Eaton Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

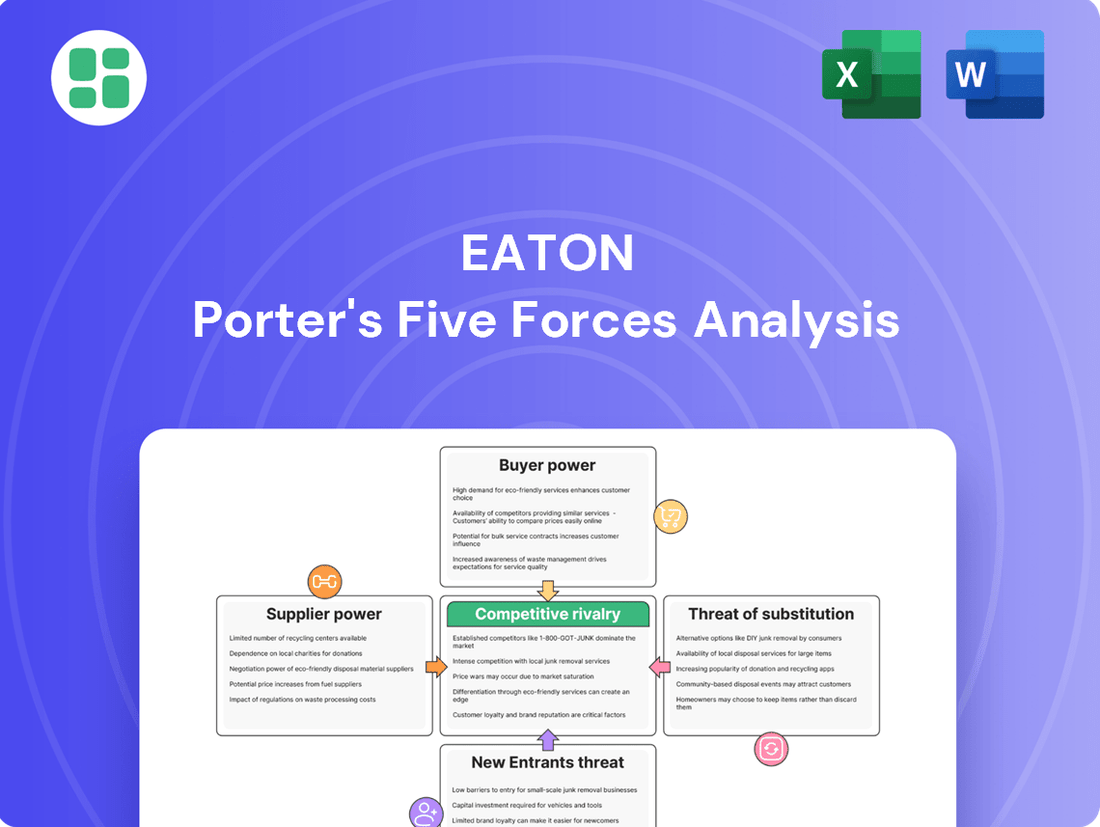

Understanding the competitive landscape is crucial for any business, and for Eaton, Porter's Five Forces Analysis offers a powerful lens. This framework dissects the industry's structure, revealing the underlying forces that shape profitability and strategic positioning.

The complete report reveals the real forces shaping Eaton’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eaton's reliance on a global supply chain for specialized components, like advanced alloys and proprietary semiconductor chips, highlights a key area of supplier bargaining power. When only a few suppliers can produce these critical inputs, often due to unique intellectual property or specialized manufacturing processes, their ability to dictate terms and prices significantly increases.

For instance, in 2024, the semiconductor industry continued to experience supply chain constraints for advanced nodes, directly impacting companies like Eaton that require these sophisticated electronic parts for their power management solutions. This limited supplier base grants them considerable leverage in negotiations, potentially affecting Eaton's cost of goods sold and production schedules.

Recent global events, such as the semiconductor shortage and shipping disruptions, have significantly impacted supply chains. For instance, by early 2024, lead times for certain electronic components remained elevated, forcing companies like Eaton to contend with extended delivery schedules and unpredictable pricing for critical inputs.

This heightened volatility directly translates to increased bargaining power for suppliers, especially those providing essential materials or specialized components where alternative sourcing is scarce. Eaton, like many manufacturers, may find itself compelled to accept higher costs or navigate prolonged lead times, impacting production efficiency and profitability.

In specialized areas like advanced aerospace components, Eaton might face suppliers with significant market power due to limited competition. For instance, if only a few companies can produce highly specific, precision-engineered hydraulic parts meeting stringent aerospace certifications, these suppliers can dictate terms more effectively. This concentration means Eaton has fewer alternatives, potentially leading to higher input costs or less favorable contract conditions.

Input Material Cost Fluctuations

Input material cost fluctuations represent a significant aspect of supplier bargaining power for Eaton. The prices of crucial raw materials such as copper and steel, which are fundamental to Eaton's extensive portfolio of electrical and mechanical products, are inherently volatile due to their dependence on global commodity markets.

Suppliers of these essential materials possess the leverage to pass on any cost increases directly to Eaton. This can put considerable pressure on Eaton's profit margins, especially if the company faces challenges in fully recovering these higher input expenses by adjusting its own product pricing to customers.

- Copper prices saw significant volatility in early 2024, with LME three-month copper trading between $7,500 and $10,000 per metric ton, impacting manufacturers reliant on the metal.

- Steel prices also experienced fluctuations throughout 2023 and into 2024, influenced by factors such as global demand and production levels, affecting the cost base for many of Eaton's components.

- Eaton's ability to pass on these material cost increases is often constrained by competitive market conditions and long-term customer contracts, limiting margin expansion opportunities.

Strategic Partnerships and Vertical Integration

Eaton actively cultivates strategic partnerships with its suppliers, aiming to secure favorable terms and ensure a reliable supply chain. This collaborative approach, exemplified by long-term agreements, can reduce the bargaining power of individual suppliers by fostering mutual dependency and shared objectives.

Furthermore, Eaton's pursuit of vertical integration for specific critical components, such as certain power electronics or advanced materials, directly addresses supplier power by bringing production in-house. This strategy, however, introduces its own set of challenges, potentially increasing capital expenditure and operational complexity.

For instance, in 2024, Eaton continued to invest in its advanced manufacturing capabilities, aiming to control more of its value chain. While specific figures on vertical integration's impact on supplier bargaining power are proprietary, industry trends suggest that companies with greater control over key inputs often experience more stable costs and reduced supply chain disruptions.

- Strategic Partnerships: Eaton's focus on long-term supplier relationships aims to create stability and predictability in its supply chain, thereby lessening the leverage of individual suppliers.

- Vertical Integration: By bringing the production of critical components in-house, Eaton seeks to gain greater control over costs, quality, and supply availability, directly counteracting supplier power.

- Dependency Risk: While integration can reduce supplier power, it can also create a significant dependency on internal capabilities, making it challenging to pivot quickly if internal production faces issues or if market demand shifts rapidly.

- Industry Context: In 2024, the electrical components sector saw continued supply chain volatility, making Eaton's strategies of partnership and integration crucial for maintaining operational resilience and competitive pricing.

Suppliers hold significant sway when their products are critical and few alternatives exist, allowing them to command higher prices and dictate terms. This is particularly true for specialized components, like those in the semiconductor industry where limited advanced node suppliers impacted companies like Eaton in 2024, leading to extended lead times and increased costs.

Fluctuations in raw material prices, such as copper and steel, directly empower suppliers who can pass on these increased costs. For example, copper prices in early 2024 traded within a wide range, affecting manufacturers. Eaton's ability to absorb these increases is often limited by market competition and existing contracts.

Eaton mitigates supplier power through strategic partnerships and vertical integration. By fostering long-term relationships and bringing production of key components in-house, Eaton aims for greater control over costs and supply stability, a strategy that became even more vital amidst 2024's supply chain volatility.

| Factor | Impact on Eaton | 2024 Context |

|---|---|---|

| Limited Supplier Base | Higher input costs, production delays | Semiconductor shortages persisted for advanced nodes |

| Raw Material Volatility | Increased cost of goods sold, margin pressure | Copper prices fluctuated significantly; steel prices remained volatile |

| Supplier Relationships | Potential for favorable terms, supply stability | Eaton focused on long-term agreements |

| Vertical Integration | Reduced reliance on external suppliers, cost control | Continued investment in advanced manufacturing capabilities |

What is included in the product

This analysis dissects the five competitive forces shaping Eaton's industry, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, Eaton's strategic positioning.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Eaton's customer base includes major industrial, commercial, and governmental organizations. Many of these are large original equipment manufacturers (OEMs) in critical sectors like aerospace and vehicles. These significant buyers, by virtue of their size and consistent demand, possess considerable bargaining power.

The sheer volume of products these key customers purchase allows them to negotiate aggressively on price and contract terms. For instance, in the automotive sector, large OEMs can demand significant discounts or specific customization that impacts Eaton's margins.

While customers might wield significant bargaining power due to sheer purchase volume, the criticality of Eaton's offerings fundamentally shifts this dynamic. Products like their power distribution systems, hydraulic components, and aerospace systems are often the backbone of customer operations, meaning failure isn't just an inconvenience, it's a potential operational standstill.

This mission-critical nature means customers are acutely aware of the high cost associated with downtime. For instance, in the industrial sector, extended outages from a faulty hydraulic system can lead to millions in lost production. Consequently, customers are less inclined to push for price concessions at the expense of the reliability and quality Eaton provides.

For sophisticated integrated power management solutions, particularly in sectors like aerospace or complex hydraulic systems, customers often encounter significant hurdles when considering a switch away from Eaton's offerings. These barriers can involve substantial expenses related to re-engineering existing systems, the need for extensive employee re-training, and the potential for disruptive operational downtime during the transition. For instance, a major airline integrating Eaton's advanced electrical systems into its fleet might face millions in re-certification and modification costs if it were to switch to a competitor, thereby diminishing its leverage.

Diverse Customer Base Across Segments

Eaton's extensive reach across electrical, aerospace, hydraulics, and vehicle sectors means its customer base is inherently diverse. This broad spectrum of industries, from critical infrastructure to transportation, means that while some major clients in specific segments might wield considerable influence, the overall customer landscape is largely fragmented.

For instance, in the electrical sector, while large utility companies represent significant purchasing power, Eaton also serves a vast number of smaller contractors and distributors. This diffusion of demand across numerous smaller entities in many of its business units helps to temper the aggregate bargaining power of customers. In 2023, Eaton reported total net sales of $23.2 billion, illustrating the sheer volume and variety of its customer interactions.

- Diverse Industry Exposure: Eaton’s operations in electrical, aerospace, hydraulics, and vehicles create a wide array of customer types.

- Fragmented Demand in Key Segments: While some large customers exist, many sectors feature a broad base of smaller buyers, diluting overall customer power.

- 2023 Sales Performance: Eaton’s $23.2 billion in net sales for 2023 underscores the breadth of its customer relationships.

Brand Reputation and After-Sales Service

Eaton's robust brand reputation, built on decades of delivering reliable, safe, and sustainable electrical and industrial solutions, significantly influences customer purchasing decisions. This strong brand equity allows customers to trust in Eaton's product performance and longevity, making them less inclined to switch based solely on price. For instance, in 2023, Eaton reported a 10% increase in revenue for its Electrical Americas segment, partly attributed to the continued demand for its trusted solutions.

Furthermore, Eaton's extensive global after-sales service network provides critical support, maintenance, and expertise. This comprehensive support system adds substantial value, ensuring operational continuity and minimizing downtime for customers. Such a commitment to service reduces customer price sensitivity, as the long-term benefits of reliable performance and readily available support often outweigh minor cost differences compared to competitors with weaker service infrastructures.

- Brand Reputation: Eaton is consistently recognized for quality and reliability, influencing customer loyalty.

- After-Sales Service: A global network ensures ongoing support, reducing customer concerns about long-term operational costs.

- Reduced Price Sensitivity: Customers prioritize performance and support, making them less likely to choose based on price alone.

- Value Proposition: Eaton's combined offering of reliable products and strong service creates a compelling value that customers are willing to pay for.

While large customers can negotiate based on volume, Eaton's mission-critical products and high switching costs often limit their bargaining power. The company's strong brand reputation and global service network further solidify customer loyalty, making price less of a deciding factor.

| Factor | Impact on Eaton's Customer Bargaining Power | Supporting Data/Observation |

| Customer Volume & Concentration | High for large OEMs, but mitigated by product criticality. | Eaton's 2023 sales of $23.2 billion reflect diverse customer base. |

| Switching Costs | High due to re-engineering, retraining, and operational risks. | Millions in re-certification and modification costs for aerospace clients switching suppliers. |

| Product Differentiation & Criticality | Lowers power as products are essential for operations. | Downtime from faulty hydraulic systems can cost millions in lost production. |

| Brand Reputation & Service | Reduces price sensitivity and fosters loyalty. | 10% revenue increase in Electrical Americas segment in 2023 linked to trusted solutions. |

Preview Before You Purchase

Eaton Porter's Five Forces Analysis

This preview showcases the complete Eaton Porter's Five Forces analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This comprehensive analysis is professionally formatted and ready for your immediate use, providing valuable insights into industry attractiveness and strategic positioning.

Rivalry Among Competitors

Eaton faces formidable competition from global giants like Siemens, Schneider Electric, ABB, Emerson Electric, Honeywell, and Parker Hannifin. These established players offer a broad spectrum of comparable electrical, hydraulic, and aerospace solutions, creating a highly competitive landscape.

For instance, in the electrical sector, Siemens' revenue for fiscal year 2023 reached €77.8 billion, while Schneider Electric reported €35.9 billion in revenue for 2023, highlighting the significant scale and market presence of Eaton's rivals.

This intense rivalry means Eaton must continuously innovate and maintain cost-efficiency to retain market share and attract new customers across its diverse product lines.

Eaton’s operating sectors, such as electrical and aerospace, necessitate substantial and ongoing investment in research and development to maintain a competitive edge. This commitment to R&D is crucial for developing innovative solutions in rapidly evolving fields like digitalization, energy efficiency technologies, and electrification, which are key drivers of industry advancement.

Companies within these industries fiercely compete on the basis of innovation, striving to introduce cutting-edge products and advanced solutions to the market. This intense rivalry underscores the importance of R&D expenditure as a primary differentiator and a critical factor in capturing market share and driving future growth.

Rivalry within Eaton's markets is intense, playing out across product performance, total cost of ownership, quality, design engineering, delivery speed, and global service capabilities. Eaton consistently demonstrates a robust competitive stance, holding leadership positions in numerous product segments.

For instance, in the electrical components sector, where Eaton is a major player, the average profit margin for companies in 2024 hovered around 10-15%, highlighting the pressure to compete on price and efficiency. Eaton's ability to offer integrated solutions and leverage its global service network provides a significant advantage in this fiercely contested landscape.

Strategic Mergers and Acquisitions

Mergers and acquisitions are a constant feature of the competitive landscape, as firms actively pursue consolidation to bolster their market presence and operational efficiency. For instance, in 2024, the global M&A market saw significant activity, with deal volumes remaining robust across various sectors, indicating a persistent drive for strategic integration.

These strategic moves often lead to the emergence of larger, more dominant players, which in turn can intensify the rivalry among existing companies. The pursuit of economies of scale and the desire to diversify product or service offerings are key motivators behind these transactions. This consolidation can create significant barriers to entry and put pressure on smaller or less integrated competitors.

- Increased Market Concentration: M&A activity can lead to fewer, larger competitors, concentrating market share and potentially increasing pricing power.

- Enhanced Economies of Scale: Combined entities can achieve greater efficiencies through larger production volumes and streamlined operations.

- Portfolio Diversification: Companies merge to broaden their product lines or enter new markets, reducing reliance on single revenue streams.

- Intensified Competitive Pressure: Larger, more resource-rich competitors can engage in more aggressive pricing or marketing strategies.

Market Growth and Backlog Strength

While certain sectors, such as automotive, have seen reduced demand, Eaton and its peers are experiencing robust backlogs fueled by significant growth in areas like data centers and electrical infrastructure. This surge is largely attributable to powerful megatrends like electrification and digitalization, which are reshaping industries and driving substantial investment in power management solutions.

This strong demand environment, particularly in high-growth segments, can serve to moderate intense price-based competition. When demand outstrips supply, companies are less inclined to engage in aggressive price wars, focusing instead on fulfilling orders and capturing market share through innovation and reliable delivery.

- Eaton's backlog reached $23.7 billion at the end of 2023, indicating strong future revenue visibility.

- Demand for electrical components in data centers and renewable energy projects remains exceptionally high.

- The electrification trend, particularly in transportation and industrial processes, is a key driver of sustained demand.

- Digitalization initiatives are increasing the need for reliable and efficient power management systems.

Competitive rivalry is a defining characteristic of Eaton's operating environment, with numerous global players vying for market share. These rivals, including Siemens and Schneider Electric, possess significant scale and resources, leading to intense competition across product performance, cost, quality, and service. The industry sees frequent mergers and acquisitions as companies seek to enhance their competitive positions, further concentrating the market and intensifying pressures.

| Competitor | 2023 Revenue (Approx.) | Key Sectors |

|---|---|---|

| Siemens | €77.8 billion | Electrical, Automation, Digital Industries |

| Schneider Electric | €35.9 billion | Electrical, Energy Management, Automation |

| ABB | $37.8 billion | Electrification, Motion, Robotics, Automation |

SSubstitutes Threaten

The global push for sustainability is a significant threat. Renewable energy sources like solar and wind, coupled with advancements in battery storage, are increasingly viable alternatives to traditional grid infrastructure and power management systems. This trend could directly impact demand for Eaton's established product lines.

For instance, the International Energy Agency reported in 2024 that renewable energy sources accounted for over 30% of global electricity generation. This growing market share for renewables signifies a direct substitute threat for components historically reliant on fossil fuel-based power generation.

The rapid advancement and decreasing costs of battery energy storage systems (BESS) present a significant threat of substitution for some of Eaton's traditional backup power solutions. As BESS technology matures, it can increasingly meet the power management needs currently served by Eaton's established electrical products, potentially eroding market share.

By mid-2024, the global BESS market was projected to reach over $200 billion by 2030, driven by falling lithium-ion battery prices. This cost reduction makes BESS a more economically viable alternative for applications like peak shaving and grid stabilization, directly competing with some of Eaton's offerings.

The increasing digitalization and the rise of software-defined power management solutions present a significant threat of substitution for traditional hardware-centric approaches. Customers are increasingly looking for integrated platforms that leverage sophisticated software to optimize energy usage, potentially diminishing the demand for certain physical components that were previously essential.

For instance, the market for smart grid technologies, heavily reliant on software for data analysis and control, is projected to reach USD 71.3 billion by 2027, indicating a strong shift towards software-enabled solutions that can perform functions previously handled by dedicated hardware. This trend directly challenges companies whose core offerings are based on physical infrastructure alone.

New Materials and Manufacturing Techniques

Innovations in materials science and advanced manufacturing, like additive manufacturing (3D printing), pose a significant threat. These advancements can create alternative components or entire systems that mimic the functionality of Eaton's offerings, potentially at a reduced price point or with novel performance attributes.

For instance, the increasing sophistication of 3D printing allows for the creation of complex electrical components and even entire power distribution modules. This could bypass the need for traditional, more costly manufacturing processes and established supply chains that Eaton relies on. The global market for additive manufacturing was valued at approximately $15.1 billion in 2023 and is projected to grow substantially, indicating a rising capability for substitute product development.

Consider the impact on electrical connectors or specialized housing for sensitive equipment. Companies leveraging these new techniques might offer custom-fit solutions that are quicker to produce and more cost-effective than mass-produced alternatives. This directly challenges Eaton's market share by providing viable, often more agile, substitutes.

The key threats from new materials and manufacturing techniques include:

- Development of lower-cost alternatives: New materials and processes can reduce production expenses, enabling competitors to offer similar products at more attractive prices.

- Introduction of products with enhanced or different functionalities: Additive manufacturing, for example, allows for intricate designs that might offer superior performance or unique capabilities not easily replicable by traditional methods.

- Disruption of traditional supply chains: On-demand, localized manufacturing through 3D printing can bypass established distribution networks, offering faster lead times and greater flexibility.

- Increased accessibility for smaller players: Advanced manufacturing technologies lower the barrier to entry, allowing smaller, innovative companies to challenge established players like Eaton with novel solutions.

Customer Adoption of Integrated Smart Systems

Customers are increasingly looking for comprehensive, integrated smart systems rather than individual components for managing power, automating buildings, and controlling industrial processes. This trend poses a threat as readily available, all-encompassing smart solutions from competitors can replace the need for Eaton's discrete product offerings.

For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $180 billion by 2028, indicating a strong customer preference for integrated solutions. This growth highlights the potential for substitute products that offer a complete smart ecosystem to capture market share from companies selling individual smart devices.

- Growing Demand for Integrated Systems: A significant driver for substitutes is the customer's desire for seamless operation across power, building, and industrial controls.

- Competitor Offerings: The market is seeing a rise in providers offering holistic smart solutions, directly challenging Eaton's approach to selling individual smart products.

- Market Value of Smart Systems: The expanding market for smart building technologies, projected to exceed $180 billion by 2028, underscores the viability and appeal of integrated substitute solutions.

The threat of substitutes arises from alternative solutions that can fulfill similar customer needs, potentially impacting Eaton's market share. Renewable energy sources and advancements in battery storage are increasingly offering viable alternatives to traditional power infrastructure. Furthermore, the shift towards integrated smart systems and software-defined power management presents a challenge to hardware-centric offerings.

The growing adoption of renewable energy, which accounted for over 30% of global electricity generation in 2024 according to the International Energy Agency, directly substitutes for traditional grid components. Similarly, the battery energy storage systems market, projected to exceed $200 billion by 2030, offers alternatives to established backup power solutions due to falling lithium-ion battery prices.

Innovations in additive manufacturing and materials science also introduce substitute components, potentially at lower costs or with enhanced functionalities. The global additive manufacturing market was valued at approximately $15.1 billion in 2023, indicating a growing capability for disruptive product development that can bypass traditional supply chains.

The increasing demand for integrated smart systems, with the global smart building market expected to surpass $180 billion by 2028, highlights a preference for holistic solutions over individual components. This trend allows competitors offering comprehensive smart ecosystems to directly challenge Eaton's discrete product sales.

| Substitute Area | Key Trend/Technology | Market Data/Projection | Impact on Eaton |

|---|---|---|---|

| Energy Generation | Renewable Energy (Solar, Wind) | Over 30% of global electricity generation (2024) | Reduces demand for traditional grid infrastructure components. |

| Energy Storage | Battery Energy Storage Systems (BESS) | Projected to exceed $200 billion by 2030 | Offers alternatives to backup power solutions due to falling battery prices. |

| Power Management | Software-Defined Power Management | Smart Grid Market: USD 71.3 billion by 2027 | Diminishes demand for hardware-centric approaches. |

| Component Manufacturing | Additive Manufacturing (3D Printing) | Global Market: ~$15.1 billion (2023) | Enables lower-cost, customized, or enhanced functional alternatives. |

| System Integration | Integrated Smart Systems | Smart Building Market: >$180 billion by 2028 | Challenges sales of individual smart products; favors holistic solutions. |

Entrants Threaten

Entering Eaton's primary sectors, including electrical components, aerospace systems, and hydraulic solutions, necessitates significant upfront capital. Companies need to invest heavily in state-of-the-art manufacturing plants, sophisticated production equipment, and robust research and development initiatives. For instance, establishing a new aerospace component manufacturing facility can easily run into hundreds of millions of dollars, creating a formidable financial hurdle.

Eaton operates in sectors like aerospace and critical electrical infrastructure, which are heavily regulated. New entrants face substantial barriers due to the need for rigorous certifications and strict adherence to safety standards, making market entry challenging and costly.

Eaton benefits from a long-standing reputation and deep-rooted relationships with its global customer base, including major OEMs and industrial clients. This established brand loyalty means new entrants face a considerable challenge in building similar trust and loyalty.

Proprietary Technology and Intellectual Property

Eaton's robust portfolio of proprietary technology and patents presents a significant barrier to entry. For instance, in 2023, Eaton continued to invest heavily in research and development, with R&D expenses totaling $1.5 billion, underscoring its commitment to innovation and the creation of unique intellectual property.

The sheer scale of investment and time required to replicate Eaton's technological advancements deters many potential new entrants. Developing comparable engineering expertise and securing the necessary patents can take years and substantial capital, often exceeding the resources available to emerging companies.

- Proprietary Technology: Eaton holds thousands of patents globally, covering areas from power management to electrical components.

- R&D Investment: The company consistently invests a significant portion of its revenue into R&D, ensuring a continuous pipeline of innovative solutions. In 2023, this investment amounted to $1.5 billion.

- High Development Costs: Creating similar technological capabilities requires extensive research, specialized talent, and lengthy development cycles, making it costly for newcomers.

- Competitive Advantage: This protected intellectual property allows Eaton to offer differentiated products and services, creating a strong competitive moat.

Economies of Scale in Manufacturing and Distribution

Existing major players in the electrical equipment sector, such as Eaton, leverage substantial economies of scale. This advantage spans procurement of raw materials, efficient manufacturing processes, and extensive global distribution networks. For instance, Eaton’s 2023 revenue reached $23.2 billion, illustrating its significant market presence and operational efficiency.

New companies entering this market would face considerable difficulty matching the cost structures of established giants. Without achieving comparable scale, new entrants would struggle to offer competitive pricing, hindering their ability to secure market share. This barrier is particularly pronounced in industries with high capital expenditure requirements.

- Eaton's 2023 revenue: $23.2 billion, showcasing significant operational scale.

- High capital investment: New entrants require substantial upfront capital to build manufacturing and distribution capabilities.

- Procurement advantage: Large companies secure better terms from suppliers due to higher volume purchases.

- Distribution efficiency: Established players have optimized logistics, reducing per-unit shipping costs.

The threat of new entrants for Eaton is generally low due to substantial capital requirements, stringent regulatory environments, and established brand loyalty. Eaton's significant investments in proprietary technology and R&D, exemplified by $1.5 billion in R&D spending in 2023, create a technological moat that is difficult for newcomers to breach.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in manufacturing, R&D, and infrastructure. | Significant financial hurdle, especially in sectors like aerospace. |

| Proprietary Technology & R&D | Thousands of patents and continuous innovation, with $1.5 billion R&D spend in 2023. | Difficult to replicate Eaton's technological edge and product differentiation. |

| Brand Loyalty & Relationships | Long-standing reputation and deep customer ties with OEMs and industrial clients. | New entrants struggle to build trust and compete for established customer bases. |

| Economies of Scale | $23.2 billion in 2023 revenue indicates operational efficiency and cost advantages. | New entrants face higher per-unit costs and price competition challenges. |

| Regulatory Hurdles | Strict certifications and safety standards in sectors like aerospace and electrical infrastructure. | Adds significant cost and time to market entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of the competitive landscape.