Ebiquity Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebiquity Bundle

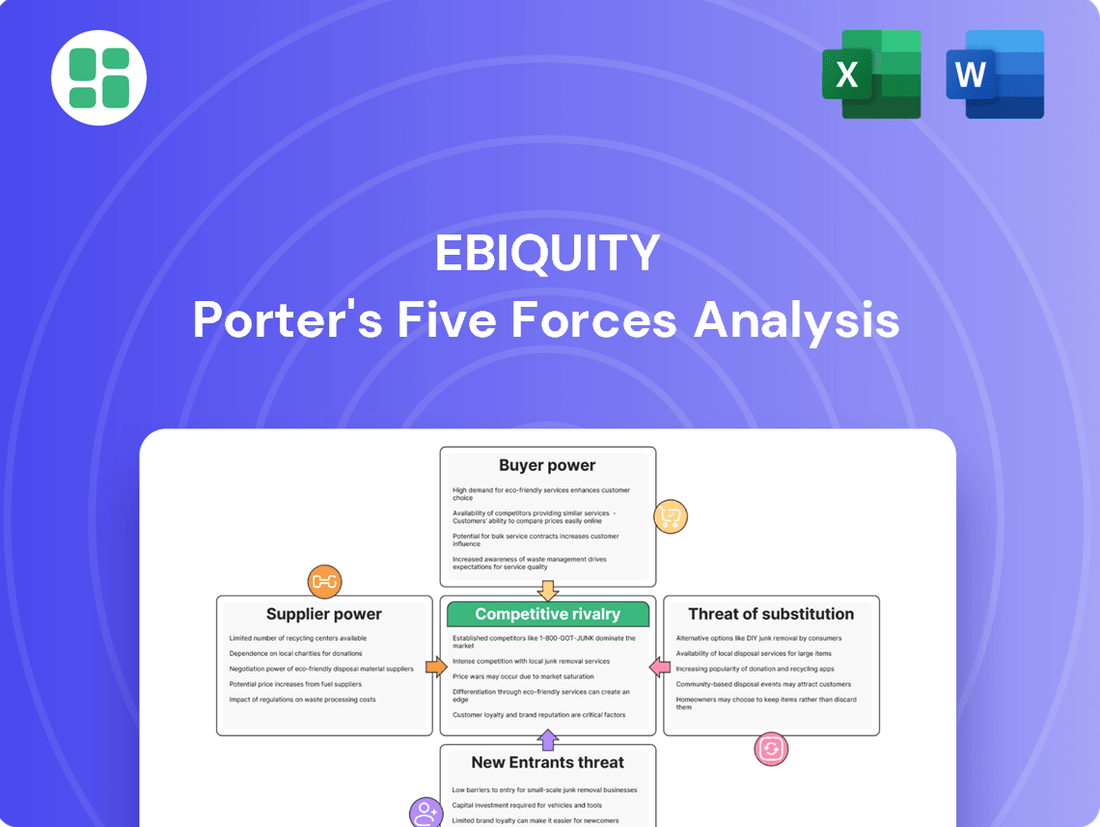

Ebiquity operates within a landscape shaped by intense competitive rivalry and significant buyer power, as clients demand greater transparency and ROI from marketing investments. The threat of new entrants is moderate, but the availability of alternative data analytics solutions presents a constant challenge.

The full Porter's Five Forces Analysis reveals the real forces shaping Ebiquity’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ebiquity's reliance on proprietary data sources significantly shapes supplier bargaining power. If key data providers possess unique or exclusive datasets, such as granular media spend or highly specific audience segmentation information, their leverage grows. This exclusivity means Ebiquity might face substantial switching costs or find it impossible to obtain comparable data elsewhere, potentially driving up acquisition expenses.

Ebiquity's core operations depend on a workforce of highly skilled media analysts, data scientists, and marketing effectiveness specialists. A scarcity of these specialized professionals in the job market, or a surge in demand for their expertise, directly amplifies the bargaining power of both employees and recruitment firms. This can lead to increased salary expectations and more intensive recruitment processes for Ebiquity.

Technology and software vendors hold significant bargaining power over Ebiquity, particularly when they offer unique or industry-standard solutions with few viable alternatives. This can lead to increased licensing costs and a dependency on their ongoing support and updates. For instance, specialized data analytics platforms or proprietary AI algorithms that are critical to Ebiquity's operations can command higher prices if switching to a competitor is complex or costly.

Market Research and Measurement Partners

Ebiquity's reliance on market research and measurement partners, such as Nielsen or Kantar, grants these entities considerable bargaining power. These firms often possess proprietary data, advanced analytical tools, and extensive consumer panels that are essential for Ebiquity to deliver its services. For instance, in 2024, the global market for marketing analytics was projected to reach over $100 billion, highlighting the significant value and specialized nature of the data these partners provide.

When these partners offer unique methodologies or exclusive access to consumer insights, their ability to dictate terms, including pricing and data availability, increases substantially. This can directly impact the cost and depth of the market intelligence Ebiquity can then offer to its own clients, potentially affecting Ebiquity's competitive pricing and service offerings.

- High data acquisition costs: Specialized market data can be expensive to license.

- Proprietary technology: Partners with unique measurement platforms command higher fees.

- Limited supplier alternatives: The niche nature of some measurement services can reduce Ebiquity's options.

- Impact on client pricing: Increased partner costs may translate to higher service fees for Ebiquity's clients.

Consultancy and Advisory Service Providers

Consultancy and advisory service providers can exert considerable bargaining power over Ebiquity. While Ebiquity itself offers consultancy, it often needs to engage external specialists for niche expertise, legal counsel, or strategic direction. The specialized knowledge and established reputations of these advisory firms mean they can command higher fees, directly influencing Ebiquity's operational expenses and its ability to adapt its strategies efficiently.

The specialized nature of these consulting services means few providers can offer the exact expertise required. This scarcity, coupled with the critical need for such advice, allows these firms to negotiate favorable terms. For instance, in 2023, the global management consulting market was valued at approximately $300 billion, with specialized segments often seeing even higher fee structures due to demand and limited supply.

- Niche Expertise: External consultants often possess highly specialized skills that Ebiquity may not have in-house, giving them leverage.

- Reputation and Brand: Well-regarded advisory firms can charge premium rates based on their track record and perceived value.

- Dependency: Ebiquity's reliance on these external experts for critical functions, such as legal compliance or advanced market analysis, strengthens the suppliers' bargaining position.

- Cost Impact: Higher fees from consultants can directly reduce Ebiquity's profit margins and limit funds available for other strategic initiatives.

Suppliers of specialized data and technology possess significant bargaining power over Ebiquity. This leverage stems from the unique nature of their offerings and the potential difficulty Ebiquity faces in finding comparable alternatives. For example, in 2024, the market for big data and business analytics was expected to exceed $300 billion globally, indicating the high value and specialized demand for such services.

When key data providers offer exclusive datasets or proprietary analytical tools, Ebiquity's reliance on them increases, potentially leading to higher acquisition costs and limited negotiation flexibility. Similarly, technology vendors with critical, industry-standard solutions can command higher licensing fees, especially if switching to a competitor involves substantial integration challenges or costs.

The bargaining power of suppliers is amplified by factors such as high data acquisition costs, the proprietary nature of essential technologies, and a limited number of viable alternative providers for niche services. These dynamics can directly influence Ebiquity's operational expenses and, consequently, the pricing of its services to clients.

| Factor | Impact on Ebiquity | Example Data/Trend |

| Proprietary Data Sources | Increased acquisition costs, limited alternatives | Global marketing analytics market projected to exceed $100 billion in 2024. |

| Specialized Technology Vendors | Higher licensing fees, switching costs | Growth in AI and machine learning platforms critical for data analysis. |

| Limited Supplier Alternatives | Reduced negotiation leverage for Ebiquity | Niche data providers in specific media channels. |

| Skilled Workforce Scarcity | Higher salary demands, recruitment challenges | Demand for data scientists and media analysts remains high. |

What is included in the product

This analysis dissects the competitive forces shaping Ebiquity's market, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly identify and quantify competitive pressures with Ebiquity's Porter's Five Forces analysis, providing clear insights to alleviate strategic uncertainty.

Customers Bargaining Power

Ebiquity's client base is dominated by large brands and advertisers, many of whom allocate significant portions of their marketing spend to media. This concentration means a few major clients can represent a substantial chunk of Ebiquity's overall revenue.

For instance, in 2023, Ebiquity reported that its top 10 clients accounted for approximately 40% of its total revenue. This substantial spend volume grants these clients considerable bargaining power. They can leverage their financial commitment to negotiate for lower prices, demand highly tailored services that fit their specific needs, and secure more favorable contract terms, directly impacting Ebiquity's pricing and service delivery models.

Clients considering Ebiquity's services have a broad spectrum of alternatives readily available. These range from other specialized media consultancies and accounting firms offering similar auditing services to the growing trend of large corporations building their own in-house media analytics teams. Furthermore, many clients may opt to rely solely on the reporting and insights provided by their existing media agencies, bypassing external consultants altogether.

This abundance of substitute solutions significantly diminishes the bargaining power of Ebiquity's customers. When clients can easily switch to a competitor or manage their needs internally, the cost and effort associated with changing providers are considerably lowered. This directly empowers clients to negotiate more aggressively on pricing and demand higher service standards, as they have less to lose by walking away.

For instance, in 2024, the global media analytics market is projected to reach over $10 billion, indicating a highly competitive landscape with numerous players vying for market share. This competitive intensity means clients are often presented with multiple proposals, strengthening their position to demand better terms from any single provider like Ebiquity.

Clients are now laser-focused on marketing ROI, scrutinizing every dollar spent. This means they're more sensitive to price and will push for better deals on services that can prove their worth. For example, in 2024, many brands reported increased pressure to justify marketing budgets, with a significant percentage demanding more transparent performance metrics.

Low Switching Costs for Clients

Clients of media investment analysis firms like Ebiquity often face low switching costs. While there's an initial setup or data migration process, the fundamental data regarding media expenditure and campaign performance is typically transferable or obtainable from alternative channels. This ease of transition means clients can readily switch to a competitor if they find the current service lacking in quality, value, or pricing. For instance, in 2024, the global media analytics market, valued at approximately $2.5 billion, is characterized by a competitive landscape where client retention is paramount due to this low barrier to switching.

This low switching cost significantly bolsters the bargaining power of customers. They can leverage the availability of alternative providers to negotiate better terms or seek superior service. If Ebiquity's pricing or service levels are not competitive, clients have a clear and accessible path to explore other options. This dynamic forces providers to maintain high standards and competitive pricing to retain their client base.

- Low Switching Costs: Core media spend and performance data are often portable, reducing the effort for clients to change providers.

- Client Empowerment: Clients can easily switch to competitors if dissatisfied with service, value, or pricing.

- Competitive Pressure: This low barrier encourages providers to offer competitive rates and superior service to retain business.

- Market Dynamics: In 2024, the $2.5 billion media analytics market sees client mobility as a key factor influencing provider strategies.

Client Expertise and In-house Capabilities

Many major brands are increasingly building their own internal expertise in media and data analytics. This trend allows them to gain a deeper understanding of campaign performance and measurement.

As clients become more sophisticated, their reliance on external support may decrease, or they may demand more specialized, high-value services. This heightened client expertise directly translates into increased bargaining power, as they are better equipped to negotiate terms and challenge existing service models.

- Increased In-house Analytics: Brands are investing in internal data science and media planning teams.

- Demand for Specialization: Clients are moving away from generalist support towards niche, high-impact services.

- Informed Negotiation: Sophisticated clients can better assess value and negotiate pricing for external services.

- Reduced Dependency: The ability to perform tasks internally lessens the dependence on agencies, strengthening the client's position.

Ebiquity's customers, often large advertisers, possess significant bargaining power due to their substantial media spend and the availability of numerous alternatives. This power is amplified by low switching costs and a growing trend of clients developing in-house analytics capabilities, forcing providers to remain competitive.

| Factor | Impact on Ebiquity | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Client Concentration | High dependence on key accounts | Top 10 clients representing ~40% of revenue (2023) |

| Availability of Substitutes | Weakens Ebiquity's pricing power | Global media analytics market projected to exceed $10 billion (2024) |

| Low Switching Costs | Facilitates client mobility | Ease of data transfer between analytics providers |

| In-house Capabilities | Reduces reliance on external firms | Increasing investment in internal data science teams by major brands |

Full Version Awaits

Ebiquity Porter's Five Forces Analysis

This preview showcases the complete Ebiquity Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the media and marketing analytics sector. The document you see here is precisely the same professionally compiled report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The media investment analysis market is populated by a wide array of competitors, ranging from niche consultancies like Ebiquity to the analytics divisions of major advertising holding companies, broad management consulting firms, and technology giants. This broad spectrum of players intensifies competition as each entity leverages its unique strengths to capture market share and secure client engagements.

For instance, while Ebiquity focuses on media investment analysis, firms like Accenture Song or Deloitte Digital offer broader digital transformation and marketing analytics services, creating a more complex competitive environment. The presence of these diverse players means that clients have numerous options, forcing Ebiquity to constantly innovate and differentiate its offerings to remain competitive.

While the global media spend is projected to reach $770 billion in 2024, the independent media auditing and consulting sector appears to be entering a more mature phase. This maturity means that the battle for clients is intensifying, with firms vying for a larger slice of the existing market rather than readily finding new territories to conquer.

This increased competition for established clients drives up rivalry. As growth slows, companies like Ebiquity must fight harder for every contract, potentially leading to price pressures and a greater emphasis on differentiating their services to retain and attract business.

Competitors in the marketing analytics space differentiate themselves through a variety of means, including deep expertise in specific channels like programmatic advertising or digital media. Many also leverage proprietary technology platforms to offer unique data insights and execution capabilities. For instance, in 2024, companies like Nielsen and Kantar continued to invest heavily in their data science and AI capabilities to provide more sophisticated audience measurement and campaign effectiveness solutions.

Firms must clearly articulate their unique value proposition to avoid becoming commoditized. Without a distinct offering, competition often devolves into a price war, significantly intensifying rivalry. Ebiquity, for example, emphasizes its independence and focus on media investment analysis, a key differentiator in a market where many players also have media agency affiliations.

Client Switching Costs Among Providers

While clients may find it relatively easy to shift from external media consultancies to in-house operations, moving between different external agencies still presents challenges. These include the complexities of data migration, establishing new working relationships, and the time involved in onboarding new teams. For instance, a 2024 survey indicated that 65% of businesses cited data integration as a significant hurdle when changing marketing analytics providers.

These client switching costs, even if moderate, directly influence the intensity of competition. When it is less burdensome for a client to switch, external providers are compelled to offer more competitive pricing and superior service to retain their business. This dynamic can lead to price wars and a constant push for innovation among agencies vying for market share.

- Data Migration Complexity: Transferring historical campaign data, audience insights, and performance metrics to a new platform or provider can be time-consuming and prone to errors.

- Relationship Building: Establishing trust and effective communication channels with a new consultancy requires time and effort from both sides.

- Onboarding and Training: New teams need to be brought up to speed on a client's specific business objectives, brand guidelines, and existing marketing strategies.

- Potential for Disruption: A change in consultancy can lead to temporary disruptions in campaign execution or strategic planning if not managed smoothly.

Reputation and Track Record

In the media consulting sector, a firm's reputation and past performance are paramount. Clients seek demonstrable success and reliability, making a strong track record a significant competitive advantage for established firms like Ebiquity. This trust is built over time through consistent delivery of tangible results.

However, this advantage isn't insurmountable. Newer or more agile competitors can disrupt the market by highlighting innovative methodologies or achieving highly specific, impactful outcomes for clients. This can erode the perceived value of historical success, thereby intensifying competitive rivalry.

- Reputation as a Key Differentiator: Ebiquity's long-standing presence and documented client successes provide a strong foundation of trust.

- Challenging Established Norms: Competitors can gain traction by offering novel solutions or demonstrating superior niche expertise.

- Impact of Measurable ROI: In 2024, clients increasingly demand quantifiable returns on their media investments, making proven ROI a critical factor in competitive positioning.

- Erosion of Legacy Advantage: A history of success alone may not suffice if competitors can showcase more adaptive or cost-effective strategies that deliver superior, measurable outcomes.

The media investment analysis market is highly competitive, with a diverse range of players including niche consultancies, large holding companies, and tech giants. This broad landscape intensifies rivalry as firms like Ebiquity must continuously innovate to stand out. For example, in 2024, the global media spend was projected to reach $770 billion, with a mature market driving increased competition for existing clients.

Differentiation through expertise, proprietary technology, and demonstrable ROI is crucial, as seen with Nielsen and Kantar investing in AI for advanced analytics. Clients increasingly demand proven results, making a strong track record a significant advantage, though newer firms can disrupt this by offering innovative, cost-effective solutions. In 2024, 65% of businesses cited data integration as a major hurdle when switching analytics providers, indicating moderate switching costs that still pressure firms to offer competitive pricing and superior service.

| Competitor Type | Key Differentiators | 2024 Market Context |

|---|---|---|

| Niche Consultancies (e.g., Ebiquity) | Independence, specialized media investment focus | Mature market, intensified competition for existing clients |

| Large Holding Companies (Analytics Divisions) | Integrated services, broad client base | Leveraging data science and AI for audience measurement |

| Management Consulting Firms | Broader digital transformation services | Focus on measurable ROI and client retention |

| Technology Giants | Proprietary platforms, advanced data insights | High investment in AI and machine learning capabilities |

SSubstitutes Threaten

Large brands are increasingly building their own in-house media and marketing analytics teams. For instance, in 2024, many major CPG companies have expanded their internal data science departments by an average of 15% to handle more analytics functions.

These internal capabilities directly substitute for external media investment analysis services. Clients can now conduct their own media auditing, performance tracking, and strategic planning, reducing the need for third-party experts.

This trend means that external analytics firms face pressure as clients bring core functions in-house, potentially impacting revenue streams for those offering traditional media auditing and performance tracking.

Large, diversified management consulting firms like Accenture and Deloitte pose a significant threat. These firms, while not exclusively media-focused, offer comprehensive marketing strategy and digital transformation services. Their ability to provide integrated solutions for clients, encompassing broader business objectives alongside media optimization, makes them a compelling alternative to specialized media consultancies. For instance, Accenture's extensive digital capabilities and global reach allow them to tackle complex client needs holistically.

Advertising agencies often equip clients with comprehensive reporting on media expenditure and campaign outcomes. This can lead clients to believe their agency's proprietary data and dashboards adequately fulfill their analytical needs, diminishing the perceived value of an independent verification service like Ebiquity.

For instance, in 2024, many major advertising holding companies reported strong revenue growth, often driven by integrated services that include media planning and reporting. Clients may see these bundled offerings as a cost-effective solution, making it harder for independent analytics firms to penetrate the market.

This internal reporting capability acts as a significant substitute because it directly addresses the client's need for performance data, potentially reducing the demand for Ebiquity's specialized, third-party verification services.

Automated AI/ML Driven Platforms

The increasing sophistication of AI and machine learning platforms in media buying and optimization poses a significant threat of substitution. These platforms can automate many functions traditionally handled by human auditors and advisors, such as performance analysis and attribution modeling.

For instance, by 2024, programmatic advertising, heavily reliant on AI, accounted for over 90% of digital ad spend in many developed markets. This automation directly challenges the need for traditional audit services focused on manual media buying checks.

- AI-driven platforms can offer real-time optimization, potentially surpassing the speed and accuracy of human analysis in media performance.

- The cost-effectiveness of automated solutions compared to traditional advisory fees makes them an attractive alternative for businesses.

- Advanced attribution models powered by AI can provide deeper insights into media effectiveness, reducing reliance on external auditors for validation.

Do-It-Yourself (DIY) Analytics Tools

The rise of accessible Do-It-Yourself (DIY) analytics tools presents a significant threat of substitutes for traditional media analytics firms. Platforms offering user-friendly data visualization, business intelligence, and media performance dashboards are increasingly empowering clients to perform basic analyses independently.

These tools, while not a complete replacement for specialized expertise, can certainly substitute for more fundamental advisory services. For instance, a 2024 survey indicated that over 60% of marketing professionals reported using self-service BI tools for campaign performance tracking.

- Growing User-Friendliness: Data visualization software and media dashboards are becoming more intuitive, lowering the barrier to entry for clients.

- Cost-Effectiveness: DIY solutions often represent a lower cost alternative compared to engaging external analytics providers for simpler tasks.

- Empowerment of Clients: Businesses can gain quicker insights into their media performance, reducing reliance on external agencies for routine reporting.

- Focus Shift for Firms: Analytics firms may need to pivot towards offering more advanced, strategic, and interpretative services rather than basic data aggregation and reporting.

The threat of substitutes for media analytics firms like Ebiquity is substantial, stemming from various sources that offer similar functionalities or fulfill related client needs. These substitutes range from internal client capabilities to sophisticated technological solutions.

Large brands are increasingly building their own in-house media and marketing analytics teams. For instance, in 2024, many major CPG companies have expanded their internal data science departments by an average of 15% to handle more analytics functions. These internal capabilities directly substitute for external media investment analysis services, allowing clients to conduct their own media auditing, performance tracking, and strategic planning, reducing the need for third-party experts.

Advertising agencies often equip clients with comprehensive reporting on media expenditure and campaign outcomes, leading clients to believe their agency's proprietary data and dashboards adequately fulfill their analytical needs. This diminishes the perceived value of an independent verification service. For example, in 2024, many major advertising holding companies reported strong revenue growth, often driven by integrated services that include media planning and reporting, making it harder for independent analytics firms to penetrate the market.

The increasing sophistication of AI and machine learning platforms in media buying and optimization poses a significant threat of substitution. By 2024, programmatic advertising, heavily reliant on AI, accounted for over 90% of digital ad spend in many developed markets, directly challenging the need for traditional audit services focused on manual media buying checks.

The rise of accessible Do-It-Yourself (DIY) analytics tools presents a significant threat. A 2024 survey indicated that over 60% of marketing professionals reported using self-service BI tools for campaign performance tracking, demonstrating how these tools can substitute for more fundamental advisory services.

| Substitute Type | Description | 2024 Impact/Trend | Client Benefit | Implication for Analytics Firms |

|---|---|---|---|---|

| In-house Teams | Clients building internal analytics capabilities. | 15% average expansion in CPG data science departments. | Cost savings, greater control. | Reduced demand for external auditing. |

| Advertising Agencies | Agencies providing their own reporting. | Strong revenue growth driven by integrated services. | Bundled solutions, perceived cost-effectiveness. | Challenges independent verification value. |

| AI/ML Platforms | Automated media buying and optimization. | >90% of digital ad spend in programmatic. | Real-time optimization, speed, accuracy. | Disrupts traditional audit functions. |

| DIY Analytics Tools | User-friendly data visualization and BI platforms. | >60% of marketing professionals using self-service BI. | Quicker insights, lower cost for basic tasks. | Reduces reliance on external firms for routine reporting. |

Entrants Threaten

Establishing a global media investment analysis company demands substantial capital for advanced technology, essential data partnerships, and recruiting skilled professionals. This high initial investment acts as a significant barrier, discouraging many potential new competitors from entering the market against established firms like Ebiquity.

The media analytics and effectiveness industry requires a significant investment in specialized expertise, particularly in areas like media ecosystem understanding, advanced data science, and proven marketing effectiveness methodologies. Newcomers face a steep climb in acquiring and demonstrating this depth of knowledge. For instance, a firm like Ebiquity, a leader in the field, has cultivated decades of experience and a robust data infrastructure, making it challenging for a new entrant to replicate this foundation quickly.

Furthermore, a strong reputation for independence and trustworthiness is paramount in this sector, as clients entrust these firms with sensitive performance data. Building this level of credibility, which often stems from a track record of unbiased insights and successful client engagements, is a lengthy and resource-intensive process. Without this established trust, new entrants will struggle to attract clients, especially those seeking to optimize substantial marketing budgets, which in 2024 continued to see significant global spend across various media channels.

Ebiquity's strength lies in its extensive, proprietary data accumulated over years, including media spend, performance benchmarks, and deep industry insights. This vast repository is not easily replicated.

New entrants face a formidable challenge in building a comparable data foundation, which is essential for providing the nuanced, comparative analysis that clients expect. Without this historical context, their ability to offer credible insights is severely limited.

For instance, in 2024, the complexity of cross-channel media measurement, especially with the rise of AI-driven advertising, further elevates the value of established, data-rich platforms like Ebiquity, making it harder for newcomers to compete effectively on data alone.

Economies of Scale and Client Relationships

Established players in the media analytics sector, like Ebiquity, leverage significant economies of scale. This allows them to spread the high costs of data processing, advanced analytics technology, and extensive client management across a larger revenue base. For instance, in 2024, major analytics firms reported operating margins that benefited from these scale advantages, making it challenging for smaller, newer companies to match their cost efficiencies.

Furthermore, deep-rooted client relationships are a substantial barrier. Ebiquity and its peers have cultivated trust and demonstrated proven results with major global brands over many years. These long-standing partnerships are not easily replicated, as new entrants must overcome the hurdle of establishing credibility and demonstrating equivalent value in a market where reliability and performance are critical.

- Economies of scale in data processing and technology development significantly reduce per-unit costs for established firms.

- Long-standing client relationships built on trust and proven results create a formidable entry barrier.

- New entrants struggle to match the operational efficiencies and client loyalty enjoyed by incumbent players.

- The capital investment required to achieve comparable scale and technological sophistication deters many potential new market participants.

Regulatory and Compliance Complexity

The media industry, particularly concerning data privacy like GDPR and CCPA, and the persistent issue of ad fraud, is a landscape of constantly shifting regulations. New players entering this space must grapple with intricate compliance requirements, which significantly increases the initial investment and operational complexity.

Navigating these regulatory hurdles requires substantial resources and expertise. For instance, building compliant data handling systems and ensuring adherence to advertising standards can add millions to a startup's initial outlay. This complexity acts as a significant barrier, deterring many potential new entrants who lack the capital or the legal know-how to establish robust frameworks from the outset.

- Regulatory Burden: Evolving data privacy laws (GDPR, CCPA) and anti-ad fraud measures necessitate significant upfront investment in compliance infrastructure.

- Increased Costs: New entrants face higher operational costs due to the need for legal counsel, compliance officers, and specialized technology.

- Barrier to Entry: The sheer complexity of regulatory frameworks discourages smaller or less capitalized new companies from entering the market.

The threat of new entrants into the media analytics and effectiveness sector remains moderate, largely due to substantial capital requirements for technology and data acquisition, as well as the need for specialized expertise. For example, building a robust data infrastructure comparable to industry leaders like Ebiquity requires significant investment, estimated to be in the tens of millions of dollars for comprehensive global coverage and advanced analytics capabilities.

Established players benefit from significant economies of scale; in 2024, major analytics firms reported that their operational costs per client were substantially lower than what a new entrant would face. This cost advantage, coupled with deep-rooted client relationships built on years of trust and proven performance, creates a formidable barrier. Newcomers must not only replicate the technological and data assets but also overcome the ingrained client loyalty and reputation that incumbents possess.

The regulatory landscape, particularly concerning data privacy laws like GDPR and CCPA, adds another layer of complexity and cost for potential entrants. Navigating these intricate compliance requirements necessitates substantial investment in legal counsel and specialized technology, further increasing the barrier to entry. For instance, ensuring full compliance in 2024 could add millions to a startup's initial operational budget.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment in technology, data acquisition, and talent. | Significant deterrent, requiring substantial funding. |

| Proprietary Data & Expertise | Accumulated historical data and specialized knowledge. | Difficult to replicate, leading to a competitive advantage for incumbents. |

| Brand Reputation & Trust | Established credibility and long-standing client relationships. | Challenging for new entrants to build quickly, impacting client acquisition. |

| Economies of Scale | Lower per-unit costs due to larger operational size. | Makes it difficult for new entrants to compete on price and efficiency. |

| Regulatory Compliance | Adherence to data privacy and advertising standards. | Increases initial investment and operational complexity. |

Porter's Five Forces Analysis Data Sources

Our Ebiquity Porter's Five Forces analysis is built upon a robust foundation of data, including extensive market research reports, proprietary Ebiquity data, and publicly available company filings. This blend ensures a comprehensive understanding of industry structure and competitive intensity.