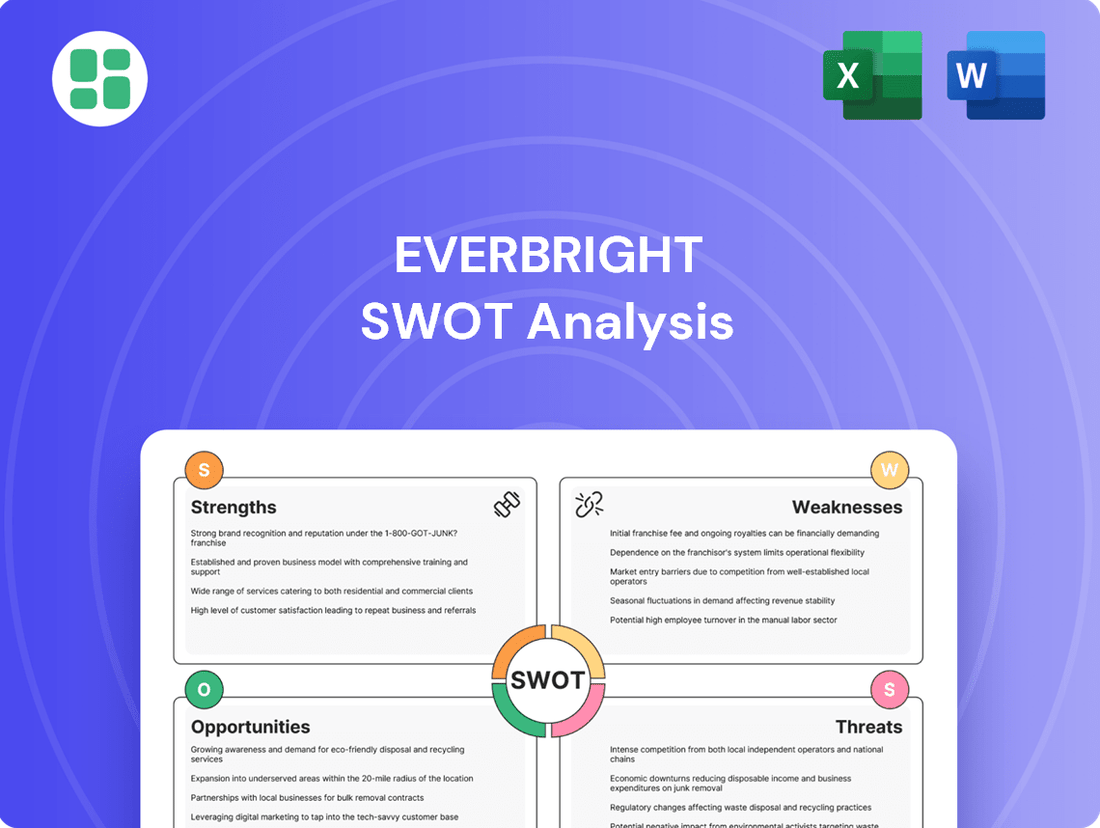

Everbright SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everbright Bundle

Everbright's robust financial backing and extensive network are significant strengths, but its reliance on specific markets presents a notable vulnerability. Understanding these dynamics is crucial for anyone looking to navigate its landscape.

Want the full story behind Everbright's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

China Everbright Group's state-owned status is a significant strength, offering a strong foundation of financial stability and implicit government backing. This governmental support often translates into advantages like easier access to capital and smoother navigation of regulatory processes, which is crucial for a large financial conglomerate.

This implicit guarantee from the Chinese government bolsters investor confidence, providing a crucial safety net during volatile economic periods. For instance, in 2023, state-owned enterprises (SOEs) in China generally maintained stronger credit ratings and access to financing compared to many private sector peers, reflecting this inherent advantage.

Everbright's diversified business portfolio, spanning banking, securities, asset management, industrial investments, and real estate, significantly reduces its dependence on any single market. This broad operational spread acts as a buffer against sector-specific volatility, fostering more consistent revenue generation.

For instance, as of the first half of 2024, Everbright Securities reported a net profit of RMB 7.5 billion, while its asset management arm contributed steadily, showcasing the benefits of this multi-faceted approach. This diversification not only stabilizes performance but also unlocks opportunities for cross-segment synergies, enhancing overall group resilience.

China Everbright Group's robust foundation in banking, securities, and asset management is a significant strength. This core financial services expertise underpins a stable revenue stream and fosters deep client relationships. For instance, as of the first half of 2024, Everbright Securities reported a net profit attributable to shareholders of RMB 4.6 billion, demonstrating the profitability of its core operations.

Extensive Domestic Network and Market Penetration

Everbright Group boasts a deeply entrenched domestic network across China, a significant advantage in a market as vast and diverse as its own. This extensive reach allows them to tap into a broad spectrum of consumers and businesses, particularly benefiting from China's ongoing economic development and localized growth opportunities. For instance, by the end of 2023, Everbright Securities reported a substantial increase in its retail investor base, underscoring their market penetration.

This strong domestic presence translates into unparalleled market penetration, giving Everbright a unique ability to leverage regional economic trends and government-led initiatives. Their established footprint facilitates direct engagement with evolving consumer financial demands throughout the nation. In 2024, Everbright Bank continued to expand its branch network, particularly in tier-two and tier-three cities, further solidifying its domestic market share.

- Extensive Network: Everbright Group operates an expansive network of branches and service points throughout China.

- Market Penetration: The group holds a significant market share across various financial services sectors within the domestic market.

- Customer Access: Deep penetration provides access to a vast and diverse customer base, crucial for growth.

- Leveraging Domestic Trends: The network enables effective capitalization on localized economic growth and consumer financial needs.

Alignment with National Strategic Goals

Everbright's strategic focus on supporting China's economic expansion through its diverse financial services directly aligns with national development priorities. This synergy positions the group to benefit from government backing and secure involvement in major national initiatives, such as the Belt and Road Initiative, which saw significant investment and policy support throughout 2024.

This alignment translates into tangible advantages, including preferential access to capital for state-backed projects and a central role in implementing national economic policies. For instance, Everbright Securities played a role in facilitating capital for key infrastructure projects in 2024, underscoring its contribution to national economic stability.

- National Strategy Alignment: Everbright's business model is intrinsically linked to China's economic growth objectives.

- Policy Support Advantage: Proximity to national goals often yields favorable regulatory treatment and policy incentives.

- Project Participation: The group is well-positioned to participate in large-scale national development and infrastructure projects, a trend that continued to be a focus in 2024.

- Economic Stability Contribution: Everbright's operations contribute to the nation's broader economic stability and prosperity.

Everbright's state-backed status provides significant financial stability and implicit government support, easing capital access and regulatory navigation. This backing, evident in the generally stronger credit ratings of Chinese state-owned enterprises in 2023 compared to private peers, bolsters investor confidence.

The group's diversified business model, encompassing banking, securities, and asset management, mitigates sector-specific risks and ensures more consistent revenue. For example, Everbright Securities reported a net profit of RMB 7.5 billion in the first half of 2024, showcasing the profitability of its core financial services.

Its extensive domestic network across China allows for deep market penetration and access to a broad customer base, capitalizing on localized economic growth. By the end of 2023, Everbright Securities saw a notable increase in its retail investor numbers, highlighting this reach.

Everbright's alignment with China's national economic development strategies positions it to benefit from government initiatives and policy support. This synergy was demonstrated in 2024 when Everbright Securities facilitated capital for key infrastructure projects, contributing to national economic stability.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| State-Owned Status | Implicit government backing and financial stability. | Chinese SOEs generally maintained stronger credit ratings in 2023. |

| Diversified Business Portfolio | Reduces reliance on single markets, fostering stable revenue. | H1 2024: Everbright Securities net profit RMB 7.5 billion. |

| Extensive Domestic Network | Deep market penetration and customer access within China. | End of 2023: Increased retail investor base for Everbright Securities. |

| National Strategy Alignment | Benefits from government support and participation in national initiatives. | 2024: Everbright Securities facilitated capital for infrastructure projects. |

What is included in the product

Analyzes Everbright’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

China Everbright Group's substantial engagement in real estate development leaves it vulnerable to the unpredictable nature and policy changes characterizing China's property market. This exposure is a key weakness, as the sector's fluctuations can directly affect the company's financial health.

The ongoing issues within China's real estate sector, such as developer defaults and falling property prices, present a significant risk. For instance, in late 2023 and early 2024, several major Chinese developers faced liquidity crises, impacting the broader market sentiment and asset values, which could directly influence Everbright's loan portfolio quality and overall profitability.

Everbright's broad operational scope, encompassing financial services, industrial ventures, and real estate, presents significant management challenges. This diversity, while offering potential synergies, can strain resources and introduce complexities in maintaining uniform risk controls and operational efficiency across all segments. For instance, in 2024, Everbright's diverse business lines required distinct regulatory compliance frameworks, adding layers of operational overhead.

As a major financial player, Everbright's broad lending, especially in real estate and industry, inherently exposes it to the risk of non-performing loans (NPLs). A slowing economy or specific industry downturns could see its NPL ratio climb, forcing higher loan loss provisions and potentially hurting its asset quality and profitability.

Government Influence and Policy Risks

Everbright's state-owned nature, while offering advantages, also exposes it to considerable government influence. This can sometimes steer decisions toward policy objectives rather than purely commercial logic, potentially impacting strategic direction and profitability.

Sudden shifts in government regulations or industrial policies pose a significant risk. For instance, a change in capital requirements or dividend payout policies mandated by the state could directly affect Everbright's financial flexibility and investment capacity. In 2024, China's financial sector experienced ongoing regulatory adjustments aimed at deleveraging and managing systemic risks, which could indirectly influence Everbright's operational environment.

- Policy-Driven Decisions: Government objectives may override market-based strategies, potentially leading to suboptimal commercial outcomes.

- Regulatory Uncertainty: Changes in financial regulations, capital adequacy rules, or foreign investment policies can swiftly alter the operating landscape.

- Impact on Autonomy: Directives from state authorities can limit Everbright's strategic and operational independence.

- Economic Sensitivity: Government interventions to manage broader economic cycles can have direct repercussions on the financial sector, including Everbright.

Intense Competition in Mature Financial Markets

The Chinese financial services landscape is incredibly crowded. Everbright Group contends with a multitude of state-owned behemoths, dynamic joint-stock banks, and nimble private financial institutions. This intense rivalry across its banking, securities, and asset management divisions directly challenges its ability to maintain healthy profit margins, secure market share, and drive product innovation.

For instance, as of the first half of 2024, the banking sector saw net profits grow by 2.1% year-on-year, a modest increase reflecting the competitive pressures. Similarly, the securities industry experienced a significant 21.7% year-on-year drop in net profits for listed firms in 2023, underscoring the margin compression faced by players like Everbright Securities.

- Intense Competition: Everbright operates in a saturated market with numerous state-owned, joint-stock, and private financial entities.

- Margin Pressure: Fierce competition directly impacts profitability across banking, securities, and asset management.

- Innovation Challenges: The need to constantly innovate to stand out in a crowded market strains resources and can slow product development.

- Market Share Erosion: Agile competitors can quickly capture market share, requiring Everbright to continually defend its position.

Everbright's significant exposure to China's volatile real estate market is a key vulnerability. Fluctuations in property values and developer liquidity issues, as seen with major defaults in late 2023 and early 2024, directly threaten its loan portfolio and profitability. Furthermore, the group's diversified operations across financial services, industry, and real estate create complex management challenges, potentially diluting focus and straining resources. This diversity also necessitates navigating varied regulatory frameworks, increasing operational overhead, as observed with distinct compliance needs in 2024.

The intense competition within China's financial services sector, from other state-owned giants to agile private firms, exerts considerable pressure on Everbright's profit margins and market share. For example, the securities industry saw a 21.7% year-on-year drop in net profits for listed firms in 2023, highlighting the margin compression faced by players like Everbright Securities. This competitive landscape demands continuous innovation, which can strain resources and slow product development, while also requiring constant defense of existing market positions.

| Weakness Category | Specific Issue | Impact Example (2023-2024) |

|---|---|---|

| Real Estate Exposure | Vulnerability to property market downturns and developer defaults | Liquidity crises among major Chinese developers in late 2023/early 2024 impacted market sentiment and asset values. |

| Operational Complexity | Challenges in managing diverse business segments (financial services, industry, real estate) | Navigating distinct regulatory compliance frameworks for each segment added operational overhead in 2024. |

| Competitive Landscape | Intense rivalry across banking, securities, and asset management | Securities industry net profits dropped 21.7% YoY for listed firms in 2023, showing margin compression. |

| State Ownership Influence | Potential for government objectives to override commercial logic | Ongoing regulatory adjustments in China's financial sector in 2024 aimed at deleveraging could indirectly affect Everbright's operations. |

Full Version Awaits

Everbright SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Everbright. The complete version becomes available after checkout, offering a comprehensive look at the company's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you receive the exact, detailed report you see here.

Opportunities

China's expanding middle class and accumulating personal wealth create a prime opportunity for China Everbright Group to grow its wealth and asset management divisions. This sector is experiencing robust expansion, with China's high-net-worth individual population projected to reach over 3 million by the end of 2024, managing trillions in assets.

By offering innovative investment products and personalized client advice, Everbright can tap into this burgeoning market. For instance, the demand for sophisticated wealth management solutions surged in 2023, with assets under management in China's private banking sector growing by an estimated 15% year-over-year.

Expanding these services allows Everbright to diversify its income, moving beyond traditional banking. This strategic pivot aims to capture a more substantial share of a market that is forecasted to continue its rapid ascent through 2025 and beyond.

Everbright Group can significantly boost its operational efficiency and customer engagement by embracing digital transformation and integrating cutting-edge FinTech solutions. This strategic move allows for the development of innovative digital financial products, catering to a growing demand for seamless online services.

Investing in technologies such as artificial intelligence (AI), big data analytics, and blockchain presents a key opportunity for Everbright to sharpen its competitive edge. These advancements are crucial for reducing operational costs and expanding its reach to a wider, digitally native customer demographic.

China Everbright Group's status as a state-owned enterprise provides a significant advantage in aligning with and participating in the Belt and Road Initiative (BRI). This strategic positioning unlocks substantial opportunities for international growth and engagement in cross-border project financing.

The BRI offers Everbright a platform to invest in vital infrastructure and industrial projects across numerous participating nations, thereby diversifying its global investment portfolio and expanding its geographical reach. For instance, by 2023, China had signed BRI cooperation agreements with over 150 countries and 30 international organizations, highlighting the vast potential for Everbright's involvement.

Green Finance and Sustainable Investments

China's unwavering dedication to environmental sustainability and achieving carbon neutrality by 2060 fuels a rapidly expanding market for green finance and ESG investments. This presents a significant opportunity for Everbright Group to deepen its involvement in sectors like renewable energy, pollution control, and green infrastructure development, directly supporting national strategic goals.

Everbright can capitalize on this trend by strategically growing its offerings in sustainable finance. For instance, by 2023, China's outstanding green loans reached approximately 13.6 trillion yuan, demonstrating the market's robust growth. Everbright can further integrate ESG principles into its investment strategies and financial products.

- Expanding Renewable Energy Portfolio: Investing in solar, wind, and other clean energy projects.

- Developing Green Bonds and Funds: Offering financial instruments specifically for environmental projects.

- Financing Environmental Protection Initiatives: Supporting businesses focused on waste management and pollution reduction.

- Promoting Sustainable Infrastructure: Funding projects like smart grids and eco-friendly transportation.

Further Financial Market Liberalization

Ongoing reforms in China's financial markets, a trend expected to continue through 2025, are opening doors for Everbright. This gradual liberalization means more opportunities in areas like international investment banking, facilitating cross-border capital flows, and broadening the range of financial products available. For instance, the Shanghai-Hong Kong Stock Connect and the expansion of the Bond Connect program demonstrate this commitment to opening up, allowing foreign investors greater access to China's vast capital markets.

These advancements foster greater innovation within the financial sector, enabling Everbright to explore enhanced market access and forge deeper collaborations with global financial institutions. As China's financial sector continues to integrate with international standards, Everbright is well-positioned to leverage these changes to expand its global footprint and service offerings.

- Increased foreign investment in Chinese markets: By the end of 2024, foreign holdings in Chinese onshore bonds were projected to exceed $500 billion, a testament to market liberalization.

- Expansion of cross-border financial services: Reforms are expected to boost cross-border wealth management and asset management services, areas where Everbright can excel.

- Enhanced collaboration with global players: The push for liberalization encourages partnerships, potentially leading to joint ventures and technology sharing with leading international financial firms.

- Broader product development: Liberalization allows for the introduction of more sophisticated financial instruments and services, catering to a wider range of investor needs.

China's growing middle class and increasing personal wealth present a significant opportunity for Everbright's wealth and asset management divisions. This segment is expanding rapidly, with China's high-net-worth individuals expected to manage trillions in assets by the end of 2024.

By offering innovative investment products and personalized advice, Everbright can tap into this market, which saw a 15% year-over-year growth in private banking assets under management in 2023.

Digital transformation and FinTech integration offer a chance to boost efficiency and customer engagement, leading to new digital financial products that cater to the demand for seamless online services.

Everbright can leverage its state-owned enterprise status to participate in the Belt and Road Initiative, unlocking international growth opportunities in cross-border project financing. By 2023, over 150 countries had signed BRI cooperation agreements, indicating vast potential.

China's focus on green finance and ESG investments, driven by its carbon neutrality goals, creates a strong market for Everbright to expand its offerings in renewable energy and environmental protection, aligning with national strategies. China's green loans reached approximately 13.6 trillion yuan by 2023.

Ongoing financial market reforms in China are opening doors for Everbright in international investment banking and cross-border capital flows. Reforms like the Shanghai-Hong Kong Stock Connect are facilitating greater foreign investor access.

| Opportunity Area | Description | Key Data Point (2023-2024) |

|---|---|---|

| Wealth & Asset Management Growth | Catering to China's expanding affluent population. | China's high-net-worth individuals projected to manage trillions in assets by end of 2024. |

| Digital Transformation & FinTech | Enhancing operational efficiency and customer experience. | 15% YoY growth in private banking AUM in China (2023). |

| Belt and Road Initiative (BRI) Engagement | International growth via cross-border project financing. | Over 150 countries signed BRI cooperation agreements by 2023. |

| Green Finance & ESG Investments | Capitalizing on China's sustainability goals. | China's outstanding green loans reached ~13.6 trillion yuan (2023). |

| Financial Market Liberalization | Expanding services in international investment banking. | Foreign holdings in Chinese onshore bonds projected to exceed $500 billion by end of 2024. |

Threats

China Everbright Group faces a significant threat from an economic slowdown in China. A projected GDP growth of around 4.5% to 5% for China in 2024, down from previous years, could translate into reduced demand for financial services, including investment banking and wealth management, which are core to Everbright's business. This economic cooling also heightens the risk of increased loan defaults across various sectors, potentially impacting the company's asset quality and profitability.

Everbright Group faces a significant threat from increased regulatory scrutiny and tightening measures implemented by the Chinese government. Beijing's proactive approach to managing financial risks, especially within the banking, real estate, and shadow banking sectors, means new rules are a constant possibility.

These regulations, which could include stricter capital requirements, anti-monopoly initiatives, or new lending restrictions, have the potential to directly impact Everbright's established business models. For instance, a hike in capital adequacy ratios, a common regulatory tool, could limit the group's capacity for new lending and investment.

The compliance burden associated with these evolving rules will likely increase operational costs for Everbright. Furthermore, such measures could constrain the group's expansion plans and overall growth trajectory as it navigates a more controlled financial environment.

Escalating geopolitical tensions, particularly between China and key global trading partners, pose a significant threat. These ongoing trade conflicts can create market volatility and erode investor confidence, potentially leading to capital flight from affected regions.

Disruptions to global supply chains are a direct consequence, impacting Everbright Group's industrial investments and operational efficiency. For instance, the ongoing trade friction between the US and China in 2024 continues to create uncertainty in key manufacturing sectors where Everbright has interests.

These international business ventures and the overall valuation of Everbright's assets could be negatively impacted by such instability. The global economic outlook for 2024, influenced by these tensions, suggests a cautious approach to cross-border investments.

Intensified Competition from FinTech Companies

The financial landscape is increasingly shaped by nimble FinTech players, presenting a formidable competitive challenge for established entities like China Everbright Group. These innovative companies leverage technology to deliver user-friendly, cost-efficient digital solutions across various financial services. For instance, by mid-2024, FinTech adoption rates in China saw significant growth, particularly in mobile payments and online lending, areas where traditional banks are also active.

These tech-forward competitors are adept at capturing market share through:

- Superior digital customer experiences, offering intuitive interfaces and personalized services.

- Lower operational costs, allowing them to offer more competitive pricing.

- Rapid product development cycles, enabling quicker responses to market demands and evolving consumer preferences.

This intensified competition particularly impacts areas such as retail banking, wealth management platforms, and payment processing, where FinTechs can often disintermediate traditional providers with specialized, technology-driven offerings.

Asset Quality Deterioration and Credit Risks

A significant threat to China Everbright Group is the potential deterioration of its asset quality, particularly in sectors like real estate or heavily indebted state-owned enterprises. Such downturns could trigger a rise in non-performing loans, leading to increased credit losses. For instance, if the Chinese property market experiences a sharp contraction, Everbright, like other major financial institutions, could see a substantial portion of its real estate-related loans become problematic.

This asset quality decline would directly impact the group's financial health. Higher loan loss provisions would be required, directly eating into profitability. Furthermore, these increased provisions could strain Everbright's capital adequacy ratios, potentially impacting its ability to lend and its overall financial stability. In 2023, for example, many Chinese banks reported an uptick in their non-performing loan ratios, a trend Everbright would need to actively manage.

- Sectoral Downturns: A slump in key industries like property or leveraged SOEs poses a direct threat to Everbright's loan portfolio.

- Increased Non-Performing Assets: Economic headwinds could lead to a significant rise in loans that are not being repaid as scheduled.

- Strain on Capital: Higher credit losses necessitate greater provisions, which can erode capital buffers and impact regulatory compliance.

- Profitability Impact: Increased loan loss provisions directly reduce net income, affecting the group's overall financial performance.

Intensified competition from FinTech firms presents a significant threat, as these agile players offer superior digital experiences and lower costs, particularly in retail banking and wealth management. Additionally, escalating geopolitical tensions, such as ongoing US-China trade friction in 2024, create market volatility and disrupt global supply chains, negatively impacting Everbright's industrial investments and asset valuations.

SWOT Analysis Data Sources

This Everbright SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial reports, detailed market research, and expert industry analyses. These sources provide a robust and accurate understanding of Everbright's internal capabilities and external market positioning.