Everbright PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everbright Bundle

Unlock the critical external factors influencing Everbright's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental concerns, and socio-cultural trends are shaping its market. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full version now and gain a distinct competitive advantage.

Political factors

As a state-owned financial conglomerate, China Everbright Group is heavily influenced by government directives. In 2025, the State-owned Assets Supervision and Administration Commission (SASAC) is focused on restructuring central state-owned enterprises (SOEs) to boost their competitiveness and strategic alignment. This means Everbright's operations and investment strategies will continue to be shaped by national economic objectives and ongoing reforms.

China's financial regulatory environment is undergoing significant transformation, with the National Financial Regulatory Administration (NFRA) setting a clear agenda for 2025. Their focus is squarely on bolstering risk prevention measures and fostering high-quality financial sector development. This proactive approach includes speeding up reforms and addressing existing risks within financial institutions.

Everbright must remain agile to adapt to these evolving regulatory requirements. The government's objective is to safeguard financial stability and mitigate the potential for systemic risks, directly impacting how financial entities operate and manage their portfolios.

China's national strategy is heavily focused on fostering new quality productive forces, aiming to invigorate the economy through technological advancement. This directive encourages state-owned enterprises, like those Everbright might interact with or invest in, to lead in critical and emerging technologies, with artificial intelligence being a key area of emphasis.

Consequently, Everbright's strategic direction will likely see an increased allocation of resources and investment towards sectors that align with these national priorities. This includes areas such as green finance, crucial for sustainable development, and advanced technologies that promise future growth and competitiveness.

Real Estate Market Stabilization Policies

Government intervention to stabilize the real estate market directly impacts Everbright's operations. Policies such as the 'white list' lending program, initiated in late 2023 and continuing into 2024, aim to ensure financing for pre-sale projects, thereby supporting developers and potentially Everbright's financial services arm.

These measures are crucial for restoring confidence in a sector that experienced significant headwinds. For instance, by early 2024, China's real estate investment had seen a notable decline, making such stabilization efforts critical for market recovery.

Everbright's real estate development segment will be influenced by the success of these policies in boosting demand and easing developer liquidity. The focus on increasing the supply of affordable housing also presents potential new avenues for development or financing for the company.

- Government support for pre-sale projects through 'white list' financing is a key stabilization tactic.

- Efforts to boost affordable housing supply could reshape market dynamics and Everbright's opportunities.

- Policy effectiveness in restoring market confidence will directly affect Everbright's real estate exposure.

Geopolitical Tensions and Trade Policies

Geopolitical tensions, particularly those involving major economies like the United States and China, create an uncertain environment for global trade and investment. For a financial conglomerate like Everbright, these tensions can directly affect cross-border capital flows and investment strategies. For instance, ongoing trade disputes could lead to retaliatory tariffs, impacting the profitability of companies operating internationally and subsequently influencing the financial services sector that supports them.

The potential for shifts in trade policies, such as adjustments to tariffs or the imposition of new trade barriers, presents a significant risk. In 2024, the global trade landscape remains dynamic, with countries reassessing their trade relationships. This could lead to increased volatility in financial markets and necessitate adjustments in Everbright's risk management frameworks to account for these external pressures.

- Global Trade Uncertainty: The International Monetary Fund (IMF) has repeatedly highlighted geopolitical fragmentation as a key risk to global economic growth, projecting a slowdown in trade expansion.

- Tariff Impact: For example, a hypothetical 10% tariff on key Chinese exports to the US could reduce bilateral trade volumes, impacting financial transactions and investment banking activities related to these flows.

- Capital Flow Volatility: Increased geopolitical risk often correlates with reduced foreign direct investment (FDI) and portfolio investment into affected regions, creating challenges for financial institutions managing international assets.

Everbright's operations are intrinsically linked to China's state-led economic agenda, with government directives shaping its strategic direction. In 2025, the emphasis on developing new quality productive forces, particularly in areas like artificial intelligence and green finance, will likely steer Everbright's investment and operational focus towards innovation-driven sectors. The ongoing restructuring of state-owned enterprises by SASAC also signifies a push for greater efficiency and strategic alignment, which Everbright, as a state-owned financial conglomerate, must actively participate in.

What is included in the product

This Everbright PESTLE analysis provides a comprehensive examination of the macro-environmental forces shaping its operating landscape, offering actionable insights for strategic decision-making.

The Everbright PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of sifting through extensive data.

Economic factors

China's economy is projected to achieve a GDP growth of approximately 5% in 2025, signaling a continued effort to solidify its recovery. This moderate pace follows a V-shaped recovery in 2024, bolstered by various pro-growth policies.

This stable, albeit not exceptionally rapid, economic expansion creates a predictable operating landscape for Everbright. It allows for strategic planning and investment, balancing the opportunities of growth with the need for sustained consolidation.

China's real estate market faced a significant downturn through 2024, marked by falling sales and property values. However, early 2025 data suggests the pace of this contraction is beginning to slow, offering a glimmer of stabilization.

Government policies are actively trying to shore up the sector. While a full-blown recovery in 2025 remains unlikely, these interventions, such as targeted stimulus and regulatory adjustments, could help reduce excess inventory and boost buyer confidence, directly influencing Everbright's exposure to real estate investments and its lending activities within the sector.

China's monetary policy is expected to remain moderately loose in 2025, with a potential for more active intervention than in 2024. This includes anticipated further reductions in the Reserve Requirement Ratio (RRR) and continued, albeit smaller, decreases in Loan Prime Rates (LPRs). For instance, the People's Bank of China (PBOC) cut the RRR by 0.5 percentage points in early 2024, releasing significant liquidity into the market.

These lower interest rates, a hallmark of this monetary stance, could compress Everbright's net interest margins, a key profitability metric for financial institutions. However, the overarching goal of this policy is to invigorate domestic demand and foster broader economic growth, which could translate into increased lending opportunities and business activity for Everbright.

Capital Market Development and Risk Management

Capital markets are anticipated to experience a gradual upward trend through 2025, characterized by sustained low bond yields and a projected decline in default risk. This environment is favorable for Everbright's core businesses, potentially boosting asset valuations and reducing credit concerns.

Financial regulators are actively identifying and mitigating systemic risks, which is crucial for fostering a more stable and transparent capital market. This proactive approach benefits Everbright by creating a more predictable operating landscape for its securities and asset management divisions.

Key developments in 2024 and projections for 2025 indicate:

- Expected structural slow bull trend in capital markets through 2025.

- Continued low bond yields, potentially supporting equity valuations.

- Decreasing default risk, which is positive for credit-sensitive financial services.

- Increased regulatory focus on identifying and managing high-risk situations.

Expansion of Green Finance

China's commitment to green finance is accelerating, with green loans experiencing robust growth throughout 2024. This expansion is further bolstered by the anticipated acceleration of transition finance standards in 2025, signaling a clear direction for sustainable economic development.

These developments present a significant avenue for Everbright to broaden its offerings in green lending and green bond issuance. By aligning with national objectives for a greener, low-carbon economy, Everbright can tap into a growing market for sustainable investment products.

- Green Loans Growth: Reports indicate a substantial year-on-year increase in green loans in China during 2024, demonstrating strong market demand.

- Transition Finance Standards: The expected finalization and implementation of transition finance standards in 2025 will provide clearer guidelines for financing carbon-intensive industries' shift towards sustainability.

- Market Opportunities: This policy environment creates fertile ground for Everbright to develop and market innovative green financial instruments, including green bonds and sustainability-linked loans.

- Alignment with National Goals: Everbright’s expansion in green finance directly supports China’s dual carbon goals, positioning the company as a key player in the nation’s sustainable economic transition.

China's economic growth is projected to be around 5% in 2025, a stable but moderate pace following a strong recovery in 2024. This steady expansion provides a predictable environment for businesses like Everbright, allowing for strategic planning and investment. However, the real estate sector is still facing challenges, with a slowdown in the pace of contraction observed in early 2025, though a full recovery is not anticipated this year.

Monetary policy is expected to remain supportive, with potential for further liquidity injections through measures like Reserve Requirement Ratio cuts. While lower interest rates might squeeze net interest margins for financial institutions, they aim to boost overall economic activity and lending opportunities. Capital markets are anticipated to trend upwards, benefiting from low bond yields and reduced default risks, creating a more favorable landscape for Everbright's asset management and securities businesses.

China's commitment to green finance is a significant growth area, with strong performance in green loans during 2024. The upcoming transition finance standards in 2025 will further clarify opportunities for financing the shift to sustainability. This presents Everbright with substantial avenues to expand its green lending and green bond offerings, aligning with national environmental goals and tapping into a growing sustainable investment market.

| Economic Indicator | 2024 (Estimate/Trend) | 2025 (Projection) |

|---|---|---|

| GDP Growth | ~5.2% | ~5.0% |

| Real Estate Market | Contraction | Slowing Contraction/Stabilization |

| Monetary Policy Stance | Moderately Loose | Moderately Loose with potential for more active intervention |

| Capital Markets Trend | Gradual Upward Trend | Sustained Gradual Upward Trend |

| Green Loan Growth | Robust | Continued Robust Growth |

Preview the Actual Deliverable

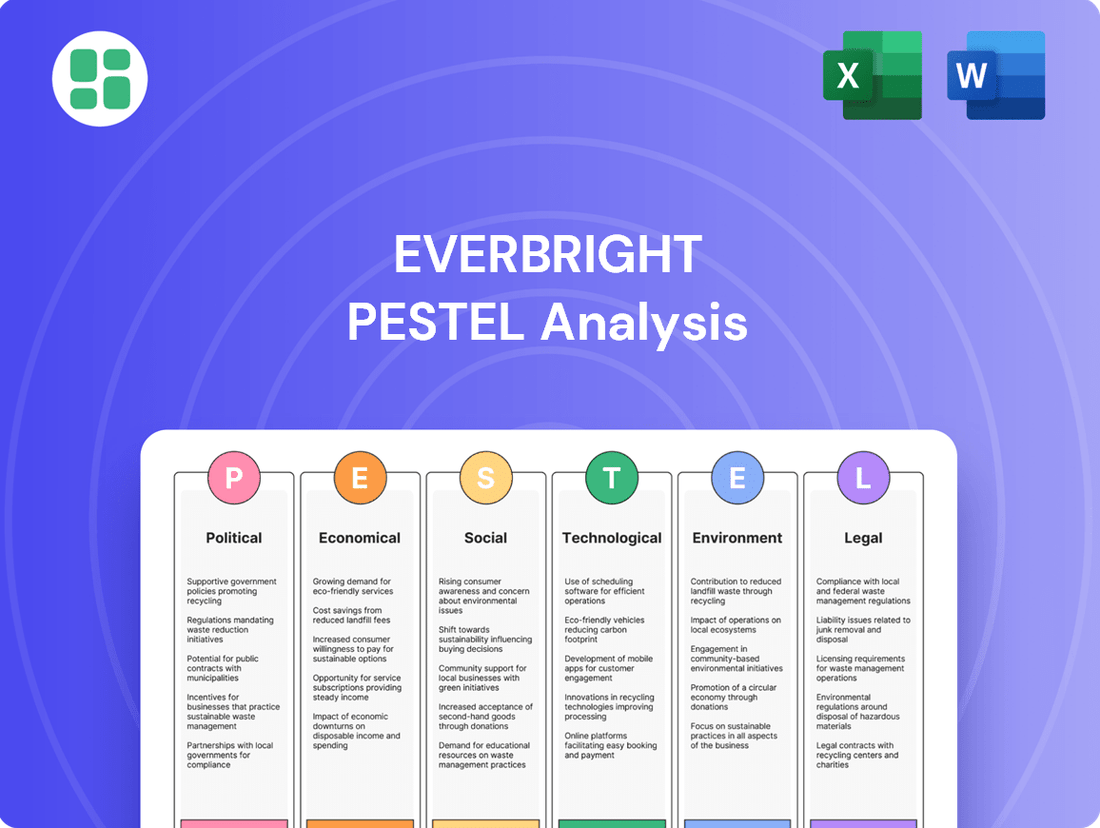

Everbright PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Everbright provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into Everbright's strategic positioning and potential challenges and opportunities.

Sociological factors

Chinese consumer behavior is currently marked by caution, largely driven by ongoing economic uncertainties and the lingering property market downturn, which has impacted household wealth. This cautiousness directly affects demand for financial products and services. For instance, retail sales in China saw a modest increase of 4.7% year-on-year in the first four months of 2024, indicating a slower recovery than anticipated by some analysts.

Everbright's retail banking and wealth management arms must therefore navigate this subdued consumer sentiment. Strategies may need to focus on products that offer stability and capital preservation rather than aggressive growth, acknowledging that consumers are prioritizing security amid economic headwinds. This shift in consumer priorities necessitates a recalibration of product offerings and marketing approaches to resonate with a more risk-averse clientele.

China's continued push for urbanization, aiming to increase the urban population by 1.4% annually through its 14th Five-Year Plan (2021-2025), directly impacts demand for housing and financial services. This demographic shift means Everbright must adapt its offerings to serve a larger urban populace, potentially focusing on accessible housing finance and specialized banking products for city dwellers.

Governments worldwide, including in regions where Everbright operates, are increasingly prioritizing financial inclusion. For instance, in 2024, the World Bank reported that over 70% of adults globally now have a bank account, a significant rise driven by policy interventions aimed at bringing underserved populations into the formal financial system.

This societal shift presents Everbright with a dual challenge and opportunity. The company can expand its reach by developing tailored financial products for micro and small enterprises, thereby tapping into new customer segments. However, this expansion might also necessitate adapting service models to accommodate potentially lower transaction values and higher operational costs per customer, impacting profit margins.

Rising Awareness of ESG and Sustainability

Societal expectations are increasingly centering on environmental, social, and governance (ESG) principles, fueling a demand for sustainable offerings and ethical business practices. This trend directly impacts Everbright, a significant state-owned enterprise.

Stakeholders, ranging from the general public to institutional investors, are placing greater scrutiny on corporate ESG performance. For Everbright, this translates into a heightened need to showcase robust sustainability initiatives and embed these principles throughout its operational framework.

For instance, by the end of 2023, global sustainable investment assets reached an estimated $37.4 trillion, indicating a substantial market shift towards ESG-conscious companies. This growing investor preference means Everbright must actively demonstrate its commitment to sustainability to attract and retain capital.

- Growing ESG Demand: Consumer and investor preference for sustainable products and services is a significant societal shift.

- Stakeholder Pressure: As a state-owned entity, Everbright faces amplified pressure from the public and investors to adopt and report on ESG metrics.

- Integration Imperative: Demonstrating strong ESG performance is becoming crucial for maintaining reputation and accessing capital markets.

- Market Trends: The global sustainable investment market continues to expand, making ESG integration a strategic necessity for long-term financial health.

Impact of Digital Lifestyles

China's digital transformation profoundly influences how people engage with financial services. Everbright needs to consistently upgrade its digital offerings, including mobile banking and online platforms, to cater to a tech-forward populace and maintain its edge in the dynamic fintech sector.

By mid-2024, over 75% of China's population was estimated to be using smartphones for daily activities, including banking and investment. This widespread adoption necessitates a robust and intuitive digital presence for financial institutions like Everbright.

- Digital Penetration: Continued growth in internet and mobile penetration rates in China, exceeding 75% smartphone usage by mid-2024, underscores the importance of digital financial services.

- Customer Expectations: A digitally-native consumer base increasingly demands seamless, personalized, and accessible online banking and investment experiences.

- Fintech Competition: The rise of agile fintech companies presents a competitive challenge, pushing traditional institutions like Everbright to innovate rapidly in their digital service delivery.

- Data Analytics: Leveraging digital interactions allows Everbright to gather valuable data for personalized product development and improved customer service, a key differentiator in 2024-2025.

Societal expectations are increasingly centering on environmental, social, and governance (ESG) principles, fueling a demand for sustainable offerings and ethical business practices. This trend directly impacts Everbright, a significant state-owned enterprise, as stakeholders place greater scrutiny on corporate ESG performance. By the end of 2023, global sustainable investment assets reached an estimated $37.4 trillion, indicating a substantial market shift towards ESG-conscious companies, making robust sustainability initiatives crucial for Everbright to attract and retain capital.

China's digital transformation profoundly influences how people engage with financial services, with over 75% of the population estimated to be using smartphones for daily activities by mid-2024. This widespread adoption necessitates that Everbright consistently upgrade its digital offerings, including mobile banking and online platforms, to cater to a tech-forward populace and maintain its edge in the dynamic fintech sector.

Financial inclusion is a growing global priority, with over 70% of adults worldwide having a bank account as of 2024, driven by policy interventions. This presents Everbright with an opportunity to expand its reach by developing tailored financial products for micro and small enterprises, though it may also require adapting service models to accommodate potentially lower transaction values and higher operational costs per customer.

Technological factors

Technological advancements are profoundly reshaping China's financial landscape, with AI adoption accelerating significantly. Driven by national strategies such as the 'AI+' initiative and the AI Industry Application Development Framework, released in December 2024, financial institutions are increasingly leveraging AI. This trend necessitates substantial investment in AI capabilities for companies like Everbright to remain competitive.

Major Chinese financial players are actively exploring AI applications across various functions. These include enhancing customer service through intelligent chatbots, improving investment analysis with sophisticated algorithms, strengthening risk management by identifying patterns, and boosting overall operational efficiency. For Everbright, this means a strategic imperative to invest in AI talent and infrastructure to capitalize on these technological shifts.

Chinese financial institutions, including Everbright, are heavily investing in artificial intelligence and data analytics to boost efficiency and channel support towards the real economy. For instance, by the end of 2023, major Chinese banks reported significant increases in their digital transformation budgets, with some allocating over 15% of their IT spending to AI and big data initiatives.

Everbright's banking, securities, and asset management divisions need to fully commit to digital transformation. This means not just adopting new technologies but fundamentally rethinking operational models to improve customer interactions and data-driven decision-making, moving beyond legacy systems.

This digital shift is crucial for competitiveness, enabling faster transaction processing and more personalized financial services. In 2024, the digital banking sector in China saw a 20% year-over-year growth in customer adoption of AI-powered advisory services.

China's national strategies heavily emphasize big data and artificial intelligence, driving a need for advanced data services and computing infrastructure. Everbright plans to utilize big data analytics for enhanced risk assessment, tailored financial products, and deeper market understanding.

To support these initiatives, Everbright will depend on scalable cloud computing solutions to efficiently manage and process the enormous volumes of data generated. This technological integration is crucial for maintaining a competitive edge in the evolving financial landscape.

Fintech Innovation and Competition

Fintech innovation in China is a driving force, with advancements in smart payments and fraud detection significantly reshaping the financial landscape. Everbright must continuously integrate these cutting-edge solutions to stay ahead.

The competitive pressure from nimble fintech startups and established financial players necessitates ongoing investment in technological upgrades. For instance, by the end of 2024, China's digital payment market volume was projected to exceed $30 trillion, highlighting the scale of innovation and competition.

- Smart Payments: Continued development in contactless and mobile payment systems.

- Fraud Detection: Advanced AI and machine learning for enhanced security.

- Algorithmic Credit: Sophisticated tools for credit assessment and advisory services.

Cybersecurity and Data Security Technologies

As financial services increasingly move online, robust cybersecurity and data security technologies are paramount. Everbright needs to prioritize investments in advanced solutions to safeguard sensitive customer information and financial transactions. This is particularly crucial given the evolving landscape of data protection laws and the rollout of new network data security regulations, which are expected to further tighten compliance requirements in 2024 and 2025.

The company must stay ahead of sophisticated cyber threats, which continue to grow in complexity and frequency. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk associated with security breaches. Everbright's commitment to these technologies directly impacts customer trust and regulatory adherence.

- Enhanced Data Protection: Implementing state-of-the-art encryption and access controls to shield customer data from unauthorized access.

- Proactive Threat Detection: Utilizing AI-powered systems to identify and neutralize cyber threats in real-time, minimizing potential damage.

- Regulatory Compliance: Ensuring all security measures align with current and upcoming data privacy mandates like GDPR and CCPA.

- Secure Transaction Processing: Employing secure payment gateways and multi-factor authentication to protect financial transactions.

Technological factors are driving significant transformation in China's financial sector, with AI and big data adoption accelerating rapidly. National strategies like the 'AI+' initiative and the December 2024 AI Industry Application Development Framework underscore this trend, compelling institutions like Everbright to invest heavily in AI capabilities to maintain competitiveness.

Major Chinese financial players are integrating AI across customer service, investment analysis, risk management, and operational efficiency. By the end of 2023, leading Chinese banks increased their digital transformation budgets, with over 15% of IT spending dedicated to AI and big data. This necessitates strategic investment in AI talent and infrastructure for Everbright.

China's emphasis on big data and AI necessitates advanced data services and computing infrastructure, which Everbright plans to leverage for enhanced risk assessment and tailored financial products. Scalable cloud computing solutions are vital for managing the immense data volumes, crucial for Everbright's competitive edge.

Fintech innovation, particularly in smart payments and fraud detection, is reshaping the financial landscape. China's digital payment market volume was projected to exceed $30 trillion by the end of 2024, indicating intense competition and the need for continuous technological upgrades by Everbright.

Legal factors

China's financial regulatory landscape is in constant flux, marked by the recent creation of the National Financial Regulatory Administration (NFRA) and a clearer division of responsibilities between the People's Bank of China (PBOC), NFRA, and the China Securities Regulatory Commission (CSRC). This restructuring is designed to enhance oversight and bolster China's financial strength.

Everbright needs to meticulously adhere to these evolving regulatory requirements, which prioritize risk mitigation and the overall stability of the financial system. For instance, the PBOC's recent monetary policy adjustments in early 2024, including targeted reserve requirement ratio cuts for certain banks, signal a focus on supporting specific economic sectors while managing systemic risk.

New corporate sustainability reporting requirements, issued by Chinese stock exchanges in April 2024, will affect listed companies, including Everbright, starting with the 2025 financial year. These comprehensive ESG disclosure rules, mandated for compliance by 2026, aim to align with international standards while integrating China-specific environmental, social, and governance considerations.

China's legal landscape concerning data protection and cybersecurity is undergoing significant transformation. The Personal Information Protection Law (PIPL), Data Security Law (DSL), and Cybersecurity Law (CSL) are key pillars, with new Network Data Security Regulations effective from January 2025. These regulations introduce a tiered approach to data handling obligations, demanding constant adaptation from companies like Everbright that manage substantial data volumes.

Company Law Revisions and Compliance

China's amended Company Law, effective July 1, 2024, introduces significant changes, including updated regulations on reserve funds and non-monetary capital contributions, as highlighted by follow-up notices in June 2024. These revisions directly impact how companies like Everbright manage their finances and report their performance.

Everbright must adapt its internal financial reporting and compliance procedures to align with these new legal mandates. This includes ensuring accurate accounting for reserve funds and properly valuing non-monetary assets used as capital contributions, which could affect the company's balance sheet and regulatory filings.

- Revised Reserve Fund Rules: The amendments clarify the calculation and utilization of statutory reserve funds, potentially impacting retained earnings and dividend distribution policies.

- Non-Monetary Capital Contributions: Stricter guidelines on the valuation and contribution of non-monetary assets require robust appraisal processes and transparent disclosure.

- Compliance Burden: Companies need to update internal control systems and training to ensure all personnel understand and adhere to the new legal framework.

- Financial Reporting Adjustments: The changes necessitate modifications to financial statements and disclosures to reflect compliance with the amended Company Law.

Anti-Money Laundering (AML) and Anti-Corruption Laws

China's commitment to combating financial crime is intensifying, with significant updates to its Anti-Money Laundering (AML) framework. These revisions mandate financial institutions to implement robust risk-based approaches and broaden the scope of predicate offenses, meaning more types of underlying crimes can trigger AML investigations.

As a major financial conglomerate, Everbright is directly impacted by these evolving legal landscapes. Stricter transparency requirements are being imposed, necessitating enhanced internal controls and greater due diligence to prevent money laundering and corruption. This aligns with global efforts to create a more secure financial system.

- Increased Scrutiny: Everbright must demonstrate enhanced vigilance in identifying and reporting suspicious transactions.

- Regulatory Compliance: Adherence to evolving AML and anti-corruption regulations is paramount to avoid penalties.

- Operational Adjustments: Investment in technology and training is likely required to meet new transparency demands.

- Reputational Risk: Failure to comply can lead to significant reputational damage and loss of investor confidence.

China's legal framework is actively adapting to modern financial and corporate governance demands. The recent restructuring of financial regulators, including the establishment of the National Financial Regulatory Administration (NFRA) in 2023, signifies a move towards more centralized oversight and a clearer division of responsibilities among key bodies like the PBOC and CSRC. This aims to bolster financial stability and manage systemic risks more effectively.

New corporate sustainability reporting requirements, effective from the 2025 financial year for listed companies, will necessitate comprehensive ESG disclosures, aligning with international standards. Furthermore, amendments to China's Company Law, effective July 1, 2024, introduce significant changes to reserve fund rules and non-monetary capital contributions, requiring careful adaptation in financial reporting and valuation practices.

The nation's data protection and cybersecurity laws, including the Personal Information Protection Law (PIPL) and Data Security Law (DSL), are being reinforced with new regulations, such as the Network Data Security Regulations effective January 2025. These laws impose stringent obligations on data handling and security, demanding robust compliance measures for companies managing large datasets.

Additionally, China is strengthening its Anti-Money Laundering (AML) framework, expanding the scope of predicate offenses and emphasizing risk-based approaches. This heightened focus on combating financial crime requires financial institutions to implement enhanced due diligence and transparency, impacting operational procedures and compliance strategies.

Environmental factors

China's commitment to green finance is accelerating, with policy development in 2024 focusing on strengthening its financial systems. The 'Opinions on Comprehensively Promoting the Construction of a Beautiful China' serves as a key directive, signaling robust government support for sustainable development.

Everbright is well-positioned to capitalize on this trend, with a clear opportunity to expand its offerings in green finance. This includes the growth of green loans and bonds, which saw significant issuance in 2023, with the China Green Bond Market reaching an estimated RMB 600 billion.

Everbright faces evolving environmental disclosure requirements, with Chinese stock exchanges and the Ministry of Finance's December 2024 Basic Guidelines for Corporate Sustainability Disclosure mandating greater transparency. This means Everbright must report on its environmental footprint and sustainability initiatives, directly supporting China's broader green development objectives.

China's ambitious goal of reaching carbon neutrality by 2060 is a powerful driver of change, impacting how companies like Everbright operate. This commitment means a significant shift towards environmentally friendly practices and investments.

Everbright's financial strategies will likely pivot, favoring investments in sectors that align with these national climate objectives. This could mean increased lending to renewable energy projects and businesses actively pursuing green transformation, moving away from carbon-intensive industries.

For instance, China's renewable energy capacity saw substantial growth, with solar power installations alone reaching over 600 GW by the end of 2023, demonstrating the tangible impact of these climate policies on investment landscapes.

Environmental Regulations and Compliance

Everbright's industrial investments and real estate ventures will face increased scrutiny due to tightening environmental regulations, particularly around pollution control and resource efficiency. For instance, China's Ministry of Ecology and Environment has been progressively strengthening its environmental protection laws, with significant updates often introduced in the lead-up to and during 2024 and early 2025, focusing on areas like carbon emissions and waste management.

Compliance with these evolving environmental protection laws and standards is crucial for Everbright to mitigate risks such as substantial fines and damage to its corporate reputation. The company must actively monitor and adapt to new mandates, potentially including stricter emissions limits for manufacturing facilities and enhanced green building standards for its real estate projects.

- Increased compliance costs: Investments in pollution abatement technologies and sustainable practices are expected to rise.

- Stricter emissions targets: New regulations may impose lower allowable levels for industrial pollutants and greenhouse gases.

- Enhanced waste management requirements: More rigorous standards for waste reduction, recycling, and disposal will be enforced.

- Focus on resource efficiency: Regulations promoting water conservation and energy efficiency will impact operational planning.

Sustainable Development and Green Innovation

The global push for sustainable development and green innovation offers significant avenues for Everbright. The increasing focus on environmentally friendly growth strategies means Everbright can actively finance and invest in cutting-edge sustainable technologies and projects. This aligns with the broader economic trend of green transformation across various industries.

Everbright is well-positioned to be a key player in supporting the expansion of new energy sources, energy-saving advancements, and crucial environmental protection initiatives. For instance, global investment in clean energy reached an estimated $1.7 trillion in 2023, a figure expected to climb further in 2024 and 2025, presenting a substantial market for Everbright's financial services.

- Green Transformation: Industries worldwide are undergoing significant green transformations, creating demand for sustainable financing.

- Investment Opportunities: Opportunities exist in financing renewable energy projects, energy efficiency solutions, and environmental remediation.

- Market Growth: The global green technology and sustainability market is projected to grow substantially, with estimates suggesting it could reach over $50 billion by 2027.

- Everbright's Role: Everbright can leverage its financial expertise to support these growth areas, contributing to both environmental goals and its own portfolio performance.

China's intensified commitment to environmental protection, driven by its 2060 carbon neutrality goal, is reshaping the financial landscape. This translates to stricter regulations and a growing demand for green finance solutions, impacting companies like Everbright.

Everbright must navigate evolving environmental disclosure mandates, such as the December 2024 Basic Guidelines for Corporate Sustainability Disclosure, requiring greater transparency on its environmental impact. This aligns with national objectives and presents opportunities for specialized green financial products.

The company's investment strategies are increasingly influenced by China's green transition, favoring renewable energy and sustainable projects. For example, China's solar capacity exceeded 600 GW by the end of 2023, highlighting the scale of investment in environmentally friendly sectors.

Tightening environmental regulations, particularly concerning pollution control and resource efficiency, will affect Everbright's industrial and real estate ventures. China's Ministry of Ecology and Environment's ongoing updates to environmental laws in 2024-2025 underscore this trend.

| Environmental Factor | Impact on Everbright | Key Data/Trend (2023-2025) |

|---|---|---|

| Carbon Neutrality Goal (2060) | Drives shift towards green investments and sustainable practices. | China's renewable energy capacity grew significantly; solar installations surpassed 600 GW by end-2023. |

| Green Finance Acceleration | Opportunity to expand green loans and bonds. | China Green Bond Market issuance estimated at RMB 600 billion in 2023. |

| Environmental Disclosure Requirements | Mandates increased transparency and reporting on sustainability. | New guidelines issued in December 2024 by Ministry of Finance and stock exchanges. |

| Stricter Environmental Regulations | Increases compliance costs and operational scrutiny for industrial/real estate. | Ministry of Ecology and Environment strengthening laws on emissions and waste management. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Everbright is meticulously constructed using data from reputable financial institutions, national and international regulatory bodies, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.