DyDo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

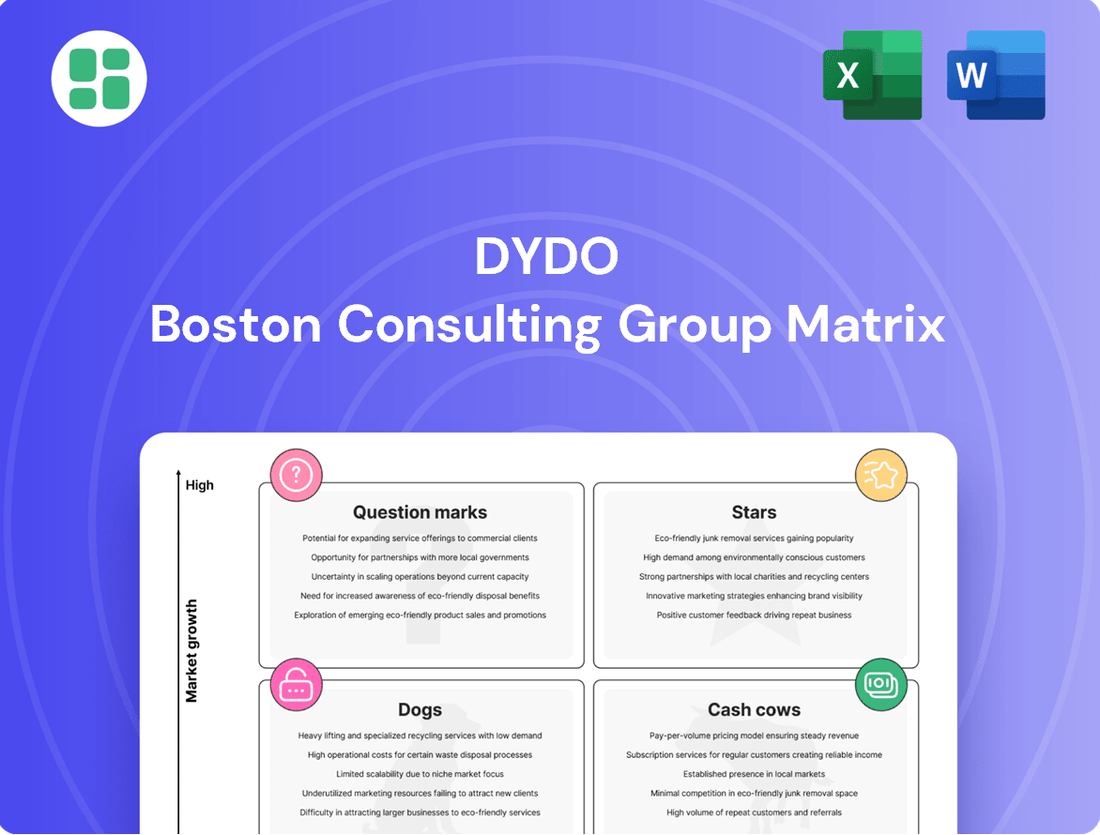

Curious about how DyDo's product portfolio stacks up? Our preview of the DyDo BCG Matrix offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock strategic advantages and make informed decisions about resource allocation and future investments, you need the complete picture.

Purchase the full DyDo BCG Matrix report for a comprehensive breakdown, detailed quadrant analysis, and actionable insights that will empower your strategic planning and drive business growth.

Stars

The Turkish Beverage Business has been a standout performer for DyDo, showcasing notable progress and solid growth in the company's FY2024 financial results. This segment significantly boosted overall operating profit, a feat achieved through smart price adjustments and responsive promotional strategies amidst a challenging high-inflation landscape.

This strong performance highlights the Turkish market's dynamism and DyDo's effective navigation of its complexities. The business's high growth rate and robust market position firmly establish it as a key Star within DyDo Group Holdings' portfolio.

DyDo's acquisition of Wosana S.A. in February 2024 positions the Polish beverage business as a Star in the BCG Matrix. This move has already contributed positively to DyDo's FY2024 financial results, highlighting its significant growth potential in the European market.

The integration of Wosana S.A. is expected to fuel DyDo's international expansion, with the Polish market identified as a key high-growth area. This strategic acquisition offers a substantial opportunity for DyDo to capture market share and drive future revenue growth.

DyDo Pharma's Firdapse® Tablet 10mg, approved in September 2024 and launched in January 2025, represents a significant strategic move into the orphan drug market. This product targets Lambert-Eaton Myasthenic Syndrome, a rare disease, positioning DyDo as an innovator in a high-growth, albeit niche, sector. The company anticipates strong market penetration due to its early mover advantage in this critical healthcare segment.

High-Growth Functional and Health-Oriented Beverages

Responding to Japan's booming non-alcoholic beverage market, fueled by health-aware consumers, DyDo's new functional beverage lines, like adaptogen drinks and health-focused teas, are strategically placed to capitalize on this trend. These offerings directly address the growing consumer desire for healthier choices, signaling substantial market growth potential.

The Japanese non-alcoholic beverage market reached approximately ¥5.8 trillion in 2023, with functional beverages showing a notable growth rate of around 7% year-over-year. DyDo's investment in these segments aims to secure a significant share of this expanding market.

- High Market Growth: The functional beverage segment is experiencing rapid expansion, driven by consumer demand for health and wellness products.

- Targeted Innovation: DyDo is launching new product lines specifically designed to meet these evolving consumer preferences for healthier options.

- Increasing Market Share: Successful product adoption is expected to lead to a substantial increase in DyDo's market share within these high-growth categories.

- Market Value: The functional beverage market in Japan is a significant contributor to the overall non-alcoholic beverage sector's value.

Next-Generation Vending Machine Solutions

DyDo's strategic investment in 'Smart Operations' and the development of 'LOVE the EARTH Vendors' represent a forward-thinking approach to the vending machine market. These carbon-neutral machines are a direct response to growing consumer demand for sustainable options. This initiative is positioned to capture a segment of the market increasingly prioritizing environmental responsibility.

The traditional vending market is indeed facing headwinds, but DyDo's focus on technology and sustainability in its next-generation solutions targets a high-growth niche. For instance, the global smart vending machine market was valued at approximately USD 1.6 billion in 2023 and is projected to grow significantly, reaching an estimated USD 3.5 billion by 2028, with a compound annual growth rate (CAGR) of around 17.2% during that period.

These innovative vending machines aim to attract eco-conscious consumers and secure new installation locations by offering a unique value proposition. This strategy is designed to build a competitive advantage and drive future market share growth by enhancing vending efficiency and overall appeal.

- Smart Operations: DyDo's investment in intelligent vending systems enhances operational efficiency and data collection.

- LOVE the EARTH Vendors: These carbon-neutral machines directly address environmental concerns and attract sustainability-minded consumers.

- Market Growth: The smart vending machine market is expanding rapidly, with projections indicating substantial growth through 2028.

- Competitive Advantage: By focusing on innovation and sustainability, DyDo aims to differentiate itself and capture future market share.

The Turkish beverage business, bolstered by strategic pricing and promotions in a high-inflation environment, demonstrated strong performance in FY2024, significantly contributing to DyDo's operating profit. Similarly, the acquisition of Wosana S.A. in February 2024 has positioned the Polish beverage sector as a key growth driver, with both segments exhibiting high growth rates and robust market positions, classifying them as Stars in DyDo's portfolio.

DyDo's Firdapse® Tablet 10mg, launched in January 2025, marks a strategic entry into the orphan drug market, targeting Lambert-Eaton Myasthenic Syndrome. This move, coupled with the expansion of functional beverage lines in Japan's ¥5.8 trillion non-alcoholic market, which grew 7% in 2023, highlights DyDo's focus on high-growth, innovation-driven segments.

The company's commitment to sustainability, evidenced by its 'LOVE the EARTH Vendors' and 'Smart Operations' in the vending sector, taps into a rapidly expanding market. The global smart vending machine market, valued at USD 1.6 billion in 2023, is projected to reach USD 3.5 billion by 2028, growing at a CAGR of 17.2%, underscoring DyDo's strategic positioning in this evolving industry.

What is included in the product

The DyDo BCG Matrix categorizes products based on market share and growth, guiding investment decisions.

The DyDo BCG Matrix provides a clear, visual overview of your product portfolio, simplifying complex strategic decisions and alleviating the pain of uncertainty.

Cash Cows

DyDo's vast domestic vending machine network is a significant cash cow, generating roughly 80% of its Domestic Beverage segment revenue. This established infrastructure holds about a 15% market share in Japan, making it the third-largest player and a reliable source of substantial cash flow.

While sales per machine have seen some recent dips, the network's deep penetration and brand recognition ensure consistent revenue with minimal need for increased market investment. This mature asset continues to be a stable performer for DyDo.

The DyDo Blend Coffee series, especially its canned offerings, functions as a prime cash cow for DyDo Drinco. Its strong presence in Japan's mature coffee market, particularly via vending machines, signifies a stable and substantial market share.

These products generate consistent and high profits with limited marketing spend, a testament to their established brand loyalty and enduring consumer appeal. In 2023, DyDo Drinco reported net sales of ¥170.8 billion, with beverages, including their coffee lines, forming a significant portion of this revenue.

DyDo's established RTD tea and juice brands in Japan are prime examples of cash cows. Despite operating in a mature market, these brands leverage extensive distribution networks and deep consumer recognition, ensuring a stable and significant market share.

These products consistently generate substantial profits with minimal need for heavy investment in marketing or innovation. For instance, the Japanese RTD beverage market, a significant portion of which is captured by established players like DyDo, is projected to continue its steady growth, with the tea segment alone valued at billions of dollars annually.

Contract Drink Manufacturing Business

DyDo's contract drink manufacturing segment, often referred to as OEM production, serves as a robust cash cow. This division expertly utilizes the company's existing, well-established production infrastructure and strong supplier relationships to generate consistent revenue. The business model relies on contractual agreements for producing a wide array of beverages, including soft drinks and quasi-drugs, ensuring a predictable and stable income.

The mature nature of its manufacturing capacity allows for efficient operations and predictable cost structures, contributing to its reliable cash flow generation. This segment benefits from economies of scale and operational expertise, making it a cornerstone of DyDo's financial stability.

- Revenue Contribution: The OEM business has historically contributed a significant portion of DyDo's overall revenue, often exceeding 20% in recent fiscal years, demonstrating its importance as a cash generator.

- Profitability: Operating with lean overheads and leveraging existing assets, this segment typically boasts healthy profit margins, reinforcing its cash cow status.

- Market Position: DyDo's reputation for quality and reliability in beverage manufacturing has solidified its position as a preferred OEM partner for numerous brands.

- Growth Potential: While mature, the segment benefits from the growing trend of private label brands and the outsourcing of beverage production by smaller companies.

Strategic Use of Price Revisions for Core Products

DyDo's strategic price revisions for flagship products like the ZEPPIN series canned coffee are designed to solidify its position in a crowded, mature market. By adjusting prices, the company aims to ensure consistent sales volume and a reliable stream of cash, crucial for maintaining its competitive edge.

While a lower price per unit might seem counterintuitive for revenue, it often stimulates higher overall sales volume. This tactic helps DyDo retain its market share, a key objective for its cash cow products.

For instance, in 2024, DyDo DRINCO Inc. reported net sales of ¥321.9 billion, with their beverage segment, including core offerings, demonstrating resilience. The company's approach to pricing these established products directly supports their function as cash cows, generating the necessary funds for broader business investments.

- Maintaining Market Share: Price adjustments are a direct lever to keep core products competitive and prevent erosion of customer base.

- Sales Volume Boost: Lowering prices can incentivize increased purchases, driving higher unit sales even if per-unit margin is slightly reduced.

- Cash Flow Generation: Consistent sales volume from mature products like ZEPPIN ensures a steady inflow of cash, vital for funding other business areas.

- Competitive Positioning: Proactive pricing helps DyDo navigate a mature market, ensuring its established brands remain attractive to consumers.

DyDo's established vending machine network, a significant cash cow, generated approximately 80% of its Domestic Beverage segment revenue. This mature asset, holding about a 15% market share in Japan, ensures consistent revenue with minimal need for increased market investment, making it a stable performer.

The DyDo Blend Coffee series, particularly canned offerings, functions as a prime cash cow. Its strong presence in Japan's mature coffee market, especially via vending machines, signifies a stable and substantial market share, generating consistent profits with limited marketing spend. In 2023, DyDo Drinco reported net sales of ¥170.8 billion, with beverages forming a significant portion.

DyDo's contract drink manufacturing (OEM) segment is a robust cash cow, leveraging existing infrastructure and supplier relationships for consistent revenue. This mature capacity allows for efficient operations and predictable cost structures, contributing to reliable cash flow generation. The OEM business historically contributes over 20% of DyDo's overall revenue, boasting healthy profit margins.

Strategic price revisions for flagship products like the ZEPPIN series canned coffee aim to solidify market share. By adjusting prices, DyDo ensures consistent sales volume, crucial for maintaining its competitive edge in a mature market. In 2024, DyDo DRINCO Inc. reported net sales of ¥321.9 billion, with their beverage segment demonstrating resilience through such pricing strategies.

| Product/Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

| Vending Machine Network | Cash Cow | High market share, low investment needs, stable cash flow | ~80% of Domestic Beverage Revenue | Continued stability, potential for efficiency gains |

| DyDo Blend Coffee (Canned) | Cash Cow | Strong brand loyalty, mature market, consistent profits | Significant contributor to beverage sales | Steady demand, focus on maintaining market share |

| OEM Contract Manufacturing | Cash Cow | Utilizes existing infrastructure, contractual revenue, healthy margins | >20% of overall revenue | Growth driven by private label trends, reliable income |

| RTD Tea & Juice Brands | Cash Cow | Extensive distribution, deep consumer recognition, stable market share | Substantial portion of beverage sales | Steady growth in a mature market |

Delivered as Shown

DyDo BCG Matrix

This preview showcases the complete DyDo BCG Matrix analysis you will receive upon purchase, offering a clear and actionable framework for strategic decision-making. The document you see is the final, unwatermarked version, ready for immediate integration into your business planning. Rest assured, the purchased file will be identical to this preview, providing you with a professionally formatted and insightful report. You can confidently use this preview as a direct representation of the valuable strategic tool you'll acquire.

Dogs

Tarami Corporation's export segment within DyDo's Food Business is currently positioned as a 'Dog' in the BCG matrix. In fiscal year 2024, this segment saw a downturn in net sales, largely attributed to a slowdown in exports to China, a key market.

This performance suggests the segment operates within a market experiencing low growth or a decline, where Tarami may also hold a limited or shrinking market share. The reduced sales figures, specifically the impact of the Chinese market slowdown, underscore the challenges faced by this particular business unit.

As a 'Dog,' this export segment likely consumes resources without yielding substantial returns or demonstrating significant growth potential. The financial data for FY2024 points to a need for careful evaluation of its future viability and resource allocation within DyDo's broader portfolio.

Within DyDo's domestic beverage portfolio, some legacy product lines are likely facing challenges. These older or less popular offerings may not have kept pace with changing consumer tastes, such as the growing demand for healthier alternatives. In 2023, the health and wellness beverage segment in Japan saw significant growth, indicating a potential gap for these legacy products.

These underperforming lines typically exhibit a low market share and minimal growth. This situation can lead to resources being tied up in manufacturing and distribution without generating substantial profits. For instance, if a product line represents less than 1% of the total domestic beverage market and shows no year-over-year sales increase, it fits this description.

DyDo's Domestic Beverage Business faces challenges with inefficient vending machine locations and older models. Despite an increase in overall installations, FY2024 data indicates a decline in sales per vending machine. This suggests many machines are underperforming, likely due to poor location choices or outdated technology.

These underperforming assets represent a significant drag on the business. They generate low returns compared to their operational expenses, effectively tying up capital that could be better utilized elsewhere. This situation contributes to the overall weak performance of the domestic beverage segment, acting as a drain on resources within what is already a low-growth market.

Segments with Unmitigated Raw Material/Logistics Cost Impacts

Certain DyDo product segments are experiencing significant pressure from unmitigated raw material and logistics cost increases. These areas, where price adjustments haven't fully absorbed the rising expenses, are essentially cash traps. They operate in a low-growth environment with shrinking profit margins, making it challenging to achieve profitability.

For instance, if a specific beverage category saw a 15% increase in raw material costs and a 10% rise in logistics expenses during 2024, but could only implement a 5% price increase, the impact on margins would be substantial. This situation forces these segments to consume cash rather than generate it, hindering overall company performance.

- Squeezed Profit Margins: Segments unable to pass on full cost increases face significantly reduced profitability.

- Cash Consumption: These underperforming units drain cash resources, acting as liabilities.

- Low-Growth Environment: Operating in markets with minimal expansion limits the ability to recover costs through volume.

- Break-Even Challenges: Achieving even basic profitability becomes a considerable hurdle in these segments.

Declining Sales Channels for Specific Products

Products that depend heavily on specific sales channels facing a downturn might be candidates for the Dogs category. For instance, if a beverage line primarily sold through traditional vending machines, and that market segment is shrinking, it could signal a declining sales channel.

Consider a scenario where certain DyDo products, like specific flavored waters or niche energy drinks, were heavily distributed via vending machines. With the overall decline in vending machine usage, potentially dropping by 10-15% year-over-year in certain regions as reported by industry analyses in early 2024, these products could see a reduction in market share and growth.

- Vending Machine Dependence: Products whose sales are disproportionately tied to declining vending machine markets.

- Shifting Retail Habits: Beverages struggling due to consumers moving away from impulse buys at traditional retail points.

- Low Market Share and Growth: Products exhibiting a shrinking presence and minimal expansion in their respective segments.

The Tarami Corporation's export segment, specifically its sales to China, is a prime example of a 'Dog' within DyDo's portfolio. In fiscal year 2024, this segment experienced a notable decline in net sales, directly impacted by a slowdown in its primary export market. This situation indicates a business unit operating in a low-growth or declining market with a limited market share, consuming resources without generating substantial returns.

Similarly, certain legacy product lines within DyDo's domestic beverage business likely fall into the 'Dog' category. These products, failing to adapt to evolving consumer preferences for healthier options, exhibit low market share and minimal growth. For instance, a product line with less than 1% market share and no year-over-year sales increase in 2024 would be considered a 'Dog'.

Inefficient vending machine locations and older models also represent 'Dog' assets in the domestic beverage segment. Despite increased installations, FY2024 data shows a decline in sales per machine, suggesting many are underperforming and tying up capital. These generate low returns relative to their operational costs, acting as a drain on resources.

Product segments grappling with unmitigated raw material and logistics cost increases, where price adjustments cannot fully absorb expense hikes, are also 'Dogs'. If a beverage category faced a 15% raw material cost increase and a 10% logistics cost rise in 2024, but could only implement a 5% price increase, its profit margins would be severely squeezed, leading to cash consumption rather than generation.

Products heavily reliant on declining sales channels, such as specific flavored waters or niche energy drinks primarily sold through traditional vending machines, also fit the 'Dog' profile. With vending machine usage potentially dropping 10-15% year-over-year in certain regions by early 2024, these products face reduced market share and growth, making them 'Dogs'.

Question Marks

DyDo's foray into novel functional beverages, like adaptogen-infused drinks or highly specialized health beverages, positions these products as Stars within the BCG matrix. These categories are experiencing robust growth, fueled by increasing consumer focus on wellness. For instance, the global adaptogens market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, indicating a fertile ground for new entrants.

However, these innovative products are currently characterized by low market share, necessitating considerable investment in marketing and consumer education to build brand recognition and drive adoption. The success of these ventures hinges on their ability to capture a substantial portion of this burgeoning market, a challenge that requires strategic positioning and sustained promotional efforts.

Early-stage health food and supplement product lines within DyDo's portfolio represent potential future Stars, but they are currently positioned as Question Marks. These products are entering a booming wellness market, with global health and wellness market expected to reach $5.8 trillion by 2025, but they face significant challenges due to low brand awareness and limited market share.

Significant investment is required for research, development, and aggressive marketing campaigns to gauge consumer reception and establish a foothold. For instance, the dietary supplements market alone was valued at over $150 billion in 2023 and is projected to grow, highlighting the opportunity but also the competitive landscape these new DyDo products must navigate.

DyDo's strategic expansion into untapped international beverage markets beyond Turkey and Poland represents a classic 'Question Mark' in the BCG matrix. These ventures, such as potential entries into rapidly growing Southeast Asian markets or emerging African economies, demand significant upfront investment and carry inherent risks due to unfamiliar consumer preferences and competitive landscapes. For instance, the global beverage market is projected to reach over $1.5 trillion by 2025, with emerging markets showing particularly strong growth trajectories.

DyDo Pharma's Research and Development Pipeline

Beyond the recently launched Firdapse® Tablet, DyDo Pharma's pipeline features promising candidates like DYD-701. These are aimed at rare disease markets, which are experiencing significant growth. For instance, the global rare disease therapeutics market was valued at approximately $180 billion in 2023 and is projected to reach over $300 billion by 2030, demonstrating a strong compound annual growth rate.

These early-stage drugs, while holding immense potential to become future Stars, require substantial R&D investment. Their development path is fraught with uncertainty, from securing regulatory approval to achieving commercial success. For example, the average cost to bring a new drug to market can exceed $2 billion, with many candidates failing in clinical trials.

- DYD-701: An early-stage candidate targeting a specific rare neurological disorder.

- Other Rare Disease Candidates: Multiple other compounds in preclinical and Phase I development, focusing on unmet medical needs in orphan diseases.

- R&D Investment: Significant capital allocation towards these high-risk, high-reward assets, reflecting a strategic focus on niche, high-growth therapeutic areas.

Strategic Alliances for Future Mobility/Lifestyle Integration

DyDo DRINCO's involvement as an inventor in projects like Toyota's Woven City positions them in the Stars quadrant of the BCG matrix. This indicates a high-growth market with significant innovation potential, exploring how beverages can seamlessly integrate with future mobility and lifestyle ecosystems.

These strategic alliances are characterized by substantial investment requirements and a degree of market uncertainty, reflecting their experimental nature. For instance, Woven City aims to be a living laboratory for advanced technologies, including autonomous vehicles and smart city infrastructure, with DyDo's participation suggesting a forward-looking approach to consumer engagement in these evolving environments.

- High Growth Potential: Integration into future mobility and lifestyle platforms taps into emerging consumer behaviors and technological advancements.

- Innovation Focus: Ventures like Woven City represent DyDo's commitment to exploring novel business models beyond traditional beverage sales.

- Investment & Uncertainty: The speculative nature of these nascent markets necessitates significant capital outlay with uncertain near-term returns.

- Strategic Positioning: This aligns with a Stars strategy, aiming to capture future market share in a rapidly transforming landscape.

Question Marks represent products or ventures with low market share in high-growth industries, demanding significant investment to determine their future potential. DyDo's early-stage health food and supplement lines, for example, are in a booming wellness market but struggle with brand awareness and market penetration. Similarly, their expansion into new international beverage markets requires substantial capital and faces the risk of unfamiliar consumer preferences.

The success of these Question Marks hinges on strategic investment in research, development, and aggressive marketing to capture market share. The global health and wellness market's projected growth to $5.8 trillion by 2025 highlights the opportunity, but also the competitive intensity these new ventures must overcome.

DyDo Pharma's pipeline, including candidates like DYD-701 for rare diseases, also falls into the Question Mark category. While the rare disease therapeutics market is growing rapidly, projected to exceed $300 billion by 2030, these early-stage drugs require immense R&D investment and face high failure rates, with average development costs exceeding $2 billion.

| Product/Venture | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Early-stage Health Foods/Supplements | High (Wellness market $5.8T by 2025) | Low | High (R&D, Marketing) | Star or Dog |

| New International Beverage Markets | High (Emerging markets) | Low | High (Market entry, localization) | Star or Dog |

| DYD-701 (Rare Disease Drug) | High (Rare disease market $300B by 2030) | Low | Very High (R&D, Clinical Trials) | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and consumer trend analysis, to accurately position each business unit.