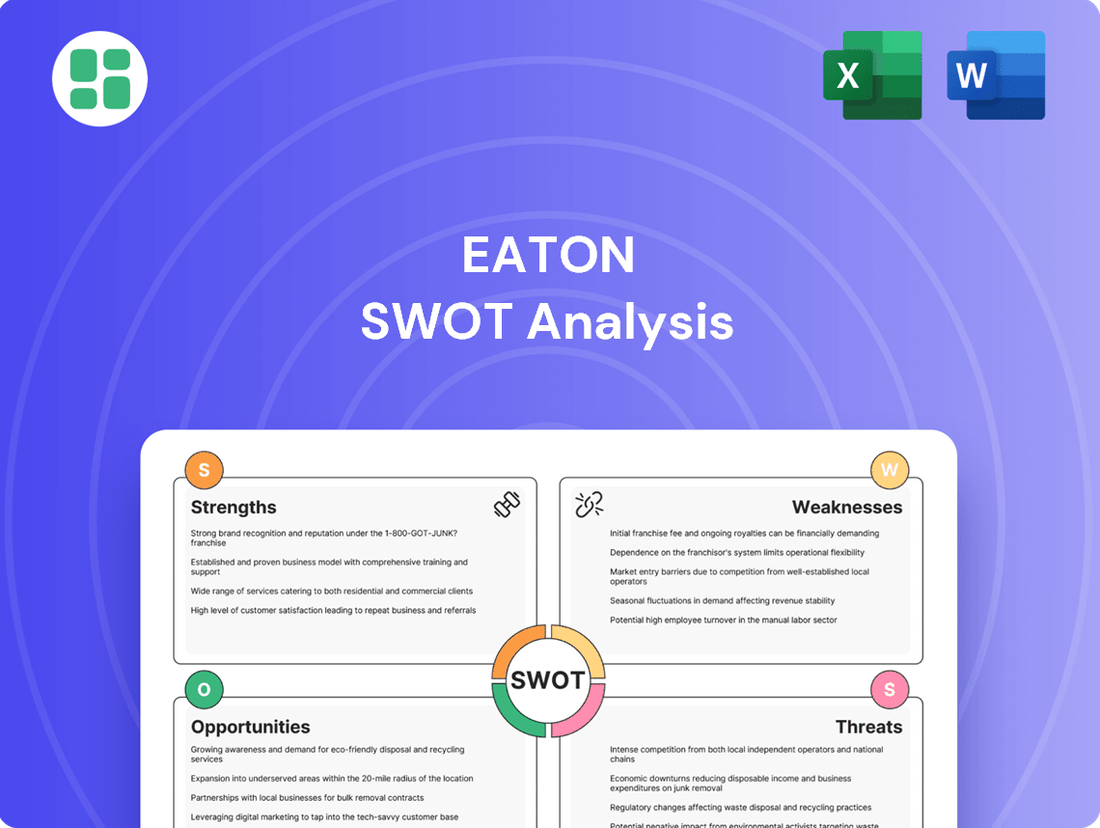

Eaton SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Eaton's diverse product portfolio and strong global presence are significant strengths, but the company also faces challenges from evolving market demands and intense competition. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Eaton's competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic decision-making.

Strengths

Eaton holds a commanding position in intelligent power management, a critical and growing sector. Its reach extends across vital industries like electrical, aerospace, hydraulics, and vehicles, effectively spreading risk and ensuring stability. This diversification is a key strength, allowing Eaton to weather economic fluctuations in any single market.

With operations spanning over 160 countries and substantial manufacturing infrastructure worldwide, Eaton's global footprint is a significant advantage. This extensive network supports its market leadership and provides a solid base for continued growth and operational efficiency, reinforcing its competitive edge.

For instance, in 2023, Eaton reported net income attributable to common shareholders of $3.5 billion, a testament to its diversified revenue streams and strong market positions. This financial performance underscores the resilience built into its broad portfolio and global reach.

Eaton has showcased exceptional financial results, achieving record performance in 2024 and continuing this trend into Q1 2025. This includes robust sales figures, a new record for earnings per share, and enhanced segment margins, demonstrating operational efficiency.

The company’s outlook for 2025 remains highly positive, with management projecting strong organic growth and an increase in adjusted earnings per share. This forward-looking guidance underscores confidence in sustained demand and effective strategic execution.

Eaton's strong strategic alignment with the global shift towards electrification and digitalization is a significant strength. The company's offerings are directly addressing the growing need for energy efficiency and intelligent power management solutions, crucial for sectors like data centers and the integration of renewable energy sources.

Significant Investment in Research and Development

Eaton's commitment to innovation is evident in its significant investment in research and development. The company has pledged $3 billion towards R&D for sustainable solutions by 2030, having already allocated $1.7 billion since 2020. This substantial funding fuels the development of cutting-edge power management technologies.

Leveraging advanced technologies like artificial intelligence, Eaton is accelerating new product development and refining its power management solutions. This strategic focus on R&D is a key driver for its future growth and strengthens its competitive position in the market.

- Substantial R&D Investment: $3 billion committed to sustainable solutions by 2030, with $1.7 billion invested since 2020.

- Technology Integration: Utilizes AI for faster product development and optimized power management.

- Future Growth Driver: Innovation focus ensures continued competitive advantage and market leadership.

Strong Commitment to Sustainability and ESG Goals

Eaton demonstrates a robust commitment to sustainability and Environmental, Social, and Governance (ESG) principles, actively pursuing ambitious targets. The company aims to be net-zero by 2050 and has set a goal to reduce its operational greenhouse gas (GHG) emissions by 50% by 2030. These efforts are not just aspirational; Eaton has already achieved notable reductions in GHG emissions and exceeded its targets for waste and water management.

This dedication to sustainability significantly bolsters Eaton's brand reputation, making it more attractive to environmentally conscious customers and investors. For instance, in 2023, Eaton reported a 23% reduction in Scope 1 and 2 GHG emissions compared to its 2018 baseline, exceeding its interim goal. Furthermore, the company achieved a 90% waste diversion rate from landfills across its global facilities in the same year.

- Net-Zero by 2050: Eaton's long-term commitment to achieving net-zero emissions.

- 2030 GHG Reduction Target: Aims for a 50% reduction in operational GHG emissions from a 2018 baseline.

- Operational Successes: Achieved significant reductions in GHG emissions and surpassed waste and water management targets in 2023.

- Market Advantage: Enhanced brand image and appeal to ESG-focused stakeholders.

Eaton's leadership in intelligent power management is a core strength, serving critical sectors like electrical, aerospace, and vehicles. This diversification across industries provides resilience against market downturns. The company's global presence, with operations in over 160 countries and extensive manufacturing, underpins its market leadership and growth potential.

Financial performance highlights this strength, with record results in 2024 and a positive outlook for 2025, including strong organic growth projections. Eaton's strategic alignment with electrification and digitalization trends, coupled with significant R&D investment of $3 billion by 2030 for sustainable solutions, positions it for future success.

| Key Strength | Description | Supporting Data/Fact |

| Intelligent Power Management Leadership | Dominant position in a growing, essential market. | Serves electrical, aerospace, hydraulics, and vehicle sectors. |

| Global Diversification & Reach | Operations in 160+ countries with significant manufacturing. | Spreads risk across diverse markets and provides operational efficiency. |

| Strong Financial Performance & Outlook | Record results in 2024 and positive 2025 projections. | Projected strong organic growth and increased adjusted EPS for 2025. |

| Innovation & Sustainability Focus | Significant R&D investment and ESG commitment. | $3 billion committed to sustainable solutions by 2030; Net-zero by 2050 target. |

What is included in the product

Analyzes Eaton’s competitive position through key internal and external factors, highlighting its strengths in power management solutions and opportunities in energy transition, while also addressing weaknesses in supply chain and threats from market volatility.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Eaton's Vehicle segment has shown weakness, with a notable sales decline in the first quarter of 2025. The company anticipates this trend to continue, projecting a negative sales outlook for the entire year 2025 for this division.

Furthermore, the eMobility sector has encountered hurdles, particularly in securing crucial contracts for its high-voltage charging systems. These specific challenges within these key segments pose a risk to Eaton's overall growth trajectory and profitability.

Eaton faces significant challenges due to ongoing supply chain disruptions and cost volatility, a vulnerability it openly acknowledges. Persistent inflation and logistical bottlenecks have directly impacted the company, driving up expenses for crucial raw materials such as copper and steel. For instance, in 2023, the company highlighted these pressures impacting its cost of goods sold.

These supply chain weaknesses can directly squeeze profit margins, making it harder for Eaton to maintain its profitability targets and affecting overall operational efficiency. The company's reliance on a global network means it remains exposed to potential disruptions that could hinder production and impact its competitive standing in the market.

Despite Eaton's robust financial performance and a notable surge in its stock price, some market analysts have voiced concerns regarding its current valuation. As of early 2024, with the stock trading at a forward P/E ratio that some deem elevated compared to industry peers, this perception of overvaluation could potentially temper investor enthusiasm. Such sentiment, if it persists, might lead to increased caution among investors or even trigger a price correction, making ongoing valuation analysis crucial for stakeholders.

Integration Risks of Acquisitions

Integrating acquired companies like Fibrebond and Resilient Power Systems into Eaton's existing structure presents significant challenges. These can include merging different IT systems, harmonizing corporate cultures, and aligning operational processes, all of which can disrupt day-to-day business and delay synergy realization. For instance, if the integration of Fibrebond's manufacturing capabilities into Eaton's electrical sector proves more complex than anticipated, it could impact production schedules and cost-saving targets for 2024.

Failure to smoothly integrate these acquisitions can lead to underperformance, failing to capture the full strategic and financial benefits of the deal. Eaton's ability to manage these complexities directly impacts its capacity to leverage new technologies and market access gained through these transactions. For example, if the integration of Resilient Power Systems' distributed energy resources expertise doesn't yield the expected cross-selling opportunities by late 2024, it would be a significant setback.

Key integration risks for Eaton include:

- Operational Disruption: Merging supply chains, manufacturing processes, and distribution networks can cause temporary inefficiencies and increased costs.

- Cultural Clashes: Differences in corporate culture between Eaton and acquired entities can hinder collaboration and employee retention, impacting productivity.

- Synergy Shortfalls: The inability to achieve projected cost savings or revenue enhancements from the acquisition, often due to integration hurdles, can negate the deal's value.

- IT System Integration: Combining disparate IT infrastructures, including enterprise resource planning (ERP) systems, is a complex and costly process that can lead to data inconsistencies and operational delays.

Exposure to Broader Macroeconomic Headwinds

Eaton faces significant exposure to broader macroeconomic headwinds. A potential economic downturn or a slowdown in industrial activity, particularly in key markets like Europe, could dampen demand for its electrical, aerospace, and industrial products. For instance, a significant contraction in global manufacturing output, a key driver for Eaton's electrical sector, would directly impact its order intake and revenue generation.

Fluctuations in currency exchange rates also present a notable risk. As a global company, Eaton's reported earnings can be significantly affected by the translation of foreign currency revenues and profits back into US dollars. For example, a strengthening US dollar against major currencies could negatively impact its reported financial performance, even if underlying operational results remain robust.

- Economic Slowdown Impact: A global GDP contraction of 1% could lead to a proportional decrease in demand for industrial goods, impacting Eaton's revenue streams.

- Regional Vulnerabilities: Slowing industrial production in Europe, which represented approximately 20% of Eaton's total sales in 2023, poses a direct threat to its performance in that region.

- Currency Translation Effects: A 5% adverse movement in currency exchange rates against the US dollar could reduce Eaton's reported earnings per share by an estimated $0.10-$0.15.

Eaton's Vehicle segment is experiencing a downturn, with sales declining in early 2025 and a negative outlook for the full year. The eMobility sector faces challenges in securing vital contracts for its high-voltage charging systems, impacting growth prospects.

Supply chain disruptions and cost volatility, particularly for raw materials like copper and steel, continue to pressure Eaton's cost of goods sold and profit margins. This reliance on global networks leaves the company vulnerable to production delays and competitive pressures.

Concerns about Eaton's valuation have been raised by market analysts, with its forward P/E ratio in early 2024 seen as elevated compared to industry peers, potentially dampening investor enthusiasm and risking price corrections.

Integrating recent acquisitions, such as Fibrebond and Resilient Power Systems, presents significant operational and cultural challenges. Delays in realizing expected synergies, like cross-selling opportunities from Resilient Power Systems by late 2024, could hinder the full realization of strategic and financial benefits.

Preview Before You Purchase

Eaton SWOT Analysis

The file shown below is not a sample—it’s the real Eaton SWOT analysis you'll download post-purchase, in full detail. You'll receive the complete, professionally structured document, ready for your strategic planning needs.

Opportunities

The relentless growth of data centers, supercharged by the widespread adoption of artificial intelligence, creates a substantial runway for Eaton. This surging demand, particularly for AI-specific infrastructure, directly translates into increased need for Eaton's specialized electrical equipment and comprehensive power management solutions.

Eaton is strategically positioned to capitalize on this trend, evidenced by its active development of high-voltage direct current (HVDC) power infrastructure tailored for AI data centers. The company reported a significant backlog in this burgeoning sector, underscoring its robust engagement and the immediate market appetite for its offerings.

The global push for cleaner energy, exemplified by a projected 30% increase in renewable energy capacity additions in 2024 according to the IEA, presents a significant opportunity. Eaton's expertise in grid modernization and power distribution solutions directly supports this transition. The company is poised to capitalize on increased infrastructure spending, with the US alone allocating billions to grid upgrades and renewable energy projects through initiatives like the Bipartisan Infrastructure Law.

Eaton consistently seeks strategic acquisitions to broaden its offerings and market presence. Recent examples include the purchases of Fibrebond Corporation, Exertherm, NordicEPOD AS, Resilient Power Systems, and Ultra PCS Limited, all aimed at integrating innovative technologies.

These acquisitions are specifically designed to strengthen Eaton's capabilities in high-growth sectors such as electric vehicle charging infrastructure, advanced data center power solutions, and aerospace technologies. This inorganic growth strategy effectively complements its organic development efforts.

By integrating these acquired businesses, Eaton not only enhances its technological portfolio but also solidifies its competitive standing in key emerging markets, demonstrating a clear strategy for sustained expansion and market leadership.

Growth in Electric Vehicle (EV) and eMobility Markets

The global electric vehicle market is experiencing robust expansion, with projections indicating continued strong growth through 2030. Eaton's strategic investments in eMobility solutions, particularly its solid-state transformer technology designed for high-power EV charging infrastructure, are well-positioned to capitalize on this trend. This focus on advanced charging solutions addresses a critical need for efficient and scalable EV charging, offering significant potential for market penetration and revenue generation as the EV ecosystem matures.

Key opportunities within the EV and eMobility sectors include:

- Expanding charging infrastructure: The demand for reliable and high-speed charging stations is a major growth driver, with significant government and private sector investment anticipated globally.

- Advancements in battery technology: Improvements in battery density, charging speed, and cost reduction will further accelerate EV adoption, creating a larger addressable market for supporting technologies.

- Grid integration solutions: Eaton's expertise in power management is crucial for integrating a large number of EVs into the existing power grid, managing demand, and potentially enabling vehicle-to-grid (V2G) services.

- Fleet electrification: The increasing trend of electrifying commercial and public transportation fleets presents a substantial opportunity for Eaton's charging and power management solutions.

Leveraging Digitalization and IoT for Enhanced Solutions

Eaton is significantly investing in digitalization and the Internet of Things (IoT) to enhance its power management offerings. Its Brightlayer software platform is a prime example, allowing customers to gain intelligent insights for optimized energy usage and improved operational value. This strategic focus on connected solutions directly addresses the growing industry-wide demand for advanced power management technologies.

The company's commitment to digital transformation is evident in its expanding portfolio of smart, connected products. For instance, Eaton's digital solutions are designed to provide real-time data and analytics, enabling proactive maintenance and reducing downtime. This not only benefits customers by improving reliability but also positions Eaton as a leader in the evolving landscape of intelligent power management.

- Brightlayer Software: Eaton's digital platform offers predictive analytics and remote monitoring capabilities for power systems.

- IoT Integration: The company is embedding IoT sensors and connectivity into its electrical and industrial equipment.

- Customer Benefits: Enhanced operational efficiency, reduced energy consumption, and improved system uptime are key advantages for users.

- Market Demand: The global industrial IoT market is projected to reach hundreds of billions of dollars by 2025, highlighting the significant opportunity for Eaton's digital solutions.

The increasing demand for AI-driven data centers presents a substantial opportunity for Eaton, as these facilities require robust and specialized electrical infrastructure. Eaton's focus on high-voltage direct current (HVDC) solutions for AI workloads directly addresses this growing market. The company's significant backlog in this sector indicates strong demand for its power management technologies.

Eaton is well-positioned to benefit from the global energy transition, with renewable energy capacity additions projected to rise significantly in 2024. Its expertise in grid modernization and power distribution aligns with increased infrastructure spending, particularly in regions like the United States investing heavily in grid upgrades and renewable energy projects.

Strategic acquisitions, such as those of Fibrebond Corporation and Ultra PCS Limited, bolster Eaton's capabilities in high-growth areas like electric vehicle charging and advanced data center solutions. These moves enhance its technological portfolio and competitive edge in emerging markets.

The expanding electric vehicle market offers considerable growth potential for Eaton's eMobility solutions, including its advanced solid-state transformer technology for high-power EV charging. This positions the company to capitalize on the increasing need for efficient and scalable EV charging infrastructure.

Eaton's investment in digitalization, exemplified by its Brightlayer software platform, taps into the growing demand for IoT-enabled power management. This focus on smart, connected products enhances operational efficiency and system uptime for customers, aligning with the projected growth of the global industrial IoT market.

Threats

Eaton faces a fierce competitive environment across its diverse business segments, contending with both long-standing industry leaders and agile new entrants. This constant rivalry puts considerable strain on pricing strategies and can compress profit margins, impacting overall financial performance.

The rapid pace of technological advancement means that more efficient or cost-effective solutions from competitors pose a significant threat to Eaton's established market position and profitability. For instance, in the electrical sector, the rise of decentralized energy solutions and advanced grid management software from specialized firms directly challenges traditional utility infrastructure providers.

Eaton faces a significant threat from the volatility in raw material prices. Fluctuations in the cost of essential inputs like iron, steel, and copper can directly impact its bottom line. For instance, during 2024, global commodity markets experienced notable price swings, which could have squeezed Eaton's operating margins if not effectively managed through hedging or pricing strategies.

Beyond raw materials, rising labor and other production expenses present another challenge. Increased wages or energy costs, which are often difficult to pass on entirely to customers, can erode profitability. Eaton's financial performance in 2024 and projections for 2025 will likely be influenced by its ability to absorb or mitigate these escalating operational expenditures.

Global geopolitical tensions, including ongoing conflicts and the risk of economic downturns, pose a significant threat to Eaton. Major markets facing potential recessions could lead to reduced industrial activity and decreased customer spending, directly impacting Eaton's sales performance.

Disruptions to global supply chains, often exacerbated by geopolitical instability, can hinder Eaton's operational stability and increase costs. For instance, the lingering effects of global trade disputes and regional conflicts in 2024 continue to create uncertainty in raw material availability and logistics, impacting manufacturing efficiency.

Risk of Technological Obsolescence and Rapid Innovation Cycles

The rapid evolution of technology, especially in AI and energy management, poses a significant threat of making Eaton's current products outdated quickly. Competitors introducing disruptive innovations that lower power demands or boost efficiency could directly impact Eaton's market position.

For example, advancements in distributed energy resources and smart grid technologies are reshaping the energy landscape, potentially reducing reliance on traditional infrastructure solutions. Eaton's ability to stay ahead requires substantial and ongoing investment in research and development, with a focus on agile adaptation to market shifts.

- Technological Obsolescence: The swift pace of innovation, particularly in AI-driven energy solutions, risks making current product lines less competitive.

- Disruptive Technologies: Competitors may introduce new technologies that significantly reduce power consumption or offer superior energy efficiency, impacting demand for Eaton's offerings.

- R&D Investment: Continuous investment in research and development is critical for Eaton to maintain its competitive edge and adapt to changing technological landscapes.

Regulatory and Compliance Risks

Eaton's global operations expose it to a complex and constantly changing web of laws, regulations, and environmental standards. For instance, in 2024, companies across sectors faced increased scrutiny on ESG reporting, potentially impacting Eaton's compliance strategies. Changes in tax legislation or more stringent environmental mandates could directly increase operating expenses or require substantial capital outlays for adherence.

Furthermore, the threat of non-compliance is significant. Penalties for failing to meet regulatory requirements can be substantial, and such failures can also lead to considerable damage to Eaton's reputation. For example, a hypothetical environmental violation in a key market could result in fines and a loss of customer trust, impacting future sales and market position.

- Evolving Global Regulations: Eaton must navigate diverse and changing legal frameworks worldwide, impacting its operational costs.

- Increased Compliance Burden: New environmental standards or tax laws could necessitate significant investments, potentially affecting profitability.

- Penalties and Reputational Risk: Non-compliance carries the risk of financial penalties and damage to Eaton's brand image.

Intensifying competition and the rapid pace of technological change, particularly in AI and distributed energy systems, pose significant threats to Eaton's market share and profitability. Disruptive innovations could render existing product lines obsolete, necessitating substantial and continuous R&D investment to maintain competitiveness. For instance, in 2024, the energy sector saw accelerated adoption of smart grid technologies, challenging traditional infrastructure providers.

Eaton's global operations are susceptible to supply chain disruptions, geopolitical instability, and volatile raw material prices, impacting production costs and efficiency. For example, in early 2024, steel prices saw fluctuations, directly affecting manufacturing expenses. Navigating evolving global regulations and environmental standards also presents a compliance burden, with potential financial penalties and reputational damage for non-adherence.

| Threat Area | Specific Risk | 2024/2025 Impact Consideration |

|---|---|---|

| Competition & Technology | Obsolescence from AI/Distributed Energy | Need for agile R&D; potential margin pressure from new entrants. |

| Operational Costs | Raw Material Volatility (e.g., Steel, Copper) | Hedging strategies and pricing adjustments crucial; 2024 saw price swings. |

| Geopolitics & Supply Chain | Disruptions, Trade Tensions | Increased logistics costs, potential production delays; lingering 2024 effects. |

| Regulatory Environment | Evolving Global Standards (ESG, Tax) | Compliance costs, risk of fines, and reputational damage. |

SWOT Analysis Data Sources

This Eaton SWOT analysis is built upon a robust foundation of verified financial statements, in-depth market research reports, and expert industry analysis to ensure a comprehensive and accurate strategic overview.