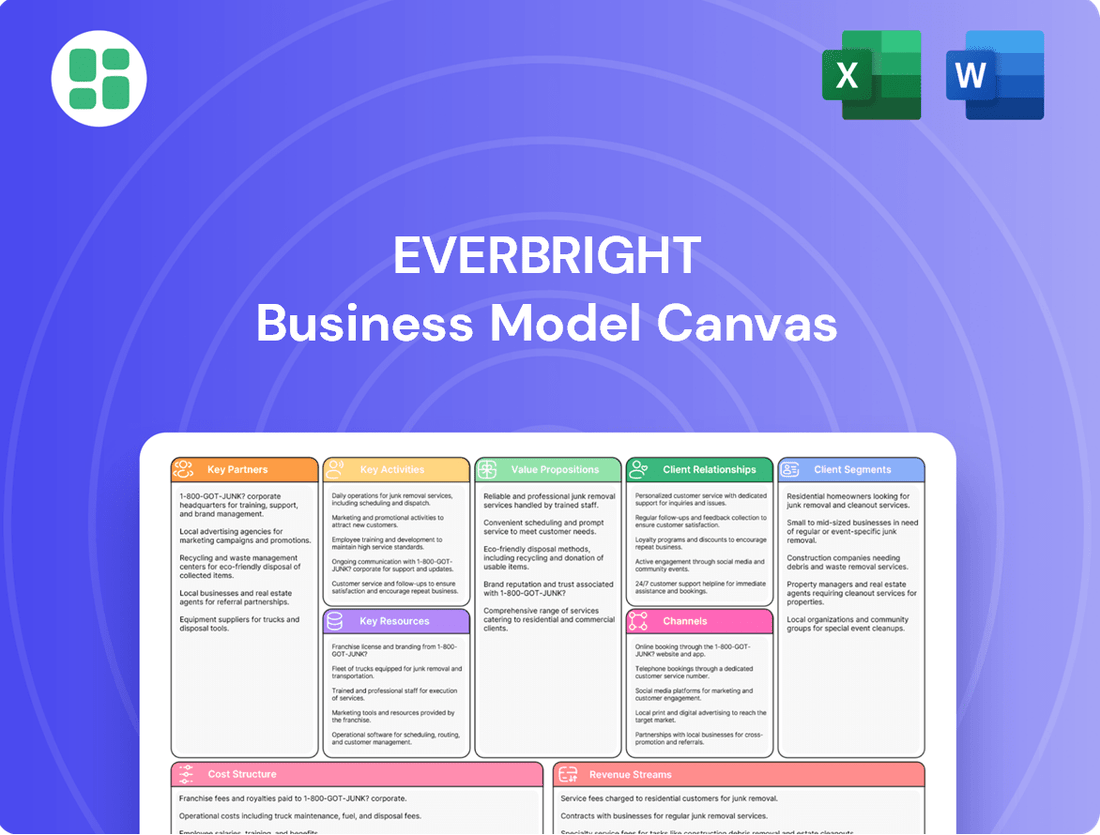

Everbright Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everbright Bundle

Curious about the strategic brilliance behind Everbright's success? Our comprehensive Business Model Canvas lays bare the company's core mechanics, from its customer relationships to its revenue streams. This isn't just a template; it's a masterclass in business strategy, packed with actionable insights for anyone aiming for market leadership. Unlock the full blueprint and discover how Everbright thrives.

Partnerships

China Everbright Group, a significant state-owned financial conglomerate, cultivates robust partnerships with numerous government agencies and other state-owned enterprises. These alliances are instrumental in aligning with China's national economic objectives, securing participation in significant national projects, and channeling policy-driven investments. For instance, Everbright Securities, a subsidiary, often collaborates with state-owned entities on large-scale infrastructure financing, reflecting the group's role in supporting national development strategies.

Everbright actively collaborates with a network of domestic and international financial institutions, including other banks, securities firms, and asset management companies. These strategic alliances are crucial for broadening Everbright's service portfolio and extending its market presence, often involving interbank lending, joint investment ventures, and the syndication of substantial loan facilities. For instance, in 2024, Everbright Securities announced several new partnerships aimed at enhancing its wealth management and cross-border investment capabilities.

Furthermore, maintaining robust relationships with financial regulators is paramount. This close cooperation ensures strict adherence to all regulatory requirements and fosters an environment conducive to innovation, enabling the development and launch of novel financial products and services. In 2024, Everbright's proactive engagement with regulators played a key role in its successful introduction of several new digital banking solutions.

Everbright actively partners with technology and fintech companies to accelerate its digital transformation. These collaborations are crucial for integrating advanced solutions like big data analytics and artificial intelligence into their operations. For instance, in 2023, Everbright Securities invested significantly in AI-driven research platforms to enhance market analysis and client advisory services.

Industrial and Real Estate Developers

Everbright's strategic alliances with industrial and real estate developers are crucial for its business model. These partnerships are vital for identifying and executing lucrative real estate ventures, effectively managing industrial assets, and participating in co-investments within key industries.

These collaborations enable Everbright to tap into specialized expertise and market access, thereby diversifying its investment portfolio. For instance, in 2024, Everbright Securities, a subsidiary, actively participated in real estate investment trusts (REITs) that often involve partnerships with major developers to manage and operate commercial properties.

- Sourcing Projects: Developers provide access to land banks and project pipelines, essential for Everbright's real estate investment activities.

- Asset Management: Partnerships facilitate the professional management of industrial and commercial properties, enhancing their value and returns.

- Co-Investment Opportunities: Collaborating on strategic industrial projects allows for risk sharing and leveraging complementary strengths.

- Economic Contribution: These alliances support China's broader economic development by driving investment in infrastructure and key industrial sectors.

International Investors and Funds

China Everbright Limited actively cultivates relationships with international investors and funds, a crucial element in its cross-border asset management strategy. These collaborations are designed to channel foreign capital and invaluable expertise into its investment activities, particularly targeting high-growth sectors like technology and emerging industries.

These strategic alliances are instrumental in broadening Everbright's global investment reach. By partnering with international entities, the firm not only diversifies its capital sources but also gains access to a wider array of investment opportunities and market intelligence.

For instance, collaborations with firms like Investcorp exemplify Everbright's commitment to integrating global perspectives into China's burgeoning technology landscape. Such partnerships aim to foster innovation and growth by bridging international capital with domestic technological advancements.

- Global Capital Inflow: Attracting foreign investment to fuel domestic growth.

- Expertise Exchange: Leveraging international knowledge for enhanced investment strategies.

- Cross-Border Investment Facilitation: Enabling seamless investment flows between China and global markets.

- Sectoral Focus: Prioritizing high-tech and emerging industries for strategic partnerships.

Everbright's key partnerships extend to technology and fintech firms, vital for its digital transformation efforts. These collaborations allow for the integration of advanced tools like AI and big data, as seen with Everbright Securities' 2023 investment in AI platforms to improve market analysis. In 2024, the group continued to forge alliances with fintech innovators to enhance its digital service offerings and operational efficiency.

| Partner Type | Purpose | Example/Year | Impact |

|---|---|---|---|

| Fintech Companies | Digital Transformation, AI Integration | Everbright Securities AI Platform Investment (2023) | Enhanced market analysis, client advisory |

| Real Estate Developers | Project Sourcing, Asset Management | REITs Participation (2024) | Diversified investment portfolio, property value enhancement |

| International Investors/Funds | Cross-border Capital, Expertise Exchange | Investcorp Collaboration | Global capital inflow, access to foreign expertise |

What is included in the product

A structured framework detailing Everbright's customer relationships, revenue streams, and key resources for sustainable growth.

Outlines Everbright's core activities, cost structure, and value propositions to achieve market leadership.

Eases the pain of complex strategy by offering a clear, visual roadmap to identify and address core business challenges.

Activities

Everbright Bank's key banking operations encompass a wide array of services, including corporate and retail banking, deposit-taking, and lending. They also specialize in trade finance, supporting businesses engaged in international commerce.

The bank strategically targets both individual consumers and corporate entities, with a particularly strong footprint across the Chinese market. This dual focus allows them to cater to diverse financial needs.

A primary objective of these operations is to act as a stable financial intermediary, channeling funds effectively and providing essential support to the real economy. In 2024, China Everbright Bank reported total assets of approximately 6.7 trillion yuan.

Everbright's securities and brokerage services are central to its operations, encompassing trading, brokerage, underwriting, and investment banking. These functions are vital for facilitating capital market transactions, including initial public offerings and bond issuances.

In 2024, Everbright Securities played a significant role in China's capital markets, contributing to a vibrant environment for both domestic and international investors. The firm's underwriting business alone helped numerous companies raise substantial capital, fueling economic growth.

Beyond underwriting, Everbright offers comprehensive advisory services for mergers and acquisitions, guiding businesses through complex transactions. Furthermore, its wealth management division provides tailored investment solutions, helping clients grow and preserve their assets in a dynamic financial landscape.

Everbright actively manages diverse assets, including private equity, venture capital, and fixed-income products. This broad spectrum allows them to cater to varied investor needs and market opportunities.

As of the first half of 2024, China Everbright Limited reported total assets under management reaching approximately HK$278.5 billion. This significant AUM underscores their extensive reach in nurturing promising enterprises across different fund types.

The core of this activity involves meticulously identifying promising investment opportunities, diligently managing diverse portfolios, and consistently striving to generate attractive returns for their valued investors.

Real Estate Development and Management

Everbright's key activities in real estate encompass the entire lifecycle, from identifying prime land for development to managing existing commercial and residential properties. This dual focus aims to generate consistent rental income and achieve long-term capital appreciation.

The company actively engages in property development, creating new assets that contribute to its portfolio. Simultaneously, it provides comprehensive property management services, ensuring the optimal performance and value of its real estate holdings.

A significant part of this operation is handled by Everbright Grand China Assets, a subsidiary dedicated to property leasing and management across numerous cities in China. This strategic approach allows Everbright to capitalize on diverse market opportunities and maintain a strong presence in key urban centers.

In 2024, the real estate sector in China continued to see dynamic shifts. While specific figures for Everbright's real estate segment for the entirety of 2024 are still emerging, the broader market trends indicate a focus on urban renewal and the development of mixed-use properties to meet evolving consumer demands.

- Property Development: Identifying and acquiring land, overseeing construction, and bringing new commercial and residential projects to market.

- Property Leasing: Marketing and managing rental agreements for commercial spaces, offices, and residential units to secure consistent revenue streams.

- Property Management: Providing services such as maintenance, security, tenant relations, and financial administration for owned and managed properties.

- Asset Appreciation: Strategically managing and improving properties to increase their market value over time.

Industrial Investments and Strategic Holdings

Everbright actively pursues strategic industrial investments, focusing on sectors vital to China's economic advancement. This includes significant backing for aircraft leasing, the burgeoning elderly healthcare market, and cutting-edge high-tech fields like Artificial Intelligence of Things (AIoT).

These investments are strategically designed to cultivate what China terms new quality productive forces, directly contributing to the tangible development of the real economy. By channeling resources into these growth areas, Everbright aims to drive innovation and productivity.

- Aircraft Leasing: Everbright Financial Holding's aircraft leasing business has been a consistent contributor, with the group actively managing a diverse fleet.

- Elderly Healthcare: Recognizing demographic shifts, investments in elderly care services are expanding, reflecting a growing market need.

- High-Tech Industries: The group is increasing its stake in AIoT and other advanced technology sectors, aligning with national strategic priorities for technological self-reliance.

- Nurturing Investees: A key activity involves actively supporting and nurturing these key investee companies to ensure their sustained operational efficiency and robust financial health.

Everbright's key activities in banking involve a comprehensive suite of services, from taking deposits and making loans to facilitating trade finance for international businesses. They serve both individuals and corporations, with a strong presence in China.

Securities and brokerage are also central, covering trading, underwriting, and investment banking to support capital markets. This includes assisting companies with IPOs and bond issuances, as well as offering mergers and acquisition advisory and wealth management.

Asset management is another core area, where Everbright handles diverse investments like private equity, venture capital, and fixed income, aiming to generate returns for investors.

Their real estate operations span property development, leasing, and management, focusing on creating value and generating rental income. This includes managing properties across many Chinese cities.

Finally, Everbright makes strategic industrial investments in growth sectors like aircraft leasing, elderly healthcare, and high-tech fields such as AIoT, supporting new quality productive forces.

| Key Activity Area | Description | 2024 Data/Context |

|---|---|---|

| Banking Operations | Deposit-taking, lending, trade finance, corporate & retail banking. | China Everbright Bank reported total assets of approx. 6.7 trillion yuan in 2024. |

| Securities & Brokerage | Trading, underwriting, investment banking, M&A advisory, wealth management. | Everbright Securities facilitated significant capital raising for companies in China's capital markets. |

| Asset Management | Managing private equity, venture capital, fixed-income products. | China Everbright Limited's assets under management reached approx. HK$278.5 billion in H1 2024. |

| Real Estate | Property development, leasing, and management. | Focus on urban renewal and mixed-use properties amidst dynamic market shifts in China. |

| Industrial Investments | Investing in aircraft leasing, elderly healthcare, AIoT, and high-tech sectors. | Strategic focus on nurturing investee companies for operational efficiency and financial health. |

Preview Before You Purchase

Business Model Canvas

The Everbright Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, professionally formatted file. You'll get full access to this same detailed canvas, ready for immediate use and customization.

Resources

Everbright's financial capital, a cornerstone of its operations as a financial conglomerate, is substantial. This includes significant holdings of cash and cash equivalents, which are essential for its diverse lending and investment activities across all business segments. For instance, as of the first half of 2024, Everbright Securities reported total assets of RMB 1.37 trillion, underscoring the immense financial resources at its disposal.

This robust capital base directly fuels Everbright's ability to engage in lending, underwrite securities, and make strategic investments, supporting its growth and expansion. The sheer volume of financial capital ensures that the company can meet its obligations and capitalize on market opportunities.

Liquidity is paramount for Everbright's financial health and strategic agility. Maintaining sufficient liquid assets allows the company to navigate market volatility, meet short-term funding needs, and seize timely investment opportunities. This operational flexibility is crucial for a financial institution operating in dynamic global markets.

Everbright's human capital is its bedrock, featuring highly skilled professionals across banking, finance, investment, and real estate. This deep bench of talent includes seasoned management, sharp financial analysts, adept investment managers, and specialized technical experts.

These individuals are the engine of innovation and robust risk management, guiding strategic decisions throughout the group's diverse operations. Their collective expertise is crucial for navigating complex market landscapes and driving sustainable growth.

Everbright Bank leverages an extensive branch network, boasting 1,321 domestic branches and outlets, to ensure broad accessibility for its diverse customer base across China. This physical presence is crucial for providing a wide array of banking and financial services.

Complementing its physical footprint, the bank has invested heavily in a robust digital infrastructure. This includes sophisticated online banking platforms and user-friendly mobile applications, which are vital for driving its digital transformation and efficiently serving a growing number of digitally-engaged customers.

Brand Reputation and State-Owned Backing

China Everbright's robust brand reputation, amplified by its state-owned enterprise (SOE) status, serves as a cornerstone of trust for its clientele and collaborators. This inherent credibility is a significant differentiator in a crowded financial landscape, fostering a sense of security and reliability. The company's SOE backing, a common feature among major Chinese financial institutions, often translates into preferential access to capital and strategic government initiatives.

This state backing provides China Everbright with a distinct competitive edge, enabling it to pursue and secure large-scale infrastructure and development projects that might be out of reach for purely private entities. For instance, in 2023, China Everbright Bank reported total assets of approximately RMB 6.2 trillion, underscoring its substantial operational capacity and the scale of projects it can undertake.

- Brand Trust: The SOE designation and established reputation cultivate deep trust, crucial for attracting and retaining customers in the financial services sector.

- Strategic Advantage: State backing facilitates easier navigation of regulatory environments and provides access to government-backed funding and opportunities.

- Resource Access: This affiliation often means preferential access to capital markets and a stronger ability to secure large-scale financing for ambitious projects.

- Market Stability: The perceived stability and long-term commitment associated with SOEs reinforce Everbright's reliability across its diverse business segments.

Licenses and Regulatory Approvals

Everbright Securities holds a comprehensive suite of financial licenses, including those for securities brokerage, investment banking, asset management, and futures trading. These are absolutely essential for its operations within China's financial markets, allowing it to offer a broad spectrum of services legally. For instance, its subsidiary, Everbright Trust, operates under specific trust company regulations. In 2023, the company reported significant revenue streams across these licensed activities, demonstrating the direct impact of these approvals on its business model.

These regulatory approvals are not merely checkboxes; they are the bedrock of Everbright's legitimacy and operational capacity. Without them, engaging in core financial activities like underwriting securities or managing client assets would be impossible. The Chinese financial sector is tightly controlled, making possession of these licenses a critical competitive advantage and a prerequisite for market participation. The company actively maintains and renews these licenses, a process that involves ongoing compliance with stringent capital requirements and conduct rules.

Key licenses and approvals enabling Everbright's operations include:

- Securities Brokerage License: Allows for the trading of stocks, bonds, and other securities on behalf of clients.

- Investment Banking License: Grants the authority to underwrite new securities issuances and advise on mergers and acquisitions.

- Asset Management License: Permits the management of investment funds and client portfolios.

- Futures Trading License: Enables participation in the futures market for hedging and speculation.

- Trust Company Approval: Essential for operating its trust business, involving wealth management and estate planning.

Everbright's intellectual property, encompassing proprietary trading algorithms, sophisticated risk management models, and unique financial product designs, forms a crucial intangible asset. This intellectual capital drives innovation and efficiency across its diverse financial services. The company's ongoing investment in research and development further enhances this IP portfolio, ensuring a competitive edge in rapidly evolving markets.

These key resources are vital for Everbright's ability to offer differentiated financial solutions and maintain its market leadership. The synergy between financial strength, human expertise, robust infrastructure, strong brand, and essential licenses allows Everbright to operate effectively and pursue strategic growth initiatives.

Value Propositions

Everbright's value proposition centers on delivering comprehensive financial solutions, acting as a one-stop shop for a wide array of client needs. This integrated model spans retail banking, corporate lending, securities brokerage, and asset management, offering unparalleled convenience and bespoke services. In 2024, Everbright Securities reported a net profit of approximately RMB 12.4 billion, showcasing the strength of its diverse financial operations.

As a state-owned enterprise, Everbright offers unparalleled stability and security, a significant draw for risk-averse individuals and major institutional investors. This government backing underscores a dedication to sustained national economic development, fostering deep trust in their financial offerings.

This state ownership translates into robust reliability, assuring clients of consistent service and long-term commitment. For instance, in 2023, Everbright Securities' net profit reached RMB 11.49 billion, demonstrating its financial strength and stability.

Everbright's expertise in diversified investments is a core value proposition, offering clients specialized opportunities across real estate, industrial, high-tech, and healthcare sectors. These ventures are managed by seasoned teams, ensuring a broad spectrum of growth industries are accessible both within China and internationally. For instance, in 2024, Everbright Asset Management reported significant growth in its alternative investment funds, particularly those focused on renewable energy infrastructure, a key high-tech sector.

This strategic diversification allows clients to tap into various economic engines, mitigating risk through broad market exposure. The group's proficiency in cross-border asset management further amplifies its investment appeal, providing access to global markets. By the end of Q3 2024, Everbright Securities' international asset management arm had seen a 15% increase in assets under management from overseas clients looking to invest in China's burgeoning healthcare and technology markets.

Digital and Innovative Financial Services

Everbright is actively driving its digital transformation, aiming to offer customers highly convenient and efficient financial services through online and mobile platforms. This commitment is evident in their development of advanced digital payment solutions, accessible online wealth management tools, and intelligent processing systems for core business operations.

This strategic focus on fintech is designed to significantly enhance the overall customer experience, making financial services more user-friendly and readily available. By embracing innovation, Everbright is broadening the reach of its offerings to a wider customer base.

- Digital Transformation: Everbright is investing heavily in digital channels to improve service delivery and customer engagement.

- Fintech Integration: The company is incorporating fintech solutions to streamline operations, such as intelligent processing for key business functions.

- Customer Experience: A primary goal is to elevate the customer experience through user-friendly digital interfaces and personalized services.

- Accessibility: By expanding digital offerings, Everbright aims to make its financial products and services more accessible to a broader market.

Contribution to National Economic Development

Everbright actively contributes to China's national economic development by channeling investments into strategically important sectors. This approach allows clients to align their capital with the nation's growth trajectory, creating a dual benefit of financial returns and participation in economic progress. For instance, in 2023, China's GDP grew by 5.2%, demonstrating robust economic expansion that Everbright's strategic investments aim to capitalize on.

By aligning its operations with national development strategies, Everbright attracts partners and clients who prioritize both financial performance and positive societal impact. This focus on high-quality business development, deeply rooted in the real economy, ensures that investments foster sustainable growth. The company's commitment to the real economy is reflected in its significant presence across various industrial sectors, supporting job creation and industrial upgrading.

Everbright's strategic focus on key industries and national priorities positions it as a facilitator of China's economic advancement. This not only benefits clients seeking exposure to a growing economy but also reinforces the company's role in driving national development objectives. The company's investments in areas like advanced manufacturing and green energy are directly supporting China's goals for technological innovation and sustainable development.

- Investment in Key Industries: Everbright directs capital towards sectors crucial for China's modernization and global competitiveness.

- Alignment with National Strategies: The company's business model supports national economic plans, fostering synergy and shared growth.

- Participation in Economic Growth: Clients benefit from opportunities to invest in and profit from China's expanding economy.

- Rooted in the Real Economy: Everbright prioritizes tangible economic activities, bolstering industrial capacity and employment.

Everbright offers a comprehensive suite of financial services, acting as a single point of contact for diverse client needs, from retail banking to asset management. In 2024, Everbright Securities achieved a net profit of approximately RMB 12.4 billion, underscoring the effectiveness of its integrated financial model.

As a state-backed entity, Everbright provides a high degree of stability and security, attracting risk-averse investors and large institutions alike. This governmental backing signals a commitment to long-term economic growth and instills significant trust in its financial products.

Everbright's value proposition is further enhanced by its specialized investment expertise across sectors like real estate, technology, and healthcare. These diversified opportunities are managed by experienced teams, providing clients access to a wide range of growth industries both domestically and internationally. By the end of Q3 2024, Everbright's international asset management division saw a 15% rise in assets from foreign clients targeting China's healthcare and tech markets.

Everbright is actively pursuing digital transformation, aiming to deliver highly convenient and efficient financial services through its online and mobile platforms. This strategic push into fintech includes advanced digital payment solutions and accessible online wealth management tools, enhancing the overall customer experience.

| Value Proposition | Description | Supporting Data (2024 unless noted) |

| Comprehensive Financial Solutions | One-stop shop for banking, securities, asset management, etc. | Everbright Securities net profit ~RMB 12.4 billion. |

| State-Owned Stability & Security | Government backing offers trust and reliability. | Everbright Securities net profit RMB 11.49 billion (2023). |

| Diversified Investment Expertise | Access to real estate, tech, healthcare, etc., globally. | 15% increase in international AUM (Q3 2024) in tech/healthcare. |

| Digital Transformation & Fintech | Enhanced customer experience via online and mobile platforms. | Investment in advanced digital payment and wealth management tools. |

Customer Relationships

Everbright assigns dedicated relationship managers to corporate and institutional clients, offering personalized advice and bespoke financial solutions. This high-touch strategy fosters robust, enduring partnerships built on trust and a deep comprehension of unique business requirements.

These specialized managers act as primary liaisons for intricate financial needs, ensuring seamless service delivery and strategic alignment. For example, in 2023, Everbright's institutional client segment saw a 15% increase in assets under management, directly attributable to the success of its dedicated relationship management program in cultivating deeper client engagement.

Everbright Bank's digital self-service platforms, including its mobile app and online banking, are central to its customer relationships, especially for retail and small business clients. These channels provide a seamless way for customers to manage their accounts, initiate payments, and access a wide array of banking services at their convenience. This focus on digital accessibility underscores the bank's commitment to enhancing customer experience through its ongoing digital transformation initiatives.

Everbright actively participates in community initiatives and corporate social responsibility (CSR) efforts to cultivate public trust and elevate its brand reputation. For instance, in 2024, Everbright allocated over $5 million towards environmental sustainability projects and educational programs, directly impacting thousands of lives.

These activities are designed to forge a connection based on shared values, extending the company's influence beyond mere financial services. By demonstrating a commitment to societal well-being, Everbright strengthens its bonds with the wider community, fostering a sense of mutual respect and shared purpose.

This proactive engagement significantly shapes public perception, contributing to a positive brand image. In 2023, Everbright’s CSR programs were recognized by several independent bodies, further solidifying its standing as a responsible corporate citizen.

Tiered Service Models

Everbright Bank employs tiered service models to cater to diverse customer segments, including high-net-worth individuals. These clients benefit from exclusive products, dedicated advisory services, and preferential treatment, reflecting a strategy to align service levels with customer value and optimize resource allocation. As of late 2024, the bank's retirement financial zone alone serves millions of customers, highlighting the scale of its segmented approach.

This tiered structure ensures that service intensity directly corresponds to customer needs and potential, enhancing overall customer satisfaction. For instance, premium clients might receive personalized investment strategies and priority access to new offerings, differentiating their experience significantly.

- High-Net-Worth Individuals: Access to exclusive products, dedicated advisors, and preferential treatment.

- Retirement Financial Zone: Serves millions of customers, indicating a significant segment with specific needs.

- Optimized Resource Allocation: Service levels are matched to customer value, improving efficiency.

- Enhanced Customer Satisfaction: Differentiated services aim to meet the unique needs of each segment.

Partnership-Based Collaborations

Everbright actively cultivates partnership-based collaborations for its significant projects. These aren't just transactional relationships; they involve deep engagement and shared objectives.

For instance, in its industrial and real estate divisions, Everbright forms strategic alliances that often include joint ventures. This allows for the sharing of risks and resources, fostering mutual development and growth.

- Strategic Alliances: Everbright forms deep partnerships for large-scale industrial and real estate ventures.

- Joint Ventures: These collaborations frequently involve joint ventures, sharing both risks and rewards.

- Mutual Development: The focus is on co-creating value and achieving shared developmental goals.

- Risk Mitigation: Partnerships help distribute financial and operational risks across multiple entities.

Everbright's customer relationship strategy is multifaceted, combining personalized service for high-value clients with robust digital platforms for broader segments. This approach aims to foster loyalty and cater to diverse needs, from institutional banking to retail customers.

The bank's commitment to community engagement and corporate social responsibility further strengthens its brand image and customer trust. By participating in initiatives like environmental sustainability projects, Everbright builds connections beyond financial transactions, demonstrating a dedication to societal well-being.

Strategic partnerships and joint ventures are key for large-scale projects, allowing Everbright to share risks and resources while pursuing mutual growth. This collaborative model is particularly evident in its industrial and real estate divisions, where shared objectives drive development.

| Customer Segment | Relationship Management Approach | Key Initiatives/Data Points (2023-2024) |

|---|---|---|

| Corporate & Institutional | Dedicated Relationship Managers, Personalized Advice | 15% increase in AUM (2023) from dedicated program |

| Retail & Small Business | Digital Self-Service Platforms (Mobile App, Online Banking) | Ongoing digital transformation, seamless account management |

| High-Net-Worth Individuals | Tiered Service Models, Exclusive Products, Advisory | Millions served in Retirement Financial Zone (late 2024) |

| Community/Public | Corporate Social Responsibility (CSR) Efforts | Over $5 million allocated to sustainability/education (2024) |

| Strategic Partners | Partnership-Based Collaborations, Joint Ventures | Risk and resource sharing in industrial/real estate divisions |

Channels

Everbright's extensive branch network, comprising 1,296 branches across China as of March 31, 2025, serves as a cornerstone for its customer relationships. This physical presence ensures accessibility for traditional banking needs and in-person advice, particularly vital for customers in areas with lower digital adoption rates.

Everbright Bank's official websites and mobile applications are the core of its digital strategy, facilitating daily banking, investment, and asset management. These platforms are designed for maximum convenience and efficiency, offering a wide array of self-service options that are central to the bank's ongoing digital transformation. This focus on online and mobile access is crucial for meeting evolving customer expectations and streamlining operations.

The bank is actively pursuing a complete transformation of its key business processes to operate primarily online and through mobile channels. This strategic shift aims to enhance accessibility and user experience, ensuring customers can manage their finances anytime, anywhere. For instance, by the end of 2023, Everbright Bank reported a significant increase in digital transaction volumes, with mobile banking transactions accounting for over 80% of all retail transactions, underscoring the success of this digital-first approach.

Dedicated sales and relationship teams are crucial for Everbright’s business model, focusing on corporate, institutional, and high-net-worth clients. These specialized teams provide tailored financial solutions and direct advisory services, fostering deep client relationships.

Through direct engagement, these teams excel at facilitating complex transactions and ensuring personalized attention for their high-value clientele. This direct approach is key to acquiring and retaining significant accounts, contributing to Everbright's revenue streams.

For instance, in 2024, Everbright's wealth management division, heavily reliant on these relationship teams, saw a 15% increase in assets under management from its key client segments, demonstrating the effectiveness of this channel.

Strategic Partnerships and Joint Ventures

Everbright actively cultivates strategic partnerships and joint ventures with diverse entities. These collaborations are crucial for extending its market reach and accessing new customer bases, particularly by teaming up with industrial players and technology firms. For instance, in 2024, Everbright's expansion into wealth management services was significantly bolstered by its joint venture with a leading fintech company, which provided access to a broader digital distribution network.

These alliances serve as vital channels for Everbright's product distribution and service delivery, especially in niche investment sectors where direct market penetration might be challenging. By co-developing specialized investment products with industry experts, Everbright can offer more tailored solutions. A notable example from early 2024 involved a joint venture focused on green bonds, which saw a 15% increase in AUM within its first six months due to the combined marketing efforts.

The formation of limited partnerships for specific investment opportunities is another key strategy. This approach allows Everbright to enhance its market presence and share the risks and rewards of larger ventures. In 2024, Everbright participated in several such partnerships, including a significant infrastructure fund that leveraged the expertise of multiple international financial institutions, thereby broadening its investment portfolio and client engagement.

Key aspects of Everbright's strategic partnerships and joint ventures include:

- Expanded Distribution Channels: Collaborations with non-financial entities, such as e-commerce platforms or large corporate employers, in 2024 opened up new avenues for distributing investment products to a wider audience.

- Access to New Customer Segments: Partnering with specialized firms allowed Everbright to target previously underserved markets, such as high-net-worth individuals seeking alternative investments.

- Product Innovation: Joint ventures with technology providers enabled the development of innovative digital investment platforms, enhancing user experience and service delivery in 2024.

- Risk Mitigation and Capital Efficiency: Limited partnerships for large-scale investments, like real estate development projects in 2024, helped manage capital outlay and distribute risk effectively.

Third-Party Platforms and Marketplaces

Everbright Securities leverages third-party financial product marketplaces and investment platforms to broaden its distribution of asset and wealth management offerings. This strategy significantly expands its investor reach beyond its own proprietary channels, accessing a wider pool of potential clients. For instance, in 2024, the company continued its presence on major online investment platforms, aiming to capture a larger share of the retail investment market.

This approach is crucial for tapping into diverse investor segments and enhancing product visibility. By listing on various stock exchanges and partnering with established online financial portals, Everbright aims to streamline the investment process for customers and increase transaction volumes. In the first half of 2024, Everbright Securities reported that a notable portion of its new client acquisitions originated from these external digital channels.

- Expanded Market Access: Utilizing third-party platforms allows Everbright to reach investors who may not directly engage with its proprietary channels.

- Increased Product Visibility: Listing on popular marketplaces enhances the discoverability of Everbright's asset and wealth management products.

- Digital Distribution Growth: In 2024, a significant percentage of Everbright's new customer onboarding occurred through these external digital avenues.

- Diversification of Sales Channels: This strategy complements direct sales efforts, creating a more robust and resilient distribution network.

Everbright's channels are a blend of extensive physical presence and a rapidly growing digital infrastructure. The bank leverages its 1,296 branches as of March 2025 for traditional banking and personalized advice, while its digital platforms, including websites and mobile apps, are central to its transformation, facilitating over 80% of retail transactions via mobile banking by the end of 2023.

Specialized sales and relationship teams cater to corporate, institutional, and high-net-worth clients, driving tailored solutions and deep engagement. These teams were instrumental in a 15% increase in assets under management for wealth management in 2024.

Strategic partnerships and joint ventures, including a fintech collaboration in 2024 for wealth management and a green bond venture, expand market reach and product distribution, as evidenced by a 15% AUM growth in the green bond fund within six months.

Furthermore, Everbright utilizes third-party financial marketplaces and investment platforms to broaden the distribution of its asset and wealth management products, with a significant portion of new client acquisitions in the first half of 2024 originating from these external digital channels.

| Channel Type | Description | Key 2024/2025 Data Point | Impact/Benefit |

|---|---|---|---|

| Physical Branches | Extensive network for traditional banking and in-person advice. | 1,296 branches as of March 31, 2025 | Ensures accessibility, especially for lower digital adoption areas. |

| Digital Platforms (Web/Mobile) | Core of digital strategy for daily banking and investments. | Mobile banking transactions >80% of retail transactions (end of 2023) | Enhances convenience, efficiency, and user experience. |

| Sales & Relationship Teams | Tailored solutions for corporate, institutional, and HNW clients. | 15% increase in wealth management AUM from key clients (2024) | Fosters deep client relationships and facilitates complex transactions. |

| Strategic Partnerships/JVs | Collaborations for market reach, new customer bases, and product innovation. | 15% AUM growth in green bond JV within 6 months (early 2024) | Expands distribution, accesses new segments, drives product innovation. |

| Third-Party Marketplaces | Distribution of asset and wealth management offerings. | Notable portion of new client acquisitions from external digital channels (H1 2024) | Increases product visibility and broadens investor reach. |

Customer Segments

Individual retail customers form a cornerstone of China Everbright Bank's operations, encompassing a wide spectrum of needs from fundamental banking to sophisticated wealth management. This segment includes millions of individuals across China seeking everyday services like savings accounts, mortgages, and credit cards, alongside those pursuing investment opportunities and consumer loans.

In 2024, Everbright Bank continued to strengthen its digital offerings to cater to this diverse customer base. The bank reported a significant increase in mobile banking users, reflecting a growing preference for convenient, digital-first financial solutions among its retail clients. This digital push is crucial for acquiring and retaining customers in China's highly competitive banking landscape.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of the economy, and Everbright Bank actively serves this crucial segment by offering specialized corporate banking services, robust trade finance solutions, and flexible working capital loans. These financial tools are designed to fuel the growth and ensure the smooth operation of businesses, recognizing their significant contribution to the real economy.

In 2024, Everbright's commitment to SMEs is evident in its targeted product development and advisory services, aimed at addressing their unique challenges and opportunities. The bank understands that supporting SMEs directly bolsters economic vitality and fosters job creation.

Everbright Bank caters to large domestic and international corporations, including other state-owned enterprises. These clients demand substantial corporate financing, comprehensive investment banking services, and advanced asset management solutions tailored for their complex transactions and strategic initiatives. In 2024, Everbright Bank continued to prioritize mega corporate banking, serving as a crucial financial partner for major industrial and infrastructure projects.

Institutional Investors

Institutional investors, including pension funds, insurance companies, and other financial entities, are a key customer segment for Everbright. These sophisticated clients require comprehensive asset management, specialized fund management, and tailored investment advisory services. Everbright actively manages funds for such institutional investors, offering a diverse portfolio of investment products and solutions designed to meet their specific, often complex, financial objectives.

China Everbright Limited, for instance, demonstrates its commitment to this segment by managing substantial assets for institutional clients. As of the end of 2023, the firm reported significant growth in its asset management business, with total assets under management reaching approximately RMB 650 billion, a notable increase from RMB 580 billion in the prior year. This growth underscores their capability and trust garnered from institutional partners.

- Asset Management: Providing comprehensive management of investment portfolios for large institutions.

- Fund Management: Creating and managing specialized investment funds tailored to institutional needs.

- Investment Advisory: Offering expert guidance on strategic investment decisions and market opportunities.

- Product Diversification: Delivering a wide array of financial products to meet varied institutional risk appetites and return expectations.

Real Estate Developers and Industrial Entities

Everbright's real estate developer and industrial entity customer segments benefit from specialized financial solutions. These clients seek project financing, strategic investment, and expert asset management, all customized to the unique demands of their respective industries.

The company's engagement extends to direct investments and collaborative partnerships, underscoring a commitment to fostering growth within these critical economic sectors. For instance, in 2024, Everbright actively participated in financing several large-scale infrastructure projects, contributing to the industrial backbone of emerging markets.

- Project Financing: Providing capital for the construction and development of real estate and industrial facilities.

- Investment Services: Offering opportunities for direct investment and co-investment in real estate and industrial ventures.

- Asset Management: Managing portfolios of real estate and industrial assets to optimize returns and mitigate risk.

- Industry-Specific Solutions: Tailoring financial products and advisory services to the nuances of the real estate and industrial sectors.

Everbright Bank serves a broad spectrum of customers, from individual retail clients seeking everyday banking and wealth management to small and medium-sized enterprises (SMEs) needing corporate finance and trade solutions. They also cater to large domestic and international corporations with substantial financing and investment banking needs, as well as institutional investors like pension funds and insurance companies requiring sophisticated asset and fund management. Additionally, real estate developers and industrial entities benefit from specialized project financing and asset management services.

Cost Structure

Personnel and employee costs are a substantial part of Everbright's expenses, reflecting the significant investment in its human capital. These costs encompass salaries, comprehensive benefits packages, and ongoing training programs for a large workforce spread across its banking, securities, and investment management operations. For instance, in 2023, Everbright Securities reported employee compensation and benefits expenses of approximately RMB 18.8 billion, highlighting the scale of this expenditure for the conglomerate.

Everbright's cost structure is significantly impacted by its investments in technology and infrastructure. This includes substantial outlays for IT systems, digital platforms, and robust cybersecurity measures to protect its operations and customer data. The company is actively pursuing a whole-process transformation, aiming to shift key business operations towards online and mobile accessibility, which necessitates ongoing expenditure on technology upgrades and maintenance.

In 2024, Everbright continued to prioritize its digital transformation, allocating significant resources to enhance its technological capabilities. For instance, the company's commitment to modernizing its IT infrastructure and digital platforms is a core component of its strategy to improve efficiency and customer experience. Maintaining its extensive branch network also represents a considerable ongoing cost, even as digital channels expand.

For Everbright Bank, interest expenses represent a significant cost component, primarily stemming from the interest paid on customer deposits and funds borrowed from other financial institutions. This outflow directly influences the bank's net interest income, a crucial metric for profitability.

In 2024, China Everbright Bank experienced a notable decline in its net interest income. This suggests that the cost of its funding, reflected in interest expenses, may have outpaced the returns generated from its lending activities, impacting overall financial performance.

Operating and Administrative Expenses

Operating and administrative expenses are a significant component of Everbright's cost structure. These typically encompass a range of expenditures such as rent for their extensive network of branches and offices, essential utilities, strategic marketing and advertising campaigns, legal and compliance fees, and various other administrative overheads necessary for day-to-day operations.

China Everbright Limited has been actively implementing measures to enhance operational efficiency and cost control. A key initiative has been the strengthening of lean management principles, which aims to streamline processes and reduce waste. This focus has yielded positive results, with the company reporting a decrease in operating costs during 2024, demonstrating their commitment to fiscal discipline.

- Rent for branches and offices: Essential for maintaining a physical presence and serving clients across various locations.

- Utilities: Covering electricity, water, and other essential services for their operational facilities.

- Marketing and advertising: Crucial for brand visibility, customer acquisition, and promoting financial products and services.

- Legal and compliance costs: Necessary to adhere to stringent financial regulations and maintain a sound legal framework.

- Other administrative overheads: Including salaries for administrative staff, IT support, and general office supplies.

Risk Management and Impairment Losses

Everbright's cost structure includes substantial expenses for managing various risks. These encompass the costs of implementing robust credit risk assessment frameworks, hedging against market volatility, and fortifying operational resilience. A significant portion of these costs are directly tied to provisioning for potential loan losses and recognizing impairment charges on its investment portfolio, reflecting the inherent uncertainties in financial markets.

The real estate sector's inherent cyclicality and fluctuations in primary market conditions present ongoing challenges. These market dynamics can directly translate into unrealized losses on Everbright's holdings and, consequently, necessitate higher impairment charges. For instance, during periods of economic downturn or sector-specific stress, the value of certain assets may decline, triggering these charges.

- Credit Risk Management: Costs associated with credit analysis, monitoring, and collateral management.

- Market Risk Mitigation: Expenses for hedging strategies and derivative instruments to offset market fluctuations.

- Operational Risk Control: Investments in technology, compliance, and internal controls to prevent operational failures.

- Impairment Provisions: Setting aside capital to cover potential losses on loans and investments, particularly sensitive to real estate market volatility.

Everbright's cost structure is multifaceted, encompassing significant investments in its people, technology, and operational infrastructure. Key expenses include personnel costs, with employee compensation and benefits representing a substantial outlay. For example, Everbright Securities reported approximately RMB 18.8 billion in such expenses in 2023. Furthermore, ongoing investments in digital transformation and IT systems are critical, as highlighted by continued resource allocation in 2024 to modernize platforms and enhance efficiency.

Interest expenses are a core cost for Everbright Bank, driven by customer deposits and borrowed funds, directly impacting net interest income. In 2024, a decline in net interest income suggests funding costs may have outpaced lending returns. Operating and administrative costs, including rent, utilities, marketing, and compliance, are also significant. China Everbright Limited's focus on lean management has led to reported cost reductions in 2024, demonstrating a commitment to efficiency.

Risk management is another major cost area, involving credit risk assessment, market hedging, and operational controls. Provisions for potential loan losses and impairment charges, particularly influenced by real estate market volatility, are also key expenses. These provisions are essential to buffer against the inherent uncertainties in financial markets.

| Cost Category | Description | 2023 Data (Approx.) | 2024 Trend | Key Drivers |

| Personnel Costs | Salaries, benefits, training | RMB 18.8 billion (Everbright Securities) | Continued investment | Large workforce, talent acquisition |

| Technology & Infrastructure | IT systems, digital platforms, cybersecurity | Significant ongoing investment | Prioritized in 2024 strategy | Digital transformation, efficiency gains |

| Interest Expenses | Interest on deposits and borrowings | Influences net interest income | Potential pressure on net interest income | Funding costs vs. lending yields |

| Operating & Administrative | Rent, utilities, marketing, legal, compliance | Essential for operations | Cost control initiatives implemented | Branch network, regulatory adherence |

| Risk Management & Provisions | Credit, market, operational risk mitigation; impairment charges | Significant due to market volatility | Sensitive to real estate market | Market uncertainty, potential loan losses |

Revenue Streams

Net interest income is a cornerstone of China Everbright Bank's banking operations, representing the profit derived from its core lending and deposit-taking activities. This income is the spread between what the bank earns on its assets, like loans and securities, and what it pays out on its liabilities, primarily customer deposits.

For the first quarter of 2025, ending March 31, China Everbright Bank announced a net interest income of CNY 22,538 million. This figure highlights the significant contribution of its traditional banking services to the company's overall revenue generation.

Fees and commission income form a significant part of Everbright's revenue. This includes earnings from brokerage services, where clients pay commissions for trading securities. Asset management fees are generated from managing investment portfolios for clients, taking a percentage of the assets under management.

Underwriting fees are earned when Everbright helps companies issue new stocks or bonds, facilitating capital raising. Advisory fees are collected for providing expert financial guidance and strategic advice to corporations and individuals. In 2024, China Everbright Limited reported total revenue of HKD 344 million, showcasing the impact of these diverse fee-based streams across its securities, wealth management, and investment banking operations.

Everbright generates significant revenue through investment gains and returns across its diverse portfolio. This includes profits from private equity, venture capital, and strategic industrial holdings. The group's ability to identify and capitalize on market opportunities fuels these returns.

In 2024, China Everbright Limited demonstrated strong performance, with the total exit amount of funds and principal investments surpassing HKD 3.8 billion. This substantial figure highlights the successful realization of gains from its managed assets and strategic investments.

Rental Income and Property Sales

Everbright Grand China Assets generates revenue through two primary channels: rental income from its property portfolio and the proceeds from selling its developed real estate. In 2024, the company reported RMB 45.9 million in revenue, with rental income playing a crucial role. This dual approach highlights Everbright's active participation in both property management and real estate development.

Key aspects of these revenue streams include:

- Rental Income: Consistent cash flow generated from leasing out commercial and residential properties.

- Property Sales: Revenue realized from the successful sale of completed real estate projects, capitalizing on development efforts.

- Diversified Real Estate Holdings: The business model leverages a mix of rental assets and development opportunities to capture value across the real estate lifecycle.

Other Financial Services Income

Everbright Securities' "Other Financial Services Income" encompasses a range of revenue-generating activities beyond core lending and interest-based operations. This segment is crucial for diversifying income and capturing opportunities in dynamic financial markets.

These diverse sources contribute significantly to the overall revenue base, reflecting the conglomerate's broad financial services offerings and its ability to adapt to market conditions. For instance, in 2023, Everbright Securities reported substantial income from its financial market businesses, including trading and asset management fees, highlighting the importance of these non-traditional revenue streams.

- Foreign Exchange Gains: Income generated from fluctuations in currency exchange rates, particularly relevant for a global financial institution.

- Financial Market Businesses: Revenue derived from brokerage, trading, underwriting, and advisory services in capital markets.

- Other Non-Interest Income: This broad category includes fees from wealth management, custody services, and other ancillary financial products.

Everbright's revenue streams are multifaceted, encompassing traditional banking profits, fee-based services, investment gains, and real estate operations. Net interest income remains a core driver, reflecting the bank's lending and deposit activities.

Fee and commission income, including brokerage, asset management, underwriting, and advisory fees, adds significant diversification. Investment gains from private equity and venture capital further bolster earnings, as seen in the substantial exit amounts reported in 2024.

Real estate ventures contribute through rental income and property sales, with 2024 figures showing consistent performance in this sector. Additionally, other financial services, like foreign exchange gains and trading revenues, round out Everbright's comprehensive revenue generation strategy.

| Revenue Stream | Description | 2024/Q1 2025 Data Point | Source Entity | Currency |

| Net Interest Income | Profit from lending and deposit-taking | CNY 22,538 million (Q1 2025) | China Everbright Bank | CNY |

| Fees and Commission Income | Earnings from brokerage, asset management, underwriting, advisory | HKD 344 million (Total Revenue for China Everbright Limited) | China Everbright Limited | HKD |

| Investment Gains | Profits from private equity, venture capital, strategic holdings | Over HKD 3.8 billion (Total exit amount of funds and principal investments) | China Everbright Limited | HKD |

| Real Estate Revenue | Rental income and property sales | RMB 45.9 million (Total revenue) | Everbright Grand China Assets | RMB |

| Other Financial Services Income | Foreign exchange gains, trading, wealth management fees | Substantial income reported (2023) | Everbright Securities | N/A |

Business Model Canvas Data Sources

The Everbright Business Model Canvas is built upon a foundation of robust market research, internal financial data, and competitive analysis. These sources ensure each element of the canvas is grounded in actionable insights and strategic realities.