Ebiquity SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebiquity Bundle

Ebiquity's current SWOT analysis reveals a company navigating a dynamic market, with clear strengths in its data analytics capabilities and a growing global presence. However, understanding the full scope of its competitive landscape and potential threats is crucial for informed decision-making.

Want the full story behind Ebiquity’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ebiquity's strength lies in its independent, data-driven insights, offering brands unbiased advice to optimize media investments. This independence from media buying or selling ensures objective analysis, a crucial factor for clients demanding transparency and accountability in their marketing expenditures.

This distinct positioning empowers clients to make smarter decisions, with Ebiquity's analysis unlocking billions in advertising value and driving an average ROI improvement exceeding 15% for its clientele. For instance, in 2023, their work directly contributed to clients identifying over $500 million in media waste.

Ebiquity's extensive global network, boasting over 575 media specialists in 123 countries, covers 80% of the global advertising market. This vast reach allows them to analyze more than US$100 billion in annual media spend and contract value, providing unparalleled insights into global advertising trends.

This deep market penetration enables Ebiquity to analyze trillions of digital media impressions, offering clients a comprehensive understanding of their media investments. Their ability to serve over 75 of the world's top 100 advertisers underscores their significant global influence and expertise.

Ebiquity champions transparency and accountability in media spending, a crucial element given the intricate nature of modern advertising. Their offerings in media performance and management directly address the client's need for clear oversight.

The company's dedication to Effective and Responsible Advertising (ERA) resonates strongly with growing industry and regulatory demands for ethical data practices and overall integrity. This focus is particularly relevant as concerns around data privacy and ad fraud continue to be paramount for brands.

Strong Client Relationships and New Wins

Ebiquity's strength lies in its robust client relationships, which have proven resilient even amidst the challenging market conditions observed in 2024. The company has not only retained its existing customer base but has also secured significant new business, especially within the crucial Marketing Effectiveness sector.

This success in client retention and acquisition, highlighted by engagements with major brands such as UBS, Airbnb, and Shiseido, underscores the deep trust and perceived value clients derive from Ebiquity's offerings. These wins are a testament to the company's ability to deliver impactful solutions that resonate with leading global organizations.

- Client Retention: Ebiquity successfully maintained relationships with key clients throughout 2024.

- New Client Wins: Major new clients were secured, particularly in the Marketing Effectiveness domain.

- Key Client Examples: Notable clients include UBS, Airbnb, and Shiseido, illustrating strong market trust.

Strategic Investment in AI Capabilities

Ebiquity is strategically investing in its research and development, particularly in expanding its artificial intelligence capabilities. This includes the development of an agentic AI solution designed to validate campaign plans, which is slated for release in the latter half of 2025. This proactive stance on technology, while recognizing the continued importance of human oversight, positions Ebiquity to harness AI for greater efficiency and more profound insights within media planning, effectively responding to the dynamic needs of the industry.

Ebiquity's core strength is its independent, data-driven approach, offering unbiased media investment advice. This allows clients to unlock significant advertising value, with average ROI improvements exceeding 15% and identifying over $500 million in media waste in 2023.

Their extensive global network, covering 80% of the global advertising market with over 575 specialists in 123 countries, enables analysis of more than $100 billion in annual media spend, providing unparalleled insights.

Ebiquity's commitment to transparency and Responsible Advertising (ERA) aligns with growing demands for ethical data practices and integrity, crucial in today's landscape.

The company demonstrated strong client relationships in 2024, retaining key clients and securing new business in Marketing Effectiveness, including major brands like UBS, Airbnb, and Shiseido.

Strategic investment in AI, including an agentic AI solution for campaign plan validation due in late 2025, positions Ebiquity for enhanced efficiency and deeper insights in media planning.

| Metric | 2023/2024 Data | Impact |

|---|---|---|

| Average Client ROI Improvement | > 15% | Drives significant value for clients |

| Identified Media Waste (2023) | >$500 million | Demonstrates efficiency gains |

| Global Market Coverage | 80% | Extensive reach and insights |

| Annual Media Spend Analyzed | >$100 billion | Comprehensive market perspective |

What is included in the product

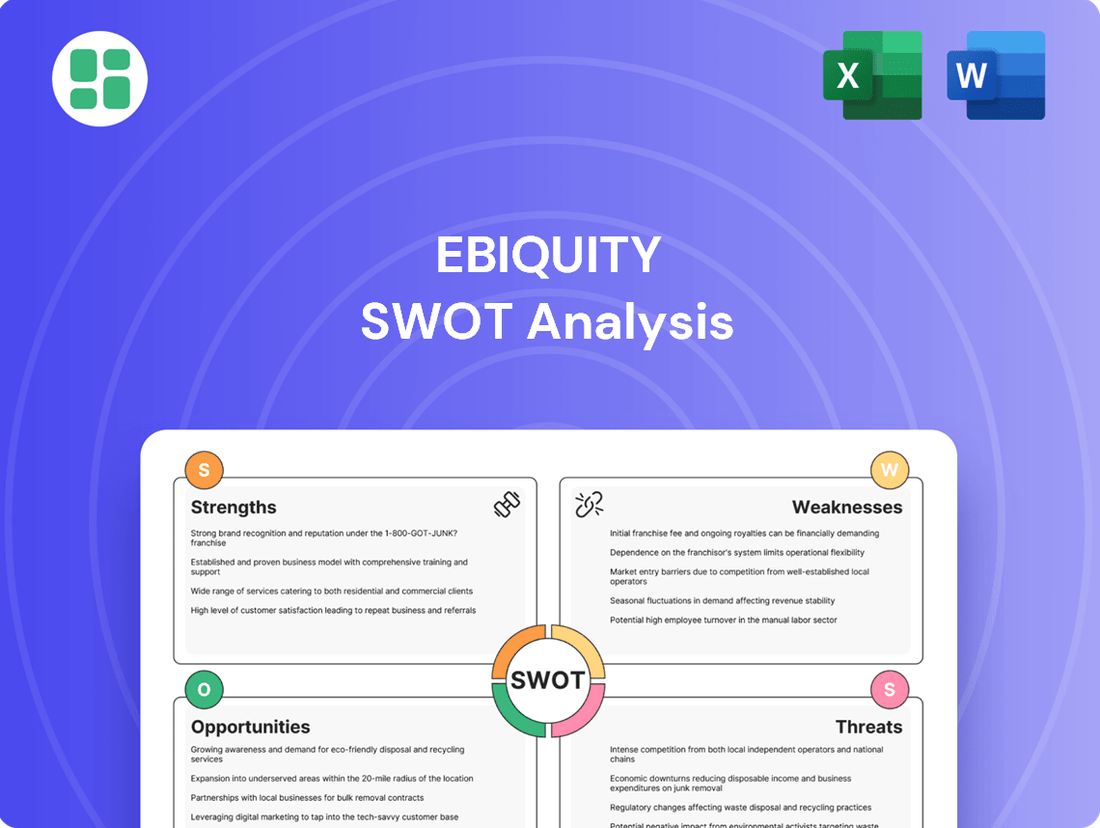

Analyzes Ebiquity’s competitive position through key internal and external factors, including its strengths in data analytics and market reputation, alongside weaknesses in brand awareness and its opportunities in emerging markets and threats from evolving technology.

Offers a clear, actionable framework to identify and leverage competitive advantages, mitigating risks and capitalizing on opportunities.

Weaknesses

Ebiquity faced a revenue downturn in 2024, reporting £76.8 million, a 4.3% decrease compared to the previous year. This decline was most pronounced in the first half of the year across key regions like Continental Europe, North America, and APAC. Challenging market dynamics and intense competition with aggressive pricing strategies were cited as the primary drivers for this revenue contraction.

Ebiquity's North American operations faced significant headwinds in 2024 due to a challenging market characterized by economic uncertainty. This directly translated into reduced client spending within the region, impacting overall performance.

While Ebiquity saw positive growth in other geographic areas, the downturn in North America, a crucial market for the company, exposed a notable regional weakness. This necessitates a focused strategic approach to address and improve performance in this key territory.

Ebiquity encountered intense competition in 2024, with rivals employing aggressive pricing tactics. This forced some clients to focus on immediate cost savings, potentially overlooking the long-term value of superior media investment analysis.

This price-driven environment directly impacts Ebiquity's profitability by squeezing margins. It also poses a challenge in articulating the distinct value proposition of its independent, high-quality data and insights compared to lower-cost alternatives.

Dependency on Marketing Budgets

Ebiquity's reliance on client marketing budgets presents a significant weakness, as these expenditures are often among the first to be cut during economic downturns or periods of market uncertainty. This sensitivity was evident in the first half of 2024, where a slowdown in revenue performance directly impacted profitability, highlighting the direct correlation between discretionary marketing spend and Ebiquity's financial results.

The company's performance is directly linked to the health of its clients' marketing budgets, which are susceptible to economic fluctuations. For instance, in the first half of 2024, Ebiquity experienced a revenue slowdown, directly impacting its profitability, a clear indicator of this dependency.

- Economic Sensitivity: Client marketing budgets are highly sensitive to economic uncertainty, directly affecting Ebiquity's revenue streams.

- H1 2024 Performance: The observed revenue slowdown in the first half of 2024 directly impacted profitability, underscoring the company's vulnerability to reduced client spending.

- Budgetary Constraints: In challenging economic environments, marketing budgets are often reduced or reallocated, posing a direct threat to Ebiquity's business.

Scalability and Operational Constraints

Ebiquity's transition to a new operating model, while promising, encountered significant strain in 2024 due to a concentrated business volume within a few months. This bottleneck highlights potential difficulties in scaling operations to meet peak demand, a crucial factor for sustained growth and client satisfaction.

The operational constraints experienced in 2024 suggest that Ebiquity may face challenges in efficiently managing fluctuating client needs. This could lead to service delivery delays or increased costs, impacting overall profitability and competitive positioning.

- Operational Strain: 2024 saw concentrated business volume leading to operational constraints.

- Scalability Concerns: Potential difficulties in scaling operations to meet fluctuating client demands.

- Service Delivery Impact: Challenges in efficiently managing peak periods could affect service quality.

Ebiquity's revenue faced a notable decline in 2024, dropping to £76.8 million, a 4.3% decrease from the prior year, primarily driven by challenging market conditions and aggressive competitor pricing. This revenue contraction was particularly evident in key markets such as Continental Europe, North America, and APAC during the first half of the year.

The company's performance is intrinsically linked to client marketing budgets, which are highly susceptible to economic downturns. The revenue slowdown experienced in the first half of 2024 directly impacted profitability, underscoring this dependency and highlighting Ebiquity's vulnerability to reduced discretionary spending.

Operational strain was evident in 2024 due to a concentration of business volume within specific periods, raising concerns about scalability. This bottleneck could impede Ebiquity's ability to efficiently manage fluctuating client demands, potentially affecting service delivery and profitability.

| Financial Metric | 2023 (Approx.) | 2024 | Change |

|---|---|---|---|

| Revenue (£m) | 80.2 | 76.8 | -4.3% |

| Key Markets Affected | N/A | Continental Europe, North America, APAC | N/A |

Full Version Awaits

Ebiquity SWOT Analysis

This is the actual Ebiquity SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Ebiquity's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for your business strategy.

Opportunities

The digital media landscape is becoming increasingly intricate, with brands actively seeking clarity on where their advertising spend is going. Concerns about ad fraud, which cost the global advertising industry an estimated $100 billion in 2023 according to Statista, and growing data privacy regulations are fueling this demand for transparency.

Ebiquity's expertise in media performance measurement and benchmarking directly aligns with this market need. As brands become more vigilant about return on ad spend and campaign effectiveness, Ebiquity's services provide the necessary insights to ensure accountability and optimize media investments, presenting a substantial growth avenue.

The substantial shift of advertising budgets towards digital channels, particularly streaming television and the burgeoning retail media networks, represents a significant growth avenue for Ebiquity. This trend is underscored by projections indicating digital media will capture approximately 75% of global advertising expenditure in 2024 and beyond.

Ebiquity's core competency in navigating and optimizing these increasingly complex and fragmented digital landscapes positions the company to assist brands in achieving both effectiveness and accountability with their media investments.

Ebiquity's strategic investment in agentic AI for campaign validation is a significant opportunity, aligning them with the growing demand for AI-powered media planning. This technological advancement allows for more efficient and data-intensive insights, directly addressing the evolving needs of clients seeking to optimize their media spend.

By blending AI capabilities with their established human expertise, Ebiquity can deliver a superior value proposition. This hybrid approach is projected to attract new clients in the 2024-2025 period, as businesses increasingly seek partners who can navigate the complexities of the digital advertising landscape with both intelligent automation and nuanced strategic understanding.

Strategic Partnerships and Acquisitions

Strategic partnerships and targeted acquisitions are key opportunities for Ebiquity to enhance its market standing and broaden its service portfolio or geographical footprint. These moves can unlock new revenue streams and strengthen its competitive edge.

For instance, Ebiquity's collaboration with the Singapore Tourism Board highlights the growth potential inherent in strategic alliances. This partnership allows Ebiquity to leverage its consulting expertise in emerging markets and new industry verticals, demonstrating a clear path for expansion.

- Market Expansion: Collaborations can open doors to new geographic regions, tapping into previously inaccessible markets.

- Service Diversification: Acquisitions can integrate complementary technologies or services, offering a more comprehensive suite to clients.

- Synergistic Growth: Partnerships can create shared value, combining strengths to achieve outcomes neither entity could accomplish alone.

Focus on Marketing Effectiveness

Ebiquity's Marketing Effectiveness division experienced robust growth in 2024, with revenue climbing 13.4%. This significant increase, driven by new client acquisitions and expanded service agreements, highlights a strong market demand for measurable return on investment in marketing efforts.

This success presents a clear opportunity for Ebiquity to double down on its expertise in this area. By further specializing and enhancing its offerings that prove tangible business outcomes, the company can capitalize on this high-growth segment.

Key opportunities stemming from this trend include:

- Deepening Specialization: Further refining analytics and consulting services to offer even more granular insights into marketing ROI.

- Expanding Service Offerings: Developing new tools and methodologies that address emerging challenges in marketing attribution and effectiveness measurement.

- Targeting New Markets: Leveraging proven success to attract clients in sectors or geographies where demonstrating marketing impact is a growing priority.

- Strengthening Client Partnerships: Building on existing relationships by providing continuous value and demonstrating the ongoing effectiveness of their strategies.

The increasing demand for transparency in digital advertising, exacerbated by concerns over ad fraud and data privacy, presents a significant opportunity for Ebiquity. As brands seek to understand their media spend better, Ebiquity's measurement and benchmarking services are well-positioned to meet this need, driving growth. The ongoing shift of advertising budgets towards digital channels, with digital media expected to account for around 75% of global ad spend in 2024, further solidifies this opportunity. Ebiquity's AI-driven validation for campaigns and strategic partnerships, like the one with the Singapore Tourism Board, also offer avenues for expansion and enhanced service offerings. The company's Marketing Effectiveness division saw a 13.4% revenue increase in 2024, underscoring the market's appetite for demonstrable ROI and providing a clear path for further specialization and growth.

Threats

Global economic uncertainty and the potential for downturns pose a significant threat to Ebiquity. Marketing and advertising budgets are often among the first to be cut during economic slowdowns, directly impacting client spending and leading to deferred or reduced programs.

This vulnerability was highlighted in 2024, a year marked by challenging market conditions that demonstrably affected Ebiquity's revenue and profitability, underscoring the direct correlation between macroeconomic health and the company's financial performance.

The media investment analysis sector is undeniably crowded. Ebiquity faces significant pressure from rivals employing aggressive pricing tactics, which directly impacted its performance in 2024. This intensified competition isn't just from similar specialized firms; larger consulting groups and even brands building their own internal analytics teams pose a threat, potentially chipping away at Ebiquity's market share and profitability.

The relentless evolution of the media sector, marked by emerging platforms, shifting consumer habits, and the swift integration of artificial intelligence, presents a significant challenge. If Ebiquity fails to adapt its offerings and strategies at a comparable pace, its current methodologies risk becoming outdated.

This rapid technological advancement necessitates substantial and ongoing investment in research and development to ensure its data analytics and media intelligence solutions remain relevant and competitive. For instance, the increasing sophistication of AI in content creation and distribution demands continuous updates to measurement frameworks.

Data Privacy Regulations and Access Limitations

Increasingly stringent data privacy regulations, such as the GDPR and CCPA, pose a significant threat by potentially limiting Ebiquity's access to the granular data essential for accurate media measurement and analysis. These regulations, which are becoming more widespread globally, could restrict the collection and utilization of user-level data, a cornerstone of many media effectiveness studies.

The evolving landscape of data privacy directly impacts Ebiquity's core business model, which relies on analyzing vast datasets to provide insights into media performance. Stricter consent requirements and data anonymization mandates might reduce the depth and breadth of available information, impacting the precision of their analytics.

- Regulatory Scrutiny: Governments worldwide are intensifying oversight of how companies handle personal data, with fines for non-compliance escalating.

- Data Access Constraints: Laws like the GDPR (General Data Protection Regulation) can limit the types of data Ebiquity can legally collect and process for its clients.

- Impact on Measurement: Reduced data availability could hinder the ability to conduct comprehensive cross-platform media analysis and attribution.

- Client Trust: Navigating these regulations is crucial for maintaining client confidence in Ebiquity's data handling practices.

Client In-housing of Media Capabilities

A significant threat to Ebiquity arises from the increasing trend of large brands bringing media planning, buying, and analysis functions in-house. This move aims for greater control and potential cost savings, directly impacting the demand for external expertise like Ebiquity's. For instance, in 2024, reports indicated a growing number of major advertisers exploring or implementing internal media teams to streamline operations and potentially reduce agency fees.

This client in-housing directly challenges Ebiquity's core service offerings, potentially shrinking the market for independent media effectiveness and analytics consultants. As brands build their internal capabilities, the reliance on third-party providers for these critical functions may diminish over time, representing a long-term strategic risk.

The financial implications are substantial, as a reduction in external demand could lead to lower revenue streams for Ebiquity. Brands prioritizing in-housing are likely seeking to consolidate their marketing spend and gain direct oversight, which could translate to fewer opportunities for Ebiquity to secure new contracts or retain existing ones.

Key considerations for Ebiquity include:

- Shifting client priorities: Brands increasingly value direct control over their media investments and data.

- Cost-efficiency drivers: In-housing is often motivated by a desire to reduce external agency and consultancy fees.

- Talent acquisition by clients: Brands are investing in building their own internal analytics and media expertise.

- Potential market contraction: A widespread adoption of in-housing could significantly reduce the addressable market for Ebiquity's services.

Intensifying competition from both specialized rivals and larger consulting firms presents a significant threat, with aggressive pricing strategies impacting Ebiquity's market position. The rapid evolution of media platforms and the integration of AI necessitate continuous adaptation and investment in R&D, as outdated methodologies risk diminishing relevance. Furthermore, stricter data privacy regulations globally could limit access to crucial granular data, directly affecting the accuracy and breadth of Ebiquity's analytics and client trust.

The trend of major brands bringing media planning and analysis functions in-house is a substantial threat, aiming for greater control and cost savings. This directly challenges Ebiquity's core services, potentially shrinking the market for independent analytics providers and impacting revenue streams as reliance on third-party expertise diminishes.

| Threat Category | Specific Challenge | Impact on Ebiquity (2024/2025 Outlook) |

|---|---|---|

| Economic Uncertainty | Reduced marketing budgets during downturns | Directly impacts client spending, leading to deferred or reduced programs. 2024 saw challenging market conditions affecting revenue. |

| Competitive Landscape | Aggressive pricing from rivals, in-housing by clients | Erodes market share and profitability; larger groups and internal teams pose significant competition. |

| Technological Evolution | Rapid changes in media, AI integration | Risk of outdated methodologies; necessitates ongoing R&D investment for relevance. AI in content creation demands continuous framework updates. |

| Data Privacy Regulations | GDPR, CCPA limiting data access | Restricts collection/utilization of user-level data essential for accurate measurement and attribution. |

SWOT Analysis Data Sources

This Ebiquity SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market research, and expert industry analysis to provide a well-rounded and actionable assessment.