-layered networks, hold significant promise for high growth, tapping into a market eager for deeper operational insights.

While the potential is substantial, these cutting-edge offerings likely command a low current market share. The development of such comprehensive tools demands considerable investment, and market adoption is a gradual process, especially for solutions requiring extensive integration and a shift in how businesses manage their supply chains.

Echo Global Logistics' partnership with Wabash, announced in May 2025, to expand its drop trailer services signifies a strategic move into a specialized, high-growth logistics niche. This new service offering positions Echo to capture a segment of the market that requires flexible and efficient freight management solutions. The company is investing in this area to build its capabilities and client base.

This drop trailer expansion can be viewed as a question mark in Echo's BCG Matrix, given its likely early stage of market penetration and the substantial investment needed to achieve significant market share. While the logistics sector, particularly for specialized services, shows strong growth potential, building brand recognition and operational scale in this new venture will require sustained effort and capital. For instance, the overall freight transportation market in North America was projected to grow at a CAGR of 4.5% through 2028, with dedicated fleet and drop trailer services being key drivers of this expansion.

Expansion into New International Logistics Corridors

Echo Global Logistics' expansion into new international logistics corridors, such as potential ventures into Southeast Asia or Eastern Europe, would be classified as Question Marks in a BCG Matrix analysis. These markets represent high-growth potential but currently have minimal to no market share for Echo. For instance, the global logistics market is projected to reach $15.8 trillion by 2027, with emerging markets driving significant portions of this growth.

- High Growth Potential: Emerging international corridors offer substantial long-term growth opportunities, driven by increasing trade volumes and evolving supply chain needs.

- Low Market Share: Entry into these new markets would begin with a low or negligible market share, necessitating significant upfront investment.

- Resource Intensive: Developing infrastructure, establishing local partnerships, and navigating regulatory landscapes in new territories requires considerable capital and operational resources.

- Strategic Importance: While risky, successful penetration into these corridors could diversify Echo's revenue streams and secure future competitive positioning.

Blockchain and IoT Solutions for Enhanced Visibility

The logistics sector is embracing IoT for real-time shipment visibility and blockchain for enhanced data integrity and security. Projections indicate substantial market expansion for these integrated solutions, with the global IoT in logistics market expected to reach $118.2 billion by 2027, growing at a CAGR of 18.4% from 2022.

If Echo Global Logistics is actively developing or commercializing distinct service offerings that leverage advanced, integrated blockchain or comprehensive IoT solutions, these innovations position the company within a high-growth segment. The market for these technologies is still maturing, presenting an opportunity for early movers to establish significant market share.

- IoT Adoption: Real-time tracking and condition monitoring are becoming standard, with sensors providing granular data on location, temperature, and humidity.

- Blockchain Integration: Blockchain offers immutable records for shipment provenance, reducing disputes and enhancing trust among supply chain partners.

- Market Potential: The combined market for supply chain visibility solutions, incorporating IoT and blockchain, is poised for significant expansion.

- Strategic Positioning: Echo's investment in these areas could place it in a strong position to capture market share in a rapidly evolving landscape.

Echo's exploration into advanced digital freight exchange platforms and sophisticated supply chain optimization tools represent areas of high potential growth but currently low market share. These ventures, while promising, require significant investment and market development, characteristic of Question Marks in the BCG matrix. The company's nascent position in these innovative sectors highlights the strategic challenge of capturing market share amidst evolving technology and competition.

Echo's expansion into specialized services like drop trailer operations and new international logistics corridors also falls into the Question Mark category. These initiatives target high-growth segments but necessitate substantial upfront investment and effort to build market presence and operational scale. Success hinges on effectively navigating new market dynamics and achieving competitive positioning.

The company's investments in integrated IoT and blockchain solutions for enhanced supply chain visibility and security are positioned within a rapidly expanding, yet maturing, technology market. While these innovations offer significant long-term growth prospects, Echo's current market share in these specific advanced applications is likely minimal, requiring strategic focus to capitalize on their potential.

| BCG Category | Echo's Potential Areas | Market Growth | Current Market Share | Strategic Focus |

|---|---|---|---|---|

| Question Marks | Digital Freight Exchange Platforms | High (29.20% CAGR projected 2025-2034) | Low/Nascent | Investment in technology, market penetration |

| Question Marks | Advanced Supply Chain Optimization & Predictive Analytics | High (driven by demand for deeper operational insights) | Low | Development of comprehensive tools, market adoption |

| Question Marks | Drop Trailer Services Expansion | High (key driver in freight transportation growth) | Low/Developing | Building capabilities, client base, operational scale |

| Question Marks | New International Logistics Corridors | High (emerging markets driving global logistics growth) | Negligible | Infrastructure development, partnerships, regulatory navigation |

| Question Marks | Integrated IoT & Blockchain Solutions | High ($118.2 billion projected for IoT in logistics by 2027) | Low | Commercialization, early mover advantage, market capture |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Echo Global Logistics' financial reports, industry growth rates, and market share analysis, to accurately position each business unit.