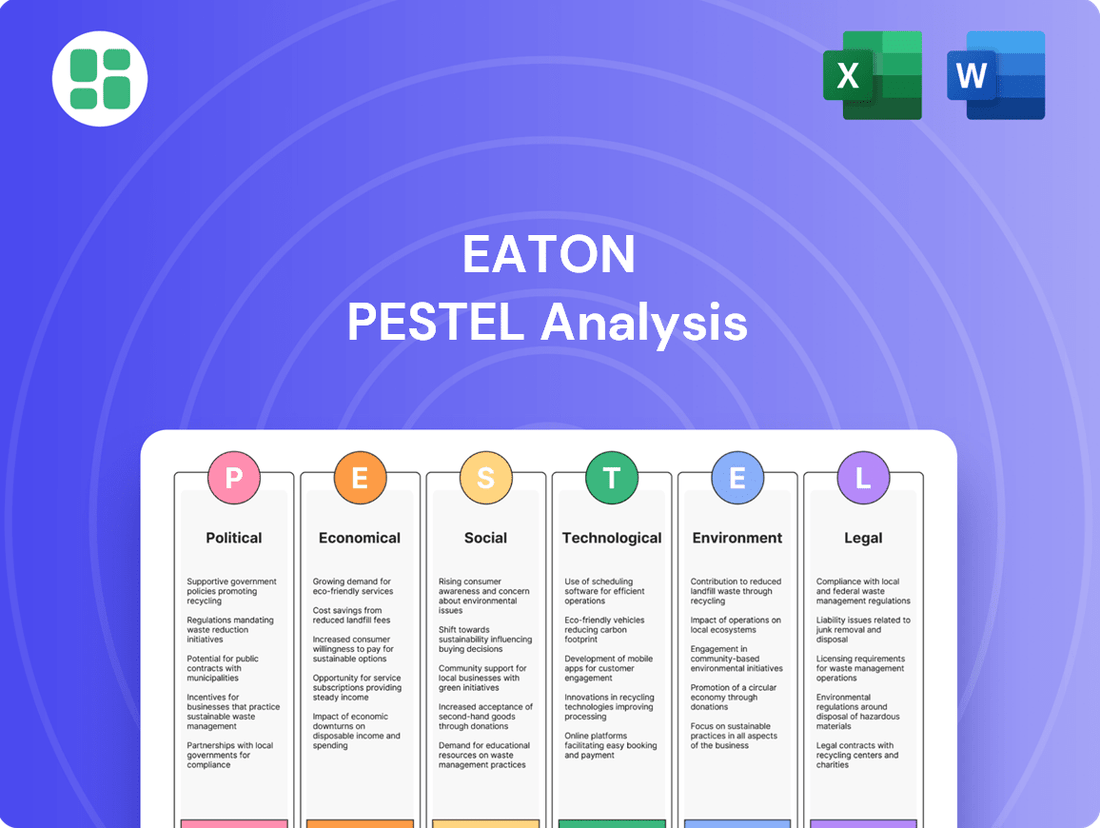

Eaton PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces shaping Eaton's strategic landscape. Our expert-crafted PESTLE analysis provides actionable intelligence to anticipate market shifts and identify opportunities. Gain a competitive edge by understanding these external drivers—download the full version now for immediate strategic clarity.

Political factors

Government infrastructure investment policies are a significant driver for Eaton. For instance, the US Infrastructure Investment and Jobs Act of 2021, with its substantial funding for grid modernization and EV charging infrastructure, directly boosts demand for Eaton's electrical distribution and power quality solutions. This legislation, allocating over $1 trillion, is expected to create substantial opportunities for companies like Eaton in the coming years, particularly in areas like smart grid technology and renewable energy integration.

Ongoing global trade tensions, particularly between major economies like the US and China, continue to influence Eaton's operational landscape. These geopolitical dynamics can disrupt supply chains and necessitate adjustments to manufacturing footprints, impacting cost structures and market access.

The imposition of tariffs and technology restrictions, such as those seen in recent years, directly increase compliance costs for multinational corporations like Eaton. For instance, the US-China trade war saw tariffs imposed on billions of dollars worth of goods, affecting components and finished products, potentially forcing Eaton to absorb these costs or pass them on to consumers, thereby impacting profitability and demand.

Such trade friction compels companies to diversify production locations and supplier bases to mitigate risks. This strategic imperative can lead to significant capital investments in new facilities or partnerships, aiming to build resilience against future trade disputes and ensure business continuity, even if it means higher initial operational expenditures.

Eaton's global operations mean it must comply with a vast and often intricate array of regulations. These cover everything from environmental standards and product safety certifications to international trade laws and cybersecurity mandates. For instance, in 2024, companies operating across Europe faced increased scrutiny under the Digital Services Act and the AI Act, impacting data handling and product development.

The sheer diversity of these rules across the approximately 175 countries where Eaton has a presence significantly complicates compliance. This complexity translates directly into substantial annual costs. Estimates suggest that for large multinational corporations, compliance costs can run into tens of millions of dollars annually, impacting profitability and requiring dedicated legal and operational resources.

Political Stability in Key Markets

Political stability in regions where Eaton operates significantly impacts its business. For instance, disruptions in major markets due to geopolitical tensions or civil unrest can directly affect supply chains and demand for electrical and industrial products. Eaton's presence in diverse global markets means it must navigate varying levels of political risk.

Geopolitical events can introduce considerable uncertainty. Changes in government policies, trade relations, or the outbreak of conflicts can alter market access and operational costs. In 2024, ongoing geopolitical realignments continue to present challenges for multinational corporations like Eaton, requiring agile strategic planning.

- Supply Chain Vulnerability: Political instability can disrupt raw material sourcing and finished goods distribution, as seen with trade disputes impacting global manufacturing hubs.

- Market Access and Demand: Changes in government regulations or economic policies in key markets can affect Eaton's sales and revenue streams.

- Investment Decisions: Uncertainty stemming from political volatility can lead to delays or cancellations of capital expenditures in affected regions.

Government Incentives for Green Technologies

Government incentives for green technologies significantly shape Eaton's strategic landscape. Policies promoting renewable energy, electric vehicles, and energy efficiency directly fuel demand for Eaton's solutions, driving product development and market expansion. For instance, the Inflation Reduction Act in the U.S. continues to offer substantial tax credits for clean energy projects, bolstering investments in solar and energy storage, areas where Eaton is a key player.

These supportive governmental actions accelerate the market penetration of sustainable technologies, reinforcing Eaton's commitment to electrification and energy transition. This alignment creates new revenue streams and strengthens its competitive position in a rapidly evolving global energy market. In 2024, the global renewable energy sector saw continued growth, with significant policy support in regions like Europe and Asia driving substantial investment in grid modernization and distributed energy resources, which directly benefits Eaton's power management offerings.

- U.S. Inflation Reduction Act (IRA): Continues to provide significant tax credits for clean energy, supporting Eaton's renewable energy and energy storage solutions.

- European Green Deal: Drives investments in energy efficiency and electrification across industries, benefiting Eaton's building and industrial power management systems.

- Global EV Adoption: Government subsidies and mandates for electric vehicles encourage infrastructure development, creating opportunities for Eaton's EV charging and power distribution equipment.

- Energy Efficiency Standards: Increasingly stringent regulations worldwide promote demand for advanced, energy-saving electrical components and systems offered by Eaton.

Government infrastructure investment policies are a significant driver for Eaton, with legislation like the US Infrastructure Investment and Jobs Act of 2021, allocating over $1 trillion, directly boosting demand for its electrical distribution and power quality solutions. Ongoing global trade tensions and tariffs, such as those seen in the US-China trade war, increase compliance costs and necessitate supply chain adjustments, potentially impacting profitability. Eaton's global operations require compliance with a vast array of regulations across approximately 175 countries, incurring substantial annual costs estimated in the tens of millions of dollars for multinational corporations.

Government incentives for green technologies, such as the U.S. Inflation Reduction Act and the European Green Deal, significantly shape Eaton's strategic landscape by fueling demand for its renewable energy and energy efficiency solutions. These supportive actions accelerate the market penetration of sustainable technologies, reinforcing Eaton's position in the global energy transition. For instance, in 2024, continued policy support in Europe and Asia drove substantial investment in grid modernization and distributed energy resources, directly benefiting Eaton's power management offerings.

| Policy/Legislation | Impact on Eaton | Key Data/Examples |

|---|---|---|

| US Infrastructure Investment and Jobs Act (2021) | Boosts demand for electrical distribution and power quality solutions. | Over $1 trillion allocated for grid modernization and EV charging infrastructure. |

| US-China Trade War | Increases compliance costs due to tariffs and potential supply chain disruptions. | Tariffs imposed on billions of dollars worth of goods affecting components and finished products. |

| U.S. Inflation Reduction Act (IRA) | Provides tax credits for clean energy, supporting renewable energy and energy storage solutions. | Drives investments in solar and energy storage projects. |

| European Green Deal | Drives investments in energy efficiency and electrification. | Benefits Eaton's building and industrial power management systems. |

What is included in the product

This Eaton PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operating landscape.

It provides actionable insights for strategic decision-making by identifying key external influences and their potential impact.

The Eaton PESTLE Analysis provides a structured framework to identify and understand the external factors impacting a business, thereby alleviating the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

Global economic growth directly impacts demand for Eaton's products. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating a generally positive environment for industrial activity and infrastructure spending, which bodes well for Eaton's electrical and hydraulic segments.

Industrial activity levels are a key driver for Eaton. In early 2024, manufacturing PMIs in major economies like the US and Eurozone showed signs of stabilization or modest expansion, suggesting increased demand for the components Eaton supplies to various industries, from automotive to aerospace.

A healthy global economy supports higher sales volumes and improved financial results for Eaton. As of Q1 2024, Eaton reported strong organic growth, partly attributed to robust demand in sectors like data centers and renewable energy, reflecting the positive correlation between economic health and the company's performance.

Persistent inflation, a significant concern throughout 2024 and into early 2025, directly impacts Eaton's operational expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in late 2024, reflecting higher input costs.

Fluctuations in raw material prices, such as copper and steel, are critical for Eaton's manufacturing processes. Copper prices, for example, experienced volatility in 2024, influenced by global demand and supply chain disruptions, directly affecting Eaton's cost of goods sold and potentially its profit margins.

To navigate these economic headwinds, Eaton must continue to implement robust supply chain management strategies and agile pricing adjustments. This proactive approach is essential to mitigate the impact of rising raw material costs and maintain profitability in a dynamic economic environment.

Interest rate fluctuations directly impact Eaton's operational costs and strategic investments. For instance, if the Federal Reserve maintains its target interest rate range, as it has done in early 2024, borrowing for significant projects like new manufacturing facilities or research initiatives becomes more expensive, potentially dampening expansion plans.

Conversely, lower interest rates, such as those seen in previous periods, make capital more accessible and cheaper, encouraging Eaton to undertake larger R&D projects or pursue acquisitions. This cost of capital is a critical determinant in the feasibility of long-term growth strategies for a company like Eaton.

Furthermore, elevated interest rates can slow down customer spending on large infrastructure and industrial equipment, directly affecting Eaton's sales pipeline. For example, if a major utility company faces higher borrowing costs for a new grid modernization project, they might delay or scale back their investment, impacting Eaton's order book.

Currency Exchange Rate Fluctuations

Eaton, as a global enterprise operating in over 160 countries, is inherently exposed to the volatility of currency exchange rates. These fluctuations can significantly impact its reported financial performance. For instance, in the first quarter of 2024, Eaton noted that unfavorable currency movements had a negative impact on its reported results, partially tempering the gains from its organic sales growth.

The company's financial statements translate foreign currency-denominated assets, liabilities, revenues, and expenses into its reporting currency, typically the U.S. dollar. When the dollar strengthens against other currencies where Eaton operates, the translated value of its foreign earnings and assets decreases, leading to a negative currency translation adjustment. This can directly reduce reported revenues and earnings per share.

For example, during the fiscal year 2023, Eaton reported that currency headwinds had a notable effect on its top-line growth, even as underlying business performance remained strong. The company's financial disclosures often detail the specific impact of currency on segments like Electrical Americas, Electrical Global, and Aerospace, highlighting how a stronger U.S. dollar can diminish the reported value of sales generated in euros, pounds sterling, or other major currencies.

- Impact on Reported Revenue: A stronger U.S. dollar can reduce the reported revenue from international operations.

- Earnings Per Share (EPS) Dilution: Negative currency translation can lead to a lower reported EPS.

- Hedging Strategies: Eaton employs various financial instruments to mitigate currency risk, though complete elimination is not always feasible.

- Geographic Diversification: While diversification helps spread risk, it also means exposure to a wider range of currency fluctuations.

Supply Chain Disruptions

Ongoing global supply chain disruptions, including logistical bottlenecks and labor actions, continue to pose challenges for companies like Eaton. These issues can affect the timely acquisition of essential components and the efficient delivery of finished goods.

The persistence of these disruptions can translate into production delays for Eaton, potentially increasing manufacturing costs due to expedited shipping or alternative sourcing. Furthermore, these operational hurdles could lead to missed revenue targets if demand cannot be met.

- Logistical Bottlenecks: Global shipping costs saw significant fluctuations in 2024, with the Drewry World Container Index averaging around $1,700 per 40ft container in early 2024, a notable increase from pre-pandemic levels, impacting freight expenses for Eaton.

- Labor Strikes: In late 2024, several key port operations in North America experienced labor disputes, causing temporary shutdowns and delays that affected the movement of goods for manufacturers relying on international trade.

- Component Shortages: The semiconductor shortage, while easing, still impacted the availability of certain electronic components critical for Eaton's electrical and aerospace products throughout 2024, leading to longer lead times.

Global economic growth trends significantly influence Eaton's performance, with projections for 2024 indicating a steady economic climate. For example, the IMF forecast global growth at 3.2% for 2024, supporting demand for Eaton's industrial and electrical products.

Industrial activity, a direct driver for Eaton, showed signs of recovery in early 2024. Manufacturing Purchasing Managers' Indexes (PMIs) in key regions like the US and Eurozone stabilized or expanded modestly, signaling increased demand for components used in automotive and aerospace sectors.

Eaton's financial results in Q1 2024 reflected this positive economic correlation, with strong organic growth partly attributed to robust demand in data centers and renewable energy sectors.

What You See Is What You Get

Eaton PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eaton PESTLE Analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the detailed insights and strategic framework presented will be immediately accessible for your business planning.

Sociological factors

Societal awareness regarding climate change and resource depletion is escalating, leading to a significant rise in consumer and business demand for sustainable and energy-efficient products. This growing preference directly impacts companies like Eaton, pushing them to innovate and market solutions that minimize environmental impact.

In 2024, the global market for green building materials alone was valued at over $250 billion, a figure projected to grow substantially. This trend underscores the increasing importance for manufacturers to offer products that align with environmental, social, and governance (ESG) principles, influencing purchasing decisions across various sectors.

Eaton's strategic focus on areas like energy storage, smart grids, and energy-efficient power management systems directly addresses this societal shift. By providing solutions that help customers reduce their carbon footprint and energy consumption, Eaton is positioning itself to capitalize on this expanding market driven by environmental consciousness.

Eaton faces evolving workforce demographics globally, with an aging population in developed nations and a surge in younger workers in emerging markets. This shift necessitates agile talent acquisition strategies to secure specialized technical skills, particularly in areas like electrical engineering and software development, crucial for their advanced energy management solutions.

In 2024, the demand for cybersecurity and AI expertise within the industrial sector is projected to grow significantly, impacting companies like Eaton that rely on sophisticated digital infrastructure. Adapting HR policies to foster continuous learning and offering competitive compensation packages are key to retaining this high-demand talent pool.

Eaton is navigating a landscape where societal demands for robust corporate social responsibility are intensifying. This includes a strong emphasis on ethical labor practices throughout its supply chain, active community engagement in the regions where it operates, and a commitment to transparent reporting on its environmental, social, and governance (ESG) performance. For instance, in 2023, Eaton reported a 20% reduction in recordable workplace injuries, highlighting its focus on employee well-being.

Meeting these elevated ESG standards is not just about good citizenship; it's a strategic imperative. Adherence to high ESG benchmarks is vital for safeguarding Eaton's brand reputation, which in turn influences consumer trust and purchasing decisions. Furthermore, it plays a significant role in attracting and retaining socially conscious investors who increasingly prioritize sustainability, and it's a key factor for drawing top talent who seek employers aligned with their values.

Urbanization and Infrastructure Development

Rapid urbanization, particularly in developing economies, is a major driver for infrastructure expansion. This surge in urban populations necessitates significant investment in power grids, smart buildings, and transportation networks, directly benefiting companies like Eaton. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a substantial increase from 56% in 2021, highlighting the growing demand for modernized infrastructure.

Eaton's electrical and hydraulic divisions are well-positioned to capitalize on this trend. As cities grow and upgrade their systems, there's an increased need for reliable power distribution, energy management solutions, and advanced hydraulic components for construction and transportation. The global smart cities market alone was valued at approximately $460 billion in 2023 and is projected to reach over $1 trillion by 2028, indicating substantial growth opportunities.

- Growing Urban Populations: The UN estimates 68% global urbanization by 2050, increasing demand for urban infrastructure.

- Smart City Investments: The smart cities market is expected to exceed $1 trillion by 2028, creating demand for smart grid and building technologies.

- Infrastructure Modernization: Urban expansion and upgrades fuel demand for Eaton's electrical and hydraulic solutions in power, construction, and transportation sectors.

Digitalization of Society

The accelerating digitalization of society, marked by the exponential growth of data centers and the widespread adoption of smart technologies, directly fuels demand for Eaton's intelligent power management solutions. This societal trend is a significant driver for Eaton's growth, particularly within the booming data center and distributed IT infrastructure markets.

For instance, global data center traffic was projected to reach 207 zettabytes by 2020, and this figure continues to climb rapidly, underscoring the critical need for robust and efficient power management. Eaton's offerings are essential for ensuring the reliability and sustainability of these increasingly vital digital ecosystems.

- Digital Transformation: The ongoing digital transformation across industries necessitates reliable power infrastructure, a core area for Eaton.

- Data Center Growth: The burgeoning data center market, driven by cloud computing and AI, presents a substantial opportunity for Eaton's power management technologies.

- Smart Technologies: The proliferation of IoT devices and smart city initiatives requires sophisticated power solutions that Eaton provides.

- Energy Efficiency: Societal focus on sustainability and energy efficiency aligns with Eaton's mission to deliver intelligent power management, reducing energy consumption in digital infrastructure.

Societal demand for sustainability is a major driver, with consumers and businesses prioritizing environmentally friendly products. This trend is evident in the global green building materials market, valued at over $250 billion in 2024 and expected to grow significantly, pushing companies like Eaton to innovate in energy efficiency and reduced environmental impact.

Eaton is also adapting to evolving workforce demographics, facing a need for specialized technical skills in electrical engineering and software development due to an aging population in some regions and a younger workforce in others. The demand for cybersecurity and AI expertise in the industrial sector is particularly high in 2024, requiring companies to focus on talent acquisition and retention strategies.

The increasing urbanization, especially in developing economies, fuels demand for infrastructure expansion. By 2050, the UN projects 68% of the world's population will live in urban areas, driving significant investment in power grids and smart buildings, areas where Eaton's electrical and hydraulic solutions are crucial. The smart cities market, valued around $460 billion in 2023, is expected to exceed $1 trillion by 2028, highlighting this growth opportunity.

Digitalization is another key societal factor, with the exponential growth of data centers and smart technologies increasing the need for intelligent power management. Global data center traffic continues to rise rapidly, making Eaton's reliable and efficient power solutions essential for these critical digital ecosystems.

Technological factors

Eaton's commitment to continuous innovation in power management and smart grid technologies is a cornerstone of its strategy. The company's substantial investment in research and development, exceeding $1.7 billion in 2023, fuels the creation of intelligent systems designed to enhance power efficiency and reliability. These advancements are crucial for integrating renewable energy sources, a growing trend in the global energy landscape.

The smart grid market is projected to reach $104.6 billion by 2027, growing at a compound annual growth rate of 13.7%, according to Mordor Intelligence. Eaton is well-positioned to capitalize on this expansion with its intelligent power distribution and control solutions, which are vital for modernizing electrical infrastructure and accommodating distributed energy resources.

The global shift towards electrification, especially evident in the booming electric vehicle (EV) market, is a significant technological driver for Eaton. This trend directly fuels demand for Eaton's eMobility and Vehicle segments, as automakers increasingly adopt electric powertrains.

Eaton is well-positioned to benefit from this electrification megatrend by offering critical components such as battery configuration switches, advanced charging infrastructure solutions, and sophisticated vehicle powertrain systems. These products are essential for the expanding EV ecosystem.

The EV market saw substantial growth, with global EV sales reaching approximately 13.6 million units in 2023, a significant increase from previous years. This sustained upward trajectory in EV adoption underscores the immense opportunity for companies like Eaton that provide enabling technologies.

Eaton's focus on digitalization and Industry 4.0 is a significant technological driver. The company is well-positioned to capitalize on the increasing adoption of automation and smart manufacturing principles across various sectors. This trend is evident in the global industrial automation market, which was projected to reach approximately $224.6 billion in 2024, with continued growth expected.

This technological shift creates substantial opportunities for Eaton's digital solutions, including intelligent insights derived from connected devices and robust cybersecurity offerings. These solutions are crucial for protecting critical infrastructure, a growing concern as more systems become interconnected. For instance, the demand for industrial cybersecurity is escalating, with the market anticipated to grow substantially in the coming years, offering a direct avenue for Eaton's expertise.

Emerging Technologies (AI and Data Centers)

The surge in AI applications, from machine learning to generative models, is driving unprecedented demand for computing power, directly impacting the need for robust data center infrastructure. This trend is projected to significantly increase energy consumption. For instance, some estimates suggest AI could account for 10% of global electricity demand by 2026.

Eaton is actively addressing this by partnering with key players in the AI ecosystem. Their collaboration with NVIDIA, a leader in AI hardware, focuses on creating advanced power solutions, including high-voltage direct current (HVDC) systems. These systems are specifically designed to efficiently power the high-density GPU clusters essential for modern AI workloads.

The expansion of data centers, fueled by AI and cloud computing, necessitates sophisticated power management and distribution. Eaton's expertise in this area is crucial for ensuring the reliability and efficiency of these critical facilities. The global data center market size was valued at approximately $242.14 billion in 2023 and is expected to grow substantially in the coming years.

- AI's Energy Footprint: AI could consume up to 10% of global electricity by 2026, highlighting the critical need for efficient power solutions.

- Data Center Growth: The global data center market, valued at over $242 billion in 2023, is expanding rapidly, demanding advanced infrastructure.

- Eaton-NVIDIA Partnership: Collaboration focuses on developing HVDC power solutions for high-density GPU deployments, optimizing AI infrastructure.

- Power Infrastructure Demand: The exponential growth in AI and data centers creates a significant market opportunity for power management and distribution technologies.

Research and Development Investment

Eaton's commitment to innovation is underscored by its substantial investment in research and development, a key driver for its technological advancements, especially in sustainable and energy-efficient solutions. This focus is vital for the company to maintain its competitive advantage in a rapidly evolving market.

The company has set an ambitious target to invest $3 billion in R&D by 2030. This significant capital allocation is designed to foster the creation of groundbreaking solutions that proactively address the complex power management challenges anticipated in the future.

- R&D Investment Target: Eaton plans to invest $3 billion in research and development by 2030.

- Focus Areas: Key R&D efforts are concentrated on sustainable and energy-efficient power management solutions.

- Strategic Goal: The investment aims to develop innovative technologies to meet future power management needs.

- Competitive Edge: Continued R&D is essential for Eaton to maintain and enhance its market leadership.

Technological advancements are reshaping the power management landscape, with Eaton at the forefront of innovation. The company's substantial R&D investments, targeting $3 billion by 2030, are crucial for developing solutions that address the growing demand for electrification and digitalization. These investments are particularly vital for capitalizing on the burgeoning electric vehicle (EV) market, which saw global sales reach approximately 13.6 million units in 2023.

Furthermore, the increasing integration of AI and cloud computing is driving significant growth in data center infrastructure, a sector valued at over $242 billion in 2023. Eaton's strategic partnerships, such as its collaboration with NVIDIA, are focused on creating advanced power solutions, including HVDC systems, to efficiently support the intense computing demands of AI workloads. This focus on cutting-edge technology ensures Eaton remains competitive in a rapidly evolving market.

Legal factors

Eaton faces increasing scrutiny under global environmental protection laws, covering carbon emissions, waste management, and resource consumption. For instance, the EU's Emissions Trading System (ETS) continues to drive costs for industrial emitters, and similar frameworks are expanding worldwide, impacting manufacturing operations and supply chains.

Adherence to these stringent environmental standards often translates into higher capital outlays for cleaner technologies and process improvements. Eaton's commitment to sustainability, as highlighted in its 2023 ESG report, involved significant investments in reducing its environmental footprint, influencing its product development cycles and operational strategies to meet evolving regulatory demands.

Eaton operates under stringent international and national product safety and quality standards, especially vital for its aerospace and electrical sectors. For instance, in 2024, the aerospace industry continues to emphasize rigorous certification processes, requiring manufacturers like Eaton to meet demanding specifications for components used in aircraft. Failure to comply can lead to significant delays in product launches and market entry, impacting revenue streams.

Adherence to these regulations is not merely a compliance issue but a critical enabler for market access and a shield against potential liabilities. Eaton's commitment to quality, evidenced by its robust testing and validation protocols, ensures its products meet or exceed industry benchmarks, fostering customer trust and brand reputation. In 2025, expect continued scrutiny on cybersecurity aspects of connected electrical systems, adding another layer of regulatory complexity.

Intellectual property laws are a cornerstone of Eaton's competitive edge, particularly concerning its advanced power management and electrical solutions. The company actively protects its innovations through patents, safeguarding its proprietary technologies and ensuring a distinct market position.

Legal frameworks governing intellectual property rights directly shape Eaton's innovation pipeline and its capacity to defend against infringement. For instance, the global patent landscape influences where Eaton invests in research and development and how it approaches licensing agreements, impacting its ability to maintain technological leadership.

Labor Laws and Employment Regulations

Eaton, operating globally, navigates a complex web of labor laws and employment regulations. These vary significantly by country, covering aspects like minimum wage, working hours, safety standards, and the right to unionize. For instance, in 2024, many European nations continued to strengthen worker protections, impacting hiring and operational costs for multinational corporations like Eaton.

Compliance is not merely a legal obligation but a strategic imperative for Eaton. Adhering to these diverse regulations helps prevent costly litigation, fines, and reputational damage. It also fosters a positive employee relations environment, crucial for talent retention and productivity. Eaton's commitment to fair labor practices is often highlighted in its sustainability reports, reflecting the growing investor focus on ESG (Environmental, Social, and Governance) factors.

Key areas of compliance for Eaton include:

- Wage and Hour Laws: Ensuring adherence to local minimum wage standards and overtime regulations.

- Workplace Safety: Meeting or exceeding country-specific occupational health and safety requirements.

- Collective Bargaining: Engaging with unions and employee representatives where applicable.

- Anti-Discrimination Policies: Implementing and enforcing policies against unfair treatment based on protected characteristics.

International Trade and Anti-Corruption Laws

Eaton operates within a dense web of international trade regulations, encompassing export controls, tariffs, and sanctions imposed by various global bodies. For instance, in 2023, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) continued to enforce stringent export control regulations on advanced technologies, impacting companies like Eaton involved in critical infrastructure and manufacturing equipment. Navigating these rules is paramount to avoiding significant penalties and maintaining market access.

Furthermore, Eaton is bound by strict anti-corruption legislation, most notably the U.S. Foreign Corrupt Practices Act (FCPA) and similar international statutes. These laws prohibit bribery and require robust compliance programs to ensure ethical business conduct across all its global operations. Failure to comply can result in substantial fines and severe reputational damage, as seen in numerous high-profile cases involving multinational corporations in recent years.

Key legal considerations for Eaton include:

- Adherence to Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR) for technology transfers.

- Compliance with sanctions programs enforced by the Office of Foreign Assets Control (OFAC).

- Implementation of rigorous anti-bribery and anti-corruption training and due diligence for all employees and third parties.

- Staying updated on evolving trade agreements and customs regulations impacting its supply chain and product distribution.

Eaton's global operations necessitate strict adherence to evolving environmental regulations, impacting manufacturing and supply chains. For example, the EU's Emissions Trading System (ETS) and similar initiatives worldwide are driving investments in cleaner technologies, as noted in Eaton's 2023 ESG report, which detailed significant environmental footprint reduction efforts.

Product safety and quality standards, particularly in the aerospace and electrical sectors, are paramount. In 2024, the aerospace industry's rigorous certification processes demand compliance with stringent specifications, directly affecting Eaton's product development and market access. Cybersecurity of connected systems is also a growing regulatory focus for 2025.

Intellectual property law is crucial for protecting Eaton's innovations in power management and electrical solutions, influencing R&D investment and licensing strategies. Labor laws, varying by country, also impact operations, with 2024 seeing strengthened worker protections in Europe, affecting hiring and operational costs.

International trade regulations, including export controls and sanctions, alongside anti-corruption laws like the FCPA, require robust compliance programs. Eaton's 2023 annual report, for instance, would detail its efforts in managing these complex legal landscapes to avoid penalties and maintain global market access.

Environmental factors

Eaton's commitment to a 50% reduction in greenhouse gas emissions by 2030 and net-zero by 2050 directly influences its strategic investments. This means a significant push towards energy-efficient products and renewable energy integration, aligning with evolving global climate change policies and carbon emission regulations.

In 2023, Eaton reported a 28% reduction in scope 1 and 2 emissions compared to its 2018 baseline, showcasing tangible progress towards its ambitious targets. This progress necessitates continuous innovation in areas like advanced power distribution and energy storage solutions to meet stricter environmental mandates.

Growing worries about the depletion of natural resources are pushing companies like Eaton to embrace circular economy models. This means a stronger focus on using sustainable materials, cutting down on waste throughout operations, and managing products from creation to end-of-life. Eaton's commitment to this is evident in its goal for all manufacturing sites to achieve zero waste-to-landfill certification by 2030.

The global transition to renewable energy, driven by climate change concerns and policy mandates, presents a significant growth avenue for Eaton. By 2023, renewable energy sources accounted for approximately 30% of new power generation capacity globally, a trend expected to accelerate. Eaton's power management technologies are crucial for integrating these intermittent sources into existing electrical infrastructure, ensuring grid stability and efficient energy distribution.

Water Management and Conservation

Water scarcity is a growing concern that directly impacts how companies like Eaton operate. Recognizing this, Eaton is actively implementing strategies to conserve water and manage its discharge responsibly, particularly in regions facing water stress.

Eaton has demonstrated significant progress in its water management efforts, exceeding its own targets. By the end of 2023, the company had successfully certified 12% of its sites located in water-stressed areas as zero water discharge facilities, surpassing its initial goal of 10% by 2030.

- Water Scarcity Impact: Regional water availability influences Eaton's operational planning and resource allocation.

- Conservation Initiatives: The company actively pursues water conservation measures across its global operations.

- Zero Water Discharge: Eaton has achieved a significant milestone by certifying 12% of its sites in water-stressed areas as zero water discharge facilities by the end of 2023.

- Exceeding Goals: This achievement surpasses the company's initial 2030 target of certifying 10% of such sites.

Sustainability Reporting and Transparency

Stakeholders are increasingly demanding clear insights into Eaton's environmental impact, making robust sustainability reporting essential. Eaton addresses this by releasing annual sustainability reports that outline its achievements and ongoing efforts related to Environmental, Social, and Governance (ESG) objectives.

These reports detail Eaton's commitment to ambitious goals, such as its science-based targets for reducing greenhouse gas emissions and improving waste management practices. For instance, in its 2023 sustainability report, Eaton announced it had achieved a 38% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, exceeding its interim target.

- Eaton's 2023 report highlighted a 38% reduction in Scope 1 and 2 GHG emissions intensity against a 2019 baseline.

- The company is committed to science-based targets for emissions reduction and waste management.

- Increased transparency is driven by growing stakeholder expectations for environmental performance.

Eaton's environmental strategy is shaped by global climate change policies and the increasing scarcity of natural resources. The company is actively investing in energy-efficient products and renewable energy integration to meet its ambitious targets, including a 50% reduction in greenhouse gas emissions by 2030.

In 2023, Eaton achieved a 28% reduction in Scope 1 and 2 emissions against its 2018 baseline, demonstrating concrete progress. This drive for sustainability also extends to water management, with 12% of its sites in water-stressed areas certified as zero water discharge facilities by the end of 2023, surpassing its 2030 goal.

The company's commitment to a circular economy is evident in its aim for all manufacturing sites to achieve zero waste-to-landfill certification by 2030. Stakeholder demand for transparency is met through annual sustainability reports, which in 2023 detailed a 38% reduction in GHG emissions intensity against a 2019 baseline.

| Environmental Focus | 2023 Progress/Data | Target |

|---|---|---|

| Greenhouse Gas Emissions Reduction (Scope 1 & 2) | 28% reduction vs. 2018 baseline | 50% reduction by 2030 |

| Zero Waste-to-Landfill Certification | N/A (Ongoing initiative) | All manufacturing sites by 2030 |

| Water Management (Water-stressed areas) | 12% of sites certified zero water discharge | 10% of sites certified zero water discharge by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eaton is meticulously constructed using data from reputable sources like the International Energy Agency (IEA), national regulatory bodies, and leading economic forecasting firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Eaton's operations.