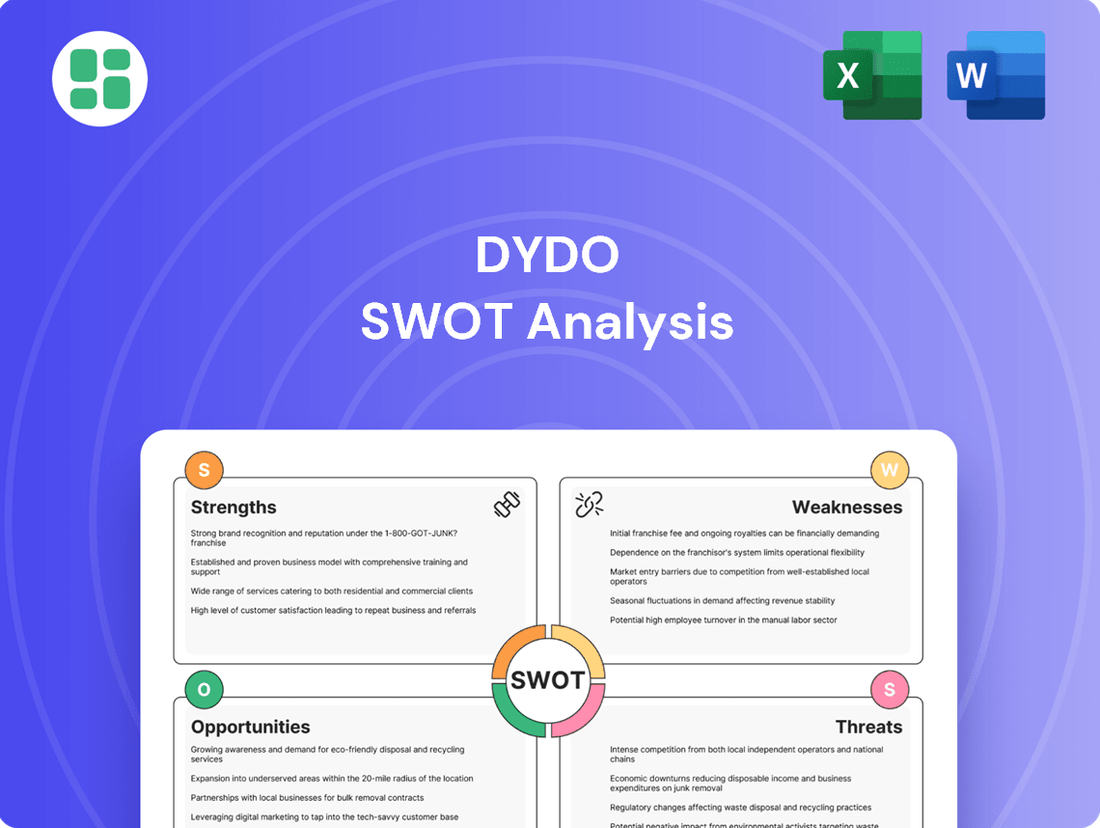

DyDo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

DyDo's strong brand recognition and diverse product portfolio present significant strengths, but its reliance on the Japanese market and intense competition pose notable challenges.

Want the full story behind DyDo's market position, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and competitive analysis.

Strengths

DyDo Group Holdings benefits from an extensive vending machine network in Japan, ranking third in vending machine revenue with a market share of around 15%. This robust network ensures a consistent and reliable stream of cash flow, directly connecting the company with a broad consumer base and contributing to strong sales stability, particularly for its popular canned coffee offerings.

DyDo's strength lies in its significantly diversified product portfolio, extending well beyond its established beverage operations. The company has strategically expanded into health foods, supplements, and a promising pharmaceutical segment, particularly focusing on orphan drugs. This multi-pronged approach mitigates risk by not depending on a single market, enabling DyDo to capture diverse consumer demands and evolving market trends.

This diversification is not merely theoretical; it's actively yielding results. For example, DyDo's pharmaceutical division achieved a notable milestone with the January 2025 launch of 'Firdapse® Tablet 10mg,' a critical treatment for a rare disease. This successful entry into a high-value niche highlights the company's innovative capacity and its commitment to growth in specialized, impactful sectors.

DyDo boasts significant brand recognition in Japan, especially for its coffee beverages, a key driver of its vending machine business. This strong domestic standing is further solidified by a strategic alliance with Asahi Soft Drinks, focusing on optimizing vending machine operations and enhancing competitiveness in a consolidating market.

This partnership facilitates the mutual sale of leading brands, reinforcing DyDo's entrenched position. For instance, in the fiscal year ending March 2024, DyDo's domestic beverage sales reached approximately ¥240 billion, underscoring its substantial market share and brand loyalty.

Commitment to Health and Wellness Sector

DyDo Group's dedication to the health and wellness sector is a significant strength, aligning with a powerful consumer shift. They are actively developing and marketing health foods and functional beverages, recognizing the growing demand for healthier choices. This focus is further solidified by the March 2025 establishment of the 'DyDo Group Future Co-Creation Institute,' dedicated to R&D in functional materials for food and beverages, aiming to deliver tangible health value.

This strategic investment in innovation is crucial for capturing market share in a sector experiencing robust growth. For instance, the Japanese functional beverage market alone was projected to reach approximately ¥2.2 trillion by the end of 2024, indicating substantial opportunity. DyDo's proactive approach positions them to benefit from this expanding market by offering products that cater to consumer well-being.

- Alignment with Market Trends: Capitalizes on the increasing consumer demand for health and wellness products.

- R&D Investment: The DyDo Group Future Co-Creation Institute (established March 2025) signals a strong commitment to innovation in functional ingredients.

- Product Development Focus: Actively developing and marketing health foods and functional beverages to meet evolving consumer needs.

- Market Potential: Positioned to leverage the significant growth observed in the Japanese functional beverage market, which was estimated to be around ¥2.2 trillion in 2024.

International Expansion and Strategic Acquisitions

DyDo's commitment to international expansion is a significant strength, evidenced by its strategic entry into markets like Turkey and Poland. This global reach helps diversify revenue streams and reduces reliance on any single market.

The acquisition of Wosana S.A. in February 2024 for an undisclosed sum, and the formation of DyDo DRINCO International, Inc. in September 2024, highlight a clear strategy to bolster its international beverage operations. These moves are designed to drive substantial top-line growth and mitigate geographical risks.

- Proactive Market Entry: Expansion into Turkey and Poland demonstrates a deliberate strategy to enter new, potentially high-growth international markets.

- Strategic Acquisitions: The acquisition of Wosana S.A. in February 2024 signals a targeted approach to acquiring established players and integrating their operations for accelerated growth.

- International Restructuring: The establishment of DyDo DRINCO International, Inc. in September 2024 indicates a focused effort to streamline and strengthen its global beverage business structure.

- Growth Ambition: These international initiatives are explicitly aimed at achieving dramatic top-line growth and enhancing geographical diversification.

DyDo's expansive vending machine network in Japan, holding a substantial 15% market share, ensures consistent cash flow and direct consumer engagement. This robust infrastructure is a cornerstone of its sales stability, particularly for its popular canned coffee products.

The company's diversified product portfolio, encompassing health foods, supplements, and pharmaceuticals, effectively mitigates risk. This strategic expansion into high-value niches, such as orphan drugs, demonstrates innovative capacity and a commitment to growth in specialized sectors.

DyDo's strong brand recognition in Japan, especially for its beverages, is further enhanced by a strategic alliance with Asahi Soft Drinks. This partnership optimizes vending machine operations and strengthens competitiveness in a consolidating market.

The company's focus on the health and wellness sector aligns with growing consumer demand, evidenced by the March 2025 establishment of the DyDo Group Future Co-Creation Institute. This institute is dedicated to R&D in functional ingredients, aiming to deliver tangible health value and capture market share in the expanding Japanese functional beverage market, projected to reach ¥2.2 trillion by the end of 2024.

DyDo's international expansion strategy, including the February 2024 acquisition of Wosana S.A. and the September 2024 formation of DyDo DRINCO International, Inc., diversifies revenue streams and reduces reliance on single markets.

| Strength Aspect | Key Feature | Impact | Supporting Data/Event |

|---|---|---|---|

| Vending Network | Extensive presence in Japan | Consistent cash flow, broad consumer reach | Ranked 3rd in vending machine revenue, ~15% market share |

| Product Diversification | Beverages, health foods, pharmaceuticals | Risk mitigation, capture diverse demands | January 2025: Launch of 'Firdapse® Tablet 10mg' |

| Brand Strength | High recognition, especially for coffee | Market loyalty, competitive advantage | Fiscal year ending March 2024: Domestic beverage sales ~¥240 billion |

| Health & Wellness Focus | Development of health foods & functional beverages | Capitalizes on market trends, R&D investment | March 2025: DyDo Group Future Co-Creation Institute established; Japanese functional beverage market ~¥2.2 trillion (2024 est.) |

| International Expansion | Entry into Turkey, Poland; Acquisitions | Revenue diversification, reduced geographical risk | February 2024: Acquisition of Wosana S.A.; September 2024: DyDo DRINCO International, Inc. formed |

What is included in the product

Delivers a strategic overview of DyDo’s internal and external business factors, highlighting its strengths in brand recognition and market presence, while also identifying weaknesses in product diversification and opportunities in emerging markets and threats from intense competition.

Offers a clear, organized framework to identify and address potential market challenges, turning weaknesses into actionable strategies.

Weaknesses

DyDo's core beverage operations, especially those from its extensive vending machine network, still draw a substantial majority of their income from within Japan. Reports indicate that around 80% of its beverage revenue is generated domestically.

This significant concentration in the Japanese market means DyDo is particularly susceptible to local economic downturns and demographic trends. An aging population and shifts in consumer preferences, such as a potential decrease in overall beverage consumption, pose direct challenges to its revenue streams.

While DyDo has been expanding its international presence, the continued heavy reliance on Japan for a large portion of its revenue, particularly in its established vending machine segment, represents a key weakness. This geographic concentration limits diversification and amplifies exposure to country-specific risks.

Japan's vending machine market, a core pillar for DyDo, grapples with significant headwinds. Labor shortages are making it harder to manage and restock the vast network of machines, a critical operational challenge. Furthermore, shifts in consumer habits, notably the rise of remote work, have led to fewer people being out and about, directly impacting sales volumes.

Despite DyDo's efforts with 'Smart Operations' to streamline processes and combat these issues, the overall market size is contracting. This shrinking demand, coupled with the escalating costs associated with maintaining a widespread vending machine infrastructure, continues to put a strain on the company's bottom line.

DyDo's reliance on globally traded commodities like coffee beans exposes it to significant price volatility. For instance, the International Coffee Organization (ICO) Composite Indicator price saw considerable swings in 2024, directly impacting DyDo's cost of goods sold. These fluctuations, amplified by currency exchange rate movements and rising energy prices, create a challenging operating environment.

Furthermore, logistics costs represent a persistent vulnerability. Global supply chain disruptions and increased fuel surcharges, which have remained elevated into early 2025, add further pressure. While DyDo has undertaken price adjustments and supply chain optimizations, these external cost pressures can still materially affect profitability.

Intense Competition in Beverage Sector

The Japanese beverage market is a battleground, with giants like Suntory and Kirin constantly innovating, making it tough for DyDo to stand out. This intense rivalry, especially in popular segments like ready-to-drink tea and coffee, often forces price adjustments, impacting profit margins.

DyDo faces the challenge of differentiating its products in a crowded market where consumers have abundant choices. Competitors are pouring resources into healthier and eco-friendly options, demanding that DyDo consistently invest in new product development and robust marketing campaigns to keep pace.

- Market Saturation: The Japanese beverage market is highly saturated, with an estimated 97% of households purchasing beverages regularly, creating a limited organic growth potential for any single player.

- Price Sensitivity: In 2024, consumer spending on non-alcoholic beverages showed increased price sensitivity, with a 3% year-on-year dip in average transaction value, directly impacting DyDo's pricing power.

- Innovation Lag: Competitors like Ito En have seen a 5% increase in market share for their functional beverages in the past year, indicating a potential gap in DyDo's innovation in health-focused product lines.

Integration Challenges with Acquisitions

While DyDo's acquisition strategy, exemplified by the purchase of Wosana S.A. in Poland, offers expansion avenues, integrating these new businesses presents significant hurdles. Aligning disparate operational systems, harmonizing distinct corporate cultures, and effectively capturing anticipated synergies are complex tasks. This can strain resources and potentially dilute focus from core operations.

Difficulties in managing a growing portfolio of international operations could impede overall profitability and operational efficiency, particularly in the short to medium term following acquisitions. For instance, if the integration of Wosana S.A. encounters unforeseen IT system incompatibilities, it could delay the realization of projected cost savings, estimated to be around 15% of Wosana's operational expenses within the first two years post-acquisition, according to initial integration plans.

- Operational System Alignment: Incompatible software and data management systems can lead to inefficiencies and increased IT costs.

- Cultural Integration: Merging different organizational cultures can create friction, impacting employee morale and productivity.

- Synergy Realization Delays: Unforeseen integration challenges can postpone the achievement of expected cost savings and revenue enhancements.

DyDo's significant reliance on the Japanese market, with approximately 80% of beverage revenue generated domestically, makes it vulnerable to local economic shifts and demographic changes like an aging population. This geographic concentration limits diversification and amplifies exposure to country-specific risks, particularly within its core vending machine segment.

The company faces challenges in its primary vending machine business due to labor shortages impacting operations and a contraction in market size, exacerbated by changing consumer habits like increased remote work. Escalating costs for maintaining this extensive infrastructure further strain profitability.

DyDo's profitability is also susceptible to the volatility of globally traded commodities, such as coffee beans, with prices showing considerable swings in 2024 impacting its cost of goods sold. Rising logistics costs and persistent supply chain disruptions into early 2025 add further pressure, despite efforts in price adjustments and optimization.

The highly saturated Japanese beverage market presents intense competition, forcing price adjustments and impacting profit margins. DyDo struggles to differentiate its products against competitors investing heavily in healthier and eco-friendly options, requiring continuous investment in innovation and marketing.

| Weakness | Description | Impact | Supporting Data (2024/2025) |

|---|---|---|---|

| Geographic Concentration | Heavy reliance on the Japanese market for revenue. | Vulnerability to domestic economic downturns and demographic trends. | ~80% of beverage revenue from Japan. |

| Vending Machine Market Challenges | Operational difficulties and market contraction in vending. | Reduced sales volumes and increased operational costs. | Labor shortages; shrinking market size; elevated fuel surcharges impacting logistics. |

| Commodity Price Volatility & Logistics Costs | Exposure to fluctuating raw material prices and rising operational expenses. | Pressure on cost of goods sold and overall profitability. | ICO Composite Indicator price swings; elevated global logistics costs into early 2025. |

| Intense Market Competition | Struggles to differentiate in a crowded and price-sensitive market. | Impacted profit margins and necessitates continuous innovation investment. | Increased price sensitivity in consumer spending (3% dip in avg. transaction value in 2024); competitors gaining share in functional beverages (5% increase for Ito En). |

What You See Is What You Get

DyDo SWOT Analysis

The file shown below is not a sample—it’s the real DyDo SWOT analysis you'll download post-purchase, in full detail. You'll get the complete, comprehensive report as presented here, ready for your strategic planning.

Opportunities

The surging global and Japanese demand for health and wellness products offers DyDo a prime avenue for expansion, especially in functional beverages and health supplements. The Japanese market alone is anticipated to see significant growth, fueled by an aging demographic increasingly prioritizing preventative healthcare.

DyDo's strategic investment in its Future Co-Creation Institute for R&D in functional materials directly positions them to capitalize on this trend. This focus allows DyDo to develop innovative products that cater to the growing health consciousness, potentially capturing a larger market share.

Innovations like IoT integration and cashless payments can boost DyDo's vending machine efficiency and customer experience. These smart operations, potentially bolstered by industry collaborations, are key to staying competitive in the evolving vending market.

DyDo's successful entry into Turkey and Poland presents a clear springboard for further international market expansion. The company can now leverage these experiences to explore high-growth regions like Southeast Asia, where beverage consumption is rapidly increasing. For instance, the Southeast Asian beverage market was valued at approximately $50 billion in 2023 and is projected to grow significantly in the coming years.

Expanding into these emerging economies offers a crucial diversification strategy, lessening DyDo's dependence on the saturated Japanese market. These regions often boast younger demographics with increasing disposable incomes, creating a fertile ground for new beverage brands. This geographic diversification is vital for long-term stability and growth.

To expedite this global reach, DyDo could pursue strategic alliances or targeted acquisitions in promising markets. For example, acquiring a local player in Vietnam or Indonesia could provide immediate market access and established distribution networks, accelerating penetration and brand recognition.

Product Innovation and Diversification

DyDo has a significant opportunity to expand its product portfolio by introducing innovative beverages. This includes developing new flavors, incorporating sustainable packaging, and catering to health-conscious consumers with low-sugar, zero-alcohol, and plant-based options. For instance, the growing global demand for functional beverages, which saw a market size of approximately USD 122.2 billion in 2023 and is projected to reach USD 221.5 billion by 2030, presents a prime area for DyDo’s innovation.

The company’s dedicated R&D institute is a key asset, capable of driving advancements in functional materials and their applications. This capability can translate into entirely new product lines and unlock access to previously untapped market segments. By leveraging its research strengths, DyDo can stay ahead of market trends and consumer demands.

Key areas for product innovation include:

- Health-focused beverages: Expanding offerings in low-sugar, high-fiber, and plant-based drinks to align with growing wellness trends.

- Sustainable packaging: Implementing eco-friendly materials and designs to appeal to environmentally conscious consumers.

- Functional ingredients: Incorporating ingredients that offer specific health benefits, such as enhanced immunity or cognitive function, tapping into the booming functional beverage market.

- Flavor diversification: Experimenting with unique and exotic flavor profiles to capture consumer interest and differentiate from competitors.

Strategic Partnerships and Collaborations

DyDo can pursue further strategic partnerships, building on successes like its joint venture with Asahi Soft Drinks. These alliances can bolster resource sharing, refine distribution, and drive economies of scale. For instance, a collaboration could enhance its reach in the growing functional beverage market, a sector that saw global sales projected to exceed $200 billion by 2025.

Expanding collaborations beyond beverages into its health and wellness or pharmaceutical divisions offers avenues for open innovation. This could accelerate market entry into new health-focused segments, mirroring trends where companies are increasingly investing in synergistic health-related ventures. Such moves can significantly improve market penetration and operational efficiencies.

- Leveraging existing joint ventures: DyDo's partnership with Asahi Soft Drinks demonstrates a successful model for resource optimization.

- Expanding into health and wellness: Collaborations in this segment can tap into a market projected for substantial growth, with global health and wellness market value anticipated to reach over $5.8 trillion by 2025.

- Synergistic market entry: Partnerships can facilitate quicker access to new geographical regions or product categories, reducing R&D costs and time-to-market.

DyDo has a significant opportunity to expand its product portfolio by introducing innovative beverages, particularly in the functional and health-conscious segments. The global functional beverage market was valued at approximately USD 122.2 billion in 2023 and is projected to reach USD 221.5 billion by 2030, indicating substantial growth potential for DyDo to tap into with its R&D capabilities.

Strategic international expansion, building on its presence in Turkey and Poland, offers a path to diversify revenue streams away from the mature Japanese market. The Southeast Asian beverage market, valued at around $50 billion in 2023, presents a prime target for this expansion, driven by growing disposable incomes and younger demographics.

Collaborations and strategic alliances, such as its existing joint venture with Asahi Soft Drinks, can accelerate market penetration and optimize resource allocation. Expanding these partnerships into the health and wellness sector, a market projected to exceed $5.8 trillion by 2025, could unlock new growth avenues and synergistic market entry.

| Opportunity Area | Market Data/Projection | DyDo's Advantage |

|---|---|---|

| Functional Beverages | Global market valued at USD 122.2 billion in 2023, projected to reach USD 221.5 billion by 2030. | R&D capabilities in functional materials, potential for innovative product development. |

| International Expansion (Southeast Asia) | Southeast Asian beverage market valued at approx. $50 billion in 2023; growing disposable incomes. | Existing international experience, opportunity to leverage brand recognition and distribution networks. |

| Strategic Partnerships | Health and wellness market projected to exceed $5.8 trillion by 2025. | Proven success with joint ventures, ability to share resources and gain market access. |

Threats

DyDo operates in a beverage market heavily influenced by global giants possessing vast marketing budgets and expansive distribution networks. This intense rivalry from major players like Coca-Cola and PepsiCo, who command significant market share, puts pressure on DyDo's pricing strategies and necessitates higher spending on promotional activities to remain visible.

The sheer scale of multinational competitors allows them to invest heavily in research and development, bringing innovative products to market rapidly. This can lead to market share erosion for smaller players like DyDo if they cannot match the pace of innovation or the appeal of these established brands, particularly in key segments like functional beverages which saw a 15% growth in Japan in 2024.

Japan's demographic shifts, marked by an aging population and declining birth rates, pose a significant threat to DyDo's consumer base, particularly impacting traditional beverage segments. This trend, projected to continue, means a shrinking pool of younger consumers who are often key drivers of beverage consumption.

Furthermore, evolving consumer tastes, such as the increasing preference for low-alcohol or non-alcoholic beverages and a strong demand for healthier, low-sugar options, necessitate continuous product innovation. For instance, the Japanese market saw a notable increase in demand for functional beverages with health benefits in 2024, requiring substantial investment in research and development to meet these changing preferences.

Global economic uncertainties, including persistent high inflation observed in markets like Turkey, pose a significant threat. This, coupled with the rising cost of living in Japan, directly impacts discretionary spending, potentially dampening demand for DyDo's beverage products.

Such macroeconomic pressures can lead to reduced sales volumes for DyDo. Furthermore, if the company cannot fully pass on rising input costs to consumers, its profit margins will likely face downward pressure, directly affecting overall financial performance.

Regulatory Changes and Health Concerns

Heightened government regulations concerning food and beverage labeling, sugar content, and advertising, especially regarding health claims, could lead to increased compliance expenses and operational limitations for DyDo. For instance, in Japan, where DyDo operates significantly, there has been a growing emphasis on health-conscious labeling and potential taxation on high-sugar beverages, mirroring trends seen globally.

Public health initiatives advocating for lower sugar consumption or discouraging specific beverage types could directly affect sales of DyDo's current offerings. For example, a 2023 report by the World Health Organization highlighted the ongoing global push to reduce sugar intake, which impacts the entire beverage industry. DyDo's portfolio, which includes many popular soft drinks, could face consumer shifts towards healthier alternatives.

- Regulatory Scrutiny: Increased government oversight on ingredients and marketing could necessitate product reformulation or stricter advertising guidelines.

- Health Trends: Growing public awareness and preference for low-sugar or sugar-free options may reduce demand for traditional sweetened beverages.

- Compliance Costs: Adapting to new labeling requirements or potential sugar taxes could add to DyDo's operational expenses.

Supply Chain Disruptions and Geopolitical Risks

DyDo's extensive global supply chain, crucial for both raw materials and finished goods, faces significant vulnerability from escalating geopolitical tensions and potential disruptions. Conflicts like the ongoing situations in Eastern Europe and the Middle East, alongside the increasing frequency of natural disasters, directly threaten the stability of DyDo's operations.

These global events can trigger severe supply shortages and drive up transportation expenses, directly impacting the cost of essential inputs. For instance, the Russia-Ukraine conflict has already demonstrated the fragility of global commodity markets, leading to price spikes in energy and agricultural products that DyDo relies upon. This volatility directly squeezes profit margins and can hinder production schedules.

- Supply Chain Vulnerability: DyDo's reliance on international sourcing makes it susceptible to trade policy changes and regional instability.

- Cost Volatility: Geopolitical events in 2024 and projected into 2025 have shown significant fluctuations in shipping costs, with some routes experiencing increases of over 50% due to rerouting and insurance premiums.

- Input Shortages: Disruptions can lead to scarcity of key ingredients or packaging materials, potentially halting production lines.

- Price Increases: The cost of raw materials, such as sugar and coffee beans, are subject to global supply and demand dynamics influenced by these geopolitical factors.

DyDo faces intense competition from global beverage giants with superior marketing power and distribution. The company must also contend with evolving consumer preferences for healthier, low-sugar options, a trend that saw functional beverages grow by 15% in Japan in 2024. Demographic shifts in Japan, including an aging population, further shrink the core consumer base for traditional beverages.

SWOT Analysis Data Sources

This DyDo SWOT analysis is built upon a foundation of robust data, including the company's official financial reports, comprehensive market research, and insights from industry experts. These sources provide a clear and accurate view of DyDo's internal capabilities and external market positioning.