DyDo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

DyDo's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any strategic decision-maker in the beverage industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DyDo’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DyDo's vulnerability to raw material price swings is a significant factor in supplier bargaining power. The company relies heavily on commodities like coffee beans, tea leaves, and sugar, all of which are subject to global market volatility. For instance, coffee bean prices saw considerable fluctuations in 2024, influenced by weather patterns in major producing regions, directly impacting DyDo's input costs.

While DyDo's substantial purchasing volume might grant it some negotiation leverage, external forces often override this. Climate change impacts on agricultural yields and geopolitical instability in supplier countries can drastically alter supply and demand, empowering suppliers. This means DyDo must actively manage these risks through smart sourcing and potentially financial instruments like hedging to stabilize costs.

The cost and availability of crucial packaging materials like PET bottles and aluminum cans directly impact DyDo's operational expenses. These costs are closely tied to global petroleum prices, which saw fluctuations throughout 2024, and the increasing stringency of environmental regulations worldwide. For instance, if petroleum prices surge, the cost of producing PET resin would rise, directly affecting DyDo's packaging budget.

Suppliers offering specialized or sustainable packaging solutions are gaining leverage. As consumer demand for eco-friendly products grows and regulations push for greener alternatives, DyDo may face pressure to adopt these more expensive, yet environmentally conscious, options. This shift could empower packaging material providers who innovate in sustainability.

DyDo's own reporting underscores this trend. Their 2024 Integrated Report explicitly mentions environmental considerations within their vending machine operations, indicating a strategic focus on sustainable practices. This internal acknowledgment suggests DyDo is already anticipating or responding to the growing influence of suppliers who can meet these emerging environmental demands.

Suppliers of specialized vending machine components, like advanced refrigeration units or sophisticated payment systems, hold moderate bargaining power over DyDo. This is because DyDo's vast network of vending machines relies on these critical, often proprietary, technologies to function effectively and attract customers.

DyDo's strategic push towards 'Smart Operations' and AI integration in its vending machines means it will likely require even more specialized and advanced technological components. This increasing reliance on cutting-edge tech could strengthen the bargaining power of those few suppliers capable of meeting these demanding specifications.

Logistics and Distribution Partnerships

External logistics partners can hold significant bargaining power over DyDo, particularly for long-distance or specialized deliveries. This leverage is amplified by current market conditions such as increased fuel prices and a scarcity of skilled labor in the logistics sector. For instance, in 2024, global shipping costs saw fluctuations, with some routes experiencing double-digit percentage increases compared to the previous year, directly impacting transportation expenses.

DyDo's strategic move to establish Shibusawa DyDo Group Logistics Co., Ltd. is a direct response to mitigate these supplier power dynamics. This joint venture is designed to create a more secure and predictable logistics network, thereby reducing DyDo's reliance on external providers and their associated pricing pressures. The aim is to gain greater control over distribution costs and ensure service reliability.

- External logistics providers can increase prices due to rising fuel costs, which averaged over $3.50 per gallon for diesel in many regions in early 2024.

- Labor shortages in the trucking industry, a persistent issue in 2024, empower existing drivers and logistics professionals, leading to higher wage demands.

- DyDo's joint venture in logistics aims to build internal capacity, reducing dependence on third-party providers and their potential for price hikes.

- Securing a stable logistics network through partnerships helps DyDo buffer against supply chain disruptions and associated cost escalations.

Innovation in Health Food Ingredients

The bargaining power of suppliers in the health food ingredient market can be substantial, especially for those offering unique or patented functional components. DyDo's strategic push into wellness products necessitates sourcing novel ingredients, thereby amplifying the leverage of specialized suppliers who can dictate terms and pricing.

For instance, suppliers of ingredients with scientifically validated health benefits, such as specific probiotics or adaptogens, can command premium prices. In 2024, the global functional food ingredients market was projected to reach over $200 billion, highlighting the value placed on these specialized inputs.

- Patented Ingredients: Suppliers holding patents for innovative health ingredients can exert significant pricing power.

- Functional Benefits: Ingredients with proven health benefits, like those supporting gut health or cognitive function, are in high demand.

- Specialized Production: DyDo's pharmaceutical-related business, which saw strong orders for pouch products, suggests a reliance on suppliers with specific production capabilities and potentially unique ingredient formulations.

DyDo's reliance on key raw materials like coffee beans, tea, and sugar exposes it to supplier price volatility, a trend evident in 2024 commodity markets. Packaging materials, particularly PET and aluminum, are also subject to price fluctuations tied to energy costs and environmental regulations, impacting DyDo's operational expenses.

The bargaining power of suppliers is amplified when they offer specialized or patented ingredients, especially in DyDo's growing health and wellness product lines. Furthermore, suppliers of advanced vending machine technology and logistics services can leverage market conditions like fuel prices and labor shortages to negotiate favorable terms.

DyDo's strategic initiatives, such as its logistics joint venture, indicate a proactive approach to mitigate supplier power by building internal capabilities and reducing external dependencies.

| Supplier Category | Factors Influencing Bargaining Power | Impact on DyDo | 2024 Market Data/Trends |

|---|---|---|---|

| Raw Materials (Coffee, Tea, Sugar) | Global commodity prices, weather patterns, geopolitical stability | Input cost volatility, potential margin squeeze | Coffee bean prices saw significant fluctuations in 2024 due to weather events in major producing regions. |

| Packaging (PET, Aluminum) | Petroleum prices, environmental regulations, recycling costs | Increased production costs, potential need for investment in alternative materials | PET resin costs are directly tied to petroleum prices, which experienced volatility throughout 2024. |

| Specialized Ingredients (Health Foods) | Patents, scientific validation, production complexity | Premium pricing for unique ingredients, reliance on few specialized suppliers | The global functional food ingredients market was projected to exceed $200 billion in 2024. |

| Vending Machine Technology | Proprietary systems, integration complexity, innovation pace | Dependence on key technology providers, potential for higher component costs with AI integration | DyDo's 'Smart Operations' push requires advanced, potentially specialized, components. |

| Logistics Services | Fuel prices, labor availability, route density | Higher transportation costs, potential service disruptions | Global shipping costs saw double-digit percentage increases on some routes in 2024; trucking labor shortages persisted. |

What is included in the product

Analyzes the competitive intensity within DyDo's beverage market by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Easily identify and address competitive threats with a visual breakdown of industry power dynamics, enabling proactive strategy adjustments.

Customers Bargaining Power

Individual consumers, though numerous, possess limited individual bargaining power with DyDo. Their ability to influence pricing is minimal on a one-to-one basis.

However, a collective shift in consumer preference towards value and affordability significantly impacts DyDo's pricing strategies. This was evident in their product price adjustments in late 2023 and again in August 2024, reflecting broader economic sentiment.

The increasing consumer focus on cost savings directly affects sales volume. For instance, reports from early 2024 indicated a noticeable slowdown in unit sales for certain beverage categories as consumers became more price-conscious.

Retailers, particularly large supermarket chains and convenience store networks, wield considerable influence over DyDo. Their ability to purchase products in massive quantities means they can dictate terms, demanding lower prices and better promotional support. For instance, in 2023, the top five global grocery retailers accounted for over $1.5 trillion in sales, highlighting their immense purchasing power.

This leverage translates into pressure on DyDo for favorable pricing and exclusive promotional activities. Furthermore, retailers control prime shelf space, a critical factor for product visibility and sales. If DyDo cannot meet these demands, it risks reduced shelf placement or even delisting, directly impacting its market access and revenue streams.

Vending machine location owners, particularly those controlling prime spots like busy train stations and large office buildings, wield significant bargaining power over DyDo. These owners can dictate terms for machine placement and ongoing maintenance, knowing that access to these high-traffic areas is crucial for DyDo's sales volume.

In 2024, the Japanese vending machine market is grappling with intensified competition and operational hurdles. Labor shortages and increasing costs for electricity and rent put location owners in a stronger negotiating position, as DyDo needs these locations to maintain its market presence amidst these broader industry challenges.

Demand for Health-Conscious Options

The increasing consumer focus on health-conscious choices, such as low-sugar and functional beverages, significantly amplifies customer bargaining power. This trend means consumers have more alternatives available, forcing companies like DyDo to be more responsive to their preferences.

DyDo faces pressure to innovate and adapt its product portfolio to align with these evolving health trends. For instance, by 2025, the company is expected to expand its offerings to include more healthier and budget-friendly beverages, directly responding to consumer demand for better-for-you options.

- Growing Demand for Health: Consumers are increasingly seeking beverages with reduced sugar and added functional benefits.

- Increased Choice: A wider variety of health-oriented drinks from competitors gives customers more leverage.

- DyDo's Adaptation: The company must adjust its product development to cater to these shifting consumer tastes.

- 2025 Outlook: DyDo aims to broaden its healthier and more affordable product lines to capture this market segment.

Brand Loyalty and Differentiation

In the fiercely competitive Japanese beverage market, DyDo's brand loyalty is a key battleground. While a loyal customer base can significantly curb the bargaining power of consumers, the reality is that switching brands is remarkably easy for the average Japanese consumer. This dynamic means DyDo faces constant pressure to keep its offerings fresh and appealing. For instance, in 2024, the Japanese soft drink market saw numerous new product launches across various categories, highlighting the intense competition and the need for continuous innovation to retain market share.

DyDo's strategy must therefore focus on robust product differentiation. This involves not just creating unique flavors but also building a strong brand identity that resonates with consumers. Without this, customers can readily shift their allegiance to competitors who offer similar products at comparable or lower prices. The ability to innovate and stand out is paramount in mitigating the inherent power of customers to choose alternatives.

- Brand Loyalty Challenges: Despite efforts to cultivate brand loyalty, the Japanese beverage market's high competition allows consumers easy access to numerous alternative brands.

- Innovation Imperative: DyDo must consistently introduce novel products and marketing strategies to maintain and strengthen customer loyalty.

- Competitive Landscape: In 2024, the Japanese beverage sector was characterized by aggressive new product introductions, underscoring the need for DyDo to differentiate effectively.

- Mitigating Customer Power: Successful differentiation directly reduces the bargaining power of customers by making DyDo's products less substitutable.

The bargaining power of customers for DyDo is multifaceted, stemming from individual consumer choices, the influence of large retailers, and the strategic importance of vending machine locations. Consumers, while individually weak, collectively drive demand and influence pricing, especially with a growing focus on health and affordability. Retailers, due to their sheer volume, can dictate terms, impacting DyDo's pricing and promotional strategies.

Vending machine location owners also hold considerable sway, particularly in high-traffic areas, as operational costs rise in 2024, strengthening their negotiating position. The increasing demand for healthier options means consumers have more alternatives, pushing DyDo to innovate its product lines. For instance, by 2025, DyDo is expected to expand its healthier and budget-friendly beverage offerings to meet this demand.

Brand loyalty remains a challenge in Japan's competitive beverage market, where consumers can easily switch brands. DyDo must therefore focus on product differentiation to mitigate customer power. In 2024, the market saw numerous new product launches, emphasizing the need for DyDo to stand out.

| Customer Segment | Bargaining Power Factor | Impact on DyDo | Relevant Data/Trend |

|---|---|---|---|

| Individual Consumers | Price sensitivity, health consciousness | Influences pricing, product development | Focus on low-sugar options by 2025; 2024 sales slowdown in some categories due to price concerns. |

| Retailers (Supermarkets, Convenience Stores) | High purchase volume, control of shelf space | Demands lower prices, promotional support; risk of delisting | Top 5 global grocery retailers' sales exceeded $1.5 trillion in 2023. |

| Vending Machine Location Owners | Control of prime locations | Dictates placement terms, maintenance; impacts sales volume | Japanese vending machine market faces rising operational costs (labor, electricity) in 2024. |

| Overall Customer Base | Ease of brand switching, availability of alternatives | Requires continuous innovation and differentiation | Intense competition with numerous new product launches in the Japanese soft drink market in 2024. |

Preview the Actual Deliverable

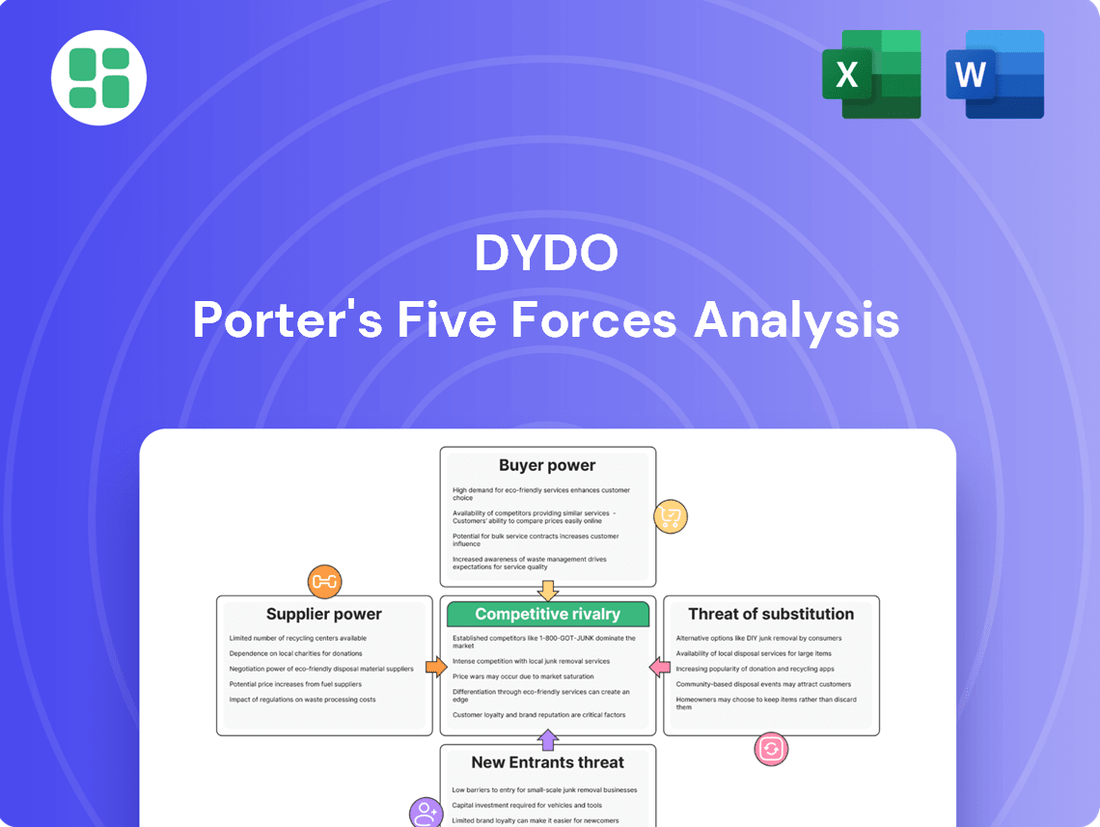

DyDo Porter's Five Forces Analysis

This preview showcases the complete DyDo Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the beverage industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The Japanese beverage market is a battleground, with giants like Suntory, Kirin, Asahi, and Coca-Cola Japan vying for market share alongside DyDo. This intense rivalry spans across a wide array of popular categories, from refreshing teas and invigorating coffees to thirst-quenching juices and performance-boosting sports drinks.

In 2023, the Japanese beverage market was valued at approximately $70 billion, highlighting the significant economic stakes involved in this competitive landscape. Major players consistently invest heavily in marketing, product innovation, and distribution networks to capture consumer attention and loyalty.

DyDo's extensive vending machine network, a cornerstone of its business, directly contends with other beverage manufacturers deploying similar infrastructure. This intense rivalry means market share is hard-won, with competitors vying for prime locations and consumer attention.

To bolster its standing, DyDo entered a joint venture with Asahi Soft Drinks in FY2023, forming Dynamic Vending Network, Inc. This strategic alliance aims to consolidate resources and enhance their collective competitive edge in the crowded vending machine market.

Competitive rivalry in the beverage sector is fierce, fueled by a relentless drive for product innovation. Companies are constantly rolling out new flavors, functional beverages, and options catering to health-conscious consumers. This dynamic means DyDo must continuously adapt its product portfolio to stay relevant.

DyDo's strategic move into health foods and supplements exemplifies this competitive pressure. By diversifying beyond its core beverage offerings, DyDo aims to capture a broader market share and reduce reliance on traditional drinks. For instance, in the fiscal year ending March 2024, DyDo reported consolidated net sales of ¥223.1 billion, underscoring the scale of operations and the need for strategic expansion to maintain growth.

Pricing Strategies and Promotions

The Japanese soft drink market is quite mature, meaning companies often engage in aggressive pricing and promotions to stand out. DyDo's move to adjust prices and introduce more budget-friendly choices is a direct response to this intense rivalry, aiming to keep sales steady.

This competitive pressure is evident in ongoing price wars and frequent promotional campaigns. For instance, in 2023, many beverage companies in Japan ran campaigns offering discounts or bundled deals, highlighting the constant need to attract price-sensitive consumers.

- Intense Price Competition: Companies frequently use price reductions and special offers to gain or maintain market share in the saturated Japanese soft drink sector.

- Promotional Activities: Frequent sales promotions, loyalty programs, and limited-time offers are common tactics employed by competitors.

- Impact on DyDo: DyDo's pricing adjustments are a strategic reaction to these market dynamics, balancing profitability with the necessity of preserving sales volume.

- Consumer Sensitivity: Japanese consumers are often responsive to price changes and promotions, making these strategies crucial for competitive positioning.

Marketing and Brand Building Investments

Competitors in the beverage industry are pouring substantial resources into marketing and brand building. This intense focus aims to carve out distinct identities and cultivate lasting consumer loyalty in a highly saturated marketplace. For instance, in 2024, major beverage players continued aggressive advertising campaigns across digital and traditional media, with some reporting marketing budgets exceeding hundreds of millions of dollars to maintain visibility and appeal.

DyDo faces the challenge of matching these significant marketing investments to effectively differentiate its offerings. Maintaining a strong brand image and capturing consumer attention requires consistent and impactful promotional activities. Without substantial marketing efforts, DyDo risks being overshadowed by competitors with more prominent brand recognition and recall.

- Marketing Spend: Competitors often allocate 10-20% of their revenue to marketing and advertising.

- Brand Loyalty: Strong brands can command premium pricing and achieve higher market share.

- Digital Engagement: Social media and influencer marketing are key battlegrounds for consumer attention.

- New Product Launches: Marketing is crucial for introducing and gaining traction for new beverage varieties.

The Japanese beverage market is characterized by intense competition, with major players like Suntory, Kirin, and Asahi constantly vying for market share. This rivalry extends across various beverage categories, from teas and coffees to juices and sports drinks, driving significant investment in marketing, innovation, and distribution. DyDo's own vending machine network directly competes with similar infrastructure deployed by rivals, making prime locations and consumer attention highly contested.

To navigate this competitive landscape, DyDo has engaged in strategic partnerships, such as its joint venture with Asahi Soft Drinks in FY2023 to form Dynamic Vending Network, Inc., aiming to consolidate resources and enhance market presence. The company also diversifies into health foods and supplements to broaden its appeal and reduce reliance on traditional beverages, as seen in its consolidated net sales of ¥223.1 billion for the fiscal year ending March 2024.

The mature nature of the Japanese soft drink market often leads to aggressive pricing and promotional activities. In response, DyDo has adjusted its pricing strategy and introduced more budget-friendly options to maintain sales volume amidst consumer sensitivity to price changes and frequent promotional campaigns observed throughout 2023.

| Competitor | Key Product Categories | Estimated Marketing Spend (2024, USD billions) | Market Share (2023, %) |

|---|---|---|---|

| Suntory | Soft drinks, Beer, Spirits, Tea | 1.5 - 2.0 | 20 - 25 |

| Kirin | Beer, Soft drinks, Pharmaceuticals | 1.0 - 1.5 | 15 - 20 |

| Asahi | Beer, Soft drinks, Food | 1.2 - 1.7 | 18 - 23 |

| Coca-Cola Japan | Soft drinks, Water, Tea | 1.3 - 1.8 | 22 - 27 |

| DyDo | Vending machine beverages, Coffee, Tea | 0.3 - 0.5 | 5 - 7 |

SSubstitutes Threaten

The threat of substitutes, particularly tap water and home-brewed beverages, remains a significant factor for DyDo. Consumers can easily access tap water, which is virtually free, or invest in home filtration systems, offering a cost-effective hydration solution. In 2024, the average household water bill in Japan was approximately ¥3,000 per month, a stark contrast to the price of bottled beverages.

Furthermore, the increasing popularity of home brewing coffee and tea presents a direct substitute for DyDo's beverage offerings. With the rising cost of living, consumers are increasingly looking for ways to save money, making these DIY options more appealing. For instance, a kilogram of coffee beans can yield dozens of servings, significantly cheaper than purchasing individual coffee drinks from convenience stores or vending machines.

The threat of substitutes for DyDo Porter's offerings is significant, stemming from the vast and diverse non-alcoholic beverage market. Consumers have access to a wide array of alternatives, including fresh juices, smoothies, specialty teas from cafes, and even energy drinks sourced from various retail and vending channels.

This substitution landscape is continually evolving with the rise of functional beverages and plant-based milks, further broadening the choices available to consumers. For instance, the global functional beverage market was valued at approximately $127.2 billion in 2023 and is projected to grow, indicating a strong consumer shift towards beverages with added health benefits, which can easily replace traditional soft drinks.

The threat of substitutes for DyDo's health and wellness products is significant, as consumers have numerous non-beverage alternatives. These include a wide array of vitamins, minerals, protein powders, and functional foods available from diverse industries, offering various health benefits that can compete with DyDo's beverage offerings.

For instance, the global dietary supplements market was valued at approximately $151.9 billion in 2023 and is projected to grow, indicating a strong consumer interest in these substitute products. This broad availability of health-focused items means consumers can easily switch from a health drink to a pill, powder, or fortified food item if they perceive it as a better value or more effective for their wellness goals.

Shift to Low/No-Alcohol Options

The burgeoning sober-curious movement and heightened health awareness in Japan are significantly boosting the appeal of zero-alcohol craft beverages and low-calorie alternatives. These products are increasingly seen as viable substitutes for traditional soft drinks and even alcoholic beverages, particularly in social contexts. This shift directly challenges established beverage markets by offering consumers choices that align with evolving lifestyle preferences.

The market for non-alcoholic beverages is experiencing robust growth, reflecting this trend. For instance, sales of non-alcoholic beer in Japan saw a substantial increase, with some reports indicating double-digit growth in recent years. This expanding segment represents a direct substitute threat to traditional alcoholic drinks and even sugary soft drinks, as consumers seek healthier, alcohol-free options for various occasions.

- Growing Demand for Zero-Alcohol: The sober-curious trend fuels demand for alternatives to traditional alcoholic beverages.

- Health Consciousness Impact: Increased focus on health and wellness drives consumers towards low-calorie and zero-alcohol options.

- Market Penetration: Zero-alcohol craft beverages are increasingly positioned as substitutes for both soft drinks and alcoholic beverages in social settings.

- Sales Data: The non-alcoholic beer market, for example, has demonstrated significant growth, underscoring the substitution threat.

Changing Consumer Lifestyles and Preferences

The threat of substitutes is amplified by evolving consumer lifestyles and preferences, particularly a growing demand for healthier and more sustainable options. Many consumers are actively seeking beverages that are natural, organic, and produced with environmental consciousness, moving away from traditional, often sugary, drinks. This shift presents a direct challenge to DyDo's existing product lines.

For instance, the global market for plant-based beverages, a key substitute category, was projected to reach over $200 billion by 2024, indicating a substantial consumer migration. DyDo needs to proactively adapt its product portfolio to align with these burgeoning trends, potentially by expanding into or reformulating existing products to cater to the demand for lower sugar content and natural ingredients to remain competitive and relevant in the beverage market.

- Evolving Consumer Demand: Growing preference for natural, organic, and sustainable beverage options.

- Shift Away from Sugary Drinks: A significant portion of consumers are reducing their intake of high-sugar beverages.

- Market Growth in Alternatives: The plant-based beverage market, for example, is experiencing robust growth, projected to exceed $200 billion by 2024.

- Strategic Imperative for DyDo: DyDo must innovate and adapt its product offerings to meet these changing consumer preferences and mitigate the substitution threat.

The threat of substitutes for DyDo is substantial, encompassing everything from tap water to premium coffee and functional health products. Consumers increasingly prioritize cost-effectiveness and health benefits, leading them to explore alternatives beyond traditional bottled beverages. This broad competitive landscape demands continuous innovation from DyDo to maintain market share.

In 2024, the accessibility of tap water, with minimal cost, and the growing appeal of home-brewed beverages like specialty coffee and tea present significant substitution opportunities for consumers seeking budget-friendly options. For example, a typical Japanese household spends around ¥3,000 monthly on water bills, a fraction of the cost of regularly purchasing bottled drinks.

The expanding market for functional beverages and zero-alcohol options further intensifies this threat. The global functional beverage market was valued at approximately $127.2 billion in 2023, showcasing a strong consumer pivot towards health-oriented drinks that can easily replace traditional soft drinks and even alcoholic beverages.

Furthermore, the rise of the sober-curious movement and heightened health awareness in Japan are driving demand for alternatives like zero-alcohol craft beverages. This trend is evident in the non-alcoholic beer market, which has seen considerable growth, indicating a direct substitution challenge to established drink categories.

| Substitute Category | Key Drivers | Market Relevance for DyDo |

|---|---|---|

| Tap Water & Home Filtration | Cost savings, environmental consciousness | Direct competitor for basic hydration needs. |

| Home-Brewed Beverages (Coffee, Tea) | Cost savings, customization, perceived quality | Challenges DyDo's ready-to-drink coffee and tea segments. |

| Functional Beverages | Health benefits, specific wellness goals | Competes with DyDo's health-focused product lines. |

| Zero-Alcohol & Low-Calorie Drinks | Health consciousness, lifestyle trends (sober-curious) | Offers alternatives for social occasions and healthier choices. |

Entrants Threaten

The beverage industry, especially for companies like DyDo with extensive vending machine operations, demands a massive upfront investment. This includes building and maintaining manufacturing plants, establishing robust distribution networks, and, crucially, acquiring and servicing a large fleet of vending machines. For instance, the cost of a single modern vending machine can range from $3,000 to $10,000 or more, and a company like DyDo operates tens of thousands of these units.

Established brand loyalty and extensive distribution networks pose a significant barrier to new entrants in the Japanese beverage market. Companies like DyDo Drinco, Suntory, and Kirin have cultivated decades of consumer trust and preference, making it difficult for newcomers to gain market share. For instance, DyDo's robust vending machine presence, a key distribution channel, is a formidable asset that new entrants would find challenging and costly to replicate.

The food and beverage sector in Japan, including companies like DyDo, faces a formidable barrier to entry due to stringent regulatory requirements. New entrants must meticulously adhere to complex health, safety, and labeling standards mandated by bodies like the Ministry of Health, Labour and Welfare.

Navigating this intricate web of regulations is not only time-consuming but also incurs significant costs, potentially deterring smaller or less capitalized new companies from entering the market. For instance, compliance with the Food Sanitation Act and the JAS (Japanese Agricultural Standards) system requires substantial investment in product testing and quality control processes.

Access to Vending Machine Locations

Securing prime vending machine locations presents a significant barrier to entry for new competitors. Limited desirable real estate, often tied up by existing, established operators through long-term contracts, makes it difficult for newcomers to gain a foothold. This scarcity of prime spots means new entrants must either invest heavily in less optimal locations or engage in costly negotiations to dislodge incumbents.

DyDo's strategic approach to bolstering its vending machine network, including partnerships like the one with Asahi Soft Drinks, further solidifies this barrier. By strengthening its existing infrastructure and securing favorable placements, DyDo makes it harder for new players to access the necessary visibility and customer traffic. For instance, in 2024, the Japanese vending machine market, estimated to be worth billions, saw continued consolidation, with major players like DyDo actively expanding their footprint.

- Limited prime locations: High demand for easily accessible and high-traffic spots creates intense competition.

- Existing contracts: Long-term agreements between established operators and property owners lock out new entrants.

- DyDo's network expansion: Strategic partnerships and internal growth efforts by DyDo reinforce existing market dominance.

- High setup costs: Acquiring and maintaining desirable locations involves significant capital investment, deterring smaller new businesses.

Economies of Scale in Production and Sourcing

Economies of scale in production and sourcing present a significant barrier for new entrants in the beverage industry, particularly for companies like DyDo. Established players benefit from substantial cost advantages due to their sheer volume. For instance, DyDo's large-scale purchasing of raw materials such as sugar, tea leaves, and packaging materials allows them to negotiate lower prices compared to a new entrant attempting to buy smaller quantities. This is a critical factor, as raw material costs can represent a significant portion of a beverage company's total expenses.

Manufacturing processes also yield economies of scale. DyDo's extensive production facilities are optimized for high-volume output, spreading fixed costs like machinery and plant maintenance over a larger number of units. This results in a lower per-unit manufacturing cost. A new competitor would struggle to achieve similar efficiency without a considerable upfront investment in comparable, large-scale production capabilities. In 2024, the average cost of goods sold for major beverage manufacturers often sits around 40-50% of revenue, highlighting the importance of scale in managing these costs.

Furthermore, logistics and distribution networks contribute to these economies of scale. DyDo's established supply chain, encompassing warehousing and transportation, is designed for efficient delivery across a wide geographic area. This allows them to reduce per-unit shipping costs. New entrants would face the challenge of building a comparable distribution network or relying on third-party logistics providers, which can be more expensive at lower volumes. The ability to achieve lower per-unit costs through these scaled operations makes it difficult for newcomers to compete on price and maintain profitability.

- Lower per-unit costs for raw materials due to bulk purchasing.

- Efficient manufacturing processes spread fixed costs over higher output.

- Optimized logistics and distribution networks reduce shipping expenses.

- Difficulty for new entrants to match cost efficiencies, impacting profitability.

The threat of new entrants in the Japanese beverage market, particularly for companies like DyDo, is significantly mitigated by substantial capital requirements. The sheer cost of establishing manufacturing facilities, distribution channels, and a vast vending machine network, estimated to require millions in initial investment, acts as a powerful deterrent. For example, acquiring and servicing a fleet of tens of thousands of vending machines, each costing upwards of $3,000, presents a formidable financial hurdle.

Existing brand loyalty and established distribution networks, like DyDo's extensive vending machine presence, create a significant barrier. Newcomers struggle to replicate the decades of consumer trust and market penetration that incumbents enjoy. In 2024, the continued strength of established brands in consumer preference surveys underscores this challenge, making it difficult for new entrants to gain traction without massive marketing and distribution investments.

Regulatory compliance, encompassing stringent health, safety, and labeling standards, adds another layer of difficulty and cost for potential new entrants. Navigating complex regulations like the Food Sanitation Act requires significant investment in product testing and quality control, further increasing the financial burden and time-to-market for new businesses in this sector.

The threat of new entrants is also diminished by the difficulty in securing prime vending machine locations. Established players like DyDo often have long-term contracts for high-traffic spots, leaving limited desirable real estate for newcomers. This scarcity, coupled with the high cost of acquiring less optimal locations, effectively limits the competitive landscape.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, government economic data, and reputable financial news outlets.