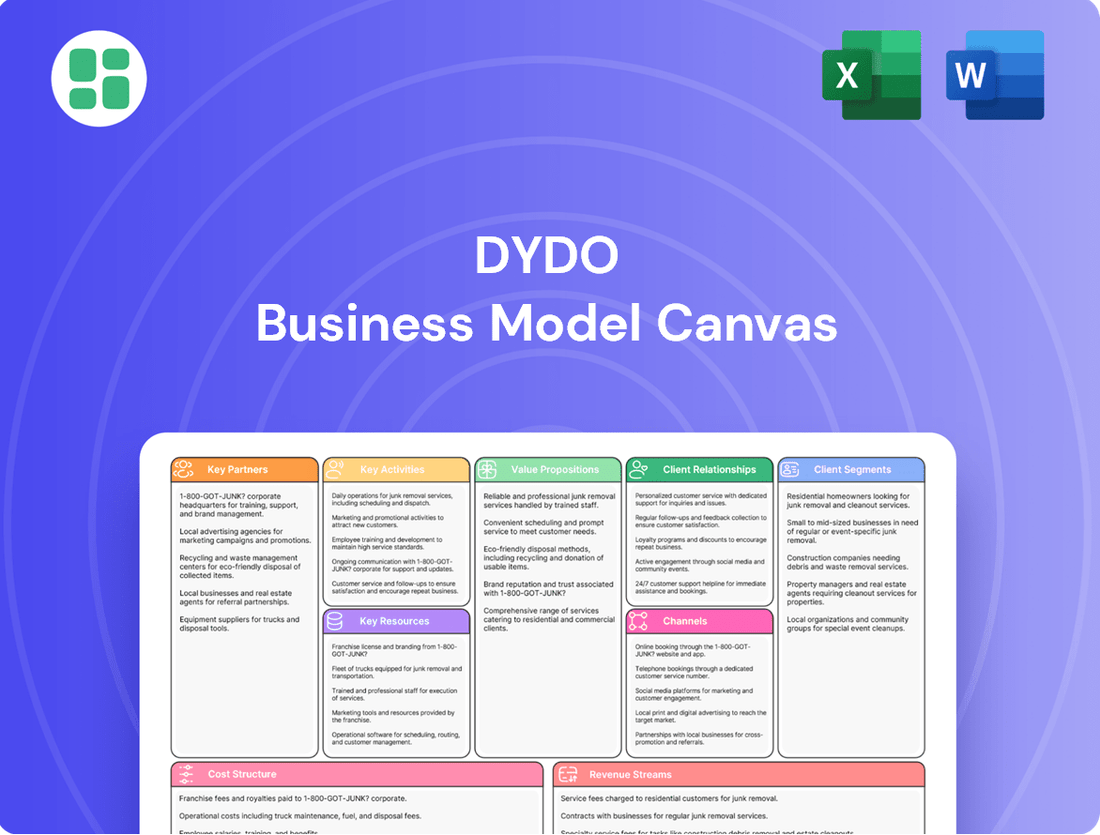

DyDo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

Unlock the core strategies that power DyDo's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational excellence. Ready to gain a competitive edge?

Partnerships

DyDo's vending machine network, a cornerstone of its business, thrives on strategic alliances with diverse location partners. These include private property owners, commercial businesses, and public sector entities such as train stations and parks throughout Japan. Securing these high-traffic sites is paramount for maximizing consumer access and sales volume.

In 2024, DyDo continued to leverage its vast network, which is estimated to comprise tens of thousands of vending machines across the country. These partnerships are not merely about placement; they are about ensuring optimal visibility and convenience for consumers, directly impacting DyDo's market penetration and brand presence.

DyDo's key partnerships with raw material suppliers are foundational to its operations, ensuring a steady flow of high-quality ingredients. This includes essential components like coffee beans, tea leaves, and various fruits for their extensive beverage portfolio. In 2024, maintaining robust relationships with these suppliers was crucial for cost management and supply chain stability, especially given global agricultural market fluctuations.

These partnerships are not limited to beverages; they extend to the sourcing of ingredients for DyDo's health food and supplement lines. By cultivating strong ties with a diverse range of suppliers, DyDo can better guarantee the consistency and quality of its products, which directly impacts consumer trust and brand reputation. This network also bolsters supply chain resilience, a critical factor in navigating potential disruptions and ensuring uninterrupted production.

Logistics and distribution companies are crucial for DyDo's success, ensuring beverages reach vending machines and retail locations efficiently. In 2024, DyDo continued to leverage strategic partnerships to streamline its supply chain.

A prime example is DyDo's joint venture with Shibusawa Warehouse Co., Ltd., forming Shibusawa DyDo Group Logistics Co., Ltd. This collaboration aims to optimize delivery routes and reduce operational costs, a critical factor for maintaining competitive pricing in the beverage market.

Technology and AI Solution Providers

DyDo's strategic alliances with technology and AI solution providers are crucial for its 'Smart Operations' initiative. These partnerships enable the integration of advanced AI and IoT capabilities into their vending machine network, driving efficiency and productivity gains.

Collaborations are focused on developing and deploying systems for real-time remote monitoring, intelligent restocking schedules, and predictive maintenance, ensuring machines operate at peak performance. For instance, in 2024, DyDo continued to expand its smart vending machine deployments, aiming to reduce operational costs by an estimated 15% through optimized logistics and reduced downtime.

- AI-powered demand forecasting to optimize inventory levels and reduce waste.

- IoT sensor integration for real-time machine performance monitoring and fault detection.

- Data analytics platforms to gain insights into consumer behavior and machine efficiency.

- Partnerships with cloud service providers for scalable data storage and processing.

Research and Development Collaborators

DyDo actively collaborates with research institutions, innovative startups, and leading universities to fuel its expansion into health foods and pharmaceuticals. This strategic approach ensures access to cutting-edge scientific advancements and novel product development.

The creation of the DyDo Group Future Co-Creation Institute underscores their dedication to open innovation. This institute serves as a hub for developing new functional materials and groundbreaking products, fostering a dynamic ecosystem for R&D.

- Research Institutions: Partnering for scientific validation and discovery.

- Startups: Engaging with agile innovators for rapid development of new technologies.

- Universities: Accessing fundamental research and talent pipelines.

- DyDo Group Future Co-Creation Institute: A dedicated platform for advanced material and product innovation.

DyDo's vending machine network is strengthened by partnerships with property owners, businesses, and public entities, ensuring prime locations. In 2024, this extensive network, comprising tens of thousands of machines, was key to maximizing consumer access and sales.

Robust supplier relationships are vital for DyDo's beverage and health product lines, guaranteeing quality ingredients. In 2024, managing these partnerships was crucial for cost control amidst agricultural market volatility.

Strategic alliances with logistics firms, like the joint venture Shibusawa DyDo Group Logistics Co., Ltd., optimize distribution. This collaboration in 2024 focused on efficient routes and cost reduction, vital for competitive pricing.

Technology and AI partnerships are integral to DyDo's 'Smart Operations,' enhancing vending machine efficiency. By 2024, smart machine deployments aimed for a 15% operational cost reduction through optimized logistics and reduced downtime.

Collaborations with research institutions, startups, and universities fuel DyDo's innovation in health foods and pharmaceuticals. The DyDo Group Future Co-Creation Institute exemplifies this commitment to open innovation and new product development.

What is included in the product

A detailed breakdown of DyDo's strategy, covering its customer segments, value propositions, and channels.

This Business Model Canvas provides a clear, actionable framework for understanding DyDo's operations and strategic direction.

The DyDo Business Model Canvas provides a structured framework to pinpoint and address critical business challenges, transforming vague problems into actionable solutions.

Activities

Beverage manufacturing and production at DyDo encompasses the creation of diverse drinks like coffee, tea, juices, and sports beverages in various packaging. Ensuring consistent quality and streamlined production processes are paramount. In 2024, DyDo continued to leverage its advanced manufacturing facilities, a key component in maintaining its competitive edge in the beverage market.

DyDo's core activities revolve around the meticulous operation and upkeep of its extensive vending machine network. This involves the crucial tasks of installation, consistent restocking, and essential technical servicing to guarantee optimal machine performance and product freshness.

Ensuring a seamless customer experience is paramount, as approximately 80% of DyDo's domestic beverage revenue is generated through this channel. This high reliance underscores the importance of maintaining machine availability and cleanliness to foster customer satisfaction.

DyDo's sales and marketing activities focus on creating and implementing strategies to boost consumer interest in their diverse beverage and health food offerings. This involves running advertising campaigns, offering special promotions, and engaging in direct sales to reach a broad customer base across their product portfolio.

In 2023, DyDo DRINKCO reported net sales of ¥181.5 billion, with a significant portion driven by their beverage segment. Their marketing efforts are crucial in maintaining this sales momentum, particularly in the competitive Japanese beverage market where brand visibility and consumer engagement are key.

The company also dedicates resources to marketing its health food and supplement lines, aiming to capture a share of the growing wellness market. These initiatives are designed to build brand loyalty and encourage repeat purchases, contributing to overall revenue growth and market penetration.

Product Research and Development

DyDo's product research and development is a cornerstone of its business. A significant part of this involves continuous innovation to create new beverage flavors and explore emerging health food products and functional ingredients. This proactive approach ensures they stay ahead of evolving consumer tastes and growing health consciousness.

Their commitment to research and development is further highlighted by a strategic focus on health-focused products, including functional beverages and even exploring the niche market of orphan drugs. This dual approach, spanning both everyday consumables and specialized health solutions, underscores their dedication to scientific advancement and market responsiveness.

- Innovation in Flavors: DyDo actively researches and develops new beverage flavors, responding to dynamic consumer preferences.

- Health-Focused Products: A key activity is the development of health-oriented food products and functional ingredients to meet market demand.

- Orphan Drug Research: DyDo's R&D extends to specialized areas like orphan drugs, demonstrating a commitment to addressing unmet medical needs.

- Market Trend Adaptation: Continuous R&D allows DyDo to adapt to and capitalize on emerging health trends and consumer demands.

Supply Chain Management

DyDo's key activities in supply chain management focus on orchestrating the flow of goods from initial sourcing to final customer delivery. This involves meticulous inventory management to balance availability with holding costs and robust logistics coordination to ensure timely and efficient product distribution. In 2024, DyDo, like many beverage companies, faced challenges in maintaining stable raw material supply due to global weather patterns affecting agricultural yields, highlighting the critical need for resilient supply chain strategies.

Effective management of the entire supply chain is paramount for DyDo to achieve operational efficiency and maintain cost control. This encompasses everything from securing quality raw materials to getting the finished beverages into consumers' hands. The company's ability to navigate a volatile market environment hinges on its success in ensuring a consistent and reliable supply.

- Sourcing: Securing high-quality raw materials like sugar, coffee beans, and fruits from reliable suppliers.

- Logistics: Managing transportation networks, warehousing, and distribution to ensure efficient product movement.

- Inventory: Optimizing stock levels across the supply chain to meet demand while minimizing waste and holding costs.

- Quality Control: Implementing stringent checks at various stages to maintain product integrity and safety.

DyDo's key activities are centered around its extensive vending machine operations, beverage manufacturing, and robust sales and marketing efforts. The company also invests significantly in product research and development, particularly in health-focused areas, and maintains a strong focus on efficient supply chain management to ensure product availability and quality.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you are seeing the actual, complete file, not a simplified sample or mockup. Once your order is finalized, you will gain full access to this identical, professionally structured Business Model Canvas, ready for your immediate use.

Resources

DyDo's extensive vending machine network, boasting over one million units across Japan as of 2024, serves as a cornerstone of its business model. This vast physical presence offers unparalleled direct access to consumers, facilitating immediate product availability and broad market penetration.

This robust infrastructure is a critical key resource, enabling efficient distribution and acting as a constant touchpoint for brand engagement. The sheer scale of DyDo's vending machine footprint in Japan significantly reduces reliance on external distribution channels, offering a distinct competitive advantage.

DyDo Drinco boasts a robust portfolio of established beverage brands, a cornerstone of its business model. These include widely recognized names in coffee, tea, juice, and sports drinks, fostering significant brand recognition and consumer loyalty. For instance, as of the fiscal year ending March 2024, DyDo reported net sales of ¥178.3 billion, demonstrating the commercial power of its brand equity.

DyDo's manufacturing facilities and technology are the backbone of its operations, enabling the efficient production of a diverse beverage and health food portfolio. Their advanced manufacturing equipment ensures high-quality output and consistent supply, crucial for meeting consumer demand.

In 2024, DyDo operates numerous production plants, including key facilities in Japan and Southeast Asia, allowing for broad market reach. The company continually invests in upgrading its technology, integrating automation and smart manufacturing principles to enhance productivity and reduce waste, as evidenced by their ongoing modernization projects.

Human Capital and Expertise

Skilled personnel are the backbone of DyDo's operations, covering everything from creating new beverages and keeping vending machines running smoothly to marketing and delivering products. In 2024, DyDo DRINCO INC. reported a total of 1,404 employees, highlighting the significant human capital investment required to manage its extensive network.

The expertise of these individuals is crucial for maintaining high operational standards and fostering innovation. This includes specialized knowledge in areas like beverage formulation, supply chain management, and customer service, all vital for adapting to evolving consumer preferences and market dynamics.

- Product Development: Expertise in creating appealing and innovative beverage formulations.

- Vending Machine Maintenance: Technical skills to ensure reliable operation and uptime of a vast vending network.

- Sales and Marketing: Professionals who drive brand awareness and sales performance.

- Logistics and Supply Chain: Ensuring efficient distribution and inventory management across diverse locations.

Financial Capital

Financial capital is the lifeblood of DyDo's operations and growth initiatives. Sufficient financial resources are crucial for investments in research and development, enabling the company to innovate and stay competitive in the beverage market. DyDo's strategic acquisitions, such as the 2023 purchase of Wosana S.A. in Poland, highlight the need for robust financial backing to expand its global footprint and market share.

Maintaining strong financial health is paramount for DyDo's sustained growth and operational efficiency. This includes managing cash flow effectively to support the expansion of its extensive vending machine network, a core component of its business model. As of the first half of fiscal year 2024, DyDo reported a net sales increase, demonstrating the positive impact of its financial management on its business performance.

- Investment in R&D: Funding innovation for new product development and improved vending technology.

- Network Expansion: Capital for acquiring and maintaining a widespread vending machine presence.

- Strategic Acquisitions: Resources allocated for mergers and takeovers to broaden market reach, exemplified by the Wosana S.A. deal.

- Operational Health: Ensuring liquidity and financial stability for day-to-day business activities and long-term growth.

DyDo's intellectual property, encompassing proprietary beverage formulas and brand trademarks, is a critical asset. This intellectual capital drives consumer preference and market differentiation. The company's commitment to innovation is reflected in its continuous development of new product lines, ensuring its offerings remain relevant and appealing to a diverse customer base.

The company's brand reputation and customer loyalty are invaluable key resources. Decades of providing quality beverages have cultivated a strong sense of trust among consumers. This positive brand perception, built through consistent product quality and effective marketing, translates directly into sales and market share, as evidenced by DyDo's enduring presence in the competitive Japanese beverage market.

DyDo's data and customer insights are increasingly vital resources. Understanding consumer purchasing habits and preferences, particularly through its extensive vending network, allows for targeted marketing and product development. By analyzing sales data from its over one million vending machines, DyDo can optimize product placement and promotions, maximizing sales effectiveness.

Key resources for DyDo Drinco include its vast vending machine network, established brands, efficient manufacturing capabilities, skilled workforce, financial capital, intellectual property, strong brand reputation, and valuable customer data. These elements collectively form the foundation of its operational strength and market competitiveness, enabling it to serve millions of customers daily.

Value Propositions

DyDo's extensive network of over one million vending machines across Japan provides unmatched convenience, enabling consumers to purchase beverages rapidly and effortlessly. This widespread presence ensures immediate availability, perfectly suiting the needs of individuals seeking quick refreshment while on the move.

DyDo's diverse product selection is a cornerstone of its business model, offering consumers an extensive array of beverage choices. This includes popular categories like coffee, tea, fruit juices, and functional sports drinks, ensuring a broad appeal across different demographics and occasions. In 2024, DyDo continued to leverage this variety, with its beverage segment contributing significantly to its overall revenue, reflecting strong consumer demand for its wide-ranging portfolio.

DyDo's commitment to quality and trusted brands is a cornerstone of its value proposition, ensuring consumers receive safe, consistently delicious, and health-conscious products. This dedication fosters deep trust, a critical asset in the competitive beverage market.

In 2024, DyDo continued to leverage its established brand equity, with flagship products like DyDo Blend Coffee consistently performing well, reflecting consumer confidence in their quality and taste. This reliability is key to customer loyalty.

Health and Wellness Focus

DyDo's commitment to health and wellness is evident in its diverse product portfolio, aiming to support enjoyable and healthy living. This extends from functional beverages designed for specific health benefits to nutritional supplements and even specialized orphan drugs, demonstrating a broad approach to health needs.

The company's health food segment, including functional beverages, saw significant activity in 2024, with a growing consumer demand for products that offer more than just basic hydration. For instance, sales of beverages with added vitamins and minerals continued to show robust growth, reflecting a heightened awareness of preventative health measures among consumers.

- Functional Beverages: DyDo offers a range of drinks fortified with vitamins, minerals, and other beneficial ingredients targeting various health aspects like immunity and energy.

- Nutritional Supplements: The company provides supplements in various forms, catering to different dietary needs and wellness goals.

- Orphan Drugs: DyDo's involvement in pharmaceuticals includes developing and distributing specialized treatments for rare diseases, highlighting a dedication to addressing unmet medical needs.

Reliable and Innovative Vending Experience

DyDo strives to offer a vending experience that is both dependable and forward-thinking. Through 'Smart Operations,' the company focuses on maintaining a consistent supply and ensuring machines are always in working order, directly addressing a key customer pain point.

This dedication to innovation isn't just about keeping machines stocked; it's about creating a modern, hassle-free interaction. For example, in 2024, vending machine operators are increasingly investing in IoT sensors and data analytics to predict stock levels and maintenance needs, a trend DyDo is likely leveraging.

- Smart Operations: Utilizes technology to ensure machine uptime and product availability.

- Customer Satisfaction: Aims to reduce instances of empty machines or malfunctioning units.

- Operational Efficiency: Streamlines restocking and maintenance processes.

- Innovation Focus: Embraces new technologies for a superior vending interaction.

DyDo's value proposition centers on unparalleled convenience through its vast vending machine network, ensuring immediate access to a wide array of high-quality, trusted beverages. The company also emphasizes health and wellness, offering functional drinks and supplements, alongside a commitment to operational excellence via smart technologies that guarantee machine availability.

Customer Relationships

For most vending machine sales, DyDo's customer relationships are automated and transactional. The focus is on making sure customers get their drinks quickly and can pay easily, with minimal human interaction. This efficiency is key to the convenience offered.

In 2024, DyDo operates a vast network of vending machines across Japan, with over 100,000 units. These machines handle millions of transactions daily, underscoring the high volume of these automated, quick exchanges. The primary goal is seamless product delivery and payment processing.

DyDo's customer service, while primarily automated through its vending machines, offers crucial human support for issues like malfunctions or product quality concerns. This direct customer interaction is vital for resolving immediate problems and ensuring a positive brand experience, especially given that beverage sales are a core revenue driver.

DyDo actively fosters customer relationships through diverse marketing initiatives, including targeted campaigns and appealing promotions designed to cultivate brand loyalty and drive repeat business. For instance, their 2024 strategy heavily features collaborations with popular anime and gaming franchises, aiming to tap into existing fan bases and create buzz. This approach saw a notable uptick in social media engagement during their 2023 campaigns, with a reported 15% increase in follower interaction across key platforms.

Direct Engagement for Health Products

For DyDo's health products, customer relationships are built on direct engagement. This includes specialized sales channels, dedicated customer support, and providing detailed information about product benefits, particularly for their pharmaceutical and health food lines. This approach is designed for a consumer base that is often more informed and seeking specific health outcomes.

- Specialized Sales Channels: Direct sales, possibly through pharmacies or dedicated health stores, allow for tailored advice and product demonstrations.

- Customer Support: Offering robust customer service helps address specific health inquiries and build trust.

- Information Dissemination: Providing clear, factual information on product efficacy and health benefits is crucial for this segment.

- Targeted Communication: Engaging with health-conscious consumers through relevant platforms ensures the message resonates.

Community and Sustainability Initiatives

DyDo actively cultivates community goodwill through its commitment to sustainability. A prime example is their development of carbon-neutral vending machines, a tangible step towards environmental responsibility. In 2023, DyDo announced plans to expand its eco-friendly vending machine initiatives, aiming for a significant reduction in its carbon footprint by 2030.

These sustainability efforts resonate with a growing public consciousness around environmental issues, reinforcing DyDo's corporate image and fostering stronger connections with consumers and stakeholders who value ethical business practices. Their engagement in environmental activities further solidifies this positive perception.

- Sustainability Focus: Development of carbon-neutral vending machines.

- Community Engagement: Promotion of environmental activities.

- Reputation Enhancement: Alignment with societal values and corporate responsibility.

- Impact: Fostering positive relationships and brand loyalty.

DyDo's customer relationships are largely automated and transactional, focusing on efficient vending machine operations. However, they also engage customers through targeted marketing, such as anime collaborations in 2024, and offer direct support for health products. Community goodwill is fostered through sustainability initiatives like carbon-neutral vending machines.

| Relationship Type | Key Activities | 2024 Focus/Data | Impact |

|---|---|---|---|

| Automated/Transactional | Vending machine sales, quick payment, product delivery | Over 100,000 vending machines, millions of daily transactions | Convenience, efficiency |

| Direct Engagement (Health Products) | Specialized sales channels, customer support, information dissemination | Targeted communication for health-conscious consumers | Trust, specific health outcomes |

| Community/Brand Loyalty | Marketing campaigns, anime collaborations, sustainability initiatives | Anime partnerships, carbon-neutral vending machine expansion | Brand image, repeat business, stakeholder connection |

Channels

DyDo's extensive vending machine network serves as its primary and most distinctive sales channel, boasting a significant presence across Japan. As of March 2024, DyDo operated approximately 280,000 vending machines, a testament to its pervasive market penetration.

These machines are strategically located in diverse settings, from busy train stations and office buildings to quieter residential areas and hospitals, ensuring 24/7 accessibility for consumers. This widespread placement is key to DyDo's strategy of making its beverages readily available to a broad customer base.

DyDo leverages convenience stores and supermarkets as crucial distribution channels, reaching a broad consumer base beyond its vending machine network. This strategy caters to shoppers who prefer traditional retail environments for their beverage purchases.

In 2024, the Japanese convenience store sector continued to be a significant player in retail, with major chains reporting steady sales figures, indicating continued consumer reliance on these outlets for everyday needs, including beverages. Supermarkets also maintained their importance, offering a wider selection and often competitive pricing for DyDo's product lines.

DyDo leverages online sales platforms to extend its reach, particularly for health foods and supplements. This digital storefront provides consumers with the ultimate convenience, allowing them to explore and buy products from the comfort of their homes. In 2024, the global e-commerce market for health and wellness products saw significant growth, with projections indicating continued expansion as more consumers prioritize health and seek accessible purchasing options.

Wholesale Distribution

DyDo's wholesale distribution channel targets businesses, offices, and institutions, offering bulk beverage purchases for employee or customer consumption. This B2B approach caters to organizational needs, ensuring consistent supply for various commercial settings.

This channel is crucial for reaching a broad customer base beyond individual consumers. For example, in 2023, the Japanese vending machine market, a significant area for DyDo, generated approximately ¥5.5 trillion, with a portion of this revenue stemming from institutional placements.

- B2B Focus: Serves corporations, educational institutions, and healthcare facilities.

- Bulk Sales: Facilitates large-volume orders for organizational use.

- Partnerships: Collaborates with facility management companies and corporate buyers.

- Market Reach: Extends beverage availability into professional and institutional environments.

Direct Sales (for specific segments like Pharma)

For its specialized pharmaceutical business, especially concerning orphan drugs, DyDo leverages direct sales channels. This approach is crucial for reaching hospitals, clinics, and individual healthcare providers who are the primary consumers of these niche treatments.

This direct engagement allows for a highly targeted and specialized sales effort, essential for communicating the complex benefits and administration protocols of orphan drugs. In 2024, the global orphan drug market continued its robust growth, with sales projected to reach over $250 billion, underscoring the importance of effective distribution strategies like direct sales for companies operating in this segment.

- Targeted Reach: Direct sales enable DyDo to precisely connect with key decision-makers in healthcare institutions.

- Product Specialization: The nature of orphan drugs necessitates detailed product knowledge and direct communication with medical professionals.

- Market Dynamics: The expanding orphan drug market in 2024 highlights the strategic advantage of direct sales channels for specialized pharmaceuticals.

DyDo's vending machine network is its most defining channel, with approximately 280,000 machines strategically placed across Japan as of March 2024. This extensive reach ensures constant availability in high-traffic areas like train stations and offices, as well as quieter residential zones, catering to diverse consumer needs around the clock.

Beyond vending, DyDo utilizes convenience stores and supermarkets, vital for reaching consumers who prefer traditional retail. In 2024, these outlets remained central to Japanese retail, with major chains reporting stable performance, reflecting their continued importance for everyday purchases, including beverages.

The company also engages in online sales, particularly for its health food and supplement lines, offering home delivery convenience. This digital approach aligns with the growing global e-commerce trend in health and wellness, which saw continued expansion in 2024 as consumers prioritized health and accessibility.

DyDo's wholesale channel targets businesses and institutions, facilitating bulk purchases for employees and clients. This B2B strategy extends beverage availability into professional settings, complementing its direct-to-consumer efforts.

For its specialized pharmaceutical business, particularly orphan drugs, DyDo employs direct sales to hospitals and healthcare providers. This targeted approach is essential for communicating complex product information, a strategy gaining importance as the global orphan drug market surged past $250 billion in sales by 2024.

Customer Segments

General consumers, the bedrock of DyDo's customer base, seek simple refreshment and convenience in their daily lives. They are the individuals grabbing a chilled drink from a vending machine during a commute or picking up a familiar beverage at a local convenience store. In 2024, the beverage market continues to be driven by these everyday purchases, with consumers prioritizing accessibility and value.

This mass market segment relies on DyDo's widespread presence, particularly its extensive network of vending machines which served millions of transactions annually. Their purchasing decisions are often impulse-driven, influenced by factors like immediate thirst, product availability, and competitive pricing. DyDo's ability to consistently meet these basic needs solidifies its position with this crucial customer group.

Office workers and commuters are a core customer segment for DyDo, driven by the ubiquitous presence of vending machines in their daily environments. These individuals often seek convenient and readily available beverages to refresh themselves during busy workdays or while traveling. In 2024, the demand for on-the-go refreshments remained robust, with vending machine sales continuing to be a significant channel for beverage consumption in urban centers.

Health-conscious individuals are a key customer segment for DyDo, actively seeking out beverages and foods that offer tangible health benefits. This includes consumers looking for functional ingredients, specific nutritional profiles, or products that support a healthy lifestyle. DyDo's investment in its health food and supplement lines directly addresses this demand, aiming to capture a significant portion of this growing market.

The market for functional foods and beverages, which aligns with this customer segment, has seen robust growth. For instance, the global functional foods market was valued at over $300 billion in 2023 and is projected to continue its upward trajectory, with a compound annual growth rate (CAGR) of approximately 8% through 2030. This indicates a strong and sustained consumer preference for products that go beyond basic nutrition.

Businesses and Institutions

DyDo's customer segment of Businesses and Institutions is crucial for its vending machine network and bulk beverage sales. This includes a wide array of organizations such as corporate offices, educational institutions like universities and K-12 schools, healthcare facilities including hospitals and clinics, and various other public and private entities. These organizations serve as prime locations for DyDo to deploy its vending machines, providing convenient access to beverages for their employees, students, patients, and visitors.

For example, in 2024, DyDo continued to expand its partnerships with businesses seeking to offer refreshment options to their workforce. These partnerships are vital, as securing placement in high-traffic business environments directly contributes to sales volume and brand visibility. Furthermore, these institutions often engage in direct purchasing of beverages for internal consumption, such as for staff break rooms or events, representing a significant revenue stream.

- Vending Machine Placement: Businesses and institutions offer key locations for DyDo's vending machines, increasing accessibility and sales.

- Bulk Beverage Sales: These organizations purchase beverages in larger quantities for internal use, boosting revenue.

- Partnership Value: Collaborations with companies, schools, and hospitals are fundamental to DyDo's distribution strategy and market penetration.

- Employee/Visitor Benefits: Providing convenient beverage options enhances the offerings for employees and visitors within these institutional settings.

Patients with Specific Health Conditions

For DyDo's pharmaceutical ventures, especially in the orphan drug niche, the primary customer base includes individuals diagnosed with rare and often life-limiting conditions. These patients, alongside the specialized physicians and medical teams managing their care, represent a critical segment. The market for orphan drugs is characterized by its high degree of specialization and stringent regulatory oversight, demanding tailored approaches to patient engagement and treatment delivery.

The global orphan drug market was valued at approximately $195.4 billion in 2023 and is projected to reach around $335.8 billion by 2030, with a compound annual growth rate of 8.1%. This growth underscores the increasing focus on addressing unmet medical needs for smaller patient populations.

- Patients with rare diseases: Individuals directly benefiting from specialized treatments.

- Healthcare Professionals: Physicians, specialists, and pharmacists involved in diagnosis and treatment.

- Patient Advocacy Groups: Organizations supporting patients and raising awareness for specific conditions.

- Research Institutions: Collaborating on clinical trials and developing new therapies.

DyDo's customer segments are diverse, ranging from general consumers seeking everyday refreshments to specialized groups like patients with rare diseases. The company caters to the mass market through its extensive vending machine network, prioritizing convenience and value for commuters and office workers. Additionally, DyDo is increasingly focusing on health-conscious individuals and the growing market for functional foods and beverages.

Businesses and institutions form another vital segment, providing prime locations for vending machines and engaging in bulk beverage purchases. DyDo's pharmaceutical arm targets patients with rare diseases and the healthcare professionals who treat them, tapping into the specialized and growing orphan drug market. This multi-faceted approach allows DyDo to maximize reach and revenue across various consumer needs.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| General Consumers | Seek convenience, value, impulse purchases | Mass market purchases continue to drive beverage sales; accessibility is key. |

| Office Workers & Commuters | Need on-the-go refreshments during busy schedules | Vending machine sales remain strong in urban centers for this segment. |

| Health-Conscious Individuals | Desire functional ingredients, nutritional benefits | Global functional foods market exceeded $300 billion in 2023, with an expected 8% CAGR. |

| Businesses & Institutions | Require vending machine placement and bulk purchases | Partnerships with companies and schools are crucial for distribution and sales volume. |

| Pharmaceutical (Orphan Drugs) | Patients with rare diseases and healthcare professionals | Global orphan drug market valued at $195.4 billion in 2023, projected for 8.1% CAGR. |

Cost Structure

A substantial part of DyDo's expenses stems from sourcing key ingredients like coffee beans, tea leaves, sugar, and water, alongside the costs of packaging materials. In 2024, the beverage industry globally faced continued volatility in commodity prices, directly affecting the cost of these raw materials.

The manufacturing and bottling processes themselves represent significant operational expenditures for DyDo. These include energy consumption for production lines, labor costs for factory staff, and maintenance of sophisticated machinery. For instance, energy prices in many regions saw upward pressure throughout 2024, impacting overall production overheads.

Fluctuations in the global prices of agricultural commodities, such as coffee and tea, can directly impact DyDo's profitability. For example, reports in late 2024 indicated that the price of certain coffee bean varieties had increased by as much as 15% due to adverse weather conditions in major producing countries, a factor DyDo would have had to manage.

DyDo's cost structure heavily relies on the investment in its vending machine network. This includes the initial purchase and installation of machines, which can range from several thousand dollars per unit depending on features and capacity. Ongoing expenses are significant, encompassing regular maintenance, repairs, and the labor and fuel required for a dedicated team to restock and service thousands of machines across Japan. For instance, in 2024, companies in the vending machine sector reported that maintenance and repair costs could represent 5-10% of a machine's initial purchase price annually.

To mitigate these operational expenses, DyDo is implementing 'Smart Operations.' This strategy leverages technology to optimize restocking routes, monitor machine inventory remotely, and predict potential maintenance issues before they arise. Such efficiency gains are crucial, as labor and fuel costs for a widespread network can be substantial, impacting overall profitability. By reducing unnecessary trips and proactive servicing, DyDo aims to lower its cost per service call and improve the uptime of its machines, directly contributing to a leaner operational model.

Logistics and distribution costs are a significant component for DyDo, encompassing the expenses of moving products from their factories to various points of sale across Japan. This includes the crucial steps of transporting goods to distribution centers, then onward to individual vending machines, and finally to retail stores.

These operational expenditures cover essential elements such as fuel for the delivery fleet, ongoing vehicle maintenance to ensure reliability, and the salaries of the personnel involved in this complex supply chain. For instance, in 2023, the Japanese logistics industry faced rising fuel prices, which directly impacted companies like DyDo, contributing to increased operational overhead.

Marketing and Advertising Expenses

DyDo's marketing and advertising expenses are crucial for building brand awareness and driving sales for its diverse product lines, including beverages and health foods. These costs encompass a wide range of activities aimed at reaching and engaging consumers.

In 2024, companies in the consumer packaged goods sector, similar to DyDo, continued to invest heavily in digital marketing, social media campaigns, and influencer collaborations. For instance, a significant portion of marketing budgets is allocated to online advertising, which offers measurable returns and targeted reach.

- Brand Promotion: Costs associated with creating brand recognition and positive perception through various channels.

- Advertising Campaigns: Expenditure on paid media placements, including television, print, radio, and digital platforms, to promote specific products or the overall brand.

- Sales Activities: Investments in point-of-sale promotions, trade marketing, and sales force incentives to encourage purchasing.

- Customer Acquisition & Retention: Strategies and spending focused on attracting new customers and maintaining loyalty among existing ones.

Research and Development (R&D) Costs

DyDo's Research and Development (R&D) costs are a significant investment in innovation, focusing on creating entirely new products, enhancing current offerings, and investigating novel functional ingredients and pharmaceutical applications. This commitment is exemplified by their dedicated 'DyDo Group Future Co-Creation Institute.'

In fiscal year 2024, DyDo Group strategically allocated substantial resources to R&D. For instance, their investment in the Future Co-Creation Institute underscores a long-term vision for developing differentiated products and exploring emerging health and wellness trends.

- Investment in Future Co-Creation Institute: This facility is central to DyDo's strategy for pioneering new beverage concepts and functional ingredient research.

- New Product Development: Funds are directed towards the entire lifecycle of new product creation, from initial ideation to market testing.

- Improvement of Existing Products: A portion of the R&D budget is dedicated to refining the taste, nutritional profile, and packaging of established product lines.

- Pharmaceutical Solutions Exploration: DyDo is actively researching and developing solutions within the pharmaceutical and health-related beverage sectors, aiming to leverage their expertise in functional ingredients.

DyDo's cost structure is dominated by the sourcing of raw materials like coffee beans and tea, along with significant expenses in manufacturing, bottling, and distribution. The company also invests heavily in its extensive vending machine network, which includes purchase, installation, and ongoing maintenance costs.

Marketing and R&D are also key cost drivers, with substantial allocations towards brand promotion, digital advertising, and the 'DyDo Group Future Co-Creation Institute' for new product development and pharmaceutical exploration.

In 2024, rising commodity prices and energy costs directly impacted DyDo's raw material and production expenses, while logistics faced increased fuel surcharges.

| Cost Category | Key Components | 2024 Impact Factors |

| Raw Materials | Coffee beans, tea leaves, sugar, water | Commodity price volatility, adverse weather conditions affecting supply |

| Manufacturing & Bottling | Energy, labor, machinery maintenance | Increased energy prices, labor cost pressures |

| Vending Machine Network | Machine purchase/installation, maintenance, servicing labor/fuel | High initial investment, ongoing operational overheads |

| Logistics & Distribution | Fuel, vehicle maintenance, driver salaries | Rising fuel prices, supply chain efficiency needs |

| Marketing & Sales | Digital advertising, brand promotion, sales activities | Increased investment in online channels, competitive market spend |

| Research & Development | New product development, functional ingredient research, pharmaceutical exploration | Strategic investment in innovation, dedicated institute funding |

Revenue Streams

DyDo's primary revenue stream is generated through the direct sale of beverages via its vast vending machine network. This channel is a cornerstone of their domestic beverage operations, providing consistent and widespread customer access.

In fiscal year 2023, DyDo DRINCO reported total revenue of ¥257.3 billion. While specific breakdowns for vending machine sales are not always granularly detailed, the vending segment is understood to be a significant contributor to this overall figure, reflecting the pervasive presence of their machines across Japan.

DyDo's beverage sales revenue streams extend significantly beyond vending machines, encompassing both retail and wholesale channels. This dual approach allows them to reach a broader customer base. For instance, they supply beverages to a vast network of convenience stores and supermarkets, ensuring their products are readily available to everyday consumers.

Furthermore, DyDo engages in wholesale operations, providing beverages to various businesses and institutions. This strategic diversification of sales channels is crucial for expanding market penetration and capturing revenue from different segments of the economy. In 2024, the beverage industry continued to see strong demand, with retail sales forming a substantial portion of overall beverage market growth.

DyDo's revenue streams include the manufacturing and sale of health foods and dietary supplements. This segment directly addresses the growing consumer demand within the wellness market, positioning it as a key area for company expansion. For example, in the fiscal year ending March 2024, DyDo reported a significant increase in sales within its health and functional beverage segment, which encompasses many of its supplement offerings, indicating strong consumer adoption.

Pharmaceutical-Related Business Revenue

DyDo's pharmaceutical segment generates revenue through specialized contract manufacturing of drinkable preparations. This business line leverages their expertise in beverage formulation and production for pharmaceutical clients.

A significant recent development is the company's entry into the sales of approved orphan drugs. This strategic move targets a niche, high-value market, representing a considerable expansion of their pharmaceutical endeavors.

For instance, in fiscal year 2023, DyDo Group Holdings reported that its pharmaceutical segment's sales reached approximately ¥18.6 billion. This demonstrates the growing contribution of this sector to the company's overall revenue.

- Contract Manufacturing: Income from producing pharmaceutical drinkable preparations for other companies.

- Orphan Drug Sales: Revenue generated from the sale of specialized drugs for rare diseases.

- Strategic Expansion: Entry into the high-value pharmaceutical market as a growth driver.

- Fiscal Year 2023 Performance: Pharmaceutical segment sales amounted to around ¥18.6 billion.

International Beverage Sales

DyDo's international beverage sales represent a growing segment of its revenue. The company has seen particularly strong performance in its Turkish beverage business, a key market for expansion.

The acquisition of a Polish subsidiary further diversifies its international footprint and revenue streams.

- International Beverage Sales: Revenue generated from beverage operations outside of Japan.

- Turkish Beverage Business: A significant contributor to international revenue, showing notable progress.

- Polish Subsidiary: The addition of this entity expands DyDo's presence and revenue base in Eastern Europe.

DyDo DRINCO's revenue streams are diverse, spanning direct beverage sales through its extensive vending machine network, retail and wholesale distribution, and a growing international presence. The company also generates income from its health food and pharmaceutical segments, including contract manufacturing and the sale of specialized orphan drugs.

In fiscal year 2023, DyDo Group Holdings reported total revenue of ¥257.3 billion, with its pharmaceutical segment contributing approximately ¥18.6 billion. The company's strategic expansion into international markets, particularly Turkey, and its acquisition of a Polish subsidiary are key drivers for future revenue growth.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approx.) |

| Vending Machine Sales | Direct sale of beverages via widespread vending machines. | Significant contributor to total revenue. |

| Retail & Wholesale | Sales through convenience stores, supermarkets, and to businesses. | Broad market reach. |

| Health Foods & Supplements | Sales in the wellness market. | Growing segment, strong consumer adoption. |

| Pharmaceuticals | Contract manufacturing and orphan drug sales. | ¥18.6 billion. |

| International Beverage Sales | Beverage operations outside Japan (e.g., Turkey, Poland). | Key area for expansion. |

Business Model Canvas Data Sources

The DyDo Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market research reports. This multi-faceted approach ensures a comprehensive understanding of our operational landscape and strategic opportunities.