Ebiquity Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebiquity Bundle

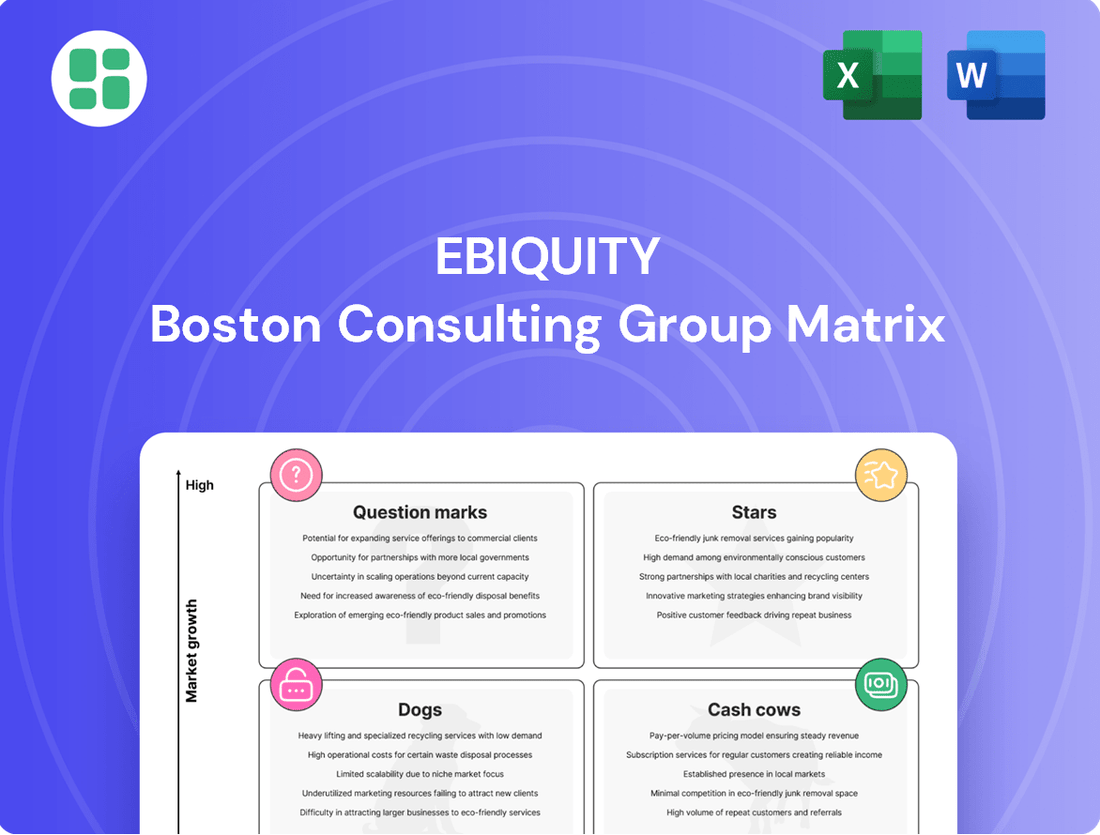

This Ebiquity BCG Matrix offers a glimpse into the strategic positioning of key product lines, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understand the immediate implications of these placements for market share and growth potential.

To truly unlock the power of this analysis and translate these insights into actionable strategies, dive into the full Ebiquity BCG Matrix report. It provides the detailed quadrant breakdowns and data-driven recommendations essential for optimizing your portfolio and driving future success.

Stars

Ebiquity's commitment to AI, including its AI Centre of Excellence and the upcoming agentic AI solution slated for the latter half of 2025, highlights a significant growth opportunity. This initiative is designed to empower clients by validating campaign strategies and optimizing media investments through sophisticated AI.

The advertising sector is rapidly embracing AI for enhanced marketing efficiency, making Ebiquity's AI-powered media optimization a key differentiator. This focus positions the company to capture substantial market share as brands increasingly leverage AI for data-driven decision-making and improved campaign performance.

As advertisers increasingly shift their budgets to Advanced/Connected TV, digital video, and paid social, Ebiquity's expertise in measuring and optimizing these burgeoning digital channels is a standout feature. Brands are actively looking for unified insights across increasingly fragmented media environments, making sophisticated, cross-platform measurement a vital and expanding need. Ebiquity's extensive data analysis, covering over $100 billion in media expenditure, uniquely positions them to excel in this intricate domain.

Retail media is experiencing explosive growth, with projections indicating a 25% increase in ad spend for 2024, reaching an estimated $50 billion in the US alone. This surge positions retail media as a critical channel for brands seeking to connect with consumers at the point of purchase.

Ebiquity's expertise in optimizing media investments, particularly in the burgeoning retail media space, is becoming increasingly vital. Brands are allocating significant portions of their budgets here, and Ebiquity's focus on transparency and ROI maximization will be key to navigating this complex landscape.

The retail media market is a prime area for Ebiquity to expand its influence. With its specialized insights, the company is well-positioned to capture substantial market share by helping brands effectively manage and measure their retail media spend, ensuring these investments deliver tangible results.

Effective and Responsible Advertising (ERA) Solutions

Ebiquity's strategic focus on Effective and Responsible Advertising (ERA) directly addresses the escalating industry imperative for ethical and sustainable media engagement. This commitment positions them to capitalize on the increasing demand for solutions that promote brand safety, foster inclusivity, and mitigate the environmental impact of advertising campaigns.

The market for services that help brands navigate complex issues like brand safety, media inclusion, and the reduction of CO2 emissions in their advertising efforts represents a significant growth opportunity. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, with increasing pressure on advertisers to ensure their spend is not associated with harmful content or unsustainable practices.

- Brand Safety: Ensuring advertisements appear alongside appropriate content, protecting brand reputation.

- Inclusion: Promoting diverse representation and equitable opportunities within media placements.

- CO2 Emission Reduction: Developing strategies to minimize the carbon footprint of digital and traditional media campaigns.

By offering robust solutions that guarantee compliance with evolving regulations and align with core brand values, Ebiquity can further cement its leadership position. This is particularly crucial in a market where consumers and stakeholders increasingly prioritize corporate responsibility, making ethical advertising a key differentiator.

Global Digital Media Governance

As digital media landscapes grow more intricate, brands need strong governance for transparency and accountability. Ebiquity's digital governance initiatives have unlocked over $1 billion in annual client value, addressing a crucial need in this rapidly expanding market.

This independent, data-driven approach to digital media investments spans 123 countries, highlighting Ebiquity's significant market influence.

- Global Reach: Ebiquity's governance programs operate across 123 countries, demonstrating a truly international impact.

- Value Generation: Collectively, their digital governance efforts have generated more than $1 billion in annual value for clients.

- Transparency Focus: The programs are designed to ensure brands have clear visibility and control over their digital media spending.

- Data-Driven Insights: Ebiquity leverages independent data to guide clients' digital media investment decisions.

Stars in the Ebiquity BCG Matrix represent high-growth, high-market-share areas where significant investment is warranted. Ebiquity's AI initiatives, particularly its agentic AI solution, and its strong position in rapidly expanding sectors like retail media and advanced TV advertising, clearly align with this category. These are areas where the company is demonstrating leadership and has the potential for substantial future returns.

The company's focus on AI for media optimization and its deep expertise in high-growth digital channels like CTV and paid social position it as a Star. Furthermore, Ebiquity's proactive approach to Effective and Responsible Advertising (ERA), addressing brand safety, inclusion, and sustainability, taps into a growing market demand. Their proven ability to unlock significant client value through digital governance, exceeding $1 billion annually across 123 countries, underscores their Star status.

| Growth Area | Ebiquity's Position | Market Data (2024 Estimates) | Strategic Importance |

|---|---|---|---|

| AI in Advertising | Developing agentic AI solutions, AI Centre of Excellence | AI adoption in marketing is rapidly increasing for efficiency | Key differentiator for future growth and client value |

| Retail Media | Expertise in optimization and transparency | US ad spend projected to reach $50 billion, up 25% | Critical channel for point-of-purchase engagement |

| Advanced/Connected TV & Paid Social | Cross-platform measurement expertise | Significant budget shifts towards these digital channels | Addresses fragmentation and need for unified insights |

| Effective & Responsible Advertising (ERA) | Focus on brand safety, inclusion, CO2 reduction | Global digital ad market over $600 billion, with growing ethical pressures | Meets increasing demand for ethical and sustainable media |

What is included in the product

The Ebiquity BCG Matrix offers a strategic framework to analyze a company's product portfolio, categorizing units by market growth and share to guide investment decisions.

Clear visualization of media investment performance to identify underperforming areas.

Cash Cows

Ebiquity's core media performance audit services are a cornerstone for their centrally-managed clients, embodying a strong market position. These services are designed to deliver consistent, recurring revenue by helping brand owners fine-tune their media investments.

Despite broader revenue headwinds faced by the company in 2024, these essential media performance solutions for central clients demonstrated resilience, experiencing a notable 9% increase in revenue. This growth underscores the continued demand and perceived value of these audits in optimizing media spend.

Ebiquity’s deep-rooted experience in managing and benchmarking traditional media, including linear TV and print, remains a significant cash generator. Despite the overall decline in ad spend for these channels, Ebiquity leverages its vast historical data and strong client connections to maintain profitability.

These established services, while in mature markets, benefit from Ebiquity’s entrenched market position, allowing them to command a high share and consistent profits. For example, in 2023, Ebiquity reported that its Media Value services, which encompass traditional media analysis, contributed significantly to its revenue, demonstrating the resilience of these offerings.

Ebiquity's marketing effectiveness consulting is a prime example of a cash cow within the BCG matrix. This service consistently delivers strong returns, with clients typically seeing an average improvement in marketing ROI of around 15%.

The mature nature of this offering, built on Ebiquity's extensive analytical expertise, ensures stable, high-margin revenue streams. These ongoing client engagements are a testament to the enduring value and proven success of their marketing effectiveness solutions.

Media Contract Compliance Audits

Media contract compliance audits represent a core offering for Ebiquity, fitting squarely into the Cash Cow quadrant of the BCG matrix. This service addresses a persistent need among major advertisers to verify that their media agencies are adhering to agreed-upon terms and conditions. Ebiquity's established reputation and deep expertise in this niche foster a predictable and robust revenue stream.

The demand for these audits is driven by the significant sums advertisers spend on media, creating a strong incentive for oversight. For instance, global ad spend was projected to reach over $700 billion in 2024, highlighting the scale of contracts that require scrutiny. Ebiquity's high market penetration among leading global advertisers further solidifies its position as a reliable revenue generator in this segment.

- Service Stability: Auditing media agency contracts is a recurring necessity for large advertisers, ensuring ongoing compliance and value.

- Revenue Predictability: Ebiquity's established expertise in this area provides a consistent and dependable income source.

- Market Dominance: The company holds a significant share of the market for these audits among top global advertisers.

- Industry Relevance: With global advertising spend projected to exceed $700 billion in 2024, the need for contract verification remains critical.

Global Spend Benchmarking Database

Ebiquity's Global Spend Benchmarking Database is a true cash cow, fueled by its proprietary analysis of over $100 billion in media spend annually across 123 countries. This extensive dataset is a unique and powerful asset, offering clients unparalleled benchmarks and critical insights into market performance.

The continuous subscription and project-based access to this rich data consistently generate stable revenue streams for Ebiquity. This is achieved with relatively low incremental investment, making it a highly efficient profit generator within their business model.

- Proprietary Database: Analyzes over $100 billion in media spend annually.

- Global Reach: Covers 123 countries, providing broad market insights.

- Stable Revenue: Generated through continuous subscriptions and project-based access.

- Low Additional Investment: High efficiency due to the nature of data utilization.

Ebiquity's marketing effectiveness consulting and media contract compliance audits are prime examples of cash cows. These services benefit from high market share and consistent demand, generating stable, high-margin revenue. For instance, marketing effectiveness consulting typically sees clients achieve an average ROI improvement of around 15%, reflecting its proven value.

The Global Spend Benchmarking Database, analyzing over $100 billion in media spend across 123 countries, also functions as a cash cow. Its proprietary nature and broad coverage ensure recurring subscription and project-based revenue with low additional investment, solidifying its position as a predictable profit generator.

| Service Area | BCG Quadrant | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| Marketing Effectiveness Consulting | Cash Cow | High ROI for clients (avg. 15%), mature offering, stable margins | Continued strong client demand for ROI optimization. |

| Media Contract Compliance Audits | Cash Cow | Recurring necessity for advertisers, predictable revenue, high market penetration | Global ad spend projected over $700 billion in 2024, requiring significant contract oversight. |

| Global Spend Benchmarking Database | Cash Cow | Proprietary data ($100B+ annually), global reach (123 countries), low incremental cost | Consistent subscription revenue from a large, established client base. |

What You See Is What You Get

Ebiquity BCG Matrix

The preview you're examining is the identical Ebiquity BCG Matrix report you will receive upon purchase. This means you're seeing the fully developed, analysis-ready document, complete with all strategic insights and formatting, ready for immediate application in your business planning.

Dogs

In 2024, Ebiquity's one-off Media Management services appear to be positioned as a 'Dog' within the BCG Matrix. Revenue from these services saw a decline, suggesting they are not a strong performer and may be draining resources.

These one-off services likely struggle with recurring revenue streams and face intense market competition. Their limited contribution to profitability and uncertain future growth prospects are key indicators of their 'Dog' status.

Legacy reporting and analytics platforms, often characterized by their age and inflexibility, fall into the question mark category of the Ebiquity BCG Matrix. These systems demand substantial upkeep but provide minimal advanced functionality, making them a drain on resources. For instance, many financial institutions still rely on legacy systems that were developed decades ago, leading to high maintenance costs that can exceed 70% of their IT budget, according to industry reports from 2024.

Ebiquity experienced significant headwinds in 2024, largely attributed to aggressive pricing tactics from competitors in certain service areas. This indicates that some of Ebiquity's offerings operate within highly price-sensitive, commoditized segments where clients are primarily focused on immediate cost savings rather than long-term value. These segments typically result in thin profit margins and struggle to gain substantial market share.

Operating in these intensely competitive, low-growth markets without a clear unique selling proposition makes Ebiquity's position vulnerable. For instance, if a significant portion of their revenue in 2024 came from such commoditized services, it would explain the pressure on profitability. Without a strategy to differentiate or move up the value chain, these services risk becoming a drain on resources.

Underperforming Regional Operations in Declining Markets

Underperforming regional operations in declining markets, as depicted in the Ebiquity BCG Matrix, represent business units that are experiencing low growth and possess a small market share. These are often referred to as 'Dogs' in the matrix.

For Ebiquity, this could manifest in specific service lines within Continental Europe, North America, or APAC that have seen revenue declines in H1 2024 and are struggling to gain traction. For instance, if a particular data analytics offering in a shrinking European market consistently misses its growth projections, it would fit this category.

These 'Dogs' can be resource drains. Ebiquity's H1 2024 results showed a revenue decline across these key regions, highlighting the challenge. If these specific operations are not showing signs of improvement or a clear path to profitability, a strategic decision regarding their future is paramount.

- Resource Drain: Operations with low market share in declining markets consume capital and management attention without generating significant returns.

- Strategic Review: A thorough assessment is necessary to determine if these units can be revitalized or if divestment is the more prudent course of action.

- Divestment/Restructuring: Options include selling off the underperforming segment or undertaking significant operational changes to improve efficiency and market position.

Outdated Traditional Media Monitoring Services

Traditional media monitoring services, those solely focused on print and linear TV, are likely positioned as Dogs in the Ebiquity BCG Matrix. These channels are seeing substantial budget cuts; for instance, global ad spend on linear TV is projected to decline by 2% in 2024, according to Magna Global.

Without a pivot to include digital channels or a distinct value proposition, these services face low growth and shrinking market share. Their ability to generate revenue may be limited, potentially just covering costs while consuming resources that could be reinvested in more promising areas.

- Declining Budgets: Linear TV ad spend is expected to decrease globally in 2024.

- Limited Growth: Lack of digital integration hinders expansion prospects.

- Resource Drain: Services may tie up capital and personnel without significant returns.

- Diminishing Relevance: Focus on legacy media alienates a growing digital audience.

Ebiquity's one-off Media Management services and traditional media monitoring are classified as Dogs in the BCG Matrix due to declining revenue and intense competition. These offerings struggle with recurring revenue and face pressure from commoditized segments, leading to thin profit margins and limited market share. For instance, global ad spend on linear TV is projected to decline by 2% in 2024, impacting traditional monitoring services.

Underperforming regional operations in declining markets also fall into the Dog category. These units, such as specific data analytics offerings in shrinking European markets, experience low growth and small market share, as evidenced by revenue declines in key regions for Ebiquity in H1 2024. These 'Dogs' represent resource drains that require strategic review, potentially leading to divestment or restructuring.

| Service Area | BCG Category | Rationale | 2024 Data/Projection |

|---|---|---|---|

| One-off Media Management | Dog | Declining revenue, intense competition, low profitability | Limited contribution to overall revenue growth |

| Traditional Media Monitoring | Dog | Shrinking market share, reliance on declining channels | Global linear TV ad spend projected to decline 2% in 2024 |

| Underperforming Regional Operations | Dog | Low growth, small market share in declining markets | Revenue declines in specific regions (e.g., Continental Europe) in H1 2024 |

Question Marks

Ebiquity's emerging market expansion initiatives are classified as Question Marks in the BCG Matrix. These efforts focus on entering new geographic territories or strengthening their foothold in developing regions where their market share is still nascent. For example, Ebiquity's strategic investments in the Southeast Asian market, a region demonstrating robust digital advertising growth, exemplify this. While these markets present substantial growth opportunities, they also necessitate considerable investment with uncertain outcomes.

The agentic AI solution slated for a second-half 2025 launch firmly resides in the Question Mark category of the Ebiquity BCG Matrix. This classification acknowledges its considerable potential for market growth, yet simultaneously highlights the inherent uncertainty surrounding its future adoption rates and the capacity to capture substantial market share.

Significant investment in research and development is a key characteristic of this phase. For 2025, Ebiquity is allocating a substantial portion of its R&D budget, estimated to be around $50 million, specifically to accelerate the development and ensure a robust market entry for this innovative AI solution.

Ebiquity's burgeoning focus on Environmental, Social, and Governance (ESG) issues, particularly in measuring and reducing the carbon footprint of media activities, positions it as a 'Question Mark' within the BCG matrix. This segment is characterized by high growth potential but currently holds a low market share for the company.

The market for sustainability consulting within the advertising sector is still in its nascent stages. This requires substantial investment from Ebiquity to build specialized expertise and gain traction with clients, mirroring the resource demands of a typical 'Question Mark' opportunity.

Achieving success in this emerging vertical could propel Ebiquity to a leading position in a new and increasingly vital area of advertising and media management. For instance, by 2024, a significant portion of global advertising spend is expected to be influenced by sustainability considerations, underscoring the market's rapid evolution.

Partnerships with Niche Ad-Tech Innovators

Forging strategic partnerships with niche ad-tech innovators falls into the Question Mark category within the Ebiquity BCG Matrix. These collaborations are designed to tap into high-growth potential by integrating cutting-edge solutions. However, they carry significant risks, including uncertain market adoption and the challenge of scaling these relationships into robust revenue streams.

These ventures require substantial investment in managing and developing the partnerships. The goal is to leverage the agility and specialized technology of these smaller firms to gain a competitive edge. For instance, a partnership might focus on a new AI-driven audience segmentation tool that promises to unlock previously inaccessible consumer groups.

- High Growth Potential: Access to emerging technologies and markets.

- High Risk: Uncertainty in market penetration and return on investment.

- Resource Intensive: Requires significant management effort to nurture and scale.

- Strategic Importance: Crucial for staying ahead in a rapidly evolving ad-tech landscape.

Direct-to-Consumer (D2C) Brand Advisory Services

Expanding Ebiquity's advisory services to the Direct-to-Consumer (D2C) sector presents a classic 'Question Mark' scenario within the BCG framework. While the D2C market is experiencing robust growth, with global e-commerce sales projected to reach $7.4 trillion by 2025, Ebiquity's established model, geared towards large global advertisers, might require significant adaptation to effectively serve these often smaller, more agile D2C brands.

To succeed, Ebiquity would need to develop specialized client acquisition strategies targeting the D2C space, potentially through partnerships or tailored marketing. Furthermore, adapting its service model to cater to the unique needs and budgets of D2C companies, which may prioritize rapid iteration and performance-based metrics over traditional large-scale campaign analysis, will be crucial for gaining traction.

- High Growth Potential: The D2C market continues its rapid expansion, driven by digital transformation and changing consumer preferences.

- Adaptation Required: Ebiquity's existing service model and client acquisition strategies may need significant adjustments to resonate with D2C brands.

- New Client Acquisition: Developing targeted outreach and value propositions for D2C businesses is essential for market penetration.

- Service Model Evolution: Flexibility in service offerings to accommodate the unique operational and financial characteristics of D2C companies is key.

Question Marks represent business units or initiatives with low market share in high-growth industries. These ventures require substantial investment to increase market share and are inherently risky due to uncertain future outcomes. Ebiquity's exploration of new markets and innovative technologies often falls into this category, demanding careful resource allocation and strategic planning.

| Initiative | Market Growth | Market Share | Investment Need | Risk Level |

| Southeast Asia Expansion | High | Low | High | High |

| Agentic AI Solution | High | Low | High | High |

| ESG Measurement Services | High | Low | High | High |

| D2C Advisory Services | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position business units.