Ebiquity PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebiquity Bundle

Navigate the complex external forces shaping Ebiquity's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate, in-depth insights.

Political factors

Governmental regulations significantly shape the media and advertising landscape, directly influencing Ebiquity's operational environment. For instance, evolving data privacy laws, such as the GDPR in Europe and similar initiatives globally, necessitate careful handling of consumer information in media planning and measurement. In 2024, regulators are increasingly scrutinizing algorithmic transparency and the use of AI in advertising, potentially impacting how media investments are optimized.

Changes in media ownership rules and content restrictions also present direct challenges and opportunities. As of early 2025, discussions around net neutrality and the potential for increased regulation on large digital platforms continue, which could alter the competitive dynamics of media buying. Ebiquity must remain agile, adapting its analytical models to comply with and leverage these regulatory shifts to provide accurate client guidance.

The global data privacy landscape, shaped by regulations like GDPR and CCPA, significantly impacts how companies like Ebiquity can use data for media targeting and measurement. As of early 2024, the ongoing evolution and enforcement of these laws, including new regional directives, demand constant adaptation in data handling, potentially altering Ebiquity's core service delivery.

Stricter data privacy enforcement, including substantial fines for non-compliance – the GDPR has seen penalties exceeding €1 billion across various sectors by mid-2024 – directly affects Ebiquity's operational capacity and client trust. Adapting to these evolving mandates is essential for maintaining legal standing and client confidence in their data-driven insights.

Political stability directly impacts advertiser confidence, a crucial factor for companies like Ebiquity that analyze media spend. For instance, periods of heightened political uncertainty, such as during the 2024 global election cycle which saw over 60 countries holding elections, can cause brands to become more cautious with their marketing budgets.

Geopolitical events, including trade disputes and regional conflicts, introduce significant volatility. Brands may pause or shift investments away from markets experiencing instability. This was evident in 2024, where ongoing geopolitical tensions led some multinational corporations to reduce their exposure in certain emerging markets, impacting media planning and measurement services.

Ebiquity must continuously assess these macro-political risks. Analyzing the potential impact of events like the evolving trade relations between major economic blocs in 2024-2025 is essential for providing accurate market analyses and strategic advice to clients navigating these complex environments.

Industry Self-Regulation and Lobbying

The advertising industry navigates a complex landscape of self-regulation and lobbying, often in response to political pressures concerning transparency, ethics, and consumer protection. For instance, the UK's Advertising Standards Authority (ASA) plays a significant role in self-regulation, with its decisions impacting advertising practices across various sectors. In 2023, the ASA reportedly received over 28,000 complaints, leading to numerous enforcement actions.

Lobbying by powerful entities like media conglomerates and ad technology firms actively shapes the regulatory framework. These groups advocate for policies that can influence data privacy rules, ad placement standards, and the overall competitive environment. Understanding these dynamics is crucial for Ebiquity to anticipate shifts in the regulatory landscape and to champion fair, transparent media practices. The influence of these lobbying efforts can be seen in ongoing debates around digital advertising taxes and data usage regulations in key markets like the EU and the US.

- Industry Self-Regulation: The UK's ASA handled over 28,000 complaints in 2023, demonstrating active self-governance.

- Lobbying Influence: Media owners and ad tech firms lobby governments to shape regulations on data privacy and ad standards.

- Political Pressure: Concerns over transparency and consumer protection often drive regulatory changes, influencing industry self-regulation.

- Anticipating Change: Ebiquity must monitor these political and lobbying trends to adapt its strategies and advocate for fair practices.

Public Sector Advertising Spend

Government and public sector organizations are substantial advertisers, with their expenditure often shaped by political objectives and public policy directions. For instance, in the UK, the government's advertising campaigns, such as those for public health initiatives or national campaigns, can represent a significant portion of the advertising market. These campaigns are directly tied to the political agenda of the ruling party.

Changes in public sector advertising expenditure can signal shifts in government priorities and economic conditions, presenting both opportunities and hurdles for media agencies and market analysis firms. For example, a focus on digital transformation within government might lead to increased spending on online advertising platforms, creating new revenue streams for agencies adept at navigating these channels. This trend was evident in 2024 with increased government investment in digital public services advertising.

Observing these spending patterns offers valuable insights into the overall health of the advertising market and potential client segments. A rise in public sector ad spend can indicate a government's confidence in economic stability or its commitment to public engagement. Conversely, a decrease might suggest austerity measures or a shift in communication strategies. In 2025, continued focus on public service delivery is expected to maintain a steady, albeit potentially targeted, level of public sector advertising.

- Government advertising spend directly reflects political priorities, influencing media channel allocation.

- Fluctuations in public sector ad budgets can create or diminish opportunities for media and advertising firms.

- Monitoring public sector advertising provides a barometer for broader economic sentiment and government focus areas.

- Digital advertising within the public sector saw a notable increase in 2024, projected to continue into 2025.

Political stability and government policies are paramount for Ebiquity, influencing everything from data handling to media investment. The global election cycle in 2024, affecting over 60 countries, highlighted how political uncertainty can lead to cautious marketing budgets. Geopolitical tensions in 2024 also prompted some corporations to reduce exposure in unstable markets, directly impacting media planning. Ebiquity must continuously assess these macro-political risks, such as evolving trade relations between major economic blocs in 2024-2025, to provide accurate client guidance.

Government regulations, particularly around data privacy, are a constant factor. The GDPR's enforcement, with penalties potentially exceeding €1 billion by mid-2024, underscores the need for strict compliance. Scrutiny of AI and algorithmic transparency in advertising is increasing in 2024, potentially altering media optimization strategies. Furthermore, ongoing debates about net neutrality and digital platform regulation, active in early 2025, could reshape the competitive media buying landscape.

Industry self-regulation and lobbying efforts also play a significant role. The UK's ASA, which handled over 28,000 complaints in 2023, exemplifies self-governance. Lobbying by media and ad tech firms actively shapes policies on data privacy and ad standards, influencing the regulatory framework. Ebiquity must monitor these dynamics to anticipate shifts and advocate for transparency.

Public sector advertising expenditure, driven by political objectives, is a key indicator. Government campaigns, like public health initiatives, are tied to the ruling party's agenda. A rise in public sector ad spend, as seen in digital public services advertising in 2024, can signal government confidence and focus. Continued focus on public service delivery in 2025 is expected to maintain steady, targeted public sector advertising.

| Political Factor | Description | 2024/2025 Relevance |

| Government Regulations | Laws governing data privacy, advertising standards, and platform operations. | Increased scrutiny on AI in advertising (2024); ongoing net neutrality debates (early 2025). |

| Political Stability | The level of predictability and absence of major political upheaval. | Global election cycle (2024) impacting marketing budgets; geopolitical tensions affecting market exposure. |

| Industry Self-Regulation & Lobbying | Industry bodies setting standards and groups influencing policy. | Significant complaint volumes for bodies like the ASA (2023); lobbying on data privacy and ad standards. |

| Public Sector Advertising | Government spending on advertising campaigns. | Digital public services advertising saw increased investment (2024); continued steady spend expected (2025). |

What is included in the product

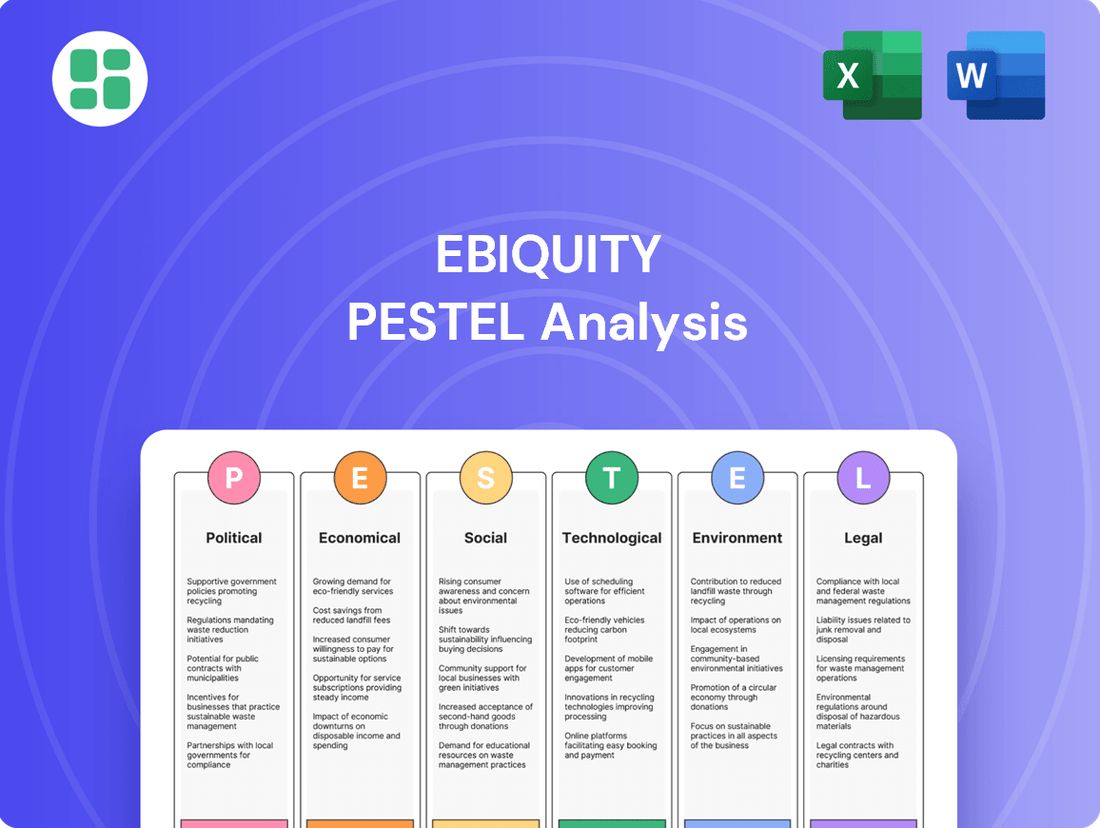

Ebiquity's PESTLE analysis offers a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company.

This detailed assessment provides actionable insights for strategic decision-making by highlighting potential threats and opportunities within the broader market landscape.

Ebiquity's PESTLE analysis provides a structured framework to identify and understand external market forces, alleviating the pain of navigating complex and unpredictable business environments.

Economic factors

Global economic growth is projected to be moderate in 2024, with the IMF forecasting 3.2% growth, a slight uptick from 2023. However, recession risks remain a concern, particularly in developed economies, due to persistent inflation and tighter monetary policies. This economic climate directly impacts advertising spend, as companies tend to reduce marketing budgets during periods of uncertainty.

For Ebiquity, understanding these macro-economic trends is crucial for advising clients. For instance, in 2023, advertising expenditure in key markets saw varied performance, with digital channels generally outperforming traditional media. Ebiquity's forecasts must account for how potential economic slowdowns in 2024 could further dampen media investment, especially in sectors heavily reliant on consumer discretionary spending.

The interplay between economic health and advertising budgets means that Ebiquity's market analysis needs to be dynamic. A slowdown in global GDP growth, for example, could lead to a more conservative approach to media planning by clients, prioritizing measurable performance marketing over broader brand-building campaigns.

Inflationary pressures are significantly impacting media costs. For instance, in early 2024, many markets saw a notable uptick in advertising spend, partly driven by rising production and media placement expenses. This means brands might find themselves needing to allocate larger budgets to maintain their previous campaign reach and effectiveness.

This trend directly underscores the value proposition of services like Ebiquity's, which focus on optimizing media spend. By helping clients navigate these increased costs, Ebiquity can ensure their advertising investments deliver maximum impact, even in a challenging economic climate. The ability to adapt and optimize is crucial for maintaining campaign efficiency.

Understanding the ripple effect of these rising costs on available media inventory and client budgets is paramount. For example, if media owners face higher operational costs, they may adjust their pricing. This necessitates a data-driven approach to media investment, where Ebiquity's analysis can guide clients toward the most cost-effective channels and strategies to achieve their marketing objectives.

Consumer spending is a powerful engine for economic growth, directly shaping how brands allocate their marketing budgets. When consumers feel secure about their financial future, they tend to spend more freely, leading brands to ramp up advertising efforts to capture this increased demand. For instance, in early 2024, retail sales in the US saw a notable uptick, indicating a degree of consumer confidence that encourages marketing investment.

Ebiquity's analysis hinges on understanding these shifts in consumer sentiment and purchasing power. By tracking metrics like consumer confidence indices and retail sales figures, Ebiquity can advise clients on the most effective ways to engage their target audiences and measure the true impact of their media campaigns. The resilience of consumer spending in the face of economic headwinds throughout 2024 underscores the importance of this data for strategic marketing decisions.

Interest Rates and Investment Capital

Changes in interest rates significantly impact a business's ability to secure capital for growth initiatives, including crucial investments in marketing technology and media. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, borrowing costs for companies can remain elevated, potentially influencing budget allocations for marketing campaigns.

Higher interest rates often prompt businesses to become more conservative, prioritizing projects with a clear and immediate return on investment. This environment could bolster demand for Ebiquity's performance-focused solutions, as clients seek to maximize the efficiency and measurable impact of their marketing spend. Companies might scrutinize long-term marketing investments more closely, weighing their potential returns against the increased cost of financing.

- Federal Funds Rate: Maintained at 5.25%-5.50% by the Federal Reserve in early 2024, influencing borrowing costs.

- Cost of Capital: Higher rates increase the hurdle rate for new investments, including marketing technology.

- ROI Focus: Businesses may shift spending towards demonstrably effective, short-term marketing outcomes.

Health of the Advertising and Media Market

The health of the advertising and media market is a critical economic factor for Ebiquity, as its business directly relies on optimizing media investments for clients. Trends in ad spend are a key indicator; for instance, global advertising spending was projected to reach $691.7 billion in 2024, with digital advertising continuing its dominance, accounting for over 60% of the total. This dynamic means Ebiquity must stay agile in advising clients on the most effective allocation of budgets across evolving channels.

Shifts in market share between media types present both challenges and opportunities. While digital channels like social media and search continue to grow, traditional media like television still command significant portions of ad budgets, especially for certain demographics. Ebiquity's ability to analyze and adapt to these shifts, such as the increasing investment in connected TV (CTV) advertising, which is expected to see substantial growth in 2024 and 2025, directly impacts its value proposition.

The emergence of new advertising models and platforms also shapes Ebiquity's strategic approach. The rise of influencer marketing, programmatic advertising, and the metaverse presents new avenues for client engagement but also requires sophisticated measurement and optimization techniques. For example, the influencer marketing market alone was valued at approximately $21.1 billion in 2023 and is projected to continue its upward trajectory, underscoring the need for Ebiquity to provide expertise in these newer, often less traditional, areas.

- Global Ad Spend Growth: Projected to reach $691.7 billion in 2024, with digital media leading the charge.

- Digital Dominance: Digital advertising is expected to constitute over 60% of total ad spend.

- CTV Investment Surge: Connected TV advertising is anticipated for significant growth in 2024-2025.

- Influencer Marketing Expansion: The influencer market, valued at $21.1 billion in 2023, continues its rapid expansion.

Economic factors significantly shape the advertising landscape. Moderate global growth is anticipated for 2024, yet recessionary fears linger due to inflation and tight monetary policy, impacting ad budgets. Rising media costs, driven by inflation, mean brands need larger budgets for equivalent reach.

Consumer spending, a key economic driver, directly influences marketing allocations. Increased consumer confidence, as seen in early 2024 US retail sales, encourages greater advertising investment. Conversely, higher interest rates, with the Federal Reserve maintaining the 5.25%-5.50% range in early 2024, increase the cost of capital, prompting a focus on short-term ROI for marketing initiatives.

| Economic Factor | 2024 Projection/Status | Impact on Advertising |

|---|---|---|

| Global GDP Growth | IMF forecasts 3.2% | Moderate spending, potential cutbacks during uncertainty |

| Inflation | Persistent in many economies | Increased media costs, higher production expenses |

| Interest Rates (US Federal Funds Rate) | 5.25%-5.50% (early 2024) | Elevated borrowing costs, emphasis on immediate ROI |

| Consumer Spending | Resilient, with some upticks (e.g., US retail sales early 2024) | Encourages marketing investment when confidence is high |

Preview Before You Purchase

Ebiquity PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ebiquity PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Ebiquity's strategic landscape.

Sociological factors

Consumers are increasingly shifting their media consumption to digital platforms. In 2024, it's estimated that over 85% of internet users globally will engage with streaming services, with platforms like Netflix and Disney+ continuing to dominate. This trend directly impacts advertising spend, as brands follow audiences to these channels.

Social media, particularly short-form video content via TikTok and Instagram Reels, is also capturing significant audience attention. By the end of 2024, projections indicate that social media advertising revenue will surpass $250 billion worldwide. Ebiquity's role is crucial in helping clients navigate this fragmented landscape to ensure their messages reach the right people.

Measuring engagement and attention across these diverse platforms is becoming more complex but is essential for effective campaign planning. Understanding how consumers interact with content on multiple screens and formats allows Ebiquity to provide data-driven strategies for optimizing media investment and maximizing return on ad spend.

Societal expectations are shifting, with a pronounced demand for brands and media companies to operate with greater transparency and ethical rigor. Consumers are more actively questioning how their data is used and scrutinizing the values espoused by the companies they support.

This heightened scrutiny means that brands must be more open about their advertising practices and data handling. For instance, a 2024 study indicated that over 60% of consumers are more likely to trust brands that are transparent about their data policies, a significant jump from previous years.

Ebiquity's core function of ensuring accountability and transparency in media investments directly aligns with this societal imperative. By providing clarity on media spend and performance, Ebiquity helps brands build stronger consumer trust and safeguard their reputation in an increasingly watchful marketplace.

Societal values are increasingly prioritizing ethical marketing practices, with a growing emphasis on combating misinformation and ensuring responsible targeting. Consumers and regulators alike are demanding greater transparency and accountability from brands.

This heightened awareness means companies are under significant pressure to ensure their advertising aligns with these evolving ethical standards. For example, a 2024 survey by Edelman found that 71% of consumers believe brands have a responsibility to protect customers from false or misleading information online, a figure up from 62% in 2022.

Ebiquity plays a crucial role in helping clients navigate this complex environment. By meticulously vetting media placements, Ebiquity ensures that advertising appears in brand-safe environments and directly supports clients' corporate social responsibility (CSR) objectives, thereby mitigating reputational risks and reinforcing brand integrity.

Generational Shifts in Media Engagement

Generational differences significantly shape how people consume media and interact with advertising. For instance, while Gen Z and younger Millennials often favor short-form video content on platforms like TikTok and Instagram, older generations may still rely more on traditional television or longer-form digital content. This divergence necessitates tailored media approaches.

In 2024, it's estimated that over 70% of Gen Z adults use TikTok daily, showcasing a profound shift towards mobile-first, algorithm-driven content discovery. Conversely, television advertising still captures a substantial portion of ad spend targeting older demographics, though its effectiveness is increasingly scrutinized against digital channels. Ebiquity's strategic recommendations must therefore address this media fragmentation.

- Gen Z Media Habits: Predominantly digital, favoring short-form video and influencer content.

- Millennial Media Habits: A blend of digital streaming, social media, and some traditional media.

- Older Generations' Media Habits: Higher reliance on traditional TV and print, though digital adoption is growing.

- Advertising Impact: Effectiveness varies greatly by platform and generational preference, demanding segmented campaign strategies.

Societal Focus on Diversity, Equity, and Inclusion (DEI)

The growing societal focus on Diversity, Equity, and Inclusion (DEI) significantly shapes media content, representation, and advertising. Brands are increasingly held accountable for authentically reflecting diverse audiences and actively avoiding harmful stereotypes. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase from brands that demonstrate a commitment to DEI.

Ebiquity plays a crucial role in helping clients navigate this evolving landscape. By evaluating media partners and specific campaigns, Ebiquity can assess their alignment with DEI principles. This ensures that media investments not only achieve marketing objectives but also contribute positively to broader societal values and brand reputation.

- Consumer Demand: Over 60% of consumers in a recent survey stated that a brand's commitment to DEI influences their purchasing decisions.

- Brand Reputation: Companies with strong DEI initiatives often experience higher brand loyalty and positive public perception.

- Media Partner Scrutiny: Advertisers are increasingly scrutinizing media platforms for their own DEI practices and content representation.

- Regulatory Trends: While not always legally mandated for advertising content, there's a growing expectation for inclusive representation.

Societal values are increasingly prioritizing ethical marketing practices, with a growing emphasis on combating misinformation and ensuring responsible targeting. Consumers and regulators alike are demanding greater transparency and accountability from brands.

This heightened awareness means companies are under significant pressure to ensure their advertising aligns with these evolving ethical standards. For example, a 2024 survey by Edelman found that 71% of consumers believe brands have a responsibility to protect customers from false or misleading information online, a figure up from 62% in 2022.

Ebiquity plays a crucial role in helping clients navigate this complex environment by meticulously vetting media placements to ensure brand safety and alignment with corporate social responsibility objectives, thereby mitigating reputational risks.

Technological factors

The rapid evolution of Artificial Intelligence and Machine Learning is fundamentally transforming media data analysis. These advancements provide unprecedented capabilities for predictive modeling and campaign optimization, allowing for a much deeper understanding of media performance. For instance, by 2024, the global AI market is projected to reach over $200 billion, with a significant portion dedicated to analytics and business intelligence, directly impacting how companies like Ebiquity can leverage these tools.

Ebiquity can harness AI and ML to automate laborious reporting processes, freeing up valuable resources and significantly enhancing decision-making speed for their clients. This automation allows for quicker identification of trends and anomalies, leading to more agile and effective media strategies. The ability to process vast datasets in near real-time is a key differentiator in today's fast-paced market.

Maintaining a leading position in AI adoption is not just beneficial but critical for Ebiquity's competitive edge. Companies that effectively integrate AI into their analytics platforms can offer superior insights and demonstrate a clearer return on investment for their clients. By 2025, it's estimated that AI-driven insights will be a primary driver of business growth for over 70% of organizations, underscoring the urgency for continuous innovation in this area.

The digital advertising landscape is rapidly evolving with the deprecation of third-party cookies, a significant shift impacting how media effectiveness is measured. This necessitates the development of new data measurement and attribution technologies. For instance, the industry is seeing increased investment in first-party data solutions and privacy-preserving measurement techniques, with some reports suggesting a potential 20-30% shift towards these methods by 2025.

Ebiquity, like other players in the field, must integrate privacy-centric solutions and innovative measurement frameworks to maintain accuracy. This includes exploring areas like data clean rooms and contextual advertising, which are projected to grow substantially. The market for privacy-enhancing technologies in advertising is expected to reach billions of dollars globally by 2026, highlighting the critical need for adaptation.

Programmatic advertising is rapidly advancing, with new bidding tactics and ad formats constantly emerging. Innovations like header bidding and server-side ad insertion are reshaping how media is bought, influencing both efficiency and clarity. In 2024, programmatic ad spend is projected to reach over $200 billion globally, highlighting its significant market presence.

These ad tech advancements, while offering potential for optimization, also increase the complexity of the digital advertising landscape. Ebiquity's role is crucial in guiding clients through this intricate ecosystem, ensuring their programmatic investments are as effective and transparent as possible.

Emergence of New Media Platforms and Channels

The advertising landscape is constantly shifting with new media platforms like advanced Connected TV (CTV), gaming environments, and emerging metaverse experiences offering novel advertising opportunities. Ebiquity needs to rigorously evaluate the potential and actual performance of these developing channels for its clients' campaigns.

Key considerations for Ebiquity include understanding the audience penetration and the measurement capabilities within these newer platforms to ensure effective campaign delivery and ROI assessment. For instance, by late 2024, CTV ad spending was projected to reach over $25 billion in the US, highlighting the growing importance of this channel.

- CTV Growth: Connected TV advertising is rapidly expanding, with significant investment expected to continue through 2025, offering advertisers new ways to reach engaged audiences.

- Gaming Reach: In-game advertising and sponsorships within gaming platforms are becoming increasingly sophisticated, attracting younger demographics and presenting unique engagement possibilities.

- Metaverse Potential: While still nascent, the metaverse presents a frontier for immersive brand experiences, requiring Ebiquity to monitor its development and potential for future client activations.

- Measurement Challenges: A critical factor for Ebiquity is developing robust measurement frameworks to track campaign effectiveness across these diverse and often fragmented new media environments.

Increased Sophistication of Ad-Blocking and Privacy Tools

Consumers are increasingly adopting ad-blocking software, privacy browsers, and tools that limit ad tracking, with some reports indicating that over 40% of internet users employ ad blockers. This technological trend challenges traditional advertising models and necessitates more creative and less intrusive approaches to media engagement.

Ebiquity can help clients develop strategies that respect user privacy while still achieving marketing objectives. For instance, a shift towards first-party data strategies and contextual advertising is becoming crucial.

- Ad Blocker Usage: Global ad blocker usage reached approximately 1.3 billion devices by early 2024.

- Privacy-Focused Browsers: Browsers like Brave reported significant user growth, highlighting the demand for privacy.

- Impact on Ad Spend: The rise of these tools forces advertisers to re-evaluate their digital ad spend and explore alternative engagement methods.

- Ebiquity's Role: Ebiquity's expertise can guide businesses in navigating these changes by focusing on consent-driven marketing and transparent data practices.

Technological advancements, particularly in AI and machine learning, are revolutionizing media data analysis, enabling predictive modeling and campaign optimization. By 2025, AI-driven insights are expected to be a primary growth driver for over 70% of organizations, making continuous innovation in this area essential for Ebiquity.

The deprecation of third-party cookies necessitates new measurement and attribution technologies, with a projected 20-30% shift towards first-party data solutions by 2025. Ebiquity must integrate privacy-centric solutions like data clean rooms, a market expected to reach billions globally by 2026.

Emerging platforms like Connected TV (CTV) and gaming environments offer new advertising avenues, with US CTV ad spending projected to exceed $25 billion by late 2024. Ebiquity's challenge lies in developing robust measurement frameworks for these diverse environments.

The increasing adoption of ad-blocking software, with over 40% of internet users employing them, forces a re-evaluation of digital ad spend towards consent-driven marketing and transparent data practices.

| Technology Area | Key Trend | Impact on Ebiquity | 2024/2025 Data Point |

|---|---|---|---|

| AI & Machine Learning | Advanced Data Analysis & Automation | Enhanced predictive modeling, campaign optimization, and reporting efficiency. | Global AI market projected over $200 billion in 2024; AI-driven insights to boost growth for 70%+ organizations by 2025. |

| Data Measurement & Privacy | Cookie Deprecation & First-Party Data | Need for new measurement solutions and privacy-centric approaches. | 20-30% shift towards first-party data by 2025; Privacy-enhancing tech market to reach billions by 2026. |

| New Media Platforms | CTV, Gaming, Metaverse | Opportunities for new ad formats and audience reach, requiring new measurement strategies. | US CTV ad spend projected over $25 billion by late 2024. |

| Consumer Technology Adoption | Ad Blockers & Privacy Browsers | Challenges traditional advertising, necessitating privacy-respecting strategies. | Over 40% of internet users employ ad blockers; ~1.3 billion devices using ad blockers by early 2024. |

Legal factors

The evolving legal framework for data privacy, exemplified by GDPR and CCPA, significantly impacts Ebiquity's operations. These regulations, and emerging global counterparts, dictate the collection, processing, and utilization of audience data crucial for media planning and execution. Failure to adhere can result in substantial fines; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Ebiquity's commitment to client success necessitates rigorous compliance with these mandates. This includes ensuring all data-handling methodologies and advisory services align with current legal requirements, safeguarding both Ebiquity and its clients from financial penalties and reputational harm.

Advertising standards and consumer protection laws are critical for businesses like Ebiquity. These regulations, which cover everything from truthful claims to influencer disclosures, differ significantly across countries and are constantly evolving. For instance, in the UK, the Advertising Standards Authority (ASA) actively enforces rules against misleading ads, with a significant number of complaints upheld annually, impacting brand reputation and campaign effectiveness.

Navigating this complex legal landscape is where Ebiquity provides essential value. By ensuring clients’ advertising campaigns adhere to these stringent requirements, Ebiquity helps them avoid costly fines, legal battles, and damage to their brand image. The firm's expertise is crucial in a market where, for example, the EU's Digital Services Act (DSA) is imposing new obligations on online platforms regarding advertising transparency and consumer rights.

Antitrust regulators globally, including the US Department of Justice and the European Commission, are intensifying their focus on major media conglomerates and ad-tech firms. This increased scrutiny, particularly concerning data aggregation and market dominance, signals a potential reshaping of how media inventory is accessed and priced.

Legal actions and new regulations designed to foster greater competition could directly influence the availability and cost of advertising space. For instance, the ongoing investigations into Google's ad-tech practices by various authorities highlight concerns about potential self-preferencing and monopolistic behavior, which could lead to significant structural changes within the industry.

Ebiquity must closely track these evolving legal frameworks and enforcement actions. Understanding these shifts is crucial for advising clients on potential market disruptions, including changes in media buying strategies and the overall ad-tech ecosystem structure, as seen with proposed legislation like the Digital Markets Act in Europe.

Intellectual Property Rights and Content Licensing

Legal frameworks governing intellectual property, such as copyright and trademark law, are fundamental to the media and advertising sectors. These laws dictate how content is created, shared, and how advertisements are placed, directly impacting companies like Ebiquity that operate within this space. In 2024, the global digital advertising market was valued at approximately $600 billion, underscoring the immense economic stakes tied to content and its monetization, making IP protection paramount.

Securing appropriate licensing and usage rights for all media assets and advertising materials is non-negotiable. Failure to do so can lead to costly legal battles and reputational damage. For instance, in 2023, a major media conglomerate faced significant fines due to unauthorized use of copyrighted music in a prominent advertising campaign, highlighting the tangible financial risks involved.

- Copyright Protection: Safeguards original works of authorship, including advertising copy, jingles, and visual elements.

- Trademark Law: Protects brand names, logos, and slogans used in advertising to prevent consumer confusion.

- Licensing Agreements: Formal contracts that grant permission to use specific intellectual property, often with defined terms and compensation.

- Enforcement Actions: Legal measures taken to address infringement, which can include cease-and-desist orders, lawsuits, and damages.

Contractual Obligations and Transparency Requirements

Legal agreements that govern how media is bought, how agencies and clients work together, and partnerships with vendors frequently contain specific clauses. These clauses often detail transparency, the right to audit, and how performance is measured. For Ebiquity's assurance services, understanding how these contracts are interpreted legally and what financial accountability is required is extremely important.

Ensuring contracts are clear and legally robust is fundamental to managing media effectively. For instance, the UK's Advertising Standards Authority (ASA) continues to enforce guidelines that indirectly impact contractual transparency, requiring advertisers to be clear about their media practices. In 2024, ongoing scrutiny of ad tech supply chains by regulatory bodies like the FTC in the US highlights the increasing demand for verifiable data and transparent dealings, which directly influences contractual obligations.

- Contractual Clauses: Specific terms in media buying agreements often mandate detailed reporting and audit access, crucial for Ebiquity's verification services.

- Legal Interpretation: The way courts interpret these clauses, particularly concerning data privacy and performance claims, directly impacts Ebiquity's assurance work.

- Financial Accountability: Legal frameworks increasingly demand clear financial breakdowns in media spend, reinforcing the need for Ebiquity's transparency solutions.

- Regulatory Compliance: Adherence to evolving advertising regulations, such as those concerning programmatic advertising transparency, shapes the legal requirements within contracts.

The legal landscape for data privacy continues to tighten globally, with significant implications for how Ebiquity handles audience data. Regulations like the EU's GDPR and the California Consumer Privacy Act (CCPA) set stringent rules for data collection and usage, impacting media planning. In 2024, the global digital ad spend was projected to exceed $600 billion, making compliance with these privacy laws critical to avoid substantial penalties, which under GDPR can reach up to 4% of global annual turnover.

Advertising standards and consumer protection laws are also a key legal factor. These vary by jurisdiction and dictate everything from truthful claims to influencer disclosures. For instance, the UK's Advertising Standards Authority (ASA) actively polices misleading advertisements, with numerous upheld complaints annually affecting brand reputations. The EU's Digital Services Act (DSA) further imposes new obligations on online platforms regarding advertising transparency and consumer rights, directly influencing campaign execution.

Antitrust and competition law are increasingly shaping the ad-tech industry. Regulators worldwide are scrutinizing large media conglomerates and ad-tech firms for monopolistic practices, particularly concerning data aggregation. Investigations into companies like Google's ad-tech operations highlight concerns about self-preferencing and market dominance, potentially leading to significant industry restructuring and changes in media buying accessibility and cost.

Intellectual property rights, including copyright and trademark law, are fundamental to advertising content. Protecting original works and brand identifiers is paramount, especially given the vast economic value in the digital advertising market. In 2023, a major media company faced significant fines for copyright infringement in an advertising campaign, underscoring the financial risks associated with inadequate IP management.

| Legal Area | Key Regulations/Concerns | Impact on Ebiquity | Example/Data Point (2024/2025) |

|---|---|---|---|

| Data Privacy | GDPR, CCPA, emerging global laws | Dictates data handling, collection, and usage for audience insights. Non-compliance risks significant fines. | GDPR fines can reach up to 4% of global annual turnover. Global digital ad spend projected over $600 billion in 2024. |

| Advertising Standards | Truthful claims, influencer disclosures, consumer protection | Ensures client campaigns are compliant, avoiding legal challenges and reputational damage. | UK ASA upholds numerous complaints annually against misleading ads. EU's DSA increases platform obligations. |

| Antitrust & Competition | Market dominance, data aggregation, ad-tech practices | Potential reshaping of media access and pricing due to regulatory actions against industry giants. | Ongoing investigations into major ad-tech firms' practices signal potential structural changes. |

| Intellectual Property | Copyright, trademark, licensing | Requires securing rights for all media assets to prevent costly legal battles and reputational harm. | Copyright infringement fines can be substantial; a major media firm faced significant penalties in 2023. |

Environmental factors

Clients are increasingly scrutinizing the environmental impact of their media spending. A 2024 survey by the Association of National Advertisers (ANA) found that 70% of marketers are prioritizing sustainability in their media planning, up from 45% in 2022. This growing demand means Ebiquity must offer guidance on reducing the carbon footprint of digital advertising, such as optimizing ad delivery and choosing energy-efficient platforms.

This presents a significant opportunity for Ebiquity to develop and market new services focused on sustainable media investment. By providing data-driven insights into greener media channels and practices, Ebiquity can help clients achieve their environmental goals while maintaining campaign effectiveness. For instance, exploring partnerships with media providers committed to renewable energy sources for their data centers could be a key offering.

The environmental impact of digital infrastructure, including data centers and servers essential for digital advertising delivery, is a significant concern. For companies like Ebiquity, which process vast amounts of data, their operational carbon footprint is under increasing scrutiny. For instance, global data center energy consumption is projected to rise, potentially reaching 8% of global electricity demand by 2030, highlighting the scale of this issue.

Mitigating this environmental impact is becoming a crucial element of corporate social responsibility. Many organizations are now investing in energy-efficient technologies and renewable energy sources to reduce their digital carbon footprint. This focus is driven by both regulatory pressures and growing investor demand for sustainable business practices.

Brands are increasingly weaving environmental sustainability into their Corporate Social Responsibility (CSR) initiatives, directly impacting their media purchasing. This means a growing preference for media partners and platforms that demonstrate robust environmental policies and a commitment to reducing their carbon footprint.

For instance, a significant portion of consumers now expect brands to be environmentally conscious, influencing their purchasing decisions. In 2024, studies indicated that over 60% of consumers consider a brand's sustainability efforts when making buying choices. This trend is expected to continue, pushing media buyers to scrutinize the environmental impact of their chosen channels.

Ebiquity can provide crucial support by helping clients assess media options through an environmental lens, identifying partners aligned with their sustainability goals. This involves analyzing the carbon emissions associated with various media consumption methods and advocating for greener digital and traditional media practices.

Regulatory Pressure for Environmental Disclosures

Governments globally are intensifying scrutiny on corporate environmental accountability, pushing for greater transparency in sustainability practices. This trend is particularly relevant for the media and advertising sectors, where Ebiquity operates. Companies are increasingly expected to report on their environmental footprint, including the impact of their media investments.

The pressure for environmental disclosures is translating into tangible regulatory action. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in January 2024, mandates extensive reporting for a broad range of companies, including those in advertising services. Similarly, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 requiring climate-related disclosures, though the final rules are still subject to ongoing developments and potential legal challenges. These regulatory shifts mean that understanding and quantifying the environmental impact of media campaigns is becoming a critical compliance issue for Ebiquity's clients.

Ebiquity's role in this evolving landscape involves assisting clients in navigating these complex disclosure requirements. This includes helping them measure, report, and potentially reduce the environmental impact associated with their advertising activities. The growing emphasis on ESG (Environmental, Social, and Governance) factors means that robust environmental data is no longer optional but a necessity for maintaining stakeholder trust and regulatory compliance.

- CSRD Mandates: The EU's CSRD requires over 50,000 companies to report on sustainability, impacting advertising agencies and their clients operating within the EU.

- Climate Disclosure Trends: Over 90% of S&P 500 companies now include some form of environmental disclosure in their annual reports, a figure expected to rise with increased regulatory push.

- Investor Demand: A significant majority of institutional investors consider ESG factors, including environmental impact, when making investment decisions, driving demand for transparent reporting.

- Supply Chain Scrutiny: Companies are increasingly being held accountable for the environmental impact across their entire value chain, including their advertising supply chain.

Reputational Risks from Environmentally Irresponsible Practices

Brands and their media partners are increasingly vulnerable to reputational damage if they are seen to be contributing to environmental harm or using unsustainable practices. This perception can significantly erode brand equity and consumer trust, impacting sales and market share. For instance, a 2024 report indicated that over 60% of consumers are more likely to purchase from brands demonstrating strong environmental commitments.

Negative public sentiment, amplified by social media, can lead to boycotts and significant financial losses. Companies failing to adapt to environmental concerns risk alienating a growing segment of environmentally conscious consumers. In 2025, studies suggest that up to 70% of Gen Z consumers consider a brand's environmental stance in their purchasing decisions.

Ebiquity assists clients in navigating these risks by providing data-driven insights into media strategies. We help identify media channels and partners that adhere to environmental best practices and align with evolving consumer expectations. This proactive approach ensures that marketing efforts do not inadvertently create reputational liabilities.

- Consumer Demand: Growing consumer preference for sustainable brands, with a significant portion willing to pay a premium.

- Media Scrutiny: Increased media and public focus on corporate environmental responsibility, leading to rapid dissemination of negative news.

- Regulatory Pressure: Anticipation of stricter regulations on advertising and corporate environmental claims, requiring proactive compliance.

- Brand Value Impact: Direct correlation between perceived environmental responsibility and brand valuation, affecting investor confidence.

Environmental factors are increasingly shaping media investment strategies, with clients prioritizing sustainability. A 2024 ANA survey revealed 70% of marketers now focus on sustainability in media planning, a significant jump from 45% in 2022. This necessitates Ebiquity's guidance on reducing the carbon footprint of digital advertising, including optimizing ad delivery and selecting energy-efficient platforms.

The operational carbon footprint of digital infrastructure, such as data centers, is a growing concern. Global data center energy consumption is projected to rise, potentially reaching 8% of global electricity demand by 2030. This highlights the critical need for companies like Ebiquity to address the environmental impact of data processing in advertising.

Regulatory pressures, like the EU's CSRD effective January 2024, mandate extensive sustainability reporting, impacting advertising services. In the US, the SEC's proposed climate disclosure rules further underscore the need for transparency. Ebiquity's role involves assisting clients in measuring, reporting, and reducing the environmental impact of their advertising activities to ensure compliance and maintain stakeholder trust.

Brands face reputational risks from environmental harm or unsustainable practices. Over 60% of consumers in 2024 favored brands with strong environmental commitments, and this trend is expected to grow, with up to 70% of Gen Z consumers considering environmental stances by 2025. Ebiquity helps clients mitigate these risks by identifying media partners aligned with environmental best practices.

| Factor | 2024/2025 Trend | Impact on Ebiquity |

| Client Demand for Sustainability | 70% of marketers prioritize sustainability (ANA, 2024) | Opportunity to develop new sustainable media services. |

| Digital Infrastructure Footprint | Data centers' energy demand projected to rise significantly. | Need to advise on energy-efficient platforms and practices. |

| Regulatory Compliance | EU CSRD (Jan 2024), SEC climate disclosure proposals. | Requirement to assist clients with environmental reporting and reduction strategies. |

| Consumer & Investor Expectations | 60%+ consumers favor sustainable brands; growing ESG investor demand. | Risk of reputational damage and need for proactive environmental alignment. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading global economic institutions, reputable market research firms, and official government publications. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide comprehensive insights.