Eaton Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Curious how Eaton masters power management and electrical solutions? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Understand the core strategies that drive their global success.

Ready to dive deep into Eaton's proven business model? This full canvas reveals their unique value propositions, cost structures, and channels to market. It's your essential guide to understanding how they achieve operational excellence and sustained growth.

Unlock the strategic blueprint behind Eaton's industry dominance. This detailed Business Model Canvas offers a clear, actionable view of their customer segments, key activities, and competitive advantages. Perfect for anyone seeking to learn from a market leader.

Partnerships

Eaton actively pursues technology and innovation collaborations to enhance its power management offerings. A prime example is its partnership with NVIDIA, focusing on developing robust high-voltage direct current (HVDC) power infrastructure specifically for the demanding needs of AI data centers. This collaboration aims to establish design best practices and create cutting-edge power management solutions.

Eaton relies heavily on a robust network of distributors and channel partners to ensure its products reach customers worldwide. These partners are crucial for delivering and installing Eaton's wide array of power management solutions, from electrical components to aerospace systems.

In 2024, Eaton continued to strengthen these relationships, recognizing their vital role in accessing diverse markets and providing localized customer support. This extensive network allows Eaton to effectively serve industries ranging from data centers and utilities to manufacturing and transportation, ensuring product availability and technical assistance where it's needed most.

Eaton cultivates crucial relationships with Original Equipment Manufacturers (OEMs) and system integrators, embedding its power management technologies into their products. For instance, in 2024, Eaton's collaboration with a major automotive OEM led to the integration of its advanced electrical components in over 100,000 new vehicle units, solidifying its presence in the evolving electric vehicle market.

These partnerships are vital for Eaton, as they ensure its solutions are part of complex systems across industries like aerospace and industrial automation. Long-term supply agreements stemming from these collaborations provide predictable revenue streams, with a significant portion of Eaton's 2024 revenue directly attributable to these strategic OEM integrations.

Acquisition-driven Partnerships

Eaton actively pursues acquisition-driven partnerships to enhance its technological prowess and market reach. This strategy involves integrating acquired entities and their innovative solutions into Eaton's existing framework.

Recent examples highlight this focus: Eaton acquired Resilient Power Systems Inc. to bolster its solid-state transformer technology. Furthermore, the acquisition of Fibrebond Corporation strengthens its modular power enclosures, crucial for expanding in high-growth sectors like electric vehicle charging infrastructure and data centers.

- Acquisition of Resilient Power Systems Inc.: Enhanced solid-state transformer technology.

- Acquisition of Fibrebond Corporation: Strengthened modular power enclosures for EV charging and data centers.

- Strategic Goal: Expand technological capabilities and market presence through integration of acquired innovations.

Utility and Energy Sector Collaborations

Eaton actively partners with utility and energy providers to drive grid modernization efforts. These collaborations are essential for integrating renewable energy sources and building a more resilient power infrastructure. For instance, in 2024, Eaton announced a significant expansion of its microgrid solutions, working with several major US utilities to pilot advanced grid management technologies.

These partnerships focus on optimizing the performance of Distributed Energy Resources (DERs), such as solar panels and battery storage systems. By working together, Eaton and its utility partners are developing innovative ways to manage and leverage these resources, contributing to a cleaner and more reliable energy supply. In 2023, a report indicated that utility investments in DER management systems, a key area of Eaton's collaboration, grew by over 15% globally.

- Grid Modernization: Collaborations with utilities to upgrade aging infrastructure and enhance grid stability.

- Renewable Energy Integration: Joint projects to facilitate the seamless incorporation of solar, wind, and other renewables.

- Microgrid Development: Partnerships focused on creating localized, resilient energy systems.

- DER Optimization: Working with energy providers to efficiently manage and utilize distributed energy resources.

Eaton's key partnerships are foundational to its market penetration and technological advancement. Collaborations with NVIDIA for AI data center power infrastructure and with major automotive OEMs for EV component integration highlight its strategic focus. These alliances, including acquisitions like Resilient Power Systems Inc. and Fibrebond Corporation, bolster its capabilities in high-growth areas.

Furthermore, partnerships with utility providers are critical for grid modernization and renewable energy integration, with a 15% global growth in DER management systems noted in 2023. Eaton's extensive distributor network ensures global reach and localized support for its diverse power management solutions.

| Partnership Type | Key Collaborator Examples | Strategic Impact | 2024 Focus/Data |

|---|---|---|---|

| Technology & Innovation | NVIDIA | AI data center power solutions | Developing HVDC infrastructure for AI |

| Distribution & Channel | Global Distributors | Market access & customer support | Strengthening network for diverse markets |

| OEM & System Integrators | Major Automotive OEMs | Product integration & market presence | Over 100,000 EV units integrated with Eaton components |

| Acquisitions | Resilient Power Systems Inc., Fibrebond Corp. | Technology enhancement & market expansion | Bolstering solid-state transformers and enclosures |

| Utilities & Energy Providers | Major US Utilities | Grid modernization & renewable integration | Piloting advanced microgrid solutions |

What is included in the product

A structured framework outlining Eaton's core business components, from customer relationships and value propositions to revenue streams and cost structures.

This canvas visualizes how Eaton creates, delivers, and captures value across its diverse energy management solutions and markets.

Addresses the pain of fragmented strategic thinking by offering a structured, visual framework for understanding and aligning all key business elements.

Eliminates the struggle of translating complex ideas into actionable plans by providing a clear, organized roadmap for business development.

Activities

Eaton's commitment to Research and Development is central to its strategy, with a strong focus on power management innovation. They are actively developing solutions in energy efficiency, digitalization, and sustainability, aiming to shape the future of energy infrastructure.

The company has a clear target to invest $3 billion in R&D for sustainable solutions by 2030. This significant investment underscores their dedication to addressing global energy challenges and creating a more sustainable future, with substantial capital already allocated since 2020.

Eaton's manufacturing and production activities are central to its business, focusing on the global creation of diverse components and systems across electrical, hydraulic, aerospace, and vehicle sectors. This involves intricate processes to ensure quality and innovation in each product line.

The company is actively investing in modernizing its manufacturing operations. For instance, Eaton is implementing smart factory technologies in facilities like Juarez, Mexico, and Changzhou, China, to enhance efficiency and output. This strategic upgrade aims to leverage advanced automation and data analytics.

Furthermore, Eaton is expanding its production capacity by establishing new facilities to address increasing market demand. This expansion is critical for maintaining its competitive edge and serving a growing customer base across its various industries.

Eaton's sales and marketing efforts are crucial for reaching its global customer base, spanning over 160 countries. These activities encompass direct sales teams, robust support for channel partners, and targeted marketing campaigns. A key focus is on communicating the significant energy efficiency and sustainability advantages of their extensive product and service portfolio.

Strategic Acquisitions and Portfolio Management

Eaton's approach to strategic acquisitions and portfolio management is a cornerstone of its business model, driving growth and market positioning. The company actively seeks opportunities to acquire businesses that align with its core strengths and future growth ambitions, particularly within the electrical and aerospace sectors. This includes integrating innovative technologies and expanding its geographic reach.

In 2024, Eaton continued this disciplined approach. For example, the company completed several divestitures of non-core businesses, refining its portfolio to focus on higher-growth, higher-margin segments. Simultaneously, strategic tuck-in acquisitions were pursued to bolster its capabilities in areas like power distribution and digital solutions.

- Portfolio Refinement: Eaton's strategy involves divesting underperforming or non-strategic assets to concentrate resources on its core electrical and aerospace businesses.

- Technology Integration: Acquisitions are targeted to bring in cutting-edge technologies, enhancing Eaton's product offerings and competitive edge.

- Market Expansion: Strategic purchases allow Eaton to enter new geographic markets or deepen its presence in existing ones, broadening its customer base.

- Growth Focus: The company prioritizes acquisitions that support its long-term vision for growth in areas like electrification and digital transformation.

Customer Service and Technical Support

Eaton's commitment to customer service and technical support is a cornerstone of its business. This focus ensures that customers receive reliable performance from their power management solutions and fosters strong, lasting relationships. For instance, in 2024, Eaton continued to invest heavily in its global support network, aiming to provide rapid response times for critical issues.

Key activities include offering comprehensive post-sale support, essential maintenance services, and expert guidance for intricate power management systems. This dedication to support helps customers maximize the lifespan and efficiency of their Eaton products.

- Post-Sale Support: Providing troubleshooting, repair, and product lifecycle management.

- Technical Expertise: Offering specialized advice on complex power solutions and system integration.

- Maintenance Services: Ensuring optimal performance and longevity through proactive upkeep.

- Customer Relationship Management: Building loyalty through responsive and effective support channels.

Eaton's customer service extends to providing comprehensive training and educational resources. This ensures clients can effectively utilize and maintain their power management systems. In 2024, Eaton expanded its digital learning platforms, offering more on-demand modules for engineers and facility managers.

The company's commitment to innovation is further demonstrated through its robust distribution network. Eaton leverages a global network of distributors and partners to ensure its products reach customers efficiently. This network is vital for providing timely access to their advanced power management solutions across various industries and geographies.

Eaton's operational excellence is underpinned by its strategic partnerships and collaborations. These alliances are crucial for co-developing new technologies and expanding market reach. For example, in 2024, Eaton strengthened its partnerships with leading technology providers in the renewable energy sector.

Eaton's global supply chain management is a critical activity, ensuring the efficient sourcing of materials and timely delivery of products worldwide. This involves intricate logistics and strong supplier relationships to maintain product availability and cost-effectiveness. The company actively works to build resilience within its supply chain, especially in light of global economic shifts.

| Activity | Description | 2024 Focus/Data |

|---|---|---|

| Customer Service & Support | Providing post-sale assistance, technical expertise, and maintenance. | Expanded digital learning platforms; invested in global support network for rapid response. |

| Distribution Network | Leveraging global partners for efficient product delivery. | Strengthened channel partner programs to enhance market access and customer engagement. |

| Strategic Partnerships | Collaborating for technology co-development and market expansion. | Deepened alliances in renewable energy and digital solutions sectors. |

| Supply Chain Management | Ensuring efficient sourcing and timely product delivery globally. | Focused on supply chain resilience and diversification; managed inventory levels to meet demand. |

Full Document Unlocks After Purchase

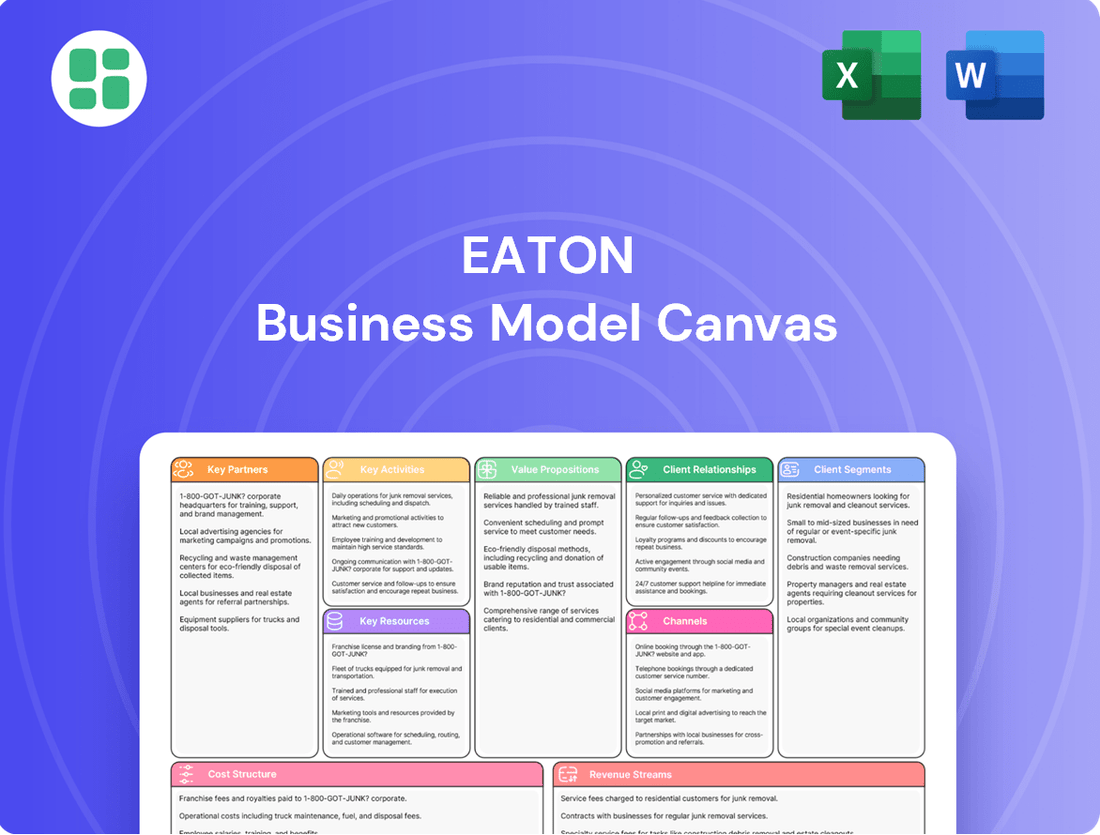

Business Model Canvas

The Eaton Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and professional formatting are exactly as you see them, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business planning tool.

Resources

Eaton's intellectual property is a cornerstone of its business, boasting a substantial portfolio of over 12,000 active patents globally as of early 2024. This vast collection of patents covers critical areas such as power distribution, power quality, and control systems, underpinning their leadership in energy management solutions.

Proprietary technologies developed in-house are another key resource, enabling Eaton to offer unique and highly efficient products across its electrical, hydraulic, aerospace, and vehicle segments. This technological edge allows for the creation of differentiated offerings that address complex customer needs in energy efficiency and sustainability.

The company's specialized expertise, cultivated through decades of innovation and acquisition, represents significant intellectual capital. This deep knowledge in areas like advanced materials, digital controls, and system integration is vital for developing next-generation power management solutions, driving competitive advantage and market leadership.

Eaton's global manufacturing and supply chain network is a cornerstone of its business model. This vast infrastructure includes numerous manufacturing facilities and assembly plants strategically located worldwide, facilitating large-scale production capabilities.

This extensive network is crucial for efficient distribution, allowing Eaton to deliver its diverse product portfolio across various segments and respond effectively to regional market demands. As of 2024, Eaton operates over 150 manufacturing sites globally, underscoring its commitment to a robust physical presence that supports its worldwide operations and customer base.

Eaton's human capital is a cornerstone of its business model, featuring a deep bench of highly skilled engineers, researchers, manufacturing specialists, and sales professionals. This collective expertise is crucial for developing and delivering sophisticated power management solutions across diverse industries globally.

In 2024, Eaton continued to invest in its workforce, recognizing that talent is a key differentiator. The company's commitment to employee development and attracting top engineering talent directly fuels its innovation pipeline and operational efficiency, enabling it to tackle complex customer challenges.

Strong Brand Reputation and Customer Relationships

Eaton's strong brand reputation, built over decades, is a cornerstone of its business. This reputation for reliability, safety, and quality is a significant intangible asset, especially in the critical sectors it serves. For instance, in 2023, Eaton's commitment to quality and safety was underscored by its consistent performance and customer satisfaction metrics.

These established, long-term relationships with key customers and partners are vital. They foster deep trust and ensure repeat business, providing a stable revenue stream. Eaton's focus on customer-centric solutions strengthens these bonds, leading to collaborative innovation and preferred supplier status in many markets.

- Brand Equity: Eaton's brand is synonymous with dependable electrical and industrial solutions, a perception reinforced through consistent product performance and service.

- Customer Loyalty: Long-standing relationships translate into high customer retention rates, as clients rely on Eaton for mission-critical applications.

- Industry Trust: In sectors like aerospace and data centers, where failure is not an option, Eaton's established trust is a significant competitive advantage.

- Partnership Value: Collaborative efforts with distributors and integrators amplify market reach and reinforce the value proposition of Eaton's offerings.

Financial Capital and Access to Funding

Eaton's robust financial health, highlighted by its record revenues of $23.2 billion in 2024 and sustained profitability, directly fuels its capacity for innovation and growth. This strong financial footing is crucial for funding extensive research and development, enabling strategic acquisitions, and supporting ongoing operational expansions.

The company's financial acumen ensures it can effectively finance future growth opportunities while maintaining a healthy balance sheet. This access to capital is a cornerstone of its business model, allowing for agility in a dynamic market.

- Record 2024 Revenues: Eaton achieved $23.2 billion in revenue for 2024, demonstrating significant market strength.

- Consistent Profitability: The company consistently generates profits, providing a stable source of internal funding.

- R&D Investment: Financial strength enables substantial investment in research and development for new technologies.

- Strategic Acquisitions: Access to capital facilitates the acquisition of complementary businesses to expand market reach and capabilities.

Eaton's intellectual property, including over 12,000 active patents globally as of early 2024, is a critical resource. This IP portfolio supports its leadership in power distribution and energy management solutions. Proprietary technologies and deep expertise in areas like advanced materials and digital controls further differentiate its offerings and drive innovation across its diverse business segments.

Value Propositions

Eaton's value proposition centers on delivering solutions that significantly boost energy efficiency and sustainability for its customers. By enabling better power management, Eaton helps organizations reduce their overall energy consumption, a critical factor in lowering operational costs and minimizing environmental impact.

These offerings directly address the growing global demand for electrification and the transition to cleaner energy sources. For instance, Eaton's intelligent power management technologies are designed to optimize energy use across various sectors, contributing to tangible environmental benefits like reduced carbon emissions.

In 2023, Eaton reported that its sustainability initiatives contributed to customers avoiding approximately 4.5 million metric tons of CO2 emissions, highlighting the real-world impact of their efficiency solutions.

Eaton's value proposition centers on delivering highly reliable electrical and power management systems. These are crucial for operations that cannot afford any interruption, such as data centers and industrial plants.

By ensuring continuous operation, Eaton directly minimizes costly downtime for its clients. For instance, in 2023, the average cost of downtime for businesses was estimated to be around $9,000 per minute, highlighting the significant financial impact of system failures.

This reliability protects essential business processes, offering customers a profound sense of security. Eaton's commitment to uptime means businesses can focus on their core functions, confident that their power infrastructure is robust and dependable.

Eaton's value proposition of Safety and Compliance is paramount, especially in critical sectors like aerospace and industrial applications. Their solutions are engineered to exceed rigorous safety standards and meet complex regulatory requirements, safeguarding both people and valuable assets. This dedication significantly lowers operational risks for their clientele.

For instance, in 2023, Eaton reported that its electrical sector solutions contributed to enhanced safety and reliability in numerous industrial facilities. The company consistently invests in research and development to ensure its products not only meet but anticipate evolving safety regulations, a crucial factor for customers operating in high-risk environments.

Comprehensive and Integrated Solutions

Eaton provides integrated power management solutions, combining electrical, hydraulic, and mechanical capabilities. This comprehensive approach offers customers a simplified, end-to-end system, from the power grid all the way down to individual electronic components.

This strategy is reflected in their market performance. For the full year 2024, Eaton reported significant revenue growth, driven by demand for its advanced power management technologies. Their ability to offer bundled solutions across diverse sectors like data centers, aerospace, and industrial automation positions them strongly against competitors offering more siloed product lines.

- End-to-End Systems: Eaton's value proposition centers on delivering complete power management solutions, not just individual parts.

- Cross-Sector Integration: Their offerings span electrical, hydraulic, and mechanical power, catering to a wide range of industrial and commercial needs.

- Simplified Complexity: By integrating these systems, Eaton helps customers navigate complex power challenges more effectively.

- Market Advantage: This integrated approach contributed to Eaton's robust financial results in 2024, highlighting customer preference for holistic solutions.

Innovation and Future-Proofing

Eaton's commitment to innovation is evident in its substantial investment in research and development. In 2023, the company reported approximately $2.2 billion in R&D spending, focusing on areas critical for future growth and customer needs.

This dedication fuels the development of solutions like advanced power management for AI data centers and robust charging infrastructure for electric vehicles, directly addressing the evolving demands of modern industries.

Strategic acquisitions further bolster Eaton's technological edge. For example, its acquisition of a significant stake in a leading EV charging solutions provider in late 2023 expanded its capabilities in this rapidly growing market.

- AI Data Center Power: Eaton's innovative power distribution units and uninterruptible power supplies are designed to handle the immense power requirements of AI workloads, ensuring reliability and efficiency.

- EV Charging Infrastructure: The company offers a comprehensive suite of EV charging solutions, from Level 2 chargers for commercial fleets to high-power DC fast chargers for public networks.

- Grid Modernization: Eaton's grid modernization technologies, including advanced sensors and intelligent control systems, help utilities improve grid resilience, integrate renewable energy sources, and reduce outages.

- Future-Proofing Investments: By adopting Eaton's forward-looking technologies, customers can ensure their infrastructure remains relevant and efficient as industry standards and demands continue to shift.

Eaton's value proposition emphasizes enhanced energy efficiency and sustainability, enabling customers to reduce operational costs and environmental impact through optimized power management. Their solutions are crucial for meeting the escalating global demand for electrification and cleaner energy, with technologies designed to minimize carbon footprints.

In 2023, Eaton's sustainability efforts resulted in customers avoiding approximately 4.5 million metric tons of CO2 emissions, demonstrating the tangible environmental benefits of their efficiency solutions.

Furthermore, Eaton provides highly reliable electrical and power management systems, critical for operations where downtime is extremely costly. By ensuring continuous uptime, they minimize financial losses for clients, offering significant peace of mind and allowing businesses to concentrate on core operations.

Eaton's integrated approach, combining electrical, hydraulic, and mechanical power management, offers customers simplified, end-to-end solutions. This holistic strategy has contributed to their strong market performance, with significant revenue growth reported for the full year 2024, driven by demand for their advanced, bundled technologies across diverse sectors.

Customer Relationships

Eaton cultivates enduring customer bonds through dedicated account managers who offer personalized service and proactive engagement. These managers act as primary points of contact, ensuring a deep understanding of each client's unique needs and operational challenges.

Specialized technical support teams are integral to this strategy, providing expert guidance and rapid problem resolution. This ensures customers receive timely and effective assistance, minimizing downtime and maximizing the value derived from Eaton's solutions.

For instance, in 2024, Eaton reported a significant increase in customer satisfaction scores directly correlated with the responsiveness and expertise of its support staff, highlighting the tangible impact of these relationship-building efforts on customer loyalty and retention.

Eaton truly excels in its customer relationships through a solution-oriented, consultative approach. They don't just sell products; they partner with clients, diving deep into understanding unique power management needs. This collaborative process often involves extensive technical discussions and the co-creation of tailored system designs, particularly for intricate and demanding projects.

For instance, in 2024, Eaton's commitment to this consultative model was evident in their work with major data center operators. These engagements frequently involved multi-day workshops to map out power redundancy and efficiency requirements, leading to customized UPS and power distribution unit configurations that exceeded standard offerings. This personalized strategy directly addresses complex challenges, fostering strong, long-term customer loyalty.

Eaton operates an extensive global service network, offering crucial installation, maintenance, and repair services. This ensures their deployed solutions, like advanced power management systems, function optimally throughout their lifecycle.

The availability of aftermarket parts directly supports the longevity and performance of Eaton's products. For instance, in 2024, the company continued to emphasize its commitment to readily available spare parts, a key factor for customers in critical infrastructure and industrial sectors.

This unwavering dedication to continuous support fosters significant trust and reinforces customer loyalty. By providing reliable service and parts, Eaton solidifies its position as a dependable partner, encouraging repeat business and long-term relationships.

Digital Engagement and Self-Service Tools

Eaton is enhancing customer relationships through robust digital engagement and self-service tools. This approach allows customers to readily access product details, technical documentation, and support resources online, meeting their need for swift information retrieval and efficient issue resolution.

In 2024, Eaton reported continued growth in digital channel engagement. For instance, their online technical support portal saw a 15% increase in user sessions compared to the previous year, highlighting customer preference for self-service options.

- Digital Support Growth: Eaton's online knowledge base and troubleshooting guides experienced a 20% rise in traffic in early 2024, indicating a strong customer reliance on digital self-help.

- Self-Service Tools Adoption: The adoption rate of Eaton's online product configurators and quote request tools grew by 12% in 2024, streamlining the procurement process for many clients.

- Customer Feedback Integration: Digital feedback mechanisms on Eaton's platforms have been instrumental, with over 5,000 customer suggestions collected and reviewed in the first half of 2024 to improve online services.

- Resource Accessibility: Eaton's commitment to digital accessibility ensures that 95% of their product datasheets and manuals are available for download 24/7 through their customer portal.

Strategic Partnerships with Key Customers

Eaton cultivates deep, collaborative relationships with its most significant clients, particularly for large-scale projects. This often extends to joint development initiatives and the early integration of cutting-edge technologies, fostering mutual growth and innovation.

These strategic partnerships are crucial for addressing complex challenges. For instance, Eaton's work with utilities on grid modernization projects in 2024, aiming to enhance reliability and integrate renewable energy sources, exemplifies this approach. Similarly, collaborations with leading technology firms on AI data center solutions highlight Eaton's commitment to co-creating value.

- Joint Development: Collaborating on new product features or solutions tailored to specific customer needs.

- Early Technology Integration: Providing customers with access to and input on emerging technologies before general release.

- Co-creation of Value: Working together to solve complex industry problems and drive mutual business success.

Eaton's customer relationships are built on a foundation of personalized service, technical expertise, and ongoing support. Dedicated account managers and specialized technical teams ensure clients receive tailored solutions and prompt assistance, fostering loyalty and trust. This consultative approach, evident in 2024 collaborations with data center operators for customized power solutions, underscores Eaton's commitment to understanding and addressing unique client needs.

Channels

Eaton’s direct sales force is a cornerstone for reaching its key customer segments, including large industrial players, utility companies, government agencies, and major original equipment manufacturers (OEMs). This approach facilitates tailored solutions and deep engagement with complex project requirements.

This direct channel is crucial for managing intricate sales cycles and fostering robust, long-term customer relationships. It enables Eaton to directly address the specific needs of these high-value clients, often involving customized product configurations and extensive technical support.

In 2024, Eaton reported significant revenue driven by its large account management and direct sales efforts, underscoring the channel's importance in securing major contracts and driving substantial business volume across its diverse product lines.

Eaton relies heavily on a vast global network of authorized distributors and resellers to reach its diverse customer base. These partners are crucial for providing localized access to Eaton's extensive product portfolio, particularly within the electrical and industrial markets. In 2024, Eaton's channel partners were instrumental in driving sales, with reports indicating that over 70% of Eaton's electrical sector revenue in North America flowed through these indirect channels.

Eaton collaborates with system integrators and EPC contractors, crucial partners for deploying its power management solutions in complex, large-scale projects. These entities are essential for embedding Eaton's products, such as uninterruptible power supplies (UPS) and switchgear, into the foundational infrastructure of data centers, commercial real estate, and critical industrial facilities.

In 2024, the global market for data center construction alone was projected to reach over $200 billion, highlighting the significant demand for integrated power solutions. Eaton's strategic relationships with EPC firms ensure that its technologies are seamlessly incorporated into these massive builds, from initial design through to final commissioning, thereby extending its market reach and project execution capabilities.

Online Platforms and E-commerce

Eaton leverages online platforms and e-commerce for specific product segments, offering customers easy access to technical documentation and the ability to purchase standard items. This digital presence enhances convenience and reach, particularly for those seeking readily available solutions or detailed product specifications. For instance, Eaton's website serves as a hub for product catalogs, engineering resources, and support, facilitating a streamlined customer experience.

In 2024, the growth of digital commerce continued to influence industrial supply chains. Eaton's strategic investment in its online channels reflects this trend, aiming to capture a segment of the market that values self-service and efficient procurement. This approach supports customers in navigating complex product offerings and accessing vital information quickly.

- Online Accessibility: Eaton's digital platforms provide 24/7 access to product information, technical support, and purchasing options for select offerings.

- E-commerce Growth: The company's e-commerce initiatives are designed to cater to the increasing demand for online transactions in the industrial sector.

- Resource Hub: Eaton's website functions as a comprehensive resource center, offering datasheets, manuals, and configuration tools to aid customer decision-making.

Service and Aftermarket Networks

Eaton’s robust service and aftermarket networks are crucial channels for delivering ongoing value to customers. These networks facilitate the sale of essential replacement parts, ensuring operational continuity for clients. In 2024, the aftermarket services sector for industrial equipment, including those offered by Eaton, continued to demonstrate strong growth, with many companies reporting double-digit percentage increases in service revenue as customers prioritize extending the life of existing assets.

Beyond parts, these channels are vital for offering comprehensive maintenance contracts, which provide predictable, recurring revenue streams for Eaton. This focus on service contracts not only secures ongoing income but also fosters deeper customer relationships. For example, many large industrial clients in the energy and manufacturing sectors have shifted towards service-based agreements, seeking guaranteed uptime and predictable maintenance costs, a trend that accelerated through 2024.

Furthermore, Eaton leverages these networks to provide critical technical upgrades and retrofits. This ensures that customers can enhance the performance and efficiency of their existing Eaton equipment, staying current with technological advancements. Such upgrades are key to customer retention and create opportunities for upselling, reinforcing loyalty by demonstrating a commitment to long-term client success.

- Aftermarket Parts Sales: Facilitates ongoing revenue through the sale of replacement components, critical for maintaining operational uptime.

- Maintenance Contracts: Generates recurring revenue and strengthens customer loyalty by offering guaranteed service and support.

- Technical Upgrades: Enables customers to improve existing equipment performance and efficiency, fostering continued engagement.

- Customer Loyalty: Comprehensive post-sale support reinforces relationships and encourages repeat business.

Eaton's channels are multifaceted, encompassing direct sales, a broad distributor network, strategic partnerships with system integrators, and robust online platforms. These channels collectively ensure broad market reach and cater to diverse customer needs, from large industrial clients to smaller businesses seeking accessible solutions.

The direct sales force is vital for high-value, complex projects, while distributors provide localized access. System integrators are key for large-scale deployments, and e-commerce offers convenience for standard products. Aftermarket services and parts sales create recurring revenue and foster long-term customer relationships.

In 2024, Eaton's continued investment in these diverse channels, particularly digital and aftermarket services, reflected a strategic focus on enhancing customer engagement and capturing growth opportunities across its global markets. This multi-channel approach is fundamental to Eaton's operational strategy and market penetration.

Customer Segments

Industrial and commercial businesses represent a significant customer segment for Eaton, encompassing a wide array of facilities from manufacturing plants and data centers to hospitals and office buildings. These entities rely heavily on robust power distribution, management, and automation systems to ensure operational continuity and efficiency. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the critical need for advanced solutions that Eaton provides.

Eaton's offerings cater to the diverse needs within this segment, addressing challenges such as energy efficiency, grid reliability, and safety compliance. In the manufacturing sector alone, which constitutes a substantial portion of this customer base, companies are increasingly investing in smart factory technologies. Eaton's power management solutions are crucial for integrating these advanced systems, supporting the trend towards Industry 4.0, which saw significant investment in 2024 as businesses aimed to boost productivity and reduce energy consumption.

Eaton's primary customer segment here consists of electric utilities and energy companies. These organizations are actively pursuing grid modernization projects, aiming to integrate renewable energy sources more effectively and enhance the overall reliability of their power distribution networks. This focus is a direct response to the accelerating global energy transition and the growing need for robust and resilient power infrastructure.

The demand for Eaton's solutions within this segment is significantly fueled by the global shift towards cleaner energy sources. Utilities are investing heavily in upgrades to handle the intermittency of renewables like solar and wind. For instance, in 2024, global investment in energy transition technologies, including grid modernization, reached an estimated $1.7 trillion, underscoring the scale of this market opportunity.

Data centers and cloud providers are a crucial customer segment for Eaton, driven by the relentless expansion of digitalization and the burgeoning demand for artificial intelligence. These clients require sophisticated, high-density power distribution, robust backup power systems, and advanced thermal management solutions to ensure uninterrupted operations and optimal performance. Eaton's commitment to innovation is evident in its active collaboration with AI data centers to address their exceptionally demanding power requirements.

Aerospace and Defense Industry

Eaton's Aerospace and Defense segment is a critical supplier, delivering specialized hydraulic, fuel, and electrical systems to major players like Boeing and Lockheed Martin. This customer base, including leading aerospace manufacturers and defense contractors, relies on Eaton for solutions that meet exceptionally high standards for reliability and precision.

The demands of this sector are rigorous, necessitating adherence to strict industry regulations and a commitment to performance under extreme conditions. For instance, in 2024, the global aerospace MRO market was projected to reach over $100 billion, highlighting the significant aftermarket support required by these customers, an area where Eaton's expertise is crucial.

- Key Customers: Major commercial aircraft manufacturers and defense prime contractors.

- Product Focus: High-reliability hydraulic, fuel, and electrical systems.

- Industry Demands: Extreme precision, unwavering reliability, and strict regulatory compliance.

- Market Context: Supports a vital sector with significant ongoing needs for advanced systems and aftermarket support.

Vehicle and eMobility Manufacturers

Vehicle and eMobility Manufacturers represent a crucial customer segment for Eaton. This group encompasses both established automotive and commercial vehicle makers, alongside newer players focused on electric mobility. Eaton provides essential components and systems for traditional internal combustion engine powertrains, while also significantly expanding its offerings for the burgeoning electric vehicle market, including critical EV charging infrastructure solutions.

In 2024, the automotive industry continued its significant pivot towards electrification. For instance, major automakers announced substantial investments in EV production lines and battery technology throughout the year. Eaton's role in this transition is exemplified by its supply of power electronics, battery management systems, and charging components, which are vital for the performance and efficiency of these new vehicles.

- Traditional Powertrain Support: Eaton continues to supply components like transmissions and engine management systems to established manufacturers, ensuring continued revenue from existing vehicle platforms.

- EV Component Integration: The company provides critical electrical components for EVs, such as DC-DC converters, onboard chargers, and battery disconnect units, enabling the functionality of electric drivetrains.

- Charging Infrastructure Solutions: Eaton offers a range of EV charging stations and power distribution equipment, supporting the build-out of charging networks essential for EV adoption.

- Partnerships for Innovation: Eaton collaborates with leading vehicle manufacturers to co-develop next-generation eMobility technologies, ensuring its product roadmap aligns with industry demands.

Eaton serves a broad spectrum of customers, from large industrial facilities and utilities to specialized aerospace and automotive manufacturers. These diverse segments require advanced power management solutions to ensure reliability, efficiency, and compliance with evolving industry standards. The company's strategy involves tailoring its product and service offerings to meet the unique challenges and technological demands of each customer group.

In 2024, Eaton's industrial and commercial segment continued to be a significant revenue driver, with businesses investing in infrastructure upgrades and smart technologies. The company's power distribution and automation solutions are vital for sectors like manufacturing and data centers, which are increasingly focused on energy efficiency and operational continuity. The global industrial automation market's growth in 2024, projected to exceed $200 billion, underscores the demand for Eaton's expertise.

Electric utilities represent another core customer base, driven by the global push for grid modernization and renewable energy integration. Eaton's solutions support utilities in enhancing grid resilience and managing the complexities of distributed energy resources. The substantial global investment in energy transition technologies in 2024, estimated at $1.7 trillion, highlights the critical role Eaton plays in this evolving energy landscape.

The aerospace and defense sector relies on Eaton for high-performance hydraulic, fuel, and electrical systems, serving major manufacturers like Boeing and Lockheed Martin. This segment demands exceptional reliability and adherence to stringent regulations, areas where Eaton has established a strong reputation. The aerospace MRO market's projected value of over $100 billion in 2024 further emphasizes the ongoing need for specialized components and support.

Eaton is also a key supplier to vehicle and eMobility manufacturers, providing components for both traditional powertrains and the rapidly expanding electric vehicle market. As automakers significantly increased EV production investments in 2024, Eaton's power electronics, battery management systems, and charging infrastructure solutions became increasingly crucial for enabling this transition.

Cost Structure

Eaton's manufacturing and production costs represent a substantial part of its overall expenses, encompassing raw materials, direct labor, and factory overhead across its worldwide operations. For instance, in 2023, the company reported cost of sales of $16.7 billion, reflecting the significant investment in producing its wide array of electrical, aerospace, hydraulic, and vehicle products.

The company is actively investing in smart factory initiatives and automation to drive efficiencies and reduce these production expenses. These technological upgrades are designed to optimize material usage, improve labor productivity, and lower energy consumption within its global manufacturing footprint, aiming to bolster profitability in a competitive market.

Eaton invests heavily in research and development, a critical component of its business model, to fuel innovation in areas like electrical, aerospace, hydraulics, and vehicle technologies. These expenses are essential for developing next-generation products and sustainable solutions, ensuring the company remains competitive. For instance, in 2023, Eaton reported R&D expenses of $1.3 billion, reflecting a significant commitment to future growth and technological advancement.

Sales, General, and Administrative (SG&A) expenses are a significant component of Eaton's operational costs. These include the salaries and commissions for their extensive global sales force, as well as investments in marketing and brand-building campaigns to drive product adoption and market share.

Furthermore, SG&A encompasses the costs associated with managing Eaton's global administrative functions and corporate overhead. This includes executive salaries, legal, finance, human resources, and other essential support services that keep the organization running smoothly. For instance, in 2023, Eaton reported SG&A expenses of approximately $4.3 billion, reflecting the scale of their global operations and sales efforts.

Acquisition and Integration Costs

Eaton's growth strategy heavily relies on acquisitions, which inherently come with substantial costs. These are not just the purchase price but also the expenses tied to merging new businesses into Eaton's existing structure. Think of it as buying a new house and then renovating it to fit your style and needs.

These acquisition and integration costs can be quite varied. They encompass everything from the due diligence and legal fees involved in the deal itself to the more complex tasks of harmonizing IT systems, consolidating supply chains, and aligning employee benefits and cultures. Restructuring expenses, such as severance packages or facility closures, also fall into this category.

For instance, in 2023, Eaton completed several significant acquisitions. While specific integration cost figures are often embedded within broader financial reports, the scale of these deals indicates millions, if not hundreds of millions, in associated integration expenses. These investments are crucial for realizing the projected synergies and strategic benefits from each acquisition.

- Due Diligence and Legal Fees: Costs incurred for investigating the target company and finalizing acquisition agreements.

- Integration Planning and Execution: Expenses related to merging operations, IT systems, and personnel.

- Restructuring Costs: Charges associated with streamlining operations post-acquisition, such as severance pay or asset write-downs.

- Synergy Realization Expenses: Investments made to achieve anticipated cost savings and revenue enhancements from the combined entities.

Supply Chain and Logistics Costs

Eaton's cost structure is significantly impacted by its supply chain and logistics. Managing a vast global network that spans over 160 countries for raw materials, components, and finished goods naturally leads to substantial expenses. These include warehousing, transportation, and the intricate coordination required to move products efficiently across continents.

Optimizing these supply chain operations is not just about efficiency; it's a critical lever for cost control. For instance, in 2024, companies with highly optimized supply chains often report lower per-unit logistics costs compared to those with less streamlined operations. Eaton's commitment to this optimization directly influences its profitability.

- Global Reach: Operating in over 160 countries necessitates extensive logistics infrastructure.

- Cost Drivers: Warehousing, transportation, and inventory management are major cost components.

- Optimization Focus: Streamlining the supply chain is crucial for managing and reducing these operational expenses.

Eaton's cost structure is heavily influenced by its manufacturing and production activities, including raw materials, direct labor, and factory overhead. In 2023, the company's cost of sales was $16.7 billion, highlighting the significant investment in producing its diverse product portfolio. Furthermore, Eaton allocates substantial resources to research and development, reporting $1.3 billion in R&D expenses in 2023 to drive innovation and maintain a competitive edge.

Sales, General, and Administrative (SG&A) expenses are another major cost driver, encompassing sales force compensation, marketing, and corporate overhead. In 2023, SG&A expenses amounted to approximately $4.3 billion, reflecting the scale of Eaton's global operations. The company also incurs considerable costs related to its growth strategy, particularly through acquisitions and subsequent integration efforts, which involve due diligence, legal fees, and operational restructuring.

| Cost Category | 2023 Expense (Billions USD) | Key Components |

|---|---|---|

| Cost of Sales | 16.7 | Raw materials, direct labor, factory overhead |

| Research & Development | 1.3 | Product innovation, new technologies |

| SG&A | 4.3 | Sales force, marketing, corporate overhead |

Revenue Streams

Eaton's primary revenue engine is the direct sale of its extensive portfolio of power management products. These sales are organized across its key segments: Electrical (Americas and Global), Aerospace, Vehicle, and eMobility. This broad product offering encompasses everything from individual components to complex, integrated systems designed to manage electrical, hydraulic, and mechanical power.

In 2023, Eaton reported total net sales of $23.7 billion, with its Electrical Americas segment alone generating $8.1 billion. The Electrical Global segment contributed $5.4 billion, showcasing the significant reliance on its electrical power management solutions. These figures highlight the substantial market demand for Eaton's products, which are crucial for infrastructure, transportation, and industrial applications.

Eaton generates significant revenue through its service and aftermarket sales segment. This includes offering installation, ongoing maintenance, and repair services for its diverse product portfolio, ensuring operational efficiency for its customers.

Furthermore, the sale of replacement parts and consumables forms a crucial recurring revenue stream. This aftermarket business is vital for customer retention and provides a stable financial foundation for Eaton.

For instance, in 2023, Eaton reported that its Electrical Americas segment, which heavily relies on aftermarket services and parts, saw organic sales growth. This highlights the consistent demand for these offerings, contributing to overall business stability.

Eaton is expanding its revenue from software and digital solutions as a key part of its digitalization efforts. This includes income generated from software licenses, cloud-based platforms, and advanced data analytics services designed to boost the performance of its physical products.

These digital offerings are crucial for customers seeking enhanced energy management and grid optimization. For instance, Eaton's digital solutions enable better monitoring and control of power systems, leading to increased efficiency and reliability, which are increasingly valued by businesses and utilities.

In 2023, Eaton reported that its Digital Office business, which encompasses many of these software and digital services, saw significant growth, contributing to the company's overall revenue diversification. This trend is expected to continue as more industries adopt digital transformation strategies.

Project-Based Solutions and System Integration

Eaton secures revenue by providing comprehensive power management solutions for large-scale infrastructure and industrial projects. This involves intricate system design, integration, and project management, with fees directly tied to the complexity and scope of these undertakings.

For instance, in 2024, a significant portion of Eaton's revenue in this segment likely stemmed from large energy projects, such as renewable energy installations and utility grid modernization efforts, where their expertise in system integration is paramount. These projects often have multi-year revenue recognition cycles.

- Customized System Design: Revenue generated from tailoring power management systems to specific project requirements.

- Integration Services: Fees for seamlessly combining various power components and technologies into a unified system.

- Project Management Fees: Compensation for overseeing the entire project lifecycle, from planning to execution.

- Long-Term Support Contracts: Additional revenue from ongoing maintenance and operational support post-integration.

Licensing and Technology Partnerships

Eaton may generate revenue by licensing its proprietary technologies, particularly in areas like power management and electrical distribution. This allows other companies to utilize Eaton's innovations, opening up new market segments or specialized applications where Eaton might not have a direct presence.

Technology partnerships can also be a revenue source. These collaborations often involve joint ventures or strategic alliances where Eaton's expertise and intellectual property are combined with a partner's market access or complementary technology. For instance, in 2023, Eaton continued to invest in and partner on advancements in energy storage and grid modernization technologies, areas ripe for licensing and collaborative revenue generation.

- Licensing Proprietary Technologies

- Joint Ventures for Market Access

- Strategic Alliances for Specialized Applications

- Leveraging Intellectual Property in New Segments

Eaton's revenue streams are diverse, primarily driven by the sale of its extensive power management products across its key segments: Electrical (Americas and Global), Aerospace, Vehicle, and eMobility. Beyond new product sales, the company also generates substantial income from services, aftermarket parts, and increasingly, from software and digital solutions. This multifaceted approach ensures a robust financial foundation.

In 2023, Eaton reported total net sales of $23.7 billion, with its Electrical Americas segment leading at $8.1 billion and Electrical Global at $5.4 billion. The company's aftermarket business, including replacement parts and maintenance services, provides a vital recurring revenue stream, contributing to overall business stability. Growth in digital offerings, such as software licenses and cloud platforms, further diversifies revenue and supports customer needs for enhanced energy management.

Eaton also capitalizes on large-scale project revenue through customized system design, integration services, and project management, particularly in infrastructure and industrial sectors. Technology licensing and strategic partnerships represent additional avenues for revenue generation, leveraging its intellectual property in new markets.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Product Sales | Direct sale of power management products across segments | Majority of $23.7 billion total net sales |

| Services & Aftermarket | Installation, maintenance, repair, replacement parts | Significant recurring revenue |

| Software & Digital Solutions | Licenses, cloud platforms, data analytics | Growing contribution, driving efficiency |

| Project-Based Solutions | System design, integration for large projects | Revenue from infrastructure and industrial sectors |

| Technology Licensing & Partnerships | Licensing IP, joint ventures, strategic alliances | Leveraging innovation for new market access |

Business Model Canvas Data Sources

The Eaton Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and extensive market research. These data sources provide a comprehensive view of Eaton's operational landscape and strategic positioning.